Ambuja Cements Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Environmental Monitoring Report IND:Chhattisgarh State Road

Environmental Monitoring Report Project Number: 44427-013 October 2017 Period: January 2016 – June 2016 IND: Chhattisgarh State Road Sector Project Subproject : Group A Roads Submitted by Public Works Department, Government of Chattisgarh, Raipur This report has been submitted to ADB by the Public Works Department, Government of Chattisgarh, Raipur and is made publicly available in accordance with ADB’s Public Communications Policy (2011). It does not necessarily reflect the views of ADB. This environmental monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. LOAN NUMBER – 2981 IND Environmental Safeguards Monitoring Report Reporting Period: From January 2016 to June 2016 IND: Chhattisgarh State Road Sector Project Group ‘A’ Roads – (Package 1-6) Prepared by Public Works Department, Government of Chhattisgarh for the Asian Development Bank. This environmental safeguard monitoring report is a document of the borrower and made publicly available in accordance with ADB’s Public Communications Policy 2011 and the Safeguard Policy Statement 2009. The views expressed herein do not necessarily represent those of ADB’s Board of Directors, Management, or staff. TABLE OF CONTENTS SL. NO. ITEMS PAGE Abbreviations 4 1.0 Introduction 5 1.1 Project Description 5 1.2 Package Wise Details 6 1.2.1 Package 1: Raipur – Bhaisa (SH-9) 6 1.2.2 Package 2: Bhaisa – Baloda Bazar (SH-9) 7 1.2.3 Package 3: Nandghat – Baloda Bazar (SH-10) 8 1.2.4 Package 4: Baloda Bazar - Gidhori (SH- 9) 8 1.2.5 Package 5: Simga – Arang(Gullu) (SH- 20) 9 1.2.6 Package 6: Arang (Gullu) – Kurud (SH-20 / MDR) 10 1.3 Project Progress Status and Implementation Schedule 11 A. -

Sustainable Development Report 2017

I II X Sustainability The essence of our existence. Organisation Profile GRI-102, SDG-8, 9 Ambuja Cements Limited (ACL), started in 1986, is India’s leading Cement Company. Ambuja Cement is the premier cement brand in India for Ordinary Portland Cement (OPC), and low carbon products such as Pozzolana Portland Cement (PPC) and Pozzolana Composite Cement (PCC) having significant footprints across the Western, Eastern and Northern markets of India. Our customers range from Individual House Builders (IHBs) to governments to global construction firms. The total cement production for 2017 was 22.98 MT against the annual capacity of 29.65 million tonnes per annum (MTPA). Our employee strength stood at 5,328. In line with the 2030 SDG targets, Ambuja aims to achieve higher level of economic productivity through diversification, technological upgradation and innovation, with a focus on value-added products and services with sustainable human capital deployment. Nature of Company Ownership Ambuja Cements Limited (ACL) is a public limited company listed on the Bombay Stock Exchange Limited and National Stock Exchange of India Limited. The GDRs issued by the Company are listed on the Luxembourg Stock Exchange. LafargeHolcim Limited, Switzerland, is the majority shareholder. For the detailed shareholding pattern, please see the Annual Report on our website: www.ambujacement.com . Integrated Cement Plants Bulk Cement Terminals 1. Ambujanagar, Taluka Kodinar, District Gir 1. Muldwarka, District Gir Somnath, Gujarat; Somnath, Gujarat; 2. Panvel, District Raigad, Maharashtra; 2. Darlaghat, District Solan, Himachal Pradesh; 3. Kochi, Kerala; 3. Maratha Cement Works, District Chandrapur, 4. Surat, Gujarat; Maharashtra; 5. Mangalore, Karnataka. 4. -

