Economic Cycles in Ancient China

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Timothy J. Schibik, Ph. D. Office: BE1019 (Inside the Main COB Offices – BE1015) Office Hours: by Appointment

University of Southern Indiana Romain College of Business Department of Economics and Marketing ECON461: History of Economic Thought Fall 2018 Instructor: Timothy J. Schibik, Ph. D. Office: BE1019 (inside the main COB offices – BE1015) Office Hours: By appointment. Office Phone: (812) 464-1979 (Mary Spahn in the Main Office) e-mail: [email protected] Course Prerequisite: Econ208 and Econ209 Note: This course counts as an economics elective for economics majors/minors and as a 300/400 level elective for all other majors at the university. Text: Heilbroner, Robert L., The Worldly Philosophers: The Lives, Times, and Ideas of the Great Thinkers, 7th Edition Newly Revised, Touchstone – Simon Shuster Pub. Co., 1999. Course Objective: The overall objective of this course is to introduce the origins and evolution of economic theory from its formative stages to the present. The focus will be on developing the interrelationships between the historical environment and development of economic theory to be used in understanding existing social realities. Upon completion of this course, student should be able to: recognize the various schools of economic thought, along with their origins and evolution; summarize the main characteristics of the various schools of economic thought; describe the technological, ideological and social forces that have influenced these schools of thought; identify the various economic theories that were/are used to explain and analyze particular choices at various points in time; distinguish the impacts that the various schools of thought have had on current “mainstream” economics, and; ask yourselves the important questions (i.e., What do I know?, How do I know?, What do I believe?, and Why do I believe it?) and arrive at defendable answers. -

Princeton/Stanford Working Papers in Classics

Princeton/Stanford Working Papers in Classics Coin quality, coin quantity, and coin value in early China and the Roman world Version 2.0 September 2010 Walter Scheidel Stanford University Abstract: In ancient China, early bronze ‘tool money’ came to be replaced by round bronze coins that were supplemented by uncoined gold and silver bullion, whereas in the Greco-Roman world, precious-metal coins dominated from the beginnings of coinage. Chinese currency is often interpreted in ‘nominalist’ terms, and although a ‘metallist’ perspective used be common among students of Greco-Roman coinage, putatively fiduciary elements of the Roman currency system are now receiving growing attention. I argue that both the intrinsic properties of coins and the volume of the money supply were the principal determinants of coin value and that fiduciary aspects must not be overrated. These principles apply regardless of whether precious-metal or base-metal currencies were dominant. © Walter Scheidel. [email protected] How was the valuation of ancient coins related to their quality and quantity? How did ancient economies respond to coin debasement and to sharp increases in the money supply relative to the number of goods and transactions? I argue that the same answer – that the result was a devaluation of the coinage in real terms, most commonly leading to price increases – applies to two ostensibly quite different monetary systems, those of early China and the Roman Empire. Coinage in Western and Eastern Eurasia In which ways did these systems differ? 1 In Western Eurasia coinage arose in the form of oblong and later round coins in the Greco-Lydian Aegean, made of electron and then mostly silver, perhaps as early as the late seventh century BCE. -

PHIL 3531: Topics in Chinese Philosophy: Huanglao Daoism Term 2, 2019

PHIL 3531: Topics in Chinese Philosophy: Huanglao Daoism Term 2, 2019 Time: Thur 9:30 am-12:15 pm Location: ELB 303 Course Overview This course examines one of the most neglected schools of ancient China: Huanglao Daoism. Arising in the late Warring States period, Huanglao reached its peak in the Han dynasty. The school is syncretic in nature, drawing upon the Legalist thought of Hanfeizi and Guanzi, the Daoist thought of Laozi, and the medical writings attributed to the Yellow Emperor. There is no central text used by this School but a selection of concepts that were discussed across a variety of texts, the most notable being: “law, standard” (fa 法), Dao 道, “punishment” (xing 刑), “virtue” (de 德), Qi 氣, Yin-Yang 陰陽, etc. These concepts were all used by the ruler as an expression of his authority and as a model for benevolent governance. The second half of the course focusses on Chinese medicine and its connection to Huanglao cosmology which saw humans as inseparable from and subject to the cycles of Nature and the spiritual power of Heaven. Advisory to Majors: to be taken in year 2 or above. Learning Outcomes 1. Become familiar with key philosophical concepts, arguments, and movements. 2. Develop your skill in reading philosophical texts. 3. Develop your critical thinking skills by discussing lecture materials in tutorials. 4. Learn how to research and write philosophical papers. Topics See lecture schedule below Learning Activities 1. Read and give thought to the assigned readings. 2. Develop the skills mentioned above in the Learning Outcomes. -

