Southern African Development Community Payment System Integration Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

African Markets Revealed

AFRICAN MARKETS REVEALED SEPTEMBER 2020 • Steven Barrow • Ferishka Bharuth • Mulalo Madula • Angeline Moseki • Fausio Mussa • Jibran Qureishi • Dmitry Shishkin • Gbolahan Taiwo www.standardbank.com/research 1 Standard Bank African Markets Revealed September 2020 Recovering, but not out of the woods • The worst of the pandemic will arguably be reflected in Q2:20 GDP growth outcomes. Of the countries in our coverage, we see only a handful of economies escaping recession in 2020. • Economic growth in Q2:20 contracted by 6.1% y/y, 3.3% y/y, and 3.2% y/y in Nigeria, Mozambique and Uganda respectively. The Ghanaian economy too contracted by 3.2% y/y in Q2:20, even worse than the 0.4% y/y contraction that we forecast for our bear scenario in the May edition of this publication. • The more diversified economies and those with large subsistence agriculture sectors could post mild, yet positive, growth in 2020. Most East African countries fall into this bracket. Egypt too might also avoid a technical recession this year. • However, Nigeria, Angola, Zambia and even Botswana, being overly reliant on just a few sectors to drive growth, will most likely contract this year. The only question is by how much? • Tourism-dependent economies will take a hit. We still don’t see any meaningful recovery in tourism until a global vaccine is at hand. The weakness in the tourism sector is mostly a BOP problem rather than a growth problem for many African countries. However, the service value chain that relies on a robust tourism sector too, will most likely weigh down growth in these economies. -

List of Participants As of 30 April 2013

World Economic Forum on Africa List of Participants As of 30 April 2013 Addis Ababa, Ethiopia, 9-11 May 2012 Messumbe Stanly Paralegal The ABENG Law Firm Cameroon Abane Yilkal Abate Secretary-General ICT Association of Ethiopia Ethiopia Zein Abdalla Chief Executive Officer PepsiCo Europe Switzerland Amin Abdulkader Minister of Culture and Tourism of Ethiopia Rakeb Abebe Chief Executive Officer and Founder GAWT International Business Ethiopia Plc Olufemi Adeyemo Group Chief Financial Officer Oando Plc Nigeria Tedros Adhanom Minister of Health of Ethiopia Ghebreyesus Tedros Adhanom Minister of Health of Ethiopia Ghebreyesus Olusegun Aganga Minister of Industry, Trade and Investment of Nigeria Alfredo Agapiti President Tecnoservice Srl Italy Pranay Agarwal Principal Adviser, Corporate Finance MSP Steel & Power Ltd India and Strategy Vishal Agarwal Head, sub-Saharan Africa Deals and PwC Kenya Project Finance Pascal K. Agboyibor Managing Partner Orrick Herrington & Sutcliffe France Manish Agrawal Director MSP Steel & Power Ltd India Deborah Ahenkorah Co-Founder and Executive Director The Golden Baobab Prize Ghana Halima Ahmed Political Activist and Candidate for The Youth Rehabilitation Somalia Member of Parliament Center Sofian Ahmed Minister of Finance and Economic Development of Ethiopia Dotun Ajayi Special Representative to the United African Business Roundtable Nigeria Nations and Regional Manager, West Africa Abi Ajayi Vice-President, Sub-Saharan Africa Bank of America Merrill Lynch United Kingdom Coverage and Origination Clare Akamanzi Chief Operating Officer Rwanda Development Board Rwanda (RDB) Satohiro Akimoto General Manager, Global Intelligence, Mitsubishi Corporation Japan Global Strategy and Business Development Adetokunbo Ayodele Head, Investor Relations Oando Plc Nigeria Akindele Kemi Lala Akindoju Facilitator Lufodo Academy of Nigeria Performing Arts (LAPA) World Economic Forum on Africa 1/23 Olanrewaju Akinola Editor This is Africa, Financial Times United Kingdom Vikram K. -

Cavmont Bank Limited Report and Financial Statements for the Year Ended 30 June 2014

