Annual Report 1980

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

US Accounts in 24 Hours

U.S. Accounts In 24 Hours - eBook Thank you for purchasing our featured "U.S. Accounts In 24 Hours" eBook / Online Information Packet offered at our web site, U.S. Account Setup.com Within our featured online information packet, you will find all of the resources, tools, information, and contacts you'll need to quickly & easily open a NON-U.S. Resident Bank Account within 24 hours. You'll find lists of U.S. Banks, Account Application Forms, Information on how to obtain a U.S. Mailing Address, plus so much more. Just point and click your way through our Online Information Packet using the links above. If you should have any questions or experience any difficulties in opening your Non-U.S. Resident Account, please feel free to email us at any time, and one of our representatives will get back with you promptly. For Support, Email: [email protected] Homepage: www.usaccountsetup.com Application Forms UPDATE - E-TRADE'S NEW ACCOUNT OPENING POLICIES Etrade is changed the rules in which they open International Banking/ Brokerage accounts for foreigners. They now require all new applications be submitted to the local branch office in your region. Once account is opened, you will be able to use it as a U.S. Bank/Brokerage Account out of your home country. Below, you will find a list of International Etrade Phone Numbers & Addresses. Contact the etrade office that best reflects where you reside or would like your account based out of and where you would like to receive your debit card. U.S. -

1985 0101 NSCCAR.Pdf

National Securities Clearing Corporation Corporate Office 55 Water Street New York, New York 10041 (212) 510-0400 Boston One Boston Place Boston, Massachusetts 02108 Chicago 135 South LaSalle Street Chicago, Illinois 60603 Cleveland 900 Euclid Avenue Cleveland, Ohio 44101 Dallas Plaza of the Americas TCBTower Dallas, Texas 75201 Denver Dominion Plaza Table of Contents 600 17th Street Denver, Colorado 80202 To NSCC Participants 2 Detroit NSCC Board of Directors 4 3153 Penobscot Building Detroit, Michigan 48226 NSCC Officers 8 Jersey City Introduction 9 One Exchange Place Jersey City, New Jersey 07302 The Year in Review 10 Los Angeles Municipal Bond Program 12 615 South Flower Street Los Angeles, California 9001.7 Fund/SERV 14 Milwaukee Automated Customer Account Transfer Service 16 777 East Wisconsin Avenue Milwaukee, Wisconsin 53202 International Securities Clearing Corporation 18 Minneapolis Audited Financial Statements 20 IDS Center 80 South 8th Street Participating Organizations 26 Minneapolis, Minnesota 55402 New York 55 Water Street New York, New York 10041 St. Louis One Mercantile Tower Cover: 1985 was a year during which NSCC anticipated and St. Louis, Missouri 63101 responded to the expanding needs of the financial services San Francisco industry ... 50 California Street • As marketplace self-regulatory organizations, represented San Francisco, California 94111 here by a New York Stock Exchange Guide/Constitution Toronto and Rules, proposed new rules on broker-dealers' transfer Two First Canadian Place of client accounts, NSCC implemented the Automated Toronto, Ontario, Canada M5X lA9 Customer Account Transfer Service. • While continuing to serve its traditional equity, corporate bond and municipal bond marketplaces, represented by volume charts on the computer screen, NSCC expanded its comparison services to include municipal bond syndi cates, when-issued and extended-settlement trades. -

Decade of Holding Company Regulation in Florida

July 1970 A Decade of Holding Com pany Regulation in Florida The Bank Holding Company Act of 1956 placed was often met through the chartering of new sub multibank holding company formation and ex urban banks by the stockholders of the com pansion within the jurisdiction of the Board of munity’s existing banks. Governors of the Federal Reserve System. By Since 1959 when the Board rendered its first the end of 1969, the Board had handed down 294 decision on a Florida holding company applica decisions. These Board decisions did not, however, tion, the holding company form of group bank fall evenly throughout the nation. They affected ing has become an important part of the struc prim arily those states having unit- or limited tural change in Florida banking. The composi branch-banking legislation that typically encour tion of Florida banking, therefore, has been ages holding company expansion. Florida is one molded to some extent by the provisions of the of these unit-banking states, and 52 of the Board’s Bank Holding Company Act of 1956 and by decisions affected Florida banks. Only Wisconsin the decisions the Board has made on individual witnessed as much holding company activity dur applications under the Act. This article reviews ing the same period. the pattern that has developed during the first ten The holding company is simply one form of years of experience. control over several separately chartered banks. Other forms of control over such a group of Genesis of Florida Holding Companies banks might be maintained through ownership by an individual, a partnership, or by common When Congress passed the Bank Holding Com m ajority stockholders. -

