Memorandum JUL 0 11986 L-8 6-92 to Director of Compensation and Certification

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

INSIDE Strive to Provide an “Authentic” Experience While the Recognition Is Great, It Is for Our Visitors

NEXT MEETING: July 18 Join us at Industry Depot for a NEWSLETTER OF THE ROCHESTER & GENESEE VALLEY RAILROAD MUSEUM ride on your museum railroad JULY 2013 VOL. 56 No. 11 Volunteer Depot Guide Jim Moore holds the door open for visitors touring Industry Depot and our museum displays. We strive to provide an authentic experience for our visitors, what else can we do to make someone’s visit special? PHOTO BY OTTO M. VONDRAK Keeping it Real “What is real?” That is a question that has right. More people are coming through the plagued philosophers for many years. door, and we would like to keep that trend As far as relating to our museum, we going as long as we can. INSIDE strive to provide an “authentic” experience While the recognition is great, it is for our visitors. That means train crews in important that we remain focused on our acceptable “period” uniforms for freight goals. We published a list of priority proj - Train Bulletin . 2 service employees. It means keeping our ects earlier this year that your board of facilities neat and clean and making a good trustees will be reviewing. Look for an first impression. Several visitors have update in these pages on how we’re doing. Museum News . 3 commented favorably about the recent Do you see areas we can improve? Is changes we have made, from less clutter in there something missing from our muse - Picnic Aug. 17 . 5 the depot, to expanded displays elsewhere. um? What can we do to keep people People are noticing our extra efforts. -

NYSDOT "Rail Program-Report 1985"

~.. ~~\ . , t····_, & NEW YORK STATE RAIL PROGRAM REPORT ·1985 . Prepared by the Rail Division November 1985 NEW YORK STATE DEPARTMENT OF TRANSPORTATION MARIO M. CUOMO, Governor FRANKLIN E. WHITE, Commissioner NEW YORK STATE RAIL PROGRAM REPORT 1985 Prepared in compliance with the rules and regulations for the: State Rail Pian, per Section 5 (j) of the Department of Transportation Act; and Annual Report to the State legislature, per Chapter 257, Section 8, of the Laws of 1975 and Chapter 369, Section 2 of the laws of 1979. TABLE OF CONTENTS ITEM PAGE INTRODUCTION iv CHAPTER 1: NEW YORK STATE'S RAIL PROGRAM 1 A. PROGRAM ELEMENTS 1 B. ACHIEVEMENTS 3 CHAPTER 2: NEW YORK STATE'S RAIL POLICY 6 A. AUTHORITY 6 B. POLICY 6 C. PLANNING PROCESS 9 CHAPTER 3: NEW YORK STATE'S RAIL SYSTEM 12 A. NEW YORK STATE'S RAIL FREIGHT SYSTEM 12 B. INTERCITY RAIL PASSENGER SERVICE 13 CHAPTER 4: RAIL ISSUES 18 CHAPTER 5: PROGRAM OF PROJECTS 29 A. PROJECT SELECTION PROCESS 29 B. CURRENT PROGRAM OF RAIL PROJECTS 30 C. PROJECTS UNDER REVIEW FOR FUTURE FUNDING 33 MAP 1 - NEW YORK STATE'S RAIL/HIGm~AY SYSTEM M.l MAP 2 - NEW YORK STATE'S RAIL SYSTEM M.2 APPENDIX I - PROJECTS COMPLETED UNDER NEW YORK STATE'S Al.1 RAIL PROGRAM A. 1974 BOND ISSUE Al.1 B. 1979 BOND ISSUE A1.3 C. FEDERAL LOCAL RAIL ASSISTANCE PROGRAM A1.4 D. STATE RAILASSISTANCE PROGRAM Al.5 E. RAILROAD BRIDGE RECONSTRUCTION PROGRAM Al.6 APPENDIX II - RAIL ABANDONMENTS A2.1 A. RAIL LINES ABANDONED DURING 1983-84 WITH NO A2.1 CONTINUATION OF SERVICE B. -