Emptying the Mind and Stilling the Body Syncretism in the Concept of Self-Regulation in Chapter 22 of the Chunqiu Fanlu

Original Paper UDC 111:159.9.016.1(315) Received April 24th, 2014 Ivana Buljan University of Zagreb, Faculty of Humanities and Social Sciences, Ivana Lučića 3, HR–10000 Zagreb [email protected] Emptying the Mind and Stilling the Body Syncretism in the Concept of Self-Regulation in Chapter 22 of the Chunqiu fanlu Abstract The concept of shen 身, meaning a person in all his or her physiological, psychological, and sociological aspects, is an important concept in Chinese philosophy. What the nature of shen is, and consequently how to maintain, regulate, and cultivate one’s own body/self/ person, has been a prominent philosophical issue in China. This article examines how this issue was comprehended in Chapter 22, the “Tong guo shen” 通 國身 (“Linking the State and the Body”) chapter, of the important Chinese philosophical compendium the Chunqiu fanlu 春秋繁露, traditionally ascribed to Dong Zhongshu 董仲舒 (c. 179 to 104 BCE). This article follows and expands upon research conducted by Sarah Queen, who suggested that some of the chapters of the unit to which the “Tong guo shen” belongs are character ised by a syncretic approach and suggest familiarity with inner-cultivation techniques. This article particularly focuses on syncretism in the notion of selfregulation in the “Tong guo shen” chapter. It examines the core principles, values, concepts, and ideas of self-regulation in the context of the Chunqiu fanlu’s earlier sources. Through an examination of texts and documents produced from the Spring and Autumn period to the end of the Eastern Han dy nasty, this paper reconstructs the idea of self-regulation through a mutually corroborative philological and philosophical analysis. -

Mirror, Death, and Rhetoric: Reading Later Han Chinese Bronze Artifacts Author(S): Eugene Yuejin Wang Source: the Art Bulletin, Vol

Mirror, Death, and Rhetoric: Reading Later Han Chinese Bronze Artifacts Author(s): Eugene Yuejin Wang Source: The Art Bulletin, Vol. 76, No. 3, (Sep., 1994), pp. 511-534 Published by: College Art Association Stable URL: http://www.jstor.org/stable/3046042 Accessed: 17/04/2008 11:17 Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you may use content in the JSTOR archive only for your personal, non-commercial use. Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at http://www.jstor.org/action/showPublisher?publisherCode=caa. Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed page of such transmission. JSTOR is a not-for-profit organization founded in 1995 to build trusted digital archives for scholarship. We enable the scholarly community to preserve their work and the materials they rely upon, and to build a common research platform that promotes the discovery and use of these resources. For more information about JSTOR, please contact [email protected]. http://www.jstor.org Mirror, Death, and Rhetoric: Reading Later Han Chinese Bronze Artifacts Eugene Yuejin Wang a 1 Jian (looking/mirror), stages of development of ancient ideograph (adapted from Zhongwendazzdian [Encyclopedic dictionary of the Chinese language], Taipei, 1982, vi, 9853) History as Mirror: Trope and Artifact people. -