School of Economics & Business Administration Master of Science in Management “MERGERS and ACQUISITIONS in the GREEK BANKI

School of Economics & Business Administration Master of Science in Management “MERGERS AND ACQUISITIONS IN THE GREEK BANKING SECTOR.” Panolis Dimitrios 1102100134 Teti Kondyliana Iliana 1102100002 30th September 2010 Acknowledgements We would like to thank our families for their continuous economic and psychological support and our colleagues in EFG Eurobank Ergasias Bank and Marfin Egnatia Bank for their noteworthy contribution to our research. Last but not least, we would like to thank our academic advisor Dr. Lida Kyrgidou, for her significant assistance and contribution. Panolis Dimitrios Teti Kondyliana Iliana ii Abstract M&As is a phenomenon that first appeared in the beginning of the 20th century, increased during the first decade of the 21st century and is expected to expand in the foreseeable future. The current global crisis is one of the most determining factors affecting M&As‟ expansion. The scope of this dissertation is to examine the M&As that occurred in the Greek banking context, focusing primarily on the managerial dimension associated with the phenomenon, taking employees‟ perspective with regard to M&As into consideration. Two of the largest banks in Greece, EFG EUROBANK ERGASIAS and MARFIN EGNATIA BANK, which have both experienced M&As, serve as the platform for the current study. Our results generate important theoretical and managerial implications and contribute to the applicability of the phenomenon, while providing insight with regard to M&As‟ future within the next years. Keywords: Mergers &Acquisitions, Greek banking sector iii Contents 1. Introduction ................................................................................................................ 1 2. Literature Review .......................................................................................................... 4 2.1 Streams of Research in M&As ................................................................................ 4 2.1.1 The Effect of M&As on banks‟ performance .................................................. -

Staff Study 174

Board of Governors of the Federal Reserve System Staff Study 174 Bank Mergers and Banking Structure in the United States, 1980–98 Stephen A. Rhoades August 2000 The following list includes all the staff studies published 171. The Cost of Bank Regulation: A Review of the Evidence, since November 1995. Single copies are available free of by Gregory Elliehausen. April 1998. 35 pp. charge from Publications Services, Board of Governors of 172. Using Subordinated Debt as an Instrument of Market the Federal Reserve System, Washington, DC 20551. To be Discipline, by Federal Reserve System Study Group on added to the mailing list or to obtain a list of earlier staff Subordinated Notes and Debentures. December 1999. studies, please contact Publications Services. 69 pp. 168. The Economics of the Private Equity Market, by 173. Improving Public Disclosure in Banking, by Federal George W. Fenn, Nellie Liang, and Stephen Prowse. Reserve System Study Group on Disclosure. November 1995. 69 pp. March 2000. 35 pp. 169. Bank Mergers and Industrywide Structure, 1980–94, 174. Bank Mergers and Banking Structure in the United States, by Stephen A. Rhoades. January 1996. 29 pp. 1980–98, by Stephen A. Rhoades. August 2000. 33 pp. 170. The Cost of Implementing Consumer Financial Regula- tions: An Analysis of Experience with the Truth in Savings Act, by Gregory Elliehausen and Barbara R. Lowrey. December 1997. 17 pp. The staff members of the Board of Governors of the The following paper is summarized in the Bulletin Federal Reserve System and of the Federal Reserve Banks for September 2000. The analyses and conclusions set forth undertake studies that cover a wide range of economic and are those of the author and do not necessarily indicate financial subjects. -