List of Railroad Contacts

Appendix 10.4 - LIST OF RAILROAD CONTACTS RAILROAD (abbr.) ADDRESS PHONE NO. / E-Mail Adirondack Scenic Railway 315-724-0700 Adirondack Railway (ADRC) Preservation Society Note: NYSDOT owns the Remsen- Mr. William Branson, President Lake Placid Travel Corridor and Union Station leases it to ARPS who operates it as 321 Main Street ADRC. Utica, NY 13501 Albany Port Railroad Mr. Richard Stack, General (518)463-8679 Corporation (APRR) Manager [email protected] Port of Albany 101 Raft Street Albany, NY 12202 Amtrak (AMTK) See National Railroad Passenger Corporation Arcade and Attica Railroad Mr. George Ling, General (585) 492-3100 Corporation (ARA) Manager 278 Main Street Arcade, NY 14009 Mr. Ray Martel, General B & H Rail Corporation (BH) (585) 384-9169 Manager [email protected] 5769 Sweeteners Blvd Note: BH and WHYP are affiliates of Lakeville, NY 14480 LAL. Batten Kill Railroad Company, Mr. William Taber, President (518) 692-2160 Inc. (BKRR). 1 Elbow Street [email protected] Greenwich, NY 12834 Boston and Maine See Pan Am Railways Corporation (BM) Buffalo & Pittsburgh Railroad, See Genesee & Wyoming, Inc. (BPRR) Incorporated Buffalo Southern Railway Mr. Albert Feasley, 716-992-4979 (BSOR) 8600 Depot Street [email protected] Eden, NY 14057 Canadian National Railway Ms. Karen Phillips, VP- 202-347-7816 (CN) Government Affairs [email protected] 601 Pennsylvania Ave, NW, Suite 500 North Building Washington, DC 20004 Canadian Pacific Railway See Delaware & Hudson (CP) Railway Catskill Mountain Railroad Mr. Harry Jameson 845-688-5553 Company, Inc. CMRR PO Box 404 [email protected] Phoenicia, NY 12464 Central New York Railroad See New York, Susquehanna & Corporation (CNYK) Western Railway Corporation Clarendon & Pittsford Railroad See Vermont Railway Systems Company (CLP) Consolidated Rail Corporation Government Relations 215-209-5025 (CSAO) 1717 Arch Street, Suite 3210 Note: Conrail Shared Assets Philadelphia, PA 19103 Organization is owned by CSXT and NS and is operated as a switching railroad. -

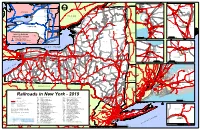

![Railroads in New York State - 2013 NJT Campbell ! LEGEND ! ! ] ! NYSW Hall MNJ Berkshire [NS] Maybrook Beacon ! ! Jct](https://docslib.b-cdn.net/cover/2180/railroads-in-new-york-state-2013-njt-campbell-legend-nysw-hall-mnj-berkshire-ns-maybrook-beacon-jct-2542180.webp)

Railroads in New York State - 2013 NJT Campbell ! LEGEND ! ! ] ! NYSW Hall MNJ Berkshire [NS] Maybrook Beacon ! ! Jct

