Standard Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

African Markets Revealed

AFRICAN MARKETS REVEALED SEPTEMBER 2020 • Steven Barrow • Ferishka Bharuth • Mulalo Madula • Angeline Moseki • Fausio Mussa • Jibran Qureishi • Dmitry Shishkin • Gbolahan Taiwo www.standardbank.com/research 1 Standard Bank African Markets Revealed September 2020 Recovering, but not out of the woods • The worst of the pandemic will arguably be reflected in Q2:20 GDP growth outcomes. Of the countries in our coverage, we see only a handful of economies escaping recession in 2020. • Economic growth in Q2:20 contracted by 6.1% y/y, 3.3% y/y, and 3.2% y/y in Nigeria, Mozambique and Uganda respectively. The Ghanaian economy too contracted by 3.2% y/y in Q2:20, even worse than the 0.4% y/y contraction that we forecast for our bear scenario in the May edition of this publication. • The more diversified economies and those with large subsistence agriculture sectors could post mild, yet positive, growth in 2020. Most East African countries fall into this bracket. Egypt too might also avoid a technical recession this year. • However, Nigeria, Angola, Zambia and even Botswana, being overly reliant on just a few sectors to drive growth, will most likely contract this year. The only question is by how much? • Tourism-dependent economies will take a hit. We still don’t see any meaningful recovery in tourism until a global vaccine is at hand. The weakness in the tourism sector is mostly a BOP problem rather than a growth problem for many African countries. However, the service value chain that relies on a robust tourism sector too, will most likely weigh down growth in these economies. -

Company Presentation April 2019

COMPANY PRESENTATION APRIL 2019 Luxembourg Finance Awards Winner 2018 INVESTOR PRESENTATION | 1 www.mybucks.com Introduction INVESTOR PRESENTATION | 2 www.mybucks.com MyBucks is a determined growing digital banking group in Sub-Saharan Africa Banking the unbanked MyBucks is a digital banking group with the vision to be the leading provider of financial services and products to the underbanked and unbanked customers in Africa using technology MyBucks provides banking, credit and insurance products 127m 374k €83.3m €63.9m 7.13% through both digital and traditional channels to c.374k Population within Active Combined Debt Default reach of MyBucks clients loan book* recapitalisation active clients in Sub-Saharan Africa today rate MyBucks uses in-house, proven successful, advanced proprietary A.I. algorithms for credit granting and fraud prevention Since inception, MyBucks has disbursed in excess of 2.9m loans for a total value that exceeds EUR971m to date First to launch a full bank branch with refugee banking 1 services unlocking local economy and providing financial Non-banking literacy courses operation Internationally awarded: 5 Banking operations Our banking 73 898 1,815 As featured in:: footprint Branches Employees Agents *Pro forma combined inclusive of Zambia and Uganda without South Africa, Kenya INVESTOR PRESENTATION | 3 www.mybucks.com Evolution of the MyBucks group The improved MyBucks platform is in position for future growth 2011 2015 2017 2019 Capitalisation with US$10m Conversion of Zimbabwe into deposit- Acquisition of NFB -

