Financial Highlights 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frieslandcampina Annual Report 2011

Annual Report 2011 Annual Annual Report 2011 Royal FrieslandCampina N.V. | Royal FrieslandCampina N.V. FrieslandCampina Royal 1 Annual Report 2011 Royal FrieslandCampina N.V. Caption on cover: Milk is one of the richest natural sources of essential nutrients. The nutritional power of milk is the basis on which FrieslandCampina provides consumers around the world with healthy, sustainably produced food. 2 Explanatory note In this Annual Report we are presenting the financial results and key developments of Royal FrieslandCampina N.V. (hereafter FrieslandCampina) during 2011. The financial statements have been prepared as at 31 December 2011. The figures for 2011 and the comparative figures for 2010 have been prepared in accordance with the International Financial Reporting Standards to the extent they have been endorsed by the European Union (EU-IFRS). The milk price for 2011 received by members of Zuivelcoöperatie FrieslandCampina U.A. for the milk they supplied was determined on the basis of FrieslandCampina’s method for determining milk prices 2011 – 2013. All amounts in this report are in euros, unless stated otherwise. This Annual Report includes statements about future expectations. These statements are based on the current expectations, estimates and projections of FrieslandCampina’s management and the information currently available. The expectations are uncertain and contain elements of risk that are difficult to quantify. For this reason FrieslandCampina gives no assurance that the expectations will be realised. The Annual Report of Royal FrieslandCampina N.V. has also been published on the website www.frieslandcampina.com and is available on request from the Corporate Communication department of FrieslandCampina ([email protected]). -

THE 42Nd NORDIC DAIRY CONGRESS 2010

THE 42nd NORDIC DAIRY CONGRESS 2010 17.-19.6.2010 Hämeenlinna, Finland THE 42nd NORDIC DAIRY CONGRESS 2010 ON JUNE 17-19 IN 2010 FINLAND HOSTS THE NEXT NORDIC DAIRY CONGRESS IN HÄMEENLINNA. 2 Background The congress programs have included exhibitions The first Nordic Dairy Congress and excursions to local production facilities. was arranged by Nordic dairy The theme of the 2010 congress has to do with the organizations already in 1920 in new technologies and innovations in dairy industry. Oslo. Eighteen years later the first Dairy Technology Congress took place in Organiser of the 2010 congress Gothenburg by academic dairy folk. These congress- The 2010 congress is organized by the Finnish Dairy es were organised in turns in alternate years, until Technology Council. in the 1970s discussions about merging the two began. The first combined congress was held in The Nordic Dairy Technology Council, NMR Århus using the ordinal number 31 which was The Nordic Dairy Technology Council, NMR, which generated by totaling the number of the earlier was established in 1977, is responsible for the conti- Dairy and Dairy Technology congresses arranged nuity of the dairy congresses as well as their quality until then. and standard. The council includes representatives from all the Nordic countries. The president of the About the program council is Product Manager Kari Toikkanen. The congress programs are based on the work of the committees. The themes have varied from the quality of milk to information technology. CONTENTS 2 Nordic Dairy Congress 2010 -

“ Arla Must Produce Good and Healthy Dairy Products and Show Respect for Animals and the Environment” 2004/05 Annual Report

“ Arla must produce good and healthy dairy products and show respect for animals and the environment” 2004/05 Annual Report Arla Foods’ organisation Corporate Centre Executive Board Peder Tuborgh, Managing Director Povl Krogsgaard, Deputy Managing Director · Andreas Lundby, Deputy Managing Director Corporate Finance/IT Jørn Wendel Andersen, Finance Director Consumer Consumer UK Consumer Global Nordic International Ingredients Hans-Åke Kim Nielsen, Mikael Sternberg Peter Lauritzen, Hammerström, Group Executive Director Christiansen, Group Executive Director Group Executive Director Group Executive Director 2 The Chairman’s Report 27 Finance review 4 Report from the Executive Board 32 Management’s statement and Contents Auditors’ report 8 Fresh products 34 Accounting policies 11 Cheese 39 Profi t and loss account 14 Butter and spreads 40 Balance sheet 16 Ingredients 42 Equity statement 18 Innovation 43 Cash fl ow statement 20 Arlagården 44 Notes 22 Arla Foods’ employees 23 Environment and 54 Group chart working environment 56 Map 25 Other activities Arla Foods Annual Report 2004/05 Financial highlights Group 01.10.2004 01.10.2003 30.09.2002 01.10.2001 02.10.2000 DKK million 30.09.2005 30.09.2004 30.09.2003 29.09.2002 30.09.2001 Profi t Net turnover 46,351 47,263 40,647 39,441 38,133 outside DK/SE 27,784 28,137 20,781 19,807 18,823 % outside DK/SE 60% 60% 51% 50% 49% Operating profi t 1,505 1,193 1,242 1,411 1,596 Interest income and expense, etc. -573 -423 -245 -367 -381 Profi t for the year 801 1,019 1,094 1,085 1,157 Supplementary payments 369 586 546 575 690 Consolidation: Reconsolidation 247 123 123 126 122 Other consolidation 185 310 425 384 345 Financing Balance sheet total 26,382 26,043 26,845 22,017 20,858 Fixed assets 14,901 14,761 13,973 10,395 10,523 Investments in tangible fi xed assets 2,499 2,981 2,062 2,046 1,877 Capital base 7,624 7,541 7,399 7,101 6,448 Equity ratios (%) Capital base 29% 29% 28% 32% 31% Capital base + subordinate bond loan 33% 33% – – – Infl ow of raw milk Total million kg. -

