Title: Updated Results on Property Assessment Accuracy, Uniformity and Equity in Philadelphia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What Is on the Other Side of the Tracks? a Spatial Examination of Neighborhood Boundaries and Segregation

University of Pennsylvania ScholarlyCommons Publicly Accessible Penn Dissertations 1-1-2012 What is on the Other Side of the Tracks? A Spatial Examination of Neighborhood Boundaries and Segregation Rory Kramer University of Pennsylvania, [email protected] Follow this and additional works at: http://repository.upenn.edu/edissertations Part of the African American Studies Commons, Geography Commons, and the Sociology Commons Recommended Citation Kramer, Rory, "What is on the Other Side of the Tracks? A Spatial Examination of Neighborhood Boundaries and Segregation" (2012). Publicly Accessible Penn Dissertations. 532. http://repository.upenn.edu/edissertations/532 This paper is posted at ScholarlyCommons. http://repository.upenn.edu/edissertations/532 For more information, please contact [email protected]. What is on the Other Side of the Tracks? A Spatial Examination of Neighborhood Boundaries and Segregation Abstract Space has always been a critical component of the sociological study of racial inequality, yet it has rarely been the central focus of empirical projects. Studies of segregation, an inherently spatial concept, have relied on techniques that are aspatial introduce an unknown amount of error into their results. This project extends standard spatial analytic techniques to the sociological study of racial segregation, using Philadelphia as its case study. By introducing non-euclidean kernel density analysis to the study of racial segregation, the project explores how a more visual and more spatially informed -

Economic Inclusion Initiative

Economy Neighborhood Research Education Civic Quality of Life Healthcare Social Services Safety Community Culture Workforce Innovation Impact UNIVERSITY OF PENNSYLVANIA Powering Philadelphia and Pennsylvania Know Penn’s Numbers WHAT IS PENN’S ECONOMIC IMPACT ON PENNSYLVANIA AND ON PHILADELPHIA? Economic impact on Direct, indirect and Pennsylvania and Philadelphia1 induced jobs2 $14.3 billion 90,400 $10.8 billion 68,500 $ Annual tax revenue3 $272 million $197 million 1 All data in this report is from Fiscal Year 2015, unless Direct: Jobs from Penn’s payroll. otherwise noted. Indirect: Jobs created by vendors, suppliers, and 2 Every dollar spent creates a multiplier effect as Penn’s companies who have contracts with Penn, and who own employees spend their earnings in Philadelphia hire staff to service those contracts. and Pennsylvania. Similarly, Penn’s vendors, suppliers, Induced: Jobs created within the larger economy and contractors meet the demand of their contracts with resulting from Penn’s direct spending on wages and Penn by adding jobs and providing supplies, which services that leads to additional spending by individual in turn creates more earning and spending. Together workers and companies. these are categories of defined economic activity known 3 Categories of tax revenue include earned income, as direct, indirect, and induced. business, sales and use, real estate and others. Powering Philadelphia and Pennsylvania THE ECONOMIC IMPACT OF THE UNIVERSITY OF PENNSYLVANIA FISCAL YEAR 2015 “The University of Pennsylvania and its Health System are an innovating force for good in Philadelphia, our region, society and the world: advancing creative knowledge, making impactful discoveries, sustaining health and educating great new leaders. -

Philadelphia House Price Indices

PHILADELPHIA HOUSE PRICE INDICES April 28, 2015 KEVIN C. GILLEN, Ph.D. [email protected] Disclaimers and Acknowledgments: The Lindy Institute for Urban Innovation at Drexel University provides this report free of charge to the public. The report is produced by Lindy Senior Research Fellow Kevin Gillen, in association with Meyers Research LLC. The author thanks Azavea.com, the Philadelphia Office of Property Assessment, the Federal Housing Finance Agency, Case-Shiller MacroMarkets LLC, RealtyTrac, Zillow.com, Trulia.com and the NAHB for making their data publicly available. © 2015, Drexel University, All Rights Reserved. © 2015 Drexel University | [email protected] House Price Indices 1980-2015: 1980Q1=100 Philadelphia County v. Philadelphia MSA and U.S. Average 600.0 550.0 Phila. County* Phila. MSA** 500.0 U.S. Avg.** 450.0 400.0 350.0 300.0 250.0 200.0 150.0 Q1 100.0 * Empirically estimated by Kevin C. Gillen, Ph.D. **Courtesy of the Federal Housing Finance Agency (FHFA). HPIs are available through 2014Q4 only. © 2015 Drexel University | [email protected] “MSA”=Metropolitan Statistical Area, which is the entire 9-county region. Total House Price Appreciation Rates by Geographic Market Philadelphia Philadelphia Period U.S.A.** County* MSA** 36-Year 137.8% 169.1% 127.6% 10-Year 4.5% 19.3% 8.4% 1-Year 4.1% 2.0% 4.8% 1-Quarter -0.3% -1.0% 1.3% *Empirically estimated by Kevin C. Gillen Ph.D. **Source: U.S. Federal Housing Finance Agency (FHFA). These numbers are through 2014Q4 only. -

