Update on African Integration and the Afcfta

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

38636 2-4 Roadcarrierpp1 Layout 1

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA Vol. 598 Pretoria, 2 April 2015 No. 38636 PART 1 OF 4 N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 501166—A 38636—1 2 No. 38636 GOVERNMENT GAZETTE, 2 APRIL 2015 IMPORTANT NOTICE The Government Printing Works will not be held responsible for faxed documents not received due to errors on the fax machine or faxes received which are unclear or incomplete. Please be advised that an “OK” slip, received from a fax machine, will not be accepted as proof that documents were received by the GPW for printing. If documents are faxed to the GPW it will be the sender’s respon- sibility to phone and confirm that the documents were received in good order. Furthermore the Government Printing Works will also not be held responsible for cancellations and amendments which have not been done on original documents received from clients. CONTENTS INHOUD Page Gazette Bladsy Koerant No. No. No. No. No. No. Transport, Department of Vervoer, Departement van Cross Border Road Transport Agency: Oorgrenspadvervoeragentskap aansoek- Applications for permits:.......................... permitte: .................................................. Menlyn..................................................... 3 38636 Menlyn..................................................... 3 38636 Applications concerning Operating Aansoeke aangaande -

Effect of Grootvlei Mine Water on the Blesbokspruit

THE EFFECT OF GROOTVLEI MINE WATER ON THE BLESBOKSPRUIT by TANJA THORIUS Mini-dissertation submitted in partial fulfilment of the requirement for the degree MASTER OF SCIENCE in ENVIRONMENTAL MANAGEMENT in the Faculty of Science at the Rand Afrikaans University Supervisor: Professor JT Harmse July 2004 The Impact of Grootvlei Mine on the Water Quality of the Blesbokspruit i ABSTRACT Gold mining activities are widespread in the Witwatersrand area of South Africa. These have significant influences, both positive and negative, on the socio-economic and bio -physical environments. In the case of South Africa’s river systems and riparian zones, mining and its associated activities have negatively impacted upon these systems. The Blesbokspruit Catchment Area and Grootvlei Mines Limited (hereafter called “Grootvlei”) are located in Gauteng Province of South Africa. The chosen study area is east of the town of Springs in the Ekurhuleni Metropolitan Municipality on the East Rand of Gauteng Province. Grootvlei, which has been operating underground mining activities since 1934, is one of the last operational mines in this area. Grootvlei pumps extraneous water from its underground mine workings into the Blesbokspruit, which includes the Blesbokspruit Ramsar site. This pumping ensures that the mine workings are not flooded, which would result in the gold reserves becoming inaccessible and would shortly lead to the closure of Grootvlei. This closure would further affect at least three other marginal gold mines in the area, namely, Springs-Dagga, Droogebult-Wits and Nigel Gold Mine, all which rely on Grootvlei’s pumping to keep their workings dry. Being shallower than Grootvlei, they are currently able to operate without themselves having to pump any extraneous water from their underground workings. -

