A New BBC Three Channel: Public Interest Test

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Verizon Fios Channel Guide

1/14/2020 Extreme HD Print 344 Ch, 151 HD # A 169 A Wealth of Entertainment 669 A Wealth of Entertainment HD 181 A&E 681 A&E HD 571 ACC Network HD 119 AccuWeather DC MD VA 619 AccuWeather DC MD VA HD 424 Action Max 924 Action Max HD 425 Action Max West 231 AMC 731 AMC HD 125 American Heroes Channel 625 American Heroes Channel HD 130 Animal Planet 630 Animal Planet HD 215 AXS tv 569 AXS tv HD # B 765 BabyFirst HD 189 BBC America 689 BBC America HD 107 BBC World News 609 BBC World News HD 596 beIN Sports HD 270 BET 225 BET Gospel 770 BET HD 213 BET Jams 219 BET Soul 330 Big Ten 1 331 Big Ten 2 Programming Service offered in each package are subject to change and not all programming Included Channel Premium Available For Additional Cost services will be available at all times, Blackout restrictions apply. 1/15 1/14/2020 Extreme HD Print 344 Ch, 151 HD 333 Big Ten 3 85 Big Ten Network 585 Big Ten Network HD 258 Boomerang Brambleton Community 42 Access [HOA] 185 Bravo 685 Bravo HD 951 Brazzers 290 BYU Television # C 109 C-SPAN 110 C-SPAN 2 111 C-SPAN 3 599 Cars.TV HD 257 Cartoon Network 757 Cartoon Network HD 94 CBS Sports Network 594 CBS Sports Network HD 277 CGTN 420 Cinemax 920 Cinemax HD 421 Cinemax West 921 Cinemax West HD 236 Cinémoi 221 CMT 721 CMT HD 222 CMT Music 102 CNBC 602 CNBC HD+ 100 CNN 600 CNN HD 105 CNN International 190 Comedy Central 690 Comedy Central HD 695 Comedy.TV HD 163 Cooking Channel 663 Cooking Channel HD Programming Service offered in each package are subject to change and not all programming Included Channel Premium Available For Additional Cost services will be available at all times, Blackout restrictions apply. -

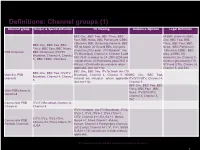

PSB Report Definitions

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

Gigabit-Broadband in the UK: Government Targets and Policy

BRIEFING PAPER Number CBP 8392, 30 April 2021 Gigabit-broadband in the By Georgina Hutton UK: Government targets and policy Contents: 1. Gigabit-capable broadband: what and why? 2. Gigabit-capable broadband in the UK 3. Government targets 4. Government policy: promoting a competitive market 5. Policy reforms to help build gigabit infrastructure Glossary www.parliament.uk/commons-library | intranet.parliament.uk/commons-library | [email protected] | @commonslibrary 2 Gigabit-broadband in the UK: Government targets and policy Contents Summary 3 1. Gigabit-capable broadband: what and why? 5 1.1 Background: superfast broadband 5 1.2 Do we need a digital infrastructure upgrade? 5 1.3 What is gigabit-capable broadband? 7 1.4 Is telecommunications a reserved power? 8 2. Gigabit-capable broadband in the UK 9 International comparisons 11 3. Government targets 12 3.1 May Government target (2018) 12 3.2 Johnson Government 12 4. Government policy: promoting a competitive market 16 4.1 Government policy approach 16 4.2 How much will a nationwide gigabit-capable network cost? 17 4.3 What can a competitive market deliver? 17 4.4 Where are commercial providers building networks? 18 5. Policy reforms to help build gigabit infrastructure 20 5.1 “Barrier Busting Task Force” 20 5.2 Fibre broadband to new builds 22 5.3 Tax relief 24 5.4 Ofcom’s work in promoting gigabit-broadband 25 5.5 Consumer take-up 27 5.6 Retiring the copper network 28 Glossary 31 ` Contributing Authors: Carl Baker, Section 2, Broadband coverage statistics Cover page image copyright: Blue Fiber by Michael Wyszomierski. -

