Flight Transportation Report R96-3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Southwest Airlines 1996 Annual Report

1996 Annual Report TABLE OF CONTENTS Consolidated Highlights 2 Introduction 3 Letter to Shareholders 4 People and Planes 6 Southwest Spirit 8 THE Low Fare Airline 10 Productivity 12 Ontime Performance 14 Customer Satisfaction 16 Mintenance and Safety 18 What’s Next? 20 Financial Review 22 Management’s Discussion and Analysis 22 Consolidated Financial Statements 31 Report of Independent Auditors 49 Quarterly Financial Data 50 Common Stock Price Ranges and Dividends 50 Corporate Data 51 Directors and Officers 52 Ten Year Summary 55 CONSOLIDATED HIGHLIGHTS (DOLLARS IN THOUSANDS PERCENT EXCEPT PER SHARE AMOUNTS) 1996 1995 CHANGE Operating revenues $3,406,170 $2,872,751 18.6 Operating expenses $3,055,335 $2,559,220 19.4 Operating income $350,835 $313,531 11.9 Operating margin 10.3% 10.9% (0.6)pts. Net income $207,337 $182,626 13.5 Net margin 6.1% 6.4% (0.3)pts. Net income per common and common equivalent share $1.37 $1.23 11.4 Stockholders’ equity $1,648,312 $1,427,318 15.5 Return on average stockholders’ equity 13.5% 13.7% (0.2)pts. Debt as a percentage of invested capital 28.3% 31.7% (3.4)pts. Stockholders’ equity per common share outstanding $11.36 $9.91 14.6 Revenue passengers carried 49,621,504 44,785,573 10.8 Revenue passenger miles (RPMs)(000s) 27,083,483 23,327,804 16.1 Available seat miles (ASMs)(000s) 40,727,495 36,180,001 12.6 Passenger load factor 66.5% 64.5% 2.0 pts. Passenger revenue yield per RPM 12.07¢ 11.83¢ 2.0 Operating revenue yield per ASM 8.36¢ 7.94¢ 5.3 Operating expenses per ASM 7.50¢ 7.07¢ 6.1 Number of Employees at yearend 22,944 19,933 15.1 NET INCOME (in millions) $207 $179 $183 250 $154 200 $97 150 100 50 0 1992 1993 1994 1995 1996 2 NET INCOME PER SHARE $1.37 $1.22 $1.23 1.40 $1.05 1.20 1.00 $.68 0.80 0.60 0.40 0.20 0.00 1992 1993 1994 1995 1996 SOUTHWEST AIRLINES CO. -

Runway Excursion During Landing, Delta Air Lines Flight 1086, Boeing MD-88, N909DL, New York, New York, March 5, 2015

Runway Excursion During Landing Delta Air Lines Flight 1086 Boeing MD-88, N909DL New York, New York March 5, 2015 Accident Report NTSB/AAR-16/02 National PB2016-104166 Transportation Safety Board NTSB/AAR-16/02 PB2016-104166 Notation 8780 Adopted September 13, 2016 Aircraft Accident Report Runway Excursion During Landing Delta Air Lines Flight 1086 Boeing MD-88, N909DL New York, New York March 5, 2015 National Transportation Safety Board 490 L’Enfant Plaza, S.W. Washington, D.C. 20594 National Transportation Safety Board. 2016. Runway Excursion During Landing, Delta Air Lines Flight 1086, Boeing MD-88, N909DL, New York, New York, March 5, 2015. Aircraft Accident Report NTSB/AAR-16/02. Washington, DC. Abstract: This report discusses the March 5, 2015, accident in which Delta Air Lines flight 1086, a Boeing MD-88 airplane, N909DL, was landing on runway 13 at LaGuardia Airport, New York, New York, when it departed the left side of the runway, contacted the airport perimeter fence, and came to rest with the airplane’s nose on an embankment next to Flushing Bay. The 2 pilots, 3 flight attendants, and 98 of the 127 passengers were not injured; the other 29 passengers received minor injuries. The airplane was substantially damaged. Safety issues discussed in the report relate to the use of excessive engine reverse thrust and rudder blanking on MD-80 series airplanes, the subjective nature of braking action reports, the lack of procedures for crew communications during an emergency or a non-normal event without operative communication systems, inaccurate passenger counts provided to emergency responders following an accident, and unclear policies regarding runway friction measurements and runway condition reporting. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