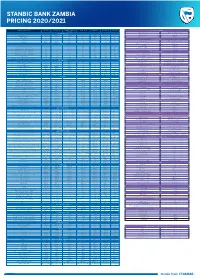

Pricing Guide 2021.Pdf

STANBIC BANK ZAMBIA PRICING 2020/2021 TYPE OF TRANSACTION PRIVATE EXECUTIVE ACHIEVER (EVERYDAY CORPORATE COMMERCIAL ENTERPRISE TAMANGA INVOICE DISCOUNTING BANKING) Arrangement Fee 2.5% Secured 5% unsecured ADMINISTRATION Interest rate LCY Customised Montly Management Fees ZMW 330 ZMW 110 ZMW 55 ZMW 200 ZMW 165 ZMW 150 ZMW 100 Interest rate FCY Customised Debit Activity Fees Free Free Free Free Free Free Free DISTRIBUTOR FINANCE Credit Activity Fees Free Free Free Free Free Free Free Arrangement fee 2.5% Secured 5% unsecured Bundle Pricing ZMW 385 ZMW 165 ZMW 87 N/A N/A N/A N/A DEPOSIT Management fee per quarter Customised Local cheque deposit at branch Free Free Free Free Free Free Free Rollover fee Customised Own Bank cheque within clearing area Free Free Free Free Free Free Free Interest rate (ZMW) Customised Own Bank cheque outside clearing area Free Free Free Free Free Free Free Interest rate (USD) Customised Agent Bank cheque within clearing area Free Free Free Free Free Free Free FOREIGN CURRENCY SERVICES Agent Bank cheque outside clearing area Free Free Free Free Free Free Free Purchase of Foreign Exchange Cash Deposit at Branch Free Free Free Free Free Free Free Foreign notes No charge Bulk Cash Deposit Foreign Currency ( Above $50,000) 1% 1% 1% 1% 1% 1% 1% Telegraphic Transfer/SWIFT (inward) US$20 flat WITHDRAWALS Drafts/Bills/Cheques 1.1% min US$40 plus VAT + Foreign charges At branch within K25,000 ATM limit Free Free ZMW 120 N/A N/A N/A N/A Drafts/Bills/Cheques 1.1% min US$40 plus VAT + Foreign charges Own ATM ZMW 9 ZMW 9 ZMW -

Registered Attendees

Registered Attendees Company Name Job Title Country/Region 1996 Graduate Trainee (Aquaculturist) Zambia 1Life MI Manager South Africa 27four Executive South Africa Sales & Marketing: Microsoft 28twelve consulting Technologies United States 2degrees ETL Developer New Zealand SaaS (Software as a Service) 2U Adminstrator South Africa 4 POINT ZERO INVEST HOLDINGS PROJECT MANAGER South Africa 4GIS Chief Data Scientist South Africa Lead - Product Development - Data 4Sight Enablement, BI & Analytics South Africa 4Teck IT Software Developer Botswana 4Teck IT (PTY) LTD Information Technology Consultant Botswana 4TeckIT (pty) Ltd Director of Operations Botswana 8110195216089 System and Data South Africa Analyst Customer Value 9Mobile Management & BI Nigeria Analyst, Customer Value 9mobile Management Nigeria 9mobile Nigeria (formerly Etisalat Specialist, Product Research & Nigeria). Marketing. Nigeria Head of marketing and A and A utilities limited communications Nigeria A3 Remote Monitoring Technologies Research Intern India AAA Consult Analyst Nigeria Aaitt Holdings pvt ltd Business Administrator South Africa Aarix (Pty) Ltd Managing Director South Africa AB Microfinance Bank Business Data Analyst Nigeria ABA DBA Egypt Abc Data Analyst Vietnam ABEO International SAP Consultant Vietnam Ab-inbev Senior Data Analyst South Africa Solution Architect & CTO (Data & ABLNY Technologies AI Products) Turkey Senior Development Engineer - Big ABN AMRO Bank N.V. Data South Africa ABna Conseils Data/Analytics Lead Architect Canada ABS Senior SAP Business One -

Standard Bank Group Risk and Capital Management Report and Annual Financial Statements 2012 Worldreginfo - 903Cd911-9Aa3-4282-8D0b-680D8a517a96 Contents