The Speakers and Chairs 2016

WEDNESDAY 24 FESTIVAL AT A GLANCE 09:30-09:45 10:00-11:00 BREAK BREAK 11:45-12:45 BREAK 13:45-14:45 BREAK 15:30-16:30 BREAK 18:00-19:00 19:00-21:30 20:50-21:45 THE SPEAKERS AND CHAIRS 2016 SA The Rolling BT “Feed The 11:00-11:20 11:00-11:45 P Edinburgh 12:45-13:45 P Meet the 14:45-15:30 P Meet the MK London 2012 16:30-17:00 The MacTaggart ITV Opening Night FH People Hills Chorus Beast” Welcome F Revealed: The T Breakout Does… T Breakout Controller: T Creative Diversity Controller: to Rio 2016: SA Margaritas Lecture: Drinks Reception Just Do Nothing Joanna Abeyie David Brindley Craig Doyle Sara Geater Louise Holmes Alison Kirkham Antony Mayfield Craig Orr Peter Salmon Alan Tyler Breakfast Hottest Trends session: An App Taskmaster session: Charlotte Moore, Network Drinks: Jay Hunt, The Superhumans’ and music Shane Smith The Balmoral screening with Thursday 14.20 - 14.55 Wednesday 15:30-16:30 Thursday 15:00-16:00 Thursday 11:00-11:30 Thursday 09:45-10:45 Wednesday 15:30-16:30 Wednesday 12:50-13:40 Thursday 09:45-10:45 Thursday 10:45-11:30 Wednesday 11:45-12:45 The Tinto The Moorfoot/Kilsyth The Fintry The Tinto The Sidlaw The Fintry The Tinto The Sidlaw The Networking Lounge 10:00-11:30 in TV Formats for Success: Why Branded Content BBC A Little Less Channel 4 Struggle For The Edinburgh Hotel talent Q&A The Pentland Digital is Key in – Big Cash but Conversation, Equality Playhouse F Have I Got F Winning in F Confessions of FH Porridge Adam Abramson Dan Brooke Christiana Ebohon-Green Sam Glynne Alex Horne Thursday 11:30-12:30 Anne Mensah Cathy -

Sky Corporate Responsibility Review 2005–06

13671_COVER.qxd 15/8/06 1:54 pm Page 1 British Sky Broadcasting Group plc GRANT WAY, ISLEWORTH, Sky Corporate Responsibility Review 2005–06 MIDDLESEX TW7 5QD, ENGLAND TELEPHONE 0870 240 3000 British Sky Broadcasting Group plc FACSIMILE 0870 240 3060 WWW.SKY.COM REGISTERED IN ENGLAND NO. 2247735 British Sky Broadcasting Group plc Group Broadcasting Sky British Corporate ResponsibilityCorporate 2005–06 Review 13671_COVER.qxd 21/8/06 1:26 pm Page 49 WHAT DO YOU WANT TO KNOW? GRI INDICATORS THE GLOBAL REPORTING INITIATIVE (GRI) GUIDELINES IS A FRAMEWORK FOR VOLUNTARY REPORTING ON AN ORGANISATION’S CORPORATE RESPONSIBILITY PERFORMANCE. THE FOLLOWING TABLE SHOWS WHERE WE HAVE REPORTED AGAINST THESE GUIDELINES. We’re inviting you to find out more about Sky. This table shows you where to find the information you’re interested in. SECTION SEE PAGE GRI INDICATORS WELCOME TO SKY A broader view.......................................4 A major commitment.............................5 INSIDE FRONT COVER/CONTENTS 2.10, 2.11, 2.12, 2.22, S04 Business overview..................................6 Talking to our stakeholders....................8 LETTER FROM THE CEO 1 1.2 WELCOME TO SKY 3 1.1, 2.2, 2.4, 2.5, 2.7, 2.8, 2.9, 2.13, 2.14, 3.9, 3.10, 3.11, 3.12, 3.15, EC1, LA4, S01 Choice and control................................12 BUILDING ON OUR BUILDING ON OUR FOUNDATIONS 11 2.19, 3.15, 3.16, EN3, EN17, EN4, EN19, EN5, EN8, EN11, PR8 FOUNDATIONS In touch with the odds.........................14 Customer service..................................15 Our environment..................................16 -

