Summary of Input from Payments System Forums September 1997

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 1980

Annual Report 1980 The Depository• Trust Company The ability of Depository Trust to conduct its activities rests largely on modern computer technology, reflecting a long chain of developments in several disciplines. Automated calculating and recordkeeping are the essence of DTC's book-entry capability. Telecommunications devices facilitate the flow of information among Participants, transfer agents, and others throughout the financial community. The ability to utilize minute intervals of time permits computers to operate in billionths of a second. The illustrations in this report depict historical developments in each of these disciplines. The graphic theme and appearance of this Annual Report were conceived by David S. Jobrack, Executive Assistant to the Chairman, who also acted as Creative Director throughout the production process, and wrote, edited and/or compiled the text, illustrations and captions. 1980 Annual Report Highlights. 2 Computer Communications A Message from Management. ..... 3 Facility (CCF) . 28 History, Ownership and Policies. ....... 4 Other Automation Developments .... 28 Growth in 1980 .... 6 Interfaces in a National Clearance and Settlement System .. ....... 30 Eligible Issues. .8 Municipal Bond Program ..... 8 Protection for Participants' Securities ..... 32 Outlook for Institutional Use. 10 Officers and Directors of The Institutional Delivery (ID) Depository Trust Company.. 38 System. 14 1980 in Retrospect . .40 Basic Services 16 Financial Statements. ............ 46 Fast Automated Securities Participants. 54 Transfer (FAST) .' 17 Stockholders. ........ 56 Ancillary Services. 20 Depository Facilities ... 56 ...... 20 Dividends Pledgees .............. 57 Voting Rights. 21 Banks Reported to be Participating in Other Ancillary Services. 22 the Depository on an Indirect Basis 57 The Automation of Depository Services. 26 Investment Companies Reported Participant Terminal System (PTS). -

US Accounts in 24 Hours

U.S. Accounts In 24 Hours - eBook Thank you for purchasing our featured "U.S. Accounts In 24 Hours" eBook / Online Information Packet offered at our web site, U.S. Account Setup.com Within our featured online information packet, you will find all of the resources, tools, information, and contacts you'll need to quickly & easily open a NON-U.S. Resident Bank Account within 24 hours. You'll find lists of U.S. Banks, Account Application Forms, Information on how to obtain a U.S. Mailing Address, plus so much more. Just point and click your way through our Online Information Packet using the links above. If you should have any questions or experience any difficulties in opening your Non-U.S. Resident Account, please feel free to email us at any time, and one of our representatives will get back with you promptly. For Support, Email: [email protected] Homepage: www.usaccountsetup.com Application Forms UPDATE - E-TRADE'S NEW ACCOUNT OPENING POLICIES Etrade is changed the rules in which they open International Banking/ Brokerage accounts for foreigners. They now require all new applications be submitted to the local branch office in your region. Once account is opened, you will be able to use it as a U.S. Bank/Brokerage Account out of your home country. Below, you will find a list of International Etrade Phone Numbers & Addresses. Contact the etrade office that best reflects where you reside or would like your account based out of and where you would like to receive your debit card. U.S. -

1999-2000 SAR Guide

A Guide to 1999-2000 SARs and ISIRs APPENDIX C NSLDS FINANCIAL AID HISTORY/NSLDS MATCH FLAGS NSLDS Financial Aid History The “Loan Satisfactory Repayment Arrange- 1999-2000 ments” flag reflects the status of loans with a “DX” (Defaulted, satisfactory arrangements Changes to NSLDS data since previous made including six consecutive monthly pay- Prescreening ments). If this flag is set to “Y” a comment will be included on the SAR/ISIR informing the student and the school of that status, but no “C” flag will An indicator will inform schools where NSLDS be set. information provided on a SAR/ISIR has changed since the last CPS transaction. A “#” sign will Aggregate Amounts for FFELP/Direct Loans print in front of the status field for Overpayments, Defaulted Loans, Discharged Loans, Loan Satis- Section factory Repayment Arrangements, or Active Bankruptcy if there has been a change in that The Unsubsidized Loans field has been deleted status since the last CPS transaction. and replaced with a Combined Loans field, which reflects the total amount of subsidized and The “#” sign will also print in front of the Aggre- unsubsidized loans the student has borrowed. gate Amount for FFELP/Direct Loans, Cumula- This change is consistent with guidance provided tive Perkins Loans, or the 1999-2000 Pell Pay- in Dear Colleague Letter, GEN-97-3, which was ment Data sections when information within that published in May 1997. In addition, the Consoli- section has changed since the last CPS transaction. dated Loans field has been renamed FFEL Con- Finally, a “#” sign will print in front of each solidated Loans, and will only include amounts of reported loan in the Loan Detail section when FFEL Consolidated Loans. -