Successful Auctions So Far

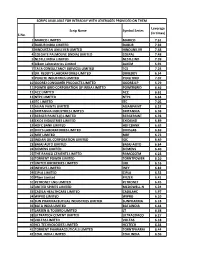

Successful Auctions so far: S State Name of the Block Mineral Date of ML / Area Reserves (in Final Preferred Bidder No auction CL (in MT) Bid (in Ha) %) 1 Andhra Gudipadu block Limestone 08.06.2016 ML 40.82 26.66 8.12 Penna Cements Pradesh 2 Andhra Erragudi-Hussainapuram Limestone 26.09.2017 ML 131.57 9.03 10.6 Sree Jayajothi Pradesh –Yanakandla Cements Pvt Ltd 3 Andhra Nandavaram–Venkatapuram Limestone 26.09.2017 ML 24.739 1.66 10.7 Sree Jayajothi Pradesh Cements Pvt Ltd 4 Andhra Chigargunta – Bisanatham Gold 27.07.2018 ML 262.01 2.22 38.25 NMDC Limited Pradesh 5 Andhra Chintalayapalle- Limestone 28.11.2018 ML 417.51 92.24 13.4 Adani Cementation Pradesh Abdullapuram-Korumanipalli Ltd (CAK) 6 Andhra Gorlagutta Limestone 27.05.2021 ML 181.03 61.14 7.25 M/s. Sree Jayajothi Pradesh Cements Private Limited 7 Chhattisgarh Karhi-Chandi Limestone 18.02.2016 ML 242.13 155 58.95 Shree Cement 8 Chhattisgarh Kesla Limestone 19.02.2016 ML 108 67 10.15 Century Cement 9 Chhattisgarh Baghmara Gold 26.02.2016 CL 474.3 2.7 12.55 Vedanta Ltd 10 Chhattisgarh Kesla II Limestone 01.05.2017 ML 357.07 215 96.15 Dalmia (bharat) cement 11 Chhattisgarh Guma Limestone block, Palari Limestone 12.03.2018 ML 249.03 124 138.25 Ultratech Cement 12 Chhattisgarh Mohra (Block A), Limestone 08.09.2020 ML 127.05 56.847 5.45 State Govt to inform Balodabazar, Balodabazar- Bhatapara 13 Chhattisgarh Parsabhadar, Balodabazar, Limestone 08.09.2020 ML 28.461 9.614 34.15 State Govt to inform Balodabazar-Bhatapara 14 Gujarat Mudhvay Sub- block B Limestone 25.05.2017 ML 233.5 301.5 -

Common Service Center List

CSC Profile Details Report as on 15-07-2015 SNo CSC ID District Name Block Name Village/CSC name Pincode Location VLE Name Address Line 1 Address Line 2 Address Line 3 E-mail Id Contact No 1 CG010100101 Durg Balod Karahibhadar 491227 Karahibhadar LALIT KUMAR SAHU vill post Karahibhadar block dist balod chhattisgarh [email protected] 8827309989 VILL & POST : NIPANI ,TAH : 2 CG010100102 Durg Balod Nipani 491227 Nipani MURLIDHAR C/O RAHUL COMUNICATION BALOD DISTRICT BALOD [email protected] 9424137413 3 CG010100103 Durg Balod Baghmara 491226 Baghmara KESHAL KUMAR SAHU Baghmara BLOCK-BALOD DURG C.G. [email protected] 9406116499 VILL & POST : JAGANNATHPUR ,TAH : 4 CG010100105 Durg Balod JAGANNATHPUR 491226 JAGANNATHPUR HEMANT KUMAR THAKUR JAGANNATHPUR C/O NIKHIL COMPUTER BALOD [email protected] 9479051538 5 CG010100106 Durg Balod Jhalmala 491226 Jhalmala SMT PRITI DESHMUKH VILL & POST : JHALMALA TAH : BALOD DIST:BALOD [email protected] 9406208255 6 CG010100107 Durg Balod LATABOD LATABOD DEKESHWAR PRASAD SAHU LATABOD [email protected] 9301172853 7 CG010100108 Durg Balod Piparchhedi 491226 PIPERCHEDI REKHA SAO Piparchhedi Block: Balod District:Balod [email protected] 9907125793 VILL & POST : JAGANNATHPUR JAGANNATHPUR.CSC@AISEC 8 CG010100109 Durg Balod SANKARAJ 491226 SANKARAJ HEMANT KUMAR THAKUR C/O NIKHIL COMPUTER ,TAH : BALOD DIST: BALOD TCSC.COM 9893483408 9 CG010100110 Durg Balod Bhediya Nawagaon 491226 Bhediya Nawagaon HULSI SAHU VILL & POST : BHEDIYA NAWAGAON BLOCK : BALOD DIST:BALOD [email protected] 9179037807 10 CG010100111 -