Dinero Chino En El Museo Oriental De Valladolid

Dinero chino en el Museo Oriental de Valladolid Por Blas Sierra de la Calle, OSA El Museo Oriental, del Real Colegio de los Padres Agustinos, en Valla dolid, es la mejor colección de arte del Extremo Oriente actualmente exis tente en España. Es un "Punto de encuentro" privilegiado entre Oriente y Occidente. Consta de catorce salas magníficamente instaladas. Comienza con una introducción histórica, a la que siguen nueve salas dedicadas a China y cua tro a Filipinas. De los varios miles de monedas chinas de sus fondos, están expuestas en la sala N° 6 más de un millar. La cronología de las mismas abarca desde la época de los Reinos Combatientes (475-221 a. C.) hasta 1912. I. HISTORIA DE LA COLECCIÓN Esta importante colección tiene su origen en la presencia de los misione ros agustinos en China, donde llegó el agustino navarro, Fr. Martín de Rada en 1575. Tras el trabajo apostólico en Kuan-Tung y Kuang-Si en los ss. XVII y XVIII, en 1879 se abrieron nuevas misiones en Hunan (Ilustración n° 1). 1.- La formación de la colección Distintos misioneros anónimos fueron coleccionando, ya desde finales del s. XIX, algunos ejemplares raros de monedas chinas, que enviaron a Valladolid. De hecho, a principios de siglo, ya hay constancia de la existencia de algunas monedas antiguas. Pero la mayor parte de la colección se debe al P. Pedro Pelaz. 368 B. SIERRA DE LA CALLE 2 Este ilustre misionero en China, había nacido el 17 de febrero de 1878, en Villanueva de la Peña, provincia de Palencia. -

Capitalizing China

This PDF is a selection from a published volume from the National Bureau of Economic Research Volume Title: Capitalizing China Volume Author/Editor: Joseph P. H. Fan and Randall Morck, editors Volume Publisher: University of Chicago Press Volume ISBN: 0-226-23724-9; 978-0-226-23724-4 (cloth) Volume URL: http://www.nber.org/books/morc10-1 Conference Date: December 15-16, 2009 Publication Date: November 2012 Chapter Title: Financial Strategies for Nation Building Chapter Author(s): Zhiwu Chen Chapter URL: http://www.nber.org/chapters/c12070 Chapter pages in book: (p. 313- 333) 7 Financial Strategies for Nation Building Zhiwu Chen 7.1 Introduction It is hard for historians to ignore the cyclical nature of Chinese history: every forty to fi fty years there was a peasant revolt, and every two to three hundred years there was a change of dynasty. For two thousand years, this pattern has continued. Those interested in China’s future will naturally ask: Will history repeat itself? What should be done to avoid the cycle? Of course, different people will have different answers. Given the advances in technology, it may seem that guided missiles, airplanes, and night vision would stifl e any peasant revolt today. Centuries ago, before the development of modern warfare technologies, revolting peasants and the government army were evenly matched in terms of weaponry. It was not difficult for revolting peasants to equip themselves with arms similar to their counter- parts in the national army. More charged by their determination and pas- sion to revolt, the peasants were a force that could successfully overthrow a dynasty. -

Ancient Economic Thought, Volume 1

ANCIENT ECONOMIC THOUGHT This collection explores the interrelationship between economic practice and intellectual constructs in a number of ancient cultures. Each chapter presents a new, richer understanding of the preoccupation of the ancients with specific economic problems including distribution, civic pride, management and uncertainty and how they were trying to resolve them. The research is based around the different artifacts and texts of the ancient East Indian, Hebraic, Greek, Hellenistic, Roman and emerging European cultures which remain for our consideration today: religious works, instruction manuals, literary and historical writings, epigrapha and legal documents. In looking at such items it becomes clear what a different exercise it is to look forward, from the earliest texts and artifacts of any culture, to measure the achievements of thinking in the areas of economics, than it is to take the more frequent route and look backward, beginning with the modern conception of economic systems and theory creation. Presenting fascinating insights into the economic thinking of ancient cultures, this volume will enhance the reawakening of interest in ancient economic history and thought. It will be of great interest to scholars of economic thought and the history of ideas. B.B.Price is Professor of Ancient and Medieval History at York University, Toronto, and is currently doing research and teaching as visiting professor at Massachusetts Institute of Technology. ROUTLEDGE STUDIES IN THE HISTORY OF ECONOMICS 1 Economics as Literature -