Small Business Banking Issues

Comptroller of the Currency Administrator of National Banks Small Business Banking Issues A National Forum Sponsored by the Office of the Comptroller of the Currency Renaissance Washington Hotel Washington, D.C. February 5, 1998 Acknowledgments The Office of the Comptroller would like to express its appreciation to the speakers at the Small Business Banking Issues Forum, whose presentations are summarized here. Appreciation is also extended to the forum attendees, listed in Appendix A of this publication, for their questions, comments, and experiences shared about small business banking. The project was developed to enable bankers and small busi- ness owners to learn about successful programs, techniques, and strategies relevant to small business banking that could be replicated in their own communities. OCC staff contributing to the planning and conduct of the forum included: Janice A. Booker, director, Community Devel- opment Division (CDD); Yvonne McIntire, senior attorney, Community and Consumer Law; Denise Kirk-Murray, commu- nity reinvestment and development specialist, Community and Consumer Policy Division; Alfred T. Mitchell, community development specialist, CDD; Glenda Cross, director, Minority and Urban Affairs; John Turner, national bank examiner, Credit Risk; and Jacquelyn C. Allen, community development specialist, CDD. Lillian M. Long, program coordinator, CD Investments Program, CDD, served as project leader. Adminis- trative assistance was provided by Tawanda Hudge and Lisa Hemphill, CDD. The Communications Division, particularly Amy A. Millen, senior editor, and Rick Progar, publications liaison officer, helped to bring this publication to fruition. The OCC welcomes your comments or questions about this publication. Please write to the Community Development Division, Office of the Comptroller of the Currency, 250 E Street, SW, Washington, DC 20219, or call (202) 874-4940. -

2016-17 Annual Report of the Michigan State Treasurer

ANNUAL REPORT Michiganof State the Treasurer 2016-2017 Rick Snyder, Governor | Nick A. Khouri, Treasurer Table of Contents State Treasurer’s Letter of Transmittal ........................................................................................................1 Cash and Investments Schedule 1 State Treasurer’s Common Cash - Assets and Equities ................................................ 2 Schedule 2 Investment Portfolios of Specific Funds ........................................................................3 Schedule 3 Investment Revenues .....................................................................................................4 Notes to Financial Schedules .................................................................................................................6 Cash and Investments ............................................................................................................................8 Table 1 Investment Revenues for Fiscal Years ...........................................................................8 Table 2 Available Month-End Common Cash ............................................................................9 Table 3 Common Cash History ...................................................................................................9 Table 4 State Treasurer’s Common Cash Fund, Cash Balances, and Transactions by Fund ..................................................................................................10 Table 5 Demand Depositories as of September 30, 2017 -

First National Bank of America Charter Number: 14740

LARGE BANK Comptroller of the Currency Administrator of National Banks Washington, DC 20219 Public Disclosure April 24, 2002 Community Reinvestment Act Performance Evaluation First National Bank of America Charter Number: 14740 241 East Saginaw Street East Lansing, Michigan 48826-0980 Office of the Comptroller of the Currency Detroit Field Office Omni Officentre, Suite 411 26877 Northwestern Highway Southfield, Michigan 48034 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, and should not be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number: 14740 Table of Contents OVERALL CRA RATING ....................................................................................................................... 2 DEFINITIONS AND COMMON ABBREVIATIONS ........................................................................... 3 DESCRIPTION OF INSTITUTION ........................................................................................................ 6 SCOPE OF THE EVALUATION............................................................................................................ 7 FAIR LENDING -

