Pkp Group a Case for Successful Restructuring of a Railway Company in Central and Eastern Europe

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rok 2019 W Przewozach Pasażerskich I Towarowych Podsumowanie Prezesa UTK

Rok 2019 w przewozach pasażerskich i towarowych Podsumowanie Prezesa UTK dr inż. Ignacy Góra Prezes Urzędu Transportu Kolejowego Szanowni Państwo, w 2019 r. z kolei skorzystało blisko 336 milionów pasażerów, podczas gdy jeszcze w 2016 r. wartość ta nie przekraczała 300 milionów. Długość zrealizowanych przez pasażerów kolei przejazdów to łącznie ponad 22 miliardy kilometrów. Znaczna część tych podróży mogłaby się zapewne odbyć prywatnymi samochodami. Jednak samochody te nie pojawiły się na drogach, nie przejechały miliardów kilometrów – dzięki kolei podróżowanie było bezpieczniejsze i bardziej ekologicznie. Kolej pełni obecnie funkcję wykorzystywanej codziennie doskonałej komunikacji aglomeracyjnej i miejskiej oraz jest chętnie wybierana podczas dalekich podróży turystycznych czy biznesowych. W przypadku transportu towarowego przewieziono 236 milionów ton ładunków. Oznacza to spadek przetransportowanej masy o 5,5%. Jednak o ile zauważalne jest zmniejszenie się zainteresowania transportem towarów masowych, to z roku na rok rośnie masa przewozów intermodalnych. Ten rodzaj transportu ma przed sobą przyszłość i należy go rozwijać. Szczególnie, że dzięki transportowi intermodalnemu optymalnie można wykorzystać transport samochodowy, kolejowy i morski. Wyniki za 2019 r. pokazują, że kolej staje się coraz bardziej dostępna. Powstają nowoczesne dworce i perony, pociągi wracają na trasy od lat nieużywane, zwiększa się dostępność kolei dla osób z niepełnosprawnością i o graniczonej możliwości poruszania się, wykorzystywane są nowoczesne kanały dystrybucji itd. Jeszcze jest wiele do zrobienia, ale od kilku lat poprawia się jakość podróżowania i znajduje to potwierdzenie w statystykach. Z wyrazami szacunku 3 4 1. Przewozy pasażerskie Koleją w 2019 r. podróżowało 335,9 mln pasażerów. To najlepszy wynik od czasu zbierania danych przez Urząd Transportu Kolejowego. Na przejazd pociągiem zdecydowało się o ponad 25 mln osób więcej niż w 2018 r. -

„BILET PRZEZ APLIKACJĘ MOBILNĄ” W „PKP INTERCITY” SPÓŁKA AKCYJNA Zwany Dalej Regulaminem Skycash-IC

