The World Bank for OFFICIAL USE ONLY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Participants As of 30 April 2013

World Economic Forum on Africa List of Participants As of 30 April 2013 Addis Ababa, Ethiopia, 9-11 May 2012 Messumbe Stanly Paralegal The ABENG Law Firm Cameroon Abane Yilkal Abate Secretary-General ICT Association of Ethiopia Ethiopia Zein Abdalla Chief Executive Officer PepsiCo Europe Switzerland Amin Abdulkader Minister of Culture and Tourism of Ethiopia Rakeb Abebe Chief Executive Officer and Founder GAWT International Business Ethiopia Plc Olufemi Adeyemo Group Chief Financial Officer Oando Plc Nigeria Tedros Adhanom Minister of Health of Ethiopia Ghebreyesus Tedros Adhanom Minister of Health of Ethiopia Ghebreyesus Olusegun Aganga Minister of Industry, Trade and Investment of Nigeria Alfredo Agapiti President Tecnoservice Srl Italy Pranay Agarwal Principal Adviser, Corporate Finance MSP Steel & Power Ltd India and Strategy Vishal Agarwal Head, sub-Saharan Africa Deals and PwC Kenya Project Finance Pascal K. Agboyibor Managing Partner Orrick Herrington & Sutcliffe France Manish Agrawal Director MSP Steel & Power Ltd India Deborah Ahenkorah Co-Founder and Executive Director The Golden Baobab Prize Ghana Halima Ahmed Political Activist and Candidate for The Youth Rehabilitation Somalia Member of Parliament Center Sofian Ahmed Minister of Finance and Economic Development of Ethiopia Dotun Ajayi Special Representative to the United African Business Roundtable Nigeria Nations and Regional Manager, West Africa Abi Ajayi Vice-President, Sub-Saharan Africa Bank of America Merrill Lynch United Kingdom Coverage and Origination Clare Akamanzi Chief Operating Officer Rwanda Development Board Rwanda (RDB) Satohiro Akimoto General Manager, Global Intelligence, Mitsubishi Corporation Japan Global Strategy and Business Development Adetokunbo Ayodele Head, Investor Relations Oando Plc Nigeria Akindele Kemi Lala Akindoju Facilitator Lufodo Academy of Nigeria Performing Arts (LAPA) World Economic Forum on Africa 1/23 Olanrewaju Akinola Editor This is Africa, Financial Times United Kingdom Vikram K. -

Malawi Rapid Etrade Readiness Assessment

UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT Malawi Rapid eTrade Readiness Assessment Geneva, 2019 II Malawi Rapid eTrade Readiness Assessment © 2019, United Nations This work is available open access by complying with the Creative Commons licence created for intergovernmental organizations, available at http://creativecommons.org/licenses/by/3.0/igo/. The findings, interpretations and conclusions expressed herein are those of the authors and do not necessarily reflect the views of the United Nations, its officials or Member States. The designation employed and the presentation of material on any map in this work do not imply the expression of any opinion whatsoever on the part of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Photocopies and reproductions of excerpts are allowed with proper credits. This publication has been edited externally. United Nations publication issued by the United Nations Conference on Trade and Development. UNCTAD/DTL/STICT/2019/14 eISBN: 978-92-1-004695-4 NOTE III NOTE Within the UNCTAD Division on Technology and Logistics, the ICT Policy Section carries out policy-oriented analytical work on the development implications of information and communication technologies (ICTs) and e-commerce. It is responsible for the preparation of the Information Economy Report (IER) as well as thematic studies on ICT for Development. The ICT Policy Section promotes international dialogue on issues related to ICTs for development and contributes to building developing countries’ capacities to measure the information economy and to design and implement relevant policies and legal frameworks. -

Malawi Stock Exchange Old Reserve Bank Building, Victoria Avenue, P/Bag 270, Blantyre, Malawi, Central Africa Phone (+265) 01 824 233, Fax

