Quality Engineering and Software Technologies Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VENDOR PROFILE R&D/Product Engineering Services — How Is

VENDOR PROFILE R&D/Product Engineering Services — How Is HCL Technologies Thinking Out of the Box and Providing Value to Technology Product Customers? Mukesh Dialani IDC OPINION m To provide services to their customers, R&D/product engineering services vendors o c . have, in the past five to seven years, continued to build additional competencies by c d i . hiring relevant engineering talent, acquiring industry-specific product development w w w and engineering capabilities, building labs, creating intellectual property (IP), and so forth. And, since this area of IT services is in a relatively nascent evolutionary phase 5 1 0 compared with its traditional IT services counterparts, vendors that implement 4 . 5 3 strategic initiatives and lead with innovative partnerships to build their own 9 . 8 ecosystems will gain market share. In studying HCL's technology product 0 5 . F development and engineering services, IDC is of the opinion that HCL has until now 0 thought through its strategy in building differentiating capabilities and that the 0 2 following initiatives are crucial for HCL sustaining its momentum in growing this 8 . 2 7 business: 8 . 8 0 5 . Increase scope and depth of offering. HCL should ensure that they continue to P build additional solutions across key industries in order to get additional A S business. U 1 0 7 Focus on customer satisfaction. Keep customer satisfaction levels high to 1 0 ensure additional opportunities to move up the value chain — resulting in higher A M , billing rates. m a h g Intellectual property. Ensure that it builds reusable intellectual property to n i m increase utilization rates. -

Diversifying India's Services Exports Through Sezs

Working Paper 312 Diversifying India’s Services Exports through SEZs: Status, Issues and the Way Forward Arpita Mukherjee Saubhik Deb Shreya Deora Tanu M. Goyal Bhavook Bhardwaj December 2015 INDIAN COUNCIL FOR RESEARCH ON INTERNATIONAL ECONOMIC RELATIONS i Table of Contents Abbreviations ........................................................................................................................... ii Acknowledgements ................................................................................................................. iv Abstract ..................................................................................................................................... v 1. Introduction ........................................................................................................................ 1 2. Free Trade Warehousing Zones ....................................................................................... 3 3. Finance SEZs .................................................................................................................... 12 4. Power SEZs....................................................................................................................... 18 5. Aviation SEZs ................................................................................................................... 22 6. Potential Services SEZs ................................................................................................... 29 6.1 Audio-visual Services SEZs................................................................................... -

Awakening of the Aerospace Supply Chain in India

awakening of the aerospace supply chain in india The aerospace industry continues to be challenged by increasing competition and cost pressures as well as rising energy costs, high raw material prices and a weak US Dollar. To combat these challenges, airframe manufacturers, aerospace OEMs and Tier 1 suppliers are leveraging the advantages arising from the globalization of the aerospace supply chain. contents 1.0 Typical Aerospace Supply Chain 04-07 2.0 Global Competitiveness: Aerospace Machined parts & Assembly (QuEST analysis based on McKinsey Institute study) 07 3.0 About the Author 08 4.0 About QuEST Global 08 © 2008, QuEST Global Services QuEST Confidential Information The aerospace industry continues to be challenged by For the aerospace supply chain, this is an opportunity as increasing competition and cost pressures as well as well as a threat. It is an opportunity for those suppliers rising energy costs, high raw material prices and a weak who can innovate, adopt high level technologies, US Dollar. To combat these challenges, airframe implement best practices and invest in change – such manufacturers, aerospace OEMs and Tier 1 suppliers suppliers will win larger amounts of work from their are leveraging the advantages arising from the customers. Those suppliers who cannot do this, could globalization of the aerospace supply chain. They are find themselves removed from the airframe adapting to these challenges by outsourcing more and manufacturer/OEMs’ supply chain. more elements of technology, design and component/sub-assembly -

