Pace (Pakistan) Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

Annual Report 2013 Contents

ANNUAL REPORT 2013 CONTENTS VISION & MISSION STATEMENT 02 VALUES 03 SERVICES 04 THE GROUP 05 MILESTONES 2013 06 CORPORATE INFORMATION 12 MANAGEMENT COMMITTEES 13 DIRECTORS' REPORT TO THE SHAREHOLDERS 14 KEY FINANCIAL DATA 18 HORIZONTAL ANALYSIS 19 STATEMENT OF VALUE ADDITION 20 NOTICE OF NINETEENTH ANNUAL GENERAL MEETING 21 STATEMENT OF COMPLIANCE WITH THE CODE OF CORPORATE GOVERNANCE 22 REVIEW REPORT TO THE MEMBERS ON STATEMENT OF CODE OF CORPORATE GOVERNANCE 23 STATEMENT OF INTERNAL CONTROLS 25 STANDALONE FINANCIAL STATEMENTS AUDITORS' REPORT TO THE MEMBERS 28 STATEMENT OF FINANCIAL POSITION 30 PROFIT AND LOSS ACCOUNT 31 STATEMENT OF COMPREHENSIVE INCOME 32 CASH FLOW STATEMENT 33 STATEMENT OF CHANGES IN EQUITY 34 NOTES TO THE FINANCIAL STATEMENTS 35 STATEMENT OF WRITTEN-OFF LOANS 90 CONSOLIDATED FINANCIAL STATEMENTS DIRECTORS' REPORT ON CONSOLIDATED FINANCIAL STATEMENTS 92 AUDITORS' REPORT TO THE MEMBERS 94 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 95 CONSOLIDATED PROFIT AND LOSS ACCOUNT 96 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 97 CONSOLIDATED CASH FLOW STATEMENT 98 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 99 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 100 STATEMENT OF WRITTEN-OFF LOANS 159 PATTERN OF SHAREHOLDING 160 BRANCH NETWORK 163 FORM OF PROXY VISION Partnering Success MISSION STATEMENT Excellence in customer service and innovation for sustained profitable growth through prudent business practices VALUES Vision - Customer Focus and Innovation Attitude - Passion and Quest that Drives Us Leadership - Sense of Integrity, -

Faysal Funds

Accounts forthe Quarter Ended September 30, 2008 FAYSAL BALANCED GROWTH FUND The Faysal Balanced Growth Fund (FBGF) is an open-ended mutual fund. The units of FBGF are listed on the Karachi Stock Exchange and were initially offered to the public on April 19, 2004. FBGFseeks to provide long-term capital appreciation with a conservative risk profile and a medium to long-term investment horizon. FBGF's investment philosophy is to provide stable returns by investing in a portfolio balanced between equities and fixed income instruments. Fund Information Management Company Faysal Asset Management Limited Board of Directors of the Management Company Mr. Khalid Siddiq Tirmizey, Chairman Mr. Salman Haider Sheikh, Chief Executive Officer Mr. Sanaullah Qureshi, Director Mr. Syed Majid AIi, Director Mr. Feroz Rizvi, Director CFO of the Management Company Mr. Abdul Razzak Usman Company Secretary of the Management Company Mr. M. Siddique Memon Audit Committee Mr. Feroz Rizvi, Chairman Mr. Sanaullah Qureshi, Member Mr. Syed Majid Ali, Member Trustee Central Depository Company of Pakistan Limited Suit #. M-13, 16, Mezzanine Floor, Progressive Plaza, Beaumont Road, Near PIDC House, Karachi. Bankers to the Fund Faysal Bank Limited MCB Bank Limited Bank Alfalah Limited Atlas Bank Limited The Bank of Punjab Auditors Ford Rhodes Sidat Hyder & Co., Chartered Accountants Legal Advisor Mohsin Tayebely & Co., 2nd Floor, Dime Centre, BC-4, Block-9, KDA-5, Clifton, Karachi. Registrars Gangjees Registrar Services (Pvt) Limited Room # 506, 5th Floor, Clifton Centre, Kehkashan Clifton - Karachi. Distributors Access Financial Services (Pvt.) Ltd. AKD Securities (Pvt.) Limited Faysal Asset Management Limited Faysal Bank Limited PICIC Commercial Bank Limited Reliance Financial Products (Pvt.) Limited Invest Capital & Securities (Pvt.) Limited Flow(Private) Limited IGI Investment Bank Limited Pak Oman Investment Bank Limited Alfalah Securities (Pvt) Limited JS Global Capital Limited t"''' e , FAYSAL BALANCED ~ . -