Ambuja Cements ( AMBCEM)

Ambuja Cements ( AMBCEM) CMP: | 407 Target: | 490 (20%) Target Period: 12 months BUY July 26, 2021 Beats estimates with strong margins… About the stock: Ambuja Cement (a Holcim group company) is a large cement player with capacity of over 29.7 MT spread across North-Central (40%), West (~35%) and East (~25%) India. It has a large marketing set-up, pan-India presence and strong operational linkages with ACC. Particulars The upcoming new capacity at Rajasthan will enhance its cement capacity by Particular Amount 1.8 MT to 31.5 MT and clinker capacity by 3.0 MT Market cap | 80816 crore Debt (CY20) | 72 crore Result Update Result In the long run, the company plans to reach over ~50 MT capacity through Cash & Invest (CY20) | 686 crore significant de-bottlenecking and setting up of satellite grinding units EV | 80202 crore 52 week H/L | 410 / 196 Equity capital | 397.1 crore Q1FY22 Results: Ambuja Cement reported 149 bps QoQ expansion in margins Face value | 2 leading to better profitability despite cost pressure. Shareholding pattern Clocked revenue of | 3,371 crore, down 6.9% QoQ led by sales volumes de- (in %) Sep-20 Dec-20 Mar-21 Jun-21 growth of 11.3% to 6.4 MT. On a YoY basis, revenues were up 53.2% Promoter 63.3 63.3 63.3 63.3 EBITDA/t was up 10.8% QoQ to | 1,495/t (vs. last quarter EBITDA/t of FII 16.8 18.1 17.8 17.7 | 1,349/t). EBITDA margin was at 28.5%, up 149 bps QoQ, 112 bps YoY DII 13.3 11.5 12.4 12.5 Others 6.6 7.1 6.6 6.5 Reported PAT was at | 723.1 crore, up 59.5% YoY, 8.8% QoQ vs. -

Uti Nifty Next 50 Index Fund

C MYK Index Fund UTI NIFTY NEXT 50 INDEX FUND Investment Objective Portfolio as on October 31, 2020 The investment objective of the scheme is to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the underlying index, subject to Equity % of NAV tracking error. Adani Green Energy Ltd. 4.41 However there is no guarantee or assurance that the investment objective of the scheme will be Avenue Supermarts Ltd. 4.39 achieved. Tata Consumer Products Ltd. 3.89 Dabur India Ltd. 3.81 Snapshot ICICI Lombard General Insurance Co Ltd. 3.55 Fund Manager - (Managing the scheme since July-2018) Info-Edge (India) Ltd. 3.54 Mr. Sharwan Kumar Goyal, CFA, MMS Godrej Consumer Products Ltd. 3.31 Pidlite Industries Ltd. 3.15 Market Capitalisation (%) Date of inception/allotment: Lupin Ltd. 2.87 28th June, 2018 Large Mid Small Aurobindo Pharma Ltd. 2.86 Fund size monthly average: ` 669.54 Crore Colgate Palmolive India Ltd. 2.66 Closing AUM: ` 680.21 Crore Fund 96 4 0 Bandhan Bank Ltd. 2.58 No. of Unit Holders : 51,072 Ambuja Cements Ltd. 2.51 Minimum Investment Amount : ` 5000/- Marico Ltd. 2.42 Subsequent minimum investment under a folio is Havells India Ltd. 2.40 Rs.1,000/- and in multiples of Rs. 1/- thereafter with no upper limit. Biocon Ltd. 2.36 Petronet Lng Ltd. 2.28 NAV (Regular) per unit as on October 31, 2020 Bharti Infratel Ltd. 2.08 Growth Option: ` 9.75 ICICI Prudential Life Insurance Company Ltd. 2.06 High/Low NAV in the month : Growth option ` 9.80, ` 9.60 Berger Paints India Ltd. -

