Fiscal 2017 Interim Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Transformation Strategy

Digital Transformation Strategy September 11, 2017 Mitsubishi UFJ Financial Group, Inc. This document contains forward-looking statements in regard to forecasts, targets and plans of Mitsubishi UFJ Financial Group, Inc. (“MUFG”) and its group companies (collectively, “the group”). These forward-looking statements are based on information currently available to the group and are stated here on the basis of the outlook at the time that this document was produced. In addition, in producing these statements certain assumptions (premises) have been utilized. These statements and assumptions (premises) are subjective and may prove to be incorrect and may not be realized in the future. Underlying such circumstances are a large number of risks and uncertainties. Please see other disclosure and public filings made or will be made by MUFG and the other companies comprising the group, including the latest kessantanshin, financial reports, Japanese securities reports and annual reports, for additional information regarding such risks and uncertainties. The group has no obligation or intent to update any forward-looking statements contained in this document. In addition, information on companies and other entities outside the group that is recorded in this document has been obtained from publicly available information and other sources. The accuracy and appropriateness of that information has not been verified by the group and cannot be guaranteed. The financial information used in this document was prepared in accordance with Japanese GAAP (which includes Japanese managerial accounting standards), unless otherwise stated. Japanese GAAP and U.S. GAAP, differ in certain important respects. You should consult your own professional advisers for a more complete understanding of the differences between U.S. -

Strategies of the 77 Bank, Ltd Growth Strategy

Strategies of The 77 Bank, Ltd Growth Strategy Best Consulting Bank Human Resource Development In order to become a bank that is truly supported by its customers and to establish a solid management base for the future, we have set the image of the bank we aspire to become as the following, and actively trained specialist resources. Interview 01 “Best Consulting Bank” that responds to customersʼ needs by offering the optimum solutions Striving to solve the issues of quality assurance Corporate Support Department and manpower shortage on the front line of manufacturing. Kei Akama I was assigned to Tohoku Electronics Industry Co., Ltd. with Tohoku Electronics Industry has about 1,000 employees in the headquarters in Ishinomaki City, Miyagi Prefecture for one year entire group, I was forced to be keenly aware of the issue of the under the Local Company Trainee program that started in 2018. shortage of manpower at the manufacturing front line. I believe I was assigned to the Quality Assurance Department, where I that these valuable experiences as a trainee at a local company dealt with automobile manufacturers and interacted with manu- can be utilized in my current work. I am currently working in the facturing sites to ensure the quality of automobile-related parts. Corporate Support Office, providing support mainly to custom- I was interested in the manufacturing industry, including ers in the fishery processing industry in the coastal areas of the automobiles and machinery, and I thought I had acquired some prefecture that are still on the road to recovery from the Great prior knowledge before I was transferred to the company, but I East Japan Earthquake. -

Sumitomo Mitsui Financial Group CSR Report Digest Version

Sumitomo Mitsui Financial Group CSR Report Digest version www.smfg.co.jp/english Today, Tomorrow and Beyond First,First, I wouldwould likelike toto extendextend ourour deepestdeepest sympathiessympathies andand heartfeltheartfelt condolencescondolences toto allall thosethose whowho havehave sufferedsuffered andand INDEX toto tthehe ffamiliesamilies andand ffriendsriends ooff tthosehose wwhoho ttragicallyragically llostost ttheirheir llivesives iinn thethe devastatingdevastating earthquakeearthquake andand tsunamitsunami Foreword 1 thatthat struckstruck northeasternnortheastern JapanJapan onon MarchMarch 11,11, 2011.2011. WeWe praypray forfor thethe earlyearly recoveryrecovery ofof thethe affectedaffected peoplepeople andand areas.areas. Commitment from the Top 3 A Conversation with Tadao Ando, SMFGSMFG isis dedicateddedicated toto seamlesslyseamlessly respondingresponding toto clients’clients’ needsneeds byby leveragingleveraging ourour group-widegroup-wide capabilities,capabilities, Takeshi Kunibe and Koichi Miyata What can we do now to spur the reconstruction and revitalization of Japan, offeringoffering optimaloptimal pproductsroducts aandnd sservices,ervices, aandnd eensuringnsuring tthathat eeveryvery employeeemployee andand thethe overalloverall groupgroup areare capablecapable ofof and help resolve global issues? respondingresponding ttoo tthehe challengeschallenges ooff gglobalization.lobalization. I bbelieveelieve tthathat throughthrough thesethese measures,measures, Measures to Support Reconstruction after the March 11 President -

