Analytics for an Online Retailer: Demand Forecasting and Price Optimization

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monopolistic Competition and Oligopoly Monopolistic Competition (獨占性競爭) an Introduction to Oligopoly (寡占) Models of Oligopoly

Monopolistic Competition and Oligopoly Monopolistic Competition (獨占性競爭) An introduction to Oligopoly (寡占) Models of Oligopoly © 2003 South-Western/Thomson Learning 1 Characteristics of Monopolistic Competition Many producers offer products: close substitutes but not identical Supplier has power over price Price makers Low barriers to enter In the long run can enter/leave Sellers act independently of each other 2 1 Product Differentiation In perfect competition, product is homogenous In Monopolistic competition, Sellers differentiate products in four basic ways Physical differences and qualities • Shampoo: size, color, focus normal (dry) hair … Location • The number of variety of locations – Shopping mall: cheap, variety of goods – Convenience stores: convenience Accompanying services • Ex: Product demonstration, money back/no return Product image • Ex: High quality, natural ingredients … 3 Short-Run Profit Maximization or Loss Minimization Because products are different Each firm has some control over price demand curve slopes downward Many firms sell close substitutes, Raises price Æ lose customers Demand is more elastic than monopolist’s but less elastic than a perfect competitors 4 2 Price Elasticity of Demand The elasticity demand depends on The number of rival firms that produce similar products The firm’s ability to differentiate its product more elastic: if more competing firms Less elastic: differentiated product 5 Profit Maximization as MR=MC The downward-sloping demand curve MR curve • slopes downward and • below the demand curve Cost curves are similar to those developed before Next slide depicts the relevant curves for the monopolistic competitor 6 3 Profit Maximization In the short run, if revenue >variable cost Profits are max. as MR=MC. -

Price Bargaining and Competition in Online Platforms: an Empirical Analysis of the Daily Deal Market

Price Bargaining and Competition in Online Platforms: An Empirical Analysis of the Daily Deal Market Lingling Zhang Doug J. Chung Working Paper 16-107 Price Bargaining and Channel Selection in Online Platforms: An Empirical Analysis of the Daily Deal Market Lingling Zhang University of Maryland Doug J. Chung Harvard Business School Working Paper 16-107 Copyright © 2016, 2018, 2019 by Lingling Zhang and Doug J. Chung Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Funding for this research was provided by Harvard Business School and the institution(s) of any co-author(s) listed above. Price Bargaining and Competition in Online Platforms: An Empirical Analysis of the Daily Deal Market Lingling Zhang Robert H. Smith School of Business, University of Maryland, College Park, MD 20742, United States, [email protected] Doug J. Chung Harvard Business School, Harvard University, Boston, MA 02163, United States, [email protected] Abstract The prevalence of online platforms opens new doors to traditional businesses for customer reach and revenue growth. This research investigates platform competition in a setting where prices are determined by negotiations between platforms and businesses. We compile a unique and comprehensive data set from the U.S. daily deal market, where merchants offer deals to generate revenues and attract new customers. We specify and estimate a two-stage supply-side model in which platforms and merchants bargain on the wholesale price of deals. -

February 2017 New York State Bar Examination MEE & MPT Questions

February 2017 New York State Bar Examination MEE & MPT Questions © 2017 National Conference of Bar Examiners MEE 1 On June 15, a professional cook had a conversation with her neighbor, an amateur gardener with no business experience who grew tomatoes for home use and to give to relatives. During the conversation, the cook mentioned that she might be interested in “branching out into making salsa” and that, if she did branch out, she would need to buy large quantities of tomatoes. Although the gardener had never sold tomatoes before, he told the cook that, if she wanted to buy tomatoes for salsa, he would be willing to sell her all the tomatoes he grew in his half-acre home garden that summer for $25 per bushel. Later on June 15, shortly after this conversation, the cook said to the gardener, “I’m very interested in the possibility of buying tomatoes from you.” She then handed a document to the gardener and asked him to sign it. The document stated, “I offer to sell to [the cook] all the tomatoes I grow in my home garden this summer for $25 per bushel. I will hold this offer open for 14 days.” The gardener signed the document and handed it back to the cook. On June 19, the proprietor of a farmers’ market offered to buy all the tomatoes that the gardener grew in his home garden that summer for $35 per bushel. The gardener, happy about the chance to make more money, agreed, and the parties entered into a contract for the gardener to sell his tomatoes to the proprietor. -