Tekst ujednolicony obowiązujący od 26 stycznia 2021 r. REGULAMIN USŁUGI „BILET PRZEZ APLIKACJĘ MOBILNĄ” W „PKP INTERCITY” SPÓŁKA AKCYJNA zwany dalej Regulaminem SkyCash-IC § 1. Postanowienia ogólne 1. Na podstawie art. 4 Ustawy z dnia 15 listopada 1984 r. Prawo przewozowe (tekst 17 jednolity Dz. U. z 2020 r. poz. 8.) „PKP Intercity” Spółka Akcyjna ustala Regulamin usługi „Bilet przez aplikację mobilną” w „PKP Intercity” Spółka Akcyjna, zwany dalej Regulaminem SkyCash-IC. 2. Regulamin SkyCash-IC obowiązuje od dnia 7 listopada 2014 r. 3. Akceptując niniejszy Regulamin SkyCash-IC Użytkownik potwierdza jednocześnie 3 akceptację Regulaminu Użytkownika Systemu SkyCash. Jeżeli Użytkownik nie akceptuje przedstawionych warunków lub nie spełnia wymagań technicznych, 18 opisanych w Regulaminie Użytkownika Systemu SkyCash zakup dokumentu przewozu jest niemożliwy. 3a. Dokument przewozu można zakupić z wykorzystaniem urządzeń mobilnych 3 z systemem operacyjnym Android, iOS, po zainstalowaniu aplikacji: a) SkyCash, 18 b) IC Navigator, udostępnionej w sklepie danego systemu. 4. Aby zakupić dokument przewozu, Użytkownik musi dokonać Rejestracji na zasadach 3 określonych w Regulaminie Użytkownika Systemu SkyCash. 18 5. Regulamin SkyCash-IC określa warunki i zasady zakupu dokumentów przewozu 18 w komunikacji krajowej. 6. Postanowienia Regulaminu SkyCash-IC oraz każdą jego zmianę zamieszcza się na stronie internetowej www.intercity.pl 3 7. Skreślony. 8. Użytkownik akceptując Regulamin SkyCash-IC wyraża zgodę na warunki w nim zawarte, która jednocześnie stanowi oświadczenie woli i stwarza prawne zobowiązania między Użytkownikiem a PKP Intercity. 9. Użytkownik może nabywać bilety elektroniczne dla siebie oraz dla innych osób. Za 3 zobowiązania finansowe odpowiada Użytkownik. 10. Dopuszczalne formy płatności wskazane są w Regulaminie Użytkownika Systemu SkyCash. -

World Bank Document

Document of The World Bank Public Disclosure Authorized Report No: 34596 IMPLEMENTATION COMPLETION REPORT (TF-29121 FSLT-70540) ON A LOAN Public Disclosure Authorized IN THE AMOUNT OF EUR 110.0 MILLION (US$ 101.0 MILLION EQUIVALENT TO POLSKIE KOLEJE PANSTWOWE S.A. (POLISH STATE RAILWAYS S.A.) WITH THE GUARANTEE OF THE REPUBLIC OF POLAND FOR A RAILWAY RESTRUCTURING PROJECT Public Disclosure Authorized June 13, 2006 Infrastructure Department Poland and Baltic States Country Unit Europe and Central Asia Region Public Disclosure Authorized CURRENCY EQUIVALENTS (Exchange Rate Effective At Completion, December 30, 2005) Currency Unit = Polish Zloty PLN 1 = US$ 0.3099 US$ 1 = PLN 3.2265 US$ 1 = Euro 0.8391 (Exchange Rates Effective at Appraisal, January 31, 2001) PLN 1 = US$ 0.2418 US$ 1 = PLN 4.1350 US$ 1 = Euro 1.0887 FISCAL YEAR January 1 - December 31 ABBREVIATIONS AND ACRONYMS EBRD European Bank for Reconstruction and Development EIB European Investment Bank EIRR Economic Internal Rate of Return FIRR Financial Internal Rate of Return FMS Financial Management System GoP Government of Poland IAS International Accounting Standards IFAC International Federation of Accountants ISPA Instrument for Structural Policies for Pre-accession KBI Capital Investment and Privatization Office KM Warsaw Regional Railways ('Koleje Mazowiekie') KAAZ Agency for Retraining and Reemployment ('Kolejowa Agencja Aktywizacji Zawodowej') LHS Linia Hutniczo-Siarkowa (Broad-gauge Railway between Ukraine and Silesia) LRS Labor Redeployment Services MoI Ministry of Infrastructure MLSP Ministry of Labor and Social Policy MTME Ministry of Transport and Maritime Economy NLO National Labor Office PAD Project Appraisal Document PLK S.A. Polish Railway Infrastructure Joint Stock Company ('Polskie Linie Kolejowe Spolka Akcyjna') PKP Polish State Railways ('Polskie Koleje Panstwowe') PKP S.A. -

Construction of a New Rail Link from Warsaw Służewiec to Chopin Airport and Modernisation of the Railway Line No

