ANNUAL INTEGRATED REPORT and FINANCIAL STATEMENTS 2017 Stanbic Holdings Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

African Markets Revealed

AFRICAN MARKETS REVEALED SEPTEMBER 2020 • Steven Barrow • Ferishka Bharuth • Mulalo Madula • Angeline Moseki • Fausio Mussa • Jibran Qureishi • Dmitry Shishkin • Gbolahan Taiwo www.standardbank.com/research 1 Standard Bank African Markets Revealed September 2020 Recovering, but not out of the woods • The worst of the pandemic will arguably be reflected in Q2:20 GDP growth outcomes. Of the countries in our coverage, we see only a handful of economies escaping recession in 2020. • Economic growth in Q2:20 contracted by 6.1% y/y, 3.3% y/y, and 3.2% y/y in Nigeria, Mozambique and Uganda respectively. The Ghanaian economy too contracted by 3.2% y/y in Q2:20, even worse than the 0.4% y/y contraction that we forecast for our bear scenario in the May edition of this publication. • The more diversified economies and those with large subsistence agriculture sectors could post mild, yet positive, growth in 2020. Most East African countries fall into this bracket. Egypt too might also avoid a technical recession this year. • However, Nigeria, Angola, Zambia and even Botswana, being overly reliant on just a few sectors to drive growth, will most likely contract this year. The only question is by how much? • Tourism-dependent economies will take a hit. We still don’t see any meaningful recovery in tourism until a global vaccine is at hand. The weakness in the tourism sector is mostly a BOP problem rather than a growth problem for many African countries. However, the service value chain that relies on a robust tourism sector too, will most likely weigh down growth in these economies. -

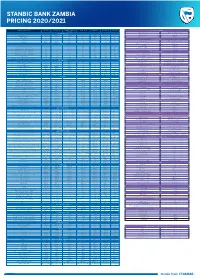

Pricing Guide 2021.Pdf

STANBIC BANK ZAMBIA PRICING 2020/2021 TYPE OF TRANSACTION PRIVATE EXECUTIVE ACHIEVER (EVERYDAY CORPORATE COMMERCIAL ENTERPRISE TAMANGA INVOICE DISCOUNTING BANKING) Arrangement Fee 2.5% Secured 5% unsecured ADMINISTRATION Interest rate LCY Customised Montly Management Fees ZMW 330 ZMW 110 ZMW 55 ZMW 200 ZMW 165 ZMW 150 ZMW 100 Interest rate FCY Customised Debit Activity Fees Free Free Free Free Free Free Free DISTRIBUTOR FINANCE Credit Activity Fees Free Free Free Free Free Free Free Arrangement fee 2.5% Secured 5% unsecured Bundle Pricing ZMW 385 ZMW 165 ZMW 87 N/A N/A N/A N/A DEPOSIT Management fee per quarter Customised Local cheque deposit at branch Free Free Free Free Free Free Free Rollover fee Customised Own Bank cheque within clearing area Free Free Free Free Free Free Free Interest rate (ZMW) Customised Own Bank cheque outside clearing area Free Free Free Free Free Free Free Interest rate (USD) Customised Agent Bank cheque within clearing area Free Free Free Free Free Free Free FOREIGN CURRENCY SERVICES Agent Bank cheque outside clearing area Free Free Free Free Free Free Free Purchase of Foreign Exchange Cash Deposit at Branch Free Free Free Free Free Free Free Foreign notes No charge Bulk Cash Deposit Foreign Currency ( Above $50,000) 1% 1% 1% 1% 1% 1% 1% Telegraphic Transfer/SWIFT (inward) US$20 flat WITHDRAWALS Drafts/Bills/Cheques 1.1% min US$40 plus VAT + Foreign charges At branch within K25,000 ATM limit Free Free ZMW 120 N/A N/A N/A N/A Drafts/Bills/Cheques 1.1% min US$40 plus VAT + Foreign charges Own ATM ZMW 9 ZMW 9 ZMW -

