UTI-Fixed Term Income Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NATIONAL AWARDS JNANPITH AWARD Year Name Language

NATIONAL AWARDS JNANPITH AWARD he Jnanpith Award, instituted on May 22, 1961, is given for the best creative literary T writing by any Indian citizen in any of the languages included in the VIII schedule of the Constitution of India. From 1982 the award is being given for overall contribution to literature. The award carries a cash price of Rs 2.5 lakh, a citation and a bronze replica of Vagdevi. The first award was given in 1965 . Year Name Language Name of the Work 1965 Shankara Kurup Malayalam Odakkuzhal 1966 Tara Shankar Bandopadhyaya Bengali Ganadevta 1967 Dr. K.V. Puttappa Kannada Sri Ramayana Darshan 1967 Uma Shankar Joshi Gujarati Nishitha 1968 Sumitra Nandan Pant Hindi Chidambara 1969 Firaq Garakpuri Urdu Gul-e-Naghma 1970 Viswanadha Satyanarayana Telugu Ramayana Kalpavrikshamu 1971 Bishnu Dey Bengali Smriti Satta Bhavishyat 1972 Ramdhari Singh Dinakar Hindi Uravasi 1973 Dattatreya Ramachandran Kannada Nakutanti Bendre 1973 Gopinath Mohanty Oriya Mattimatal 1974 Vishnu Sankaram Khanldekar Marathi Yayati 1975 P.V. Akhilandam Tamil Chittrappavai 1976 Asha Purna Devi Bengali Pratham Pratisruti 1977 Kota Shivarama Karanth Kannada Mukajjiya Kanasugalu 1978 S.H. Ajneya Hindi Kitni Navon mein Kitni Bar 1979 Birendra Kumar Bhattacharya Assamese Mrityunjay 1980 S.K. Pottekkat Malayalam Oru Desattinte Katha 1981 Mrs. Amrita Pritam Punjabi Kagaz te Canvas 1982 Mahadevi Varma Hindi Yama 1983 Masti Venkatesa Iyengar Kannada Chikka Veera Rajendra 1984 Takazhi Siva Shankar Pillai Malayalam 1985 Pannalal Patel Gujarati 1986 Sachidanand Rout Roy Oriya 1987 Vishnu Vaman Shirwadkar Kusumagraj 1988 Dr. C. Narayana Reddy Telugu Vishwambhara 1989 Qurratulain Hyder Urdu 1990 Prof. Vinayak Kishan Gokak Kannada Bharatha Sindhu Rashmi Year Name Language Name of the Work 1991 Subhas Mukhopadhyay Bengali 1992 Naresh Mehta Hindi 1993 Sitakant Mohapatra Oriya 1994 Prof. -

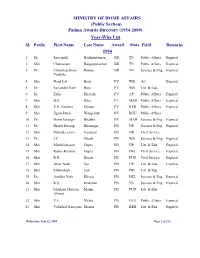

(Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl

MINISTRY OF HOME AFFAIRS (Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl. Prefix First Name Last Name Award State Field Remarks 1954 1 Dr. Sarvapalli Radhakrishnan BR TN Public Affairs Expired 2 Shri Chakravarti Rajagopalachari BR TN Public Affairs Expired 3 Dr. Chandrasekhara Raman BR TN Science & Eng. Expired Venkata 4 Shri Nand Lal Bose PV WB Art Expired 5 Dr. Satyendra Nath Bose PV WB Litt. & Edu. 6 Dr. Zakir Hussain PV AP Public Affairs Expired 7 Shri B.G. Kher PV MAH Public Affairs Expired 8 Shri V.K. Krishna Menon PV KER Public Affairs Expired 9 Shri Jigme Dorji Wangchuk PV BHU Public Affairs 10 Dr. Homi Jehangir Bhabha PB MAH Science & Eng. Expired 11 Dr. Shanti Swarup Bhatnagar PB UP Science & Eng. Expired 12 Shri Mahadeva Iyer Ganapati PB OR Civil Service 13 Dr. J.C. Ghosh PB WB Science & Eng. Expired 14 Shri Maithilisharan Gupta PB UP Litt. & Edu. Expired 15 Shri Radha Krishan Gupta PB DEL Civil Service Expired 16 Shri R.R. Handa PB PUN Civil Service Expired 17 Shri Amar Nath Jha PB UP Litt. & Edu. Expired 18 Shri Malihabadi Josh PB DEL Litt. & Edu. 19 Dr. Ajudhia Nath Khosla PB DEL Science & Eng. Expired 20 Shri K.S. Krishnan PB TN Science & Eng. Expired 21 Shri Moulana Hussain Madni PB PUN Litt. & Edu. Ahmed 22 Shri V.L. Mehta PB GUJ Public Affairs Expired 23 Shri Vallathol Narayana Menon PB KER Litt. & Edu. Expired Wednesday, July 22, 2009 Page 1 of 133 Sl. Prefix First Name Last Name Award State Field Remarks 24 Dr. -

