Investment Perspectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ELLAKTOR Presentation March 5Th, 2020 Table of Contents

ELLAKTOR Presentation March 5th, 2020 Table of contents 1 Executive summary 2 Business Overview 3 Capital Structure 4 9M 2019 Financials 1 1 Executive summary 2 Business Overview 3 Capital Structure 4 9M 2019 Financials 2 Executive Summary ELLAKTOR history 1950s-1990s 1990s-2000s 2000-2009 2010-2018 2018 - forward 1950s: Establishment of 1999: Led domestic 2007: Acquisition of TEB, ELLINIKI construction sector Pantechniki, leading to Industry TECHNODOMIKI and consolidation (Merger of controlling stake in Attiki consolidation AKTOR TEB, Elliniki Odos (59%) Technodomiki & AKTOR) 1996: Signed first 2003: Entry into concession projects environment segment Diversification (Attiki Odos and Rio- 2008: Signed 3 out of 5 of activities Antirrio Bridge) major concession projects awarded in Greece 2004: First international 2012: c. €600m of construction contracts in projects in the Balkans Romania and Kuwait Geographic 2014: €3.2bn Doha metro 2005: Internationalisation diversification project in Qatar of HELECTOR through acquisition of Herhof GmbH 2010-2012: Sale of gold 2018: Sale of Athens Resort assets Casino (€13.5 ml) Focus on core 2014: ELTECH ANEMOS 2018: Increased stake in IPO Attiki Odos by 6.5% competencies 2019: Sold Corporate Headquarters (€25.5 ml) and stake in Elpedison (€ 18 ml) 2015: 1st Waste PPP in July 2018: Newly elected Greece Board post 1st proxy fight in Renewed 2016: Moreas completed Greece opportunity / in full operation July 2019: Group 2017-18 :Olympia Odos rationalization / ELTECH & Maliakos completed ANEMOS absorption 4 The ELLAKTOR group led the construction sector consolidation in Greece H’ (Highest) grade construction companies in 1998 (€m) 7th grade(1) construction companies in 2018 (€m)(2) Thessaliki SA Etep SA Parnon SA Themeli SA Odon & Odostromaton SA Ekter SA INTRAKAT SA Gekat SA Europaiki Techniki SA I.G. -

AXIA Research

Greece Outlook 2019: The year of the elections AXIA Research Table of Contents Start of a new era ......................................................................................................... 3 Early elections or at the end of the government’s term? ....................................................................... 3 Unexciting economic performance, while fiscal space shrinks without pro-growth ........................................... 4 Elections is the key catalyst for the markets .................................................................................... 5 Top picks ......................................................................................................................... 5 2019, the year of the elections ......................................................................................... 6 The day after the Prespa Agreement ......................................................................................................................................... 6 Timing of elections: May vs. September/October ...................................................................................................................... 7 Looking at recent polls ............................................................................................................................................................... 9 Strategies by Syriza and ND ahead and after the elections ...................................................... 13 Syriza to try to close the gap with ND as is already regrouping -