Institutionalizing Islamic Banking: the Case of Bank of Khyber, Pakistan

Journal of Islamic Business and Management 2018, 8(S), 218-226 https://doi.org/10.26501/jibm/2018.080S-002 Institutionalizing Islamic Banking: The Case of Bank of Khyber, Pakistan Muhammad Mohsin Khan 1∗, Muhammad Atiq 2, Karim Ullah 3 1Director, Institute of Management Sciences, Peshawar, Pakistan 2 Assistant Professor, Institute of Management Sciences, Peshawar, Pakistan 3 Founding Head of Centre for Excellence in Islamic Finance, Institute of Management Sciences, Peshawar, Pakistan Keywords Abstract. This article discusses the move for conversion of a conventional Islamic Banking bank into Islamic one taking the Bank of Khyber (BoK), Pakistan as a Financial Intermediation case study. It provides an in-depth and emprical narrative of how Islamic Institutional Theory banking has been introduced at the Bank of Khyber particularly motivated by political and social incentives to reconstruct the current conventional banking model. Initially, BoK was operating on conventional model of financial intermediation and gradually, an Islamic banking division, a Shar¯i‘ah Board, and multiple Islamic depository and financing processes have been introduced and institutionalized to establish social and political legitimacy within the context. This case highlights the core challenges to the BoK team and value creation of the institutional intervention, particularly shared value creation and collaborative efforts across the industry, from an institutional theory perspective. This case carries multiple implications for the Islamic banking professionals and offers practical insights on the process of business model reconstruction within the context of Islamic banking. KAUJIE Classification: H13, I2, J0 JEL Classification: G2 c 2018 JIBM. All rights reserved. INTRODUCTION Institutionalization and Institutional Theory Institutional theory focuses on institutional pressures and how firms give into those pressures to adapt to social initiatives to gain legitimacy. -

Excellence Entity

year of excellence entity Long term A Short term A2 JCR-VIS Credit Rating Company Ltd. (JCR-VIS) has upgraded the medium to long term entity rating of the Bank from ‘A-’ (Single A Minus) to ‘A’ (Single A) while maintaining the short term rating at ‘A-2’ (A Two). Outlook on the assigned rating is “Stable”. The Pakistan Credit Rating Agency Limited (PACRA) has maintained long term entity rating of the Bank to “A-“ (Single A Minus) and short term entity rating at “A2” (A Two). Rating outlook is “Positive”. The ratings denote low expectation of credit risk emanating from a strong capacity for timely payment of financial commitments. Milestones Achieved 4 Serving with Distinction & Pride 6 Our Vision & Mission 8 Company Information 10 Our Products & Services 12 Board Profile 14 From the Managing Director 16 Financial Spectrum 18 Six Years Financial Highlights 20 Notice of 22nd Annual Genreal Meeting 22 Directors’ Report 24 Statement of Compliance 37 Review Report to the Members 40 Statement of Internal Control 41 Shariah Advisor Report 42 Auditors' Report to the Members 45 Financial Highlights 47 02 03 milestones DEPOSITS RS. ADVANCES 60BILLION RS. UP BY 32 % OVER 2O11 BILLION30 UP BY 17 % OVER 2O11 INVESTMENTS RS. ASSETS 46BILLION UP BY 25 % OVER 2O11 RS. 82BILLION UP BY 20 % OVER 2011 PROFIT AFTER TAX ONE BILLION UP BY 23% OVER 2011 04 05 serving with We embarked upon our journey 22 years ago, as one of the public sector bank, catering to the banking needs of our people. After successfully coming out of all sort of challenges, today we are all set to be a bank that is present almost in every part of the country. -