IT-BPM Sector in India 2019 DECODING DIGITAL

IT-BPM Sector in India 2019 DECODING DIGITAL STRATEGIC REVIEW The IT-BPM Sector in India: Strategic Review 2019 Copyright ©2019 Plot 7 to 10, Sector 126, Noida 201303, India Phone: 91-120-4990111 Email: [email protected] First Print: February 2019 Published by NASSCOM Designed & Produced by Purplemango (India) www.purplemango.in NASSCOM is the industry association for the IT-BPM sector in India. A not-for-profit organisation funded by the industry, its objective is to build a growth led and sustainable technology and business services sector in the country. NASSCOM Research is the in-house research and analytics arm of NASSCOM generating insights and driving thought leadership for today’s business leaders and entrepreneurs to strengthen India’s position as a hub for digital technologies and innovation. NASSCOM Research, the most credible source of technology insights in India publishes an annual edition of its Strategic Review which analyses the key trends in IT-BPM industry and disseminates the latest status of the industry performance. Disclaimer The information contained herein has been obtained from sources believed to be reliable. NASSCOM disclaims all warranties as to the accuracy, completeness or adequacy of such information. NASSCOM shall have no liability for errors, omissions or inadequacies in the information contained herein, or for interpretations thereof. The material in this publication is copyrighted. No part of this report can be reproduced either on paper or electronic media without permission in writing from NASSCOM. Request for permission to reproduce any part of the report may be sent to NASSCOM. Usage of Information Forwarding/copy/using in publications without approval from NASSCOM will be considered as infringement of intellectual property rights. -

ITO: Engineering Services Outsourcing; Aerospace, Automotive and Electronics Sectors Continue to Drive ESO Growth

ITO: Engineering Services Outsourcing; Aerospace, Automotive and Electronics Sectors Continue to Drive ESO Growth Pratibha Verma Engineering work is becoming more and more internationalized and engineering companies are becoming increasingly global. There is increasing pressure on the part of European companies to reduce costs, which requires more innovative solutions from suppliers in order to keep a stable price level. As the global spending on overall engineering services (which includes design, manufacturing and field engineering areas) increases, many IT-BPO service providers have added specific engineering services to their offerings portfolio. These companies acquired the skill-sets, tools and experience from generic IT software and services, to evolve from providing basic data conversion, through 2D and 3D CAD/CAM/CA E, advanced simulation, prototyping, testing, PLM, product design (engineering), process engineering, plant automation and asset management services. Analysts note that companies in the electronics industry have recently become comfortable with outsourcing. "In the past three years, more work is getting outsourced," says Mukesh Dialani, Research Manager at IDC in Framingham, Mass. "At some level, confidence has grown in what engineering vendors have to offer. Outsourced engineering has been validated with successful outsourcing engagements." For some companies, particularly large manufacturers in the United States, design firms have become a source of specialized expertise. "One of the key benefits for Fortune 500 companies is the qualified engineering labor they get through outsourcing," says Dialani. "They go to third parties because they can get qualified labor and manage it cost effectively." "In some sectors such as aerospace, defense, and medical, companies are dealing with the aging workforce in the United States," said IDC's Dialani. -

Moneytreetm India Report Q4 2015

www.pwc.com/globalmoneytree www.pwc.in PricewaterhouseCoopers India Pvt Ltd MoneyTreeTM India Report Q4 2015 Data provided by Venture Intelligence Technology Institute This special report provides summary results of Q4 ’14, Q3 ’15 and Q4 ’15. Table of contents 1. Overview 3 A big year for Indian private equity! 3 2 Analysis of PE investments 4 Total equity investments 4 Investments by industry 5 Investments by stage of development 7 Investments by region 8 Top 20 PE deals 9 3. Analysis of PE exits 10 Total PE exits 10 Exits by industry 11 Exits by type 12 Top five PE exits 13 4. Active PE firms 14 5. Sector focus: IT & ITeS sector 15 Technology sector analysis 15 Total PE investments 16 Investments by stage of development 18 Investments by region 19 Investments by subsector 20 PE exits in the sector 21 6. Definitions 22 Contacts 23 PwC MoneyTreeTM India Report – Q4 ’15 2 1. Overview A big year for Indian private equity! The year 2015 was the best year ever for private equity (PE) investing in India, Considering the levels of PE activity in 2015, it may be natural to assume that with record investments as well as exits. It saw investments worth 19.5 billion the momentum will continue in 2016. However, e-commerce fundraising USD in 730 deals and exits worth 8.7 billion USD in 230 deals. slowed down at the tail end of the year and this will test the depth of the market in 2016. While financial services, technology and healthcare continue Around 40% of the total investments were contributed by the technology to see sustained activity (which could lead them to even better their 2015 sector (IT & ITeS), with total investments in that sector amounting to 7.6 numbers), the same cannot be said for consumer, industrials billion USD. -