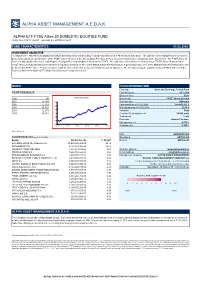

Alpha Asset Management Α.Ε.D.Α.Κ

ALPHA ASSET MANAGEMENT Α.Ε.D.Α.Κ. ALPHA ETF FTSE Athex 20 DOMESTIC EQUITIES FUND HCMC Rule 789/13.12.2007 Gov.Gaz. s.n. 2474/B/31.12.07 FUND CHARACTERISTICS 01.02.2008 INVESTMENT OBJECTIVE The Alpha ETF FTSE Athex 20 DOMESTIC EQUITIES FUND is the first Exchange Traded Fund listed on the Athens Stock Exchange. The objective of the Mutual Fund’s investment policy is to replicate the performance of the FTSE® Athex 20 Index of the Athens Stock Exchange in Euro, by mirror matching the composition of the Benchmark. The FTSE® Athex 20 Index is a big capitalization Index, capturing the 20 largest blue chip companies listed on the ATHEX. The total value of investments in shares of the FTSE® Athex 20 Index and in FTSE® Athex 20 Index derivatives accounts for a regulatory minimum of 95% of the Mutual Fund’s Net Asset Value. A percentage up to 35% of the Mutual Fund’s Net Asset Value may be invested in FTSE® Athex 20 Index derivatives with the aim of achieving the Mutual Fund’s investment objectives. The derivatives may be tradable (such as FTSE® Athex 20 Index futures) and/or non-tradable (OTC Swap Transactions) in a regulated market. INDEX FUND INFORMATION Fund type Domestic Exchange Traded Fund PERFORMANCE First listing date 24.1.2008 Base currency Euro Year (%) FTSE Athex 20 Index Benchmark FTSE® Athex 20 Index 2007 15,79% 3300 Currency risk Minimum 2006 17,73% Fund assets as of 01.02.2008 141.403.221 € 2800 2005 30,47% Net unit price as of 01.02.2008 23,40 € 2004 32,27% 2300 Valuation Daily 2003 35,43% 1800 Creation / Redemption unit 50.000 units 1300 Trading unit 1 unit Dividends Annual - 30 June 800 Management fee 0,275% 300 31/12/02 31/12/03 31/12/04 31/12/05 31/12/06 31/12/07 Custodian fee 0,100% Source: Bloomberg ISIN GRF000013000 COMPOSITION (as of 01.02.2008) Bloomberg AETF20 GA Equity Market Cap (€) % Weight Reuters AETF20.AT NATIONAL BANK OF GREECE S.A. -

Marfin Investment Group Financial Results: First Half 2013

Investor Relations +30 210 3504046 www.marfininvestmentgroup.com Investor Release 2 September 2013 MARFIN INVESTMENT GROUP FINANCIAL RESULTS: FIRST HALF 2013 MIG achieves operating EBITDA profitability from recurring business operations (€11.1m vs. €1.6m losses in H1 2012) Consolidated H1 2013 revenues of €581.3m, 3.6% annual reduction, amid ongoing adverse economic and market conditions. Consolidated Q2 2013 revenues of €313.2m, vs. €323.3m in Q2 2012, implying a deceleration to the annual rate of revenue decline on a quarterly basis. H1 2013 EBITDA from recurring business operations 1 of €11.1m, a significant improvement vs. €1.6m loss in H1 2012, attributed to market share gains, expanding gross profit margins, cost containment effectiveness and improved efficiency. Reported group EBITDA of €4.0m, vs. €7.6m loss in H1 2012. Consolidated net loss, after tax and minorities, of €139.7m, adversely impacted by one-off deferred taxes (€35m) and discontinued operations’ losses (€22.8m), vs. €960.5m losses in H1 2012. H1 2013 Net Asset Value (NAV) of €1.23bn (vs. €1.30bn in FY2012), translating to a NAV per share of €1.59 (vs. €1.68 in FY2012). Cash balances, including restricted cash, of €177m at group and €100m at parent company level. Group receivables from the Greek state at €130m in H1 2013 vs. €146m in FY2012. Continuous dynamic asset rebalancing, aimed at deleveraging, yields the desired results, as consolidated gross debt declined by €61m vs. FY2012. Convertible Bond Loan (CBL) issue (29.07.2013) was covered by a total amount of €215m, of which €211.9m originated from the tender for exchange of bonds issued by the Company on 19.03.2010 and €3.1m represents new capital from the exercise of pre-emption rights. -