Malawi Stock Exchange Old Reserve Bank Building, Victoria Avenue, P/Bag 270, Blantyre, Malawi, Central Africa Phone (+265) 01 824 233, Fax. (+265) 01 823 636, E-mail: [email protected] Website: www.mse.co.mw Listed Share Information th 11 December, 2015 Weekly Last This P/E P/BV Market After No. Of Range Week’s week’s Dividend Earnings Capitalisation Tax Shares in issue VWAP VWAP MKmn Profit MKmn High (t) Low MSE Buy (t) Sell (t) Price(t) Price (t) Volume Net Yield Yield Ratio Ratio (t) Code (t) (%) (%) Domestic - - BHL CA 960 - 960 - - 60.00 6.25 12.95 7.72 0.35 1,240.25 160.653 129,192,416 - - FMB 1300 1400 1400 - - 100.00 7.14 15.89 6.29 1.53 32,707.50 5,197.00 2,336,250,000 23000 23000 ILLOVO - 23000 24500 23000 435 750.00 3.26 8.25 12.13 3.92 164,092.21 13,531.000 713,444,391 850 820 MPICO CA - 820 900 820 234,373 4.00 0.49 23.34 4.28 0.52 9,421.99 2,199.146 1,149,023,730 25800 25800 NBM CA - 25800 25800 25800 1,946 1535.00 5.95 12.06 8.29 2.73 120,468.39 14,529.000 466,931,738 - - NBS - 2300 2550 - - 55.00 2.16 14.51 6.89 1.58 18,554.91 2,692.518 727,643,339 2800 2800 NICO - 2800 2800 2800 1,743 85.00 3.04 25.12 3.98 0.99 29,205.15 7,335.000 1,043,041,096 - - NITL - 5500 5500 - - 165.00 3.00 29.73 3.36 1.00 7,425.00 2,207.710 135,000,000 - - PCL - 53500 53500 - - 1250.00 2.34 34.40 2.91 0.86 64,336.86 22,134.00 120,255,820 - - REAL 170 200 200 - - 0.00 0.00 22.16 4.51 0.82 500.00 110.808 250,000,000 - - Standard - 44000 44000 - - 1281.00 2.91 11.90 8.40 2.78 103,253.99 12,289.00 234,668,162 - - SUNBIRD - 2300 2209 - - 22.00 1.00 12.03 -

Malawi RISK & COMPLIANCE REPORT DATE: March 2018

Malawi RISK & COMPLIANCE REPORT DATE: March 2018 KNOWYOURCOUNTRY.COM Executive Summary - Malawi Sanctions: None FAFT list of AML No Deficient Countries Not on EU White list equivalent jurisdictions Higher Risk Areas: Corruption Index (Transparency International & W.G.I.) Failed States Index (Political Issues)(Average Score) Non - Compliance with FATF 40 + 9 Recommendations Medium Risk Areas: World Governance Indicators (Average Score) Major Investment Areas: Agriculture - products: tobacco, sugarcane, cotton, tea, corn, potatoes, cassava (tapioca), sorghum, pulses, groundnuts, Macadamia nuts; cattle, goats Industries: tobacco, tea, sugar, sawmill products, cement, consumer goods Exports - commodities: tobacco 53%, tea, sugar, cotton, coffee, peanuts, wood products, apparel Exports - partners: Canada 9.8%, Zimbabwe 9.5%, Germany 6.7%, South Africa 6.3%, Russia 6%, US 5.7%, Egypt 5.3% (2012) Imports - commodities: food, petroleum products, semi-manufactures, consumer goods, transportation equipment Imports - partners: South Africa 26.5%, China 16.2%, Zambia 9.1%, India 8.5%, Tanzania 5.5%, US 4.1% (2012) Investment Restrictions: 1 The government encourages both domestic and foreign investment in most sectors of the economy without restrictions on ownership, size of investment, source of funds, or the destination of the final product. There is no government screening of foreign investment in Malawi. Apart from the privatization program, the government's overall economic and industrial policy does not have discriminatory effects on foreign investors. Since industrial licensing in Malawi applies to both domestic and foreign investment, and is only restricted to a short list of products, it does not limit competition, protect domestic interests, or discriminate against foreign investors at any stage of investment. -