HISTORY of ECONOMIC THOUGHT a Selected Bibliography John F

HISTORY OF ECONOMIC THOUGHT A Selected Bibliography John F. Henry Department of Economics California State University, Sacramento A. Texts and Commentaries of a General Nature (The following list is not meant to be exhaustive, but does represent general accounts from varying points of view. The student should also examine the bibliographies in these works, particularly that in Spiegel. There are also a number of series studies now available, notably from Edward Elgar publisher: Perspectives in the History of Economic Thought which features papers presented at the annual History of Economics Society meeting (9 vols); Pioneers in Economics, Marc Blaug, ed., which contains papers on particular economists (currently at 46 titles); Schools of Thought in Economics, Marc Blaug, general ed. which contains (currently 11) volumes of essays on particular general approaches in economics. Routledge is publishing a Critical Assessments series, edited by John Wood featuring articles written on specific economists: currently, volumes on Joan Robinson, Leontief, Say, and Pareto are published. Routledge also publishes a “Library of 20th Century Economists,” organized around themes–The Chicago Tradition, Socialism and the Market, Origins of Macroeconomics, etc. And, the firm has a “Critical Reviews” and Critical Responses” series. Macmillan has a new series on Contemporary Economists, edited by John Pheby. Finally, Pickering and Chatto (UK) is publishing series on various topics that collect articles written over a several hundred year period: Hageman, H., ed., Business Cycle Theory (4 vols); Emmett, R., Reactions to the South Sea Bubble, the Mississippi Scheme, and the Tulip Mania Affair (3 vols); White, L, ed., The History of Gold and Silver (3vols); O’Brien, D., The History of Taxation (8 vols); Bridel, P., The Foundations of Price Theory (6 vols); Barber, W., et al., eds, Early American Thought (6 vols); Samuels, W., ed., Law and Economics (2 vols); Capie, F., ed., History of Banking, 1650-1850 (10 vols); Ross, D., History of Banking II, 1844-1959 (10 vols). -

A Western Perspective on Kautilya's 'Arthasastra'

ISSN 1444-8890 ECONOMIC THEORY, APPLICATIONS AND ISSUES Working Paper No. 18 A Western Perspective on Kautilya’s ‘Arthasastra’: Does it Provide a Basis for Economic Science? by Clem Tisdell January 2003 THE UNIVERSITY OF QUEENSLAND ISSN 1444-8890 WORKING PAPERS ON ECONOMIC THEORY, APPLICATIONS AND ISSUES Working Paper No.18 A Western Perspective on Kautilya’s ‘Arthasastra’: Does it Provide a Basis for Economic Science* by Clem Tisdell† January 2003 © All rights reserved † School of Economics, The University of Queensland, Brisbane 4072 Australia. Email: [email protected] * A contribution prepared for a book on Kautilya’s Economics to be jointly edited by Professor Raj Kumar Sen. This contribution owes its original genesis to an invitation from Dr K. V. Ramesh, Director, Oriental Research Institute, University of Mysore, to attend an International Symposium on Kautilya’s ‘Arthasastra’ held to commemorate the centenary of the first discovery of the complete manuscript of this work. ` WORKING PAPERS IN THE SERIES, Economic Theory, Applications and Issues, are published by the School of Economics, University of Queensland, 4072, Australia. For more information write to Professor Clem Tisdell, School of Economics, University of Queensland, Brisbane 4072, Australia or email [email protected] A Western Perspective on Kautilya’s ‘Arthasastra’: Does It Provide a Basis for Economic Science? ABSTRACT In Arthasastra, Kautilya shows a knowledge of basic economics that had no parallels in Western economic thought until the publication of Adam Smith’s Wealth of Nations in 1776. Although the king was at the centre of the body politic in Kautilya’s time, Kautilya makes it clear that the king is bound by an implicit social contract and that the ultimate objective of the king, in economic and other affairs, should be to benefit his subjects. -