Behind Miami's Surge in International Banking

April 1981 Behind Miami's Surge in International Banking Miami's international banking activity has expanded substantially since 1969. Regulatory changes have made the Edge Act corporation a more viable entity. Florida's legal and tax structure has become more accommodating to international financial development. And banking activity with Latin American individuals and nonfinancial firms has surged. In the past two decades, Miami has emerged Edge Act Corporations as one of the new international banking cen- » ters. The move to Miami by major U. S. and foreign banks has been stimulated by both It was not until 1969 that a non-Florida regulatory changes and economic factors. U. S. bank entered the Miami international banking market. In that year, the Georgia- International Banking from Miami: based Citizens and Southern National Bank The Cast of Participants opened the first Edge Act corporation in Miami. Edge Act corporations are restricted to International banking from Miami consists international transactions. Since 1969, 21 of locally based commercial banks, Edge Act more banks have entered Miami's banking corporations set up by out-of-state and market as Edge Act corporations; another 11 foreign banks, and foreign bank agencies and have applications approved or pending (see representative offices. Using June 1980 data, Table 3). transactions with the Caribbean Basin and the rest of Latin America constituted at least half, All New York banks with banking Edges and regularly 80 to 90 percent, of Miami's have or have applied for Miami presence. commercial bank, Edge, and agency activity Four of the six California banks and three of with foreigners. -

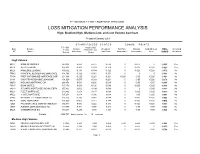

LOSS MITIGATION PERFORMANCE ANALYSIS High, Medium-High, Medium-Low, and Low Volume Servicers

FY 2000 SINGLE FAMILY MORTGAGE SERVICING LOSS MITIGATION PERFORMANCE ANALYSIS High, Medium-High, Medium-Low, and Low Volume Servicers Prepared January 2001 S T A N D A R D I Z E D S C O R E S B O N U S P O I N T S FY 1999 Actual Loss/ Svcr Servicer Loans Default Potential Loss Weighted FirstTime Minority UnderServed FINAL Increased ID * Name Scored Rate Score Score Total Score Homeowner Homeowner Area SCORE Incentives High Volume MUL1 BANK OF AMERICA 240,318 0.059 -0.727 -0.530 0 -0.025 0 -0.555 Yes MUL6 WELLS FARGO 656,303 -0.005 -0.503 -0.379 0 -0.025 -0.025 -0.429 Yes MUL5 HOMESIDE LENDING 439,502 -0.136 -0.384 -0.322 0 -0.025 -0.025 -0.372 No 75640 PRINCIPAL RESIDENTIAL MORTGAGE 191,398 -0.122 -0.361 -0.301 0 0 0 -0.301 No 77396 FIRST NATIONWIDE MORTGAGE COR 211,449 -0.125 -0.227 -0.201 -0.025 -0.05 -0.025 -0.301 No 64141 COUNTRYWIDE HOME LOANS INC 491,029 -0.075 -0.243 -0.201 0 -0.05 -0.025 -0.276 No 39276 MIDLAND MORTGAGE CO 266,458 0.521 -0.286 -0.085 0 -0.05 -0.05 -0.185 No 73815 BANK UNITED 117,179 0.039 -0.120 -0.080 0 -0.025 -0.025 -0.130 No 68013 ATLANTIC MORTGAGE AND INVESTM 155,832 -0.032 -0.104 -0.086 0 0 -0.025 -0.111 No MUL3 FLEET MORTGAGE 319,862 -0.258 0.137 0.038 0 -0.025 -0.025 -0.012 No MUL2 CHASE MORTGAGE 597,276 -0.018 0.096 0.068 0 -0.05 -0.025 -0.007 No 38092 NATIONAL CITY MORTGAGE CO 105,256 -0.236 0.142 0.048 0 -0.025 -0.025 -0.002 No MUL4 GMAC MORTGAGE 136,099 -0.057 0.211 0.144 0 -0.025 -0.025 0.094 No 12621 PNC MORTGAGE CORP OF AMERICA 102,937 0.082 0.222 0.187 0 -0.025 -0.025 0.137 No 10757 AURORA LOAN -

Download (Pdf)