0.30560 0.30570 Daily Treasury Market Commentary KUWAITI DINAR

KUWAITI DINAR 0.30560 0.30570 Daily Treasury Market Commentary October 28, 2020 Foreign Exchange Developments: Economic Updates: The euro fell against the dollar on Wednesday following a New orders for key US-made capital goods increased Currency Price MTD % 3M% YTD% media report that France's government was leaning to six-year high in September, wrapping up a quarter EUR/USD 1.1779 0.51 0.55 5.07 toward reinstating a national lockdown to curb a of potentially record growth in business spending and GBP/USD 1.3043 0.98 0.87 -1.64 resurgence in coronavirus cases. the economy. AUD/USD 0.7145 -0.24 -0.18 1.75 The dollar, however, gave up early gains against other Britain must spell out how far it wants to diverge from USD/CHF 0.909 -1.28 -0.98 -6.09 major currencies as sentiment turned bearish due to European Union rules if it wants access to the bloc's USD/JPY 104.26 -1.16 -0.81 -4.25 uncertainty about the outcome of the U.S. presidential financial market from January, a top European USD/CAD 1.3191 -0.97 -1.39 1.57 election next week. The euro fell 0.14% to $1.1780 in Asia Commission official said on Tuesday. on Wednesday, down for a third consecutive session. Sterling held steady at $1.3035, supported by hopes for a Local & GCC news: last-minute trade deal between Britain and the European Kuwait's central bank announced on Tuesday it was Index Price Change MTD% YTD% Union. -

Habibmetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION)

A N N U A L R E P O R T 2017 1 HabibMetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION) 2 A N N U A L R E P O R T 2017 JOURNEY OF CONTINUOUS SUCCESS A long term partnership Over the years, First Habib Modaraba (FHM) has become the sound, strong and leading Modaraba within the Modaraba sector. Our stable financial performance and market positions of our businesses have placed us well to deliver sustainable growth and continuous return to our investors since inception. During successful business operation of more than 3 decades, FHM had undergone with various up and down and successfully countered with several economic & business challenges. Ever- changing requirement of business, product innovation and development were effectively managed and delivered at entire satisfaction of all stakeholders with steady growth on sound footing. Consistency in perfect sharing of profits among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. Our long term success is built on a firm foundation of commitment. FHM's financial strength, risk management protocols, governance framework and performance aspirations are directly attributable to a discipline that regularly brings prosperity to our partners and gives strength to our business model which is based on true partnership. Conquering with the challenges of our operating landscape, we have successfully journeyed steadily and progressively, delivering consistent results. With the blessing of Allah (SWT), we are today the leading Modaraba within the Modaraba sector of Pakistan, demonstrating our strength, financial soundness and commitment in every aspect of our business. -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

IBOR Transition Faqs

Sep 2021 IBOR Transition FAQs September 2021 About IBOR Transition This explanation and general risk warning is provided for customers of Al Ahli Bank Kuwait and each of its subsidiaries (collectively, “ABK”) who may have conventional products or agreements which uses the London Interbank Offered Rate ('LIBOR') or another inter-bank offered rate (together with LIBOR, the 'IBORs') as a benchmark rate. This explanation and general risk warning is provided for information purposes only and is subject to change. Where information in this explanation and general risk warning has been obtained from third party sources, we believe those sources to be reliable, but we do not guarantee the information’s accuracy, and you should note that it may be incomplete or condensed. Benchmark Reform LIBOR and other IBORs are currently the focus of international and national reforms. The UK Financial Conduct Authority (‘FCA’), which regulates LIBOR, has stated that it will no longer compel banks to submit rates for the calculation of LIBOR after the end of 2021. The US Federal Reserve and other regulators have also taken measures to move markets away from IBORs within set timelines. As a result, the continuation of LIBOR and other IBORs on their current basis cannot be guaranteed after 31 December 2021. These reforms may result in: (i) changes to the rules or methodologies used in calculating benchmark rates; (ii) restrictions on the use of benchmark rates; and/or (iii) discontinuance of benchmark rates. Even if certain benchmark rates might continue to be published, changes to their methodology, or restrictions on use, may mean that they are no longer representative of the underlying market and economic reality that the benchmark rate was originally intended measure or otherwise become no longer appropriate for products or agreements that customers have entered into with ABK. -