Ex post evaluation of major projects supported by the European Regional Development Fund (ERDF) and Cohesion Fund between 2000 and 2013 Construction of a new rail link from Warsaw Służewiec to Chopin Airport and modernisation of the railway line no. 8 between Warsaw Zachodnia (West) and Warsaw Okęcie station Poland EUROPEAN COMMISSION Directorate-General for Regional and Urban Policy Directorate Directorate-General for Regional and Urban Policy Unit Evaluation and European Semester Contact: Jan Marek Ziółkowski E-mail: [email protected] European Commission B-1049 Brussels EUROPEAN COMMISSION Ex post evaluation of major projects supported by the European Regional Development Fund (ERDF) and Cohesion Fund between 2000 and 2013 Construction of a new rail link from Warsaw Służewiec to Chopin Airport and modernisation of the railway line no. 8 between Warsaw Zachodnia (West) and Warsaw Okęcie station Poland Directorate-General for Regional and Urban Policy 2020 EN Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). Manuscript completed in 2018 The European Commission is not liable for any consequence stemming from the reuse of this publication. Luxembourg: Publications Office of the European Union, 2020 ISBN 978-92-76-17419-6 doi: 10.2776/631494 © European Union, 2020 Reuse is authorised provided the source is acknowledged. The reuse policy of European Commission documents is regulated by Decision 2011/833/EU (OJ L 330, 14.12.2011, p. -

Eco-Drivingiem Oraz OZE

Raport PODSUMOWANIE PIERWSZEGO ROKU DZIAŁAŃ CEEK KWIECIEŃ 2020 CZYM JEST CEEK…3 RADA PROGRAMOWA CEEK…4 Spis treści CEL…5 CO POZWOLI NAM OSIĄGNĄĆ CEL?...7 INICJATYWY PODJĘTE W PIERWSZYM ROKU…9 PODSUMOWANIE…18 CEEK W MEDIACH…23 PODZIĘKOWANIE…27 Czym jest CEEK ▪ W działania CEEK zaangażowani są KRAJOWI PRZEWOŹNICY, ZARZĄDCY INFRASTRUKTURY ORAZ EKSPERCI m.in. z Instytutu Kolejnictwa, Politechniki Warszawskiej, Instytutu Jagiellońskiego i Klubu Jagiellońskiego. ▪ CEEK jest partnerską inicjatywą CAŁEGO SEKTORA KOLEJOWEGO ,,Z dużymi nadziejami i zapałem przystąpiliśmy do pracy przy tworzeniu CEEK. W ciągu minionego ▪ CEEK to PRZESTRZEŃ DEDYKOWANA WYMIANIE WIEDZY I POMYSŁÓW, a także EDUKACJI roku dzieliliśmy się naszą wiedzą i doświadczeniem w zakresie efektywności energetycznej i racjonalnego gospodarowania zasobami kolei. w zakresie efektywności energetycznej i deklarujemy ▪ CEEK wspiera WYMIANĘ DOBRYCH PRAKTYK pomiędzy spółkami kolejowymi gotowość do kontynuowania rozpoczętych działań”. i dyskusję na temat najlepszych rozwiązań legislacyjnych w zakresie efektywności energetycznej. Zespół KAPE ▪ CENTRUM JEST PLATFORMĄ DO REALIZACJI PRZEDSIĘWZIĘĆ przedstawicieli branży kolejowej, ekspertów i naukowców w zakresie oszczędnego zużycia energii elektrycznej na kolei. STRONA 3 Rada Programowa CEEK Pracami CEEK kieruje Rada Programowa, składająca się z przedstawicieli przewoźników kolejowych oraz ekspertów branży kolejowej i energetycznej. Radzie Programowej przewodniczy Prezydium w składzie: ▪ Przewodniczący Janusz Malinowski - Łódzka Kolej Aglomeracyjna -

Regulamin Przewozu Osób, Rzeczy I Zwierząt Przez Spółkę „PKP Intercity” (RPO-IC)