Stanbic Bank Zambia PMI™ Output Returns to Growth in May

News Release Embargoed until 1030 CAT (0830 UTC) 3 June 2021 Stanbic Bank Zambia PMI™ Output returns to growth in May Key findings PMI sa, >50 = improvement since previous month 60 First rise in activity for 27 months 55 Near-stabilisation of employment 50 45 Sharpest rise in purchase costs since December 40 2016 35 30 '15 '16 '17 '18 '19 '20 '21 Data were collected 12-24 May 2021 Sources: Stanbic Bank, IHS Markit. Output returned to growth in the Zambian private sector meant that firms were able to work through backlogs during May, one month after the same had been the case during May. A modest reduction in outstanding business for new orders. New business ticked back down slightly was recorded, ending a two-month sequence of in the latest survey period, but there were further signs accumulation. that overall business conditions are more conducive to Employment was broadly stable, falling only fractionally growth than has been the case for some time. As a result, and at the joint-slowest pace in the current 16-month firms continued to expand their purchasing activity and sequence of decline. kept their staffing levels broadly unchanged. Firms meanwhile increased their purchasing activity The headline figure derived from the survey is the for the second month running, leading to a further Purchasing Managers’ Index™ (PMI™). Readings above accumulation of inventories as suppliers' delivery times 50.0 signal an improvement in business conditions on improved for the first time in 16 months. Firms reported the previous month, while readings below 50.0 show a that competition among suppliers had been behind deterioration. -

ANNUAL FINANCIAL STATEMENTS 2020 Our Reporting Suite

Standard Bank Group Bank Standard Standard Bank Group ANNUAL FINANCIAL ANNUAL FINANCIAL STATEMENTS STATEMENTS FINANCIAL ANNUAL STATEMENTS 2020 2020 Our reporting suite Our integrated report Our primary report to stakeholders, providing a holistic view of our ability to create sustainable shared value in the short, medium and long term. We produce a full suite of reports to cater for the diverse needs of our stakeholders. Our integrated report contextualises and connects to information in the following reports, which provide additional disclosure and satisfy compliance reporting requirements: Governance Risk and Annual Environmental, Report to Subsidiary and capital financial social and society annual reports remuneration management statements governance (RTS) Our subsidiaries report report Sets out the (ESG) report Assesses the provide an account group’s full group's social, to their stakeholders Discusses Sets out An overview of the the group’s audited annual group's processes economic and through their own governance the group’s financial and governance environmental annual reports, approach and approach to risk statements, structures, including (SEE) impacts. available on their priorities, as well as management. including the task-force on respective websites. the remuneration report of the climate-related • The Standard policy and group audit financial disclosures Bank of South committee. Africa (SBSA) implementation (TCFD). Intended report. readers • Liberty Our clients, • Other subsidiary employees reports, including Intended readers and broader legal entities in Our shareholders, debt providers and regulators society Africa Regions. We urge our stakeholders to make use of our reporting site at The invitation to the annual general meeting (AGM) and https://reporting.standardbank.com/. -

LETSHEGO HOLDINGS LTD 2019 GROUP INTEGRATED ANNUAL REPORT Table of Contents

LETSHEGO HOLDINGS LTD 2019 GROUP INTEGRATED ANNUAL REPORT Table of Contents About this Report 4 Evolving the Integration of our Annual Reports 4 Scope 4 Materiality 4 A Note on Disclosures 4 Our Values 5 Our Business 6 Commentary from our Group Chairman 8 Group Chief Executive Review 12 2019 Milestones 17 Our Journey 18 Our Group Structure 20 Our Solutions 22 Our Footprint 23 How We Create Value 24 Financial Highlights 25 Non-Financial Highlights 28 Portfolio Review 32 Our Leadership 36 Group Board of Directors 38 Group Executive Committee 46 Country CEOs 48 The Board 50 Composition and Structure 52 Board Process and Outcomes 54 Composition of the Board Committees 58 Executive Management Committees 62 Attendance at Meetings 66 Remuneration Policy 67 Governance Enablers 70 Compliance with King IV 74 Stakeholder Engagement and Material Matter 78 Stakeholder Mapping Process 80 Our Key Stakeholders 81 Our Material Matter Identification and Management Process 83 Material Stakeholder Matters 84 2 INTEGRATED ANNUAL REPORT 2019 Our People 88 Employee Value Proposition 90 Promoting Diversity 91 Employee Training and Development 92 Realising Financial Inclusion while Enhancing Financial Performance 94 Addressing the Needs of our Customers 96 Returning to Growth 98 Returning to Growth 100 Non-Communicable Disease (NCD) Care 104 Measuring our Social Impact 106 Consolidated Annual Financial Statements 112 Group Corporate Information 114 Directors’ Report 115 Directors’ Responsibility Statement 117 Independent Auditor’s Report 118 Consolidated Annual -