Financial Results for the Fiscal Year Ended March 31, 2007(Non

Financial Results for the Fiscal Year ended March 31, 2007 (Non-Consolidated Data) May 11, 2007 Company Name Seven Bank, Ltd. (URL http://www.sevenbank.co.jp/ ) President: Takashi Anzai, President For inquiries: Director, Executive Officer and General Manager of Plannning Division Kensuke Futagoishi Telephone: +81-3-3211-3041 Scheduled Date of Annual Shareholders’ Meeting: June 22, 2007 Scheduled Starting Date of Dividend Payment: June 25, 2007 Scheduled Filing Date of Financial Statement Report: June 25, 2007 Special Trading Accounts: Not established. (Fractions less than 1 million yen and digits that are shown after the 1st decimal place after the decimal point (excluding the 1st place decimals) shall be truncated.) 1.Performance for Fiscal Year ending March 31, 2007 (April 1, 2006 to March 31, 2007) (1) Operating Results (The percentages show an increase or decrease from the corresponding period of the previous fiscal year.) Ordinaryt Income Ordinary Profit Current Term Net Profit Million Yen % Million Yen % Million Yen % FY 2007 75,427( 16.7 ) 25,021( 28.9 ) 12,667( 19.6 ) FY 2006 64,612( 34.7 ) 19,409( 92.6 ) 10,590( (2.3) ) Current Term Net Profit Ratio of Ratio of Current Current Term per Share Current Term Expenses to Net Profit Deposit Balance after Latent Share Net Profit to Ordinary Income per Share Adjustment(Note 1) Net Worth (Note 2) Yen Yen % % Million Yen FY 2007 10,736 . 56 - 17.0 66.8 187,836 FY 2006 8,680 . 89 - 15.8 69.9 181,770 (Reference)Investment Profit or Loss on Equity Method: -million yen for FY March 2007 -million yen for FY March 2006 (Note 1)Since there are no latent shares, nothing is stated in the “Current Term Net Profit per Share after Latent Share Adjustment.” (Note 2)Ratio of Current Expenses to Ordinary Income=Ordinary Expenditure / Ordinary Income×100 (2) Financial Position Non-Consolidated Equity Ratio Net Assets per Equity Ratio Total Assets Net Assets (Note 1) Share (Domestic Standards) (Note 2) Million Yen Million Yen % Yen % FY 2007 532,757 73,849 13.8 63,317. -

Besta Besta: Banking

What is BeSTA? BeSTA is a standard banking application developed by NTT DATA. NTT DATA will meet a wide variety of needs from financial institutions in Japan through the utilization of BeSTA, which is developing each day. BeSTA: Banking application engine for STandard Architecture Vendor free Maintain competition Neutral application for unspecified hardware vendors principles Because of its high degree of flexibility, systems of other companies can Reduce procurement BeSTA be connected. cost Multiple banks Reduce development Multiple banks can use a single piece of software. cost Plenty of functions that respond to a large number of user requirements Shrink maintenance have already been installed. cost Advanced functions Save development Flexibility: Operational functions can be set and changed flexibly by setting efforts parameters. Enable efficient Expandability: The AP structure formed by the components allows the expansion system to be easily expanded in the future. No need for reconstructuring Promising future: Continuing updates by NTT DATA ensures long- term utilization. Copyright © 2017 NTT DATA Corporation 1 Expanding BeSTA network More than 50 banks are currently using or planning to use BeSTA, the core banking software developed by NTT DATA, and the network is the largest of its kind in Japan. Regional Bank Integrated STELLA CUBE Service Center (15 banks) (9 banks) Aomori Bank Senshu Ikeda Bank Tohoku Bank Kanagawa Bank AKITA BANK TOTTORI BANK Tokyo Tomin Bank Nagano Bank Bank of Iwate San-in Godo Bank TOYAMA BANK Sendai Bank Ashikaga Bank Shikoku Bank Tajima Bank Kirayaka Bank Chiba Kogyo Bank Oita Bank FUKUHO BANK NISHI-NIPPON Hokuetsu Bank CITY BANK Fukui Bank Aichi Bank MEJAR (5 banks) Bank of Kyoto Hokkaido Bank HOKURIKU BANK Bank of Yokohama 77 Bank BeSTAcloud (10 banks) Higashi-Nippon Bank FIDEA Holdings Hokuto Bank SHONAI BANK NEXTBASE (13 banks) Aozora Bank * BeSTA package provided from Hitachi, Ltd. -