David Neeleman

David Neeleman David Neeleman is that rarest of entrepreneurs, a man who has created and launched four successful, independent airlines, including the USA’s JetBlue and Morris Air, Canada’s WestJet and Brazil’s Azul. Azul, just seven years old, has already boarded tens of millions of customers. Born in Brazil while his father was Reuter’s São Paulo Bureau Chief, David has always had a deep love for the country. After his family moved to Utah while he was still a child, David would return to Brazil many times throughout his life. A dual citizen, David today relishes the dream before him to make flying cheaper and easier for Brazilians, giving access to air travel for many who have never experienced the opportunity before. Azul serves more than 100 destinations with an operating fleet of more than 140 aircraft, including Brazilian-built Embraer E-190 and E-195 jets, and ATR-72s. Just as JetBlue in the US before it, Azul is the first airline in Latin America to offer LiveTV inflight TV programming via satellite. It has been named Best Low Cost Airline in South America for the last five years at the Skytrax World Airline Awards. In June 2015, it was announced that the Gateway consortium, led by David, had won the bidding to acquire a stake in Portugal’s national carrier TAP. Gateway’s investment represents 50% of the airline. With the new investment, TAP is taking delivery of A330s and inaugurated new daily service from both Boston’s Logan airport and New York’s John F Kennedy International in June and July, respectively. -

1995 Annual Report

Southwest Airlines Co. 1995 Annual Report OUR 6 SECRETS OF SUCCESS Table of Contents Consolidated Highlights ..................................................................2 Introduction .....................................................................................3 Letter to Shareholders.....................................................................4 1. Stick To What You’re Good At ....................................................4 2. Keep It Simple .............................................................................8 3. Keep Fares Low, Costs Lower ..................................................10 4. Treat Customers Like Guests....................................................12 5. Never Stand Still .......................................................................14 6. Hire Great People .....................................................................16 Looking Ahead ..............................................................................18 Destinations ..................................................................................20 Financial Review ...........................................................................21 Management’s Discussion and Analysis .......................................21 Consolidated Financial Statements...............................................27 Report of Independent Auditors ....................................................39 Quarterly Financial Data ...............................................................40 Common Stock Price Ranges -

Adaptive Connected.Xlsx

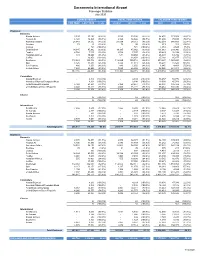

Sacramento International Airport Passenger Statistics July 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2020/21 2019/20 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 3,593 33,186 (89.2%) 3,593 33,186 (89.2%) 54,432 173,858 (68.7%) Horizon Air 6,120 14,826 (58.7%) 6,120 14,826 (58.7%) 31,298 75,723 (58.7%) American Airlines 28,089 54,512 (48.5%) 28,089 54,512 (48.5%) 162,319 348,689 (53.4%) Boutique 79 95 (16.8%) 79 95 (16.8%) 613 201 205.0% Contour - 721 (100.0%) - 721 (100.0%) 4,461 2,528 76.5% Delta Airlines 14,185 45,962 (69.1%) 14,185 45,962 (69.1%) 111,063 233,946 (52.5%) Frontier 4,768 7,107 (32.9%) 4,768 7,107 (32.9%) 25,423 38,194 (33.4%) Hawaiian Airlines 531 10,660 (95.0%) 531 10,660 (95.0%) 26,393 64,786 (59.3%) Jet Blue - 16,858 (100.0%) - 16,858 (100.0%) 25,168 85,877 (70.7%) Southwest 112,869 300,716 (62.5%) 112,869 300,716 (62.5%) 899,647 1,963,253 (54.2%) Spirit 8,425 11,318 (25.6%) 8,425 11,318 (25.6%) 38,294 15,526 146.6% Sun Country 886 1,650 (46.3%) 886 1,650 (46.3%) 1,945 4,401 (55.8%) United Airlines 7,620 46,405 (83.6%) 7,620 46,405 (83.6%) 98,028 281,911 (65.2%) 187,165 544,016 (65.6%) 187,165 544,016 (65.6%) 1,479,084 3,288,893 (55.0%) Commuters Alaska/Skywest - 4,304 (100.0%) - 4,304 (100.0%) 36,457 50,776 (28.2%) American/Skywest/Compass/Mesa - 8,198 (100.0%) - 8,198 (100.0%) 18,030 45,781 (60.6%) Delta/Skywest/Compass 5,168 23,651 (78.1%) 5,168 23,651 (78.1%) 62,894 146,422 (57.0%) United/Skywest/GoJet/Republic 4,040 16,221 (75.1%) 4,040 16,221 (75.1%) -