CAVMONT BANK LIMITED REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2014 Cavmont Bank Limited Report and Financial Statements For the year ended 30 June 2014 Table of Contents Page No Directors’ report 1-3 Statement of directors’ responsibilities 4 Report of the independent auditor 5-6 Financial statements: Income statement 7 Statement of Financial Position 8 Statement of Changes in Equity 9-10 Statement of Cash Flows 11 Notes 12-49 Cavmont Bank Limited Directors’ Report For the year ended 30 June 2014 The directors submit their report together with the audited financial statements for the year ended 30 June 2014, which disclose the state of affairs of Cavmont Bank Limited (“the bank”). PRINCIPAL ACTIVITIES The Bank is engaged in the business of banking and the provision of related services. The Bank had 17 branches and 2 Agencies at 30 June 2014. RESULTS AND DIVIDENDS The number of customer accounts of the bank increased from 58,000 as at 30 June 2013 to 63,227 as at 30 June 2014. Loans and advances grew from K235.40 million to K295.82 million in the period. While a positive trend was experienced in expenses, revenues grew faster than costs with monthly losses trending down wards significantly compared to the same time last year. It is also important note that the Bank recorded a profit in the last quarter (three months) of the financial year ended 30 June 2014. Notwithstanding, these positive trends the Bank recorded a loss for the financial year ended 3o June 2014 of K6.726million. -

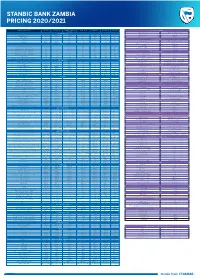

Pricing Guide 2021.Pdf

STANBIC BANK ZAMBIA PRICING 2020/2021 TYPE OF TRANSACTION PRIVATE EXECUTIVE ACHIEVER (EVERYDAY CORPORATE COMMERCIAL ENTERPRISE TAMANGA INVOICE DISCOUNTING BANKING) Arrangement Fee 2.5% Secured 5% unsecured ADMINISTRATION Interest rate LCY Customised Montly Management Fees ZMW 330 ZMW 110 ZMW 55 ZMW 200 ZMW 165 ZMW 150 ZMW 100 Interest rate FCY Customised Debit Activity Fees Free Free Free Free Free Free Free DISTRIBUTOR FINANCE Credit Activity Fees Free Free Free Free Free Free Free Arrangement fee 2.5% Secured 5% unsecured Bundle Pricing ZMW 385 ZMW 165 ZMW 87 N/A N/A N/A N/A DEPOSIT Management fee per quarter Customised Local cheque deposit at branch Free Free Free Free Free Free Free Rollover fee Customised Own Bank cheque within clearing area Free Free Free Free Free Free Free Interest rate (ZMW) Customised Own Bank cheque outside clearing area Free Free Free Free Free Free Free Interest rate (USD) Customised Agent Bank cheque within clearing area Free Free Free Free Free Free Free FOREIGN CURRENCY SERVICES Agent Bank cheque outside clearing area Free Free Free Free Free Free Free Purchase of Foreign Exchange Cash Deposit at Branch Free Free Free Free Free Free Free Foreign notes No charge Bulk Cash Deposit Foreign Currency ( Above $50,000) 1% 1% 1% 1% 1% 1% 1% Telegraphic Transfer/SWIFT (inward) US$20 flat WITHDRAWALS Drafts/Bills/Cheques 1.1% min US$40 plus VAT + Foreign charges At branch within K25,000 ATM limit Free Free ZMW 120 N/A N/A N/A N/A Drafts/Bills/Cheques 1.1% min US$40 plus VAT + Foreign charges Own ATM ZMW 9 ZMW 9 ZMW -

Commercial Banks

COMMERCIAL BANKS AGRIBANK MBCA BANK LTD P. O. Box 369 P. O. Box 3200 Harare Harare Tel: +263 4 774400-19; 773704 Tel: +263 4 701636-52; 799291; 732227 Fax: +263 4 777556 Fax: +263 4 708005; 739084 E-mail: [email protected] E-mail: [email protected] Website: www.agribank.co.zw Website: www.mbca.co.zw BANCABC NMB BANK LTD P. O. Box 2786 P. O. Box 2567 Harare Harare Tel: +263 4 369260-69; 369701-9 Tel: +263 4 759601-6; 759651-9 Fax: +263 4 369932 Fax: + 263 4 759648; 798850 E-mail: [email protected] E-mail: [email protected] Website: www.bancabc.co.zw Website: www.nmbz.co.zw BARCLAYS BANK OF ZIMBABWE LTD POSB P. O. Box 790 P. O. Box CY1628, Causeway Harare Harare Tel: +263 4 758314/9 Tel: +263 4 793831-9; 729701 Fax: +263 4 750972 Fax: +263 4 708537 E-mail: [email protected] E-mail: [email protected] Website: zw.barclays.com Website: www.posb.co.zw CABS STANBIC BANK ZIMBABWE LTD P. O. Box 2798 P. O. Box 300 Harare Harare Tel: +263 4 883823–59 Tel: +263 4 757627; 701287; 701270 Fax: +263 4 883804 E-mail: [email protected] E-mail: [email protected] Website: www.stanbicbank.co.zw Website: www.cabs.co.zw CBZ BANK STANDARD CHARTERED BANK P. O. Box 3313 ZIMBABWE LTD Harare P. O. Box 373 Tel: +263 4 748050-79; 795101-16 Harare Fax: +263 4 758077 Tel: +263 4 752852-8; 253801-8 E-mail: [email protected] Fax: +263 4 752609 Website: www.cbzbank.co.zw E-mail: [email protected] Website: www.sc.com/zw ECOBANK ZIMBABWE STEWARD BANK P. -

