Bank AL Habib Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FACTSHEET - AS of 01-Oct-2021 Solactive GBS Pakistan Large & Mid Cap USD Index PR

FACTSHEET - AS OF 01-Oct-2021 Solactive GBS Pakistan Large & Mid Cap USD Index PR DESCRIPTION The Solactive GBS Pakistan Large & Mid Cap USD Index PR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Pakistani market. It is calculated as a pricereturn index in USD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,200 1,000 800 600 400 200 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Pakistan Large & Mid Cap USD Index PR CHARACTERISTICS ISIN / WKN DE000SLA8Y15 / SLA8Y1 Base Value / Base Date 1139 Points / 08.05.2006 Bloomberg / Reuters / .SPKLMCUP Last Price 347.48 Index Calculator Solactive AG Dividends Not included Index Type Price Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency USD History Available daily back to 08.05.2006 Index Members 13 FACTSHEET - AS OF 01-Oct-2021 Solactive GBS Pakistan Large & Mid Cap USD Index PR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -11.24% -18.75% -20.18% -6.01% -14.20% -69.49% Performance (p.a.) - - - - - -7.42% Volatility (p.a.) 17.33% 14.90% 15.54% 17.78% 16.87% 23.20% High 391.47 429.41 459.90 459.90 459.90 1310.60 Low 343.18 343.18 343.18 343.18 343.18 250.61 Sharpe Ratio -4.42 -3.83 -2.37 -0.36 -1.11 -0.33 Max. -

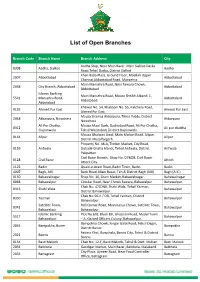

List of Open Branches

List of Open Branches Branch Code Branch Name Branch Address City Aadha Stop, Near Main Bazar, Main Sialkot-Daska 0308 Aadha, Sialkot Aadha Road,Tehsil Daska, District Sialkot Khan Baba Plaza, Ground Floor, Moallah Upper 2007 Abbottabad Abbottabad Channai,Abbottabad Road, Mansehra. Main Mansehra Road, Near Fawara Chowk, 2038 City Branch, Abbottabad Abbottabad Abbottabad Islamic Banking Main Mansehra Road, Mouza Sheikh Albandi 1, 5541 Mansehra Road, Abbottabad Abbotabad. Abbotabad Khewat No. 54, Khatooni No. 55, Katchery Road, 0193 Ahmed Pur East Ahmed Pur East Ahmed Pur East. Mauza Shamsa Akbarpura, Tehsil Pabbi, District 2048 Akbarpura, Nowshera Akbarpura Nowshera Ali Pur Chatha, Mauza Akaal Garh, Qadirabad Road, Ali Pur Chatha, 0312 Ali pur chattha Gujranwala Tehsil Wazirabad, District Gujranwala. Mouza Ghalwan Awal, Main Multan Road, Alipur, 0164 Alipur Alipur District Muzaffargarh. Property No. 48-A, Timber Market, City Road, 0159 Arifwala Outside Ghalla Mandi, Tehsil Arifwala, District Arifwala Pakpattan. Civil Bazar Branch, Shop No. D7&D8, Civil Bazar 0128 Civil Bazar Attock Attock City. 1122 Badin Quaid-e-Azam Road, Badin Town, Badin. Badin 4007 Bagh, AJK Bank Road, Main Bazar, Teh & District Bagh (AJK) Bagh (A.K.) 0150 Bahawalnagar Shop No. 10, Grain Market, Bahawalnagar. Bahawalnagar 0068 Bahawalpur Circular Road, Near Chowk Fawara, Bahawalpur Bahawalpur Chak No. 47/DNB, Shahi Wala, Tehsil Yazman, 0315 Shahi Wala Bahawalpur District Bahawalpur. Chak No.56-A / DB, Tehsil Yazman, District 0330 Yazman Bahawalpur Bahawalpur. Satellite Town, Rafi Qamar Road, Main Kanju Chowk, Satellite Town, 0341 Bahawalpur Bahawalpur Bahawalpur. Islamic Banking Plot No.6/B, Block B/I, Ghaznavi Road, Model Town 5517 Bahawalpur Bahawalpur – A, Gazted Officers Colony, Bahawalpur. -