India Meets Britain Tracker 2020

India meets Britain Tracker The latest trends on Indian investment in the UK 2020 About our research Our Tracker, developed in collaboration with the Confederation of Indian Industry, identifies the top fastest-growing Indian companies in the UK as measured by percentage revenue growth year-on-year. The Tracker includes Indian-owned corporates with operations headquartered or with a significant base in the UK, with turnover of more than £5 million, year-on-year revenue growth of at least 10% and a minimum two-year track record in the UK, based on the latest published accounts filed as at 31 March 2020, where available. Turnover figures have been annualised where periods of less or more than 12 months have been reported. Our report also highlights the top Indian employers – those companies that employ more than 1,000 people in the UK1. To compile the India meets Britain Tracker 2020, Grant Thornton analysed data from almost 850 UK-incorporated limited companies that are owned directly or indirectly, or controlled, by either an Indian-incorporated parent or an Indian citizen resident outside the UK2. 1 Employment numbers may include employees outside the UK in overseas subsidiaries of UK companies 2 Branches of India parent companies are excluded due to lack of public information India meets Britain Tracker 2020 Contents Introduction 1 India-UK partnership endures as times turn turbulent 2 The fastest-growing Indian companies in Britain 4 Top Indian employers in the UK 9 Looking to the future 11 About Grant Thornton and CII 13 India meets Britain Tracker 2020 Introduction This is the seventh edition of the Grant Thornton India meets Britain Tracker, developed in collaboration with the Confederation of Indian Industry. -

TCS Showcases Cutting-Edge Solutions at Paris Air Show

JUNE 2007 VOL - 1 ISSUE 2 AeromagAsia TCS showcases Cutting-edge Solutions at Paris Air Show A publication from SIATI in association with Bangalore Excelsior GermanNews_420x273_RZ 12.10.2006 16:33 Uhr Seite 1 Invest in Bavaria www.invest-in-bavaria.com Invest in � Germany’s high-tech location number one Contact State of Bavaria - India Office Mr. John Kottayil Namaste! � Home of BMW, Audi, Siemens, adidas Executive Director � Gateway to Central and Eastern Europe Address Prestige Meridian 2 12th Floor, Unit 1201 � Hosts the European headquarters of various 30, MG Road Bangalore 560 001, India Bavaria important international companies Phone +91 802 / 509-5860 � Broad base of Indian companies like WIPRO, Fax +91 802 / 509-5862 TCS, Reliance, Tata and a great number of Welcome! E-Mail [email protected] Indian midsized companies Internet www.invest-in-bavaria.com Invest in Bavaria – a joint project between the Bavarian Ministry of Economic Affairs, Infrastructure, Transport Invest in Bavaria assists Indian companies to set up their operations in Bavaria – free of charge. and Technology and Bayern International Aeromag Asia A bimonthly publication dedicated to In Aviation & Aerospace Industry Focus Cover Story: Cutting-edge Solutions for Aerospace 6 Niche in QuEST 10 BIAL CEO Albert Brunner: Targeting High Performance Standards 14 Editor’s Note Breathtaking, and truly heartwarming! We were Avi-Oil: Fluid Synergy 21 overwhelmed by the tremendous response to our inaugural issue, hogging the limelight at the Aero India 2007 – the Sixth International Aerospace and Defence Dr CG Krishnadas Nair 47th International Paris Air Show – Le Bourget 2007: Boom & Dazzle 22 Show in Bangalore. -