History and Political Science

The Coordination Committee formed by GR No. Abhyas - 2116/(Pra.Kra.43/16) SD - 4 Dated 25.4.2016 has given approval to prescribe this textbook in its meeting held on 29.12.2017 and it has been decided to implement it from the educational year 2018-19. HISTORY AND POLITICAL SCIENCE STANDARD TEN Maharashtra State Bureau of Textbook Production and Curriculum Research, Pune. The digital textbook can be obtained through DIKSHA App on a smartphone by using the Q. R. Code given on title page of the textbook and useful audio-visual teaching-learning material of the relevant lesson will be available through the Q. R. Code given in each lesson of this textbook. First Edition : 2018 © Maharashtra State Bureau of Textbook Production and Curriculum Reprint : Research, Pune - 411 004. The Maharashtra State Bureau of Textbook Production and Curriculum Research reserves October 2020 all rights relating to the book. No part of this book should be reproduced without the written permission of the Director, Maharashtra State Bureau of Textbook Production and Curriculum Research, ‘Balbharati’, Senapati Bapat Marg, Pune 411004. History Subject Committee Authors History Political Science Dr Sadanand More, Chairman Dr Shubhangana Atre Dr Vaibhavi Palsule Shri. Mohan Shete, Member Dr Ganesh Raut Shri. Pandurang Balkawade, Member Dr Shubhangana Atre, Member Translation Scrutiny Dr Somnath Rode, Member Shri. Bapusaheb Shinde, Member Dr Shubhangana Atre Dr Manjiri Bhalerao Dr Vaibhavi Palsule Dr Sanjot Apte Shri. Balkrishna Chopde, Member Shri. Prashant Sarudkar, Member Cover and Illustrations Shri. Mogal Jadhav, Member-Secretary Shri. Devdatta Prakash Balkawade Typesetting Civics Subject Committee DTP Section, Balbharati Dr Shrikant Paranjape, Chairman Paper Prof. -