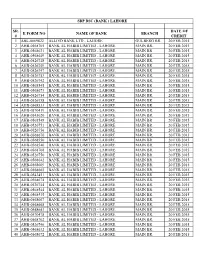

Sr. # E Form No Name of Bank Branch Date of Credit 1 Abl-0069822 Allied Bank

SBP BSC (BANK ) LAHORE SR. DATE OF E FORM NO NAME OF BANK BRANCH # CREDIT 1 ABL-0069822 ALLIED BANK LTD - LAHORE GULBERG BR. 20 FEB 2015 2 AHB-0568705 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 3 AHB-0568631 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 4 AHB-0568649 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 5 AHB-0526748 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 6 AHB-0526749 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 7 AHB-0526747 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 8 AHB-0526753 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 9 AHB-0526742 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 10 AHB-0568545 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 11 AHB-0568673 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 12 AHB-0526754 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 13 AHB-0526758 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 14 AHB-0568533 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 15 AHB-0570419 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 16 AHB-0543020 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 17 AHB-0568548 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 18 AHB-0526751 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 19 AHB-0526756 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 20 AHB-0568670 BANK AL HABIB LIMITED - LAHORE MAIN BR. -

WHY SILK? 111-007-455 2009 Inspiration for the Name Silkbank Comes from the Silk Route - a Trade Corridor Connecting Asia to Europe and the Rest of the World

Silkbank Building ANNUAL I.I. Chundrigar Road, Karachi REPORT www.silkbank.com.pk WHY SILK? 111-007-455 2009 Inspiration for the name Silkbank comes from the Silk Route - a trade corridor connecting Asia to Europe and the rest of the world. Silk, known for its distinctive properties and characteristics, symbolizes Silkbank’s brand beliefs. Premium & Upscale Silk is known for class and premium quality. Silkbank is positioned as an upscale bank providing its customers with premium banking experience. Talent & Innovation Silk embodies talent and timeless innovation. Silkbank promises its customers innovative products delivered through talented staff. Strong & Reliable Silk is amongst the strongest fibres known to mankind. Silkbank derives its strength from its strong international institutional sponsors giving it credibility and reliability. Dependable Silk through the times has held its value. Silkbank driven by a team of professionals provides an optimal experience that you can depend on. Contents Vision & Mission 02 Chairman's Message 03 Silkbank Products President & CEO's Message 05 Senior Management Committee 07 Assets Corporate Information 11 Directors’ Report 15 Statement of Compliance with the Code of Liabilities Corporate Governance 23 Statement of Internal Control 25 Notice of AGM 29 Review Report to the Members on Statement of Compliance with the Best Practices of Code of Corporate Governance 30 Independent Auditors’ Report 33 Balance Sheet 37 Profit and Loss Account 38 Statement of Comprehensive Income 39 Cash Flow Statement -

Snapshot of Results of Banks in Pakistan Snapshot of Results of Banks in Pakistan Six Months Period Ended 30 June 2016

KPMG Taseer Hadi & Co. Chartered Accountants Snapshot of results of Banks in Pakistan Snapshot of results of banks in Pakistan Six months period ended 30 June 2016 This snapshot has been prepared by KPMG Taseer Hadi & Co. and summarizes the performance of selected banks in Pakistan for the 6 months period ended 30 June 2016. The information contained in this snapshot has been obtained from the published consolidated financial statements of the banks and where consolidated financial statements were not available, standalone financials have been used. Reference should be made to the published financial statements of the banks to enhance the understanding of ratios and analysis of performance of a particular bank. We have tried to provide relevant financial analysis of the banks which we thought would be useful for benchmarking and comparison. However, we welcome any comments, which would facilitate in improving the contents of this document. The comments may be sent on [email protected] Dated: 23 September 2016 Karachi © 2016 KPMG Taseer Hadi & Co., a Partnership firm registered in Pakistan and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 2 Document Classification: KPMG Public HBL NBP UBL MCB ABL BAF 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 Ranking By total assets 1 1 2 2 3 3 4 4 5 5 6 6 By net assets 1 1 2 2 3 3 4 4 5 5 7 7 By profit before tax 1 1 4 4 2 3 3 2 5 5 7 8 Profit before tax * 28,298