Estate Plan Is Not Properly Effectuated

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Howard Hughes

Howard Hughes Howard Hughes September 24, 1905 Born Houston, Texas, USA April 5, 1976 (aged 70) Died Houston, Texas, USA Chairman, Hughes Aircraft; Occupation industrialist; aviator; engineer; film producer Net worth US$12.8 bn (1958 Forbes 400) Ella Rice (1925-1929) Spouse Terry Moore (1949-1976) Jean Peters (1957-1971) For the Welsh murderer, see Howard Hughes (murderer). Howard Robard Hughes, Jr. (September 24, 1905 – April 5, 1976) was, in his time, an aviator, engineer, industrialist, film producer and director, a palgrave, a playboy, an eccentric, and one of the wealthiest people in the world. He is famous for setting multiple, world air-speed records, building the Hughes H-1 Racer and H-4 Hercules airplanes, producing the movies Hell's Angels and The Outlaw, owning and expanding TWA, his enormous intellect[1], and for his debilitating eccentric behavior in later life. Early years Hughes was born in Houston, Texas, on 24 September or 24 December 1905. Hughes claimed his birthday was Christmas Eve, although some biographers debate his exact birth date, (according to NNDB.com, it was most likely "the more mundane date of September 24"[2] ). His parents were Allene Stone Gano Hughes (a descendant of Catherine of Valois, Dowager Queen of England, by second husband Owen Tudor) [3][4] and Howard R. Hughes, Sr., who patented the tri-cone roller bit, which 1 allowed rotary drilling for oil in previously inaccessible places. Howard R. Hughes, Sr. founded Hughes Tool Company in 1909 to commercialize this invention. Hughes grew up under the strong influence of his mother, who was obsessed with protecting her son from all germs and diseases. -

Fall 2000.Indd

CENTER E FO H R T L FALL 2000 A N N O THE LAY OF THE LAND I D THE CENTER FOR LAND USE INTERPRETATION NEWSLETTER T U A S T E RE INTERP “In the field of Interpretation, whether of the National Park System or other institutions, the activity is not instruction so much as what we may call provocation. It is true that the visi- tors to these preserves frequently desire straight information, which may be called instruction, and a good interpreter will always be able to teach when called upon. But the purpose of ➣ Interpretation is to stimulate the reader or hearer toward a desire to widen his horizon of interests and knowledge, and to gain an understanding of the greater truths that lie behind any statements of fact.” -From Interpreting our Heritage: Principles and Practices for Visitor Services, by Freeman Tilden FORMATIONS OF ERASURE CLUI OPENS INTERPRETIVE SITE IN DESERT EARTHWORKS AND ENTROPY SHOW LAUNCHES NEW CLUI LA EXHIBIT SPACE DESERT RESEARCH STATION IN HINKLEY, CALIFORNIA The Desert Research Station opened to the public in November, 2000, and is currently open The Formations of Erasure: Earthworks and Entropy exhibit and Land Art Database terminal to visitors during the weekends. at CLUI, Los Angeles. CLUI photo THE DESERT RESEARCH STATION, in the desert near Barstow, California, THE NEW EXHIBIT SPACE at the renovated CLUI Los Angeles location was once a thriving educational nature station for biologists and local opened in September with the exhibit Formations of Erasure: Earthworks school groups. In recent years, however, it was abandoned and vandal- and Entropy. -

