December 31, 2020 Unaudited - for Information Purposes Only

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNITED CHURCH of CHRIST, INC. SCHEDULE of INVESTMENTS March 31, 2021 Unaudited - for Information Purposes Only

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS March 31, 2021 Unaudited - for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 32,253,645 $ 32,253,645 Synthetic Guaranteed Investment Contracts Liquidity Strategy 22,775,770 22,775,770 Total Return Strategy 113,816,896 113,816,896 TOTAL STABLE VALUE INVESTMENTS $ 168,846,312 $ 168,846,312 SHORT-TERM INVESTMENTS Short-term Investments $ 99,844,082 $ 99,844,082 TOTAL SHORT-TERM INVESTMENTS $ 99,844,082 $ 99,844,082 FIXED-INCOME INVESTMENTS Bonds $ 1,100,460,107 $ 1,102,627,965 Bond funds 127,197,863 136,853,018 Asset-backed & Mortgage-backed Securities 252,260,633 255,492,647 TOTAL FIXED-INCOME INVESTMENTS $ 1,479,918,603 $ 1,494,973,630 EQUITY INVESTMENTS Common stocks and equivalents $ 948,021,079 $ 1,367,282,966 Equity funds 295,450,197 366,566,153 TOTAL EQUITY INVESTMENTS $ 1,243,471,276 $ 1,733,849,120 OTHER INVESTMENTS Hedge funds $ 92,035,561 $ 122,358,507 Real assets 107,927,936 98,977,251 Participation in the United Church Funds, Inc. 34,869,973 45,987,425 TOTAL OTHER INVESTMENTS $ 234,833,470 $ 267,323,183 TOTAL INVESTMENTS $ 3,226,913,743 $ 3,764,836,327 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 32,253,645 $ 32,253,645 TOTAL SHORT-TERM INVESTMENT $ 32,253,645 $ 32,253,645 SYNTHETIC GUARANTEED INVESTMENT CONTRACTS- LIQUIDITY STRATEGY: Asset-Backed Securities 801,908 AEP Texas Inc. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

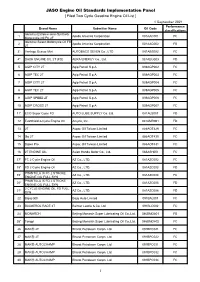

JASO Engine Oil Standards Implementation Panel

JASO Engine Oil Standards Implementation Panel [ Filed Two Cycle Gasoline Engine Oil List ] 1 September 2021 Performance Brand Name Submitter Name Oil Code classifications Idemitsu Extreme semi-Synthetic 1 Apollo America Corporation 001AAC001 FC Motorcycle Oil FC 2T Idemitsu Select Motorcycle Oil FB 2 Apollo America Corporation 001AAC002 FB 2T 3* Vantage Beaver Mini AUTOBACS SEVEN Co., LTD 081ABS002 FC 4* DASH ENGINE OIL 2T (FD) AERA ENERGY Co., Ltd. 081AEG003 FD 5 AGIP CITY 2T Agip Petroil S.p.A. 039AGP002 FC 6 AGIP TEC 2T Agip Petroil S.p.A. 039AGP003 FC 7 AGIP CITY 2T Agip Petroil S.p.A. 039AGP004 FC 8 AGIP TEC 2T Agip Petroil S.p.A. 039AGP005 FC 9 AGIP SPEED 2T Agip Petroil S.p.A. 039AGP006 FC 10 AGIP CROSS 2T Agip Petroil S.p.A. 039AGP007 FC 11* ECO Super Cycle FD AUTO LUBE SUPPLY Co. Ltd. 081ALS001 FD 12 EvoShield 2-Cycle Engine Oil Amyris, Inc. 001AMR001 FD 13 2T Aspac Oil Taiwan Limited 886AOT429 FC 14 Go 2T Aspac Oil Taiwan Limited 886AOT430 FC 15 Super Pro Aspac Oil Taiwan Limited 886AOT431 FC 16 2T ENGINE OIL Asian Honda Motor Co., Ltd. 066ASH001 FC 17* FC 2 Cycle Engine Oil AZ Co., LTD. 081AZC002 FC 18* FD 2 Cycle Engine Oil AZ Co., LTD. 081AZC003 FD PHANTULA IX FC 2 STROKE 19* AZ Co., LTD. 081AZC004 FC ENGINE OIL FULL SYN PHANTULA IX FD 2 STROKE 20* AZ Co., LTD. 081AZC005 FD ENGINE OIL FULL SYN 2 CYCLE ENGINE OIL FD FULL 21* AZ Co., LTD. 081AZC006 FD SYN 22 Bajaj GDI Bajaj Auto Limited 091BAL001 FC 23 BALMEROL RACE 2T Balmer Lawrie & Co. -

