Irish Continental Group Plc: Half-Yearly Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Integrated Report 2019 Welcome – Tēnā Koutou

F.18A KIWIRAIL’S EVOLUTION ANNUAL INTEGRATED REPORT 2019 WELCOME – TĒNĀ KOUTOU Rail has a long and proud history in reservation and tracking system. Those services contribute to our New Zealand, stretching back more We will also be replacing aging purpose of building a better than 150 years. The financial year to locomotives and wagons and improve New Zealand through stronger 30 June 2019 (FY19) has seen the our major maintenance depots at Hutt connections. Government renew that commitment and Waltham. It will also be used to We do this by putting the customer at to rail, laying the foundations for us to progress the procurement of two new, the centre of everything we do, and our play the role we should in delivering for rail-enabled ferries that will replace workers strive every day to meet their the country. Interislander’s aging Aratere, Kaitaki, needs. In the 2019 Budget, the Government and Kaiarahi ferries. allocated $741 million through Vote Our workforce, spread throughout That outstanding level of investment Transport over the next two years and New Zealand, reflects the nation. It made a further $300 million available is a clear recognition of the value includes men and women from all for regional rail projects through the rail adds to New Zealand’s transport corners of the world, and from diverse Provincial Growth Fund (PGF). system. ethnic backgrounds. There is however still room to improve. The money is being used to address It is a driver of economic development legacy issues to improve reliability and employment, delivered through These are exciting times for rail in and resilience for tracks, signals, our freight network, world-class tourism New Zealand, and we look forward to bridges and tunnels, for new freight services, and the commuter services building a future on the investment that handling equipment and a new freight we enable in Auckland and Wellington. -

2017 Results Presentation 8Th March 2018 Full Year 2017 Performance Summary

2017 Results Presentation 8th March 2018 Full Year 2017 Performance Summary • Revenue for the year grew 3.0% to €335.1 million (2016: €325.4 million). In the Ferries division revenue* increased Revenue by 0.8% to €204.4 million (2016: €202.7 million) while in the Container and Terminal division revenue* increased €335.1m by 6.5% to €130.7 million (2016: €122.7 million). 2017 2016 +3.0% • EBITDA for the year decreased by 3.0% to €81.0 million (2016: €83.5 million). EBITDA in the Ferries division EBITDA decreased by 4.8% to €67.3 million (2016: €70.7 million). The EBITDA in the Container and Terminal division €81.0m increased by 7.0% to €13.7 million (2016: €12.8 million) 2017 2016 -3.0% • Net cash of €39.6 million at 31 December 2017 (Net debt of €37.9 million in 2016). Net Cash €39.6m • Adjusted EPS decreased by 7.6% to 29.0 cent from 31.4 2017 2016 cent in 2016. • IAS 19 accounting surplus on retirement benefit schemes of €4.7m (31 December 2016 – deficit of €14.5m). Basic EPS 44.1c • Disposal of MV Kaitaki for a total consideration of €45m, 2017 2016 +40.4% giving a gain on disposal (after tax) of €24.9m. *Exclusive of Inter-segment Revenue Irish Continental Group 2017 Results Presentation - 8th March 2018 2 ICG Business Units Ferries Division Container & Terminal Division Irish Ferries, the leading ferry Eucon, the leading container shipping company operating between the operator between Ireland and the UK/Continent and the Republic of Continent. -