Regional Banks in Japan 2008

Regional Banks in Japan 2008 We, the 64 regional banks in Japan, have for a long time enjoyed the patronage of the people of our regions as banks that move in step with the community. Hokkaido The Hokkaido Bank The regional banks as financial institutions that have the trust of their customers, will continue to contribute to the activation of regional societies through meeting various financial needs in the regions, by enhancing financial functions such as relationship- based banking. Aomori The Aomori Bank THE MICHINOKU BANK Akita Iwate THE AKITA BANK The Bank of Iwate The Hokuto Bank THE TOHOKU BANK Yamagata THE SHONAI BANK The Yamagata Bank Miyagi The 77 Bank Niigata The Daishi Bank Fukushima The Hokuetsu Bank The Toho Bank Ishikawa Toyama The Hokkoku Bank The Hokuriku Bank THE TOYAMA BANK Tochigi Gunma The Ashikaga Bank Tottori Fukui Nagano The Gunma Bank Ibaraki The Hachijuni Bank The Joyo Bank Shimane THE TOTTORI BANK The Fukui Bank Gifu The San-in Godo Bank Kyoto Saitama The Kanto Tsukuba Bank The Ogaki Kyoritsu Bank The Musashino Bank Hyogo The Bank of Kyoto The Juroku Bank Okayama The Tajima Bank Tokyo Shiga Hiroshima The Chugoku Bank The Tokyo Tomin Bank Fukuoka Yamaguchi The Hiroshima Bank Osaka THE SHIGA BANK Chiba THE BANK OF FUKUOKA The Yamaguchi Bank The Kinki Osaka Bank Aichi The Chikuho Bank The Senshu Bank The Chiba Bank THE NISHI-NIPPON CITY BANK Kagawa The Bank of Ikeda The Chiba Kogyo Bank Saga Ehime The Hyakujushi Bank Mie THE BANK OF SAGA Oita The Iyo Bank The Mie Bank Tokushima Nara THE OITA BANK The Hyakugo Bank -

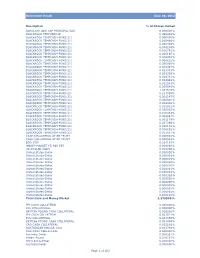

Retirement Funds June 30, 2012 Description % of Shares Owned

Retirement Funds June 30, 2012 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK FEDFUND(30) 0.440244% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000486% BLACKROCK TEMPCASH-FUND(21) 0.000485% BLACKROCK TEMPCASH-FUND(21) 0.008246% BLACKROCK TEMPCASH-FUND(21) 0.006791% BLACKROCK TEMPCASH-FUND(21) 0.005165% BLACKROCK TEMPCASH-FUND(21) 0.006043% BLACKROCK TEMPCASH-FUND(21) 0.004035% BLACKROCK TEMPCASH-FUND(21) 0.035990% BLACKROCK TEMPCASH-FUND(21) 0.020497% BLACKROCK TEMPCASH-FUND(21) 0.023343% BLACKROCK TEMPCASH-FUND(21) 0.008326% BLACKROCK TEMPCASH-FUND(21) 0.000781% BLACKROCK TEMPCASH-FUND(21) 0.004848% BLACKROCK TEMPCASH-FUND(21) 0.022593% BLACKROCK TEMPCASH-FUND(21) 0.000646% BLACKROCK TEMPCASH-FUND(21) 1.307615% BLACKROCK TEMPCASH-FUND(21) 0.214356% BLACKROCK TEMPCASH-FUND(21) 0.001147% BLACKROCK TEMPCASH-FUND(21) 0.024810% BLACKROCK TEMPCASH-FUND(21) 0.009406% BLACKROCK TEMPCASH-FUND(21) 0.018922% BLACKROCK TEMPCASH-FUND(21) 0.030062% BLACKROCK TEMPCASH-FUND(21) 0.010464% BLACKROCK TEMPCASH-FUND(21) 0.004697% BLACKROCK TEMPCASH-FUND(21) 0.001179% BLACKROCK TEMPCASH-FUND(21) 0.007266% BLACKROCK TEMPCASH-FUND(21) 0.000112% BLACKROCK TEMPCASH-FUND(21) 0.008062% BLACKROCK TEMPCASH-FUND(21) 0.011657% CASH COLLATERAL AT BR TRUST 0.000001% CASH COLLATERAL AT BR TRUST 0.000584% EOD STIF 0.024153% MONEY MARKET FD FOR EBT 0.000000% US DOLLAR CASH 0.008786% United States-Dollar 0.000000% United States-Dollar 0.000003% United States-Dollar 0.000019% United States-Dollar 0.000003% United States-Dollar -

THE 77 BANK, LTD. the 77 Bank, Ltd., Was Founded in 1878 As Japan’S 77Th National Bank

