Zhejiang Geely Holding Group Co. Ltd. Assigned 'BBB-' Rating; Outlook Stable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

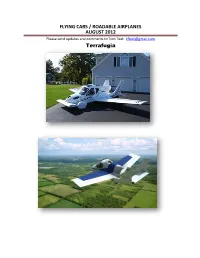

FLYING CARS / ROADABLE AIRPLANES AUGUST 2012 Please Send Updates and Comments to Tom Teel: [email protected] Terrafugia

FLYING CARS / ROADABLE AIRPLANES AUGUST 2012 Please send updates and comments to Tom Teel: [email protected] Terrafugia INTERNATIONAL FLYING CAR ASSOCIATION http://www.flyingcarassociation.com We'd like to welcome you to the International Flying Car Association. Our goal is to help advance the emerging flying car industry by creating a central resource for information and communication between those involved in the industry, news networks, governments, and those seeking further information worldwide. The flying car industry is in its formative stages, and so is IFCA. Until this site is fully completed, we'd like to recommend you visit one of these IFCA Accredited Sites. www.flyingcars.com www.flyingcarreviews.com www.flyingcarnews.com www.flyingcarforums.com REFERENCE INFORMATION Roadable Times http://www.roadabletimes.com Transformer - Coming to a Theater Near You? http://www.aviationweek.com/Blogs.aspx?plckBlo PARAJET AUTOMOTIVE - SKYCAR gId=Blog:a68cb417-3364-4fbf-a9dd- http://www.parajetautomotive.com/ 4feda680ec9c&plckController=Blog&plckBlogPage= In January 2009 the Parajet Skycar expedition BlogViewPost&newspaperUserId=a68cb417-3364- team, led by former British army officer Neil 4fbf-a9dd- Laughton and Skycar inventor Gilo Cardozo 4feda680ec9c&plckPostId=Blog%253aa68cb417- successfully completed its inaugural flight, an 3364-4fbf-a9dd- incredible journey from the picturesque 4feda680ec9cPost%253a6b784c89-7017-46e5- surroundings of London to Tombouctou. 80f9- Supported by an experienced team of overland 41a312539180&plckScript=blogScript&plckElement -

A New VTOL Propelled Wing for Flying Cars

A new VTOL propelled wing for flying cars: critical bibliographic analysis TRANCOSSI, Michele <http://orcid.org/0000-0002-7916-6278>, HUSSAIN, Mohammad, SHIVESH, Sharma and PASCOA, J Available from Sheffield Hallam University Research Archive (SHURA) at: http://shura.shu.ac.uk/16848/ This document is the author deposited version. You are advised to consult the publisher's version if you wish to cite from it. Published version TRANCOSSI, Michele, HUSSAIN, Mohammad, SHIVESH, Sharma and PASCOA, J (2017). A new VTOL propelled wing for flying cars: critical bibliographic analysis. SAE Technical Papers, 01 (2144), 1-14. Copyright and re-use policy See http://shura.shu.ac.uk/information.html Sheffield Hallam University Research Archive http://shura.shu.ac.uk 20XX-01-XXXX A new VTOL propelled wing for flying cars: critical bibliographic analysis Author, co-author (Do NOT enter this information. It will be pulled from participant tab in MyTechZone) Affiliation (Do NOT enter this information. It will be pulled from participant tab in MyTechZone) Abstract 2. acceleration of the fluid stream on the upper surface of the wing by mean of EDF propellers [13] that produces a much higher lift coefficient, with respect to any other aircrafts (up to 9-10); This paper is a preliminary step in the direction of the definition of a 3. very low stall speed (lower than 10m/s) and consequent increase radically new wing concept that has been conceived to maximize the of the flight envelope in the low speed domain up to 10÷12 m/s; lift even at low speeds. It is expected to equip new aerial vehicle 4. -