Mv Kaitaki Docking

MV KAITAKI DOCKING Client Thales Australia Pty Ltd / Interislander Ferries Location Garden Island, NSW, Australia Scope • High Pressure water washing • Mechanical descaling • Ultra-High Pressure water blasting • Dry abrasive blasting • Application of protective coatings by spray and roller Asset Preservation & Rehabilitation When Risk Matters ASMD UPGRADE Project Details The MV Kaitaki is a ROPAX ferry built in 1995. As of 2008, MV Kaitaki is the largest ferry providing the Inter-islander service between the North and South Islands of New Zealand having taken its latest name in 2007. KiwiRail, the operator of the Inter-islander ferries, bought the Kaitaki in 2017. Eptec Marine was commissioned by Thales Australia Pty Ltd to undertake the preparation and preservation works for MV Kaitaki for its 2017 Docking. This was a particularly short docking period, with only 16 days to complete a range of works. Eptec completed High Pressure Washing on all external surfaces and conducted surface preparation works to various areas of the ship. A key aspect of this docking was the application of a silicone coating to the underwater hull, to an area size of over 4,830 sqm. Due to such extensive work over a short period, Eptec had assigned a workforce of over 60 employees to this project. We ran day and night shifts to accommodate for the workload and other trades, whilst ensuring the safety of our employees at every avenue. Eptec delivered the project to a satisfied client whilst managing risk at every level. We aim to keep our employees and the environment safe, every day. Contact Details Head Office: 463-467 Harris Street, Ultimo, Sydney Phone: 02 9034 6969 | Fax: 02 9034 6970 | Email: [email protected] | Web: www.eptec.com.au. -

ANNUAL INTEGRATED REPORT 2017 F.18A

Reliable. Sustainable. Valuable. ANNUAL INTEGRATED REPORT 2017 F.18a Welcome – Tēnā koe For more than 150 years rail has played a vital role as an enabler of economic growth in New Zealand, evolving and adapting to meet customer needs despite significant geographical challenges and changing trends in trade. In the 1800s engineers designed a rail network that could operate in New Zealand’s uncompromising landscape, implementing wooden infrastructure that ran across swamps, rugged mountains, dense forests and wide rivers, to connect otherwise isolated communities and industries to the market. Much has changed since KiwiRail’s humble beginnings in 1863. Wooden infrastructure has been replaced by more resilient materials and today we look to advanced technological solutions to ensure the safety of the network and our people. To this day KiwiRail’s rail network continues to connect businesses, communities, importers and exporters to the world. As history shows, rail is adept at changing its services to meet the evolving needs of industry. As port flows increase and commuter demands continue to grow, KiwiRail is developing dynamic and innovative solutions to meet New Zealand’s changing transport requirements. 2 | Reliable. Sustainable. Valuable. | KiwiRail Annual Integrated Report 2017 Contents Overview of our business Capitals review Governance review At a glance 4 Main North Line case study 20 The KiwiRail Board 48 Who we are and what we do 6 Financial 22 The KiwiRail Executive Team 50 Tourism case study 25 How we are governed 52 Management -

Waitohi Picton Ferry Precinct Redevelopment

PORT MARLBOROUGH NEW ZEALAND LTD & KIWIRAIL HOLDINGS LTD & MARLBOROUGH DISTRICT COUNCIL WAITOHI PICTON FERRY PRECINCT REDEVELOPMENT Summary of Applications 21 December 2020 TABLE OF CONTENTS 1. Introduction ___________________________________________________________ 1 2. Background __________________________________________________________ 2 2.1 History and Background 2 2.2 KiwiRail Objectives 3 2.3 Port Marlborough Objectives 5 3. Description of the Site and Surrounding Area ________________________________ 7 3.1 Overview of the Site 8 3.2 Surrounding Area 9 4. Project Description _____________________________________________________ 11 4.1 Key Outcomes of the Precinct Redevelopment 11 4.2 Ferry Terminal Works 12 4.3 Works within the Coastal Marine Area 13 4.4 Works within the Rail Yard 15 4.5 Works within Roads 16 4.6 Construction Staging of Waitohi Picton Ferry Precinct 16 5. Statutory Context and Requirements_______________________________________ 17 5.1 The COVID-19 Recovery (Fast-track Consenting) Act 2020 17 5.2 Consenting Strategy under the CRA and RMA 18 5.3 Consenting Requirements 19 6. Overview of the Applications _____________________________________________ 19 6.1 Outline Plan of Works 1A – KiwiRail Works within Railway Designation 20 6.2 Outline Plan of Works 1B – MDC Works within Roads 21 6.3 Resource consent 2A – Port Marlborough Terminal Works 22 6.4 Resource Consent 2B – KiwiRail Retaining Wall 23 6.5 Resource Consent 2C – Accessways and Works Over the Waitohi Awa 23 7. Consultation and Community Engagement _________________________________ -

Interim Report 2005

Wednesday 31 August 2016 Interim Management Report for the half year ended 30 June 2016 Irish Continental Group (ICG) the leading Irish-based maritime transport group, reports a solid financial performance for the half year ended 30 June 2016. Highlights Revenue up 5.2% to €150.5 million (2015: €143.1 million) EBITDA up 19.6% to €30.5 million (2015: €25.5 million) Basic EPS up 32.1% to 10.3c (2015: 7.8c) RoRo freight volumes up 5.6% to 139,100 units (2015: 131,700 units) Cars carried up 5.5% in the period to 170,500 units (2015: 161,600 units) Container volumes shipped in the period up 7.4% to 152,700 teu (2015: 142,200 teu) Port lifts handled in the period up 39.6% to 144,800 lifts (2015: 103,700 lifts) MV Kaitaki to remain on charter to June 2020 Net Debt down 57.3% to €18.9 million from €44.3 million at 31 December 2015 IAS 19 accounting deficit on retirement benefit schemes has increased from €5.1 million at 31 December 2015 to €32.8 million at 30 June 2016 Interim dividend 3.820 cent, up 5.0% (2015: 3.638 cent) Commenting on the results of Irish Continental Group, Chairman John B. McGuckian said; ‘‘I am pleased to report a strong performance for the first six months of the financial year underpinned by increased car and freight volumes, lower fuel prices and increased charter revenues. In the second half of the year the uncertainty caused by the outcome of the UK Referendum on European Union membership held on 23 June 2016 had an initial negative impact on tourism bookings which have since recovered. -

Full Year Results 2017

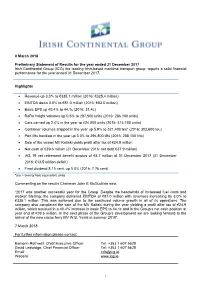

8 March 2018 Preliminary Statement of Results for the year ended 31 December 2017 Irish Continental Group (ICG) the leading Irish-based maritime transport group, reports a solid financial performance for the year ended 31 December 2017. Highlights Revenue up 3.0% to €335.1 million (2016: €325.4 million) EBITDA down 3.0% to €81.0 million (2016: €83.5 million) Basic EPS up 40.4% to 44.1c (2016: 31.4c) RoRo freight volumes up 0.5% to 287,500 units (2016: 286,100 units) Cars carried up 2.4% in the year to 424,000 units (2016: 414,100 units) Container volumes shipped in the year up 5.9% to 321,400 teu* (2016: 303,600 teu) Port lifts handled in the year up 3.0% to 296,800 lifts (2016: 288,100 lifts) Sale of the vessel MV Kaitaki yields profit after tax of €24.9 million Net cash of €39.6 million (31 December 2016: net debt €37.9 million) IAS 19 net retirement benefit surplus of €4.7 million at 31 December 2017 (31 December 2016: €13.5 million deficit) Final dividend 8.15 cent, up 5.0% (2016: 7.76 cent) *teu = twenty foot equivalent units Commenting on the results Chairman John B McGuckian said, “2017 was another successful year for the Group. Despite the headwinds of increased fuel costs and weaker Sterling, the company delivered EBITDA of €81.0 million with revenues increasing by 3.0% to €335.1 million. This was achieved due to the continued volume growth in all of its operations. -

Annual Report 2018

2018 Annual Report and Financial Statements 01 W. B. Yeats at Eastlink, Dublin Irish Continental Group 2018 Annual Report and Financial Statements Contents Our Investment Case Positioning the group for growth 04–55 Business Review Irish Continental Group (ICG) is the leading Irish-based maritime transport group. We carry passengers and cars, Roll on Roll off 06 The Group freight and Container Lift on Lift off freight, on routes between 02 08 Financial Highlights Ireland, the United Kingdom and Continental Europe. We also 03 09 Our Group at a Glance operate container terminals in the ports of Dublin and Belfast. 10 Five Year Summary 13 Chairman’s Statement We aim for continued success in our chosen markets and focus our efforts on the provision 17 Chief Executive’s Review of a safe, reliable, timely and high quality experience for all our customers. 20 Operating and Financial Review 52 Our Fleet We will achieve success by anticipating our customers’ needs and matching their 55 Executive Management Team requirements with superior services through constant innovation and the rapid application of technology. We measure our success through the quality of our service, as seen by our customers, which should result in delivering sustained and profitable growth for the benefit of our 56–91 Corporate Governance shareholders and staff. 58 The Board More online at icg.ie 60 Report of the Directors 64 Corporate Governance Report 74 Report of the Audit Committee 78 Report of the Nomination Committee 80 Report of the Remuneration Committee rior customer -

Annual Report 2013

7534 IF Annual Report 2013_Cover AW_04/14 14/04/2014 10:10 Page 1 IRISH CONTINENTAL GROUP PLC. IRISH CONTINENTAL ANNUAL REPORT AND FINANCIAL STATEMENTS 2013 ANNUAL REPORT AND FINANCIAL STATEMENTS ANNUAL REPORT AND FINANCIAL STATEMENTS 2013 7534 IF Annual Report 2013_Cover AW_04/14 14/04/2014 10:10 Page 2 Irish Continental Group plc, Ferryport, Alexandra Road, Dublin 1, Ireland. Tel +353 1 607 5628 Fax +353 1 855 2268 email [email protected] www.icg.ie Ferryport, Alexandra Road, Dublin 1, Ireland. Tel +353 1 607 5700 Fax +353 1 607 5679 email [email protected] www.irishferries.com Seattleweg 7, 3195 ND Rotterdam, Netherlands. Tel +31 10 428 3700 Fax +31 10 429 0607 email [email protected] www.eucon.nl Container Terminal, Breakwater Road Dublin 1, Ireland. email [email protected] Tel +353 1 607 5700 Fax +353 1 607 5623 Herdman Channel Road, Belfast Harbour North, BT3 9AP Belfast, Northern Ireland. Tel +44 28 9075 5843 Fax +44 28 9074 8539 email [email protected] Irish Continental Group (ICG) is the Contents leading Irish-based maritime transport group. We carry passengers and cars, Business Review The Group 3 Roll On Roll Off freight and Container Financial Highlights 5 Lift On Lift Off freight, on routes Our Group at a Glance 6 between Ireland, the United Kingdom Five Year Summary 8 Chairman’s Statement 10 and Continental Europe. We also Operating and Financial Review 13 operate container terminals in the Our Fleet 28 ports of Dublin and Belfast. Corporate Governance The Board 30 We aim for continued success in our chosen markets and focus our Report of the Directors 32 efforts on the provision of a reliable, timely and high quality Corporate Governance Statement 36 experience for all our customers. -