Our Responsibility CORPORATE RESPONSIBILITY REPORT Arla Foods Is a Global Dairy Company Owned by More Than 11,200 Dairy Farmers in Seven European Countries

2017 Our Responsibility CORPORATE RESPONSIBILITY REPORT Arla Foods is a global dairy company owned by more than 11,200 dairy farmers in seven European countries. Our products are sold on 120 markets globally. Foreword. Åke Hantoft, Chairman, and Peder 02 Tuborgh, CEO, share their views on corporate responsibility. Arla’s foundation for sustainability. Starting with 04 our Code of Conduct, we will achieve our vision through our strategy. UN Sustainable Development Goals. We focus 06 our efforts on the goals on which we can have the biggest positive impact. Our contribution to society. We engage in 08 stakeholder dialogue and actively contribute to society. 480,000 In Denmark, Sweden, the UK and Germany, consumers can visit Arla farms to learn more about dairy production and to enjoy Open Farm and cows out to pasture events. More than 480,000 consumers visited farms through these events. 93 % 93 per cent of Arla® branded products fulfill our Nutrition Criteria. No. 1 Arla is the world’s largest producer of organic dairy products. 100 % 100 per cent of our production volume is manufactured at sites with GFSI (Global Food Safety Initiative) certification or similar. We believe sustainability and profitability go hand in hand, and that our dedication to being responsible will benefit our business. Health. We offer a wide range of tasty 10 dairy products and help consumers live healthier lives. Inspiration. We see inspiration in all 16 parts of Arla, from our farmer owners sharing experiences to consumers exploring our products. Natural. We maintain high animal 22 welfare and reduce climate and environmental impact all the way from cow to consumer. -

MILK and HEALTH in a SUSTAINABILITY PERSPECTIVE November 12–14, 2019

16th International Symposium on Milk Genomics and Human Health MILK AND HEALTH IN A SUSTAINABILITY PERSPECTIVE November 12–14, 2019 Radisson Blu Scandinavia Hotel Aarhus, Denmark Meet our Consortium-Level Sponsors Arla Foods amba Sønderhøj 14 8260 DK-Viby J Denmark Contact: Peter Langborg Wejse, Head of Open Innovation, Universities & Consortia Email: [email protected] Phone: +45 7217 7819 www.arlafoods.com Arla Foods is an international dairy company owned by 9,900 farmers from Denmark, Sweden, the UK, Germany, Belgium, Luxembourg and the Netherlands. Arla Foods is one of the leading players in the international dairy arena with well-known brands like Arla®, Lurpak®, Puck® and Castello®. Arla Foods is focused on providing good dairy nourishment from sustainable farming and operations and is also the world's largest manufacturer of organic dairy products. California Dairy Research Foundation (CDRF) 501 G Street, Suite 203 Davis, CA 95616 Contact: Denise Mullinax, Executive Director Email : [email protected] Phone : 530-753-0681 www.cdrf.org The California Dairy Research Foundation (CDRF) was created as a not-for-profit research corporation in 1988 for the purpose of promoting research and development activities that benefit California’s dairy producers and processors in the consumer marketplace. The organization is uniquely positioned to act as a link between industry and R&D institutions, and to lead the development of needed science-based research and education programs in critical areas. CDRF utilizes its independent structure to lead and deliver the best-practice research and science-based education programs to promote industry innovation and long-term sustainability. Close collaboration with associated industry organizations allows research outcomes to be fully communicated and utilized to maximize stakeholder benefits. -