DEPT. of MARATHI Syllabus for P.G. in Marathi

RANI CHANNAMMA UNIVERSITY, BELAGAVI DEPT. OF MARATHI Syllabus for P.G. in Marathi (As per CBCS Guidelines) From the academic year 2020-21 to 2021-22 onwards … Revised syllabus for M.A. in Marathi for I to IV Semester under CBCS system from the academic year 2020-21 to 2021-22 onwords… Semester – I Paper 1.1 Madhyayugin Marathi : Gadya/Padya Objectives 1. Pracheen Marathi wangmayacha parichay karun ghene 2. Marathi sahityachi poorpeethika samjun ghene 3. Pracheen Marathi Granthakaranchi olakh karun ghene Topics/Units 1. Madhyayugin Bhakti sampradaya 2. Madhyayugin wangmaya 3. Mahanubhav panth 4. Mahanubhav panthacha achardharm ani tatvavichar 5. Mahandamba Text Books 1. Mahandambeche Dhawale (Padya)- Dr. Suhasini Irlekar, Snehavardhan Prakashan, Pune Practical 1. Hastalikhitanche swaroop pahun lekhan karane 2. Handibhadanganath ani belemath Aadi pracheen mathana bhet dene. Reference Books 1. Mahanubhav Panth ani tyanche wangmaya-S.G.Tulpule, Venus Prakashan, Pune. 2. Mahanubhav Sahitya- Sourabh – Dr. Ramesh Awalgaonkar Sarvadnya Veedyapeeth Prakashan, Pune 3. Mahanubhav Sanshodhan –V.B.Kolate, Arun Prakashan, Malkapur. 4. Mahanubhavancha achardharma - V.B.Kolate, Arun Prakashan, Malkapur. 5. Paanch Bhaktisampraday –R.R.Gosavi Moghe, Prakashan, Kolhapur 6. Pracheen Marathi Wangmayacha Itihaas-A.N.Deshpande, Venus Prakashan Pune 7. Madhyayugin Marathi Sahityavishayi-Dr. Satish Badave, Meera Books & Publications, Aurangabad. 8. Mahadamba: Adya Marathi Kavayitri-V.N. Deshpande, Continental Prakashan, Pune 9. Mahadambeche Dhavale:Sahitya ani Sameeksha-Madan Kulkarni, Piplapure Prakashan,Nagpur Paper 1.2 Streevadi Sahitya Objectives 1. Streevadi sahityachi olakh karun ghene 2. Marathitil streevadi sahityacha parchaya ghene 3. Streevadi sahityache yogadan abhyasane Topics/Units 1. Streevadi Sahitya : Sankalpana ani swaroop 2. Streevadi Sahityachi Chalawal 3. -

217 Semester – II

NAAC ACCREDITED Reference Material for Three Years Bachelor of English (Hons.) Code : 217 Semester – II DISCLAIMER :FIMT, ND has exercised due care and caution in collecting the data before publishing tis Reference Material. In spite of this ,if any omission,inaccuracy or any other error occurs with regards to the data contained in this reference material, FIMT, ND will not be held responsible or liable. COPYRIGHT FIMT 2020 Page 1 BA ENGLISH (HON) SEM IV PAPER CODE 202 LITERARY CRITICISM Q1. What are Aristotle's views on mimesis? Ans: Mimesis is a Greek term that means imitation. The first step in understanding Aristotle's account of mimesis is remembering that he spent many years studying at Plato's Academy. In Platonic thought, the things we encounter via our senses, the phenomena, are imitations of ideal forms. Art (whether poetry or painting), in imitating the phenomena, is thus merely an imitation of an imitation. Plato also divides imitation by medium (words, paint, marble, etc.). He further divides the verbal techniques of imitation into pure imitation or mimesis, in which an actor impersonates a character on stage, and diegesis, or narration, in which a narrator speaks in the third person about events. Epic is a mixed form, using both impersonation and narration when performed by a rhapsode. Plato tends to condemn imitation as degrading, because (1) impersonation can inculcate bad or non-rational habits and (2) because it focuses attention on mere phenomena. Aristotle accepts the Platonic distinction between mimesis and diegesis, but finds both valuable as modes of training and educating emotions. -