FREEVIEW DTT Multiplexes (UK Inc NI) Incorporating Planned Local TV and Temporary HD Muxes

As at 07 December 2020 FREEVIEW DTT Multiplexes (UK inc NI) incorporating planned Local TV and Temporary HD muxes 3PSB: Available from all transmitters (*primary and relay) 3 COM: From *80 primary transmitters only Temp HD - 25 Transmiters BBC A (PSB1) BBC A (PSB1) continued BBC B (PSB3) HD SDN (COM4) ARQIVA A (COM5) ARQIVA B (COM6) ARQIVA C (COM7) HD ARQIVA D (COM8) HD LCN LCN LCN LCN LCN LCN LCN 1 BBC ONE 65 TBN UK 12 QUEST 11 Sky Arts 22 Ideal World 64 Free Sports BBC RADIO: 1 BBC ONE NI Cambridge, Lincolnshire, 74 Shopping Quarter 13 E4 (Wales only) 17 Really 23 Dave ja vu 70 Quest Red+1 722 Merseyside, Oxford, 1 BBC ONE Scot Solent, Somerset, Surrey, 101 BBC 1 Scot HD 16 QVC 19 Dave 26 Yesterday 83 NOW XMAS Tyne Tees, WM 1 BBC ONE Wales 101 BBC 1 Wales HD 20 Drama 30 4Music 33 Sony Movies 86 More4+1 2 BBC TWO 101 BBC ONE HD 21 5 USA 35 Pick 36 QVC Beauty 88 TogetherTV+1 (00:00-21:00) 2 BBC TWO NI BBC RADIO: 101 BBC ONE NI HD 27 ITVBe 39 Quest Red 37 QVC Style 93 PBS America+1 726 BBC Solent Dorset 2 BBC TWO Wales BBC Stoke 102 BBC 2 Wales HD 28 ITV2 +1 42 Food Network 38 DMAX 96 Forces TV 7 BBC ALBA (Scot only) 102 BBC TWO HD 31 5 STAR 44 Gems TV 40 CBS Justice 106 BBC FOUR HD 9 BBC FOUR 102 BBC TWO NI HD 32 Paramount Network 46 Film4+1 43 HGTV 107 BBC NEWS HD Sony Movies Action 9 BBC SCOTLAND (Scot only) BBC RADIO: 103 ITV HD 41 47 Challenge 67 CBS Drama 111 QVC HD (exc Wales) 734 Essex, Northampton, CLOSED 24 BBC FOUR (Scot only) Sheffield, 103 ITV Wales HD 45 Channel 5+1 48 4Seven 71 Jewellery Maker 112 QVC Beauty HD 201 CBBC -

What Is Bbc Three?

We tested the public value of the proposed changes using a combination of quantitative and qualitative methodologies Quantitative methodology Qualitative methodology We ran a 15 minute online survey with 3,281 respondents to We conducted 20 x 2 hour ‘Extended Group’ sessions via Zoom with understand current associations with BBC Three, the appeal of BBC a mix of different audiences to explore and compare reactions, Three launching as a linear channel, and how this might impact from a personal and societal value perspective, to the concept of existing services in the market. BBC Three becoming a linear channel again. In the survey, we explored the following: In the sessions, we explored the following: - Demographics and brand favourability - Linear TV consumption and BBC attitudes - Current TV and video consumption - (S)VOD consumption behaviours, with a focus on BBC Three - BBC Three awareness, usage and perceptions (current) - A BBC Three content evaluation (via BBC Three on iPlayer exploration) - Likelihood of watching new TV channel and perceptions - Responses to the proposal of BBC Three becoming a TV channel - Impact on services currently used (including time taken away from each) - Expected personal and societal impact of the proposed changes - Societal impact of BBC Three launching as a TV channel - Evaluation of proposed changes against BBC Public Purposes 4 The qualitative stage involved 20 x 2-hour extended digital group discussions across the UK with a carefully designed sample 20 x 2 hour Extended Zoom Groups The qualitative -