42158 Arla Omslag GB

Arla Foods amba Annual Report 2001/02 Skanderborgvej 277 DK-8260 Viby J. Denmark tel. +45 89 38 10 00 fax +45 86 28 16 91 e-mail [email protected] www.arlafoods.com CVR-nr. 25 31 37 63 Design, production & print: Datagraf Auning AS, Denmark Annual Report 2001/02 Contents Key figures . 2 Managing financial risk at Arla Foods . 38 The Chairman’s report . 5 Accounts . 40 Report . 6 Accounting policies . 41 Changes in the production structure . 10 Profit & loss account . 45 Market reports Home markets . .13 Balance sheet . 46 European markets . .17 Overseas markets . .20 Equity movements . 48 Ingredients for the food industry . 24 Cash flow statement . 49 Relations with co-operative owners . 25 Notes . 50 Innovation . 27 Group companies . 56 Environmental considerations . 28 Arla Foods’ Supervisory Board . 58 Subsidiaries . 30 The people behind Arla Foods’ products. Lars Wamberg met some of them in Sweden, the UK and Denmark and photographed them in typical working situations. The photos were all shot under available light. Front cover: Jessica Russo, 22, a machine operator at Gothenburg Dairy for the past year, works with The product photos show some of the year’s new products. production of drinking milk and yoghurt. The numbers refer to the back flap of the report where there is a short description of the products. 3 The Chairman’s Report As a milk producer myself, I can the merger agreement, will adopt agricultural policies of the future, confirm that earnings from prima- a common milk price for co-oper- including the EU’s expansion ry production remain under pres- ative owners in both countries. -

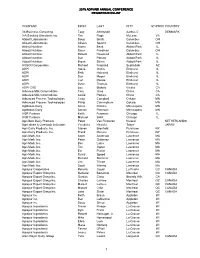

Final List.Xlsx

2015 ADPI/ABI ANNUAL CONFERENCE REGISTRATION LIST COMPANY FIRST LAST CITY ST/PROV COUNTRY 3A Business Consulting Tage Affertsholt Aarhus C DENMARK 3-A Sanitary Standards Inc. Tim Rugh McLean VA Abbott Laboratories Doug Smith Columbus OH Abbott Laboratories Allison Specht Columbus OH Abbott Nutrition Aaron Beak Abbott Park IL Abbott Nutrition Dana Friedman Columbus OH Abbott Nutrition Robert Hoaglund Abbott Park IL Abbott Nutrition Dan Potratz Abbott Park IL Abbott Nutrition Bryan Stirrat Abbott Park IL ACSON Corporation Richard Freeland Scottsdale AZ ADPI Steve Griffin Elmhurst IL ADPI Beth Holcomb Elmhurst IL ADPI Dan Meyer Elmhurst IL ADPI Carl Roode Elmhurst IL ADPI Dave Thomas Elmhurst IL ADPI COE Lee Blakely Visalia CA Advance Milk Commodities Tom Groe Chino CA Advance Milk Commodities Leslie Perkins Chino CA Advanced Process Technologies Craig Campbell Cokato MN Advanced Process Technologies Philip Cunningham Cokato MN AgMotion Dairy Steve Perkins Minneapolis MN AgMotion Dairy Steven Peterson Minneapolis MN AGR Partners Keith Freeman Chicago IL AGR Partners Michael Solot Chicago IL Agri-Best Dairy Products Peter Van Pinxteren Nuland NETHERLANDS Agriculture & Livestock Industries Yasuhisa Hiraishi Tokyo JAPAN Agri-Dairy Products, Inc. Steven Bronfield Purchase NY Agri-Dairy Products, Inc. Frank Reeves Purchase NY Agri-Mark, Inc. Scott Anderson Lawrence MA Agri-Mark, Inc. Peter Gutierrez Lawrence MA Agri-Mark, Inc. Ben Laine Lawrence MA Agri-Mark, Inc. Tim Opper Lawrence MA Agri-Mark, Inc. Ed Pcolar Lawrence MA Agri-Mark, Inc. David Speed Lawrence MA Agri-Mark, Inc. Richard Stammer Lawrence MA Agri-Mark, Inc. Jim Tringe Lawrence MA Agri-Mark, Inc. Scott Werme Lawrence MA Agropur Cooperative Reneck Cayen La Prairie QC CANADA Agropur Export Group Inc. -