World Bank Document

CONFORMED COPY Public Disclosure Authorized CREDIT NUMBER 2221 MAI (Financial Sector and Enterprise Development Project) between Public Disclosure Authorized REPUBLIC OF MALAWI and INTERNATIONAL DEVELOPMENT ASSOCIATION Dated June 24, 1991 CREDIT NUMBER 2221 MAI Public Disclosure Authorized DEVELOPMENT CREDIT AGREEMENT AGREEMENT, dated June 24,1991, between REPUBLIC OF MALAWI (the Borrower) and INTERNATIONAL DEVELOPMENT ASSOCIATION (the Association). WHEREAS: (A) the Borrower, having satisfied itself as to the feasibility and priority of the Project described in Schedule 2 to this Agreement, has requested the Association to assist in the financing of the Project; (B) part of the Project will be carried out by Reserve Bank of Malawi (RBM) with the Borrower’s assistance and, as part of such assistance, the Borrower will make available to RBM part of the proceeds of the Credit as provided in this Agreement; and WHEREAS the Association has agreed, on the basis, inter alia, of the foregoing, to extend the Credit to the Borrower upon the terms and conditions set forth in this Agreement and in the Project Agreement of even date herewith between the Association and RBM; Public Disclosure Authorized NOW THEREFORE the parties hereto hereby agree as follows: ARTICLE I General Conditions; Definitions Section 1.01. The "General Conditions Applicable to Development Credit Agreements" of the Association, dated January 1, 1985, with the modifications set forth in Schedule 6 to this Agreement (the General Conditions) constitute an integral part of this -

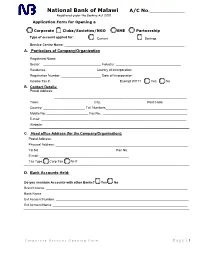

National Bank of Malawi A/C No.______Registered Under the Banking Act 2010 Application Form for Opening A

National Bank of Malawi A/C No.____________ Registered under the Banking Act 2010 Application Form for Opening a Corporate Clubs/Societies/NGO SME Partnership Type of account applied for: Current Savings Service Centre Name: __________________________________________________________________ A. Particulars of Company/Organization Registered Name: _____________________________________________________________________ Sector: ________________________________ Industry: ____________________________________ Residence: ___________________________ Country of Incorporation ____________________________ Registration Number: ______________________ Date of Incorporation Income Tax #: ______________________________________Exempt WHT? Yes No B. Contact Details: Postal Address: _________________________________________________________________________ _________________________________________________________________________ Town: ______________________________City: _________________________Post Code: ____________ Country: _______________________ Tel. Numbers_____________________________________________ Mobile No: _______________________ Fax No. : ______________________________________________ E-mail: ________________________________________________________________________________ Website: _______________________________________________________________________________ C. Head office Address (for the Company/Organisation): Postal Address: __________________________________________________________________________ Physical Address: _________________________________________________________________________ -

English Common Law Tradition

Report on the Observance of Standards and Codes (ROSC) Corporate Governance Public Disclosure Authorized Corporate Governance Public Disclosure Authorized Country Assessment Malawi June 2007 Public Disclosure Authorized Public Disclosure Authorized Overview of the Corporate Governance ROSC Program WHAT IS CORPORATE GOVERNANCE? THE CORPORATE GOVERNANCE ROSC ASSESSMENTS Corporate governance refers to the structures and processes for the direction and control of com - Corporate governance has been adopted as one panies. Corporate governance concerns the relation - of twelve core best-practice standards by the inter - ships among the management, Board of Directors, national financial community. The World Bank is the controlling shareholders, minority shareholders and assessor for the application of the OECD Principles of other stakeholders. Good corporate governance con - Corporate Governance. Its assessments are part of tributes to sustainable economic development by the World Bank and International Monetary Fund enhancing the performance of companies and (IMF) program on Reports on the Observance of increasing their access to outside capital. Standards and Codes (ROSC). The OECD Principles of Corporate Governance The goal of the ROSC initiative is to identify provide the framework for the work of the World weaknesses that may contribute to a country’s eco - Bank Group in this area, identifying the key practical nomic and financial vulnerability. Each Corporate issues: the rights and equitable treatment of share - Governance ROSC assessment reviews the legal and holders and other financial stakeholders, the role of regulatory framework, as well as practices and com - non-financial stakeholders, disclosure and trans - pliance of listed firms, and assesses the framework parency, and the responsibilities of the Board of relative to an internationally accepted benchmark. -