Roxborough Memorial Hospital School of Nursing

ROXBOROUGH MEMORIAL HOSPITAL SCHOOL OF NURSING INFORMATION FOR ACADEMIC YEAR 2020-2021 TABLE OF CONTENTS About Us ............................................................................................................................................................... 1 • The School of Nursing • The Hospital • The Neighborhood School of Nursing Accreditation/ Approval ......................................................................................................... 1 • Accreditation Commission For Education in Nursing, Inc. (ACEN) • The Pennsylvania State Board of Nursing Hospital Accreditation/ School of Nursing Membership. ..................................................................................... 2 • The Joint Commission on Accreditation of Healthcare Organizations (TJC) • The Hospital & Healthsystem Association of Pennsylvania (HAP) • The Delaware Valley Healthcare Council of Hospital Association of Pennsylvania (DVHC) The Academic Educational Program .................................................................................................................... 2 Admission Requirements ...................................................................................................................................... 3 • High School Requirements • College Requirements • Non-Discriminatory Policy • Admission Procedures • Time Committment Transfer Policy ..................................................................................................................................................... 3 Curriculum -

Federally Qualified Health Centers in Philadelphia

Last updated: March 9th, 2020 by Jefferson Center for Urban Health Federally Qualified Health Centers in Philadelphia Federally Qualified Health Centers (FQHCs) are clinics which provide free or low-cost medical care to residents of Philadelphia. These clinics will accept patients regardless of insurance status. Many clinics will accept walk-in patients, call ahead to request when walk in hours are. South Philadelphia Facility Address Zip Phone Services Philadelphia Health Center #2 1700 S Broad St Apt 201 19145 215-685-1810 Carl Moore Health Center (GPHA) 1401 S 31st St 19146 215-925-2400 Southeast Health Center (GPHA) 800 Washington Ave 19147 215-339-5100 Philadelphia Health Center #1 1930 S Broad St 19145 215-685-6570 STD/STI Testing Only Al-Assist Behavioral Care (GPHA) 1401 S 4th St 19147 215-339-1070 Snyder Avenue Dental Center (GPHA) 640 Snyder Ave 19148 215-334-4900 Reed Street Health Center 1325 S 33rd St Fl 3 19146 215-471-2761 .. West and Southwest Philadelphia Facility Address Zip Phone Services Philadelphia Health Center #3 555 S 43rd St 19104 215-685-7522 Philadelphia Health Center #4 4400 Haverford Ave 19104 215-685-7630 The Health Annex (FPCN) 6120 Woodland Ave 19142 215-727-4721 The Sayre Health Center 5800 Walnut St Ste 121 19139 215-474-4444 Woodland Ave Health Center (GPHA) 5000 Woodland Ave 19143 215-726-9807 Spectrum Community Health Center 5201 Haverford Ave 19139 215-471-2761 . Center City Philadelphia Facility Address Zip Phone Services Chinatown Medical Services (GPHA) 432 N 6th St 19123 215-925-2400 11th St -