FY20 Main Stats- Adaptive Connected.Xlsx

Sacramento International Airport Passenger Statistics April 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2019/20 2018/19 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 254 28,618 (99.1%) 224,058 220,143 1.8% 47,617 78,326 (39.2%) Horizon Air 930 9,009 (89.7%) 83,551 91,930 (9.1%) 19,285 37,628 (48.7%) American Airlines 5,310 48,633 (89.1%) 409,920 487,335 (15.9%) 107,335 187,996 (42.9%) Boutique 33 - 0.0% 749 - 0.0% 265 - 0.0% Contour - 356 (100.0%) 12,339 356 3366.0% 4,461 356 1153.1% Delta Airlines 3,279 32,727 (90.0%) 326,111 320,143 1.9% 80,412 114,168 (29.6%) Frontier 377 4,882 (92.3%) 57,938 38,146 51.9% 17,415 15,939 9.3% Hawaiian Airlines - 10,114 (100.0%) 88,524 76,513 15.7% 25,862 33,152 (22.0%) Jet Blue 200 10,670 (98.1%) 108,591 118,825 (8.6%) 24,751 38,730 (36.1%) Southwest 17,308 288,513 (94.0%) 2,416,279 2,754,196 (12.3%) 650,717 1,066,115 (39.0%) Spirit 306 - 0.0% 95,033 - 0.0% 27,531 - 0.0% Sun Country - - 0.0% 13,538 - 0.0% 526 - 0.0% United Airlines 1,694 44,250 (96.2%) 328,432 409,471 (19.8%) 81,057 141,974 (42.9%) 29,691 477,772 (93.8%) 4,165,063 4,517,058 (7.8%) 1,087,234 1,714,384 (36.6%) Commuters Alaska/Skywest 1,124 8,489 (86.8%) 74,773 85,618 (12.7%) 30,401 33,050 (8.0%) American/Skywest/Compass/Mesa 17 5,226 (99.7%) 62,461 66,389 (5.9%) 18,030 21,698 (16.9%) Delta/Skywest/Compass 1,669 20,212 (91.7%) 178,479 198,099 (9.9%) 49,697 74,471 (33.3%) United/Skywest/GoJet/Republic 616 15,458 (96.0%) 111,450 135,979 (18.0%) 28,937 53,523 (45.9%) 3,426 49,385 -

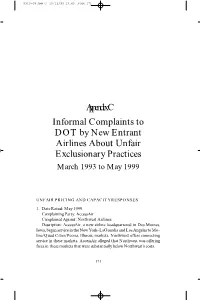

Appendix C Informal Complaints to DOT by New Entrant Airlines About Unfair Exclusionary Practices March 1993 to May 1999

9310-08 App C 10/12/99 13:40 Page 171 Appendix C Informal Complaints to DOT by New Entrant Airlines About Unfair Exclusionary Practices March 1993 to May 1999 UNFAIR PRICING AND CAPACITY RESPONSES 1. Date Raised: May 1999 Complaining Party: AccessAir Complained Against: Northwest Airlines Description: AccessAir, a new airline headquartered in Des Moines, Iowa, began service in the New York–LaGuardia and Los Angeles to Mo- line/Quad Cities/Peoria, Illinois, markets. Northwest offers connecting service in these markets. AccessAir alleged that Northwest was offering fares in these markets that were substantially below Northwest’s costs. 171 9310-08 App C 10/12/99 13:40 Page 172 172 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY 2. Date Raised: March 1999 Complaining Party: AccessAir Complained Against: Delta, Northwest, and TWA Description: AccessAir was a new entrant air carrier, headquartered in Des Moines, Iowa. In February 1999, AccessAir began service to New York–LaGuardia and Los Angeles from Des Moines, Iowa, and Moline/ Quad Cities/Peoria, Illinois. AccessAir offered direct service (nonstop or single-plane) between these points, while competitors generally offered connecting service. In the Des Moines/Moline–Los Angeles market, Ac- cessAir offered an introductory roundtrip fare of $198 during the first month of operation and then planned to raise the fare to $298 after March 5, 1999. AccessAir pointed out that its lowest fare of $298 was substantially below the major airlines’ normal 14- to 21-day advance pur- chase fares of $380 to $480 per roundtrip and was less than half of the major airlines’ normal 7-day advance purchase fare of $680. -