Low Cycle Fatigue Evaluation Tool Planned Starting Fall 2019 QG TOOL Semester

UNC Charlotte – Lee College of Engineering Senior Design Program Senior Design Project Description Company Name QuEST Gloabl Date Submitted 6/6/2019 Project Title Low Cycle Fatigue Evaluation Tool Planned Starting Fall 2019 QG_TOOL Semester Personnel Typical teams will have 4-6 students, with engineering disciplines assigned based on the anticipated Scope of the Project. Please provide your estimate of staffing in the below table. The Senior Design Committee will adjust as appropriate based on scope and discipline skills: Discipline Number Discipline Number Mechanical 2 Electrical Computer 2 Systems Other ( ) Company and Project Overview: QuEST Global (Quality Engineering & Software Technologies) is a production engineering company in the Aero Engines, Aerospace & Defense, Hi-Tech & Industrial, Medical Devices, Oil & Gas, Power, and Transportation verticals. The company has operations spread across 42 locations in 13 countries including US, Canada, Singapore, UK, Germany, Italy, Spain, France, Sweden, Romania, Japan, and India. Quest Global was founded in 1997 and employs 12,000 people as of April 2019. At QuEST, we have a rich range of multi-national customers from diverse backgrounds and industry verticals that bring many challenging projects to the table. This offers our employees the opportunity to work with some of the leading engineers in industry and chase their dreams of taking on challenging roles that QuEST has to offer. This project objective is to automate calculations that QuEST does in order to determine Low Cycle Fatigue (LCF) Life. LCF life is currently calculated using external resources and software. This method is costly and time-consuming to the company. Developing an automation tool would have significant impact in our future analysis scopes. -

June 2021 Contact Key Highlights June 2021

INVEST KARNATAKA MONTHLY JUNE 2021 CONTACT KEY HIGHLIGHTS JUNE 2021 Ms Gunjan Krishna Commissioner, Dept of Industries and Commerce, GOK Phone: +91 80 2238 6796 Email: [email protected] Mr H.M. Revanna Gowda Managing Director, Karnataka Udyog Mitra Ph: 91-80-2228 2392, 2228 5659; 2238 1232 Email : [email protected] FOLLOW US ON FOLLOW US ON FOLLOW US ON To subscribe to our newsletter CLICK HERE Visit us at: www.investkarnataka.co.in Special feature: Aequs Journey from a speck to a sparkle Aequs’ journey is a story of how aeroplanes stay in the sky, would also sow the precision engineered aerospace components it has helped Karnataka become seeds of yet another successful enterprise, this could be manufactured in India. time, to make actual aeroplane parts. a shining star of manufacturing And the way to do it was to set up a global excellence in the Aerospace & Unchartered territory manufacturing ecosystem which, going Defence sector forward, was to house a series of integrated Though Karnataka had earned its wings as an and co-located facilities to support the entire Aerospace & Defence destination by then, most It all started with the passion to dream big. manufacturing value-stream – a platform When Aravind Melligeri and his childhood friend activity was limited to public sector units, of sorts that aimed for extreme efficiencies Ajit Prabhu set out to chase the American with a few private through the entire manufacturing process. Dream by pursuing their master’s degrees in players involved in a Way ahead of Way ahead of the times, and conceived with a the US, the seeds of entrepreneurship had limited way. -