Creating Value in a Year Like No Other

CREATING VALUE IN A YEAR LIKE NO OTHER CONSOLIDATED ANNUAL REPORT 2020 ViN SiO TABle OF contents MANAGEMENT reviEW OUR GOVERNANCE C REATE the 03 2020 Performance at a glance 38 Governance framework 04 CEO and Chairman letters 40 Diversity and inclusion FUTURE OF DAiRY 05 Message from the Chairman: 42 Board of Directors A busy and challenging year 45 Executive Management Team 06 Message from the CEO: Creating value 47 Management remuneration TO BRiNG health and in a year like no other 48 Responsible and transparent tax practices 07 Highlights 49 Risk and compliance management iNSPiRATiON TO the 10 Five year overview WORLD, naturally. OUR PERFORMANCE ReviEW OUR strategy 56 Market overview 12 Business model 57 Performance review 13 Good Growth 2020 strategy 61 Financial outlook 16 Creating efficiencies with Calcium programme 18 Embracing change: Major trends OUR CONSOLidated and strategic responses FiNANCiAL STATEMENTS 20 Dealing with Brexit 63 Primary financial statements 21 Essential business priorities for 2020 73 Notes OUR BRANDS AND OUR CONSOLidated CommerciAL SEGMENTS ENVironmental, SociAL 23 Brands AND GOVERNANCE DATA 25 Europe 120 Primary statements 27 International 123 Notes 29 Arla Foods Ingredients 30 Global Industry Sales 135 Glossary 137 Corporate calendar OUR ResponsiBiLiTY 32 Sustainability strategy 33 Environmental ambition 34 Climate Checks on farms 35 Facilitating better animal welfare 36 International dairy development Management Review Our Strategy Our Brands and Commercial Segments Our Responsibility Our Governance Our -

What Impact Did the Muhammad Crisis Have on Arla Foods' Brand in Denmark?

Aalborg University What impact did the Muhammad Crisis have on Arla Foods’ brand in Denmark? Christian Munk CCG 10. Sem Page 1 of 68 Aalborg University Title Page Name: Christian Munk Subject of study: CCG – 10. Sem Name of project: What impact did the Muhammad Crisis have on Arla Foods’ brand in Denmark? Supervisor: Lars Ib Pages: 54,8 pages (131423 characters) Signature:________________________________ Christian Munk CCG 10. Sem Page 2 of 68 Aalborg University Abstract This thesis investigates how an external factor can influence consumers’ perceptions of a well-established brand. In this thesis, it is investigated if the Muhammad Crisis has had an influence on the then much-criticized Arla brand in Denmark. This implies a combination of principles, values and associations that might have an impact on consumers’ feelings towards the company and its products. Consequently, branding concepts such as brand equity, image, loyalty and reputation will be discussed in order to collect correct data and relate it to the case. The case refers to how Arla Foods was drawn into the Muhammad Crisis a victim, and it will be analyzed how the crisis affected how the media portrays Arla Foods and if it has change consumers’ feelings towards the company. In order to assure as high reliability and validity as possible, both secondary and primary data will be collected. The secondary data consist of e.g. articles written by the press from before, during and after the crisis and annual reports and press releases from Arla Foods’ own archives. Because this thesis also deals with consumer perception and feelings, the primary data consist of in-depth interviews with consumers as well as a journalist, co-op manager and a sales director at Thise Mejeri. -

Driving Innovation in Dairy

CONSOLIDATED ANNUAL REPORT 2017 Arla Foods Consolidated Annual Report 2017 Consolidated Annual Report Arla Foods Driving innovation in dairy Content MANAGEMENT REVIEW As people all over the world 04 Performance at a glance 06 Message from the Chairman of the Board of Directors are focusing on obtaining the 08 Message from the CEO 10 Highlights 12 Financial overview most out of life, a healthy 13 Business priorities 2017 Our Strategy lifestyle is becoming the new 16 Good Growth 2020 18 Trends in the world around us 20 Responding to change normal. How we fuel ourselves 22 Business priorities 2018 Our Brands and and our families starts by what Commercial Segments 26 Arla® we find in our fridge. 28 Lurpak® 29 Castello® 29 Puck® 30 Europe 32 International 34 Arla Foods Ingredients At Arla, we create innovative 35 Trading Our Cooperative products that delight consumers 38 Our business model 40 Arlagården® quality programme 42 Code of conduct and help them live a balanced 43 Compliance 44 Corporate responsibility 46 Risk management and healthier life. We push 48 Our risk landscape 50 Preparing for Brexit the boundaries of science and 51 Our tax affairs Our Governance technology to build a bright 54 Governance framework 56 Executive Management Team 58 Board of Directors future for dairy, and natural 60 Management remuneration 61 Diversity and inclusion food for everyone. Our Financial Review 64 Market overview 66 Financial review 72 Financial outlook CONSOLIDATED FINANCIAL STATEMENTS 74 Primary financial statements 84 Statement by the Board of Directors and the Executive Board 85 Notes Project management: Corporate external reporting, Arla. -