Hotel Folks Hold Farewell Assembly

The Home Paper For Home News, m il Lest Yon Forget, Remember Between Seasons There’s Nothing The Home Paper With Your Printing Like News of the Grove At First Hands, The Times Gives It. Vol. XXXIII-No. 2 5 , 1 9 2 5 OCEAN GROVE, N. FRIDAY, SEPTEMBER f o u r c e n t s - x f t w t NEPTUNE TOWNSHIP ROADS HOTEL FOLKS HOLD DISCl/SSED BY COMMITTEE TENTATIVE PROGRAM BRANDT LECTURE ON c' T, v o 5 ° - ~ 29. i 14 SOCIAL SERVICE § At the Neptune township committee With Mrs. Laura B. Bimbler, of i FAREWELL ASSEMBLY meeting Tuesday evening, a short ses FOR SEASON OF 1 9 2 6 FUTURE OF AMERICA Bradley Beach, in the chair, the fall j sion, only routine business was trans convention of the . Monmouth C<-unty ! GROUPS ORGANIZED f t acted—reports of committees, pass Woman’s Christian Temperance Jnion — — age of bills, etc; ' BEFORE SEPARATING FOR will be held Tuesday of next week in o n m m T ir p n r a *™-™-. Whim the calendar had been cleared OPENING SUNDAY, JUNE 13; BROADSIDE AGAINST BOOZE the Methodist Protestant church; Avon, “GHEDULE-PLANNED IS FOR IS FALL AND WINTER and Clerk Knox gave way to Auditor CLOSING SEPT. 12 There will be a morning session a t) Reynolds, an informal discussion of SELLING IN JERSEY 10.30, an afternoon session at 2.30 and MONMOUTH COUNTY civic matters drew from Committee £ii evening session at 8.00. Following man Hulshart the statement that the is the program in detail. -

Faith on the Avenue

FAITH ON THE AVENUE DDay200613OUS.indday200613OUS.indd i 110/29/20130/29/2013 99:47:25:47:25 PPMM DDay200613OUS.indday200613OUS.indd iiii 110/29/20130/29/2013 99:47:26:47:26 PPMM FAITH ON THE AVENUE Religion on a City Street Katie Day Photographs by Edd Conboy 1 DDay200613OUS.indday200613OUS.indd iiiiii 110/29/20130/29/2013 99:47:26:47:26 PPMM 1 Oxford University Press is a department of the University of Oxford. It furthers the University’s objective of excellence in research, scholarship, and education by publishing worldwide. Oxford New York Auckland Cape Town Dar es Salaam Hong Kong Karachi Kuala Lumpur Madrid Melbourne Mexico City Nairobi New Delhi Shanghai Taipei Toronto With offi ces in Argentina Austria Brazil Chile Czech Republic France Greece Guatemala Hungary Italy Japan Poland Portugal Singapore South Korea Switzerland Th ailand Turkey Ukraine Vietnam Oxford is a registered trademark of Oxford University Press in the UK and certain other countries. Published in the United States of America by Oxford University Press 198 Madison Avenue, New York, NY 10016 © Oxford University Press 2014 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, without the prior permission in writing of Oxford University Press, or as expressly permitted by law, by license, or under terms agreed with the appropriate reproduction rights organization. Inquiries concerning reproduction outside the scope of the above should be sent to the Rights Department, Oxford University Press, at the address above. You must not circulate this work in any other form and you must impose this same condition on any acquirer. -

©2019 Spencer T. Clayton ALL RIGHTS RESERVED

©2019 Spencer T. Clayton ALL RIGHTS RESERVED TAX ABATEMENTS AND GENTRIFICATION: HOW GOVERNMENT POLICY DISRUPTS COMMUNITIES by SPENCER T. CLAYTON A dissertation submitted to the Graduate School-Camden Rutgers, the State University of New Jersey In partial fulfillment of the requirements For the degree of Doctor of Philosophy Graduate Program in Public Affairs Written under the direction of Richard A. Harris, Ph.D. And approved by ____________________________________ Richard A. Harris, Ph.D., Committee Chair ____________________________________ Paul Jargowsky, Ph.D. ____________________________________ Lorraine C. Minnite, Ph.D. ____________________________________ Adam Okulicz-Kozaryn, Ph.D. Camden, New Jersey May 2019 ABSTRACT OF DISSERTATION Tax Abatements and Gentrification: How Government Policy Disrupts Communities by SPENCER T. CLAYTON Dissertation Director: Richard A. Harris, Ph.D. Urban municipal governments often face challenges when redeveloping their distressed centers. In 2000, the City Council of Philadelphia passed a series of bills modifying its existing residential tax abatement policies to expand their eligibility and to make them last for ten years. The timing of the passage of these bills also corresponded with Mayor John Street’s Neighborhood Transformation Initiative (NTI), which aimed to prepare land for redevelopment. The combination of the revised abatement policies and NTI created a series of competing interests for politicians, business owners, and community organizations. Utilizing a methodological design consisting a historical critical analysis based on urban regime theory, GIS, and regression analysis, this dissertation profiles the formulation, implementation, and impact of Philadelphia’s tax abatement policies from 2000 to 2010. It also proposes a mechanism by which government policies can facilitate or accelerate gentrification. Results show support for a relationship between the incidence of tax abatements and gentrification. -