The the Roadable Aircraft Story

www.PDHcenter.com www.PDHonline.org Table of Contents What Next, Slide/s Part Description Flying Cars? 1N/ATitle 2 N/A Table of Contents 3~53 1 The Holy Grail 54~101 2 Learning to Fly The 102~155 3 The Challenge 156~194 4 Two Types Roadable 195~317 5 One Way or Another 318~427 6 Between the Wars Aircraft 428~456 7 The War Years 457~572 8 Post-War Story 573~636 9 Back to the Future 1 637~750 10 Next Generation 2 Part 1 Exceeding the Grasp The Holy Grail 3 4 “Ah, but a man’s reach should exceed his grasp, or what’s a heaven f?for? Robert Browning, Poet Above: caption: “The Cars of Tomorrow - 1958 Pontiac” Left: a “Flying Auto,” as featured on the 5 cover of Mechanics and Handi- 6 craft magazine, January 1937 © J.M. Syken 1 www.PDHcenter.com www.PDHonline.org Above: for decades, people have dreamed of flying cars. This con- ceptual design appeared in a ca. 1950s issue of Popular Mechanics The Future That Never Was magazine Left: cover of the Dec. 1947 issue of the French magazine Sciences et Techniques Pour Tous featur- ing GM’s “RocAtomic” Hovercar: “Powered by atomic energy, this vehicle has no wheels and floats a few centimeters above the road.” Designers of flying cars borrowed freely from this image; from 7 the giant nacelles and tail 8 fins to the bubble canopy. Tekhnika Molodezhi (“Tech- nology for the Youth”) is a Russian monthly science ma- gazine that’s been published since 1933. -

Geely Holding Group and Renault Group to Sign MOU on Joint Cooperation in China and South Korean Markets

Geely Holding Group and Renault Group to sign MOU on joint cooperation in China and South Korean Markets • Geely Holding and Renault Group have signed a MOU to accelerate ‘Renaulution Plan’ in China and South Korea. • In China, both partners will jointly introduce Renault-branded hybrid vehicles. • In South Korea, Geely Holding and Renault Group will explore localization of vehicles based on Lynk & Co energy efficient platforms. • Geely Holding and Renault Group will enhance their competitive advantages in technology and industrial systems to create leading mobility experience. 9th August 2021, Hangzhou China and Paris France. Renault Group, a global company with French roots and 120 years of history in the automotive industry, and Geely Holding Group, China’s largest privately-owned automotive group, today jointly announced an MoU framework agreement to create an innovative cooperation. The cooperation, focused on China and South Korea as initial key core markets, will allow Renault Group and Geely Holding to share resources and technologies. The focus will be on hybrid vehicles in the fast-growing Asian markets. Following the adoption by Geely Holding’s opensource strategy for its full vehicle architectures, Geely Holding will partner with Renault Group in the Chinese and Korean markets. In China, based on Geely Holding’s existing technologies and mature industrial footprint, both partners will jointly introduce Renault- branded hybrid vehicles. Renault will contribute on branding strategy, channel and service development, defining appropriate customer journey. In South Korea, where Renault Samsung Motors has over two decades of experience, the MoU allows Renault Group and Geely Holding to jointly explore localization of vehicles based on Lynk & Co’s energy-efficient vehicle platforms for local markets. -

Qwikconnect GLENAIR N Jan Uary 2013 N Vo Lu M E 17 N Numb Er 1 Qwikconnect

QwikConnect GLENAIR n Jan uary 2013 n Vo Lu m E 17 n Numb er 1 QwikConnect insulation, open-ended wire splices vulnerable to moisture, non-compliant repairs, deteriorated wiring, corrosion, improper installation, and contamination by metal shavings, dust, and flammable fluids. As a result of these findings, the Federal Aviation Administration initiated programs to improve safety related to wiring systems, and created training materials to define and describe wiring system design, installation, maintenance Chemical contamination — Chemicals such as hydraulic fluid, minimize fatigue. Wires should be plated to defend against and repair. fuel, waste system chemicals, cleaning agents, deicing fluids, surface oxidation. Elevated temperature degradation of tin- and even soft drinks can contribute to EWIS degradation. and silver-plated copper conductors will occur if they are A “Systems Approach” to Interconnect EWIS Degradation EWIS in the vicinity of these chemicals should be inspected for exposed to continuous high-temperature operation. Historically, wiring and interconnect components were Cabling damage or degradation. Hydraulic fluids, for example, are very While there is no “perfect” insulation system for aerospace installed in aircraft in a “fit and forget” manner—without Fixed wing and rotary aircraft manufacturers treat large, damaging to connector grommet and wire bundle clamps, wire and cable, the EWIS designer must consider the best much thought given to aging and degradation. The FAA interdependent equipment sets as systems: avionics, galleys, and can lead to indirect damage such as arcing and chafing. balance of properties (electrical, mechanical, chemical and outlines several variables in EWIS degradation including cabin lighting, HVAC, IFE, navigation, and so on. -