CP to CSXT to Montreal [AMTK] ! Montreal CP St. Lambert, QUE CN [CSXT] ! Montreal, QUE N i a g a r a FRR [CSX] Mechanicville ST Huntingdon SOM ! Hoffmans Central Station ! [CP] [AMTK/NS] Mechanicville [CN] Lockport CSXT ! CP Rooseveltown ! East Alburg NIAGARA Lockport CP [CSX/NS/ST] CSXT ! ! Rouses Point Fort Covington NECR FALLS CSXT CSXT [AMTK/NS] RotterdamCSXT MSTR ! CSXT AMTK S a r a t o g a Rouses Point ! [CN] Massena CSXT Jct. ST Helena Mohawk Niagara Falls ST [AMTK] Yard Plattsburgh I T Yard X CP CSXT NorfolkNYOG S ! C [AMTK/NS] CANADA Port Kent North Tonawanda South [AMTK/NS] SCHENECTADY [CSX] CP ! ! CP C l i n t o n CSXT Schenectady Port of NYOG Norwood C l i n t o n ! !Plattsburgh Martinsville Carman Ogdensburg ! Westport CP [NS] CSXT Cohoes ! NECR North CSXT Port Henry Bluff Point CANADA Tonawanda ! Schenectady VT Yard CSXT AMTK Ticonderoga T F r a n k l i n X Toronto, ONT S [CP/CSXT] Castleton C Watervliet NECR Essex Jct. Tonawanda Oakville, ONT ! ! CSXT Whitehall Rutland Burlington E r i e St Lawrence [CSX] Aldershot, ONT Kenmore SNY CP TROY NECR Yard SNY West Albany CP BUFFALO Rome Fort Edward [CP] Grimsby, ONT Niagara Falls VTR Yard Rochester CSXT [CN/CP/NS] [AMTK] ! St. Catherines, ONT Buffalo Syracuse Utica to NECR Black Rock CSXT Niagara Falls, ONT Gouverneur! ! ADCX White River Jct. Depew Amsterdam Saratoga Springs CSXT [AMTK] ! CSXT Saranac International Lake Voorheesville ! CSXT [AMTK] Frontier Buffalo Lake Bridge CSXT [AMTK] ALBANY ! Placid Kenwood Schenectady Newton ! Yard DLWR ! Rensselaer Exchange St. -

The Semaphore

The Semaphore Newsletter of the Rochester NY Chapter, NRHS October 2003 P.O. Box 23326, Rochester, NY 14692-3326; Published Monthly Volume 46, No. 2 Program for Oct. 16: Cleveland in the 1970s by Bob Zimmerman The program for the October meeting will be by Bob Zimmerman and will be "Cleveland in the 1970s". The show will feature slides from Bob's trips, rail and road, to the Cleveland area in the 1970s as he was checking out operations that were winding down. Images will include ALCOs and F-units on PC/Conrail, PCC cars on the Shaker Heights and other goodies. Place: 40&8 Club, 933 University Ave. Meeting: 7:30 PM As part of the railroad operations during our annual picnic, LV-211 pulls the Erie C-254 out of the Industry yard on one of its several runs throughout the day. Looks really good at 50 Program: 8:00 PM years years of age! Photo and caption by Chris Hauf Store open before Meeting and at Rome Watertown & Fall Foliage Update Ogdensburgh Railroad The frequent rain showers 'dampen' the attendance for Saturday's (Oct 4) trips. History We hope that the weather will be more favorable for the remainder of the excursions. Your The first installment Harold Russell's efforts at publicizing these excursions would be GREATLY appreciated! research on the Rome Watertown & Ogdens- Train Information: burgh Railroad appears as an insert in this issue of The Semaphore. The Schedule: Two trains each day: Subsequent installments will appear in Saturday: October 11 future issues. Someday, we hope to com- Sundays: October 12 & 19 Noon and 2:15 PM bined them into one booklet. -

PC*MILER Geocode Files Reference Guide | Page 1 File Usage Restrictions All Geocode Files Are Copyrighted Works of ALK Technologies, Inc

Reference Guide | Beta v10.3.0 | Revision 1 . 0 Copyrights You may print one (1) copy of this document for your personal use. Otherwise, no part of this document may be reproduced, transmitted, transcribed, stored in a retrieval system, or translated into any language, in any form or by any means electronic, mechanical, magnetic, optical, or otherwise, without prior written permission from ALK Technologies, Inc. Copyright © 1986-2017 ALK Technologies, Inc. All Rights Reserved. ALK Data © 2017 – All Rights Reserved. ALK Technologies, Inc. reserves the right to make changes or improvements to its programs and documentation materials at any time and without prior notice. PC*MILER®, CoPilot® Truck™, ALK®, RouteSync®, and TripDirect® are registered trademarks of ALK Technologies, Inc. Microsoft and Windows are registered trademarks of Microsoft Corporation in the United States and other countries. IBM is a registered trademark of International Business Machines Corporation. Xceed Toolkit and AvalonDock Libraries Copyright © 1994-2016 Xceed Software Inc., all rights reserved. The Software is protected by Canadian and United States copyright laws, international treaties and other applicable national or international laws. Satellite Imagery © DigitalGlobe, Inc. All Rights Reserved. Weather data provided by Environment Canada (EC), U.S. National Weather Service (NWS), U.S. National Oceanic and Atmospheric Administration (NOAA), and AerisWeather. © Copyright 2017. All Rights Reserved. Traffic information provided by INRIX © 2017. All rights reserved by INRIX, Inc. Standard Point Location Codes (SPLC) data used in PC*MILER products is owned, maintained and copyrighted by the National Motor Freight Traffic Association, Inc. Statistics Canada Postal Code™ Conversion File which is based on data licensed from Canada Post Corporation. -