BBC Learning – Commissioning Meeting

BBC Learning – Commissioning Meeting May 2012 Welcome and Introduction Saul Nassé – Controller, BBC Learning BBC North • BBC Learning is now located at MediaCityUK, Salford • The move to Salford aims to ensure we better serve and reflect Northern audiences • Other departments based here include: o Sport o Children’s o 5 live o Future Media o BBC Breakfast Welcome and Introduction • Our fourth session to share plans and future thinking • This is the second of two sessions held today: o AM – aimed at education publishers and distributors o PM – commissioning meeting for BBC suppliers • Minutes and recordings of both events will be put online Welcome and Introduction At the last meeting in October 2011 we covered: o Update on Learning activity and content o Information on BBC Learning online activity and plans o Emerging thoughts on the Knowledge and Learning Product o Information on BBC Learning television and Learning Zone plans o Update on finance and public affairs activity Agenda model Timing Agenda Item Speaker 2.30pm Introduction and Welcome Saul Nassé – Controller, BBC Learning Learning and Strategy Update The Knowledge and Learning Product Saul Nassé – Controller, BBC Learning Chris Sizemore – Executive Editor, BBC Learning BBC Learning Online Commissioning Chris Sizemore – Executive Editor, BBC Learning BBC Learning Television Abigail Appleton – Head of Commissioning, BBC Learning BBC Two: The Learning Zone Katy Jones – Executive Producer, BBC Learning Finance and Industry Engagement Alex Lloyd – Head of Operations and Public Affairs, -

The State of Artistic Freedom 2021

THE STATE OF ARTISTIC FREEDOM 2021 THE STATE OF ARTISTIC FREEDOM 2021 1 Freemuse (freemuse.org) is an independent international non-governmental organisation advocating for freedom of artistic expression and cultural diversity. Freemuse has United Nations Special Consultative Status to the Economic and Social Council (UN-ECOSOC) and Consultative Status with UNESCO. Freemuse operates within an international human rights and legal framework which upholds the principles of accountability, participation, equality, non-discrimination and cultural diversity. We document violations of artistic freedom and leverage evidence-based advocacy at international, regional and national levels for better protection of all people, including those at risk. We promote safe and enabling environments for artistic creativity and recognise the value that art and culture bring to society. Working with artists, art and cultural organisations, activists and partners in the global south and north, we campaign for and support individual artists with a focus on artists targeted for their gender, race or sexual orientation. We initiate, grow and support locally owned networks of artists and cultural workers so their voices can be heard and their capacity to monitor and defend artistic freedom is strengthened. ©2021 Freemuse. All rights reserved. Design and illustration: KOPA Graphic Design Studio Author: Freemuse Freemuse thanks those who spoke to us for this report, especially the artists who took risks to take part in this research. We also thank everyone who stands up for the human right to artistic freedom. Every effort has been made to verify the accuracy of the information contained in this report. All information was believed to be correct as of February 2021. -

Stream Name Category Name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---TNT-SAT ---|EU| FRANCE TNTSAT TF1 SD |EU|