Tekst ujednolicony obowiązuje od dnia 4 czerwca 2020 r. „PKP Intercity” Spółka Akcyjna R E G U L A M I N PRZEWOZU OSÓB, RZECZY I ZWIERZĄT przez Spółkę „PKP Intercity” (RPO-IC) Obowiązuje od dnia 16 listopada 2014 r. Regulamin przewozu osób, rzeczy i zwierząt przez Spółkę „PKP Intercity” (RPO-IC) Z chwilą wejścia w życie niniejszych przepisów tracą moc przepisy Regulaminu przewozu osób, rzeczy i zwierząt przez Spółkę „PKP Intercity” (RPO-IC) obowiązującego od dnia 19 marca 2013 r. ZMIANY Podpis osoby Podstawa wprowadzenia zmiany Numer Zmiana wnoszącej zmianę zmiany Uchwała Zarządu PKP Intercity S.A. obowiązuje od dnia Nr Data 1 932/2014 01.12.2014 r. 03.12.2014 r. 2 987/2014 11.12.2014 r. 14.12.2014 r. 3 227/2015 24.03.2015 r. 27.03.2015 r. 4 293/2015 02.04.2015 r. 09.04.2015 r. 5 387/2015 28.04.2015 r. 05.05.2015 r. 6 528/2015 17.06.2015 r. 21.06.2015 r. 7 572/2015 30.06.2015 r. 07.07.2015 r. 8 639/2015 28.07.2015 r. 30.07.2015 r. 9 718/2015 03.09.2015 r. 09.09.2015 r. 10 769/2015 18.09.2015 r. 22.09.2015 r. 11 869/2015 28.10.2015 r. 14.12.2015 r. 12 1011/2015 08.12.2015 r. 13.12.2015 r. 13 1069/2015 22.12.2015 r. 28.12.2015 r. 14 59/2016 04.02.2016 r. 04.02.2016 r. 15 161/2016 15.03.2016 r. -

Eighth Annual Market Monitoring Working Document March 2020

Eighth Annual Market Monitoring Working Document March 2020 List of contents List of country abbreviations and regulatory bodies .................................................. 6 List of figures ............................................................................................................ 7 1. Introduction .............................................................................................. 9 2. Network characteristics of the railway market ........................................ 11 2.1. Total route length ..................................................................................................... 12 2.2. Electrified route length ............................................................................................. 12 2.3. High-speed route length ........................................................................................... 13 2.4. Main infrastructure manager’s share of route length .............................................. 14 2.5. Network usage intensity ........................................................................................... 15 3. Track access charges paid by railway undertakings for the Minimum Access Package .................................................................................................. 17 4. Railway undertakings and global rail traffic ............................................. 23 4.1. Railway undertakings ................................................................................................ 24 4.2. Total rail traffic ......................................................................................................... -

The New Warszawa Zachodnia Station Opens Tomorrow

8 December 2015 Press Release The new Warszawa Zachodnia station opens tomorrow The new Warszawa Zachodnia (Warsaw West) railway station is ready for passengers' use just one year after its construction process begun. The building, which has an area of approx. 1,300 sq m, is located in the immediate vicinity of Aleje Jerozolimskie street in Warsaw, enabling residents from Ochota, Włochy and Mokotów districts to quickly and easily reach the station. The landmark new station’s striking design including a distinctive glass dome is the result of an efficient collaboration partnership between PKP S.A., Xcity Investment, and HB Reavis, an international developer group. As of tomorrow, people travelling from the Warszawa Zachodnia railway station will be able to access this brand new building, situated at Aleje Jerozolimskie street, closer to the tracks where local connections are available. The scheme will expand on the previous facility at Tunelowa street, which will continue to serve passengers. Due to its location, the new railway station will be more easily accessible by public means of transportation. 'This is our first investment undertaken in collaboration with PKP S.A. and we hope that it is not the last as the Warszawa Zachodnia station is great success. Within less than 12 months since construction works began, the building is now ready for use. Without a doubt, passengers will appreciate its striking design, impressive glass dome and surroundings, which already look attractive but will make even more of an impact once the adjacent office buildings are completed,' said Stanislav Frnka, CEO of HB Reavis Poland. -

List of Numeric Codes for Railway Companies (RICS Code) Contact : [email protected] Reference : Code Short