The International Record Company Discography

The International Record Company Discography Second Edition Allan Sutton Data Compiled by William R. Bryant and The Record Research Associates Contributors Mark McDaniel, Ryan Barna, and David Giovannoni Mainspring Press Online Editions This Edition Is Licensed for Personal Use Only Sale or Other Commercial Use Is Prohibited © 2021 by Allan R. Sutton. All rights are reserved. This publication is protected under U.S. copyright law as a work of original scholarship. It may downloaded free of charge for personal, non-commercial use only, subject to the following conditions: No portion of this work may be duplicated or distributed in any form, or by any means, including (but not limited to) print and digital media, transmission via the Internet, or conversion to and dissemination via digital archives, databases, or e-books. Sale or any other commercial or unauthorized duplication and distribution of this work, whether or not for monetary gain, is prohibited and will be addressed under applicable civil and/ or criminal statutes. For information on licensing this work, or for reproduction exceeding customary fair- use standards, please contact the publisher. Mainspring Press www.mainspringpress.com / [email protected] Using the Discography All titles were issued in single-sided form under the catalog numbers shown in the left column. Labels on which each selection are confirmed to have appeared are listed following the artist line. Unless otherwise noted in parentheses, corresponding issues use the identical catalog number. Given the rarity of these records, and the lack of original catalogs for most client labels, there are undoubtedly releases on other labels that have yet to be discovered. -

PRICE THEORY Price Theory Is a Microeconomics Principle That

PRICE THEORY Price theory is a microeconomics principle that involves the analysis of demand and supply in determining an appropriate price point for a good or service. This section is concerned with the study of prices and it forms the basis of economic theory. PRICE DEFINITION Price is the exchange value of a commodity expressed in monetary terms. OR Price is the monetary value of a good or service. For example the price of a mobile phone may be shs. 84,000/=. PRICE DETERMINATION Prices can be determined in different ways and these include; 1. Bargaining/ haggling. This involves the buyer negotiating with the seller until they reach an agreeable price. The seller starts with a higher price and the buyer starts with a lower price. During bargaining, the seller keeps on reducing the price and the buyer keeps on increasing until they agree on the same price. 2. Auctioning/ bidding This involves prospective buyers competing to buy a commodity through offering bids. The commodity is usually taken by the highest bidder. This method is common in fundraising especially in churches, disposal of public and company assets and sell of articles that sellers deem are treasured by the public. Note that the price arising out of an auction does not reflect the true value of the commodity. 3. Market forces of demand and supply. In this case, the price is determined at the point of intersection of the market forces of demand and supply. This is common in a free enterprise economy. The price set is called the equilibrium price. -

Applied Microeconomics: Consumption, Production and Markets David L

University of Kentucky UKnowledge Agricultural Economics Textbook Gallery Agricultural Economics 6-2012 Applied Microeconomics: Consumption, Production and Markets David L. Debertin University of Kentucky, [email protected] Right click to open a feedback form in a new tab to let us know how this document benefits oy u. Follow this and additional works at: https://uknowledge.uky.edu/agecon_textbooks Part of the Agricultural Economics Commons Recommended Citation Debertin, David L., "Applied Microeconomics: Consumption, Production and Markets" (2012). Agricultural Economics Textbook Gallery. 3. https://uknowledge.uky.edu/agecon_textbooks/3 This Book is brought to you for free and open access by the Agricultural Economics at UKnowledge. It has been accepted for inclusion in Agricultural Economics Textbook Gallery by an authorized administrator of UKnowledge. For more information, please contact [email protected]. __________________________ Applied Microeconomics Consumption, Production and Markets David L. Debertin ___________________________________ Applied Microeconomics Consumption, Production and Markets This is a microeconomic theory book designed for upper-division undergraduate students in economics and agricultural economics. This is a free pdf download of the entire book. As the author, I own the copyright. Amazon markets bound print copies of the book at amazon.com at a nominal price for classroom use. The book can also be ordered through college bookstores using the following ISBN numbers: ISBN‐13: 978‐1475244342 ISBN-10: 1475244347 Basic introductory college courses in microeconomics and differential calculus are the assumed prerequisites. The last, tenth, chapter of the book reviews some mathematical principles basic to the other chapters. All of the chapters contain many numerical examples and graphs developed from the numerical examples. -