Air Taxi SOLUTIONS GLENAIR

GLENAIR • JULY 2021 • VOLUME 25 • NUMBER 3 LIGHTWEIGHT + RUGGED Interconnect AVIATION-GRADE Air Taxi SOLUTIONS GLENAIR Transitioning to renewable, green-energy fuel be harvested from 1 kilogram of an energy source. would need in excess of 6000 Tons of battery power much of this work includes all-electric as well as sources is an active, ongoing goal in virtually every For kerosene—the fuel of choice for rockets and to replace its 147 Tons of rocket fuel. And one can hybrid designs that leverage other sources of power industry. While the generation of low-carbon- aircraft—the energy density is 43 MJ/Kg (Mega only imagine the kind of lift design that would be such as small form-factor kerosene engines and footprint energy—from nuclear, natural gas, wind, Joules per kilogram). The “energy density” of the required to get that baby off the ground. hydrogen fuel cells. and solar—might someday be adequate to meet our lithium ion battery in the Tesla, on the other hand, And therein lies the challenge for the nascent air Indeed, it may turn out that the most viable air real-time energy requirements, the storage of such is about 1 MJ/kg—or over 40 times heavier than jet taxi or Urban Air Mobility (UAM) industry. In fact, the taxi designs are small jet engine configurations energy for future use is still a major hurdle limiting fuel for the same output of work. And yet the battery only realistic circumstance in which eVTOL air taxis augmented with backup battery power, similar in the wholesale shift to renewable power. -

Ano Desenvolvedor Modelos Status Motivo Foto 1917 Glenn Curtiss Curtiss Autoplane Falha Projeto Deixado De Lado Devido a 1ª

Ano Desenvolvedor Modelos Status Motivo Foto Projeto deixado Curtiss de lado devido a 1917 Glenn Curtiss Falha Autoplane 1ª Guerra Mundial Modo 1921 Rene Tampier Roadable Falha carro/avião não automatizado. Raúl Pateras Carro- Não há registros 1922 Falha Pescaras Cóptero de protótipos. Waldo Waterman 1937 - - Waterman Arrowbile Dixon Sem registro de 1940 Jess Dixon Falha Flying Car voo. Consumo excessivo de Governo Hafner 1944 Falha combustível e Britânico Rotabuggy operação complicada. Falta de 1945 Robert Fulton Airphibian Falha investidores. Acidente de voo Ted Hall que matou o 1947 ConvAirCar Falha Convair piloto e projetista. Taylor Existem versões 1949 Moulton Taylor Aerocar, Sucesso melhoradas. s200 Morte do 1953 Leland D. Bryan Autoplane Falha projetista em um voo de teste. Altura máxima 1957 David Dobbins Simcopter Falha do solo de 1,5m Grupo União Desenvolvido do - Européia Mycopter Conceito projeto conceito. (Concórscio) Eficiência menor Piasecki que um Piasecki 1957 VZ-8 Falha helicóptero no Helicopter Airgeep transporte de pessoas. Curtiss- 1958 Curtiss-Wright Wright VZ- Falha - 7 Carro Modelo Roy L. Clough, 1962 Voador do Conceito detalhado em Jr Futuro escala reduzida Sky - Aircar - Protótipo Technologies Henry Smolinski Morte dos 1971 AVE(Advanced AVE Mizar Falha projetistas em Vehicle voo teste. Engineers) Incapaz de 1974 Avro Aircraft Avrocar Falha alcançar os objetivos Está à venda Arlington Sky 1980 Protótipo protótipo deste Washington Commuter modelo. G150, Sem previsão G412, para o 1996 Gizio Conceito G440 e lançamento do G450 protótipo. Skycar Aguardando - Parajet Expedition, Sucesso liberação para SkyRunner produção. SkyRider - Macro/Alabama - Projeto X2R Moller Existem vários M100, protótipos em Moller 2002 M200G e Desenvolvimento teste, porém International M400 sem previsão de Skycar lançamento. -