U.S. Department of Justice Federal Bureau of Investigation Washington

U.S. Department of Justice Federal Bureau of Investigation Washington, D.C. 20535 June 22, 2021 MR. JOHN GREENEWALD JR. SUITE 1203 27305 WEST LIVE OAK ROAD CASTAIC, CA 91384-4520 FOIPA Request No.: 1432458-000 Subject: DUMMAR, MELVIN Dear Mr. Greenewald: The enclosed documents were reviewed under the Freedom of Information/Privacy Acts (FOIPA), Title 5, United States Code, Section 552/552a. Below you will find check boxes under the appropriate statute headings which indicate the types of exemptions asserted to protect information which is exempt from disclosure. The appropriate exemptions are noted on the enclosed pages next to redacted information. In addition, a deleted page information sheet was inserted to indicate where pages were withheld entirely and identify which exemptions were applied. The checked exemption boxes used to withhold information are further explained in the enclosed Explanation of Exemptions. Section 552 Section 552a (b)(1) (b)(7)(A) (d)(5) (b)(2) (b)(7)(B) (j)(2) (b)(3) (b)(7)(C) (k)(1) (b)(7)(D) (k)(2) (b)(7)(E) (k)(3) (b)(7)(F) (k)(4) (b)(4) (b)(8) (k)(5) (b)(5) (b)(9) (k)(6) (b)(6) (k)(7) 11 pages were reviewed and 11 pages are being released. Please see the paragraphs below for relevant information specific to your request as well as the enclosed FBI FOIPA Addendum for standard responses applicable to all requests. Document(s) were located which originated with, or contained information concerning, other Government Agency (ies) [OGA]. This information has been referred to the OGA(s) for review and direct response to you. -

The Deseret News

The Deseret News SALT LAKE CITY 15C Nostrums in the Newsroom Raised Sights and Raised Expectations at the DeseretNews By Paul Swenson Nineteen Hundred and Seventy-Six was not a dull year for the 127-year-old Deseret News. Melvin Dummar, a Box Elder County service station operator, was named, along with The Church of Jesus Christ of Latter-day Saints, as a major beneficiary in a purported Howard Hughes will. Idaho's Teton Dam burst, leaving hundreds homeless in the path of the flood. Rep. Allan Howe was arrested and convicted of soliciting sex in Salt Lake City. Theodore Bundy, a University of Utah law student and former aide to the Governor of Washington, was found guilty of attempted kidnapping. In addition, the newspaper's "Pinpoint" investigative team capped its second year of existence with a Sigma Delta Chi award for the year's best piece of investigative print journalism in Utah, a documented indictment of misspent Salt Lake County funds. And then there was Gary Gilmore. Before his execution, Jan. 17, 1977, Gilmore and the press were locked in a painful embrace that neither party could—or would—quit. The manipulative Gilmore engineered the newsflow on front pages worldwide with a degree of control he had never been able to apply to his own life. It was an irresistable news story: a brutal killer who wanted to die, and in the process challenged the hypocrisy behind a death sentence that seemed tortuously slow to culminate. Never mind that Gilmore was the first person likely to be executed in the United States in nine years and that the future of capital punishment in America perhaps hung in the balance. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

Case 3:88-cv-02779-WHA Document 902 Filed 09/30/20 Page 1 of 27 1 2 3 4 UNITED STATES DISTRICT COURT 5 NORTHERN DISTRICT OF CALIFORNIA 6 7 COLLEEN MARY ROHAN, ex rel. Case No. 88-cv-02779-WHA OSCAR GATES, 8 DEATH PENALTY CASE Petitioner, 9 ORDER GRANTING-IN-PART AND v. DENYING-IN-PART FIRST MOTION 10 FOR EVIDENTIARY HEARING RON BROOMFIELD, Acting Warden, San 11 Quentin State Prison, Respondent. 12 13 14 INTRODUCTION 15 In 1981, Oscar Gates was convicted, inter alia, of first-degree murder accompanied by the 16 robbery-murder special circumstance and received a death sentence, all affirmed on appeal. 17 People v. Gates, 43 Cal.3d 1168, 1176 (1987). He now seeks a writ of habeas corpus and, in United States District United States Court support of that effort, requests an evidentiary hearing on several claims presented in his petition. Northern District of CaliforniaNorthern of District 18 19 This order grants an evidentiary hearing on some of those claims. 20 STATEMENT 21 The pertinent facts underlying petitioner’s conviction and sentence have been previously 22 summarized and are repeated here as follows: 23 On December 10, 1979, Maurice Stevenson and his uncle, Lonnie Stevenson, waxed his car in front of Maurice’s grandfather’s house in Oakland at about 3:30 24 p.m. Petitioner appeared, holding a gun with the hammer cocked. Petitioner herded Maurice and Lonnie to the side of the house and ordered them to put their hands on 25 the wall, empty their pockets, and remove their jewelry. -

Estate Analyst®

The Estate Analyst® April 2012 Train Wrecks of Estate Planning Chief Justice Burger; When Not To Adopt Your Girlfriend; and the Enigmatic Estate of Howard Hughes By Robert L. Moshman, Esq. A wise person once observed train wrecks of bad planning can be “A helping word to one that a wreck on the shore serves as a mesmerizing. in trouble is often like beacon at sea. Without further adieu, here is a a switch on a railroad track Perhaps the estate planning collection of testators who left …an inch between wreck and errors of others can also serve as behind estates with notable errors, instructive examples. But one must smooth, rolling prosperity.” issues, and messes. concede that the most egregious —Henry Ward Beecher Presented With Our Compliments Warren E. Burger unified credit. So the use of an A/B plan to take advantage of both spouses’ unified credit was entirely inapplicable. One would expect a substantive and carefully wrought Burger’s estate had properly used the unified credits of both testamentary plan from an accomplished jurist such as the spouses, properly deferred taxes until the death of the second former Chief Justice of the United States Supreme Court, yet spouse, and had also shifted assets out of the estate using the will of Warren E. Burger consisted of a mere 176 words, lifetime gifts and inter vivos trusts. most of which consisted of the certifications of the witnesses. A smattering of newspapers printed corrections, but, to this In fact, there was only one sentence of dispositive instruction: day, Justice Burger’s estate is cited, incorrectly, as an example “The remainder of my estate will be distributed as follows: of what not to do. -

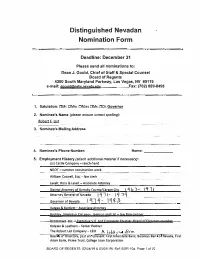

Distinguished Nevadan Nomination Form

Distinguished Nevadan Nomination Form Deadline: December 31 Please send all nominations to: Dean J. Gould, Chief of Staff & Special Counsel Board of Regents 4300 South Maryland Parkway, Las Vegas, NV 89119 e-mail: [email protected] Fax: (702) 889-8495 1. Salutation: □Mr. □Mrs. □Miss □Ms. □Dr. Governor 2. Nominee's Name (please ensure correct spelling): Robert E, List 3. Nominee's Mailing Address 4. Nominee's Phone Number: Home: _______ 5. Employment History (attach additional material if necessary): List Cattle Company-ranch-hand NDOT- summer construction work William Crowell, Esq. - law clerk Laxalt, Ross & Laxalt -Associate Attorney District Attorney of Ormsby County/Carson City \ Cf � 7- l q 7 I Attorney General of Nevada I Gj 11- I q l £J Governor of Nevada l q 7 q - I tf'6 3 Vargas & Bartlett -Associate Attorney Beckley, Singleton. Delanoy, Jemison and List- law firmpartner Baamtowo lac -ExerntiveY P aod CocpocateCrn msel Baaedat Directocsmember Kolesar & Leatham -Senior Partner The Robert List Company-CEO A. \ t,bb ii\ ,f;rm Boar so Directors, past an present: First Interstate Bank, Business Ban o Nevada, First Asian Bank, Prime Trust, College Loan Corporation (BOARD OF REGENTS 02/28/19 & 03/01/19) Ref. BOR-10g, Page 1 of 20 6. Educational Background (attach additional material if necessary): CarsonHigb School CarsonCity NV Utah State University, BS University of California, Hastings College of Law, JD \ '1'. (..:z... 7. Reasons for Nomination: (Please include outstanding accomplishments, achievements, and contributions to Nevada and its people. Please be specificand provide considerable detail. You may attach additionalpages if necessary.) ___________ .:See. -