National Banks Placed in Liquidation, the Names of Succeeding Banks In

1920 (Volume 2) REPORT OF THE COMPTROLLER OF THE CURRENCY. 31 TABLE NO. 9.—National banks re/ported in liquidation from Nov. 1, 1919, to Oct. SI, 1920, the names, where known, of succeeding banks in cases of successions, together with date of liquidation and capital. Date of Capital. Name and location of bank. liquidation. Commercial National Bank of Oshkosh, Wis. (5557); absorbed by Old Na- tional Bank of Oshkosh, Wis. (title changedtothe Old-Commercial National Bank of Oshkosh) Nov. 1,1919 $200,000 First National Bank of Harriman, Tenn. (4501);succeeded by First & Manu- facturers Bank of Harriman, Tenn Oct. 25,1919 50,000 Manufacturers National Bank of Harriman, Tenn. (4654); succeeded by First & Manufacturers Bank of Harriman, Tenn ....do 75,000 Market National Bank of Cincinnati, Ohio (3642); absorbed by Fifth-Third National Bank of Cincinnati, Ohio July 2,1919 500,000 First National Bank of Fort Meade, Fla. (10386); absorbed by Bank of Fort Meade, Fla Nov. 3,1919 25,000 Third National Bank of Atlanta, Ga. (5030); absorbed by Citizens & Southern Bank of Savannah, Ga Oct. 30,1919 1,000,000 York County National Bank of York Village, Me. (4844); succeeded by York County Trust Co., York Village, Me.. Oct. 31,1919 60,000 American National Bank of Tampa, Fla. (7153); absorbed by Citizens Bank & Trust Co. of Tampa, Fla. (title changed to Citizens-American Bank & Trust Co.) Nov. 22,1919 250,000 Commercial National Bank of Steubenville, Ohio (5039); absorbed by Steuben- yille Bank & Trust Co., Steubenville, Ohio Nov. 24,1919 125,000 First National Bank of Lexington, N. -

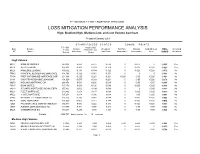

LOSS MITIGATION PERFORMANCE ANALYSIS High, Medium-High, Medium-Low, and Low Volume Servicers

FY 2000 SINGLE FAMILY MORTGAGE SERVICING LOSS MITIGATION PERFORMANCE ANALYSIS High, Medium-High, Medium-Low, and Low Volume Servicers Prepared January 2001 S T A N D A R D I Z E D S C O R E S B O N U S P O I N T S FY 1999 Actual Loss/ Svcr Servicer Loans Default Potential Loss Weighted FirstTime Minority UnderServed FINAL Increased ID * Name Scored Rate Score Score Total Score Homeowner Homeowner Area SCORE Incentives High Volume MUL1 BANK OF AMERICA 240,318 0.059 -0.727 -0.530 0 -0.025 0 -0.555 Yes MUL6 WELLS FARGO 656,303 -0.005 -0.503 -0.379 0 -0.025 -0.025 -0.429 Yes MUL5 HOMESIDE LENDING 439,502 -0.136 -0.384 -0.322 0 -0.025 -0.025 -0.372 No 75640 PRINCIPAL RESIDENTIAL MORTGAGE 191,398 -0.122 -0.361 -0.301 0 0 0 -0.301 No 77396 FIRST NATIONWIDE MORTGAGE COR 211,449 -0.125 -0.227 -0.201 -0.025 -0.05 -0.025 -0.301 No 64141 COUNTRYWIDE HOME LOANS INC 491,029 -0.075 -0.243 -0.201 0 -0.05 -0.025 -0.276 No 39276 MIDLAND MORTGAGE CO 266,458 0.521 -0.286 -0.085 0 -0.05 -0.05 -0.185 No 73815 BANK UNITED 117,179 0.039 -0.120 -0.080 0 -0.025 -0.025 -0.130 No 68013 ATLANTIC MORTGAGE AND INVESTM 155,832 -0.032 -0.104 -0.086 0 0 -0.025 -0.111 No MUL3 FLEET MORTGAGE 319,862 -0.258 0.137 0.038 0 -0.025 -0.025 -0.012 No MUL2 CHASE MORTGAGE 597,276 -0.018 0.096 0.068 0 -0.05 -0.025 -0.007 No 38092 NATIONAL CITY MORTGAGE CO 105,256 -0.236 0.142 0.048 0 -0.025 -0.025 -0.002 No MUL4 GMAC MORTGAGE 136,099 -0.057 0.211 0.144 0 -0.025 -0.025 0.094 No 12621 PNC MORTGAGE CORP OF AMERICA 102,937 0.082 0.222 0.187 0 -0.025 -0.025 0.137 No 10757 AURORA LOAN -