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/rics code short name full name country request date allocation date modified date of begin validity of end validity recent Freight Passenger Infra- structure Holding Integrated Other url 0006 StL Holland Stena Line Holland BV NL 01/07/2004 01/07/2004 x http://www.stenaline.nl/ferry/ 0010 VR VR-Yhtymä Oy FI 30/06/1999 30/06/1999 x http://www.vr.fi/ 0012 TRFSA Transfesa ES 30/06/1999 30/06/1999 04/10/2016 x http://www.transfesa.com/ 0013 OSJD OSJD PL 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits FR 30/06/1999 30/06/1999 x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance GB 30/06/1999 30/06/1999 x http://www.rmf.co.uk/ 0016 RD RAILDATA CH 30/06/1999 30/06/1999 x http://www.raildata.coop/ 0017 ENS European Night Services Ltd GB 30/06/1999 30/06/1999 x 0018 THI Factory THI Factory SA BE 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited GB 30/06/1999 30/06/1999 x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' RU 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways BY 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi UA 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova MD 30/06/1999 30/06/1999 x http://railway.md/ 0024 LG AB 'Lietuvos geležinkeliai' LT 28/09/2004 24/11/2004 x http://www.litrail.lt/ 0025 LDZ Latvijas dzelzceļš LV 19/10/2004 24/11/2004 x http://www.ldz.lv/ 0026 EVR Aktsiaselts Eesti Raudtee EE 30/06/1999 30/06/1999 x http://www.evr.ee/ 0027 KTZ Kazakhstan Temir Zholy KZ 17/05/2004 17/05/2004 x http://www.railway.ge/ 0028 GR Sakartvelos Rkinigza GE 30/06/1999 30/06/1999 x http://railway.ge/ 0029 UTI Uzbekistan Temir Yullari UZ 17/05/2004 17/05/2004 x http://www.uzrailway.uz/ 0030 ZC Railways of D.P.R.K. -

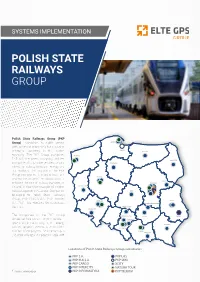

Implementation for Polish State Railways Group

SYSTEMS IMPLEMENTATION POLISH STATE RAILWAYS GROUP Polish State Railways Group (PKP Group) combines its public service GDYNIA with activity characteristic for a modern GDAŃSK enterprise operating in the market OLSZTYN economy. The PKP Group comprises SZCZECIN PKP S.A., the parent company, and ten BIAŁYSTOK companies that provide services, among BYDGOSZCZ others, on railway transport, energy and ICT markets. The mission of the PKP Group companies is to build trust and POZNAŃ improve the image of the railway, so as to SIEDLCE enhance the role of railway transport in WARSZAWA Poland, following the example of modern ZIELONA GÓRA railways operating in Europe. Companies ŁÓDŹ belonging to Polish State Railways Group: PKP CARGO S.A., PKP Intercity WROCŁAW LUBLIN S.A., PKP Linia Hutnicza Szerokotorowa SKARŻYSKO-KAMIENNA Sp. z o.o.. CZĘSTOCHOWA WAŁBRZYCH The companies of the PKP Group TARNOWSKIE GÓRY KIELCE ZAMOŚĆ altogether hire almost 70,000 people – SOSNOWIEC specialists in the railway, IT, ICT, energy RZESZÓW and real property sectors. In terms of the KATOWICE KRAKÓW number of employees, the PKP Group is NOWY SĄCZ the second largest employer in Poland.[1] Locations of Polish State Railways Group subsidiaries. PKP S.A. PKP LHS PKP PLK S.A. PKP SKM PKP CARGO XCITY PKP INTERCITY NATURA TOUR [1] Source: www.pkp.pl PKP INFORMATYKA PKP TELKOM ET GPS Positioning system The ET GPS system is designed to monitor the position of locomotives and wagons. GPS tracker saves the object location, speed, direction of movement and information from sensors and interfaces. The data saved in the internal memory of the GPS tracker are transferred to the monitoring system. -