ANNUAL REPORT Prof ile Bank Data THE 77 BANK, LTD. The 77 Bank, Ltd., was founded in 1878 as Japan’s 77th national bank. Head- As of March 31, 2013 2013 quartered in Sendai—the capital of Miyagi Prefecture—the Bank is the largest in the Tohoku region, with a branch network covering the northern part of Honshu, Head Office Paid-in Capital Japan’s largest island. 3-20, Chuo 3-chome, Aoba-ku, Sendai, ¥24,658 million (US$262 million) Based on its philosophy, The 77 Bank continues to strengthen its business foun- Miyagi 980-8777, Japan Number of Stockholders Phone: +81-22-267-1111 dation and enhance its management quality in order to be the “Best creative bank” 10,260 http://www.77bank.co.jp/ that creates a new era together with the region. As of March 31, 2013, The 77 Bank Shares Outstanding Founded had capital of ¥24.7 billion, 141 domestic branches and 2,819 employees. 383,278 thousand December 1878 Major Stockholders Number of Branches Number of 141 Shares (Thousands) % Number of Employees Meiji Yasuda Life Insurance Company 18,928 4.93 2,819 The Bank of Tokyo-Mitsubishi UFJ, Ltd. 16,219 4.23 Treasury Administration & Nippon Life Insurance Company 15,431 4.02 International Division Sumitomo Life Insurance Company 15,412 4.02 Planning & Business Department Japan Trustee Services Bank, Limited (trust account) 12,726 3.32 3-20, Chuo 3-chome, Aoba-ku, Sendai, The Dai-ichi Life Insurance Company, Limited 12,275 3.20 Miyagi 980-8777, Japan The Master Trust Bank of Japan, Limited (trust account) 12,032 3.13 Phone: +81-22-211-9914 Aioi Nissay Dowa Insurance Co., Ltd. -

Aomori Bank, Ltd. Form CB Filed 2021-05-14

SECURITIES AND EXCHANGE COMMISSION FORM CB Notification form filed in connection with certain tender offers, business combinations and rights offerings, in which the subject company is a foreign private issuer of which less than 10% of its securities are held by U.S. persons Filing Date: 2021-05-14 SEC Accession No. 0000947871-21-000522 (HTML Version on secdatabase.com) SUBJECT COMPANY Aomori Bank, Ltd. Mailing Address Business Address 9-30, HASHIMOTO 1-CHOME 9-30, HASHIMOTO 1-CHOME CIK:1859034| IRS No.: 981195453 | State of Incorp.:M0 | Fiscal Year End: 0331 AOMORI M0 030-8668 AOMORI M0 030-8668 Type: CB | Act: 34 | File No.: 005-92536 | Film No.: 21921953 81-17-777-1111 FILED BY Aomori Bank, Ltd. Mailing Address Business Address 9-30, HASHIMOTO 1-CHOME 9-30, HASHIMOTO 1-CHOME CIK:1859034| IRS No.: 981195453 | State of Incorp.:M0 | Fiscal Year End: 0331 AOMORI M0 030-8668 AOMORI M0 030-8668 Type: CB 81-17-777-1111 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________ FORM CB TENDER OFFER/RIGHTS OFFERING NOTIFICATION FORM Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to file this Form: Securities Act Rule 801 (Rights Offering) o Securities Act Rule 802 (Exchange Offer) x Exchange Act Rule 13e-4(h)(8) (Issuer Tender Offer) o Exchange Act Rule 14d-1(c) (Third Party Tender Offer) o Exchange Act Rule 14e-2(d) (Subject Company Response) o Filed or submitted in paper if permitted by Regulation S-T Rule 101(b)(8) o Kabushiki Kaisha Aomori Ginko Kabushiki Kaisha Michinoku Ginko (Name of Subject Company) The Aomori Bank, Ltd. -