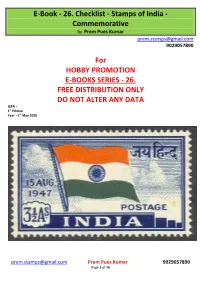

Stamps of India - Commemorative by Prem Pues Kumar [email protected] 9029057890

E-Book - 26. Checklist - Stamps of India - Commemorative By Prem Pues Kumar [email protected] 9029057890 For HOBBY PROMOTION E-BOOKS SERIES - 26. FREE DISTRIBUTION ONLY DO NOT ALTER ANY DATA ISBN - 1st Edition Year - 1st May 2020 [email protected] Prem Pues Kumar 9029057890 Page 1 of 76 Nos. YEAR PRICE NAME Mint FDC B. 1 2 3 1947 1 21-Nov-47 31/2a National Flag 2 15-Dec-47 11/2a Ashoka Lion Capital 3 15-Dec-47 12a Aircraft 1948 4 29-May-48 12a Air India International 5 15-Aug-48 11/2a Mahatma Gandhi 6 15-Aug-48 31/2a Mahatma Gandhi 7 15-Aug-48 12a Mahatma Gandhi 8 15-Aug-48 10r Mahatma Gandhi 1949 9 10-Oct-49 9 Pies 75th Anni. of Universal Postal Union 10 10-Oct-49 2a -do- 11 10-Oct-49 31/2a -do- 12 10-Oct-49 12a -do- 1950 13 26-Jan-50 2a Inauguration of Republic of India- Rejoicing crowds 14 26-Jan-50 31/2a Quill, Ink-well & Verse 15 26-Jan-50 4a Corn and plough 16 26-Jan-50 12a Charkha and cloth 1951 17 13-Jan-51 2a Geological Survey of India 18 04-Mar-51 2a First Asian Games 19 04-Mar-51 12a -do- 1952 20 01-Oct-52 9 Pies Saints and poets - Kabir 21 01-Oct-52 1a Saints and poets - Tulsidas 22 01-Oct-52 2a Saints and poets - MiraBai 23 01-Oct-52 4a Saints and poets - Surdas 24 01-Oct-52 41/2a Saints and poets - Mirza Galib 25 01-Oct-52 12a Saints and poets - Rabindranath Tagore 1953 26 16-Apr-53 2a Railway Centenary 27 02-Oct-53 2a Conquest of Everest 28 02-Oct-53 14a -do- 29 01-Nov-53 2a Telegraph Centenary 30 01-Nov-53 12a -do- 1954 31 01-Oct-54 1a Stamp Centenary - Runner, Camel and Bullock Cart 32 01-Oct-54 2a Stamp Centenary -

Kusumagraj Poems in Marathi Pdf

Kusumagraj poems in marathi pdf Continue Kusumagrai Kavita Sangra! MarathiKavitaSangrah.in is a collection of marathi poems written by famous marathi poets. You can also find Kusumagraj marathi poems (kavita). Kusumagraj – Vishnu Vaman Shirwadkar (Vishnu Vaman Shirwadkar): (Born: 27 February 1912, Died: 10 March 1999) The famous poet Marathi in Indian literature. The work of Natsamrat has an important role in Marathi literature. He was born in Pone, Maharashtra. Find out more... Name: Kusumagraj Kusumagraj Full Name: Vishnu Vaman Shirwadkar Vishnu Vaman Shirwadkar Born: February 27, 1912 Address: Pune, Maharashtra Died: March 10, 1999 (age 87) Nationality: Indian poem collections Kawyawa Sahityasuwarna Phularani Pimppan Chandanawel Rasyatra Plays Yayati Ani Dewayani Weeja Mhanali Dharateela Natas Amamrat Doorche Diwe Dashara Peshwa Waija yanti Kunteya Rajmukut Amche Naw Baburao Vidushak Ek Hoti Wahin anand Mukhyamantri Chandra Jithe Ugawat Nahi Mahant Kaikeyi Becket Reports from Wikipedia Vishnu Vaman Shirwadkar (February 27, 1912 - March 10, 1999) Will was a pioneer, writer, playwright and marathi critic. Tyanni Safmanagraj or Topnwane writing bananas. The most important and socially conscious janiv asnare marathi-like manle author. Saraswaithya Mandiratil resplendendent Ratna Ace tyanche describes. V. Khandekar Yanchiantar Marathi Literary Prize Jnanpith would be the second literary until noon. Tyancha Birthday Ha Marathi Language Day Mhunun Sajra Banana Jaato. Swatter Datawar is based Ashich Tyanchi a ajaramar kalakriti.. Pananchi Umar Gathali greetings. Mich Vinvite Hat Jomuni Wat Wakadi Dharu Naka. SuryaKulcha Aunt Warsaw dear Putrano Tumha Mihe. Kalokatse Karun Ouyan Gabaras Vrat Varu Kusumagraj – Vishnu Vaman Shirwadkar – Olakhlat ka sir mala?. Old & New Marathi Poets and Poems in Marathi Literature | See more ideas for Literatura, ेस यांचे िनधन ~ Marathi 'Marathi' Marithina Blog. -

Jnanpith Award * *

TRY -- TRUE -- TRUST NUMBER ONE SITE FOR COMPETITIVE EXAM SELF LEARNING AT ANY TIME ANY WHERE * * Jnanpith Award * * The Jnanpith Award (also spelled as Gyanpeeth Award ) is an Indian literary award presented annually by the Bharatiya Jnanpith to an author for their "outstanding contribution towards literature". Instituted in 1961, the award is bestowed only on Indian writers writing in Indian languages included in the Eighth Schedule to the Constitution of India and English Year Recipient(s) Language(s) 1965 G. Sankara Kurup Malayalam 1966 Tarasankar Bandyopadhyay Bengali Kuppali Venkatappa Puttappa Kannada 1967 Umashankar Joshi Gujarati 1968 Sumitranandan Pant Hindi 1969 Firaq Gorakhpuri Urdu 1970 Viswanatha Satyanarayana Telugu 1971 Bishnu Dey Bengali 1972 Ramdhari Singh Dinkar Hindi Dattatreya Ramachandra Bendre Kannada 1973 Gopinath Mohanty Oriya 1974 Vishnu Sakharam Khandekar Marathi 1975 P. V. Akilan Tamil 1976 Ashapoorna Devi Bengali 1977 K. Shivaram Karanth Kannada 1978 Sachchidananda Vatsyayan Hindi 1979 Birendra Kumar Bhattacharya Assamese 1980 S. K. Pottekkatt Malayalam 1981 Amrita Pritam Punjabi 1982 Mahadevi Varma Hindi 1983 Masti Venkatesha Iyengar Kannada 1984 Thakazhi Sivasankara Pillai Malayalam 1985 Pannalal Patel Gujarati www.sirssolutions.in 91+9830842272 Email: [email protected] Please Post Your Comment at Our Website PAGE And our Sirs Solutions Face book Page Page 1 of 2 TRY -- TRUE -- TRUST NUMBER ONE SITE FOR COMPETITIVE EXAM SELF LEARNING AT ANY TIME ANY WHERE * * Jnanpith Award * * Year Recipient(s) Language(s) 1986 Sachidananda Routray Oriya 1987 Vishnu Vaman Shirwadkar (Kusumagraj) Marathi 1988 C. Narayanareddy Telugu 1989 Qurratulain Hyder Urdu 1990 V. K. Gokak Kannada 1991 Subhas Mukhopadhyay Bengali 1992 Naresh Mehta Hindi 1993 Sitakant Mahapatra Oriya 1994 U. -

KEY INFORMATION MEMORANDUM UTI FOCUSED EQUITY FUND (An Open Ended Equity Scheme Investing in Maximum 30 Stocks Across Market Caps)

KEY INFORMATION MEMORANDUM UTI FOCUSED EQUITY FUND (An open ended equity scheme investing in maximum 30 stocks across market caps) THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING*: v Long term capital Growth v Investment in equity & equity related securities across market capitalization in maximum 30 stocks Product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made. * Investors should consult their financial advisers if in doubt about whether the product is suitable for them Offer of Units of Rs. 10/- each during New Fund Offer (NFO) and Continuous Offer of Units at NAV based prices New Fund Offer will not be kept open for more than 15 days New Fund Offer Opens on : Wednesday, August 4, 2021 New Fund Offer Closes on : Wednesday, August 18, 2021 Scheme Re-opens on : Thursday, August 26, 2021 This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, Key Personnel, Investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document (SID) and Statement of Additional Information (SAI) available free of cost at any of the UTI Financial Centres or distributors or from the website www.utimf.com. The scheme particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). -

UTI Medium Term Fund (An Open Ended Income Scheme with No Assured Returns)

SCHEME INFORMATION DOCUMENT UTI Medium Term Fund (An open ended income scheme with no assured returns) This Product is suitable for investors who are seeking* • Steady and reasonable income over the medium term • Investment in Debt/Money Market Instrument/Govt Securities • Riskometer _____________________________________________________________________________________________ * Investors should consult their financial advisers if in doubt about whether the product is suitable for them UTI Mutual Fund UTI Asset Management Company Limited UTI Trustee Company Private Limited Address of the Mutual Fund, AMC and Trustee Company: UTI Tower, Gn Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Website: www.utimf.com The particulars of the Scheme have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI, nor has SEBI certified the accuracy or adequacy of the Scheme Information Document (SID). This Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this Scheme Information Document after the date of this Document from the Mutual Fund / UTI Financial Centres (UFCs) / Website / Distributors or Brokers. The investors are advised to refer to the Statement of Additional Information (SAI) for details of UTI Mutual Fund, Tax and Legal issues and general information on www.utimf.com . SAI is incorporated by reference (is legally a part of the Scheme Information Document). -

THE RECORD NEWS ======The Journal of the ‘Society of Indian Record Collectors’ ------ISSN 0971-7942 Volume: Annual - TRN 2012 ------S.I.R.C

THE RECORD NEWS ============================================================= The journal of the ‘Society of Indian Record Collectors’ ------------------------------------------------------------------------ ISSN 0971-7942 Volume: Annual - TRN 2012 ------------------------------------------------------------------------ S.I.R.C. Units: Mumbai, Pune, Solapur, Nanded and Amravati ============================================================= Feature Articles: Cardboard Player Vasant Desai, Bollywood Mine, Ravi Shankar 1 ‘The Record News’ Annual magazine of ‘Society of Indian Record Collectors’ [SIRC] {Established: 1990} -------------------------------------------------------------------------------------------- President Narayan Mulani Hon. Secretary Suresh Chandvankar Hon. Treasurer Krishnaraj Merchant ==================================================== Patron Member: Mr. Michael S. Kinnear, Australia -------------------------------------------------------------------------------------------- Honorary Members V. A. K. Ranga Rao, Chennai Harmandir Singh Hamraz, Kanpur -------------------------------------------------------------------------------------------- Membership Fee: [Inclusive of the journal subscription] Annual Membership Rs. 1000 Overseas US $ 100 Life Membership Rs. 10000 Overseas US $ 1000 Annual term: July to June Members joining anytime during the year, pay the full membership fee and get a digital copy of ‘The Record News’ published in that year. Life members are entitled to receive all the back issues on two data DVD’s. -

E-Newsletters, Publicity Materials Etc

DELHI SAHITYA AKADEMI TRANSLATION PRIZE PRESENTATION September 4-6, 2015, Dibrugarh ahitya Akademi organized its Translation Prize, 2014 at the Dibrugarh University premises on September 4-6, 2015. Prizes were presented on 4th, Translators’ Meet was held on 5th and Abhivyakti was held on S5th and 6th. Winners of Translation Prize with Ms. Pratibha Ray, Chief Guest, President and Secretary of Sahitya Akademi On 4th September, the first day of the event started at 5 pm at the Rang Ghar auditorium in Dibrugarh University. The Translation Prize, 2014 was held on the first day itself, where twenty four writers were awarded the Translation Prizes in the respective languages they have translated the literature into. Dr Vishwanath Prasad Tiwari, President, Sahitya Akademi, Eminent Odia writer Pratibha Ray was the chief guest, Guest of Honor Dr. Alak Kr Buragohain, Vice Chancellor, Dibrugarh University and Dr K. Sreenivasarao were present to grace the occasion. After the dignitaries addressed the gathering, the translation prizes were presented to the respective winners. The twenty four awardees were felicitated by a plaque, gamocha (a piece of cloth of utmost respect in the Assamese culture) and a prize of Rs.50, 000. The names of the twenty four winners of the translation prizes are • Bipul Deori won the Translation Prize in Assamese. • Benoy Kumar Mahanta won the Translation Prize in Bengali. • Surath Narzary won the Translation Prize in Bodo. • Yashpal ‘Nirmal’ won the Translation Prize in Dogri • Padmini Rajappa won the Translation Prize in English SAHITYA AKADEMI NEW S LETTER 1 DELHI • (Late) Nagindas Jivanlal Shah won the Translation Prize in Gujarati.