Special Offer Weekend Ticketmania 1. Entitled Persons

Special Offer Weekend Ticketmania 1. Entitled persons Any person. 2. Scope of validity Tickets according to the special offer Weekend Ticketmania can be purchased for over 50 km class 2 through train journey by national means of communication. a) TLK in accordance with fast train tariffs for trains with carriages with seats, or b) Express InterCity (EIC) in accordance with express tariff and between stations where these trains stop, with the exception of international trains returning from abroad. 3. Terms and Conditions 1) Special offer tickets can be purchased only on Saturday and Sunday for travel on any day – not earlier than 30 days prior to departure and not later than 7 days prior to departure (e.g. on 6 April 2014 one can purchase a ticket for travel on 15 April 2014) - only through a system of online ticket sales (the e-IC system) – under the principles laid down in the Terms and Conditions of online ticket sales in domestic and international communications by PKP Intercity SA (e-IC Terms and Conditions), subject to paragraph 2; 2) Offer cannot be combined with other offers; 3) online ticket in accordance with special offer Weekend Ticketmania is valid only on the day of travel and only to the place therein specified; 4) the number of seats covered by the offer is limited; 5) in matters not covered by these terms and conditions of tariff appropriate provisions of the Terms and Conditions of e-IC shall apply mutatis mutandis; 6) offer is available for sale from 29 March 2014. 4. Fees Tickets issued under special offer Weekend Ticketmania are at a flat rate independent of the tariff distance and the rates are as follows: Type of train Gross Price VAT Net Price class 2 In PLN TLK 29.00 2.15 26.85 EIC 49.00 3.63 45.37 The above prices are not subject to any rebates (legal and commercial) or discounts. -

Sieciowe Systemy Informatyczne W Polskim Transporcie Kolejowym W Okresie Przemian Ustrojowych I Technologicznych

PRACE NAUKOWE POLITECHNIKI WARSZAWSKIEJ z. 104 Transport 2014 8^ Henryk Rudowski Politechnika Warszawska, Instytut Informatyki, ^)< SIECIOWE SYSTEMY INFORMATYCZNE W POLSKIM TRANSPORCIE KOLEJOWYM W OKRESIE PRZEMIAN USTROJOWYCH I TECHNOLOGICZNYCH #B: L`hYx Streszczenie: ?B b < B? L $ ?b w wyniku tego ? GB $ = ? V = bB V < ?= = 4 = technologicznym realizowane z wykorzystaniem technologii sieci komputerowych BV=4= B ? m ICT. W pracy uB ? =<?b?=B <= ?b= b ? = < V ?b B b V = = I wieku. W tym = = = oraz automatyza= <, b zmianami nymi w G $ = L = <= = = È $ B : sieciowe systemy informatyczne, Grupa PKP 1. A W artykule przedstawiono historyczne, ?b powstania sieciowych informatycznych ? L $LBNawet w okresie PRL, bV ? b ? = sy biznesowe b = B 90 /#dowski V?otu, VbVB? ? $ Lstwowe. Zaprezentowano wybrane systemy sieciowe, czyli ? 4 $ zrealizowane w technologiach sprzed zniesienia embargo na technologie informatyczne, i zmiany w systemach < $ < B Systemy b È $ na podstawie ustawy z \ V `hhh B B ?V4 cie. L < ? b4 ? VLVÈ$ b = V B Wskazano bna za=È$= informatycznych =B 2. HISTORYCZNE, 6"%a&7!TECHNOLGICZNE +"6+%&"%!"6"a"NIA SYSTEMÓW SIECIOWYCH W PKP $, B zawsze == = ? = gdzie V systemy informatyczne. W $ L b?<BCentralnego Biura Statystyki utworzonego 1 stycznia 1958 r. Biuro to o =?L =-analitycznych. ?L b . ! V " ?L V }G~ ?V $ V = ! hh ) B analitycznymi a elektronicznymi maszynami cyfrowymi.