Malawi-Financial-Sector-Technical

Document of The World Bank FOR OFFICIAL USE ONLY Public Disclosure Authorized Report No: ICR00004184 IMPLEMENTATION COMPLETION AND RESULTS REPORT (IDA-48970) ON A CREDIT IN THE AMOUNT OF SDR 18.1 MILLION Public Disclosure Authorized (US$28.2 MILLION EQUIVALENT) TO THE THE REPUBLIC OF MALAWI MINISTRY OF FINANCE, ECONOMY AND DEVELOMENT FOR THE MALAWI - FINANCIAL SECTOR TECHNICAL ASSISTANCE PROJECT (P122616) Public Disclosure Authorized May 29, 2019 Finance, Competitiveness and Innovation Global Practice Africa Region Public Disclosure Authorized This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without World Bank authorization. CURRENCY EQUIVALENTS (Exchange Rate Effective Currency Unit = Malawi Kwacha (MK) MK 726.35 = US$1 US$1 = SDR 0.71 FISCAL YEAR January 1 – December 31 ABBREVIATIONS AND ACRONYMS ACH Automated Clearing House ADR Alternative Dispute Resolution ATM Automated Teller Machine ATS Automated Transfer System CAS Country Assistance Strategy CSD Central Securities Deposit CDS Central Depository System CPFL Consumer Protection and Financial Literacy DFID U.K. Department for International Development EFT Electronic Funds Transfer FIU Financial Intelligence Unit FM Financial Management FSAP Financial Sector Assessment Program FSDT Financial Sector Deepening Trust FSPU Financial Sector Policy Unit FSTAP Financial Sector Technical Assistance Project GCI Global Competitiveness Index GDP Gross Domestic Product GoM Government -

World Bank Document

Report No. 3460-MAI Mjawi The DevelocpmenIt of Manufacturng 8, 1981 Public Disclosure Authorized May Eastern Africa Regional Office FOR OFFOCDAL USE ONLY Public Disclosure Authorized Public Disclosure Authorized Document of the World Bank Public Disclosure Authorized This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without World Bank authorization. CURRENCY EQUIVALENTS Currency Unit = Kwacha (K) Exchange Rate Kwacha 1 = US$ US$1 = Kwacha Average 1973 1.2206 0.8193 Average 1974 1.1888 0.8412 Average 1975 1.1577 0.8638 Average 1976 1.0953 0.9130 Average 1977 1.1075 0.9029 Average 1978 1.1851 0,8438 Average 1979 1,2241 0.8169 ABBREVIATIONS ADMARC - Agriculture Development and Marketing Corporation AMEC - American Management and Engineering Corporation, Inc. BTN - Brussels Tariff Nomenclature CDC - Commonwealth Development Corporation DEG - Deutsche Gesellschaft fur Wirtschaftliche Zusammenarbeit DEVRES - Development Resources EAD - Economic Affairs Division, Ministry of Finance EDD - Economic Development Division, Office of the President and Cabinet EPD - Economic Planning Division, Office of the President and Cabinet FMO - Nederlanse Financierings-Maatschappij voor Ontwikkelingslanden N.V. IFC - International Finance Corporation IMEXCO - Import and Export Company of Malawi INDEBANK - Industrial Development Bank MES - Minimum Economic Size Plant MTIT - Ministry of Trade, Industry and Tourism NSO - National Statistical Office Press - Press Holdings Ltd. FISCAL YEAR April 1 - March 30 - i- FOR OFFICIAL USE ONLY PREFACE 1. This report is one of a series of six special reports that have been produced as the result of the 1979 Basic Economic Mission.l/ The major purposes of the Basic Economic Mission were to review the performance of the Malawian economy since independence (1964) and to assess the future prospects for growth over the next decade or more, identifying the major constraints to development and making recommendations for their relief. -

2010, Significant Efforts Focused on the Implementation of a New Core Banking IT Platform and the Completion of the New Business and Office Complex Project

In 2010, significant efforts focused on the implementation of a new core banking IT platform and the completion of the new Business and Office Complex project. The Bank of the Nation 2010 ANNUAL REPORT C O N T E N T S 4 Vision, Mission Statement and Core Values 5 Group Financial Highlights 6 Current Directors 8 Report of the Directors 12 Chairman’s Report 14 Senior Management 16 Chief Executive Officer’s Statement 23 Corporate Activities 31 Selected Key Clients’ Activities 39 Economic Review and Prospects for 2011 42 Corporate Governance Statement 43 Statement of Directors’ Responsibilities 44 Report of the Independent Auditor 45 Statements of Financial Position 46 Statements of Comprehensive Income 47 Statements of Changes in Equity 50 Statements of Cashflows 51 Notes to the Financial Statements 110 Correspondent Banks 111 Head Office and Service Centres 112 Map of Malawi - National Bank of Malawi Service Centres Mangochi andMulanjeServicecentres. We concludedtherenovationandre-brandingprogramwithrefurbishmentofChichiri, 3 N ATIONAL B ANK OF M ALAWI - THE B ANK OF THE N ATION VISION To be the most successful financial institution in Malawi with a visible presence in the Southern Africa Region. MISSION STATEMENT To provide the best financial services in Malawi and the region, distinguished by outstanding service, product innovation and sustained earnings growth. CORE VALUES Customer Satisfaction Employee Commitment Always striving to meet our customers’ The Bank will be commited to excellence in its 2010 expectations and putting the customer first. performance and that the employees will have a clear understanding of its objectives and goals. EPORT Employee Recruitment R and Development Integrity and Trust Employees are the key to the success of National All Bank employees will fully comply with and Bank of Malawi. -