Report of Independent Registered Public Accounting Firm to The

Report of Independent Registered Public Accounting Firm To the Board of Trustees of Thrivent Mutual Funds and Shareholders of Thrivent Aggressive Allocation Fund, Thrivent Balanced Income Plus Fund, Thrivent Global Stock Fund, Thrivent High Yield Fund, Thrivent Income Fund, Thrivent International Allocation Fund, Thrivent Limited Maturity Bond Fund, Thrivent Moderate Allocation Fund, Thrivent Moderately Aggressive Allocation Fund, Thrivent Moderately Conservative Allocation Fund, Thrivent Municipal Bond Fund and Thrivent Opportunity Income Plus Fund Opinions on the Financial Statements We have audited the accompanying statements of assets and liabilities, including the summary schedules of investments, of Thrivent Aggressive Allocation Fund, Thrivent Balanced Income Plus Fund, Thrivent Global Stock Fund, Thrivent High Yield Fund, Thrivent Income Fund, Thrivent International Allocation Fund, Thrivent Limited Maturity Bond Fund, Thrivent Moderate Allocation Fund, Thrivent Moderately Aggressive Allocation Fund, Thrivent Moderately Conservative Allocation Fund, Thrivent Municipal Bond Fund and Thrivent Opportunity Income Plus Fund (twelve of the funds constituting Thrivent Mutual Funds, hereafter collectively referred to as the "Funds") as of October 31, 2020, the related statements of operations for the year ended October 31, 2020, the statements of changes in net assets for each of the two years in the period ended October 31, 2020, including the related notes, and the financial highlights for each of the five years in the period ended -

Husqvarna Annual Report 2015

Annual Report 2015 R e s p e c t i n g n a t u r e – c a r i n g f o r p e o p l e The year and operations Board of Directors’ Report Financial statements Other information Husqvarna Group in brief A global leading producer of outdoor power products Husqvarna Group is a global leading producer of outdoor power products for forest, park and garden care. Products include chainsaws, trimmers, robotic lawn mowers and ride-on lawn mowers. The Group is also the European leader in garden watering products and a global leader in cutting equipment and diamond tools for the construction and stone industries. The Group’s products and solutions are sold under brands including Husqvarna, Gardena, McCulloch, Poulan Pro, Weed Eater, Flymo, Zenoah and Diamant Boart via dealers and retailers to consumers and professionals in more than 100 countries. Net sales in 2015 amounted to SEK 36bn and the Group has more than 13,000 employees in 40 countries. Divisions Husqvarna Gardena A global leader with a broad and innovative Share of Group A European leader in garden watering and Share of Group range of premium outdoor products such as net sales hand tools. The leadership position is built net sales chainsaws, trimmers and mowers for forest, park on offering innovative products based on and garden care. Products are sold to profession- consumer insight driven design and a strong als and demanding consumers through servicing 49% brand recognition among the passionate 13% dealers in more than 100 countries. Brands gardeners. -