ANNUAL REPORT 2007 Financial Highlights Financial Highlights

ANNUAL REPORT Arla Foods is committed to fulfilling the needs and wishes of consumers. This enables us to maximise value in the market and pay our owners 2007 the highest possible price for their milk. FINANCIAL HIGHLIGHTS Financial highlights Group DKK million 01.01.2007 2006-01-01 01.10.20051) 01.10.2004 01.10.2003 31.12.2007 2006-31-12 31.12.2005 30.09.2005 30.09.2004 Profit Revenue 47,742 45,491 11,487 46,351 47,263 Outside DK/SE 29,339 27,393 6,955 27,784 28,137 % outside DK/SE 61% 60% 61% 60% 60% Operating profit 1,520 1,161 113 1,459 1,193 Net financial items –562 –409 –124 –573 –423 Profit for the year 938 933 30 755 1,019 Supplementary payments 503 336 75 369 586 Consolidation Reconsolidation acc. to the articles of association 121 122 0 247 123 Change in policy 0 91 –45 –46 – Delivery-based owner certificates 174 184 0 185 – Strategy fund 140 200 – – – Other consolidation 0 0 0 0 310 Financing Total assets 30,725 26,611 27,057 26,336 26,043 Fixed assets 17,473 15,762 15,682 15,593 15,441 Investments in property, plant and equipment 1,895 1,792 599 2,499 2,981 Equity 8,145 7,971 7,411 7,435 7,361 Equity ratios (%) Equity 27% 30% 27% 28% 28% Equity + subordinate bond loan 30% 34% 31% 32% 32% Inflow of raw milk Total million kg. weighed in in the group 8,360 8,592 2,063 8,415 8,512 Members in DK 3,976 4,047 970 4,058 4,053 Members in SE 1,957 2,067 499 2,114 2,141 Others 2,427 2,478 594 2,243 2,318 Number of members In DK 4,170 4,591 4,987 5,197 5,877 In SE 4,352 4,817 5,288 5,360 5,728 Total 8,522 9,408 10,275 10,557 11,605 Employees Average number of full-time employees 16 559 17 933 19 356 20 076 20 855 1) As from 2006, the financial year was changed to follow the calendar year, the period 1 October – 31 December 2005 being the transitional period. -

Our Responsibility Arla Foods’ Corporate Social Responsibility Report 2007 Contents

our responsibility ARLA FOODS’ CORPORATE SOCIAL RESPONSIBILITY REPORT 2007 contents ABOUT ARLA FOODS 4 BUSINESS PRINCIPLES 6 OPERATIONAL PRINCIPLES 8 FOOD SAFETY 10 FOOD AND HEALTH 12 Interview: Food and health 14 ENVIRONMENT AND CLIMATE 16 Interview: Environment and climate 18 AGRICULTURE 20 Interview: Agriculture 22 PROCUREMENT 24 WORKPLACE 26 Interview: Workplace 28 MARKET CONDUCT 30 COMMUNITY RELATIONS 32 HUMAN RIGHTS 34 Unless otherwise indicated, this report concerns the Arla Foods Group’s activities in 2007.The term home markets refers to Denmark, Sweden and the UK. More information is available at www.arlafoods.com ©Arla Foods amba, 2008 Project coordination: Arla Foods Project manager: Anna Michélsen Text: Arla Foods in collaboration with Anna Michélsen Graphic form: Waldton Translations: Amesto Translations Photography: ©Getty Images (cover, page 2, 6, 8, 10, 16, 24, 30, 34), ©Nordic Photos (page 12, 32), Niels Åge Skovbo (page 14, 18), ©Johnér (page 26), Jonas Ahlstrøm (page 22, 23), Lasse Hejdenberg (page 28). Printing: Scanprint, 2008 2 taking responsibility means taking a stand Welcome to a new type of report from Arla Foods. For the first time, we are reporting on the progress we have made on our corporate social responsibility commitments. Arla Foods’ mission is to offer modern consumers milk-based food products that contribute inspiration, confidence and well-being. We understand that today’s consumers are not only interested in our products; they also expect our company to demonstrate social, environmental and ethical responsibility. For this reason, we feel that it is appropriate for us to describe how we understand our role and our position on key issues.