Bridgepath-Capital-Financial-Market-Update-30-April-2021

Financial Market Update I Week ending 30 April 2021 Financial market highlights for the week ending 30 April 2021 The following highlights compare the week ending 30 April 2021 to the week ending 23 April 2021: Government securities market (Source: RBM) Equity market (Source: MSE) • A total of K200.94 million was allotted in the TB auctions held • The stock market was bullish this week as the MASI this week. increased to 33,380.63 points from 33,327.20 points in the • There were nil rejections during the TB auctions. previous week. This was due to share price gains for Airtel • The 364-days TB was not allotted during this week’s auction. (to K31.00 from K30.47), NBM (to K650.06 from K650.05) and NICO (to K51.92 from K51.72) which offset share price losses for NBS (to K23.00 from K24.00), FDH bank (to Currency market (Source: RBM) K16.47 from K16.48) and TNM (to K16.36 from K16.38), during the period under review. • Based on middle rates, the Malawi Kwacha marginally • The year-to-date return of the MASI was 3.05% at the close depreciated against the USD by 0.44% to K798.78 per USD of this week. It was negative 4.61% in the previous year, from K795.28 per USD in the previous week. during the same period. • Based on middle rates, the Kwacha depreciated against the GBP (K1,165.33 per GBP from K1,155.99 per GBP), and • According to their audited summary consolidated financial EUR (K1,039.97 per EUR from K1,015.03 per EUR) and ZAR statements for the year ended 31 December 2020: (K60.13 per ZAR from K58.84 per ZAR) during the period o FMB Capital Holdings Plc closed the year with a profit under review. -

2019 Annual Report 2019 / Press Corporation PLC | 5 FIVE YEAR GROUP FINANCIAL REVIEW

P R E C S L S P CO N RPORATIO ANNUAL REPORT 2019 CONTENTS The Group is Strategic Report Financial Statements determined to - Financial Highlights 4 - Directors’ Report 52 - Five Year Group Financial Review 6 - Statement of Directors’ Responsibilities 58 - Vision, Mission Statement, Core Values 7 - Independent Auditor’s Report 59 spread its wings - Chairman’s Report 8 - Consolidated and Separate - Group Chief Executive’s Report 12 Statements of Financial Position 66 across the borders - Business Review 16 - Consolidated and Separate- Statements of Comprehensive Income 68 in its expansion Corporate Social Responsibility 37 - Consolidated and Separate Statements of Changes in Equity 69 drive Corporate Governance - Consolidated and Separate Statements of Cash Flows 71 - Board of Directors 40 - Notes to the Consolidated and - Board Committees 41 Separate Financial Statements 72 - 170 - Internal Audit, Integrity and Diversity 42 - Profile of Directors 44 On the Malawi Stock Exchange 171 - Profile of Management 48 Administration 172 FINANCIAL HIGHLIGHTS (CONTINUED) FINANCIAL HIGHLIGHTS Malawi Kwacha US Dollars PROFIT ORDINARY ATTRIBUTABLE On the Malawi Stock Exchange On the Malawi Stock Exchange TURNOVER 2019 2018 Change % 2019 2018 Change % TO ORDINARY SHAREHOLDERS’ SHAREHOLDERS FUNDS Group Summary (in millions) Turnover 220,066 214,420 2.63 300 295 1.69 Attributable earnings 8,157 18,373 (55.60) 11 25 (55.94) Financial Statements Financial Statements Shareholders’ equity 157,027 150,912 4.05 213 207 2.89 Share performance Basic earnings per