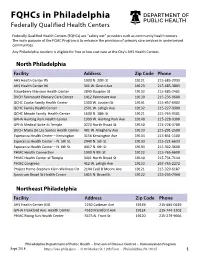

Fqhcs in Philadelphia Federally Qualified Health Centers

FQHCs in Philadelphia Federally Qualified Health Centers Federally Qualified Health Centers (FQHCs) are “safety net” providers such as community health centers. The main purpose of the FQHC Program is to enhance the provision of primary care services in underserved communities. Any Philadelphia resident is eligible for free or low cost care at the City’s AHS Health Centers. North Philadelphia Facility Address Zip Code Phone AHS Health Center #5 1900 N. 20th St 19121 215-685-2933 AHS Health Center #6 301 W. Girard Ave 19123 215-685-3803 Strawberry Mansion Health Center 2840 Dauphin St 19132 215-685-2401 DVCH Fairmount Primary Care Center 1412 Fairmount Ave 19130 215-235-9600 QCHC Cooke Family Health Center 1300 W. Louden St 19141 215-457-6902 QCHC Family Health Center 2501 W. Lehigh Ave 19132 215-227-0300 QCHC Meade Family Health Center 1600 N. 18th St 19121 215-765-9501 GPHA Hunting Park Health Center 1999 W. Hunting Park Ave 19140 215-228-9300 GPHA Medical Suite At Temple 3223 North Broad St 19140 215-226-3789 DVCH Maria De Los Santos Health Center 401 W. Allegheny Ave 19133 215-291-2500 Esperanza Health Center – Kensington 3156 Kensington Ave 19134 215-831-1100 Esperanza Health Center – N. 5th St. 2940 N. 5th St 19133 215-221-6633 Esperanza Health Center – N. 6th St. 4417 N. 6th St 19134 215-302-3600 PHMC Health Connection 1900 N 9th St 19122 215-765-6690 PHMC Health Center at Temple 3401 North Broad St 19140 215-731-7144 PHMC Congreso 412 W. Lehigh Ave 19133 267-765-2272 Project Home-Stephen Klein Wellness Ctr 2144 Cecil B Moore Ave 19121 215-320-6187 Spectrum Broad St Health Center 1415 N. -

SHCA Newsletter Summer 2009.Pub

Spruce Hill Community Association Summer 2009 257 S. 45th St., Phila. PA 19104 www.sprucehillca.org 215-349-7825 Community Calendar Exhibit on Historic West Philly A very special exhibition titled and growth. Arts League Gallery This project, which includes web What : Steven Martin paintings “West Philadelphia: Building a Com- munity” is on display at the Arthur and video pieces, is co-sponsored by When: July 10- Aug. 9 the Arthur Ross Gallery, the Historical Where : 4226 Spruce Street Ross Gallery of the University of Society of Pennsylvania, and the Uni- Info: 215-382-7811 or Pennsylvania. www.ucartsleague.org The exhibit documents the versity of Pennsylvania’s archives and ooo neighborhood’s 19th-century architec- records center. Philly Orchestra Tickets tural and urban development while After the grand opening on July 7, What: Free Philadelphia Orchestra also highlighting today’s dynamic, a series of free public lectures will be tickets multicultural community. offered in September and October. A When: All concerts are at 8 pm. July The earliest works in the exhibition free Family Day will be held on Sept. 21, Hollywood Classics; July 23, include watercolors by self-taught 26 from 11 a.m. to 2 p.m. with events Scheherazade and Other Tales; July for children. 24, All Gershwin; July 28, Verdi and Scottish immigrant, David J. Kennedy. He depicts West Philadelphia houses, What: Exhibit, “West Philadelphia: Rachmaninoff; July 29, Tchaikovsky Building a Community” with Fireworks; July 30, Herbie Han- institutions, and streets between When: July 7 – Oct. 11 cock and Lang Lang 1836-1898. His paintings are comple- Where: The Mann Center, 5201 Park- mented by city land maps, early pho- Where: Arthur Ross Gallery, 220 S. -