THIS COMPILATION IS DERIVED LARGELY FROM SECONDARY SOURCES. NOT AN OFFICIAL REPORT OF CHANGES IN THE BANKING STRUCTURE.' NOT FOR PUBLICATION BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM L. 4.5 October 22, 1962 CHANGES IN STATUS OF BANKS AND BRANCHES DURING SEPTEMBER 1962 Class Date of MAP ? ae and location of banks and branches of bank change New Banks (Except successions and conversions) First State Bank Lake Village, Ark. Ins. non. 9-19-62 Chicot County First National Bank Fresno, Calif. National 9-14-62 Fresno County- Colfax National Bank Denver, Colo. National 9-24-62 Denver County Republic National Bank Pueblo, Colo. National 9- 4-62 Pueblo County Bank of Commerce Fort Lauderdale, Fla. Ins. non. 9-11-62 Broward County First National Bank of North Broward County- Lighthouse Point, Fla. National 9- 4-62 Broward County Trail National Bank P. 0. Sarasota, Fla. National 9-26-62 Manatee County Hampshire National Bank South Hadley, Mass. National 9- 4-62 Hampshire County Troy National Bank Troy, Mich. National 9-20-62 Oakland County Grant Square Bank & Trust Co. Oklahoma City, Okla. Ins. non. 9-24-62 Oklahoma County First National Bank Owasso, Okla. National 9- 8-62 Tulsa County Bassett National Bank El Paso, Tex. National 9-27-62 El Paso County Coronado State Bank El Paso, Tex. Ins. non. 9- 4-62 El Paso County Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Class Date of Name and location of banks and "branches of bank change New Banks (Cont'd) ' (Except successions and conversions) Wolfforth State Bank Wolfforth, Tex. -

Download (Pdf)

STATISTICAL SUPPLEMENT to the 1966 Annual Report The Administrator of National Banks William B. Camp Comptroller of the Currency THE UNITED STATES TREASURY, WASHINGTON Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis U.S. GOVERNMENT PRINTING OFFICE WASHINGTON : 1967 For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, D.C. 20402 - Price $1.25 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis TREASURY DEPARTMENT, OFFICE OF THE COMPTROLLER OF THE CURRENCY, Washington, D.C., September 1,1967. SIRS: I am pleased to submit the Statistical Supplement to the 1966 Annual Report of the Comptroller of the Currency. Respectfully, WILLIAM B. CAMP, Comptroller of the Currency. THE PRESIDENT OF THE SENATE THE SPEAKER OF THE HOUSE OF REPRESENTATIVES Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Contents Title of Section Page I. The National Banking System in 1966 2 A. Assets, Liabilities, and Capital Accounts 3 B. Income and Expenses of National Banks 3 C. Structural Changes in the National Banking System 4 II. Financial Operations of the Office of the Comptroller of the Currency, 1966 16 Appendices A. Merger Decisions, 1966 22 B. Statistical Tables 116 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis I. The National Banking System In 1966 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis INDEX Statistical Tables Table No. Title Page Table No. Title Page 1 Assets, liabilities, and capital of National banks, 1965 6 Branches of National banks: in operation December and 1966. -

FDIC Institution Listing ACTIVE AS of 3/25/2013

FDIC Institution Listing ACTIVE AS OF 3/25/2013 ‐ FOR UPDATES SEE SOURCE URL (below) Source: http://www2.fdic.gov/idasp/main.asp NAME ADDRESS CITY STATE ZIP WEBADDR 1st Advantage Bank 240 Salt Lick Road Saint Peters MO 63376 http://www.1stadvantagebank.com:80/ 1st Bank 120 Second Street, N.W. Sidney MT 59270 http://www.our1stbank.com:80/ 1st Bank & Trust 710 South Park Drive Broken Bow OK 74728 http://www.1stbankandtrust.com:80/ 1st Bank of Sea Isle City 4301 Landis Avenue Sea Isle City NJ 08243 http://www.1stbankseaisle.com:80/ 1st Bank of Troy 212 South Main Street Troy KS 66087 https://secure.fbtroyks.com 1st Bank Yuma 2799 South 4th Avenue Yuma AZ 85364 http://www.1stbankyuma.com:80/ 1st Cameron State Bank 124 South Walnut Cameron MO 64429 http://www.1stcameron.com:80/ 1st Capital Bank 5 Harris Court, Building N, Suite #3 Monterey CA 93940 http://www.1stcapitalbank.com:80/ 1st Century Bank, National Association 1875 Century Park East, Suite 1400 Los Angeles CA 90067 http://www.1cbank.com:80/ 1st Colonial Community Bank 1040 Haddon Avenue Collingswood NJ 08108 http://www.1stcolonial.com:80/ 1st Commerce Bank 5135 Camino Al Norte, Suite 4 North Las Vegas NV 89031 http://www.1stcommercebank.com:80/ 1st Community Bank 407 Third Street Sherrard IL 61281 http://www.1stcommunitybanks.com:80/ 1st Constitution Bank 2650 Route 130 Cranbury NJ 08512 http://www.1stconstitution.com:80/ 1st Enterprise Bank 818 West Seventh Street, Suite 220 Los Angeles CA 90017 http://www.1stenterprisebank.com:80/ 1st Equity Bank 3956 West Dempster Street Skokie IL 60076 1st Equity Bank Northwest 1330 Dundee Road Buffalo Grove IL 60089 1st Financial Bank USA 331 North Dakota Dunes Boulevard Dakota Dunes SD 57049 http://www.1fbusa.com:80/ 1st Manatee Bank 12215 Us Highway 301 N Parrish FL 34219 http://www.1stmanatee.com:80/ 1st National Bank 730 East Main Street Lebanon OH 45036 http://www.bankwith1st.com:80/ 1st National Bank of South Florida 1550 North Krome Avenue Homestead FL 33030 http://www.1stnatbank.com:80/ 1st National Community Bank 16924 St. -