Faysal Funds

Accounts forthe Quarter Ended September 30, 2008 FAYSAL BALANCED GROWTH FUND The Faysal Balanced Growth Fund (FBGF) is an open-ended mutual fund. The units of FBGF are listed on the Karachi Stock Exchange and were initially offered to the public on April 19, 2004. FBGFseeks to provide long-term capital appreciation with a conservative risk profile and a medium to long-term investment horizon. FBGF's investment philosophy is to provide stable returns by investing in a portfolio balanced between equities and fixed income instruments. Fund Information Management Company Faysal Asset Management Limited Board of Directors of the Management Company Mr. Khalid Siddiq Tirmizey, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mr. Sanaullah Qureshi, Director Mr. Syed Majid AIi, Director Mr. Feroz Rizvi, Director CFO of the Management Company Mr. Abdul Razzak Usman Company Secretary of the Management Company Mr. M. Siddique Memon Audit Committee Mr. Feroz Rizvi, Chairman Mr. Sanaullah Qureshi, Member Mr. Syed Majid Ali, Member Trustee Central Depository Company of Pakistan Limited Suit #. M-13, 16, Mezzanine Floor, Progressive Plaza, Beaumont Road, Near PIDC House, Karachi. Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Atlas Bank Limited The Bank of Punjab Auditors Ford Rhodes Sidat Hyder & Co., Chartered Accountants Legal Advisor Mohsin Tayebely & Co., 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrars Gangjees Registrar Services (Pvt) Limited Room # 506, 5th Floor, Clifton Centre, Kehkashan Clifton - Karachi. Distributors Access Financial Services (Pvt.) Ltd. AKD Securities (Pvt.) Limited Faysal Asset Management Limited Faysal Bank Limited PICIC Commercial Bank Limited Reliance Financial Products (Pvt.) Limited Invest Capital & Securities (Pvt.) Limited Flow(Private) Limited IGI Investment Bank Limited Pak Oman Investment Bank Limited Alfalah Securities (Pvt) Limited JS Global Capital Limited t"''' e , FAYSAL BALANCED ~ . -

0.30560 0.30570 Daily Treasury Market Commentary KUWAITI DINAR

KUWAITI DINAR 0.30560 0.30570 Daily Treasury Market Commentary October 28, 2020 Foreign Exchange Developments: Economic Updates: The euro fell against the dollar on Wednesday following a New orders for key US-made capital goods increased Currency Price MTD % 3M% YTD% media report that France's government was leaning to six-year high in September, wrapping up a quarter EUR/USD 1.1779 0.51 0.55 5.07 toward reinstating a national lockdown to curb a of potentially record growth in business spending and GBP/USD 1.3043 0.98 0.87 -1.64 resurgence in coronavirus cases. the economy. AUD/USD 0.7145 -0.24 -0.18 1.75 The dollar, however, gave up early gains against other Britain must spell out how far it wants to diverge from USD/CHF 0.909 -1.28 -0.98 -6.09 major currencies as sentiment turned bearish due to European Union rules if it wants access to the bloc's USD/JPY 104.26 -1.16 -0.81 -4.25 uncertainty about the outcome of the U.S. presidential financial market from January, a top European USD/CAD 1.3191 -0.97 -1.39 1.57 election next week. The euro fell 0.14% to $1.1780 in Asia Commission official said on Tuesday. on Wednesday, down for a third consecutive session. Sterling held steady at $1.3035, supported by hopes for a Local & GCC news: last-minute trade deal between Britain and the European Kuwait's central bank announced on Tuesday it was Index Price Change MTD% YTD% Union. -

Habibmetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION)

A N N U A L R E P O R T 2017 1 HabibMetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION) 2 A N N U A L R E P O R T 2017 JOURNEY OF CONTINUOUS SUCCESS A long term partnership Over the years, First Habib Modaraba (FHM) has become the sound, strong and leading Modaraba within the Modaraba sector. Our stable financial performance and market positions of our businesses have placed us well to deliver sustainable growth and continuous return to our investors since inception. During successful business operation of more than 3 decades, FHM had undergone with various up and down and successfully countered with several economic & business challenges. Ever- changing requirement of business, product innovation and development were effectively managed and delivered at entire satisfaction of all stakeholders with steady growth on sound footing. Consistency in perfect sharing of profits among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. Our long term success is built on a firm foundation of commitment. FHM's financial strength, risk management protocols, governance framework and performance aspirations are directly attributable to a discipline that regularly brings prosperity to our partners and gives strength to our business model which is based on true partnership. Conquering with the challenges of our operating landscape, we have successfully journeyed steadily and progressively, delivering consistent results. With the blessing of Allah (SWT), we are today the leading Modaraba within the Modaraba sector of Pakistan, demonstrating our strength, financial soundness and commitment in every aspect of our business. -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