Standard Bank Group Risk and capital management report and annual financial statements 2012 WorldReginfo - 903cd911-9aa3-4282-8d0b-680d8a517a96 Contents Risk and capital Our reports management report We produce a full suite of reporting publications Cross-referencing tools to cater for the needs of our diverse stakeholders. Overview 1 The following reports, which support our primary Capital management 19 annual integrated report, are tailored to readers Credit risk 25 requiring specific information. Indicates that additional Country risk 55 information is Liquidity risk 57 ¡ Financial results presentation and booklet available online. Market risk 66 Provides management’s analysis of financial The following icons refer Insurance risk 79 results for the period and the performance of the group’s divisions. readers to information Operational risk 84 www.standardbank.com/reporting relevant to a specific Business risk 91 section elsewhere in this Reputational risk 92 ¡ Sustainability report report, or in other reports Restatements 93 Presents a balanced and comprehensive that form part of the analysis of the group’s sustainability group’s suite of reporting Annual financial statements performance in relation to issues material publications: Directors’ responsibility for to the group and stakeholders. 95 financial reporting www.standardbank.com/sustainability AIR Group secretary’s certification 95 Report of the group audit committee 96 ¡ Risk and capital management report Annual Directors’ report 98 Provides a detailed discussion of the management of strategic risks related to the integrated report Independent auditors’ report 103 group’s banking and insurance operations, Statement of financial position 104 including capital and liquidity management SR Income statement 105 and regulatory developments. -

Stanbic Bank Zambia PMI™ Output Returns to Growth in May

News Release Embargoed until 1030 CAT (0830 UTC) 3 June 2021 Stanbic Bank Zambia PMI™ Output returns to growth in May Key findings PMI sa, >50 = improvement since previous month 60 First rise in activity for 27 months 55 Near-stabilisation of employment 50 45 Sharpest rise in purchase costs since December 40 2016 35 30 '15 '16 '17 '18 '19 '20 '21 Data were collected 12-24 May 2021 Sources: Stanbic Bank, IHS Markit. Output returned to growth in the Zambian private sector meant that firms were able to work through backlogs during May, one month after the same had been the case during May. A modest reduction in outstanding business for new orders. New business ticked back down slightly was recorded, ending a two-month sequence of in the latest survey period, but there were further signs accumulation. that overall business conditions are more conducive to Employment was broadly stable, falling only fractionally growth than has been the case for some time. As a result, and at the joint-slowest pace in the current 16-month firms continued to expand their purchasing activity and sequence of decline. kept their staffing levels broadly unchanged. Firms meanwhile increased their purchasing activity The headline figure derived from the survey is the for the second month running, leading to a further Purchasing Managers’ Index™ (PMI™). Readings above accumulation of inventories as suppliers' delivery times 50.0 signal an improvement in business conditions on improved for the first time in 16 months. Firms reported the previous month, while readings below 50.0 show a that competition among suppliers had been behind deterioration. -

The Standard Bank of South Africa

The Standard Bank of South Africa Annual report 2013 About Standard Bank Contents About this report 3 Established in 1862, the Standard Bank of South Africa (SBSA or Standard Bank) is one of South Africa’s oldest Our business companies. The bank’s original vision was to understand its How we make money 4 customers better, have people with strong knowledge of local How we create socioeconomic value 6 business conditions and to connect borrowers with lenders. This vision created the platform for the kind of bank it has Our performance become and the qualities on which its customers and clients Chief executive’s review 8 rely. Over its history, Standard Bank has grown and extended Executive committee 12 its roots deep into the fabric of South African society. Finance review 14 We have evolved and adapted along with our customers and Seven-year review 24 clients, growing a rich heritage while nurturing and protecting Sustainability report 28 our reputation. We uphold high standards of corporate Risk and capital management report 46 governance, are committed to advancing the principles and practices of sustainable development, and are inspired to Governance and transparency advance national development objectives. Our success and Corporate governance report 101 growth over the long term is built on making a difference in Our board of directors 103 the communities in which we operate. Annual financial statements Directors’ responsibility for financial reporting 122 Group secretary’s certification 122 Report of the audit committee 123 Salient -