Annual Report 2020

Business segments Enter/ Full Financial Financial Exit Screen Highlights R&D&I and Statements 2020 Aluminium Copper Cables Steel pipes Steel Real estate Technology 2020 ● ● ● ● ● ● ● ● ● Annual Report 2020 Business segments Enter/ Full Financial Financial Exit Screen Highlights R&D&I and Statements 2020 Aluminium Copper Cables Steel pipes Steel Real estate Technology 2020 ● ● ● ● ● ● ● ● ● Copper Steel Pipes page 22 page 36 Aluminium Cables page 16 page 30 © Noble Energy © Noble Energy Business segments Enter/ Full Financial Financial Exit Screen Highlights R&D&I and Statements 2020 Aluminium Copper Cables Steel pipes Steel Real estate Technology 2020 ● ● ● ● ● ● ● ● ● Table of contents A. Viohalco 2 B. Message from the President of the Board of Directors 4 C. Business segments 6 D. Financial highlights 2020 10 E. Business segments review 16 F. Subsequent events 58 G. Risks and uncertainties 60 H. Non-financial information report 66 I. Corporate governance statement 80 J. Appendix – Alternative Performance Measures (APMs) 96 K. Consolidated financial statements 2020 and Auditor’s report 102 L. Declaration of responsible persons 194 M. Condensed statutory balance sheet and income statement 195 N. Glossary 198 Real Estate page 48 Steel R&D&I and page 42 Technology page 52 Business segments Enter/ Full Financial Financial Exit Screen Highlights R&D&I and Statements 2020 Aluminium Copper Cables Steel pipes Steel Real estate Technology 2020 ● ● ● ● ● ● ● ● ● A. Viohalco Viohalco S.A. (‘Viohalco’) is the Belgium-based holding company -

Hellenic Equities: a New Start-July 2015

Hellenic Equities: A New Start-July 2015 In view of the imminent Hellenic stock market re-opening sometime in the short term future we attempt to re-value our preferred picks and affirm our investment thesis. It is more than obvious that in such extraordinary circumstances with low visibility and high volatility in the market and financial /fiscal operations, any assumptions regarding valuations fall under certain culprits. At the core of our problem lies the Risk free rate crucial for our model. We have utilized both the normalized scenario of 6.50% R.f. rate and the 10.50% stressed R.f. rate to better evaluate our picks. We are obliged to pinpoint that at 11.00% current 10yr Hellenic Government Bond yield both our scenarios fall short. Our fundamental research indicates as top picks in our Hellenic Equities Universe the following listed stocks: Coca Cola Hellenic (CCH), OTE Hellenic Telecommunications Organization (HTO), Aegean Airlines (ARAIG), Mytilineos Holdings (MYTIL), Metka S.A (METK), Hellenic Organization of Football Prognostics (OPAP), Titan Cement (TITK) and Hellenic Exchanges Group (EXAE). Additionally we have a positive view on Motor Oil, Thrace Plastics, Kri Kri S.A, Thessaloniki Sewage Company and Terna Energy S.A from smaller capitalizations. Coca Cola Hellenic Bottling operates largely in a broad geographical area covering the Balkan markets, Russia, certain parts of Europe and Greece. The Company is headquartered in Switzerland, a relocation offering an improved risk- return profile due to the significantly lower risk premium. We expect Coca Cola Hellenic to preserve its strong Cash Flow ability and regard it a safe and value play on Greek Equities. -

Company Update Strategy to Penetrate New Markets Pays Off

Metka Greece/ Basic Resources Company update Investment Research Reason: Estimates Revision 3 June 2013 Buy Strategy to penetrate new markets pays off Recommendation unchanged Share price: EUR 10.70 Despite the uncertain global economic environment, Metka’s strategy to closing price as of 31/05/2013 penetrate new markets in Africa and Middle East bears fruits, securing Target price: EUR 13.80 new EPC contracts that help replenish backlog. Metka’s attractive from Target Price: EUR 12.70 investment case remains intact due to: a) solid position in a broad region Reuters/Bloomberg MTKr.AT/METTK GA (SE Europe, Middle East, Africa) which is characterized by substantial Daily avg. no. trad. sh. 12 mth 46,695,000 opportunities due to rising demand and high infrastructure needs, b) Daily avg. trad. vol. 12 mth (m) 488,890.88 increasing importance of natural gas as the fuel of choice for thermal Price high 12 mth (EUR) 12.70 power plants, c) strong balance sheet estimating a net cash position of Price low 12 mth (EUR) 5.55 c.EUR 190m by the end of 2013 and c.EUR 260m by the end of 2014. In Abs. perf. 1 mth -7.2% this framework, we raise our target price to EUR 13.80 from EUR 12.70 Abs. perf. 3 mth -12.3% Abs. perf. 12 mth 82.9% previously, reiterating our Buy recommendation. Market capitalisation (EURm) 556 Metka’s backlog currently stands at around EUR 1.0bn, conservatively Current N° of shares (m) 52 excluding from our estimates the second awarded project in Syria with a budget of EUR 678m as opposed to the first project which is in an Free float 43% advanced phase. -