Bank Supervision Annual Report 2019 1 Table of Contents

CENTRAL BANK OF KENYA BANK SUPERVISION ANNUAL REPORT 2019 1 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE IX FOREWORD BY DIRECTOR, BANK SUPERVISION X EXECUTIVE SUMMARY XII CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 7 1.7 Microfinance Banks Market Share Analysis 9 1.8 Distribution of Foreign Exchange Bureaus 11 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 13 2.2 Banking Sector Charter 13 2.3 Demonetization 13 2.4 Legal and Regulatory Framework 13 2.5 Consolidations, Mergers and Acquisitions, New Entrants 13 2.6 Medium, Small and Micro-Enterprises (MSME) Support 14 2.7 Developments in Information and Communication Technology 14 2.8 Mobile Phone Financial Services 22 2.9 New Products 23 2.10 Operations of Representative Offices of Authorized Foreign Financial Institutions 23 2.11 Surveys 2019 24 2.12 Innovative MSME Products by Banks 27 2.13 Employment Trend in the Banking Sector 27 2.14 Future Outlook 28 CENTRAL BANK OF KENYA 2 BANK SUPERVISION ANNUAL REPORT 2019 TABLE OF CONTENTS CHAPTER THREE MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE 3.1 Global Economic Conditions 30 3.2 Regional Economy 31 3.3 Domestic Economy 31 3.4 Inflation 33 3.5 Exchange Rates 33 3.6 Interest -

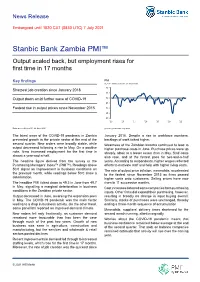

Stanbic Bank Zambia PMI™ Output Scaled Back, but Employment Rises for First Time in 17 Months

News Release Embargoed until 1030 CAT (0830 UTC) 7 July 2021 Stanbic Bank Zambia PMI™ Output scaled back, but employment rises for first time in 17 months Key findings PMI sa, >50 = improvement since previous month 60 Sharpest job creation since January 2018 55 Output down amid further wave of COVID-19 50 45 Fastest rise in output prices since November 2015 40 35 30 '15 '16 '17 '18 '19 '20 '21 Data were collected 11-24 June 2021 Sources: Stanbic Bank, IHS Markit. The latest wave of the COVID-19 pandemic in Zambia January 2018. Despite a rise in workforce numbers, prevented growth in the private sector at the end of the backlogs of work ticked higher. second quarter. New orders were broadly stable, while Weakness of the Zambian kwacha continued to lead to output decreased following a rise in May. On a positive higher purchase costs in June. Purchase prices were up note, firms increased employment for the first time in sharply, albeit to a lesser extent than in May. Staff costs almost a year-and-a-half. also rose, and at the fastest pace for two-and-a-half The headline figure derived from the survey is the years. According to respondents, higher wages reflected Purchasing Managers’ Index™ (PMI™). Readings above efforts to motivate staff and help with higher living costs. 50.0 signal an improvement in business conditions on The rate of output price inflation, meanwhile, accelerated the previous month, while readings below 50.0 show a to the fastest since November 2015 as firms passed deterioration. -

Cfc Stanbic Holdings Limited

Annual report 2014 CfC Stanbic Holdings Limited 1 Contents About CfC Stanbic 01 About this report Transparency and Holdings 40 accountability 02 Integrated thinking 41 Corporate information East Africa is our home, 42 Board of Directors and we are focused on Our business 46 Corporate governance report driving her growth. 03 04 Corporate profile 48 Report of the Board Audit With a heritage of over 05 Our vision and values Committee 100 years, we are a leading integrated financial services 06 How we create value 49 Report of Directors group in the East Africa region. 08 Our group strategic construct 50 Statement of Directors’ We have an on-the-ground 10 Our operating context responsibilities presence in 5 countries in East Africa and a member of 12 Realising the East Africa 51 Report of independent Standard Bank Group, opportunity auditor fit-for-purpose representation 14 Measuring our strategic outside Africa and a strategic progress partnership with ICBC. This 52 Annual financial statements unique footprint supports our 54 Consolidated and company strategy to connect African Our performance statement of profit or loss markets to each other and to 16 18 Chairman’s statement pools of capital globally. 55 Consolidated and company 20 Economic review statement of comprehensive 21 Business unit reviews income • PBB case study 56 Consolidated and company • CIB case study statement of financial 22 Financial review position 26 Five year review 57 Consolidated statement of changes in equity 58 Company statement of Ensuring our sustainability 28 changes in equity 30 Sustainability report 59 Consolidated and company 32 Risk management report statement of cash flows 60 Notes to the financial statements 140 Shareholder information 143 Group shareholding 144 Notice of Annual General Meeting 145 Proxy form About this report Materiality determination Our annual report aims to present a balanced and succinct analysis of As a financial services group focused on our strategy, performance, governance and prospects. -