Short Line Railcar Storage Locations

Short Line Car Storage Directory State Short Short Line Name Contact Name E-Mail Phone Car Hazmat Hazmat TIH/PIH TIH/PIH Restrictions Line Spots Loads Residue Loads Residue SCAC (Max) (empty but not cleaned) AL RJAL RJ Corman Childersburg Adam Boyles [email protected] 859 314-0891 42 YES YES YES YES AL SQSC Sequatchie Valley Railroad Byron Clinton [email protected] 931 580-7375 750 YES YES NO YES AL ATN Alabama & Tennessee River Railway, LLC Chris Richter [email protected] 920 209-0118 260 YES YES NO NO AL TASD Terminal Railway, Alabama State Docks Cliff Melton [email protected] 251 408-7077 100 NO NO NO NO AL AGR Alabama & Gulf Coast Railway Kevin Phillips [email protected] 904 562-0692 130 NO YES NO NO AL CAGY Columbus & Greenville Railway Kevin Phillips [email protected] 904 562-0692 440 YES YES NO NO AL COEH Conecuh Valley Railroad Co., Inc. Kevin Phillips [email protected] 904 562-0692 300 NO YES NO NO AL MNBR Meridian & Bigbee Railroad Kevin Phillips [email protected] 904 562-0692 240 NO YES NO NO AL TNHR Three Notch Railroad Co. Inc. Kevin Phillips [email protected] 904 562-0692 30 YES YES NO NO AL WGCR Wiregrass Central Railroad Kevin Phillips [email protected] 904 562-0692 100 NO YES NO NO AL EARY Eastern Alabama Railway Kevin Phillips [email protected] 904 562-0692 135 NO YES NO NO AL ALAB Alabama Railroad Co. Nathan Johns [email protected] 309 605-0119 300 YES YES NO NO 263k restriction AL ALE Alabama Export Railroad Meaghan Davis [email protected] 228 474-0711 80 NO NO NO NO CT CNZR Central New England Railroad Deb Belliveau [email protected] 860 666-1030 88 NO NO NO NO 263k restriction CT CSO Connecticut Southern Railroad Kevin Phillips [email protected] 904 562-0692 150 NO NO NO NO 263k restriction, Plate F CT NECR New England Central Railroad Kevin Phillips [email protected] 904 562-0692 400 NO NO NO NO CT HRRC Housatonic Railroad Co., Inc. -