View a PDF of This Issue

CENTER E FO SPRING H R T 2005 L A N N O I THE LAY OF THE LAND D THE CENTER FOR LAND USE INTERPRETATION NEWSLETTER T U A S T E RE INTERP Interpretation is an art, which combines many arts, whether the materials presented are scientific, historical, or architectural. -Freeman Tilden IMMERSED TOWNS SURFACE FOR EXHIBIT AT CLUI TERMINAL ISLAND INTENTIONALLY SUBMERGED AMERICA SUBJECT OF PROGRAM TOURING THE EDGE OF THE CONTINENT Part of the Immersed Remains exhibit at CLUI Los Angeles. CLUI photo by Elon Schoenholz OVER THE PAST CENTURY, hundreds of towns have been drowned in the nation, primarily for reservoir construction. Collectively, these lost places offer an alternate version of the history of America. An exhibit at Terminal Island: isolated from, yet connected to the World. Port of LA photo CLUI Los Angeles from January 21 through March 27, 2005 explored the phenomenon of these intentionally submerged communities. TERMINAL ISLAND IS AN artificial landmass in the heart of the ports of Long Beach and Los Angeles, and was the subject of an exhibit at the The exhibit was the result of three years of periodic research on the CLUI Los Angeles from March 31 to May 30th, 2005. subject, conducted by CLUI researcher Angela Loughry, assisted by Carrie Lincourt, Mike Asbill, and Matthew Coolidge. Research included The exhibit looked at Terminal Island as a sort of organismic, flowing, communicating with many local historic organizations, town offices, landscape machine, composed of five separate terminal activities that museums, municipalities, and archivists, as well as government agencies occur on the island: importation, exportation, excretion, deportation like the TVA, the Bureau of Reclamation, state parks departments, and and expulsion. -

Judge in Hughes Casit Calls Witness a 'Liar'

SFehron icle JAN 2 i= 1977 "When I first saw it, it was on the back bar (counter) of the Judge in Hughes Casit station," Dummar said. "A man drove in and started talking about `wouldn't it be nice if I were in it (the will).' I thought he was off his Calls Witness a 'Liar' rocker." Las Vegas Dummar said the mystery man showed up at his station about 10 District Judge Keith Hayes suddenly lashed out yesterday at witness a.m. that day. Melvin Dummar, calling him a "liar" and threatening to "have a piece of your hide" if he fails to tell the truth about his involvement with the so- "What did I think of Howard called "Mormon will" of Howard Hughes. Hughes dying? — I remember him saying that," Dummar said. "I also "Brother Dummar," said the, . remember him saying he had been judge, who is a Mormon, in a looking for me. traditional religious greeting to a fellow Mormon, "I want the truth., "I remember him saying `Wouldn't it be nice if a guy like me Where did it (the will) come from?" were in Howard Hughes' will." "A man brought it to the station," Dummar, a Utah gas sta- Dummar said he recalled tell- tion operator, responded. ing the man the story about picking up a disheveled old man in the "Do you know who wrote it?" Nevada desert, giving him a quart- the judge asked. "I do not," the witness replied. er and taking him to Las Vegas "Did you participate in its where the man identified himself preparation in any way?" as Hughes. -