Power Lawn & Garden Equipment

INDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS CLICK TO VIEW Table of Contents 2 List of Tables & Charts 3 Study Overview 4 Sample Text, Table & Chart 5 Sample Profile, Table & Study Coverage 6 Order Form & Corporate Use License 7 About Freedonia, Custom Research, Related Studies 8 Power Lawn & Garden Equipment Industry Study with Forecasts for 2019 & 2024 Study #3340 | December 2015 | $5300 | 341 pages The Freedonia Group 767 Beta Drive Cleveland, OH • 44143-2326 • USA www.freedoniagroup.com Toll Free US Tel: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 Email: [email protected] Study #3340 December 2015 $5300 Power Lawn & Garden Equipment 341 Pages Industry Study with Forecasts for 2019 & 2024 Table of Contents Walk Behind .........................................................84 Research & Product Development ......................187 Self-Propelled ..................................................87 Manufacturing ........................................................188 EXECUTIVE SUMMARY Push ..................................................................87 Marketing ................................................................191 Robotic .............................................................88 Distribution .............................................................194 MARKET ENVIRONMENT Foreign Trade .......................................................89 Residential Distribution Channels ...................195 Turf & Grounds Equipment ....................................92 -

1832 , 15/01/2018 Class 44 1948972 12/04/2010 Trading As

Trade Marks Journal No: 1832 , 15/01/2018 Class 44 1948972 12/04/2010 PANKAJ SHARMA trading as ;REFLECTION BEAUTY PARLOUR FF-1 IST FLOOR CENTREAL MARKET SHIPRA SUN CITY INDRAPURAM GHAZIABAD U.P SERVICES PROVIDER INDIAN Address for service in India/Attorney address: GOOD DEAL CONSULTANTS 334A/4, IST FLOOR GOVINDPURI KALKAJI NEW DELHI Used Since :11/11/2005 DELHI HAIR DRESSING SALOON, BEAUTY SALOON, HAIR IMPLANTATION, BATH & SPA AND SERVICES INCLUDED IN CLASS 42 5650 Trade Marks Journal No: 1832 , 15/01/2018 Class 44 ITS ALL ABOUT SMILES 2021870 13/09/2010 SURBHI MALHOTRA C-7 FIRST FLOOR SECTOR-40 NOIDA 201301 SERVICE PROVIDER Address for service in India/Attorney address: AUXILIUM PARTNERS APARTMENT NO.644 NEW ASHIANA APARTMENTS SECTOR-6 DWARK NEW DELHI-110075 Proposed to be Used DELHI DENTISTRY SERVICES. REGISTRATION OF THIS TRADE MARK SHALL GIVE NO RIGHT TO THE EXCLUSIVE USE OF THE.ITS ALL ABOUT SMILES. 5651 Trade Marks Journal No: 1832 , 15/01/2018 Class 44 2033796 06/10/2010 CHALASANY HOSPITALS PVT LTD trading as ;CHALASANY HOSPITALS PVT LTD 50-53-14, GURUDWARA LANE, SEETHAMMADHARA, VISAKHAPATNAM - 530 013, A.P SERVICE PROVIDING A COMPANY INCORPORATED UNDER THE INDIAN COMPANIES ACT. Address for service in India/Agents address: V. VEERARAGHAVAN, ADVOCATE. NO.10, SECOND MAIN ROAD, C. I. T. COLONY, MYLAPORE, MADRAS - 600 004. Used Since :01/06/1990 CHENNAI ALL TYPES OF MEDICAL SERVICES, BASIC HOSPITAL SERVICES AND DIAGNOSTIC SERVICES No exclusive right over NRI Hospital separately except as substantially shown in the representation of the mark. 5652 Trade Marks Journal No: 1832 , 15/01/2018 Class 44 INFINITY CONCIOUSNESS HEALING 2087845 21/01/2011 SATISH KUMAR SAINI 23/29 - C, MOTI NAGAR, THIRD FLOOR, NEW DELHI - 110015 SERVICES Address for service in India/Attorney address: TYAGI CERTIFICATIONS SERVICES PVT. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

