Bajaj Finserv (BAFINS)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Model Portfolio Update

Model Portfolio update January 21, 2016 LatestDeal Team Model – PortfolioAt Your Service Large cap Midcap Name of the company Weightage(%) Name of the company Weightage(%) Auto 14 Aviation 6 Tata Motor DVR 4 Interglobe Aviation 6 Bosch 3 Auto 6 Maruti 4 Bharat Forge 6 EICHER Motors 3 BFSI 6 BFSI 23 BjjFiBajaj Finserve 6 HDFC Bank 8 Capital Goods 6 Axis Bank 3 HDFC 8 Bharat Electronics 6 Bajaj Finance 4 Cement 6 Capital Goods 5 Ramco Cement 6 L & T 5 Consumer 24 Cement 3 Symphony 6 UltraTech Cement 3 Supreme Ind 6 FMCG/Consumer 14 Kansai Nerolac 6 ITC 7 Pidilite 6 United Spirits 2 FMCG 8 Asian Paints 5 Nestle 8 IT 21 Infrastructure 8 Infosys 10 NBCC 8 TCS 8 Oil & Gas 6 Wipro 3 Meida 2 CtlCastrol 6 Zee Entertainment 2 Logistics 6 Metal 2 Container Corporation of India 6 Tata Steel 2 Pharma 12 Oil & Gas 4 Natco Pharma 6 Reliance Industries 4 Torrent Pharma 6 Pharma 12 Textile 6 Lupin 5 Arvind 6 Dr Reddys 4 Total 100 Aurobindo Pharma 3 Total 100 • Exclusion - Eicher Motors, Bajaj Finance (transferred to large cap), PVR, • Exclusion- State Bank of India, Bharti Airtel and ONGC CARE, Cummins & Shree Cement • Inclusion – Eicher Motors, Bajaj Finance (transferred from midcap), Wipro, • Inclusion – Ramco Cement, Bajaj Finserv, Supreme Industries, Indigo, Reliance Industries & Aurobindo Pharma Pidilite, Bharat Electronics and Bharat Forge Source: Bloomberg, ICICIdirect.com Research *Diversified portfolio - Combination of 70% large cap and 30% midcap portfolio OutperformanceDeal Team – At continues Your Service across all portfolios… • Our indicative large cap equity model portfolio (“Quality -20”) has • In the large cap space we continue to remain positive on pharma & IT. -

Bajaj Finserv (BAFINS)

Bajaj Finserv (BAFINS) CMP: | 5983 Target: | 7000 (17%) Target Period: 12 months BUY October 22, 2020 Steady revival & holdco discount remains favourable Bajaj Finserv reported steady traction in its lending business. With slower premium accretion for Bajaj Finserv, consolidated topline was up 5.8% YoY to | 15052 crore, lower compared to earlier run rate, due to moderation in the lending business. While the insurance business witnessed an improvement in earnings, contingent provisioning of | 1370 crore impacted consolidated earnings reported at | 986 crore, down 18% YoY. Particulars Amid lockdown & risk aversion, AUM remained flat at | 137300 crore. Particu lar Am o u n t Subsequently, NII growth came in at 4% YoY to | 4158 crore. Contingent Market C apitalization | 93801 crore Result Update Result provision of | 1370 crore was partially offset by tight cost control, leading to Net worth | 32243 crore 14% YoY growth in operating profit to | 3005 crore. PAT came in at | 965 52 week H/L (|) 10297/3986 crore, down 36% YoY and flat QoQ. Asset quality improved amid standstill E quity capital | 80 C rore classification with GNPA at 1.03% vs 1.4% in Q1FY21. F ace value | 5 DII Holding (% ) 6.8 The pick-up seen in premium accretion in general insurance was at | 4156 FII Holding (% ) 7.7 crore, down 3% YoY. Crop insurance premium broadly stayed flat YoY at | 1759 crore. Non crop premium declined ~6% YoY to | 2397 crore, led by Key Highlights de-growth in CV & two-wheeler due to base effect. Cautious approach led 10% de-growth in group health business though retail health insurance Healthy revival witnessed in insurance increased 28.5% in H1FY21. -

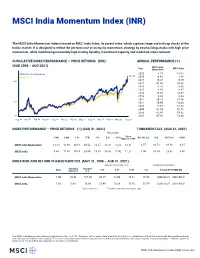

MSCI India Momentum Index (INR) (PRICE)

MSCI India Momentum Index (INR) The MSCI India Momentum Index is based on MSCI India Index, its parent index, which captures large and mid cap stocks of the Indian market. It is designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price momentum, while maintaining reasonably high trading liquidity, investment capacity and moderate index turnover. CUMULATIVE INDEX PERFORMANCE — PRICE RETURNS (INR) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI India Year Momentum MSCI India MSCI India Momentum 2020 4.74 16.84 453.82 MSCI India 2019 14.91 8.46 423.96 2018 -10.28 -0.19 400 2017 47.32 28.68 2016 -1.26 -0.30 2015 -2.59 -2.97 2014 19.60 24.37 2013 9.89 6.93 2012 30.23 27.86 200 2011 -20.90 -26.33 2010 21.67 14.74 2009 68.04 91.51 2008 -62.86 -56.82 50 2007 95.83 52.49 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — PRICE RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr May 31, 1996 Div Yld (%) P/E P/E Fwd P/BV MSCI India Momentum 12.03 13.69 44.58 29.22 12.27 12.31 12.22 12.31 0.57 36.78 19.56 4.15 MSCI India 8.80 11.41 50.55 24.89 13.10 13.38 11.92 11.25 1.00 31.04 23.31 3.86 INDEX RISK AND RETURN CHARACTERISTICS (MAY 31, 1996 – AUG 31, 2021) ANNUALIZED STD DEV (%) 2 MAXIMUM DRAWDOWN Tracking Turnover Beta Error (%) (%) 1 3 Yr 5 Yr 10 Yr (%) Period YYYY-MM-DD MSCI India Momentum 1.00 10.48 127.60 20.17 18.90 16.61 76.66 2000-02-21—2001-09-21 MSCI India 1.00 0.00 16.96 21.44 18.28 16.70 65.74 2000-02-21—2001-09-21 1 Last 12 months 2 Based on monthly price returns data The MSCI India Momentum Index was launched on Dec 11, 2013. -

Directors Ceased

Bajaj Finserv Limited Note on cessation of Directors due to death or resignation 1. Cessation of directorship of Late Shri S H Khan on account of sad demise Shri S H Khan, an Independent Director of the Company since 2008 passed away on 12 January 2016. He was 77 years old. Shri Khan served on various committees including Audit Committee and the Nomination and Remuneration Committee (Chairman) of the Company. He was also on the boards of other Bajaj Group companies, including the two insurance companies. The Board of Directors of the Company at its meeting held on 3 February 2016 recorded its whole- hearted appreciation of the valuable contribution made by Shri S H Khan during his long tenure as a member of the Board and noted his sad demise. 2. Cessation of directorship of Late Shri Naresh Chandra on account of sad demise Shri Naresh Chandra, an Independent Director of the Company since 11 September 2008, passed away in Goa on 9 July 2017. He was 82 years old. He was a member of the Audit Committee and Chairman of the Nomination and Remuneration Committee. The Board of Directors of the Company at its meeting held on 19 July 2017 recorded its whole- hearted appreciation of the valuable contribution made by Shri Naresh Chandra during his long tenure as a member of the Board and noted his sad demise. 3. Resignation of Shri Rahul Bajaj as a Non-Executive Chairman of the Company Shri Rahul Bajaj, Non-Executive Chairman of the Company, having been at the helm of the Company since its inception in 2007 and the Group for around five decades, as part of succession planning, has expressed his intention to step down as the Non-Executive Chairman of the Company with effect from the conclusion of Board meeting of the Company scheduled on 16 May 2019. -

AI Makes Tainted Pilot North Head, Backtracks

CCI NG 3.7 Product: TOIMumbaiBS PubDate: 01-05-2019 Zone: MumbaiCity Edition: 2 Page: TOIMIND2 User: manju.chandran Time: 05-01-2019 01:45 Color: CMYK THE TIMES OF INDIA, MUMBAI * WEDNESDAY, MAY 1, 2019 TIMES NATION 9 IndiGo pilots AI makes tainted pilot grounded for I-T dept searches premises, five in unsafe landing Mumbai, of ‘Lottery King’ Martin north head, backtracks information about tax eva- [email protected] in Nagpur Martin operates in Kerala and sion committed by Martin Chennai: The investigation and his family members. “As Failed Breath TIMES NEWS NETWORK wing of the income tax (I-T) north-eastern states, where lottery of now, we have seized Rs40 Jet’s mediclaim lapses; department on Tuesday business is still permitted. The lakh cash from one of his Test Twice, Was New Delhi: An IndiGo Air- started searches on at least ED had attached many of his premises. There are more seizures, but it would take lines aircraft reportedly 70 premises belonging to properties, worth Rs122cr, in TN Barred From 100 pilots & 450 crew landed in Nagpur this Sunday businessman Santiago some time to collate informa- with the nose wheel reported- Martin, known by the mo- tion trickling in from vari- ly touching down first, fol- niker ‘Lottery King’. Though five in Mumbai, three in Del- now,” said an I-T official. ous places,” said the official. Flying For 3 Yrs lowed by the main landing a resident of Coimbatore, hi, and two each in Hydera- I-T sleuths took Martin Martin had come under get jobs with Vistara gear later. -

