SYO Pet Business Compiled.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

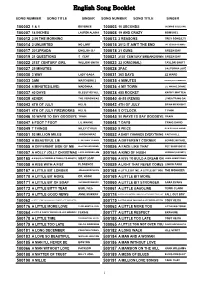

English Song Booklet

English Song Booklet SONG NUMBER SONG TITLE SINGER SONG NUMBER SONG TITLE SINGER 100002 1 & 1 BEYONCE 100003 10 SECONDS JAZMINE SULLIVAN 100007 18 INCHES LAUREN ALAINA 100008 19 AND CRAZY BOMSHEL 100012 2 IN THE MORNING 100013 2 REASONS TREY SONGZ,TI 100014 2 UNLIMITED NO LIMIT 100015 2012 IT AIN'T THE END JAY SEAN,NICKI MINAJ 100017 2012PRADA ENGLISH DJ 100018 21 GUNS GREEN DAY 100019 21 QUESTIONS 5 CENT 100021 21ST CENTURY BREAKDOWN GREEN DAY 100022 21ST CENTURY GIRL WILLOW SMITH 100023 22 (ORIGINAL) TAYLOR SWIFT 100027 25 MINUTES 100028 2PAC CALIFORNIA LOVE 100030 3 WAY LADY GAGA 100031 365 DAYS ZZ WARD 100033 3AM MATCHBOX 2 100035 4 MINUTES MADONNA,JUSTIN TIMBERLAKE 100034 4 MINUTES(LIVE) MADONNA 100036 4 MY TOWN LIL WAYNE,DRAKE 100037 40 DAYS BLESSTHEFALL 100038 455 ROCKET KATHY MATTEA 100039 4EVER THE VERONICAS 100040 4H55 (REMIX) LYNDA TRANG DAI 100043 4TH OF JULY KELIS 100042 4TH OF JULY BRIAN MCKNIGHT 100041 4TH OF JULY FIREWORKS KELIS 100044 5 O'CLOCK T PAIN 100046 50 WAYS TO SAY GOODBYE TRAIN 100045 50 WAYS TO SAY GOODBYE TRAIN 100047 6 FOOT 7 FOOT LIL WAYNE 100048 7 DAYS CRAIG DAVID 100049 7 THINGS MILEY CYRUS 100050 9 PIECE RICK ROSS,LIL WAYNE 100051 93 MILLION MILES JASON MRAZ 100052 A BABY CHANGES EVERYTHING FAITH HILL 100053 A BEAUTIFUL LIE 3 SECONDS TO MARS 100054 A DIFFERENT CORNER GEORGE MICHAEL 100055 A DIFFERENT SIDE OF ME ALLSTAR WEEKEND 100056 A FACE LIKE THAT PET SHOP BOYS 100057 A HOLLY JOLLY CHRISTMAS LADY ANTEBELLUM 500164 A KIND OF HUSH HERMAN'S HERMITS 500165 A KISS IS A TERRIBLE THING (TO WASTE) MEAT LOAF 500166 A KISS TO BUILD A DREAM ON LOUIS ARMSTRONG 100058 A KISS WITH A FIST FLORENCE 100059 A LIGHT THAT NEVER COMES LINKIN PARK 500167 A LITTLE BIT LONGER JONAS BROTHERS 500168 A LITTLE BIT ME, A LITTLE BIT YOU THE MONKEES 500170 A LITTLE BIT MORE DR. -