20110314 a History of the Maine-Aomori Connection

MAINE-AOMORI SISTER-STATE RELATIONSHIP A Brief History from the perspective of one participant Torii, beach and surf, Shariki-mura, Tsugaru-shi, Aomori-ken, site of the wreck of the Chesebrough of Bath, Maine, October 31, 1881 The Maine-Aomori link began with a shipwreck, October 31, 1889. The bark Chesebrough, out of Bath, Maine, was caught in a fierce storm off the coast of the Tsugaru Peninsula in Aomori Prefecture at the northern tip of the Japanese main island of Honshu. Powerful westerly winds drove the ship onto the shoals near the village of Shariki. The ship was destroyed, but some of the crew and passengers were saved, brought to shore and cared for by villagers, who then sought help from the Aomori government. The memory of the rescue and the enormous efforts of those who sheltered the survivors and those who made the journey for more assistance remained vivid in the isolated community through the Russo-Japanese War, World War I and World War II. As the 100th anniversary of the wreck of the Chesebrough approached, Shariki Mayor Narita and his colleagues decided to seek a sister- city relationship with the City of Bath, Maine, and to institute the Chesebrough Cup swim meet. The Chesebrough Cup combines races with the goal of accumulating a total distance equal to that of the distance between Shariki and Bath, 10,200 km. 2 From Shariki-Bath to Aomori-Maine The Shariki-Bath linkage led to efforts in Aomori and in Maine to form a sister- state relationship. Governors McKernan and Kimura signed the sister-state agreement in 1994. -

Outline of IWATE UNIVERSITY for International Students a Wide Variety of Research Topics, Made Possible by the Extensive Campus

Outline of I ATE UNIVERSITY for International Students Contact Information Support available in Japanese, English, Chinese, and Korean International Office YouTube 3-18-34 Ueda, Morioka-shi, Iwate 020-8550 Japan TEL+81-19-621-6057 / +81-19-621-6076 FAX+81-19-621-6290 E-mail: [email protected] Website Instagram Support available only in Japanese Topic Division/Office in Charge TEL E-mail General Administration and Public Relations About the university in general Division, General Administration Department 019-621-6006 [email protected] Admissions Office, About the entrance exam Student Services Department 019-621-6064 Student Support Division, Facebook About student life Student Services Department 019-621-6060 [email protected] About careers for students Career Support Division, INDEX after graduation Student Services Department 019-621-6709 [email protected] Graduation certificates for graduates and Student Services Division, 1. About Iwate University ………………………………… p.2 students who have completed their studies Student Services Department 019-621-6055 [email protected] 2. Undergraduate and Graduate Programs ………… p.4 3. Research Topics ………………………………………… p.14 Twitter 4. Types of International Students …………………… p.16 5. Support for International Students ……………… p.18 Website Iwate University Japanese English https://www.iwate-u.ac.jp/english/index.html 6. A Day in the Life of an International Student… p.20 Global Education Center Japanese English Chinese Korean https://www.iwate-u.ac.jp/iuic/ 7. Interviews with International Students ………… p.22 Researchers Database Japanese English http://univdb.iwate-u.ac.jp/openmain.jsp 8. Campus Calendar………………………………………… p.23 Questions related to the entrance exam Japanese https://www.iwate-u.ac.jp/admission/index.html WeChat (Chinese International Students Association) 9. -

Current Management Information Briefing

Strategic Business Innovator Current Management Information Briefing June 29, 2017 Yoshitaka Kitao Representative Director, President & CEO SBI Holdings, Inc. The items in this document are provided as information related to the financial results and the business strategy of the SBI Group companies and not as an invitation to invest in the stock or securities issued by each company. None of the Group companies guarantees the completeness of this document in terms of information and future business strategy. The content of this document is subject to revision or cancellation without warning. Note: Fiscal Year (“FY”) ends March 31 of the following year 1 I. SBI Group’s Financial Results for the Past Five Years II. Various Measures for the Next Generation Based on the Changes in the Business Environment 2 I. SBI Group’s Financial Results for the Past Five Years 3 Consolidated Financial Results for the Past Five Fiscal Years (IFRS) [Revenue] Historical high (JPY billion) Financial Services Asset Management 261.7 261.9 Biotechnology-related 4.0 5.5 250 245.0 232.8 2.2 2.2 91.5 80.4 200 65.8 72.7 154.3 150 1.0 33.0 100 177.0 162.6 166.2 147.8 50 113.3 0 FY2012 FY2013 FY2014 FY2015 FY2016 * Abovementioned figures are before elimination of the inter-segment transactions. Also, since there are Group companies that have been transferred from one segment to an another, the abovementioned figures reflect disclosed figures during each fiscal year, therefore, there may be some discrepancies 4 Consolidated Financial Results for the Past Five Fiscal Years (IFRS) [Profit before income tax expense] (JPY billion) Financial Services Asset Management Biotechnology-related 78 63.1 8.1 52.2 68 43.1 58 17.6 13.9 48 38.9 9.0 38 67.3 28 15.0 50.8 48.9 6.3 18 37.3 8 18.7 -2 -7.3 -6.6 -3.9 -2.4 -9.6 -12 FY2012 FY2013 FY2014 FY2015 FY2016 * Abovementioned figures include profit or loss not allocated to specific business segments and inter-segment eliminations.