Branch Lectures & Events

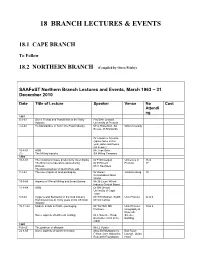

18 BRANCH LECTURES & EVENTS 18.1 CAPE BRANCH To Follow 18.2 NORTHERN BRANCH (Compiled by Owen Frisby) SAAFoST Northern Branch Lectures and Events, March 1963 – 31 December 2010 Date Title of Lecture Speaker Venue No Cost Attendi ng 1963 5-3-63 Some Trends and Possibilities in the Dairy Prof SH Lombard. Industry University of Pretoria 2-4-63 To Standardise or Not in the Food Industry Mr G Robertson. SA Wits University Bureau of Standards Dr Lawrence Novellie (spoke twice in this year, dates and topics not known) 15-8-63 AGM Mr J van Selm. (?) The Milling Industry SA Milling Company 1964 10-3-64 The cooking of maize products by roller drying Dr F Schweigart University of 16 & The Birs low-temperature spray-drying Dr E Rickert Pretoria 17 process. Mr C Saunders The pasteurization of liquid whole egg. 7-4-64 The use of glass in food packaging Dr Donen. Johannesburg 10 Consolidated Glass Works 19-5-64 Aspects of Wheat Milling and Bread Baking Mr JB Louw. Wheat Industry Control Board 11-8-64 AGM Dr GN Dreosti University of Cape Town 8-9-64 Hygiene and Sanitation in the food industry Mr WR Mottram. SABS Univ Pretoria 22 & 6 Reminiscences of thirty years in the UK food Mr VA Cachia industry 10-11-64 Modern trends in flexible packaging. Mr TG Hutt. MD Univ Pretoria: 19 & 6 Packsure Geography & Domestic Some aspects of kaffircorn malting Dr L Novellie. Head, Science Bantu Beer Unit of the Building CSIR 1965 Feb-65 The problem of aflatoxin Mr LJ Vorster 22-6-65 Some aspects of starch chemistry. -

Gauteng Gauteng

Gauteng Gauteng Thousands of visitors to South Africa make Gauteng their first stop, but most don’t stay long enough to appreciate all it has in store. They’re missing out. With two vibrant cities, Johannesburg and Tshwane (Pretoria), and a hinterland stuffed with cultural treasures, there’s a great deal more to this province than Jo’burg Striking gold International Airport, says John Malathronas. “The golf course was created in 1974,” said in Pimville, Soweto, and the fact that ‘anyone’ the manager. “Eighteen holes, par 72.” could become a member of the previously black- It was a Monday afternoon and the tees only Soweto Country Club, was spoken with due were relatively quiet: fewer than a dozen people satisfaction. I looked around. Some fairways were in the heart of were swinging their clubs among the greens. overgrown and others so dried up it was difficult to “We now have 190 full-time members,” my host tell the bunkers from the greens. Still, the advent went on. “It costs 350 rand per year to join for of a fully-functioning golf course, an oasis of the first year and 250 rand per year afterwards. tranquillity in the noisy, bustling township, was, But day membership costs 60 rand only. Of indeed, an achievement of which to be proud. course, now anyone can become a member.” Thirty years after the Soweto schoolboys South Africa This last sentence hit home. I was, after all, rebelled against the apartheid regime and carved ll 40 Travel Africa Travel Africa 41 ERIC NATHAN / ALAMY NATHAN ERIC Gauteng Gauteng LERATO MADUNA / REUTERS LERATO its name into the annals of modern history, the The seeping transformation township’s predicament can be summed up by Tswaing the word I kept hearing during my time there: of Jo’burg is taking visitors by R511 Crater ‘upgraded’. -