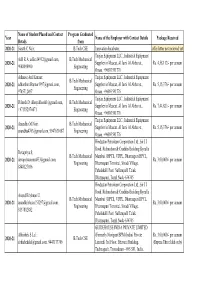

Placements List

Name of Student Placed and Contact Program Graduated Year Name of the Employer with Contact Details Package Received Details from 2020-21 Sarath C Nair; B.Tech CSE Innovation Incubator, offer letter not recieved yet Teejan Equipment LLC., Industrial Equipment Adil R A; [email protected], B.Tech Mechanical 2020-21 Supplier in Muscat, Al Jami Al Akbar st., Rs. 4,58,112/- per annum 9048098900 Engineering Oman, +96893591776 Adharse Anil Kumar; Teejan Equipment LLC., Industrial Equipment B.Tech Mechanical 2020-21 [email protected], Supplier in Muscat, Al Jami Al Akbar st., Rs. 5,15,376/- per annum Engineering 9745712497 Oman, +96893591776 Teejan Equipment LLC., Industrial Equipment Dileesh D; [email protected], B.Tech Mechanical 2020-21 Supplier in Muscat, Al Jami Al Akbar st., Rs. 7,44,821/- per annum +971552974471 Engineering Oman, +96893591776 Teejan Equipment LLC., Industrial Equipment Anandhu M Nair; B.Tech Mechanical 2020-21 Supplier in Muscat, Al Jami Al Akbar st., Rs. 5,15,376/- per annum [email protected], 9947631087 Engineering Oman, +96893591776 Hindustan Petrolium Corporation Ltd., Sir J J Road, Richardson & Cruddas Building Byculla Devapriya S; B.Tech Mechanical Mumbai. (HPCL, VDPL, Dharmapuri HPCL, 2020-21 [email protected], Rs. 3,00,000/- per annum Engineering Dharmapuri Terminal, Sivadi Village, 8848127036 Pahalahalli Post, Nallampalli Taluk, Dharmapuri, Tamil Nadu-636705 Hindustan Petrolium Corporation Ltd., Sir J J Road, Richardson & Cruddas Building Byculla Anand Krishnan U; B.Tech Mechanical Mumbai. (HPCL, VDPL, Dharmapuri HPCL, 2020-21 [email protected], Rs. 3,00,000/- per annum Engineering Dharmapuri Terminal, Sivadi Village, 8137882882 Pahalahalli Post, Nallampalli Taluk, Dharmapuri, Tamil Nadu-636705 GUIDEHOUSE INDIA PRIVATE LIMITED Abhishek S Lal; (Formerly Navigant BPM (India) Private Rs. -

Medical Devices Segment Capabilities 60% Companies

Engineering Service Providers – Capabilities Study July 2018 1 1 Source : DRAUP 1 Ranking Modular Framework and Methodology Rating Parameters Weightages Financials 25% Total Employees 100% Project Headcount 25% Design & Development 25% Testing & Automation 25% Sustenance & Maintenance 25% The list of total 8 companies Regulatory Compliances & Support Services 25% were analysed on all mentioned parameters and Client Base 25% weightage has been given for Client partnership 60% Partnership Maturity 40% each of them to arrive at the list of Top 8 Service Providers Capabilities 25% catering to Medical Devices Segment Capabilities 60% companies. Imaging Diagnostics 10% Non-Imaging Diagnostics 10% Surgical Devices 10% Monitoring Devices 10% Prosthetics 10% Other Therapeutic Devices 10% Emerging Technologies 40% 2 Note – Framework and Modular Created by DRAUP and updated in July 2018 Source : DRAUP 2 Service Providers Ranking across Medical Devices Outsourcing Landscape 1 HCL 2 TCS 3 Altran 4 Wipro Financials 5 4 3 2 Project Headcount 4 3 2 2 Client Base 5 4 5 3 Capabilities 3 4 3 2 5 Quest Global 6 Infosys 7 Global Logic 8 Tech Mahindra Financials 1 1 2 1 Project Headcount 1 1 2 1 Client Base 4 3 2 3 Capabilities 3 3 3 2 Lowest rating 1 2 3 4 5 Highest rating 3 Note : The above analysis is based on the DRAUP’s proprietary engineering and talent database and insights from industry stakeholders, updated as on July, 2018 Source : DRAUP 3 Wipro – Financial Overview • In 2018, the company began building software to help with the General Data Protection Regulation (GDPR) in Europe.