Rub-A-Dub in the Hot

14 發光的城市 A R O U N D T O W N FRIDAY, AUGUST 28, 2009 • TAIPEI TIMES BY ALita RICKards MUSIC STOP Rub-a-dub in the hot tub here is a feeling of decadence when you We hope it will be fresh, with something sit in a hot tub with dozens of your closest for everyone.” friends (at least in terms of proximity) New electronic acts include The Soul Tdrinking a cocktail and bobbing to a DJ. Sweat and Swank Show, vDub, Genetically COMPILED BY Ian BartHOLOmeW Every act interviewed for this story Modified Beats, DJ Charles, Juni, Edify and mentioned the hot tub, with both bands and Supermilkmen, with returning favorites to such an extent that he called DJs playing at this weekend’s Lost Lagoon including Marcus Aurelius and Hooker. the marriage off, making the blowout at Wulai craving a soak as part of Two bands are flying in from Australia particularly hurtful comment that their party experience. to perform: electric glam rock solo artist he wasn’t sure if he loved Chu Add three natural spring-water FutureMan, and God’s Wounds. The latter enough to make the commitment swimming pools, a venue surrounded by formed last year and gained a residency at of marriage. mountains and lush foliage, free camping The Excelsior, in Sydney, with its Nintendo- Lau is not the only superstar and cabins with private hot tubs, and you influenced live punk-electro. Its influences who has worked hard to keep a have an event that combines the best of include car crashes, Japanese monster long-standing relationship secret. -

19-368 Ford Motor Co. V. Montana Eighth Judicial

(Slip Opinion) OCTOBER TERM, 2020 1 Syllabus NOTE: Where it is feasible, a syllabus (headnote) will be released, as is being done in connection with this case, at the time the opinion is issued. The syllabus constitutes no part of the opinion of the Court but has been prepared by the Reporter of Decisions for the convenience of the reader. See United States v. Detroit Timber & Lumber Co., 200 U. S. 321, 337. SUPREME COURT OF THE UNITED STATES Syllabus FORD MOTOR CO. v. MONTANA EIGHTH JUDICIAL DISTRICT COURT ET AL. CERTIORARI TO THE SUPREME COURT OF MONTANA No. 19–368. Argued October 7, 2020—Decided March 25, 2021* Ford Motor Company is a global auto company, incorporated in Delaware and headquartered in Michigan. Ford markets, sells, and services its products across the United States and overseas. The company also encourages a resale market for its vehicles. In each of these two cases, a state court exercised jurisdiction over Ford in a products-liability suit stemming from a car accident that injured a resident in the State. The first suit alleged that a 1996 Ford Explorer had malfunctioned, killing Markkaya Gullett near her home in Montana. In the second suit, Adam Bandemer claimed that he was injured in a collision on a Min- nesota road involving a defective 1994 Crown Victoria. Ford moved to dismiss both suits for lack of personal jurisdiction. It argued that each state court had jurisdiction only if the company’s conduct in the State had given rise to the plaintiff’s claims. And that causal link existed, according to Ford, only if the company had designed, manufactured, or sold in the State the particular vehicle involved in the accident. -

Introductory Price Elasticity

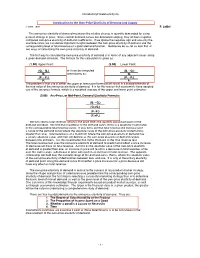

IntroductoryPriceElasticity.xls Introduction to the Own-Price Elasticity of Demand and Supply © 2003, 1999 P. LeBel The own-price elasticity of demand measures the relative change in quantity demanded for a one percent change in price. Since normal demand curves are downward-sloping, they all have negative computed own-price elasticity of demand coefficients. If we ignore the negative sign and use only the absolute value, we can derive important insights between the own-price elasticity of demand and the corresponding level of total revenue of a given demand function. Before we do so, let us look first at two ways of calculating the own-price elasticity of demand. The first way to calculate the own-price elasticity of demand is in terms of any adjacent values along a given demand schedule. The formula for this calculation is given as: (1.00) Upper Point: (2.00) Lower Point: (Q1 - Q2) or it can be computed (Q1 - Q2) Q1 alternatively as: Q2 (P1 - P2) (P1 - P2) P1 P2 The problem is that use of either the upper or lower point formulat will result in a biased estimate of the true value of the own-price elasticity of demand. It is for this reason that economists have adopted use of the arc-price formula, which is a weighted average of the upper and lower point estimates: (3.00) Arc-Price, or Mid-Point, Demand Elasticity Formula: (Q1 - Q2) (Q1+Q2) (P1-P2) (P1+P2) We turn next to total revenue, which is the price times the quantity along each point of the demand schedule. -

Competition-Based Dynamic Pricing in Online Retailing: a Methodology Validated with Field Experiments