IBOR Transition Faqs

Sep 2021 IBOR Transition FAQs September 2021 About IBOR Transition This explanation and general risk warning is provided for customers of Al Ahli Bank Kuwait and each of its subsidiaries (collectively, “ABK”) who may have conventional products or agreements which uses the London Interbank Offered Rate ('LIBOR') or another inter-bank offered rate (together with LIBOR, the 'IBORs') as a benchmark rate. This explanation and general risk warning is provided for information purposes only and is subject to change. Where information in this explanation and general risk warning has been obtained from third party sources, we believe those sources to be reliable, but we do not guarantee the information’s accuracy, and you should note that it may be incomplete or condensed. Benchmark Reform LIBOR and other IBORs are currently the focus of international and national reforms. The UK Financial Conduct Authority (‘FCA’), which regulates LIBOR, has stated that it will no longer compel banks to submit rates for the calculation of LIBOR after the end of 2021. The US Federal Reserve and other regulators have also taken measures to move markets away from IBORs within set timelines. As a result, the continuation of LIBOR and other IBORs on their current basis cannot be guaranteed after 31 December 2021. These reforms may result in: (i) changes to the rules or methodologies used in calculating benchmark rates; (ii) restrictions on the use of benchmark rates; and/or (iii) discontinuance of benchmark rates. Even if certain benchmark rates might continue to be published, changes to their methodology, or restrictions on use, may mean that they are no longer representative of the underlying market and economic reality that the benchmark rate was originally intended measure or otherwise become no longer appropriate for products or agreements that customers have entered into with ABK. -

ANNUAL REPORT 2008 the Management Team Is Also Being Trained on Various Basel II Requirements

Contents Corporate Information......................................................................01 Director’s Report to the Shareholders........................................02 Statement of Compliance with the Code of Corporate Governance.......................................................07 Statement of Internal Control........................................................09 Notice of Annual General Meeting...........................................10 Review Report to the Members on Statement of the Compliance with Best Practices of Code of Corporate Governance...................................................................12 Auditor’s Report to Members.......................................................13 Balance Sheet......................................................................................15 Profit and Loss Account..................................................................16 Cash Flow Statement.......................................................................17 Statement Of Changes In Equity................................................18 Notes to Financial Statements.....................................................19 Six Years Key financial Data...........................................................62 Annexure - 1.........................................................................................63 Combined Pattern of CDC and Physical Share Holdings...................................................................64 Combined Pattern of CDC and Physical Share Holdings ..................................................................65 -

Debit Cards Visa Silver Clearing SMS Alerts Monthly ADC/Digital For

Key Fact Statement (KFS) for Deposit Accounts BANK AL HABIB LTD Date __________ branch IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may also use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison. Account Types & Salient Features: Fixed Term Deposit This information is accurate as of the date above. Services, fees and mark up rates may change on Quarterly basis. For updated fees/charges, you may visit our website at www.bankalhabib.com or visit our branches. • No penalty on Premature Encashment. Indicative Rates of Profit on Fixed Deposit Schemes 1 Month Deposit 5.50% p.a 3 Months Deposit 5.50% p.a 6 Months Deposit 5.50% p.a 1 Year Deposit 6.10% p.a 2 Year Deposit 6.30% p.a 3 Year Deposit 6.55% p.a 4 Year Deposit 6.55% p.a 5 Year Deposit 6.55% p.a On premature encashment, profit will be calculated as per rate of last nearest completed tenure while profit on the remaining number of days deposit held, will be calculated and paid on the Savings Account Profit Rate, applicable at the time of Booking of deposit Note: Kindly refer Schedule of Charges (SOC) for exemptions of service charges. Conventional Particulars Fixed Term Deposit Currency PKR Minimum Balance for To open 0 Account To keep 0 Account Maintenance Fee 0 Is Profit Paid on account Yes Subject to the applicable tax rate Indicative Profit Rate. -

CEE Qu 3-08.Qxd

Analysis of the UniCredit Group CEE Research Network CEE Quarterly 03 2008 For authors see last page Imprint Disclaimer Published by UniCredit Group/Bank Austria Creditanstalt Aktiengesellschaft This document (the “Document”) has been prepared by UniCredito Italiano S.p.A. and its http://www.unicreditgroup.eu controlled companies1 (collectively the “UniCredit Group”). The Document is for information http://www.bankaustria.at purposes only and is not intended as (i) an offer, or solicitation of an offer, to sell or to buy any financial instrument and/or (ii) a professional advice in relation to any investment decision. Edited by CEE Research Department The Document is being distributed by electronic and ordinary mail to professional investors and [email protected] may not be redistributed, reproduced, disclosed or published in whole or in part. Information, Bernhard Sinhuber, Phone +43 (0)50505-41964 opinions, estimates and forecasts contained herein have been obtained from or are based upon sources believed by the UniCredit Group to be reliable but no representation or warranty, Produced by Bank Austria Identity & Communications Department, express or implied, is made and no responsibility, liability and/or indemnification obligation shall Editorial Desk ([email protected]), be borne by the UniCredit Group vis-à-vis any recipient of the present Document and/or any Phone +43 (0)50505-56141 third party as to the accuracy, completeness and/or correctness of any information contained in the Document. The UniCredit Group is involved in several businesses and transactions that may Printed by Holzhausen relate directly or indirectly to the content of the Document. -