ABN AMRO, 1990-Present

ABN AMRO History Department ABN AMRO, 1990-PRESENT The merger, 1990-1991 On 22 September 1991, the two largest general banks The South American operations of ABN AMRO’s subsidi- in the Netherlands, Algemene Bank Nederland (ABN) ary Hollandsche Bank-Unie were combined with those of and Amsterdam-Rotterdam Bank (Amro), merged. The Banco Real under the name Banco ABN AMRO Real. In resulting company adopted the name ABN AMRO. The the following years, more Brazilian take-overs followed, two principal motives for the merger were to concentrate and the country became the company’s third home market strengths and to scale up business internationally. after the Netherlands and the United States. Multiple take-overs occurred in Europe as well, such as that of the London stockbroking firm Hoare Govett (1992), the Swedish investment bank Alfred Berg (1995) and the centuries-old German private bank Delbrück & Co. (2002), which was merged with BethmannMaffei, an acquisition from 2004. In France Banque Odier Bungener Courvoisier, Banque Demachy and Banque du Phénix were acquired and merged with Banque de Neuflize, Schlumberger, Mallet to become Banque NSMD. After a long and controversial struggle regarding Banca Antonveneta, ABN AMRO acquired a majority stake in this Italian bank at the start of 2006. Barriers to growth An important reason for the creation of ABN AMRO was international strengthening and expansion. This goal was National and international expansion, 1990-2007 energetically pursued with many national and internati- In September 1990, the consumer credit activities in The onal acquisitions, but the company also divested itself Netherlands via intermediaries of the subsidiaries Finata, IDM and Mahuko were brought under a new subsidiary Interbank (sold in 2007). -

Download (Pdf)

THIS COMPILATION IS DERIVED LARGELY FROM SECONDARY SOURCES. NOT AN OFFICIAL REPORT OF CHANGES IN THE BANKING STRUCTURE.' NOT FOR PUBLICATION BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM L. 4.5 October 22, 1962 CHANGES IN STATUS OF BANKS AND BRANCHES DURING SEPTEMBER 1962 Class Date of MAP ? ae and location of banks and branches of bank change New Banks (Except successions and conversions) First State Bank Lake Village, Ark. Ins. non. 9-19-62 Chicot County First National Bank Fresno, Calif. National 9-14-62 Fresno County- Colfax National Bank Denver, Colo. National 9-24-62 Denver County Republic National Bank Pueblo, Colo. National 9- 4-62 Pueblo County Bank of Commerce Fort Lauderdale, Fla. Ins. non. 9-11-62 Broward County First National Bank of North Broward County- Lighthouse Point, Fla. National 9- 4-62 Broward County Trail National Bank P. 0. Sarasota, Fla. National 9-26-62 Manatee County Hampshire National Bank South Hadley, Mass. National 9- 4-62 Hampshire County Troy National Bank Troy, Mich. National 9-20-62 Oakland County Grant Square Bank & Trust Co. Oklahoma City, Okla. Ins. non. 9-24-62 Oklahoma County First National Bank Owasso, Okla. National 9- 8-62 Tulsa County Bassett National Bank El Paso, Tex. National 9-27-62 El Paso County Coronado State Bank El Paso, Tex. Ins. non. 9- 4-62 El Paso County Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Class Date of Name and location of banks and "branches of bank change New Banks (Cont'd) ' (Except successions and conversions) Wolfforth State Bank Wolfforth, Tex. -