CURRENT FUTURE FLOWS Final Revision.Doc

SEDIIBENG REGIIONAL SANIITATIION SCHEME A STUDY OF CURRENT AND EXPECTED FUTURE SEWER FLOWRATES TO DETERMIINE THE WASTEWATER TREATMENT CAPACITY REQUIREMENTS OF THE REGIION UP TO 2025 FINAL DRAFT NOVEMBER 2008 A STUDY OF CURRENT AND EXPECTED FUTURE SEWER FLOWRATES TO DETERMINE THE WASTEWATER TREATMENT CAPACITY REQUIREMENTS OF THE REGION UP TO 2025 CONTENTS Chapter Description Page 1 INTRODUCTION AND BACKGROUND 1 1.1 Background to the Study Area 1 1.2 Scope of the Study 1 1.3 Overview of the Existing Wastewater Treatment in the Region 3 2 AN EVALUATION OF FACTORS AND TRENDS INFLUENCING CURRENT AND FUTURE SEWER FLOWRATES 5 2.1 Current Demographics and Service Levels 5 2.1.1 Emfuleni Local Municipality 5 2.1.2 Midvaal Local Municipality 7 2.2 Population Growth Projections – Emfuleni and Midvaal 9 2.3 Future Land Use and Residential Developments 10 2.3.1 Emfuleni Local Municipality 10 2.3.2 Midvaal Local Municipality 11 2.4 Anticipated Improvements in Sanitation Levels of Service 12 2.4.1 Emfuleni Local Municipality 12 2.4.2 Midvaal Local Municipality 13 3 CALCULATIONS OF CURRENT AND FUTURE SEWER FLOW RATES 14 3.1 Calculation of Current Sewer Flows 14 3.1.1 Emfuleni Local Municipality 14 3.1.2 Midvaal Local Municipality 15 3.2 Calculation of Future Sewage Flow Rates 16 3.2.1 Emfuleni Local Municipality 16 3.2.2 Midvaal Local Municipality 17 3.2.3 Consolidated Future Sewage Flow Rates 18 4 CONCLUSIONS 20 Current and Future Sewer Flows Rev 01 Figures Figure 2.1 Emfuleni population distribution per settlement type ............................................ -

Protest May 2021

National Crime Assist (NCA) REG NO 2018/355789/08 K2018355789 (NPC) PROTEST MAY 2021 www.nca247.org.za Fighting crime is what we do! 01 May 2021 MP - Secunda WC - Cape Town * CBD (peaceful march) GP - Kliprivier/Heidelberg, R59, Petrol Tanker set alight 02 May 2021 KZN - Durban * Warwick/Old Dutch rd (Taxi blockade) GP - Pretoria *Dr Swanepoel/ Dr vd Merwe str (road blocked with stones) 03 May 2021 KZN - Greytown > Mooiriver * TRP, Dwarsriver mine (all entrances blocked) GP - Midrand * c/o Klipriver dri/ Booysens rd GP – Vosloosrus * N3 LP - Vaalwater *R33, various locations (stone throwing, vehicle taken, violence, closing shops) (protestors tried to enter Police Station) EC - East London * Various roads closed (stone throwing, burning tyres) EC- Mdantsane * All entrys closed (burning tyres) KZN - Louwsburg / Vryheid, R69 * road closed (with rocks and branches) NC - Jan Kempdorp (town closed off) KZN – Richards Bay * N2, Closed (truck blocking road) KZN - Nseleni * N2, blocked at Zenith Estates NW - Brits * van Velden str (court protest) WC- Mitchels Plain * 10th Ave/ Charlie str GP - Bronkhorstspruit *Diamond Hill Plaza * N4 Bridge (Stone throwing) KZN - Durban * Broad str (Eff march, firing shots) * West str KZN - Eshowe * R66 LP Steelpoort * Minning Area MP Bethal/Morgenzon * R35, truck set alight, by ADTF protesters driver shot, luckily not serious. 04 May 2021 KZN - Eshowe * R66, 10km before Eshowe (burning tyres) WC – Cape Town * R300/N1 (7 taxi blocked road) *Botlary Rd (Paarl taxis blocking road) *c/o N7 / Malibongwe dr * M17, -