The World Bank for OFFICIAL USE ONLY

Document of The World Bank FOR OFFICIAL USE ONLY Public Disclosure Authorized Report No: 59793-MW PROJECT APPRAISAL DOCUMENT ON A PROPOSED CREDIT IN THE AMOUNT OF SDR 18.1 MILLION Public Disclosure Authorized (US$28.2 MILLION EQUIVALENT) TO THE THE REPUBLIC OF MALAWI FOR THE FINANCIAL SECTOR TECHNICAL ASSISTANCE PROJECT (FSTAP) Public Disclosure Authorized February 28, 2011 Finance and Private Sector Development East and Southern Africa Africa Region Public Disclosure Authorized This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without World Bank authorization. CURRENCY EQUIVALENTS (Exchange Rate Effective January 31, 2011) Currency Unit = Malawi Kawacha (MK) US$1 = MK 150.77 US$1 = SDR 0.640229 FISCAL YEAR January 1 – December 31 ABBREVIATIONS AND ACRONYMS ACH Automated Clearing House AfDB African Development Bank AFRITAC African Technical Assistance Center ATS Automated Transfer System BAM Bankers’ Association of Malawi BESTAP Business Environment Strengthening Technical Assistance Project BSD Banking Supervision Department CAS Country Assistance Strategy CEM Country Economic Memorandum CSC Credit and Savings Co-operatives CSD Central Securities Depository DEMAT Development of Malawi Trader’s Trust DFID UK Department of International Development EFT Electronic Funds Transfer FIMA The Financial Inclusion in Malawi FIRST Financial Sector Reform and Strengthening Initiative FMP Financial Management Plan FSAP Financial Sector -

Registered Attendees

Registered Attendees Company Name Job Title Country/Region 1996 Graduate Trainee (Aquaculturist) Zambia 1Life MI Manager South Africa 27four Executive South Africa Sales & Marketing: Microsoft 28twelve consulting Technologies United States 2degrees ETL Developer New Zealand SaaS (Software as a Service) 2U Adminstrator South Africa 4 POINT ZERO INVEST HOLDINGS PROJECT MANAGER South Africa 4GIS Chief Data Scientist South Africa Lead - Product Development - Data 4Sight Enablement, BI & Analytics South Africa 4Teck IT Software Developer Botswana 4Teck IT (PTY) LTD Information Technology Consultant Botswana 4TeckIT (pty) Ltd Director of Operations Botswana 8110195216089 System and Data South Africa Analyst Customer Value 9Mobile Management & BI Nigeria Analyst, Customer Value 9mobile Management Nigeria 9mobile Nigeria (formerly Etisalat Specialist, Product Research & Nigeria). Marketing. Nigeria Head of marketing and A and A utilities limited communications Nigeria A3 Remote Monitoring Technologies Research Intern India AAA Consult Analyst Nigeria Aaitt Holdings pvt ltd Business Administrator South Africa Aarix (Pty) Ltd Managing Director South Africa AB Microfinance Bank Business Data Analyst Nigeria ABA DBA Egypt Abc Data Analyst Vietnam ABEO International SAP Consultant Vietnam Ab-inbev Senior Data Analyst South Africa Solution Architect & CTO (Data & ABLNY Technologies AI Products) Turkey Senior Development Engineer - Big ABN AMRO Bank N.V. Data South Africa ABna Conseils Data/Analytics Lead Architect Canada ABS Senior SAP Business One -