Competition-Based Dynamic Pricing in Online Retailing: A Methodology Validated with Field Experiments Marshall Fisher The Wharton School, University of Pennsylvania, fi[email protected] Santiago Gallino Tuck School of Business, Dartmouth College, [email protected] Jun Li Ross School of Business, University of Michigan, [email protected] A retailer following a competition-based dynamic pricing strategy tracks competitors' price changes and then must answer the following questions: (1) Should the retailer respond? (2) If so, respond to whom? (3) How much of a response? (4) And on which products? The answers require unbiased measures of price elasticity as well as accurate knowledge of competitor significance and the extent to which consumers compare prices across retailers. To quantify these factors empirically, there are two key challenges: first, the endogeneity associated with almost any type of observational data, where prices are correlated with demand shocks observable to pricing managers but not to researchers; and second, the absence of competitor sales infor- mation, which prevents efficient estimation of a full consumer-choice model. We address the first issue by conducting a field experiment with randomized prices. We resolve the second issue by proposing a novel iden- tification strategy that exploits the retailer's own and competitors stock-outs as a valid source of variation to the consumer choice set. We estimate an empirical model capturing consumer choices among substitutable products from multiple retailers. Based on the estimates, we propose a best-response pricing strategy that takes into account consumer choice behavior, competitors' actions, and supply parameters (procurement costs, margin target, and manufacturer price restrictions). -

Microeconomics

MICROECONOMICS This book is a compilation from MBA 1304-Microeconomics Course. The copyright of the book belongs to Bangladesh Open University. The compiler is not liable for any copyright issue with this book. Compiled by: Md. Mahfuzur Rahman Assistant Professor (Economics) School of Business Bangladesh Open University School of Business BANGLADESH OPEN UNIVERSITY MICROECONOMICS 1 Contents Unit 1: Introduction Lesson 1: Nature and Methodology of Economics Lesson 2: The Basic Problems of an Economy Unit 2: Demand and Supply Lesson 1: Theory of Demand Lesson 2: Theory of Supply Lesson 3: Price Determination: Equilibrium of Demand and Supply Unit 3: Elasticity of Demand Lesson 1: Elasticity of Demand Unit-4: Consumer Behavior Lesson 1: Introduction Lesson 2: The Cardinal Utility Approach Lesson 3: Ordinal Utility Theory Indifference curves Unit-5: Production, Cost and Supply Lesson 1: Concepts Related to Production Lesson 2: Short-run and Long-run Cost Curves Lesson 3: Laws of Returns Unit 6: Perfect Competition Lesson 1: Characteristics of Perfect Competition, AR & MR Curves in Perfect Competition Lesson 2: Equilibrium of a Competitive Firm Unit 7: Monopoly Lesson 1: Nature of Monopoly Market and AR and MR Curves in Monopoly Market Lesson 2: Price and Output Determination under Monopoly: Equilibrium of Monopolist Lesson 3: Monopoly Power, Regulating the Monopoly and the Comparison between Competitive and Monopoly Markets Unit 8 Monopolistic Competition and Oligopoly Lesson 1: Monopolistic Competition Lesson 2: Oligopoly 2 Unit 1: INTRODUCTION -

Vanguard Label Discography Was Compiled Using Our Record Collections, Schwann Catalogs from 1953 to 1982, a Phono-Log from 1963, and Various Other Sources

Discography Of The Vanguard Label Vanguard Records was established in New York City in 1947. It was owned by Maynard and Seymour Solomon. The label released classical, folk, international, jazz, pop, spoken word, rhythm and blues and blues. Vanguard had a subsidiary called Bach Guild that released classical music. The Solomon brothers started the company with a loan of $10,000 from their family and rented a small office on 80 East 11th Street. The label was started just as the 33 1/3 RPM LP was just gaining popularity and Vanguard concentrated on LP’s. Vanguard commissioned recordings of five Bach Cantatas and those were the first releases on the label. As the long play market expanded Vanguard moved into other fields of music besides classical. The famed producer John Hammond (Discoverer of Robert Johnson, Bruce Springsteen Billie Holiday, Bob Dylan and Aretha Franklin) came in to supervise a jazz series called Jazz Showcase. The Solomon brothers’ politics was left leaning and many of the artists on Vanguard were black-listed by the House Un-American Activities Committive. Vanguard ignored the black-list of performers and had success with Cisco Houston, Paul Robeson and the Weavers. The Weavers were so successful that Vanguard moved more and more into the popular field. Folk music became the main focus of the label and the home of Joan Baez, Ian and Sylvia, Rooftop Singers, Ramblin’ Jack Elliott, Doc Watson, Country Joe and the Fish and many others. During the 1950’s and early 1960’s, a folk festival was held each year in Newport Rhode Island and Vanguard recorded and issued albums from the those events.