National Road N12 Section 6: Victoria West to Britstown

STAATSKOERANT, 15 OKTOBER 2010 NO.33630 3 GOVERNMENT NOTICE DEPARTMENT OF TRANSPORT No. 904 15 October 2010 THE SOUTH AFRICAN NATIONAL ROADS AGENCY LIMITED Registration No: 98109584106 DECLARATION AMENDMENT OF NATIONAL ROAD N12 SECTION 6 AMENDMENT OF DECLARATION No. 631 OF 2005 By virtue of section 40(1)(b) of the South African National Roads Agency Limited and the National Roads Act, 1998 (Act NO.7 of 1998), I hereby amend Declaration No. 631 of 2005, by substituting the descriptive section of the route from Victoria West up to Britstown, with the subjoined sheets 1 to 27 of Plan No. P727/08. (National Road N12 Section 6: Victoria West - Britstown) VI ~/ o8 ~I ~ ~ ... ... CD +' +' f->< >< >< lli.S..E..I VICTORIA WEST / Ul ~ '-l Ul ;Ii; o o -// m y 250 »JJ z _-i ERF 2614 U1 iii,..:.. "- \D o lL. C\J a Q:: lL. _<n lLJ ~ Q:: OJ olLJ lL. m ~ Q:: Q) lLJ JJ N12/5 lL. ~ fj- Q:: ~ I\J a DECLARATION VICTORIA lLJ ... ... .... PLAN No. P745/09 +' a REM 550 +' :£ >< y -/7 0 >< WEST >< 25 Vel von stel die podreserwe voor von 'n gedeelte Z Die Suid Afrikoonse Nosionole Podogentskop 8eperk Die figuur getoon Sheet 1 of 27 a represents the rood reserve of 0 portion ~:~:~:~: ~ :~: ~:~:~:~:~:~ The figure shown w The South African Notional Roods Agency Limited ........... von Nosionole Roete Seksie 6 Plan w :.:-:-:-:.:.:-:.:-:-:.: N12 OJ of Notional Route Section P727108 w a D.O.9.A • U1 01 o II') g 01' ICTORIA0' z " o o (i: WEST \V II> ..... REM ERF 9~5 II') w ... -

Declaration of Existing Provincial Road P16 Section 1 As

STAATSKOERANT, 28 SEPTEMBER 2012 No. 35719 3 GOVERNMENT NOTICE DEPARTMENT OF TRANSPORT No. 784 28 September 2012 THE SOUTH AFRICAN NATIONAL ROADS AGENCY SOC LIMITED Registration No: 98/09584/06 A. DECLARATION OF EXISTING PROVINCIAL ROAD- PROVINCIAL ROAD P16 SECTION 1 AS NATIONAL ROAD R24- DISTRICT OF RUSTENBURG, IN THE NORTH-WEST PROVINCE By virtue of Section 40(1 )(a) of The South African National Road Agency Limited and National Roads Act 1998 (Act No. 7 of 1998), I hereby declare the Section of Route R24, also known as Provincial Road P16 Section 1, as declared by all Administrator's Notices which might be relevant to this section of road, commencing from its junction with Provincial District Road 0108, at Rustenburg, from where it proceeds in a general easterly direction along the existing Provincial Road P16 Section 1 up to the junction with the North-West!Gauteng Provincial Border, where it terminates as a National Road. (National Road R24: Rustenburg - North-West/Gauteng Provincial Border, a distance of approximately 31.4km) B. DECLARATION OF EXISTING PROVINCIAL ROADS- (I) PROVINCIAL ROAD P32 SECTION 2 , (II) PROVINCIAL ROAD P32 SECTION 1 AND (Ill) PROVINCIAL ROAD P20 SECTION 3 AS NATIONAL ROAD R30- DISTRICTS OF KLERKSDORP, VENTERSDORP, KOSTER AND RUSTENBURG, IN THE NORTH-WEST PROVINCE By virtue of Section 40(1 )(a) of The South African National Road Agency Limited and National Roads Act 1998 (Act No. 7 of 1998), I hereby declare: I) The Section of Route R30, also known as Provincial Road P32 Section 2, as declared by all Administrator's -