MSCI Pakistan IMI (USD)

MSCI Pakistan IMI (USD) The MSCI Pakistan Investable Market Index (IMI) is designed to measure the performance of the large, mid and small cap segments of the Pakistani market. With 16 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in Pakistan. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (NOV 2010 – AUG 2021) MSCI Year MSCI Emerging MSCI Pakistan IMI Markets IMI ACWI IMI MSCI Pakistan IMI 2020 -3.90 18.78 16.81 2019 4.60 18.10 27.04 MSCI Emerging Markets IMI 314.71 300 MSCI ACWI IMI 2018 -29.46 -14.71 -9.61 2017 -24.18 37.28 24.58 2016 41.77 10.30 8.96 2015 -8.82 -13.55 -1.68 2014 21.51 -1.42 4.36 200 2013 37.44 -1.86 24.17 163.45 2012 34.80 19.08 17.04 151.92 2011 -10.19 -19.24 -7.43 100 50 Nov 10 Oct 11 Sep 12 Aug 13 Jun 14 May 15 Apr 16 Mar 17 Jan 18 Dec 18 Nov 19 Oct 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Nov 30, 2010 Div Yld (%) P/E P/E Fwd P/BV MSCI Pakistan IMI -2.43 -10.66 7.17 -0.60 -8.27 -8.68 4.25 3.96 7.99 6.26 5.23 1.21 MSCI Emerging Markets IMI 2.47 -3.26 23.85 4.85 10.56 10.78 5.30 4.67 2.07 16.45 13.09 1.95 MSCI ACWI IMI 2.51 4.33 30.65 16.38 14.53 14.72 11.84 11.24 1.69 23.40 18.53 2.90 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Nov 30, (%) Period YYYY-MM-DD (%) 2010 MSCI Pakistan IMI 12.00 30.98 26.66 23.18 -0.16 -0.25 0.27 0.26 69.36 2017-05-24—2020-03-26 MSCI Emerging Markets IMI 8.27 19.45 16.62 17.50 0.55 0.62 0.34 0.31 38.05 2018-01-26—2020-03-23 MSCI ACWI IMI 3.24 18.47 14.81 14.00 0.76 0.92 0.82 0.78 34.47 2020-02-12—2020-03-23 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Pakistan IMI was launched on Dec 01, 2010. -

Pakistan Stock Exchange Limited BROKER to BROKER

Pakistan Stock Exchange Limited Stock Exchange Building, Stock Exchange Road, Karachi (Copy of the same is also available on our website www.psx.com.pk) Off Market Transactions PSX/N-557 Report For: April 30, 2021 BROKERS HAVE SUBSEQUENTLY REPORTED THE FOLLOWING TRANSACTIONS BROKER TO BROKER Member Code C o m p a n y Turnover of Shares Rate Nos. (+)223 (-)120 Jubilee General Ins. 213,183 40.000 Jubilee General Ins. 618,997 40.000 Jubilee General Ins. 861,954 40.000 Jubilee General Ins. 367,422 40.000 Jubilee General Ins. 173,742 40.000 T o t a l / Weighted Avg. Rate 2,235,298 40.000 (+)084 (-)117 Nat. Refinery 500 559.500 T o t a l / Weighted Avg. Rate 500 559.500 (+)117 (-)084 Nat. Refinery 500 560.000 T o t a l / Weighted Avg. Rate 500 560.000 (+)046 (-)050 Service Global Footw 30,000 57.000 T o t a l / Weighted Avg. Rate 30,000 57.000 (+)194 (-)050 Service Global Footw 100,000 58.000 T o t a l / Weighted Avg. Rate 100,000 58.000 (+)117 (-)108 Siddiqsons Tin Plate 1,000 14.200 T o t a l / Weighted Avg. Rate 1,000 14.200 Total Tunover 2,367,298 CROSS TRANSACTIONS BETWEEN CLIENT TO CLIENT & FINANCIAL INSTITUTIONS Member Code Nos. C o m p a n y Turnover of Shares Rate 019 TRG Pakistan Ltd. 300,000 160.000 T o t a l / Weighted Avg. Rate 300,000 160.000 Pakistan Stock Exchange Limited Stock Exchange Building, Stock Exchange Road, Karachi (Copy of the same is also available on our website www.psx.com.pk) Off Market Transactions PSX/N-557 Report For: April 30, 2021 CROSS TRANSACTIONS BETWEEN CLIENT TO CLIENT & FINANCIAL INSTITUTIONS Member Code Nos.