08072017Eaj1w8okbriefreport.Pdf

INDEX S. NO. CONTENTS PAGE NO. 1.0 Introduction of Project Proponent 1 2.0 Description of the Existing Project 1 3.0 Existing Clearances 3 4.0 Existing Source of Limestone 3 5.0 Project Proposal 5 6.0 Outsourcing of Limestone 5 7.0 Approach to the Plant Site 5 8.0 Impact Due to Transportation of Limestone to be Outsourced 5 i Proposed Amendment in Environmental Clearance reg. outsourcing of Limestone in existing Cement Plant At Villages: Risda & Dhandhani, Tehsil: Balodabazar, District: Balodabazar - Bhatapara (Chhattisgarh) Project Report Project Report 1.0 INTRODUCTION OF PROJECT PROPONENT Emami group founded by Mr. R. S. Agarwal and Mr. R. S. Goenka in 1974 is a well-diversified, professionally managed group with the turnover of Rs. 9,000 Crore. Emami group has established itself in other sectors as; FMCG, news print, writing instruments, Health care and Hospitals, Retail pharmacies, Departmental stores, Bio diesel, Edible Oil, Real estate and construction. Now, the group is planning to vary its field of operation to manufacturing of Cement. Emami Cement Limited is an incorporated Company under Company’s Act 1956, is a unit of Emami Group and has entered MoU with Government of Chhattisgarh for setting up of an Integrated Cement Plant along with Limestone Mine, Captive Power Plant and Waste Heat Recovery Power Plant in Risda, Kukurdih and Dhandhani villages of Balodabazar Tehsil of District: Balodabazar -Bhatapara (Chhattisgarh). Emami Group is also setting up cement plant in other states; Grinding Unit is under operation in Panagarh (West Bengal) and another Clinker Grinding Unit is under construction in Jajpur (Odisha). -

Inner 9 Flexicap Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata Flexi Cap Fund o i L g (An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks.) h Riskometer Investors understand that their principal As on 31st July 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investing in equity and equity related Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets instruments of well researched companies across market Equity & Equity Related Total 185889.49 93.44 Leisure Services capitalization. Auto Jubilant Foodworks Ltd. 115000 4341.42 2.18 INVESTMENT OBJECTIVE Eicher Motors Ltd. 102000 2580.86 1.30 Easy Trip Planners Ltd. 500000 2045.50 1.03 The investment objective of the Scheme is to generate capital Auto Ancillaries Pesticides appreciation over medium to long term. However, there is no MRF Ltd. 4750 3795.60 1.91 Astec Lifesciences Ltd. 173000 2401.59 1.21 assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any Banks Bayer Cropscience Ltd. 34921 2017.88 1.01 returns. ICICI Bank Ltd. 2200000 15015.00 7.55 Petroleum Products DATE OF ALLOTMENT HDFC Bank Ltd. 560000 7988.12 4.02 Reliance Industries Ltd. 565000 11499.45 5.78 September 06,2018 Axis Bank Ltd. 761500 5398.27 2.71 Pharmaceuticals Kotak Mahindra Bank Ltd. 225000 3723.30 1.87 Dr Reddys Laboratories Ltd. -