Trading Update May 2017

TRADING UPDATE Volumes (Year to date, 13 May 2017) 2017 2016 Change Cars 103,200 103,900 -0.7% RoRo Freight 100,300 102,000 -1.7% Container Freight (teu) 119,500 114,400 +4.5% Terminal Lifts 107,600 107,450 +0.1% Irish Continental Group (ICG) issues this trading update which covers carryings for the year to date to 13 May 2017 and financial information for the first four months of 2017, i.e. 1 January to 30 April with comparisons against the corresponding period in 2016. All figures are unaudited. Consolidated Group revenue in the period was €95.1 million, an increase of 4.0% compared with last year. Net debt at the end of April was €24.5 million compared with €37.9 million at 31 December 2016. It should be noted that ICG’s business is significantly weighted towards the second half of the year when a higher proportion of the Group’s operating profit is normally generated than in the first six months. Ferries Division Total revenues recorded in the period to 30 April amounted to €53.6 million (including intra-division charter income), a 3.9% increase on the prior year. For the year to 13 May, in this seasonally less significant period for tourism, Irish Ferries carried 103,200 cars, a decrease of 0.7% on the previous year, while freight carryings were 100,300 RoRo units, a decrease of 1.7% compared with 2016.The decline this year reflects the tougher comparisons due to the outperformance in the same period in 2016 and is primarily related to drydocking schedules. -

2018 Annual Report and Financial Statements Worldreginfo - 622605E8-F360-44F9-97F2-0D9c1633f8f1

2018 Annual Report and Financial Statements WorldReginfo - 622605e8-f360-44f9-97f2-0d9c1633f8f1 01 W. B. Yeats at Eastlink, Dublin WorldReginfo - 622605e8-f360-44f9-97f2-0d9c1633f8f1 Irish Continental Group 2018 Annual Report and Financial Statements Contents Our Investment Case Positioning the group for growth 04–55 Business Review Irish Continental Group (ICG) is the leading Irish-based maritime transport group. We carry passengers and cars, Roll on Roll off 06 The Group freight and Container Lift on Lift off freight, on routes between 02 08 Financial Highlights Ireland, the United Kingdom and Continental Europe. We also 03 09 Our Group at a Glance operate container terminals in the ports of Dublin and Belfast. 10 Five Year Summary 13 Chairman’s Statement We aim for continued success in our chosen markets and focus our efforts on the provision 17 Chief Executive’s Review of a safe, reliable, timely and high quality experience for all our customers. 20 Operating and Financial Review 52 Our Fleet We will achieve success by anticipating our customers’ needs and matching their 55 Executive Management Team requirements with superior services through constant innovation and the rapid application of technology. We measure our success through the quality of our service, as seen by our customers, which should result in delivering sustained and profitable growth for the benefit of our 56–91 Corporate Governance shareholders and staff. 58 The Board More online at icg.ie 60 Report of the Directors 64 Corporate Governance Report 74 Report of the -

Annual Report and Financial Statements 2017

2017 Annual Report and Financial Statements WorldReginfo - eacafb01-c165-48aa-8d5d-c86488fdc780 Irish Continental Group (ICG) is the leading Irish based maritime transport group. We carry passengers and cars, Roll on Roll off freight and Container Lift on Lift off freight, on routes between Ireland, the United Kingdom and Continental Europe. We also operate container terminals in the ports of Dublin and Belfast. More online www.icg.ie WorldReginfo - eacafb01-c165-48aa-8d5d-c86488fdc780 01 CONTENTS 04-50 Strategic Report 04 The Group 10 Chairman’s Statement 06 Financial Highlights 14 Operating and Financial Review 07 Our Group at a Glance 48 Our Fleet 08 Five Year Summary 50 Executive Management Team 54-85 Corporate Governance 54 The Board 73 Report of the Nomination Committee 56 Report of the Directors 75 Report of the Remuneration Committee 60 Corporate Governance Statement 85 Directors’ Responsibilities Statement 69 Report of the Audit Committee 88-167 Financial Statements 88 Independent Auditor’s Report 102 Company Statement of Financial Position 97 Consolidated Income Statement 103 Company Statement of Changes in Equity 98 Consolidated Statement of Comprehensive 105 Consolidated Statement of Cash Flows Income 106 Company Statement of Cash Flows 99 Consolidated Statement of Financial Position 107 Notes to the Financial Statements 100 Consolidated Statement of Changes in Equity 170-173 Other Information 170 Investor Information 173 Index to the Annual Report WorldReginfo - eacafb01-c165-48aa-8d5d-c86488fdc780 02 Irish Continental Group