Exim Bank EXIM JOURNEY – Key Milestones

Exim Bank EXIM JOURNEY – Key Milestones Second Strategic “Number One Bank in IFC- “Women overseas subsidiary in Customer Care” by the KPMG Entrepreneur DJIBOUTI Finance Africa Banking Survey, 2013 Programme” “Best Workplace Best Practice Environmental Practices for Training Award 2013 Introduced First and Development” in the 5.8% Stake in Visa Credit Card East Africa CSR Awards Crossed TZS 1 Trillion asset NMB mark Best Presented New Core Banking Introduced Financial System ‘Intellect’ 2013 First Master Statements NBAA Card Credit - 2008 and 2009 2011 Card in Times / IFC CB – CFC Tanzania Bank, Deutsche 2009 2014-15 Bank Loan From NORFUND 2012 Loan From – 2010 5th Largest bank in Tanzania IFC & 2004-07 PROPARCO Total Branches – 34 Stake in State of Art Tanzania Exim 2008 Total Asset – USD 640 Mn Mortgage Academy for Incorporated 2002 Refinance Training First Overseas Total Equity– USD 104 Mn First Branch in Company 2003 Subsidiary - Tanzania USD 15 Mn COMOROS Customers – 500,000 Introduced loan from First Debit - PROPARCO CB– PTA Bank “Sustainable Total Staff Strength - 750 Master , VISA 2001Introduced & HSBC Bank of the Platinum & Banking Started Year 2008 Partner with DEG -USD 20 Mn Credit Card in Software “MONEYGRAM” Award” by Loan 1997 TZ “FLEXICUBE” Money Transfer Financial “CB “– Correspondent Bank Services Times / IFC Presence Tanzania Comoros Djibouti Branches ATMs Extension Counters Tanzania 27 54 2 Comoros 5 7 0 Djibouti 2 1 0 34 62 2 • 10 Branches across • Established in • Established in 2010 Dar es Salaam 2007 • 2 Branches across Horn • 17 branches • Has 5 branches of Africa’s country. strategically located in connecting the • Strategically positioned upcountry business in the country with Indian Ocean opportunities such as; Islands good FDIs flows, entry / • Economy is mostly exit point for Ethiopia, import oriented logistics (ports) and transit (to and from Ethiopia) • Link between Africa and Asia / Europe The Vision and Strategy Retail Banking . -

Letshego Holdings Limited Annual Financial Statements for the Year

Letshego Holdings Limited Annual Financial Statements For the year ended 31 December 2018 CONTENTS ____________________________________________________________ Details Corporate information 3 Directors 4 Directors 6 7 Financial statements Statement of financial position 11 Statement of profit or loss and other comprehensive income 12 Statement of changes in equity 13 Statement of cash flows 14 Significant accounting policies 15 Notes to the financial statements 24 2 CORPORATE INFORMATION Letshego Holdings Limited is incorporated in the Republic of Botswana Registration number: Co. 98/442 Date of incorporation: 4 March 1998 A publicly listed commercial entity whose liability is limited by shares Company Secretary and Registered Office Lawrence Khupe (appointed 1 January 2018 and resigned 26 February 2019) Dumisani Ndebele (26 February 2019 and resigned 27 March 2019) Matshidiso Kimwaga (appointed 27 March 2019) Second Floor Letshego Place Plot 22 Khama Crescent Gaborone, Botswana Independent External Auditors PricewaterhouseCoopers Plot 50371 Fairground Office Park Gaborone, Botswana Transfer Secretaries PricewaterhouseCoopers (Pty) Limited Plot 50371 Fairground Office Park Gaborone, Botswana Attorneys and Legal Advisors Armstrongs Acacia House Plot 53438 Cnr Khama Crescent Extension and PG Matante Road Gaborone, Botswana Bankers Standard Chartered Bank Botswana Limited Barclays Bank Botswana Limited First National Bank Botswana Limited First National Bank of South Africa Limited Stanbic Bank Botswana Limited 3 DIRECTORS The Directors have pleasure in submitting to the Shareholders their report and the audited financial statements of Letshego Holdings Limited (the Company) for the year ended 31 December 2018. Nature of business The Company is engaged in investment in foreign and local operations involved in financial services. Stated capital Stated Capital of the Group at 31 December 2018 amounted to P862, 621,720 (31 December 2017: P849, 845,234). -