Corporate Presentation

Corporate Presentation Viohalco at a glance Diversified metals processing leader providing a wide range of products and solutions tailored to international customers’ needs. Listed holding company 7 business Serving Investments 2020 Focused on 80+ years of leading metal segments 21 markets EUR 283 million technology history processing companies and innovation across Europe Sales across the globe Sales revenue in EUR million Aligned with European Green Deal principles through low carbon operations and circular products 4,406 4,198 Product line supporting the transition to a 3,850 3,721 climate neutral economy 3,119 Strong environmentally focused investment Revenue 2020 a-EBITDA 2020 EBT 2020 programme with annual expenditures in EUR 3.9 billion EUR 295 million EUR 59.5 million excess of EUR 26 million Highly skilled personnel with industrial 2016 2017 2018 2019 2020 experience in secondary metals production Corporate Presentation | 2 Segments Operating through distinct business segments, Viohalco companies provide quality, innovative products and services Segmentsto a diverse range of industries. Aluminium Copper Cables Steel pipes Steel Real estate Technology and R&D&I Viohalco and Cenergy Holdings are listed on the Euronext Brussels and the Athens Stock Exchange ElvalHalcor is listed on the Athens Stock Exchange Corporate Presentation | 3 Markets Diversified portfolio of businesses serving dynamic markets, such as building and construction, beverages and food packaging, sea, road and rail transportation, automotive, telecommunications, -

Permanent University Fund Detail Schedules of Investment Securities and Independent Auditors’ Report

PERMANENT UNIVERSITY FUND DETAIL SCHEDULES OF INVESTMENT SECURITIES AND INDEPENDENT AUDITORS’ REPORT August 31, 2014 INDEPENDENT AUDITORS' REPORT ON SUPPLEMENTAL SCHEDULES The Board of Regents of The University of Texas System The Board of Directors of The University of Texas Investment Management Company We have audited the financial statements of the Permanent University Fund (the “PUF”) as of and for the years ended August 31, 2014 and 2013, and have issued our report thereon dated October 31, 2014, which contained an unmodified opinion on those financial statements. Our audits were conducted for the purpose of forming an opinion on the financial statements as a whole. The supplemental schedules consisting of the PUF’s equity securities (Schedule A), preferred stocks (Schedule B), purchased options (Schedule C), debt securities (Schedule D), investment funds (Schedule E), physical commodities (Schedule F), cash and cash equivalents (Schedule G), hedge fund investment funds (Schedule H), and private investment funds (Schedule I) as of August 31, 2014 are presented for the purposes of additional analysis and are not a required part of the financial statements. These schedules are the responsibility of The University of Texas Investment Management Company and were derived from and relate directly to the underlying accounting and other records used to prepare the financial statements. Such schedules have been subjected to the auditing procedures applied in our audits of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. -