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

IBEF Presentataion

CEMENT For updated information, please visit www.ibef.org December 2017 Table of Content Executive Summary……………….…..……3 Advantage India…………………..….……. 4 Market Overview and Trends………..…….6 Porter’s Five Force Framework Analysis...12 Growth Drivers and Opportunities……… 13 Investment Scenario...…….………......... 15 Policies and Initiatives……….………….. 18 Case Studies……….………..............….. 19 Key Industry Organizations……….…….. 24 Useful information……….……….......….. 26 EXECUTIVE SUMMARY Second largest cement Dominated by private Higher share of large Large concentration in market players plants south and west . With cement . Of the total capacity, . 210 large cement . Of the total 210 production capacity 98 per cent lies with plants account for a large cement of nearly 420 million the private sector & cumulative installed plants in India, 77 tonnes, as of March the rest with public capacity of over are situated in the 2017. sector. 350 million tonnes, states of Andhra while over 350 mini . India’s cement . The top 20 companies Pradesh, production capacity accounting for around cement plants have Rajasthan & Tamil is expected to reach 70 per cent of the total an estimated Nadu. production capacity 550 million tonnes by production 2025. of nearly 11.10 million tonnes, as . India is the second of 2016. largest cement producer in the world. Source: Business Standard, Ministry of External Affairs, 3 Cement For updated information, please visit www.ibef.org Cement ADVANTAGE INDIA ADVANTAGE INDIA Robust demand Long-term potential . Increased allocation to infrastructure . Oligopoly market, where large players projects in Union Budget 2017-18 to have partial pricing control drive demand . Low threat from substitutes . Initiative to build 100 smart cities and boost to affordable housing projects to give a further stimulus ADVANTAGE INDIA Attractive opportunities Increasing investments . -

Loan Against Securities – Approved Single Scrip

Loan against securities – Approved single scrip Security ISIN Code Scrip Name Type Margin INE769A01020 AARTI INDUSTRIES Single Scrip 50 INE012A01025 ACC LIMITED Single Scrip 50 INE079A01024 AMBUJA CEMENTS LTD Single Scrip 50 INE437A01024 APOLLO HOSPITALS ENTERPRISE LTD Single Scrip 50 INE208A01029 ASHOK LEYLAND LTD Single Scrip 50 INE021A01026 ASIAN PAINTS LTD Single Scrip 50 INE406A01037 AUROBINDO PHARMA LTD Single Scrip 50 INE192R01011 AVENUE SUPERMARTS Single Scrip 50 INE917I01010 BAJAJ AUTO LTD Single Scrip 50 INE296A01024 BAJAJ FINANCE LTD Single Scrip 50 INE028A01039 BANK OF BARODA Single Scrip 50 INE084A01016 BANK OF INDIA Single Scrip 50 INE463A01038 BERGER PAINTS INDIA LTD Single Scrip 50 INE029A01011 BHARAT PETROLEUM CORPORATION LTD Single Scrip 50 INE323A01026 BOSCH LTD Single Scrip 50 INE216A01030 BRITANNIA INDUSTRIES LIMITED Single Scrip 50 INE010B01027 CADILA HEALTHCARE LTD Single Scrip 50 INE476A01014 CANARA BANK Single Scrip 50 INE172A01027 CASTROL INDIA LTD Single Scrip 50 INE059A01026 CIPLA LTD Single Scrip 50 INE522F01014 COAL INDIA LTD Single Scrip 50 INE259A01022 COLGATE-PALMOLIVE (INDIA) LTD Single Scrip 50 INE016A01026 DABUR INDIA LTD Single Scrip 50 INE361B01024 DIVIS LABORATORIES LTD Single Scrip 50 INE089A01023 DRREDDYS LABORATORIES LTD Single Scrip 50 INE066A01021 EICHER MOTORS LIMITED Single Scrip 50 INE302A01020 EXIDE INDUSTRIES LTD Single Scrip 50 INE129A01019 GAIL (INDIA) LTD Single Scrip 50 INE176B01034 HAVELLS INDIA LTD Single Scrip 50 INE860A01027 HCL TECHNOLOGIES LTD Single Scrip 50 INE040A01034 HDFC -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues.