~61,000 >1,700,000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State of Public Sector of Moscow Region Agriculture in 1940-1942S

Asian Social Science; Vol. 11, No. 8; 2015 ISSN 1911-2017 E-ISSN 1911-2025 Published by Canadian Center of Science and Education State of Public Sector of Moscow Region Agriculture in 1940-1942s Andrey Anatolevich Androsov1, Alexander Alekseevich Fedulin1 & Vadim Vadimovich Kortunov1 1 Russian State University of Tourism and Service, Russian Federation Correspondence: Andrey Anatolevich Androsov, Glavnaya str., 99, Cherkizovo, 141221, Pushkino district, Moscow region, Russian Federation. Received: November 19, 2014 Accepted: December 10, 2014 Online Published: March 20, 2015 doi:10.5539/ass.v11n8p1 URL: http://dx.doi.org/10.5539/ass.v11n8p1 Abstract For the first time in Russian historiography public economic setup in the Soviet agriculture in 1940-1942s has been analyzed basing on unknown archive materials. Most attention was paid to historiography of this subject, new methods applied by contemporary historians in research of rural economy of this period have been mentioned. Specific challenges that arose in the process and as a result of evacuation of sovkhoz' (state farms) and machine and tractor stations' (MTS) property, preparation to spring sowing in realization of On self-reliance directive of All-Russian party of Bolsheviks have been analyzed. The conclusion about the reasons and consequences of unreadiness of governing bodies to evacuation and spring sowing has been made. Keywords: property evacuation, self-reliance, sovkhoz, MTS, agriculture, Moscow region 1. Introduction Assessment of condition of state agricultural objects in 1940-1942s and state policy of their use in conditions that had changed after the beginning of the war has been made in the present research. This topic remained undiscovered until now and objective assessment of events that took place at that time wasn't given. -

Moscow United Electric Grid Company” As of July 13, 2007 (Minutes No.46 As of July 17, 2007)

Approved by the Board of Directors decision of Open Joint-Stock Company “Moscow United Electric Grid Company” as of July 13, 2007 (Minutes No.46 as of July 17, 2007) Amendments No. 1 to the Charter Open Joint-Stock Company “Moscow United Electric Grid Company” To introduce the following amendments in the Charter of Open Joint-Stock Company “Moscow United Electric Grid Company”: To state the Company List of Branches (Appendix No. 1 to the Charter) as follows: List of Branches OJSC “Moscow United Electric Grid Company” No. Name Address 1. Central Electric Networks 115201, Moscow city, Kashirskoye highway, 18 2. Southern Electric Networks 115201, Moscow city, Kashirskoye highway, 18 3. Eastern Electric Networks 107140, Moscow city, Nizhnyaya Krasnoselskaya street, 6, bld. 1 4. Oktyabrskie Electric Netwowrks 127254, Moscow city, Rustaveli street, 2 5. Northern Electric Networks 141070, Moscow region, Korolev city, Gagarina street, 4 6. Noginsk Electric Networks 142400, Moscow region, Noginsk city, Radchenko street, 13 7. Podolsk Electric Networks 142117, Moscow region, Podolsk city, Kirova street, 65 8. Kolomna Electric Networks 140408, Moscow region, Kolomna city, Oktyabrskoy Revolyutsii street, 381а 9. Shatura Electric Networks 140700, Moscow region, Shatura city, Sportivnaya street, 12 10. Western Electric Networks 121170, Moscow city, 1812 Goda street, estate 15 11. Kashira Electric Networks 142900, Moscow region, Kashira city, Klubnaya street, 4 12. Mozhaisk Electric Networks 143200, Moscow region, Mozhaisk city, Mira street, 107 13. Dmitrov Electric Networks 141800, Moscow region, Dmitrov city, Kosmonavtov street, 46 14. Volokolamsk Electric Networks 143600, Moscow region, Volokolamsk city, Novosoldatskaya street, 58 15. Moskabelenergoremont (MKER) 115569, Moscow city, Shipilovskaya street, 13, bld. -

Russian Museums Visit More Than 80 Million Visitors, 1/3 of Who Are Visitors Under 18

Moscow 4 There are more than 3000 museums (and about 72 000 museum workers) in Russian Moscow region 92 Federation, not including school and company museums. Every year Russian museums visit more than 80 million visitors, 1/3 of who are visitors under 18 There are about 650 individual and institutional members in ICOM Russia. During two last St. Petersburg 117 years ICOM Russia membership was rapidly increasing more than 20% (or about 100 new members) a year Northwestern region 160 You will find the information aboutICOM Russia members in this book. All members (individual and institutional) are divided in two big groups – Museums which are institutional members of ICOM or are represented by individual members and Organizations. All the museums in this book are distributed by regional principle. Organizations are structured in profile groups Central region 192 Volga river region 224 Many thanks to all the museums who offered their help and assistance in the making of this collection South of Russia 258 Special thanks to Urals 270 Museum creation and consulting Culture heritage security in Russia with 3M(tm)Novec(tm)1230 Siberia and Far East 284 © ICOM Russia, 2012 Organizations 322 © K. Novokhatko, A. Gnedovsky, N. Kazantseva, O. Guzewska – compiling, translation, editing, 2012 [email protected] www.icom.org.ru © Leo Tolstoy museum-estate “Yasnaya Polyana”, design, 2012 Moscow MOSCOW A. N. SCRiAbiN MEMORiAl Capital of Russia. Major political, economic, cultural, scientific, religious, financial, educational, and transportation center of Russia and the continent MUSEUM Highlights: First reference to Moscow dates from 1147 when Moscow was already a pretty big town. -

Dead Heroes and Living Saints: Orthodoxy

Dead Heroes and Living Saints: Orthodoxy, Nationalism, and Militarism in Contemporary Russia and Cyprus By Victoria Fomina Submitted to Central European University Department of Sociology and Social Anthropology In partial fulfillment of the requirements for the degree of Doctor of Philosophy Supervisors: Professor Vlad Naumescu Professor Dorit Geva CEU eTD Collection Budapest, Hungary 2019 Budapest, Hungary Statement I hereby declare that this dissertation contains no materials accepted for any other degrees in any other institutions and no materials previously written and / or published by any other person, except where appropriate acknowledgement is made in the form of bibliographical reference. Victoria Fomina Budapest, August 16, 2019 CEU eTD Collection i Abstract This dissertation explores commemorative practices in contemporary Russia and Cyprus focusing on the role heroic and martyrical images play in the recent surge of nationalist movements in Orthodox countries. It follows two cases of collective mobilization around martyr figures – the cult of the Russian soldier Evgenii Rodionov beheaded in Chechen captivity in 1996, and two Greek Cypriot protesters, Anastasios Isaak and Solomos Solomou, killed as a result of clashes between Greek and Turkish Cypriot protesters during a 1996 anti- occupation rally. Two decades after the tragic incidents, memorial events organized for Rodionov and Isaak and Solomou continue to attract thousands of people and only seem to grow in scale, turning their cults into a platform for the production and dissemination of competing visions of morality and social order. This dissertation shows how martyr figures are mobilized in Russia and Cyprus to articulate a conservative moral project built around nationalism, militarized patriotism, and Orthodox spirituality. -

BR IFIC N° 2581 Index/Indice

BR IFIC N° 2581 Index/Indice International Frequency Information Circular (Terrestrial Services) ITU - Radiocommunication Bureau Circular Internacional de Información sobre Frecuencias (Servicios Terrenales) UIT - Oficina de Radiocomunicaciones Circulaire Internationale d'Information sur les Fréquences (Services de Terre) UIT - Bureau des Radiocommunications Part 1 / Partie 1 / Parte 1 Date/Fecha 31.10.2006 Description of Columns Description des colonnes Descripción de columnas No. Sequential number Numéro séquenciel Número sequencial BR Id. BR identification number Numéro d'identification du BR Número de identificación de la BR Adm Notifying Administration Administration notificatrice Administración notificante 1A [MHz] Assigned frequency [MHz] Fréquence assignée [MHz] Frecuencia asignada [MHz] Name of the location of Nom de l'emplacement de Nombre del emplazamiento de 4A/5A transmitting / receiving station la station d'émission / réception estación transmisora / receptora 4B/5B Geographical area Zone géographique Zona geográfica 4C/5C Geographical coordinates Coordonnées géographiques Coordenadas geográficas 6A Class of station Classe de station Clase de estación Purpose of the notification: Objet de la notification: Propósito de la notificación: Intent ADD-addition MOD-modify ADD-ajouter MOD-modifier ADD-añadir MOD-modificar SUP-suppress W/D-withdraw SUP-supprimer W/D-retirer SUP-suprimir W/D-retirar No. BR Id Adm 1A [MHz] 4A/5A 4B/5B 4C/5C 6A Part Intent 1 106088371 BEL 0.3655 BRASSCHAAT BEL 4E31'00'' 51N20'00'' AL 1 SUP 2 106087638 -

On State Register of Microfinance Organisations | Банк России

ул. Неглинная, 12, Москва, 107016 8 800 300-30-00 www.cbr.ru Новости On state register of microfinance organisations 31 декабря 2015 года Пресс-релиз On 29 December 2015, the Bank of Russia took the following decisions: to include information on the following entities in the state register of microfinance organisations: Microfinance Organisation ROSA Finprogress, limited liability company (the city of Moscow), Microfinance Organisation Cash Security, limited liability company (the city of Moscow), Microfinance Organisation Alpha Potential-M, limited liability company (the city of Moscow), Microfinance Organisation Financial Group Capitol, limited liability company (the city of Yaroslavl), Microfinance Organisation World of Opportunities, limited liability company (the city of Yaroslavl), Microfinance Organisation Zolotaya Zhila, limited liability company (the city of Yaroslavl), Microfinance Organisation Star Trek, limited liability company (the city of Moscow), Microfinance Organisation VERSAILLES, limited liability company (the city of Moscow), Microfinance Organisation Golden Style, limited liability company (the city of Moscow), Microfinance Organisation Plus, limited liability company (the city of Novosibirsk), Microfinance Organisation Zanachka, limited liability company (the city of Blagoveshchensk), MICROFINANCE ORGANISATION TRADEPROM, limited liability company (the city of Moscow), Microfinance Organisation Rigel Finance, limited liability company (the city of Ulan-Ude), Microfinance Organisation CENTRE OF LOANS Siberia, limited -

Towards More Flexibility in Training: a Review of Some Experiences in Rationalizing the Provision of Vocational Qualifications

DOCUMENT RESUME ED 477 815 CE 082 578 AUTHOR Tchaban, A., Ed. TITLE Towards More Flexibility in Training: A Review of Some Experiences in Rationalizing the Provision of Vocational Qualifications. Employment and Training Papers. INSTITUTION International Labour Office, Geneva (Switzerland). REPORT NO No-56 ISBN ISBN-92-2-111856-8 ISSN ISSN-1020-5322 PUB DATE 1999-00-00 NOTE 166p. AVAILABLE FROM For full text: http://www.ilo.org/public/english/ employment/strat/download/etp56 .pdf. PUB TYPE Information Analyses (070) EDRS PRICE EDRS Price MF01/PC07 Plus Postage. DESCRIPTORS Adult Education; *Adult Vocational Education; Continuing Education; Corporate Education; Economics of Education; *Educational Innovation; Educational Policy; Educational Technology; Foreign Countries; *Individualized Instruction; Labor Force Development; Learner Controlled Instruction; Organizational Development; Outcomes of Education; *Partnerships in Education; Postsecondary Education; *Program Implementation; *Relevance (Education); Technology Integration; Training Methods IDENTIFIERS Australia; Customized Training; *Flexible Learning System; France; Information Economy; International Labour Office; Russia (Moscow); Scotland; United Kingdom ABSTRACT This document presents five papers, each describing different experiences in the introduction, promotion and implementation of innovative adult training approaches aimed at achieving more flexibility in'skill development. An introduction (Anatoli Tchaban) presents background information and a synthesis of the studies covering -

Invest in Moscow Region

INVEST IN MOSCOW REGION LOCATION GENERAL INFORMATION Dubna Sergiev Posad Mytishchy Population - 7.1 million Korolev Khimki Balashiha Urban population - 80% Odintsovo Lyubertsy More than 100 000 people live Zhukovsky in 20 cities of Moscow Region Podolsk Shatura Zaraysk DEVELOPED TRANSPORT INFRASTRUCTURE Road density km/1000 km2 3 international airports 232 Total passengers - 60 million people/year The total volume of cargo transportation in Russia (%) Moscow Central Federal Region District of Russia Density of railways 40 km/1000 km2 60 26 - Volume of cargo transportation in Moscow and Central Federal Moscow Region Moscow District of Russia Region QUALIFIED WORK FORCE Key Facts: 4.5 million people are 18-60 years old Salaries are 30% lower than in Moscow 71% of population has a higher education or vocational training CITIES OF MOSCOW REGION HAVE HISTORICALLY HIGH PERSONNEL POTENTIAL INNOVATIVE, HIGH-TECH HI-TECH BIOTECHNOLOGY DEVELOPMENT and SPACE ENGINEERING PHARMACEUTICALS Korolev, Podolsk, Dubna Podolsk, Kolomna, Klimovsk Pushchino, Chernogolovka, Obolensky Population Population Population 464 793 people 404 583 people 47 615 people THE LARGEST CONSUMER MARKET IN RUSSIA Tver region 30 million people live in the Moscow agglomeration or 20% of Russia's Smolensk region 300 km population Yaroslavl 1/3 of consumer spending in Russia Kaluga region region Tula region Ivanovo region Vladimir region Ryazan region ECONOMIC AND INVESTMENT INDICATORS Gross regional product of Regions of the Russian Federation (2012, billion USD) 352.57 -

Monthly Update

Russian Folk Art as Souvenirs Every person traveling around the world often questions: “what would be a good souvenirs to bring back home?” Now, of course your child is a best thing that you get from the country, but there are always things that you would like to give to your relatives and friends once you are back home. Here are several suggestions and historical background on some of most famous Russian Folk gifts that you can choose as souvenirs. Souvenirs that would be unique, beautiful and useful. You will be amazed with the variety of choice… Hohloma Hohloma wood painting is a unique ancient Russian folk craft. The birth-place of Hohloma is the forest area of Nizhny Novgorod region to the north-east of the river Volga. Hohloma is the name of a big village on the left bank of the Volga. From the earliest times masters who lived in that region made amazingly beautiful woodenware, and in the 17th century hohloma painting art was formed as a folk art phenomenon. The craft has gained world fame due to its original technique and the beauty of traditional Russian decorative patterns. Turned or carved with special chisels, articles made of limewood, are primed with clay, coated with "olifa" (boiled linseed oil), and then with powdered aluminium. After being silvered in this way, the objects are painted with refractory oil colours and then lacquered several times and tempered in ovens. The heat of 1000 makes the varnish yellow, turning "the silver" into "gold" and softening the bright colours of the painted ornament with an even golden tone. -

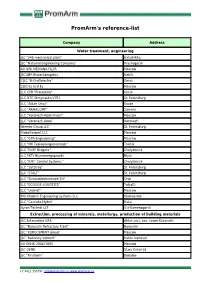

Promarm's Reference-List

PromArm's reference-list Company Address Water treatment, engineering JSC "345 mechanical plant" Balashikha JSC "National Engineering Company" Krasnogorsk AO NPK MEDIANA-FILTR Moscow JSC NPP Biotechprogress Kirishi CJSC "B-Graffelectro" Omsk CJSC Es End Ey Moscow LLC CPB "Protection" Omsk LLC NTC Stroynauka-VITU St. Petersburg LLC "Aidan Stroy" Kazan LLC "ARMACOMP" Samara LLC "Voronezh-Aqua Invest" Moscow LLC "Voronezh-Aqua" Voronezh Hermes Group LLC St. Petersburg Globaltexport LLC Moscow LLC "GPA Engineering" Moscow LLC "MK Teploenergomontazh" Troitsk LLC "NVK" Niagara " Chelyabinsk LLC PKTs Biyskenergoproekt Biysk LLC "RPK" Control Systems " Chelyabinsk LLC "SetStroy" St. Petersburg LLC "STALT" St. Petersburg LLC "Stroisantechservice-1N" Orsk LLC "ECOLINE-LOGISTICS" Tolyatti LLC "Unimet" Moscow PKK Modern Engineering Systems LLC Vladivostok LLC "Cascade-Hydro" Baku Ayron-Technik LLP Ust-Kamenogorsk Extraction, processing of minerals, metallurgy, production of building materials JSC Aldanzoloto GRK Aldan ulus, pos. Lower Kuranakh JSC "Borovichi Refractory Plant" Borovichi JSC "EUROCEMENT group" Moscow JSC "Katavsky cement" Katav-Ivanovsk AO OKHK URALCHEM Moscow JSC OEMK Stary Oskol-15 JSC "Firstborn" Bodaibo +7 8412 350797, [email protected], www.promarm.ru JSC "Aleksandrovsky Mine" Mogochinsky district of Davenda JSC RUSAL Ural Kamensk-Uralsky JSC "SUAL" Kamensk-Uralsky JSC "Khiagda" Bounty district, with. Bagdarin JSC "RUSAL Sayanogorsk" Sayanogorsk CJSC "Karabashmed" Karabash CJSC "Liskinsky gas silicate" Voronezh CJSC "Mansurovsky career management" Istra district, Alekseevka village Mineralintech CJSC Norilsk JSC "Oskolcement" Stary Oskol CJSC RCI Podolsk Refractories Shcherbinka Bonolit OJSC - Construction Solutions Old Kupavna LLC "AGMK" Amursk LLC "Borgazobeton" Boron Volga Cement LLC Nizhny Novgorod LLC "VOLMA-Absalyamovo" Yutazinsky district, with. Absalyamovo LLC "VOLMA-Orenburg" Belyaevsky district, pos. -

Download 'Market Study on Greenhouse Sector in the Russian Federation and Kazakhstan Republic'

MARKET STUDY GREENHOUSE SECTOR IN THE RUSSIAN FEDERATION AND KAZAKHSTAN REPUBLIC January 2020 1 Ltd. «Rusmarketconsulting» www.agricons.ru, [email protected] +7 (812) 712 50 14 CONTENT METHODOLOGY ................................................................................................................................. 5 THE RUSSIAN FEDERATION ............................................................................................................ 9 1 GREENHOUSE SECTOR SITUATION ........................................................................................ 9 1.1 RUSSIA IN THE WORLD ................................................................................................. 9 1.2 AREA AND STRUCTURE OF GREENHOUSES IN RUSSIA....................................... 10 1.3 MAIN TYPES OF PRODUCTS ...................................................................................... 13 1.4 BRIEF OVERVIEW OF THE SECTORS ....................................................................... 14 1.4.1 PRODUCTION OF GREENHOUSE VEGETABLES ....................................................................... 14 1.4.2 PRODUCTION OF CUT FLOWERS ................................................................................................ 16 1.4.3 PRODUCTION OF SEEDLINGS AND POTTED PLANTS .............................................................. 21 1.5 PRODUCTION OF GREENHOUSE GROWN VEGETABLES IN THE RUSSIAN FEDERATION .......................................................................................................................... -

CRR) of Moscow Region, Start-Up Complex № 4

THE CENTRAL RING ROAD OF MOSCOW REGION INFORMATION MEMORANDUM Financing, construction and toll operation of the Central Ring Road (CRR) of Moscow Region, start-up complex № 4 July 2014, Moscow Contents Introduction 3–4 Project goals and objectives 5–7 Relevance of building the Central Ring Road Timeline for CRR project implementation Technical characteristics Brief description 8–34 Design features Cultural legacy and environmental protection Key technical aspects Concession agreement General provisions 34–37 Obligations of the concessionaire Obligations of the grantor Project commercial structure 38–46 Finance. Investment stage Finance. Operation stage Risk distribution 47–48 Tender criteria 49 Preliminary project schedule 50 The given information memorandum is executed for the purpose of acquainting market players in good time with information about the given project and the key conditions for its implementation. Avtodor SC reserves the right to amend this memorandum. 2 Introduction The investment project for construction and subsequent toll operation of the Central Ring Road of the Moscow Region A-113 consists of five Start-up complexes to be implemented on a public-private partnership basis. Start-up complex No. 4 of the Central Ring Road (the Project or SC No.4 of the CRR) provides for construction of a section of the CRR in the south-east of the Moscow Region, stretching from the intersection with the M-7 Volga express highway currently under construction to the intersection with the M-4 public highway. Section SC No. 4 of the CRR was distinguished as a separate investment project because the given section is of major significance both for the Region and for the economy of the Russian Federation in general.