News & Insights

News & Insights Rasul M. Raheem Joins Dykema’s Detroit Office November 8, 2018 Dykema, a leading national law firm, today announced the addition of Rasul M. Raheem to its Financial Services Litigation Practice Group as a Senior Counsel in the firm’s Detroit office. Raheem joins Dykema with nearly 30 years of experience as in-house counsel to banking entities, including serving as Senior Vice President and Assistant General Counsel with Bank of America, as well as time with LaSalle Bank Corp. and Michigan National Bank. Raheem’s practice focuses on business transactions, bank regulatory and compliance, and banking law. He provides legal counsel and advice to senior management regarding finance and lending relationships, credit issues, restructuring and recovery strategies, reputational risk, treasury services, bank policy and regulatory issues, and cyber currency issues, as well as litigation related to financial services disputes. Raheem serves as a member of the Michigan Roundtable for Diversity & Inclusion and was an adjunct professor at Western Michigan University Cooley Law School, where he taught a course on banking and financial institutions law. “Rasul’s reputation in the world of financial services law precedes him,” said Laura Baucus, Leader of Dykema’s Financial Services Litigation Practice Group. “His invaluable experience as in-house with banking organizations will be a great benefit to our financial institutions clients.” Raheem earned a J.D. and an LL.M., in Corporate & Finance Law, from Wayne State University Law School. He also earned a BGS from The University of Michigan. Attorneys Rasul M. Raheem Practice Areas Bankruptcy, Insolvency & Creditors' Rights Financial Services Litigation – Consumer Government Policy & Practice Litigation Industries Financial Industry Group Financial Services Regulatory & Compliance California Illinois Michigan Minnesota Texas Washington, D.C.. -

<Type Presentation Title Here>

NETWORKING AT ITS BEST BANKERS EDUCATION SUMMIT AND TRADE SHOW How To Generate Prudent Loan Growth April 25, 2013 John C. Donnelly Andrew C. Christians, CFA Confidential Table of Contents 1. Where Have We Been?* 2. Where Has This Left Us?* 3. Who Do We Admire?* 4. Techniques for Generating Prudent Loan Growth* 5. Loan Growth Through M&A 6. Summary 7. Donnelly Penman & Partners Bios *Data source utilized throughout presentation – SNL Securities, FDIC 2 Donnelly Penman & Partners Boutique investment banking firm based in Grosse Pointe, Michigan Established in 2000 Specialize in merger advisory, raising capital, and valuation and strategic advisory services Industry concentration in the financial institution and automotive industries Owned by the employees of the firm 3 1. Where Have We Been? 4 Current Macro Issues Facing Community Banks Economic headwinds (domestic and global) Regulatory pressure – particularly compliance Legislative uncertainty (Dodd-Frank still being defined) Improving loan delinquencies and credit costs Limited quality loan growth opportunities and aggressive pricing by nationals and regionals The latter point of loan growth has become a key gating item for community banks as we recover from the Credit Crisis 5 Backdrop to Current Lending Environment Record Low Interest Rates Low Loan Demand Excess Liquidity/Low Yields Fierce Pricing/Fixed Rates/Longer Maturities (10 years) Easing of Loan Covenants/Personal Guarantees Limited quality loan growth opportunities and aggressive pricing by nationals and regionals Community Banks are at a critical juncture on where to seek prudent loan growth 6 Bank Failures Across the Nation FDIC opportunities can offer buyers great opportunities to create shareholder value 7 FDIC Problem List Remains High Despite continued bank failures, the FDIC Problem Institution List has begun to trend downward after not materially changing over the last 2 years, indicating bank failures should subside in 2013, as seen in 2012.