Brown Brothers Harriman Global Custody Network Listing

BROWN BROTHERS HARRIMAN GLOBAL CUSTODY NETWORK LISTING Brown Brothers Harriman (Luxembourg) S.C.A. has delegated safekeeping duties to each of the entities listed below in the specified markets by appointing them as local correspondents. The below list includes multiple subcustodians/correspondents in certain markets. Confirmation of which subcustodian/correspondent is holding assets in each of those markets with respect to a client is available upon request. The list does not include prime brokers, third party collateral agents or other third parties who may be appointed from time to time as a delegate pursuant to the request of one or more clients (subject to BBH's approval). Confirmations of such appointments are also available upon request. COUNTRY SUBCUSTODIAN ARGENTINA CITIBANK, N.A. BUENOS AIRES BRANCH AUSTRALIA CITIGROUP PTY LIMITED FOR CITIBANK, N.A AUSTRALIA HSBC BANK AUSTRALIA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) AUSTRIA DEUTSCHE BANK AG AUSTRIA UNICREDIT BANK AUSTRIA AG BAHRAIN* HSBC BANK MIDDLE EAST LIMITED, BAHRAIN BRANCH FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BANGLADESH* STANDARD CHARTERED BANK, BANGLADESH BRANCH BELGIUM BNP PARIBAS SECURITIES SERVICES BELGIUM DEUTSCHE BANK AG, AMSTERDAM BRANCH BERMUDA* HSBC BANK BERMUDA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BOSNIA* UNICREDIT BANK D.D. FOR UNICREDIT BANK AUSTRIA AG BOTSWANA* STANDARD CHARTERED BANK BOTSWANA LIMITED FOR STANDARD CHARTERED BANK BRAZIL* CITIBANK, N.A. SÃO PAULO BRAZIL* ITAÚ UNIBANCO S.A. BULGARIA* CITIBANK EUROPE PLC, BULGARIA BRANCH FOR CITIBANK N.A. CANADA CIBC MELLON TRUST COMPANY FOR CIBC MELLON TRUST COMPANY, CANADIAN IMPERIAL BANK OF COMMERCE AND BANK OF NEW YORK MELLON CANADA RBC INVESTOR SERVICES TRUST FOR ROYAL BANK OF CANADA (RBC) CHILE* BANCO DE CHILE FOR CITIBANK, N.A. -

Standard Chartered Bank Zambia Annual Report 2017

New valued behaviours REPORT STRATEGIC 1. Do the right thing 2. Never settle 3. Better together Directors’ report Contents 02 Chairman’s statement 04 Chief Executive Officer’s statement 06 Retail banking 08 Commercial banking 10 Corporate and Institutional banking statements Financials 12 Wealth management 14 Board of Directors 16 Executive Management Team 18 Directors’ report 22 Corporate governance 26 Sustainability 29 Directors’ responsibilities in respect of the preparation of consolidated and separate financial statements 30 Independent auditor’s report 34 Consolidated and separate statement of profit or loss Supplementary information and other comprehensive income 35 Consolidated and separate statement of financial position 36 Consolidated and separate statement of changes in equity 39 Consolidated and separate statement of cash flows 40 Notes to the consolidated and separate financial statements 100 Appendix – Five year summary 101 Principal Addresses 102 Branch Network 103 Dividend 104 Notice of 47th Annual General Meeting Agenda 105 Form of Proxy 1 STRATEGIC REPORT Chairman’s statement Chairman’s statement Annual Report 2018 Earnings per share stemming over 110 years. The potential Risk and Governance to grow the business remains huge, positioning the Bank to grow its strategic Risk continues to be at the forefront Z M W 0.171 footprint across different client profiles. It of every aspect of our business. It 2016: 0.208 is clear from the interaction I have had so is imperative that we continue to be far with both clients and employees that vigilant so that we stay ahead and they appreciate the value of our brand. It mitigate possible economic and social is therefore, our responsibility to ensure headwinds. -