Mobile Accommodation Solutions CC

Mobile Accommodation Solutions CC Direction Instructions A view of 10 Top Road, Anderbolt, Boksburg, 1459, South Africa – Mobile Accommodation Solutions CC From Pretoria (North) Travel along the R21 highway towards Johannesburg – Southern Direction. At Johannesburg international R 24 1221 split carry on towards Boksburg on the R21. Before highway comes to an end turn left onto N12 Witbank highway heading east. Pass the Rondebult offramp. Next offramp – Atlas – take the 2nd offramp – Atlas Road Boksburg/Anderbolt. Drive along 360° bend – across the highway – carry on towards Boksburg/Anderbolt on Atlast Road (south) – 1,35km down Atlast Road. Cross over North Rand Road intersection (Renault car agency on your right hand side). Carry along Atlas crossing over another robot (Spar on your right hand side). At the next robot – Top Road – turn right. Carry down Top Road for 200m – Entrance on your right hand side – number 10 Top Road. From Vereeniging (South) Travel along the R59 towards Johannesburg – Northern Direction. Closer to Alberton take the highway split N12 Witbank/W3 PTA. Travel in an easterly direction towards Johannesburg. Pass Voortrekker offramp. Pass the N3 split to Durban. Carry on on the N1 Pretoria/N12 Witbank towards Johannesburg. Pass the PPC factory on your left hand side. Carry on straight on the N12/N1 PTA/Witbank highway. Pass van Buuren offramp. As you approach Gilloolys interchange take the R24/N12 O.R. Tambo Witbank slid way. Carry on on the R24/N12 – 1km the highway splits Keep right. Carry on with R24 towards Witbank Boksburg. Pass offramp to Edenvale, Kraft Road, Jet Park, R21 O.R. -

South African Tourism Annual Report 2018 | 2019

ANNUAL REPORT 2018 | 2019 GENERAL INFORMATIONSouth1 African Tourism Annual Report 2018 | 2019 CELEBRATING 25 YEARS OF TOURISM 2 ANNUAL REPORT 2018 | 2019 GENERAL INFORMATION TABLE OF CONTENTS PART A: GENERAL INFORMATION 5 Message from the Minister of Tourism 15 Foreword by the Chairperson 18 Chief Executive Officer’s Overview 20 Statement of Responsibility for Performance Information for the Year Ended 31 March 2019 22 Strategic Overview: About South African Tourism 23 Legislative and Other Mandates 25 Organisational Structure 26 PART B: PERFORMANCE INFORMATION 29 International Operating Context 30 South Africa’s Tourism Performance 34 Organisational Environment 48 Key Policy Developments and Legislative Changes 49 Strategic Outcome-Oriented Goals 50 Performance Information by Programme 51 Strategy to Overcome Areas of Underperformance 75 PART C: GOVERNANCE 79 The Board’s Role and the Board Charter 80 Board Meetings 86 Board Committees 90 Audit and Risk Committee Report 107 PART D: HUMAN RESOURCES MANAGEMENT 111 PART E: FINANCIAL INFORMATION 121 Statement of Responsibility 122 Report of Auditor-General 124 Annual Financial Statements 131 CELEBRATING 25 YEARS OF TOURISM ANNUAL REPORT 2018 | 2019 GENERAL INFORMATION 3 CELEBRATING 25 YEARS OF TOURISM 4 ANNUAL REPORT 2018 | 2019 GENERAL INFORMATION CELEBRATING 25 YEARS OF TOURISM ANNUAL REPORT 2018 | 2019 GENERAL INFORMATION 5 CELEBRATING 25 YEARS OF TOURISM 6 ANNUAL REPORT 2018 | 2019 GENERAL INFORMATION SOUTH AFRICAN TOURISM’S GENERAL INFORMATION Name of Public Entity: South African Tourism -

The Development of Informal Settlements in South Africa, with Particular Reference to Informal Settlements Around Daveyton on the East Rand, 19704999

THE DEVELOPMENT OF INFORMAL SETTLEMENTS IN SOUTH AFRICA, WITH PARTICULAR REFERENCE TO INFORMAL SETTLEMENTS AROUND DAVEYTON ON THE EAST RAND, 19704999 SEMANGALIISO SAMUEL MALINGA THESIS SUBMITTED IN THE FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE DOCTOR OF LITERATURE AND PHILOSOPHY [IN HISTORICAL STUDIES If N THE FACULTY OF ARTS AT THE RAND AFRIKAANS UNIVERSITY PROMOTER: Professor G. Verhoef MAY 2000 THE DEVELOPMENT OF INFORMAL SETTLEMENTS IN SOUTH AFRICA, WITH PARTICULAR REFERENCE TO INFORMAL SETTLEMENTS AROUND DAVEYTON ON THE EAST RAND, 1970-11999 TA I it LE OF CONTENTS PAGE 1 Introduction and Background 1 1.1 Exposition of the problem 3 1.2 Aim of the study and time frame 5 1.3 Research methodology 6 1.3.1 Primary Sources 7 1.3.2 Secondary Sources 8 1.3.3 Newspapers, Magazines and Chronicles 11 1.4 Historiography 12 1.5 The comparative international perspective on 22 informal settlements 1.6 Conclusion 33 Informal settlements in South Africa 40 2.1 Introduction 40 2.2 The emergence of informal settlements in South Africa 41 2.3 Reasons for the emergence of informal settlements 48 2.4 Manifestation of informal settlements as a problem 58 in South Africa: a historical perspective 2.5 Distribution of informal settlements in South Africa 62 2.6 Types of informal settlements 65 2.6.1 Backyard shacks and outbuildings in proclaimed 66 Black townships 2.6.2 Free standing settlements within proclaimed 66 Black townships 2.6.3 Peri-urban squatting and free standing settlements 71 outside proclaimed Black townships 2.7 Conclusion 73 Official -

Table of Contents

ANNUAL REPORT 2016/17 FINANCIAL YEAR TABLE OF CONTENTS PART A: GENERAL INFORMATION 4 1. DEPARTMENT GENERAL INFORMATION 5 2. LIST OF ABBREVIATIONS/ACRONYMS 6 3. FOREWORD BY MEMBER OF THE EXECUTIVE COUNCIL 7 4. REPORT OF THE ACCOUNTING OFFICER 9 5. STATEMENT OF RESPONSIBILITY AND CONFIRMATION OF ACCURACY 17 FOR THE ANNUAL REPORT 6. STRATEGIC OVERVIEW 19 6.1 Vision 19 6.2 Mission 19 6.3 Values 19 7. LEGISLATIVE AND OTHER MANDATES 20 7.1 The Constitutional Mandate 20 7.2 National and Provincial Legislative Mandates 20 7.3 National and Provincial Policy Mandates 24 8. ENTITIES REPORTING TO THE MEC 27 9. ORGANISATIONAL STRUCTURE 28 9.1 Management Team 29 PART B: PERFORMANCE INFORMATION 31 1. AUDITOR GENERAL’S REPORT: PREDETERMINED OBJECTIVES 32 2. OVERVIEW OF DEPARTMENTAL PERFORMANCE 32 2.1 Service Delivery Environment 32 2.2 Service Delivery Improvement Plan 34 2.3 Organisational environment 36 2.4 Key policy developments and legislative changes 37 3. STRATEGIC OUTCOME ORIENTED GOALS 37 4. PERFORMANCE INFORMATION BY PROGRAMME 38 4.1 Programme 1: Administration 38 4.2 Programme 2: Cultural Affairs 47 4.3 Programme 3: Library and Archival Services 69 4.4 Programme 4: Sport and Recreation 80 GAUTENG DEPARTMENT OF SPORT, ARTS, CULTURE AND RECREATION 1 ANNUAL REPORT 2016/17 FINANCIAL YEAR 5. TRANSFER PAYMENTS 102 5.1. Transfer payments to public entities 102 5.2. Transfer payments to all organisations other than public entities 102 6. CONDITIONAL GRANTS 115 6.1. Conditional grants paid 115 6.2 Conditional grants received 117 7. DONOR FUNDS 121 8.