Geely Auto 吉利汽车 (175 HK) ACCUMULATE

Hong Kong Equity | Automobile Company in-depth Geely Auto 吉利汽车 (175 HK) ACCUMULATE Sales Rebound Following Mid-2019 Weak Performance Share Price Target Price Geely ranked No. 7 among Chinese auto makers in 2018, according to CAAM. HK$15.36 HK$16.7 Though Geely’s sales volume declined in 2Q2019, it has recovered gradually since 9/2019 and sold 143,234 units (+1.1%/10% YoY/MoM) in 11/2019. We believe the launch of 6-8 new models in 2020E and fuel vehicles sales pick-up in China may China / Automobile / Auto Maker continue to boost its sales volume. Combined with rising contribution from mid-to-high end vehicles to support ASP, we estimate 2020E profit to improve by 9 December 2019 26% YoY to RMB11.3 bn. We initiate Accumulate with TP of HK$16.7, suggesting 9% upside potential. Alison Ho (SFC CE:BHL697) Sales decline narrowed down: Geely sales dropped significantly in 2Q2019 & 3Q2019 (852) 3519 1291 mainly due to 1) the implementation of China VI vehicle emission standard from [email protected] 1/Jul/2019 in some cities resulting in customers squeezing demand for new cars in 1H2019; 2) the uncertainties on relations between China and US; 3) economic downturn to drag consumer’s purchasing power. However, we saw Geely’s auto sales decline has Latest Key Data narrowed since 9/2019 and recorded a growth of 1.1% yoy in 11/2019. Under Total shares outstanding (mn) 9,146 consideration that December and January are regarded as the high season for auto sales, Market capitalization (HK$mn) 140,476 with customers traditionally making purchases before Chinese New Year, we therefore Enterprise value (HK$mn) 126,335 believe Geely’s auto sales growth will keep improving in the near future. -

Geely Holding to Acquire Cevian Capital's Shares in AB Volvo

Press release December 27, 2017 Geely Holding to acquire Cevian Capital’s shares in AB Volvo • In an agreement announced today, Cevian Capital has agreed to sell its entire shareholding in AB Volvo (“Volvo” or the “Company”) and Zhejiang Geely Holding Group (“Geely Holding”) has committed to acquire the shares following necessary regulatory approvals. • The acquisition of AB Volvo shares comprises 88.47 million A-shares and 78.77 million B-shares, corresponding to 8.2 per cent of the capital and 15.6 per cent of the votes, which represents the largest ownership in AB Volvo by capital and the second largest by votes1. • Nomura International Plc and Barclays Capital Securities Limited have agreed to acquire Cevian Capital’s shares in AB Volvo and committed to sell the shares to Geely Holding, following necessary regulatory approvals. Cevian Capital’s co-founder, Christer Gardell, said: “Today’s announcement concludes over 11 years’ ownership in AB Volvo by Cevian Capital. During Cevian Capital’s ownership, AB Volvo has been transformed into a more competitive and valuable company, through strengthened governance, improved efficiency and increased focus on its core business. This is reflected in structurally improved profitability and a higher market value. We are proud to have played a role in this positive development.” “AB Volvo is now leading the industry into a new era. The agreement will not only give AB Volvo a new large and committed shareholder, but one with significant expertise in strategically important areas for future value-creation, such as electrification, autonomous driving, connectivity and the Chinese market.” Geely Holding Chairman Li Shufu said: “We are delighted to have reached agreement with Cevian to acquire its holding in AB Volvo, making us the largest shareholder by capital in a company that leads the world in many aspects of commercial vehicle development, manufacturing and sales. -

The Dispatcher

The Dispatcher Telematics Industry Insights by Michael L. Sena April 2018 – Volume 5, issue 6 In this issue: The Future Networked Car - Geneva Notes from the Future Networked Car Symposium Dispatch Central Geneva Motor Show European Car of the Year VW’s CEO on Diesels Broadcom Broadsided Zetsche’s Photo Op Dissent and a Death Another Geely Deal What is Geely’s Chairman up to? Are We Ready to Fly? Options for Personal Aerial Transport Musings Do we really need to choose between diesel engines and tofu? Winter arrived in most of Europe at the end of February. Below is London on the 28th of February. I wonder if the buses had on their winter tyres or if they just slip slided along the unplowed roadways. The Dispatcher Telematics Industry Insights by Michael L. Sena April 2018 – Volume 5, issue 6 The Future Networked Car – 8 March 2018 THE ITU/UNECE SYMPOSIUM ON "THE FUTURE NETWORKED CAR (FNC-2018)" was held in Geneva, Switzerland at the Palexpo on 8 March 2018. It is an annual conference that has been held since 2005, and it is always co-located with the Geneva International Motor Show. Launched by the International Telecommunication Union (ITU), the Symposium was co-organized with the sister international organizations ISO (International Organization for Standardization) and IEC (International Electrotechnical Commission) until 2013. Five years ago, UNECE (United Nations Economic Commission for Europe) joined the ITU as co-organizer of the Symposium. Your Editor was there this year as both an interested listener and a session moderator. This was the third time I attended. -