Journal 2376

PATENTS OFFICE JOURNAL IRISLEABHAR OIFIG NA bPAITINNÍ Iml. 94 Cill Chainnigh 09 January 2019 Uimh. 2376 CLÁR INNSTE Cuid I Cuid II Paitinní Trádmharcanna Leath Leath Applications for Patents 2 Applications for Trade Marks 2 Applications Published 7 Oppositions under Section 43 43 Patents Granted 8 Application(s) Amended 43 European Patents Granted 9 Application(s) Withdrawn 44 Applications Withdrawn, Deemed Withdrawn or Trade Marks Registered 44 Refused 179 Trade Marks Renewed 45 Applications Lapsed 180 Merger of Separate Trade Mark Registrations 47 Request for Grant of Supplementary Protection Surrender of Registered Trade Mark(s) 48 Certificate 181 Trade Mark(s) Restored 48 Supplementary Protection Certificate Granted 181 International Registrations under the Madrid Supplementary Protection Certificate Withdrawn 183 Protocol 49 Supplementary Protection Certificate Rejected 184 International Trade Marks Protected 68 Cancellations effected under the Madrid Protocol 68 Errata 68 Dearachtaí Designs Information under the 2001 Act Designs Registered 185 Designs Renewed 216 The Patents Office Journal is published fortnightly by the Irish Patents Office. Each issue is freely available to view or download from our website at www.patentsoffice.ie © Government of Ireland, 2019 © Rialtas na hÉireann, 2019 (09/01/2019) Patents Office Journal (No. 2376) 1 Patents Office Journal Irisleabhar Oifig Na bPaitinní Cuid I Paitinní agus Dearachtaí No. 2376 Wednesday, 9 January, 2019 NOTE: The office does not guarantee the accuracy of its publications nor undertake any responsibility for errors or omissions or their consequences. In this Part of the Journal, a reference to a section is to a section of the Patents Act, 1992 unless otherwise stated. -

Mizuho BK Custody and Proxy Board Lot Size List FEB 2 , 2021 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730

Mizuho BK Custody and Proxy Board Lot Size List FEB 2 , 2021 Board Lot Stock Name (in Alphabetical Order) ISIN Code QUICK Code Size 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730000 7777 4CS HOLDINGS CO.,LTD. 100 JP3163300001 3726 A DOT CO.,LTD 100 JP3160590000 7063 A-ONE SEIMITSU INC. 100 JP3160660001 6156 A.D.WORKS GROUP CO.,LTD. 100 JP3160560003 2982 A&A MATERIAL CORPORATION 100 JP3119800005 5391 A&D COMPANY,LIMITED 100 JP3160130005 7745 ABALANCE CORPORATION 100 JP3969530009 3856 ABC-MART,INC. 100 JP3152740001 2670 ABHOTEL CO.,LTD. 100 JP3160610006 6565 ABIST CO.,LTD. 100 JP3122480001 6087 ACCESS CO.,LTD. 100 JP3108060009 4813 ACCESS GROUP HOLDINGS CO.,LTD. 100 JP3108190004 7042 ACCRETE INC. 100 JP3108180005 4395 ACHILLES CORPORATION 100 JP3108000005 5142 ACMOS INC. 100 JP3108100003 6888 ACOM CO.,LTD. 100 JP3108600002 8572 ACRODEA,INC. 100 JP3108120001 3823 ACTCALL INC. 100 JP3108140009 6064 ACTIVIA PROPERTIES INC. 1 JP3047490002 3279 AD-SOL NISSIN CORPORATION 100 JP3122030004 3837 ADASTRIA CO.,LTD. 100 JP3856000009 2685 ADEKA CORPORATION 100 JP3114800000 4401 ADISH CO.,LTD. 100 JP3121500007 7093 ADJUVANT COSME JAPAN CO.,LTD. 100 JP3119620007 4929 ADTEC PLASMA TECHNOLOGY CO.,LTD. 100 JP3122010006 6668 ADVAN CO.,LTD. 100 JP3121950004 7463 ADVANCE CREATE CO.,LTD. 100 JP3122100005 8798 ADVANCE RESIDENCE INVESTMENT CORPORATION 1 JP3047160001 3269 ADVANCED MEDIA,INC. 100 JP3122150000 3773 ADVANEX INC. 100 JP3213400009 5998 ADVANTAGE RISK MANAGEMENT CO.,LTD. 100 JP3122410008 8769 ADVANTEST CORPORATION 100 JP3122400009 6857 ADVENTURE,INC. 100 JP3122380003 6030 ADWAYS INC. 100 JP3121970002 2489 AEON CO.,LTD. 100 JP3388200002 8267 AEON DELIGHT CO.,LTD. 100 JP3389700000 9787 AEON FANTASY CO.,LTD. -