2019 NYS Rail Map.Pdf

C ] P K T T X to S M A ] C Montreal [ to ] T S N X ! N C Montreal S / Montre al, Q UE C C P ! [ R K St. Lam b e rt, Q UE M R T F [ Me c hanic ville S O C Ce ntral Station Huntingd on S ! M T Hoffm ans S ! A [C [ X Mechanicville Loc kp ort P ] ] ] XT [CN P /NS/ST ] CS ! C [CSX Roose ve ltown ! East Alb urg NIAGARA CP C ! ! Rouse s Point S N T Fort Covington T CSX R X E FALLS X Lockport T C T R S /NS] S MTK C XT [A Rotte rd am C M ! CS A S a r a toga Rouse s Point ! ] S MT S a r a toga SXT [CN X K Masse na C ] Jc t. T S He le na K T T ] T Mohawk St. Alb ans S M Niagara Falls S ] A N S [ / Y ard N T Y ard Plattsb urgh I P K / ] X C C SXT T K T X NorfolNk S M ! M S Y C A [ A C O [ [ T SCHENECTADY Port Ke nt G VT South P P C A N ADA X North Tonawanda C C ! S ! OG C li n ton C Sc he ne c tad y Port of NY Norwood C li n ton Plattsb urgh Martinsville Ogd e nsb urg ! ! XT Carm an NS CS ! W e stp ort R C T Cohoes X ! E S N North C Erie Bluff Point Port He nry C A N ADA Tonawand a S cc h ee n ee ccttadd y Y ard C F r a n klin S A Tic ond e roga T F r a n klin M X X T S T K C [C Toronto, ONT Castle ton CR P Watervliet E ] N Esse x Jc t. -

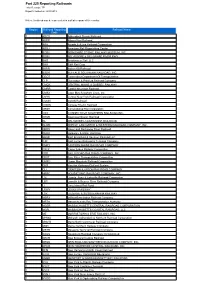

Part 225 Reporting Railroads.Pdf

Part 225 Reporting Railroads Total Records: 771 Report Created on: 4/30/2019 Notes: A railroad may be represented in multiple regions of the country. Region Railroad Reporting Railroad Name Code 1 ADCX Adirondack Scenic Railroad 1 APRR Albany Port Railroad 1 ARA Arcade & Attica Railroad Corporation 1 ARDJ American Rail Dispatching Center 1 BCRY BERKSHIRE SCENIC RAILWAY MUSEUM, INC. 1 BDRV BELVEDERE & DELAWARE RIVER RWY 1 BHR Brookhaven Rail, LLC 1 BHX B&H Rail Corp 1 BKRR Batten Kill Railroad 1 BSOR BUFFALO SOUTHERN RAILROAD, INC. 1 CDOT Connecticut Department Of Transportation 1 CLP Clarendon & Pittsford Railroad Company 1 CMQX CENTRAL MAINE & QUEBEC RAILWAY 1 CMRR Catskill Mountain Railroad 1 CMSX Cape May Seashore Lines, Inc. 1 CNYK Central New York Railroad Corporation 1 COGN COGN Railroad 1 CONW Conway Scenic Railroad 1 CRSH Consolidated Rail Corporation 1 CSO CONNECTICUT SOUTHERN RAILROAD INC. 1 DESR Downeast Scenic Railroad 1 DL DELAWARE LACKAWANNA RAILROAD 1 DLWR DEPEW, LANCASTER & WESTERN RAILROAD COMPANY, INC. 1 DRRV Dover and Rockaway River Railroad 1 DURR Delaware & Ulster Rail Ride 1 EBSR East Brookfield & Spencer Railroad LLC 1 EJR East Jersey Railroad & Terminal Company 1 EMRY EASTERN MAINE RAILROAD COMPANY 1 FGLK Finger Lakes Railway Corporation 1 FRR FALLS ROAD RAILROAD COMPANY, INC. 1 FRVT Fore River Transportation Corporation 1 GMRC Green Mountain Railroad Corporation 1 GRS Pan Am Railways/Guilford System 1 GU GRAFTON & UPTON RAILROAD COMPANY 1 HRRC HOUSATONIC RAILROAD COMPANY, INC. 1 LAL Livonia, Avon & Lakeville Railroad Corporation 1 LBR Lowville & Beaver River Railroad Company 1 LI Long Island Rail Road 1 LRWY LEHIGH RAILWAY 1 LSX LUZERNE & SUSQUEHANNA RAILWAY 1 MBRX Milford-Bennington Railroad Company 1 MBTA Massachusetts Bay Transportation Authority 1 MCER MASSACHUSETTS CENTRAL RAILROAD CORPORATION 1 MCRL MASSACHUSETTS COASTAL RAILROAD, LLC 1 ME MORRISTOWN & ERIE RAILWAY, INC. -