Occ), 2012-2013

Description of document: FOIA Logs for The Office of The Comptroller of the Currency (OCC), 2012-2013 Request date: 01-April-2013 Released date: 10-June-2013 Posted date: 01-June-2015 Source of document: Freedom of Information Act Officer Disclosure Services, Communications Division Office of the Comptroller of the Currency 400 7th Street, SW Washington, DC 20219 The governmentattic.org web site (“the site”) is noncommercial and free to the public. The site and materials made available on the site, such as this file, are for reference only. The governmentattic.org web site and its principals have made every effort to make this information as complete and as accurate as possible, however, there may be mistakes and omissions, both typographical and in content. The governmentattic.org web site and its principals shall have neither liability nor responsibility to any person or entity with respect to any loss or damage caused, or alleged to have been caused, directly or indirectly, by the information provided on the governmentattic.org web site or in this file. The public records published on the site were obtained from government agencies using proper legal channels. Each document is identified as to the source. Any concerns about the contents of the site should be directed to the agency originating the document in question. GovernmentAttic.org is not responsible for the contents of documents published on the website. June 10, 2013 This is in response to your Freedom of Information Act request dated April 1, 2013, received in my office on April 5, 2013. You requested a copy of the OCC FOIA case log from October 1, 2012 to the present. -

H.2 Actions of the Board, Its Staff, and The

ANNOUNCEMENT BT BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM H.2, 1987, No. 18 Actions of the Board Applications and Reports Received Daring the Week Ending May 2, 1987 ACTIONS OF THE BOARD Statement by Chairman Volcker before the Subcommittee on General Oversight and Investigations of the House Committee on Banking, Finance and Urban Affairs, concerning the joint proposal of the U.S. federal banking agencies and the Bank of England for the establishment of a risk-based capital framework, April 30, 1987. Boston Granite Bank, Amherst, New Hampshire — proposed acquisition of assets and assumption of deposit liabilities of the Amherst, New Hampshire, branch of Amoskeag Bank, Manchester, New Hampshire — report to the Federal Deposit Insurance Corporation on competitive factors. 1/ Philadelphia Union Bancorp, Pottsville, Pennsylvania — extension for three months to acquire Union Bank and Trust Company. 1/ Philadelphia Liberty State Bank, Mount Carmel, Pennsylvania — extension for one year to establish a branch at Elysburg, Pennsylvania. 1/ Richmond Maryland National Corporation, Baltimore, Maryland — extension to August 4, .1987, to acquire Maryland National Bank/D.C., Washington, D.C., a de novo bank. 1/ Atlanta North Georgia Bancshares, Inc., Canton, Georgia — extension to July 21, 1987, to comply with a commitment in connection with its acquisition of North Georgia Bank. 1/ 1/ Application processed on behalf of the Board of Governors under delegated authority. Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis H.2, 1987, No. 18 2 ACTIONS OF THE BOARD - Continued Atlanta Community Bankshares, Inc. Cornelia, Georgia — extension to July 20, 1987, to engage in insurance activities through Community Insurance Agency.