Kpmgvaluationdatasourcecom

KPMGValuationDataSourceCompanyOverview No. Company No. Company No. Company 1 ”Bank ”Saint‐Petersburg” Public Joint‐Stock 46 A. O. Smith Corporation 91 Ability Opto‐Electronics Technology Co.,Ltd. Company 47 A.D.O. Group Ltd. 92 Abiomed, Inc. 2 1‐800‐FLOWERS.COM, Inc. 48 A.G. BARR p.l.c. 93 ABIST Co.,Ltd. 3 1&1 AG 49 A.P. Møller ‐ Mærsk A/S 94 ABIVAX Société Anonyme 4 10x Genomics, Inc. 50 A.S. Création Tapeten AG 95 Abko Co., Ltd. 5 11 bit studios S.A. 51 A10 Networks, Inc. 96 ABL Bio Inc. 6 111, Inc. 52 A2A S.p.A. 97 Able C&C Co., Ltd. 7 11880 Solutions AG 53 A2B Australia Limited 98 ABM Industries Incorporated 8 17 Education & Technology Group Inc. 54 AA plc 99 ABN AMRO Bank N.V. 9 1Life Healthcare, Inc. 55 AAC Technologies Holdings Inc. 100 Abnova (Taiwan) Corporation 10 1st Constitution Bancorp 56 AAG Energy Holdings Limited 101 ABO Wind AG 11 1st Source Corporation 57 AAK AB (publ.) 102 Aboitiz Equity Ventures, Inc. 12 21Vianet Group, Inc. 58 Aalberts N.V. 103 Aboitiz Power Corporation 13 22nd Century Group, Inc. 59 Aamal Company Q.P.S.C. 104 ABOV Semiconductor Co., Ltd. 14 2G Energy AG 60 AAON, Inc. 105 Abpro Bio Co., Ltd. 15 2invest AG 61 aap Implantate AG 106 Abraxas Petroleum Corporation 16 2U, Inc. 62 AAR Corp. 107 Absa Group Limited 17 3‐D Matrix, Ltd. 63 Aareal Bank AG 108 Absolute Clean Energy Public Company Limited 18 360 DigiTech, Inc. 64 Aarti Drugs Limited 109 Absolute Software Corporation 19 361 Degrees International Limited 65 Aarti Industries Limited 110 Abu Dhabi Commercial Bank PJSC 20 3D Systems Corporation 66 Aavas Financiers Limited 111 Abu Dhabi Islamic Bank PJSC 21 3i Group plc 67 AB Electrolux (publ) 112 Abu Dhabi National Oil Company for 22 3M Company 68 AB Fagerhult Distribution PJSC 23 3M India Limited 69 AB Industrivärden (publ) 113 AC Energy Corporation 24 3R Petroleum Óleo e Gás S.A. -

History Major Activities Organization

□History Land Engine Manufacturers Association (LEMA) has been established on May 1, 1948 by land engine and engine component manufactures to aim at promoting growth and technical development of the land engine industries in Japan while promoting development in the related industries as a whole. In November 1965 , the results of the activities up to that point were recognized, and the company was approved as an incorporated association. Furthermore, we participate not only in Japan but also in international activities including the United States, Europe, and China as a representative manufacturer association of Japan. In February 1999, the name was changed from “Japan Land Internal Combustion Engine Association” to “Japan Land Internal Combustion Engine Association”, and in April 2012, in accordance with the national new public interest corporation system, “General incorporated foundation” It has been reorganized as "Japan Land Internal Combustion Engine Association" and has reached the present day. □Major Activities LEMA is aiming prompted develop and improve the technology of land-based internal combustion engine industry and protect the environment, through the research and study of production, demand, trade, distribution, and technology related to land-based internal combustion engine. This activity is also contributing to economical development wealth of people life of this country and world. Environmental Protection 〇Regulatory support ●Public Interest Activities 〇Establishment and management of self-imposed standards for members