Aegon Life Indepth May 2021.Pdf

MAY 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | May 2021 | 2 Commentary on the Indian Securities Market for April 2021 Nifty (down 0.4%) was largely flat in April post a flattish march. The covid situation has worsened in the month of April in India leading to different levels of lockdowns in various states. The vaccination program for the age group of 18-44 years has been allowed from 1 st May. However, vaccination availability is a concern in the short term and may lead to some delays. The dollar index corrected after three months of up move. It was down 2.09% and closed at 91.28 level. Despite the fall in Dollar index, the rupee was weak and depreciated by 97 paise to close at 74.08 level. Brent Crude gained almost 6% after one month of correction and ended at 67.25 level. Gold was up by 3.6% after three months of correction. Foreign institutional investors (FIIs) investment turned negative after six month of positive inflows. They sold about $1.3 bn worth of equity in April. Domestic institutional investors (DIIs) investment continued to be positive for a second month in a row. -

Demerger News - Bajaj Auto

LISTING OF GDRs Pursuant to the Scheme of Demerger, the GDR programs for Bajaj Auto Limited (BAL) and Bajaj Finserv Limited (BFS) have got established on 21 August 2008. Deutsche Bank has been appointed as Depository Bank for the Regulation S Global Depository Receipt (GDR) programs of BAL & BFS. GDRs of BHIL (earlier known as Bajaj Auto Limited) continue to be listed in LSE. PRESS RELEASE The process of demerger of erstwhile Bajaj Auto Ltd (BAL), which was approved by the board of directors of the company on 17 May 2007 has now been completed with all approvals being obtained, including that of Bombay High Court and SEBI. Pursuant to the Scheme of Arrangement of Demerger, Bajaj Holdings & Investments Ltd (BHIL, erstwhile BAL) was demerged into three undertakings with effect from the effective date, viz. 20 February 2008. It is now hereby informed that :- 1. The equity shares (14,46,83,510 Nos.) of Bajaj Auto Ltd (in whom manufacturing business undertaking has been vested) will be listed and permitted for trading on Bombay Stock Exchange and National Stock Exchange with effect from Monday, 26 May 2008. The listing ceremony is scheduled to take place at the designated Stock Exchange, i.e., BSE on 26 May 2008; and 2. The equity shares (14,46,83,510 Nos.) of Bajaj Finserv Ltd (in whom strategic business undertaking has been vested) will be listed and permitted for trading on Bombay Stock Exchange and National Stock Exchange with effect from Monday, 26 May 2008. The listing ceremony is scheduled to take place at the designated Stock Exchange, i.e., NSE on 26 May 2008. -

Antique's Morning Presentation

STRICTLY CONFIDENTIAL AMP 16 October 2014 ANTIQUE’S MORNING PRESENTATION Market Snapshot Global Indices Closing % Chg % YTD FROM THE RESEARCH DESK Dow Jones 16,142 (1.1) (2.6) 2QFY15 RESULTS REVIEW NASDAQ 4,215 (0.3) 0.9 FTSE 6,212 (2.8) (8.0) Bajaj Finance Limited CAC 3,940 (3.6) (8.3) Defying slowdown yet again DAX 8,572 (2.9) (10.3) Cyient Limited Russia 1,067 (0.8) (26.0) Strong beat in performance; Acceleration to continue Bovespa 56,135 (3.2) 9.0 Nikkei 15,074 0.9 (9.8) Hang Seng 23,140 0.4 (0.7) Shanghai Composite 2,374 0.6 12.2 Global News Indian Indices Closing % Chg % YTD Sensex 26,349 (0.1) 24.5 U.S. stocks plunged on Wednesday in wake of disappointing U.S. retail sales and wholesale pricing data. The Census Bureau reported earlier that Nifty 7,864 (0.3) 24.7 U.S. retail sales fell 0.3% last month, exceeding forecasts for a 0.1% decline, MSCI India 495 - 21.5 after expanding 0.6% in August. DJIA fell 1% to close at 16142, the S&P CNX Midcap 11,270 (0.1) 39.6 500 index fell 0.8% to close at 1862.5 BSE Smallcap 10,631 (0.1) 62.3 Tokyo stocks closed 0.92% higher on Wednesday, recovering slightly after five days of losses on bargain hunting and coutesy a weaker yen. Nikkei Flows (USDm) Prev. Day MTD which sank to a two-month low on Tuesday, gained 0.9% to finish at 15,073.5 FII (89) (325) Sector & Corporate News Locals 79 431 DLF, India's largest builder, which has been in the centre of a political storm Provisional flows (USDm) for its alleged dealings with Robert Vadra, has now received a body blow FIIs (113) from the capital market watchdog: Securities and Exchange Board of India. -