Group Profile and Structure

GROUP PROFILE AND STRUCTURE WHO WE ARE Capricorn Group at a glance Capricorn Group is a diversified financial services group based in Windhoek, Namibia. We provide strategic guidance, oversight and support to our subsidiaries, whose operations are primarily focused on banking, insurance, wealth and asset management, and finance. Registered as: Capricorn Investment Group Limited 84.3% 100% 29.5% 97.9% Capricorn Investment Sanlam Namibia Cavmont Capital Bank Windhoek Ltd Holdings (Botswana) Ltd Holdings (Pty) Ltd Holdings Zambia PLC 100% 100% 28% 100% Bank Gaborone Ltd Capricorn Asset Santam Namibia Ltd Cavmont Bank Ltd Management (Pty) Ltd BOTSWANA ZAMBIA 100% 30% Capricorn Unit Trust Nimbus Management Company Ltd Infrastructure Ltd Acquired in 2018 100% Namib Bou (Pty) Ltd 100% Capricorn Capital (Pty) Ltd Launched in 2018 55.5% Entrepo Holdings (Pty) Ltd Acquired in 2018 NAMIBIA Epupa Falls, Kaokoveld GROUP PROFILE AND STRUCTURE 15 WHO WE ARE continued A wide spectrum of financial solutions for business clients includes structured finance, working capital finance as well as tailor-made term financing options. Bank Windhoek offers a wide range of treasury services, including money market and foreign currency exchange services. BARONICE HANS Our international banking services comprise foreign payment Managing director products, trade finance and foreign currency accounts. I AM inspired by the dedication, resilience Our bancassurance options include short-term, life, travel and and tenacity of the Bank Windhoek team as commercial insurance, and guarantees. together we translate vision into reality. One of the biggest highlights of the 2019 financial year has been when we became the first commercial bank in southern Africa to issue a green bond and the international recognition we received for WINDHOEK, NAMIBIA winning this year’s Green Bonds Pioneer Award from Climate Bonds. -

Curriculum Vitae

CURRICULUM VITAE PERSONAL INFORMATION SURNAME: HAKUYU. OTHER NAMES: THOMAS. DATE OF BIRTH: 14 SEPTEMBER, 1993. MARITAL STATUS. SINGLE. SEX: MALE. RELIGION: CHRISTIAN. NRC NO: 309582/10/1. NATIONALITY: ZAMBIAN. PLACE OF BIRTH: LUSAKA. CONTACT NO: +260 955 016 788. EMAIL: [email protected] ACADEMIC QUALIFICATION DURATION MULUNDUSHI UNIVERSITY 2012-2016 BACHELOR OF COMMERCE (DEGREE): ACCOUNTING AND FINANCE. FIRM LIGHT SCHOOL 2007-2009 GRADE TWELVE GCE. FIRM LIGHT SCHOOL 2005-2006 JUNIOR SECONDARY CERTIFICATE. PERSONAL SKILLS Computer Literate: Microsoft Word, Microsoft Excel, Microsoft Power Point, Internet Explorer, Access, outlook. Others are Data Analysis using statistical package for the social science (SPSS) and Basic Computer skills like software installation. WORK EXPERIENCE 1) CAVMONT BANK – MAKUMBI BRANCH November 2016 – January 2017 ATM CARD CLERK. DUTIES: - Ordering and Dispatching of ATM Cards. - Attending to walk-in clients. - Assisting with the monthly reports. - Marketing the Banks products. 2) MULTICHOICE ZAMBIA LIMITED - NDOLA BRANCH September 2017 - December 2017. CUSTOMER SERVICE REPRESENTATIVE (CASHIER) DUTIES: - Raising of Cash Sale/Receipts/Invoices for products sold. - Receiving payments and reconciling them with total sales on a daily basis. - Educating customers on products on offer. - Maintain financial accounts by processing customer adjustments. - Resolve customer complaints. - Calculate total payments received during a time period, and reconcile this with total sales. HOBBIES AND INTERESTS - Reading Fiction Novels. - Movies. - Music. - Playing Soccer REFERENCES 1) Mrs. MATIMBA CHIKUBA. 2) Mr. CHERA DERESSA. BRANCH MANAGER. HEAD OF DEPARTMENT. CAVMONT BANK – MAKUMBI BRANCH SCHOOLOFBUSINESSSTUDIES P.O BOX 38474 MULUNGUSHI UNIVERSITY. PIZIYA OFFICE PARK. P.O BOX 80415. THABO MBEKI ROAD. KABWE. LUSAKA. [email protected] CELL: +260 973 44 00 00 CELL: + 260 976 17 51 20 2) Mrs. -