Regional Trails Initiative Final Report & Action Plan

REGIONAL TRAILS INITIATIVE FINAL REPORT & ACTION PLAN PHASE 2 – NON-TMA REGION PREPARED BY: PREPARED FOR: CLARK PATTERSON ASSOCIATES GENESEE TRANSPORTATION COUNCIL NORTHEAST GREENWAYS TROWBRIDGE & WOLF MARCH 2004 Acknowledgements Regional Trails Initiative Steering Committee William Nojay * Rochester-Genesee Regional Transportation Authority Keith Ashby Seneca County Matthew Balling Genesee County Peg Churchill Wayne County John DiMura New York State Canal Corporation Ed Doherty City of Rochester Wayne Hale, Jr. Orleans County Kristen Mark Hughes Ontario County Anne Humphrey Wyoming County Paul Johnson Monroe County Greg Marshall Greater Rochester Visitors Association Charles Moynihan New York State Department of Transportation – Region 4 Robert Multer Yates County David Woods Livingston County * Steering Committee Chair Genesee Transportation Council Staff Richard Perrin, Executive Director Kristin Bennett, AICP, Bicycle/Pedestrian Program Manager Consultant Team Clark Patterson Associates Northeast Greenways, Inc. Trowbridge & Wolf Landscape Architecture Cover Photo/Image Credits (clockwise from top left) Ontario Pathways Trail (Ontario Pathways, Inc.) Trails for the 21st Century, 2nd Edition, Rails-to-Trails Conservancy Ontario Pathways Trail (Ontario Pathways, Inc.) Canalway Trail in Orleans County (NYSDOT – Region 4) Genesee Transportation Council 1 Regional Trails Initiative – Phase 2 March 2004 Final Report Table of Contents 1. Introduction and Purpose ......................................................................................................... -

New York Rail Fast Facts for 2019 Freight Railroads …

Freight Railroads in New York Rail Fast Facts For 2019 Freight railroads ….............................................................................................................................................................41 Freight railroad mileage …..........................................................................................................................................3,687 Freight rail employees …...............................................................................................................................................2,645 Average wages & benefits per employee …...................................................................................................$125,240 Railroad retirement beneficiaries …......................................................................................................................20,600 Railroad retirement benefits paid ….....................................................................................................................$525 million U.S. Economy: According to a Towson University study, in 2017, America's Class I railroads supported: Sustainability: Railroads are the most fuel efficient way to move freight over land. It would have taken approximately 3.7 million additional trucks to handle the 66.7 million tons of freight that moved by rail in New York in 2019. Rail Traffic Originated in 2019 Total Tons: 10.4 million Total Carloads: 201,000 Commodity Tons (mil) Carloads Waste and Scrap 3.7 39,900 Nonmetallic Minerals 2.1 20,500 Chemicals -

Working with Railroads to Build Trails in New York State

Getting on Track Working with Railroads to Build Trails in New York State A publication of Parks & Trails New York Creation and distribution of this guide was made possible by the generous support from: Educational Foundation of America NYS Council on the Arts This guide is based in large part on information compiled by Jack Madden of the Freight Bureau of the New York State Department of Transportation and generously shared with Parks & Trails New York. Parks & Trails New York also acknowledges the valuable insight provided by the NYS Offi ce of Parks, Recreation and Historic Preservation. Wallace Elton, Parks & Trails New York Project Director, wrote the guide. © 2008 29 Elk Street, Albany, NY 12207 518-434-1583, f 518-427-0067 [email protected], www.ptny.org New York State Trails Coalition Parks & Trails New York invites state, regional and local organizations and agencies involved in de- veloping, promoting or maintaining trails to join the New York State Trails Coalition in order to more effectively advocate for trails and greenway policies, programs and funding. Membership is free. To review the Coalition’s vision and action plan and to sign up, visit: www.ptny.org/advocacy/coalition.shtml Cover photo: Harlem Valley Rail Trail, Wassaic Getting on Track Working with Railroads to Build Trails in New York State Table of Contents 1 - Introduction ...................................................................................................................................... 1 2 - Background: Railroad Corridor Status .........................................................................................1