Aegon Life Indepth Mar 2021

MARCH 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | Mar 2021 | 2 Commentary on the Indian Securities Market for February 2021 Nifty (up 6.5%) was up for the month after a correction in January as the markets were enthused by a pro-growth Budget. In the budget, the government signalled its inten- tion to support growth without any meaningful change in tax regime. The active covid cases has seen a slight uptick in the month of February. The vaccination program has entered the second phase in the country with senior citizens and comorbid patients also eligible to receive vaccination from 1st March. The dollar index was up for second month in a row. It was up 0.3% and closed at 90.88 level. The rupee depreciated after three months of appreciation. It depreciated by 51 paise to end at 73.46 level. Brent crude continued its upmove and was up another 18% to close above $65 mark. It has moved up by 78% in the last four months. Gold corrected by 6% to close at $1734. Foreign institutional investors (FIIs) investment continued to be strong in February with inflow of $3.5 bn. -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues. -

Report on Corporate Governance

BAJAJ FINSERV LIMITED 14th Annual Report 2020-21 REPORT ON CORPORATE GOVERNANCE Corporate governance is about promoting fairness, transparency, accountability, commitment to values, ethical business conduct and about considering all stakeholders’ interests while conducting business. In accordance with the provisions of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and amendments thereto, (‘SEBI Listing Regulations’), given below are the corporate governance policies and practices of Bajaj Finserv Ltd. (‘the Company’, ‘BFS’ or ‘Bajaj Finserv’) for FY2021. This report states compliance with requirements of the Companies Act, 2013, as amended (the ‘Act’) and SEBI Listing Regulations, as applicable to the Company. As will be seen, the Company’s corporate governance practices and disclosures are well beyond complying with the statutory and regulatory requirements stipulated in the applicable laws. Philosophy For us, corporate governance is a reflection of principles entrenched in our values and policies and also embedded in our day-to-day business practices, leading to value driven growth. The commitment of Bajaj group to the highest standards of good corporate governance practices predates the provisions of SEBI Listing Regulations and clause 49 of erstwhile Listing Agreement. Ethical dealings, transparency, fairness, disclosure and accountability are the main thrusts of the Bajaj group. The Company maintains the same tradition and commitment. Bajaj Finserv is conglomerate of different financial services businesses – lending, general and life insurance, digital distribution, digital healthcare platform, stock broking and so on – operated through its subsidiaries and joint ventures. Through its representation on the Boards of the subsidiaries, Bajaj Finserv seeks adoption of key group principles of corporate governance across its subsidiaries. -

Bajaj Finance Limited Q3 FY21 Investor Presentation 20 January 2021 Presentation Path

Bajaj Finance Limited Q3 FY21 Investor Presentation 20 January 2021 Presentation Path Section 01 Section 03 Section 05 Section 07 Executive summary Financial performance Customer franchise and Update on Q3 FY21 Q3 FY21 distribution reach credit quality 3 25 36 43 Section 02 Section 04 Section 06 Bajaj Finance Limited Asset liability Business segment wise overview management AUM 12 29 40 Click on the section to view 1.1 Quarter gone by Section 01 Executive summary Q3 FY21 1.2 Executive summary on Q3 FY21 3 Quarter gone by A quarter marked by granular business recovery, significant improvement in risk metrics, tracking implementation of business transformation plan and putting into motion a plan for pre-COVID growth and financial performance from Q1 FY22. AUM Opex to NII PAT ROE Net NPA* 32.3% ₹ 1,146 Cr Q3 FY21 ₹ 1,43,550 3.3% 0.19% Crore YoY Growth Q3 FY20 YoY Growth Q3 FY20 Q3 FY20 (1%) 33.8% (29%) 5.9% 0.70% *Not annualized 4 Executive summary Q3 FY21 Balance Sheet and Franchise: 1. Q3 AUM was at ₹ 143,550 crore as against ₹ 145,092 crore last year. Core AUM growth in Q3 FY21 was approximately ₹ 8,000 crore (adjusted for IPO receivable of ₹ 987 crore and higher ECL of Rs 520 crore) as compared to ₹ 9,559 crore in Q3 FY20. The Company expects core AUM growth to resume to pre-COVID levels by Q4 FY21. 2. AUM growth is back across all businesses except auto finance. AUM growth was granular across all lines. The Company booked 6.04 MM new loans in Q3 FY21 as against 7.67 MM in Q3 FY20.