stream_name category_name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---------- TNT-SAT ---------- |EU| FRANCE TNTSAT TF1 SD |EU| FRANCE TNTSAT TF1 HD |EU| FRANCE TNTSAT TF1 FULL HD |EU| FRANCE TNTSAT TF1 FULL HD 1 |EU| FRANCE TNTSAT FRANCE 2 SD |EU| FRANCE TNTSAT FRANCE 2 HD |EU| FRANCE TNTSAT FRANCE 2 FULL HD |EU| FRANCE TNTSAT FRANCE 3 SD |EU| FRANCE TNTSAT FRANCE 3 HD |EU| FRANCE TNTSAT FRANCE 3 FULL HD |EU| FRANCE TNTSAT FRANCE 4 SD |EU| FRANCE TNTSAT FRANCE 4 HD |EU| FRANCE TNTSAT FRANCE 4 FULL HD |EU| FRANCE TNTSAT FRANCE 5 SD |EU| FRANCE TNTSAT FRANCE 5 HD |EU| FRANCE TNTSAT FRANCE 5 FULL HD |EU| FRANCE TNTSAT FRANCE O SD |EU| FRANCE TNTSAT FRANCE O HD |EU| FRANCE TNTSAT FRANCE O FULL HD |EU| FRANCE TNTSAT M6 SD |EU| FRANCE TNTSAT M6 HD |EU| FRANCE TNTSAT M6 FHD |EU| FRANCE TNTSAT PARIS PREMIERE |EU| FRANCE TNTSAT PARIS PREMIERE FULL HD |EU| FRANCE TNTSAT TMC SD |EU| FRANCE TNTSAT TMC HD |EU| FRANCE TNTSAT TMC FULL HD |EU| FRANCE TNTSAT TMC 1 FULL HD |EU| FRANCE TNTSAT 6TER SD |EU| FRANCE TNTSAT 6TER HD |EU| FRANCE TNTSAT 6TER FULL HD |EU| FRANCE TNTSAT CHERIE 25 SD |EU| FRANCE TNTSAT CHERIE 25 |EU| FRANCE TNTSAT CHERIE 25 FULL HD |EU| FRANCE TNTSAT ARTE SD |EU| FRANCE TNTSAT ARTE FR |EU| FRANCE TNTSAT RMC STORY |EU| FRANCE TNTSAT RMC STORY SD |EU| FRANCE TNTSAT ---------- Information ---------- |EU| FRANCE TNTSAT TV5 |EU| FRANCE TNTSAT TV5 MONDE FBS HD |EU| FRANCE TNTSAT CNEWS SD |EU| FRANCE TNTSAT CNEWS |EU| FRANCE TNTSAT CNEWS HD |EU| FRANCE TNTSAT France 24 |EU| FRANCE TNTSAT FRANCE INFO SD |EU| FRANCE TNTSAT FRANCE INFO HD -

Download Symposium Brochure Incl. Programme

DEUTSCHE TV-PLATTFORM: HYBRID TV - BETTER TV HBBTV AND MUCH, MUCH MORE Deutsche TV Platform (DTVP) was founded more than 25 years ago to introduce and develop digital media tech- nologies based on open standards. Consequently, DTVP was also involved in the introduction of HbbTV. When the HbbTV initiative started at the end of 2008, three of the four participating companies were members of the DTVP: IRT, Philips, SES Astra. Since then, HbbTV has played an important role in the work of DTVP. For example, DTVP did achieve the activation of HbbTV by default on TV sets in Germany; currently, HbbTV 2.0 is the subject of a ded- icated DTVP task force within the Working Group Smart Media. HbbTV is a perfect blueprint for the way DTVP works by promoting the exchange of information and opinions between market participants, stakeholders and social groups, coordinating their various interests. In addition, DTVP informs the public about technological develop- ments and the introduction of new standards. In order to HYBRID BROADCAST BROADBAND TV (OR “HbbTV”) IS A GLOBAL INITIATIVE AIMED achieve these goals, the German TV Platform sets up ded- AT HARMONIZING THE BROADCAST AND BROADBAND DELIVERY OF ENTERTAIN- icated Working Groups (currently: WG Mobile Media, WG Smart Media, WG Ultra HD). In addition to classic media MENT SERVICES TO CONSUMERS THROUGH CONNECTED TVs, SET-TOP BOXES AND technology, DTVP is increasingly focusing on the conver- MULTISCREEN DEVICES. gence of consumer electronics, information technology as well as mobile communication. HbbTV specifications are developed by industry leaders opportunities and enhancements for participants of the To date, DTVP is the only institution for media topics in to improve the video user experience for consumers by content distribution value chain – from content owner to Germany with such a broad interdisciplinary membership enabling innovative, interactive services over broadcast consumer.