Southern African Development Community Payment System Integration Project

Southern African Development Community Payment System Integration Project SADC Integrated Regional Electronic Settlement System List of Participants as at April 2020 Number of Participants April 2020 Central Banks 7 Commercial 77 Total 84 Participants per country Country Participants Angola 1. Banco Angolano de Investimentos S.A. 2. Credisul-Banco de Credito do Sul S.A. 3. Banco de Negỏcios Internacional S.A. 4. Banco Prestígio SA Botswana 1. First National Bank of Botswana Pty Ltd 2. Stanbic Bank Botswana Limited 1 Country Participants Democratic Republic of Congo 1. Rawbank CD 1. Central Bank of Eswatini Eswatini 2. First National Bank of Eswatini 3. Nedbank Eswatini Limited 4. Standard Bank Eswatini Limited 5. Eswatini Development and Savings Bank Lesotho 1. Central Bank of Lesotho 2. First National Bank of Lesotho Limited 3. Lesotho Post Bank 4. Nedbank Lesotho Limited 5. Standard Lesotho Bank Madagascar No Participants yet 2 Country Participants 1. CDH Investment Bank Limited Malawi 2. Ecobank Malawi Limited 3. FDH Financial Holdings 4. First Merchant Bank Limited 5. National Bank of Malawi 6. NBS Bank Limited 7. New Finance Bank Malawi Limited 8. Reserve Bank of Malawi 9. Standard Bank Limited – Malawi 10. Opportunity Bank of Malawi Mauritius 1. Absa Bank Mauritius Limited 2. The Mauritius Commercial Bank Limited 3. Standard Bank Mauritius Limited 4. Standard Chartered Bank Mauritius Limited Mozambique 1. Barclays Bank Mocambique SA 2. FNB Mocambique SA 3. Banco Mais-Banco Mocambicano de Apoio aos Investimentos SA 4. Mozabanco SA 5. Standard Bank Mozambique SA 6. Banco Unico SA 3 Country Participants Namibia 1. Bank Windhoek Limited 2. -

Weekly Equity Update 15Th SEP 2017

Weekly Equity Update 15th SEP 2017 Market Overview Market Perfomance Previous Today %Change Shares traded 188,327,000 136,140,300 -27.71% During the week, the equities market was on a downward trend with NSE 20, NASI and NSE 25 Equity Turnover (KES Bill) 5.72 4.57 -20.13% losing 1.5%, 0.7% and 0.4%, respectively, taking their YTD performance to 23.4%, 22.0% and Market Cap (KES Bill) 2,427 2,410 -0.70% Market Cap (USD Mil) 23.5 23.4 -0.32% 18.8% for NASI, NSE 25 and NSE 20 The market was weakened by shrinking large caps counters. NSE-20 Share Index 3,840 3,784 -1.46% Week’s volumes declined to 136.14Mn from 188.93Mn on low trades on telecommunication and banking NSE All Share Index 165.7 164.5 -0.70% NSE 25 Share Index 4,324 4,307 -0.40% sectors. Market turnover thinned by 20.75% to KES 4.57Bn from KES 5.76Bn. Foreign activity was at 51.6% 91-day Treasury Bills 8.130 8.134 0.05% with a net outflow of KES 1.55Bn. 182-day Treasury Bills 10.313 10.314 0.01% Safaricom closed the week with 8.74Mn shares trading at an average of KES 25.25 for a total value of KES 364-day Treasury Bills 10.920 10.930 0.09% Top Gainers & Losers 221.45Mn as the counter closed its book. Foreign activity, at 71.3%, continues to play a major role in the Week Close w-o-w % Shares Traded value drop with the telecom shedding KES 20.03Bn in market value on a w/w basis.