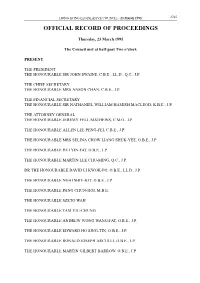

Official Record of Proceedings

HONG KONG LEGISLATIVE COUNCIL - 23 March 1995 2765 OFFICIAL RECORD OF PROCEEDINGS Thursday, 23 March 1995 The Council met at half-past Two o'clock PRESENT THE PRESIDENT THE HONOURABLE SIR JOHN SWAINE, C.B.E., LL.D., Q.C., J.P. THE CHIEF SECRETARY THE HONOURABLE MRS ANSON CHAN, C.B.E., J.P. THE FINANCIAL SECRETARY THE HONOURABLE SIR NATHANIEL WILLIAM HAMISH MACLEOD, K.B.E., J.P. THE ATTORNEY GENERAL THE HONOURABLE JEREMY FELL MATHEWS, C.M.G., J.P. THE HONOURABLE ALLEN LEE PENG-FEI, C.B.E., J.P. THE HONOURABLE MRS SELINA CHOW LIANG SHUK-YEE, O.B.E., J.P. THE HONOURABLE HUI YIN-FAT, O.B.E., J.P. THE HONOURABLE MARTIN LEE CHU-MING, Q.C., J.P. DR THE HONOURABLE DAVID LI KWOK-PO, O.B.E., LL.D., J.P. THE HONOURABLE NGAI SHIU-KIT, O.B.E., J.P. THE HONOURABLE PANG CHUN-HOI, M.B.E. THE HONOURABLE SZETO WAH THE HONOURABLE TAM YIU-CHUNG THE HONOURABLE ANDREW WONG WANG-FAT, O.B.E., J.P. THE HONOURABLE EDWARD HO SING-TIN, O.B.E., J.P. THE HONOURABLE RONALD JOSEPH ARCULLI, O.B.E., J.P. THE HONOURABLE MARTIN GILBERT BARROW, O.B.E., J.P. 2766 HONG KONG LEGISLATIVE COUNCIL - 23 March 1995 THE HONOURABLE MRS PEGGY LAM, O.B.E., J.P. THE HONOURABLE MRS MIRIAM LAU KIN-YEE, O.B.E., J.P. THE HONOURABLE LAU WAH-SUM, O.B.E., J.P. DR THE HONOURABLE LEONG CHE-HUNG, O.B.E., J.P. -

THE RECORD of the LANDS of YUE Introduction Is Chapter Describes Key Sites in the Kingdom of Yue, Including King Goujian's

'A6G*+B *+) THE RECORD OF THE LANDS OF YUE Introduction !is chapter describes key sites in the kingdom of Yue, including King Goujian’s capital, which was one of China’s oldest recorded planned cities.1 !is chapter emphasises the impact King Goujian had on the land- scape of this region: virtually every building mentioned is said to have been erected either for his personal use or as part of the war e"ort he ini- tiated to defeat the kingdom of Wu. In this text the authors repeatedly link landscape features of northern Zhejiang province to events from the life of the greatest king of Yue. However these attributions (in the absence of further evidence) must remain largely speculative. Numerous geograph- ical features and ancient buildings south of the Yangtze river have been linked to famous ?gures from the con#ict between Wu, Yue and Chu, and sometimes these attributions have been conclusively disproved.2 It is important to stress that unlike King Helü’s capital (modern Suzhou), 1 !e site of King Goujian’s capital is now the city of Shaoxing in Zhejiang province. !e name Shaoxing commemorates a turn in the fortunes of the Southern Song dynasty. In 0015, the capital of the Northern Song dynasty Bianliang ϰΔ (now known as Kaifeng –ݶǭ) fell to the Jurchen Jin dynasty. !e new emperor, Song Gaozong LJࠆlj (r. 0012 0051), moved south to evade capture, and established his capital at a series of southern dž (now known as Hangzhou ʹș), Pingjiang ȳϭ (modernט cities, including Lin’an ș) and Yuezhou ۚș (Shaoxing).