Seed Award Grant

PHILADELPHIA AUTISM PROJECT SEED AWARD GRANT 2021 Philadelphia Autism Project Seed Award Recipients The Philadelphia Autism Project is excited to announce the 2020-2021 seed award recipients. Please see below for group descriptions. Feel free to contact recipients directly to get involved. To learn more about all seed award groups, please visit: www.phillyautismproject.org/seed WHERE ARE THE PROJECTS? FAR NORTHEAST PHILADELPHIA Autism Friendly Environment GERMANTOWN/ Creative Arts CHESTNUT HILL OLNEY/ OAK LANE NORTHEAST Family Focused PHILADELPHIA Events ROXBOROUGH/ MANAYUNK UPPER NORTH PHILADELPHIA Life Skills LOWER NORTH KENSINGTON WEST PHILADELPHIA PHILADELPHIA Recreation CENTER CITY Social Skills SOUTH Support Group PHILADELPHIA SOUTHWEST Workshops/ PHILADELPHIA Training Efforts ADVOCATE FOR ME - MOMS NIGHT OUT Autism Mom’s Night Out is an event which honors mothers of children diagnosed on the autism spectrum. Contact: L’Vonne McMillen @AdvocateforMe1 Email: [email protected] Group: Moms Educating to Thrive On! Phone: 267.265.7792 @lvonne_mcmillan_advocateforme Website: lmadvocateforme.com Region Served: Southwest Philadelphia, South Philadelphia, West Philadelphia, North Philadelphia, Near Northeast Philadelphia, Far Northeast Philadelphia, Olney/Oak Lane ASCEND GROUP INC. - VIRTUAL PARENT SUPPORT GROUP The ASCEND Group provides monthly meetings for up to 20 parents with children with autism. Includes a licensed marriage and family therapist. Includes tools that help focus on behavior modification, building on existing strengths, reducing isolation, self-care, and maintaining positivity. Contact: Elena Perri Email: [email protected] @AscendPhilly Phone: 610-449-6776 @AscendGroupPhilly Website: ascendgroup.org @ascendgroup Region Served: Greater Philadelphia Area SIGN LANGUAGE FOR AUTISM Sign Language for Autism provides sign language workshops for children and their families. Sign language holds a unique promise for every child on the autism spectrum. -

Housing Markets and Social Capital: the Role of Participation, Institutions, and Diversity in Neighborhood Transformation

University of Pennsylvania ScholarlyCommons Culture Builds Community Culture Builds Community Evaluation—1997-2002 6-2001 Housing Markets and Social Capital: The Role of Participation, Institutions, and Diversity in Neighborhood Transformation Mark J. Stern University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/siap_culture_builds_community Part of the Arts and Humanities Commons, Social Policy Commons, Sociology Commons, and the Urban Studies and Planning Commons Stern, Mark J., "Housing Markets and Social Capital: The Role of Participation, Institutions, and Diversity in Neighborhood Transformation" (2001). Culture Builds Community. 14. https://repository.upenn.edu/siap_culture_builds_community/14 The release of the John Street administration’s Neighborhood Transformation Initiative (NTI) in April 2001 marked a bold step by city government and the private sector to address the long-term problems of economic and social decline in the city of Philadelphia. The plan called for a differentiated strategy of public-private partnership with the goal of reinvigorating housing markets throughout the city. According to the NTI housing market analysis, more than four out of five Philadelphians lived in the bottom three market clusters—transitional, distressed, and reclamation. SIAP's Culture Builds Community inquiry was undertaken from 1996 to 2001 with support by the William Penn Foundation. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/siap_culture_builds_community/14 For more information, please contact [email protected]. Housing Markets and Social Capital: The Role of Participation, Institutions, and Diversity in Neighborhood Transformation Abstract This paper examines the housing markets described in the Philadelphia Neighborhood Transformation Initiative (NTI), launched by Mayor John Street in April 2001, through the lens of social capital indicators.