6/2/2016 Dvdjan03 Page 1

DVDjan03 6/2/2016 MOVIE_NAME WIDE_STDRD STAR1 STAR2 02june2016 BuRay Disney remove group 5198 should add Dig Copies DOC was pbs now most donate Point Break (1991) Bray + dvd + DigHD BluR Patrick Swayze, Keanu Reeves gary busey / lori petty RR for railroad: SURF-separate ; DG (SAVEdv TRAV MUSIC ELVIS (500) day of summer BluRay Joseph Gordon-Levitt zooey deschanel 10 first time on BluRay (Blake Edwards) Dudley Moore / Julie Andrews Bo Derek 10 (blake edwards) 1st on BR BluR dudney moore / julie andrews bo derek / robert webber 10 items of less (netF) 101 one hundred one dalm (toon) Bray dvd dig disney studios diamond edition 101 one hundred one dalmations ws glenn close jeff daniels 12 monkeys ws bruce willis / brad pitt madelaeine stowe / christopher 127 hours BluR james franco 13 going on 30 (sp. Ed.) - bad ws jennifer garner / mark ruffalo judy greer / andy serkis 13 rue madeleine (war classic) james cagney / annabella richard conte / frank latimore 15 minutes robert deniro edward burns 16 Blocks B ray Bruce Willis / David Morse Mos Def 1776 ws william daniels / howard da silv ken howard / donald madden 1941 john belushi 1984 (vhs->dvd) richard burton john hurt 20 feet from stardom DVD + Bluray best doc oscar 2014 20,000 leagues under the sea (disney) kirk douglas / james mason paul anka / peter lorre 2001 a space odyssey ws keir dullea gary lockwood 2001 A Space Odyssey (S Kubrik) top 10 BluR keir dullea / gary lockwood play: Stanley Kubrick / Arthur C 2001:A Space Odyssey Best WarnerBros 50 B 1968 2010 the year make contct wd roy scheider -

Statp Held Key to Hughes Fate

StaTp‘i Held Key to Hughes Fate By Bill Richards if th, ink in the stamp was used be- mal manner into any Model R series Freese charged in court today that Washington Feet IStall Writer fore or after 1969. The Mormon will is machine and meter combination," the Dummar learned all he could about LAS VEGAS, Jan. 27—Despite . dated 1968. memo said. A company spokesman Hughes to help his wife write the In addition, Pitney-Bowes said in said the meter in the Desert Inn in three-page Mormon will. Freese al- three days of inconclusive testimony 1968 was the Model R series. leged that Dummar researched the in a court here about the validity of a three-page memo to List's office Jan. 17 that there was only one post. Pitney-Bowes has not had access to material on Hughes while attending the so-called Morman will of Howard Weber State University in Utah and Hughes, investigators said privately age meter at the Desert Inn where the envelope containing the stamp. Hughes lived in seclusion during the The spokesman said company experts reading the book, 'Hoax," written by today they can now tell for certain convicted Hughes' autobiography for- the will is a fake. time the alleged will was drawn up. worked from photographs of the enve- The company supplied the six-digit lope that showed the stamp en the ger Clifford Irving, and then gave The will is one of 35 that have been identification number of that machine back across the envelope's flap. -

Melvin Dummar, 74, Who Claimed Howard Hughes Left Him Millions, Dies - the New York Times

12/25/2018 Melvin Dummar, 74, Who Claimed Howard Hughes Left Him Millions, Dies - The New York Times Melvin Dummar, 74, Who Claimed Howard Hughes Left Him Millions, Dies By Katharine Q. Seelye Dec. 12, 2018 On a long drive through the Nevada desert one night in 1967, Melvin Dummar spotted a scruffy man lying by the side of the road. He picked him up and drove him to Las Vegas. During the ride, he said, the man told him he was Howard Hughes. The encounter might have been forgotten except for what happened nine years later, when Mr. Hughes, one of the richest men in the world, died. Mr. Dummar claimed to have received a copy of his handwritten will and, lo and behold, it said that Mr. Hughes had left him one‑sixteenth of his estate, an estimated $156 million. The revelation catapulted Mr. Dummar, at that point the owner of a gas station in Willard, Utah, to the center of a media circus. He was even the subject of a monologue by Johnny Carson on his late‑night talk show. (Mr. Carson remarked that people all over the country would probably start picking up hitchhikers.) Mr. Hughes died with no surviving immediate family and, according to his extended family, no will — which was why the document produced by Mr. Dummar, loaded with misspellings and incorrect information (unusual for the meticulous Mr. Hughes), caused such a sensation. Those relatives stood to inherit the Hughes fortune, estimated at more than $2 billion (about $9 billion today), if they could prove that the will brought forth by Mr.