Standard Chartered

Standard Chartered standard Chartered PLC (LSE: STAN, SEHK: 2888, OTCBB: SCBFF, NSE: STAN) is a multinational financial services company headquartered in London, United Kingdom with operations in more than seventy countries. It operates a network of over 1,700 branches and outlets (including subsidiaries, associates and joint ventures) and employs around 80,000 people. It is a universal bank and has operations in consumer, corporate and institutional banking and treasury services. Despite its British base around 90% of its profits come from Africa, Asia and the Middle East. Standard Chartered has its primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has secondary listings on theHong Kong Stock Exchange and the Indian Stock Exchanges. Its largest shareholder is Temasek Holdings.[2] History The name Standard Chartered comes from the two original banks from which it was founded and which merged in 1969 ± The Chartered Bank of India, Australia and China, and The Standard Bank of British South Africa.[3] [edit]Chartered Bank Main article: Chartered Bank of India, Australia and China The Chartered Bank was founded by Scotsman James Wilson following the grant of a Royal Charter by Queen Victoria in 1853. Chartered opened its first branches in Mumbai, Kolkata and Shanghai in 1858, followed by Hong Kong and Singapore in 1859.[3] The Bank started issuing banknotes of the Hong Kong dollar in 1862. With the opening of the Suez Canal in 1869 and the extension of the telegraph to China in 1871, Chartered was -

ANNUAL FINANCIAL STATEMENTS 2020 Our Reporting Suite

Standard Bank Group Bank Standard Standard Bank Group ANNUAL FINANCIAL ANNUAL FINANCIAL STATEMENTS STATEMENTS FINANCIAL ANNUAL STATEMENTS 2020 2020 Our reporting suite Our integrated report Our primary report to stakeholders, providing a holistic view of our ability to create sustainable shared value in the short, medium and long term. We produce a full suite of reports to cater for the diverse needs of our stakeholders. Our integrated report contextualises and connects to information in the following reports, which provide additional disclosure and satisfy compliance reporting requirements: Governance Risk and Annual Environmental, Report to Subsidiary and capital financial social and society annual reports remuneration management statements governance (RTS) Our subsidiaries report report Sets out the (ESG) report Assesses the provide an account group’s full group's social, to their stakeholders Discusses Sets out An overview of the the group’s audited annual group's processes economic and through their own governance the group’s financial and governance environmental annual reports, approach and approach to risk statements, structures, including (SEE) impacts. available on their priorities, as well as management. including the task-force on respective websites. the remuneration report of the climate-related • The Standard policy and group audit financial disclosures Bank of South committee. Africa (SBSA) implementation (TCFD). Intended report. readers • Liberty Our clients, • Other subsidiary employees reports, including Intended readers and broader legal entities in Our shareholders, debt providers and regulators society Africa Regions. We urge our stakeholders to make use of our reporting site at The invitation to the annual general meeting (AGM) and https://reporting.standardbank.com/. -

Banking on Africa Standard Chartered’S Social and Economic Impact

Banking on Africa Standard Chartered’s social and economic impact A report by Dr René Kim and Professor Ethan B Kapstein Contents 1 Introduction 4 1.1 Methodology 4 About the authors 1.2 Non-quantifiable impact 5 1.3 Scope 5 René Kim is founding Ethan B Kapstein is 2 Africa’s growth story 6 partner of Steward currently a Visiting Fellow 2.1 Reduced reliance on resources 8 Redqueen. He has worked at the Centre for Global 2.2 Economic fundamentals 8 with many multinational Development in Washington 2.3 Urbanisation, productivity and the growing middle class 9 companies and private DC. Previously he was the 2.4 The growing importance of trade 9 2.5 Remaining challenges 10 equity funds in both Chair of Political Economics 2.6 The role of the financial sector 10 developed and emerging at INSEAD and held positions markets. Previously, he at Georgetown University, 3 Standard Chartered in Africa 12 worked for the Boston Harvard University, the 3.1 Strong growth in Africa 13 3.2 Wholesale banking 13 Consulting Group in University of Minnesota, 3.3 Consumer banking 13 Amsterdam and as an and the Organisation for 3.4 Helping small businesses 13 academic at the Economic Cooperation and 3.5 Deep local knowledge 13 Massachusetts Institute Development. A former 3.6 Leveraging international knowledge and finance 14 of Technology. He holds a international banker and 3.7 Spurring innovation 15 cum laude PhD in Hydrology naval officer, Professor 3.8 Acting responsibly 15 3.9 Opportunities for the future 15 and Meteorology and is the Kapstein serves as an author of many academic economic and strategy 4 Standard Chartered’s quantitative impact 16 articles.