Stanbic Bank Zambia PMI™ Output Returns to Growth in May

News Release Embargoed until 1030 CAT (0830 UTC) 3 June 2021 Stanbic Bank Zambia PMI™ Output returns to growth in May Key findings PMI sa, >50 = improvement since previous month 60 First rise in activity for 27 months 55 Near-stabilisation of employment 50 45 Sharpest rise in purchase costs since December 40 2016 35 30 '15 '16 '17 '18 '19 '20 '21 Data were collected 12-24 May 2021 Sources: Stanbic Bank, IHS Markit. Output returned to growth in the Zambian private sector meant that firms were able to work through backlogs during May, one month after the same had been the case during May. A modest reduction in outstanding business for new orders. New business ticked back down slightly was recorded, ending a two-month sequence of in the latest survey period, but there were further signs accumulation. that overall business conditions are more conducive to Employment was broadly stable, falling only fractionally growth than has been the case for some time. As a result, and at the joint-slowest pace in the current 16-month firms continued to expand their purchasing activity and sequence of decline. kept their staffing levels broadly unchanged. Firms meanwhile increased their purchasing activity The headline figure derived from the survey is the for the second month running, leading to a further Purchasing Managers’ Index™ (PMI™). Readings above accumulation of inventories as suppliers' delivery times 50.0 signal an improvement in business conditions on improved for the first time in 16 months. Firms reported the previous month, while readings below 50.0 show a that competition among suppliers had been behind deterioration. -

Annual Report Table of Contents

2 FBC HOLDINGS LIMITED ANNUAL REPORT 2018 Annual Report Table of contents OVERVIEW Group Structure 4 Independent Auditor’s Report 60 FBC Footprint 5 Consolidated Statement of Financial Position 66 Our Pillars of Strength 6 Consolidated Statement of Profit or Loss Our Promise to Our Stakeholders 6 and Other Comprehensive Income 67 General Information 7 Consolidated Statement of Changes in Equity 69 Report Profile 10 Consolidated Statement of Cash Flows 70 Notes to the Consolidated Financial Statements 71 Financial Highlights 11 Company Statement of Financial Position 182 Group Chairman’s Statement 12 Company Statement of Comprehensive Income 183 Group Chief Executive’s Report 18 Company Statement of Changes in Equity 184 Sustainability Report 27 Company Statement of Cash Flows 185 Recognition and Awards 39 Notes to Company Financial Statements 186 Directors’ Report 40 Company Secretary’s Certification 47 Shareholders’ Information 190 Board of Directors 48 Notice of AGM 191 Corporate Governance 51 Proxy Form 193 FBC HOLDINGS LIMITED ANNUAL REPORT 2018 3 About This Report This integrated annual report was prepared for FBC Holdings and its subsidiaries. This annual report can be viewed at www.fbc.co.zw 4 FBC HOLDINGS LIMITED ANNUAL REPORT 2018 Group Structure FBC Holdings Limited strength • diversity • service Consumer and Investment Banking Services Insurance Services FBC Insurance Company Limited 100 100 100 100 100 95% C M M E S Term NL B F F Trading R I + + S + + + A P S L H M S D B RA I + + F L I S + C S FBC HOLDINGS LIMITED ANNUAL REPORT -

Table of Contents

TABLE OF CONTENTS GROUP OVERVIEW Group Salient features 2 How we create value 3 GROUP COMMUNICATION Statements Group Chairman’s Statement 12 Group Chief Executive Officer’s Report 16 CORPORATE PROFILE Business Overview 22 Group Structure 23 Our Success 24 Stakeholder Overview 26 SHAREHOLDER INFORMATION Analysis of Shareholders 30 Share Option Scheme 31 Shareholders’ calendar 32 SUBSIDIARIES COMMUNICATION STATEMENTS Managing Director’s Report - CBZ Bank Limited 34 Managing Director’s Report - CBZ Asset Management (Private) Limited (t/a Datvest) 37 Managing Director’s Report - CBZ Insurance Operations 40 CBZ Insurance (Private) Limited Actuary’s Report 44 CBZ Life (Private) Limited Actuary’s Report 45 CORPORATE SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 48 Group Human Resources 55 Consumer Issues and Fair Operating Practices 56 CORPORATE GOVERNANCE Corporate Governance Framework 60 Report of the Directors 71 Our Directorate 74 FINANCIAL STATEMENTS Statement of Directors’ Responsibility 82 Independent Auditors Report 83 Consolidated Statement of Profit or Loss and Other Comprehensive Income 88 Consolidated Statement of Financial Position 89 Consolidated Statement of Changes In Equity 90 Consolidated Statement of Cash Flows 91 Group Accounting Policies 92 Notes to the Consolidated Financial Statements 110 Company Financial Statements 159 OTHER Notice of Annual General Meeting 172 Group Details 173 Form of Proxy 174 1 CBZ HOLDINGS LIMITED / INTEGRATED ANNUAL REPORT 2017 GROUP SALIENT FEATURES Financial Highlights Total Assets