AXIA Research

AXIA Research Bloomberg <AXVA> Greece-Daily Note April 13, 2018 Headlines Athens General Index Macroeconomic News According to press, EuroWorking Group (EWG) officials told the Greek government that the draft growth strategy it presented for the day after Greece’s exit from the adjustment program, needs to be more precise in specific areas and to clearly account for the associated costs on the budget. According to Kathimerini, in parallel to the EWG meeting yesterday, there was also a Washington Group meeting yesterday. Debt relief and reforms will be the focus in today’s meeting between the Greek Finance Minister Euclid Tsakalotos and his German counterpart Olaf Scholz in Berlin. ELSTAT announced that the seasonally adjusted unemployment rate for January 2018 came to 20.6% compared to the upward revised 23.2% in January 2017 and 20.8% in December 2017. According to ELSTAT, total building activity in Jan’18 on the basis of issued permits increased close daily % Ytd % by 18.0% y-o-y, by 45.8% in volume terms while increased by 45.2% in surface terms. For the Athens General 806.08 0.85% 0.46% Market Turnover (EURm) 60.847 21.35% rolling 12-month period, building permits are up 9.2% (+20.7% surface, +23.5% volume). Market Cap (EURbn) 55.507 Market Cap / GDP* 29.67% Additional Headlines *2016 th ECB’s Governing Council on April 11 lowered the ELA ceiling for Greek banks by EUR 1.9bn to FTSE ASE movers (last trading day) EUR 14.7bn TOP Aegean Airlines announced that traffic volumes in 1Q18 increased by 12%. -

Press Release of Viohalco Sa

REGULATED INFORMATION INSIDE INFORMATION PRESS RELEASE OF VIOHALCO SA Brussels, March 10, 2021 The enclosed information constitutes regulated information as defined in the Belgian law of 2nd August 2002 and the Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. Viohalco’s subsidiary, ElvalHalcor today submits its results for the year ended 31 December 2020 to the Athens Stock Exchange Highlights • Strong profitability with a-EBIDTA at EUR 136 mil • Robust and well-established presence across all markets • Completion of the investment and successful operation of the new four-stand Tandem hot rolling aluminium mill • Uninterrupted operations for all production facilities despite the Covid-19 pandemic 2020 was marked by the new coronavirus pandemic that affected and continues to test all countries at a global scale by affecting all aspects of human activity. All countries imposed restrictions in movement, which were called to confront a significant number of challenges. As a result, during the first half of 2020, rapid signs of a substantial slowdown of the global economy started to show at unprecedented levels. ElvalHalcor responded immediately by prioritising the health and safety of its employees, suppliers, customers and partners, taking measures that secure the unhindered operation of its production facilities with the least possible repercussions, supporting our society. Under these circumstances, ElvalHalcor's consolidated revenues presented a slight decrease by 0.8% for 2020 despite the 6.8% recession in the Eurozone reaching total sales of EUR 2,028.6 million, compared to EUR 2,044.6 million for the respective prior year. -

Chapter 15 Greece: Case Studies of a Mechanism for Company ‘Exit’ from a Crisis-Ridden Country

Chapter 15 Greece: case studies of a mechanism for company ‘exit’ from a crisis-ridden country Christos A. Ioannou 1. Introduction Since the onset of the financial crisis, there have been a number of prominent cases of companies ‘exiting’ Greece through an effective transfer of their registered headquarters to another country. These have been complex, multi-stage processes, particularly in the cases in which the companies were listed on the Athens stock exchange, thus engaging securities law as well as company law. This chapter analyses three of these cases, the relocation of the metals group Viohalco to Belgium, the dairy company FAGE to Luxembourg and the Coca-Cola Hellenic Bottling Company to Switzerland. The Cross-border Mergers Directive played a direct role in the first two cases, both of which involved forming a subsidiary in another Member State and then merging the parent company into that subsidiary. The third case used a similar mechanism, however, as the transfer was to a country outside of the EU (Switzerland), the Directive was not used specifically. Significantly, in all three cases the mergers were one component of ‘in- house’ restructurings rather than the joining together of truly independent companies. These three cases had very different impacts on labour and labour relations. The first case analysed – the merger of the metals group Viohalco SA Group into a Belgian listed holding in 2013 – was received positively by the trade union and the workers’ side. There were no direct negative implications for employment relations in the group of companies involved and affected by the Cross-border Mergers Directive.