Craig David Trust Me Mp3, Flac, Wma

Craig David Trust Me mp3, flac, wma DOWNLOAD LINKS (Clickable) Genre: Electronic / Hip hop / Pop Album: Trust Me Country: US Released: 2007 Style: RnB/Swing, UK Garage MP3 version RAR size: 1280 mb FLAC version RAR size: 1922 mb WMA version RAR size: 1574 mb Rating: 4.5 Votes: 637 Other Formats: ASF MMF MP4 XM WMA VOX AUD Tracklist Hide Credits Hot Stuff (Let’s Dance) 1 3:39 Guitar – Fraser T SmithWritten-By – David Bowie 6 Of 1 Thing 2 3:47 Backing Vocals – Rita Ora Friday Night 3 3:34 Written-By – Eg White Awkward 4 3:37 Vocals – Rita OraWritten-By – Glen Scott, Martin Jonsson, Tommy Sims Just A Reminder 5 Acoustic Guitar – Tommy SimsBacking Vocals – Martin TerefeBass – Martin TerefeWritten- 3:50 By – Glen Scott, Martin Jonsson, Tommy Sims Officially Yours Backing Vocals – Ian James Guitar – Paulo Mendonca*Synthesizer – Glen ScottTalking 6 3:56 Drum – Andreas OlssonWritten-By – Curtis Richardson, Hiten Bharadia, Ian James , Paulo Mendonca* Kinda Girl For Me 7 3:48 Backing Vocals – Nina WoodfordWritten-By – Linda Creed, Thomas Bell* She's On Fire Sounds [Coca Cola Bottle Shape Sample] – SimpletonSounds [Performer Hot Dis Year 8 5:04 Sample] – DirtsmanWritten-By – Christopher Harrison, Cleveland Browne*, Patrick Thomas, Philip Smart, Wycliffe Johnson Don’t Play WIth Our Love 9 4:00 Synthesizer – Glen ScottWritten-By – P Barry* Top Of The Hill 10 Backing Vocals – Martin TerefeBass – Martin TerefeDrums – Kristoffer SonneGuitar – 3:55 Andreas OlssonTalking Drum – Andreas Olsson This Is The Girl 11 Mixed By – Steve FitzmauriceProducer – Craig David, Kano Written-By – C. David*, T. 4:10 Smith* Companies, etc. -

Atlantic Crossing

Artists like WARRENAI Tour Hard And Push Tap Could The Jam Band M Help Save The Music? ATLANTIC CROSSING 1/0000 ZOV£-10806 V3 Ii3V39 9N01 MIKA INVADES 3AV W13 OVa a STOO AlN33219 AINOW AMERICA IIII""1111"111111""111"1"11"11"1"Illii"P"II"1111 00/000 tOV loo OPIVW#6/23/00NE6TON 00 11910-E N3S,,*.***************...*. 3310NX0A .4 www.americanradiohistory.com "No, seriously, I'm at First Entertainment. Yeah, I know it's Saturday:" So there I was - 9:20 am, relaxing on the patio, enjoying the free gourmet coffee, being way too productive via the free WiFi, when it dawned on me ... I'm at my credit union. AND, it's Saturday morning! First Entertainment Credit Union is proud to announce the opening of our newest branch located at 4067 Laurel Canyon Blvd. near Ventura Blvd. in Studio City. Our members are all folks just like you - entertainment industry people with, you know... important stuff to do. Stop by soon - the java's on us, the patio is always open, and full - service banking convenience surrounds you. We now have 9 convenient locations in the Greater LA area to serve you. All branches are FIRSTENTERTAINMENT ¡_ CREDITUNION open Monday - Thursday 8:30 am to 5:00 pm and An Alternative Way to Bank k Friday 8:30 am to 6:00 pm and online 24/7. Plus, our Studio City Branch is also open on Saturday Everyone welcome! 9:00 am to 2:00 pm. We hope to see you soon. If you're reading this ad, you're eligible to join. -

Journal of Hip Hop Studies

et al.: Journal of Hip Hop Studies June 2016 Published by VCU Scholars Compass, 2016 1 Journal of Hip Hop Studies, Vol. 3 [2016], Iss. 1, Art. 1 Editor in Chief: Daniel White Hodge, North Park University Senior Editorial Advisory Board: Anthony Pinn, Rice University James Paterson, Lehigh University Book Review Editor: Gabriel B. Tait, Arkansas State University Associate Editors: Cassandra Chaney, Louisiana State University Jeffrey L. Coleman, St. Mary’s College of Maryland Monica Miller, Lehigh University Associate & Copy Editor: Travis Harris, PhD Student, College of William and Mary Editorial Board: Dr. Rachelle Ankney, North Park University Dr. Jason J. Campbell, Nova Southeastern University Dr. Jim Dekker, Cornerstone University Ms. Martha Diaz, New York University Mr. Earle Fisher, Rhodes College/Abyssinian Baptist Church, United States Dr. Daymond Glenn, Warner Pacific College Dr. Deshonna Collier-Goubil, Biola University Dr. Kamasi Hill, Interdenominational Theological Center Dr. Andre E. Johnson, University of Memphis Dr. David Leonard, Washington State University Dr. Terry Lindsay, North Park University Ms. Velda Love, North Park University Dr. Anthony J. Nocella II, Hamline University Dr. Priya Parmar, SUNY Brooklyn, New York Dr. Soong-Chan Rah, North Park University Dr. Rupert Simms, North Park University Dr. Darron Smith, University of Tennessee Health Science Center Dr. Jules Thompson, University Minnesota, Twin Cities Dr. Mary Trujillo, North Park University Dr. Edgar Tyson, Fordham University Dr. Ebony A. Utley, California State University Long Beach, United States Dr. Don C. Sawyer III, Quinnipiac University https://scholarscompass.vcu.edu/jhhs/vol3/iss1/1 2 et al.: Journal of Hip Hop Studies . Sponsored By: North Park Universities Center for Youth Ministry Studies (http://www.northpark.edu/Centers/Center-for-Youth-Ministry-Studies) Save The Kids Foundation (http://savethekidsgroup.org/) Published by VCU Scholars Compass, 2016 3 Journal of Hip Hop Studies, Vol. -

(Eighteen Visions) 1910 Fruit Gum Company

1 Pound Fish Man 2 Brothers On The Fourth Floor (4Th Floor) One Pound Fish SH27383 Let Me Be Free SH03417 10 Years 2 Chainz Through The Iris SH21020 I'm Different (Clean) SH27274 Wasteland SH24179 I'm Different (Explicit) SH27273 10,000 Maniacs 2 Chainz & Drake More Than This SH15953 No Lie HD90160 10Cc 2 Chainz & Drake & Lil Wayne Dreadlock Holiday HD02812 I Do It (Clean) SH29169 I'm Not In Love HD03021 2 Chainz & Drake & Quavo 12 Gauge Bigger Than You (Clean) HD05277 Dunkie Butt SH23798 Bigger Than You (Clean) SH33610 12 Stones Bigger Than You (Explicit) HD05276 Far Away SH17657 Bigger Than You (Explicit) SH33609 The Way I Feel SH18123 2 Chainz & Nicki Minaj 18 Visions (Eighteen Visions) I Love Dem Strippers (Clean) SH25910 Victim SH24185 I Love Dem Strippers (Explicit) SH25892 1910 Fruit Gum Company 2 Eivissa Simon Says SH01661 I Wanna Be Your Toy SH08598 1975 Oh La La La SH06774 Chocolate HD02897 2 Live Crew Chocolate SH27596 Me So Horny (Clean) HD05684 Girls (Clean) SH28297 Me So Horny (Explicit) HD05683 Girls (Explicit) SH28296 2 Play & Thomas Jules & Jucxi D Love Me HD03588 Careless Whisper HD00102 Love Me SH29922 Careless Whisper SH13507 Love Me (Workout Mix) SH29942 2 Play And Thomas Jules And Jucxi D Robbers SH28878 Careless Whisper HD00102 Settle Down SH28636 2 Unlimited Sex HD02979 Do What's Good For Me SH04468 Sex (Clean) SH28075 Faces SH02672 Sex (Explicit) SH28074 Get Ready For This SH03549 The City HD02913 Get Ready For This (Full Vocal Version) SH28056 The City SH27799 Here I Go SH03922 The Sound HD03638 Jump For Joy SH04668 -

Redox DAS Artist List for Period: 01.02.2018

Page: 1 Redox D.A.S. Artist List for period: 01.02.2018 - 28.02.2018 Date time: Number: Title: Artist: Publisher Lang: 01.02.2018 00:00:52 HD 13814 GOODBYE MICHELLE RENDEZ VOUS SLO 01.02.2018 00:04:02 HD 19287 SISTERS ARE DOIN' IT FOR THEMSELVESEURYTHMICS & ARETHA FRANKLIN ANG 01.02.2018 00:09:56 HD 60099 WHY DID YOU DO IT STRETCH ANG 01.02.2018 00:13:26 HD 60894 BAD LIAR SELENA GOMEZ ANG 01.02.2018 00:17:04 HD 61737 T-SHIRT KATY PERRY ANG 01.02.2018 00:20:36 HD 44813 SE JE CAS...OSTANI FUSIONPOP SLO 01.02.2018 00:24:17 HD 29190 DISAPPEAR INXS ANG 01.02.2018 00:28:17 HD 31198 ERES TU MOCEDADES OSTALO 01.02.2018 00:31:47 HD 42326 SAMOTNI OTOK CUDEZNA POLJA SLO 01.02.2018 00:34:44 HD 61249 PRIDI ZDEJ K MEN (VER.2) FRENK NOVA SLO 01.02.2018 00:37:35 HD 55841 READY FOR THE GOOD LIFE PALOMA FAITH ANG 01.02.2018 00:40:57 HD 42764 LETIM MUNCHMELLOW SLO 01.02.2018 00:44:15 HD 02482 IN YOUR EYES SYLVER ANG 01.02.2018 00:47:46 HD 10466 JEDINA PETAR GRASO HRV 01.02.2018 00:52:19 HD 61739 CESTA MESTA GREEN NOTE COLLECTIVE SLO 01.02.2018 00:55:06 HD 00548 DALEC STRAN PANDA SLO 01.02.2018 00:59:44 HD 54852 ROCK AND ROLL SHOES JOHNNY CASH ANG 01.02.2018 01:02:26 HD 32132 SOMEDAY LOVE WILL FIND YOU JOURNEY ANG 01.02.2018 01:07:49 HD 60478 TAK DAN NUSKA DRASCEK SLO 01.02.2018 01:11:08 HD 48217 SE POCASI DALEC PRIDE ADI SMOLAR & MESTNI POSTOPACI SLO 01.02.2018 01:16:14 HD 39645 FREEZE FRAME J.GEILS BAND ANG 01.02.2018 01:20:05 HD 37765 YOUNG LOVE CARTERS CHORD ANG 01.02.2018 01:23:26 HD 16504 NOCOJ BOMO MI PRIZGALI DAN MARTIN KRPAN SLO 01.02.2018 01:27:21 HD 34973 HUMANITY SCORPIONS ANG 01.02.2018 01:32:08 HD 48962 THE OTHER SIDE OF BROKEN MARK MEDLOCK ANG 01.02.2018 01:35:52 HD 15110 NEKOGA MORAS IMETI RAD BABILON SLO 01.02.2018 01:39:57 HD 61717 MARRY ME THOMAS RHETT ANG 01.02.2018 01:43:23 HD 46222 HOLD MY HAND MICHAEL JACKSON FEAT. -

Craig David Slicker Than Your Average Mp3, Flac, Wma

Craig David Slicker Than Your Average mp3, flac, wma DOWNLOAD LINKS (Clickable) Genre: Funk / Soul Album: Slicker Than Your Average Country: Poland Released: 2002 Style: RnB/Swing MP3 version RAR size: 1745 mb FLAC version RAR size: 1638 mb WMA version RAR size: 1813 mb Rating: 4.4 Votes: 164 Other Formats: AHX DXD MIDI MP2 MP4 DTS XM Tracklist Hide Credits Slicker Than Your Average A1 Rap – Trell A2 What's Your Flava? A3 Fast Cars A4 Hidden Agenda Eenie Meenie A5 Featuring – Messiah Bolical You Don't Miss Your Water ('Til The Well Runs Dry) A6 Producer – Biker*, Soulshock Rise & Fall A7 Producer – Soulshock & KarlinVocals – Sting B1 Personal B2 Hands Up In The Air 2 Steps Back B3 Producer – Soulshock & Karlin Spanish B4 Featuring – Duke OneProducer – Marshall* What's Changed B5 Vocals [Additional] – Katie Holmes World Filled With Love B6 Producer – Craig David, Fraser T. Smith* Companies, etc. Distributed By – Warner Music Poland Manufactured By – TAKT Notes Made in Poland Hologram ZPAV-ZAiKS Barcode and Other Identifiers Barcode: 824678002544 Other versions Category Artist Title (Format) Label Category Country Year Slicker Than Your Craig Wildstar CDWILD42 Average (CD, Album, CDWILD42 UK 2002 David Records Ltd) Craig Slicker Than Your Wildstar VICP-62160 VICP-62160 Japan 2002 David Average (CD, Album) Records Slicker Than Your Craig Wildstar PROP05295 Average (CD, Album, PROP05295 Europe 2002 David Records Copy Prot., Promo) Wildstar TWR0025-2, Craig Slicker Than Your Records, TWR0025-2, Europe 2002 2467 80025-2 David Average (CD, Album) Wildstar 2467 80025-2 Records Slicker Than Your Craig SP999 Average (CD, Album, Sony Records SP999 Russia 2002 David Unofficial) Related Music albums to Slicker Than Your Average by Craig David 1. -

Standesamtli- Daumen

FEBRUAR / MÄRZ 2008 · UNBEZAHLBAR Hindenburger ZEITSCHRIFT FÜR MÖNCHENGLADBACH MG NIMMT AB Mit dem HINDENBURGER zur Traumfigur MIT GROSSEM GASTRO Leckere Läden TERMIN- AUSBILDUNG KALENDER Textilstadt MG braucht PARTY · KULTUR · MUSIK Nachwuchs SPORT · KIDS MOTHER AFRICA Circus der Sinne PFLANZEN QUEERBEET Der Hephata Garten-Shop AUFSTIEGSKAMPF Interview mit Borussentrainer Jos Luhukay MUSIK Die Behindertenband tschitschaPeng! Ja,Ja, ichich will!will! SCHÖNERSCHÖNER HEIRATENHEIRATEN ININ MÖNCHENGLADBACHMÖNCHENGLADBACH KSS-Werbecenter kopieren . drucken . werben PUNKT GEMERKT Endverarbeitung Bindungen Laminat & Grosslaminat • Hardcoverbindung • Wasserfest • Leimbindung • Lichtgeschützt 1BSLFOEJSFLU BN)BVT • Metallspiralbindung • Reissfest 4JUUBSEQMBU[ • Plastikspiralbindung • Bis A1 Werbung & Promotion • Feuerzeuge • Taschen • Kugelschreiber • Schlüsselbänder • Mousepads • Luftballons Werbetechnik • Puzzle • Blöcke • Autobeschriftungen • LED-Schriften • Folienschnitte • Beschilderungen aller Art Print- Service • Montage • Displays/Blenden • Digitaldruck • Flyerdruck • Fensterbeschriftung • Ausstellungssysteme • Offsetdruck • Leinwanddruck • Leuchtwerbung • Shop-Systeme • Posterdruck • Bannerdruck 3D Logos & Schriften Satz & Layout • Laserschneiden • Lasergravur • Flyer • Geschäftspapiere • Fräsen • Wasserstrahlschneiden • Broschüren • Speisekarten • Plakate • Bildbearbeitung/Retusche Grossformat-Reprokopien • Kataloge • Scan-Service bis A0 • Architektenpläne • Zeichnungen Textildruck • T-Shirts • Hemden Besuchen Sie unsere neue Internetseite -

Backing Tracks Catalog

1 fois 5 ~ Chacun dit je t'aime 1, 2, 3 Soleils ~ Comme d'habitude 1, 2, 3 Soleils ~ Abdel Kader 10 Years ~ Wasteland 10 Years ~ Through The Iris 10,000 Maniacs ~ Like the Weather 10,000 Maniacs ~ More Than This 10,000 Maniacs ~ Because the Night 10,000 Maniacs ~ These Are Days 101 Dalmatians (1996 film) ~ Cruella De Vil 10cc ~ Dreadlock Holiday 10cc ~ I'm Not in Love 10cc ~ The Wall Street Shuffle 10cc ~ The Things We Do For Love 10cc ~ Rubber Bullets 10cc ~ Donna 10cc ~ Life Is a Minestrone 112 ~ Cupid 112 ~ Peaches And Cream 112 ~ Dance With Me 112 ~ Only You (Bad Boy remix) 12 Gauge ~ Dunkie Butt 12 Stones ~ Far Away 12 Stones ~ Crash 12 Stones ~ The Way I Feel 1789, Les Amants de la Bastille ~ Ça ira mon amour 1789, Les Amants de la Bastille ~ Pour la peine 1789, Les Amants de la Bastille ~ La sentence 1789, Les Amants de la Bastille ~ Fixe 1789, Les Amants de la Bastille ~ Le temps s'en va 1789, Les Amants de la Bastille ~ Je mise tout 1789, Les Amants de la Bastille ~ Hey Ha 1789, Les Amants de la Bastille ~ La nuit m'appelle 1789, Les Amants de la Bastille ~ Je veux le monde 1789, Les Amants de la Bastille ~ Tomber dans ses yeux 1789, Les Amants de la Bastille ~ Sur ma peau 1789, Les Amants de la Bastille ~ La guerre pour se plaire 1789, Les Amants de la Bastille ~ Au palais royal 1789, Les Amants de la Bastille ~ Allez viens (c'est bientôt la fin) 1789, Les Amants de la Bastille ~ Pour un nouveau monde 1789, Les Amants de la Bastille ~ La rue nous appartient 1789, Les Amants de la Bastille ~ A quoi tu danses ? 1789, Les Amants -

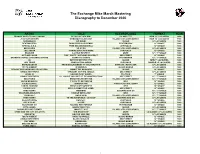

The Exchange Mike Marsh Mastering Discography to December 2020

The Exchange Mike Marsh Mastering Discography to December 2020 ARTIST TITLE RECORD LABEL FORMAT YEAR FRANKIE GOES TO HOLLYWOOD RELAX (12" SEX MIX) ISLAND / ZTT NEW 12" LACQUERS 1988 JOCEYLYN BROWN SOMEBODY ELSES GUY ISLAND / 4TH & BROADWAY NEW 12" LACQUERS 1988 SHRIEKBACK GO BANG! ISLAND LP LACQUERS 1988 BEATMASTERS BURN IT UP (ACID REMIX) RHYTHM KING 12" SINGLE 1988 SPECIAL A.K.A. FREE NELSON MANDELA CHRYSALIS 12" SINGLE 1988 MICA PARIS SO GOOD ISLAND / 4TH & BROADWAY LP LACQUERS 1988 JELLYBEAN COMING BACK FOR MORE CHRYSALIS 12" SINGLE 1988 ERASURE A LITTLE RESPECT MUTE 12" / 7" SINGLE 1988 OUTLAW POSSE THE * PARTY / OUTLAWS IN EFFECT GEE STREET 12" SINGLE 1988 BRANDON COOKE & ROXANNE SHANTE SHARP AS A KNIFE PHONOGRAM 12" / 7" SINGLE 1988 U2 WITH OR WITHOUT YOU ISLAND NEW 7" LACQUERS 1988 JUDI TZUKE COMPILATION ALBUM CHRYSALIS DOUBLE LP LACQUERS 1988 NAPALM DEATH FROM ENSLAVEMENT TO OBLITERATION EARACHE / REVOLVER LP LACQUERS 1988 TOOTS HIBBERT IN MEMPHIS ISLAND MANGO LP LACQUERS 1988 REGGAE PHILHARMONIC ORCHESTRA MINNIE THE MOOCHER ISLAND 12" SINGLE 1988 JUNGLE BROTHERS STRAIGHT OUT THE JUNGLE GEE STREET LP LACQUERS 1988 LEVEL 42 HEAVEN IN MY HANDS POLYDOR 7" SINGLE 1988 JUNGLE BROTHERS I'LL HOUSE YOU (GEE ST. RECONSTRUCTION) GEE STREET 12" / 7" SINGLE 1988 MICA PARIS BREATHE LIFE INTO ME ISLAND / 4TH & BROADWAY 12" / 7" SINGLE 1988 BLOW MONKEYS IT PAYS TO BE TWELVE RCA 12" SINGLE 1988 STEVEN DANTE IMAGINATION CHRYSALIS COOLTEMPO 12" SINGLE 1988 TANITA TIKARAM TWIST IN MY SOBRIETY WEA 10" SINGLE 1988 RICHIE RICH MY D.J. (PUMP IT UP SOME) GEE STREET 12" SINGLE 1988 TODD TERRY WEEKEND SLEEPING BAG UK 12" / 7" SINGLE 1988 TRAVELING WILBURYS HANDLE WITH CARE WEA 12" / 7" SINGLE 1988 YOUNG M.C. -

February 2008 Entertainment on Board

February 2008 Entertainment on board Elizabeth: The Golden Age Omslag_FEB08_mj.inx 1 08-01-15 16.02.02 Airbus A340 Handset Business Class Cursor Navigation Arrows Press to enter your selection Video Screen On/Off On-Screen Menu Channel Select Volume Control Reading Light Attendant Call Call Reset Game Controls Instructions will be given when playing the game. Menu Bar X1 Quit Light Language Pause Forward Sound Reverse Play Airbus A340 Handset Economy Extra and Economy Class Cursor Navigation Arrows Channel Select Volume Control Attendant Call Call Reset Reading Light Video Screen On/Off On-Screen Menu Game Controls Press to enter your selection Menu Bar Quit Light Language Sound To play, place the handset in a horizontal position and use both hands to control the action. To replace the handset in the armrest, pull the cable gently to release the cable lock. Omslag_FEB08_mj.inx 2 08-01-15 16.02.07 Welcome aboard For your enjoyment on board this aircraft, SAS has provided first-class entertainment. Using touch-screen technology, choose your own entertainment directly on your personal video screen. Alternatively, you can use your personal handset to navigate around the screen and make your choices. We have provided a variety of movies, audio programs and games, as well as information on the progress of your flight. Before take-off, the forward-looking camera and the moving map are available on all seatback-mounted video screens. Just reach out and touch the screen to activate it. Once airborne, armrest-mounted screens may be used. The downward-looking camera will now be activated and the moving map channel will continually be updated to let you know where you are, how far it is to your destination, and to display other relevant flight information as well as video information programs relating to your flight. -

Billboard Magazine

THE HOT 100 ODD COUPLE Wiz Khalifa and Charlie Puth on their No. 1 hit PITCH PERFECT 2’S 91 STEALTH SOUNDTRACK No tracklist, no ‘Cups’ -.1 ...no worries? the BILLBOARD MUSIC2015 AWARDS STARRING Hosts Ludacris and Chrissy Teigen: ‘We’re turning the BBMAs into a party!’ May 16, 2015 | billboard.com Performer portfolio: Hozier, Pete Wentz, Nick Jonas and Meghan Trainor Stars reveal awards show horror stories: ‘...then the monkey bit Shakira’ Baller’s guide to Vegas: Pet a tiger, shop with Nas UK £5.50 WAKE UP ON THE RIGHT SIDE OF THE PLANE. Catch some Z’s when catching your next flight. Arriving ready is just one of the perks of flat-bed seats, Westin Heavenly® In-Flight Bedding, and everything else available on all our nonstops from LAX to JFK. KEEP CLIMBING AD E LTA Delta One available on long-haul international flights, and on transcontinental flights between JFK and LAX, and JFK and SFO. Get the details at delta.com/deltaone billboard (c SELIM LC and Nielsen Music, Inc.LC All rights reserved. “I’ve really been working to get here,” says T-Wayne of his chart leap. I. -- . "nil om/biz for complete rules and explanations. © 2015, Prometheus Global Media, L © 2015, Prometheus om/biz for complete rules and explanations. Title CERTIFICATION Artist 2 Weeks Ago Last Week This Week PRODUCER (SONGWRITER) IMPRINT/PROMOTION LABEL Peak Position Weeks On Chart #1 AG 18 4 WK S See You Again Wiz Khalifa Feat. Charlie Puth T-Wayne Whips Up A 0 DJ FRANK E,C.PUTH,A.CEDAR (J.FRANKS,A.CEDAR,C.J.THOMAZ,C.PUTH) UNIVERSAL STUDIOS/ATLANTIC/RRP sic, sales data as compiled by Nielsen Music and streaming activity data by online music sources tracked by Nielsen Music.