Geely Holding Group Corporate Social Responsibility Report

Geely Holding Group 2019 CSR Corporate Social Responsibility Report CSR 2019 - - Geely Holding Group Corporate Social Responsibility Report 1 2 Geely Holding Group 2019 CSR Corporate Social Responsibility Report About this report 1 Overview of Geely 17 Respecting, supporting and providing 45 Integration and co-existence with 59 Organisation chart 18 happy lives to people the environment Geely’s 2019 Timeline 22 Responsibility focus 45 Responsibility focus 59 Maintaining a strategic determi- 3 Honours and social evaluation 23 Multi-pronged approach to ensure 45 Multi-line approach for and accel- 60 nation and strengthening confi- workers' rights eration of the new energy strategy dence to advance a high-quali- Being people-oriented and caring for 47 upgrade ty development Responsible management 25 employee’s occupational health and Redefining Geely’s green factories 62 Governance Structure 25 safety Challenging the zero-CO2 emissions 63 Compliance management 26 Finding the formula for talent cultiva- 47 lifecycle Building smart city solutions 5 Corporate Social Responsibility 27 tion and designing intelligent travel Management Sharing and caring to enhance the 49 Let society experience love 65 blueprints employees’ happiness Responsibility focus 65 Integration across disciplines, deep- 66 Making fine cars for everyone 33 Growing with partners 53 ening philanthropic work Good engine makes great work 10 Responsibility focus 33 Responsibility focus 53 Encouraging ingenuity, solidifying 67 while precision at the micron Building a community -

Charlie Kingdollar MARCH 2018

Charlie Kingdollar MARCH 2018 1 Follow Charlie on: ckingdollar.com Charlie Kingdollar Emerging Issues | Charlie Kingdollar 2 The Future of Auto Driverless Cars / Autonomous Vehicles Tesla Nissan www.hellmotor.com www.cityam.com Mercedes Google www.pcmag.com www.google.com Emerging Issues | Charlie Kingdollar Proprietary and Confidential | © General Reinsurance Corporation 3 The Future of Auto May 18, 2017 44 Corporations Working On Autonomous Vehicles Apple Ford Man SoftBank Group Audi GM Mercedes-Benz TATA ELXSI Autoliv Honda Microsoft Tesla Baidu Huawei Mobileye Toyota BMW Hyundai Nissan Valeo Bosch Intel Renault Volkswagen DAF IVECO Nvidia Volvo Daimler Jaguar PACCAR Waymo Delphi Land Rover PSA Groupe Yutong DiDi Lyft Samsung FCA Magna Scania Source: CBINSIGHTS Emerging Issues | Charlie Kingdollar Proprietary and Confidential | © General Reinsurance Corporation 4 The Future of Auto Notable Acquisitions in the Autonomous Vehicle Space Company Name Company Acquired Deal Value Closing Date Intel Mobileye $15.3 Billion 8/2017 Uber Otto $680 Million 8/2016 Verizon Telogis $900 Million 7/2016 Intel Itseez Undisclosed 5/2016 General Motors Cruise Automation $581 Million 5/2016 Lear Corporation Arada Systems Undisclosed 11/2015 Freescale CogniVue Undisclosed 9/2015 Delphi Ottomatika $35 Million 7/2015 Ambarella VisLab $30 Million 7/2015 Delphi Nutonomy $450 Million 10/2017 Source: KPMG, 6/2017 Emerging Issues | Charlie Kingdollar Proprietary and Confidential | © General Reinsurance Corporation 5 The Future of Auto Where are driverless vehicles already on roads? WA OR NY MI PA OH NV DC VA CA AZ TX FL Emerging Issues | Charlie Kingdollar Proprietary and Confidential | © General Reinsurance Corporation 6 The Future of Auto Autonomous Vehicles Legislation According to the National Conference of State Legislatures, self-driving legislation has been adopted in 24 states and Washington, D.C.