National Aviation Safety Inspection Program Federal Aviation Administration

Memorandum U.S. Department of Transportation Office of the Secretary of Transportation Office of Inspector General Subject: INFORMATION: Report on the National Date: April 30, 1999 Aviation Safety Inspection Program, Federal Aviation Administration, AV-1999-093 From: Lawrence H. Weintrob Reply to Attn. of: JA-1:x61992 Assistant Inspector General for Auditing To: Federal Aviation Administrator This report summarizes our review of the Federal Aviation Administration’s (FAA) National Aviation Safety Inspection Program. We are providing this report for your information and use. Your April 30, 1999, comments to our April 9, 1999, draft report were considered in preparing this report. An executive summary of the report follows this memorandum. In your comments to the draft report, you concurred with all recommendations. We consider your actions taken and planned to be responsive to all recommendations. The recommendations are considered resolved subject to the followup provisions of Department of Transportation Order 8000.1C. We appreciate the cooperation and assistance provided by your staff during the review. If you have questions or need further information, please contact me at (202) 366-1992, or Alexis M. Stefani, Deputy Assistant Inspector General for Aviation, at (202) 366-0500. Attachment # Alongtin/Rkoch/Arobson/jea/4-29-99 V:\Airtran\A-report\Final1.doc A:\NASIPRPT2.doc EXECUTIVE SUMMARY National Aviation Safety Inspection Program Federal Aviation Administration AV-1999-093 April 30, 1999 Objectives and Scope Congressman Peter A. DeFazio requested the Office of Inspector General to review the National Aviation Safety Inspection Program (NASIP) final report on ValuJet Airlines, Inc. (ValuJet)1 issued in February 1998. -

2013 Jetsuite

JetSuite’s vision to provide the freedom and exhilaration of private air travel to more people than ever is realized through efficient operations, acute attention to detail, acclaimed customer service, and industry-leading safety practices. And JetSuite continues to be the only jet charter company to guarantee its instant, online quotes for its fleet of WiFi-equipped JetSuite Edition CJ3 and Phenom 100 aircraft. Refreshingly transparent! ©©2013 2014 JetSuiteJetSuite || jetsuite.com JetSuite.com THE EXECUTIVE TEAM ALEX WILCOX, CEO With over two decades of experience in creating highly innovative air carriers in ways that have improved air travel for millions, Alex Wilcox now serves as CEO of JetSuite – a private jet airline which launched operations in 2009. In co-founding JetSuite in 2006, Alex brought new technology and unprecedented value to an industry in dire need of it. JetSuite is a launch customer for the Embraer Phenom 100, an airplane twice as efficient and more comfortable than other jets performing its missions, as well as the JetSuite Edition CJ3 from Cessna. Also a founder of JetBlue, Alex was a driving force behind many airline industry changing innovations, including the implementation of live TV on board and all-leather coach seating. Alex was also named a Henry Crown Fellow by the Aspen Institute. KEITH RABIN, PRESIDENT AND CHIEF FINANCIAL OFFICER With a background that spans over a decade in the financial services and management consulting industries, Keith Rabin has served as President of JetSuite since 2009. Prior to co-founding JetSuite, Keith was a Partner at New York based hedge fund Verity Capital, where he was responsible for portfolio management and the development of Verity’s sector shorting strategy. -

Biz Tips: Know Your End-Game Sunday, October 31, 2004 by Art Hill

BIZTIPS - October 31, 2004 Biz Tips: Know Your End-Game Sunday, October 31, 2004 By Art Hill Like the world champion Red Sox, you need a clear objective for your business when you start the season. You might not be setting out to win your first World Series in 86 years, but knowing your business objective can be just as important. Remember to “begin with the end in mind.” Whether your business is just forming or has sustained your family for generations, you need to think about your last day in business as well as your first. Take Morris Air for example. In 1984, David Neeleman and June Morris, then travel agency execs, started a modest charter airline in Salt Lake City. Some airlines had brightly painted planes and slogans like “Your Top Banana to Reno.” Others adopted a slightly older sales technique and cut flight attendant uniforms to fit the miniskirt craze. Neeleman and Morris were a bit more creative. They offered discount fares to undermine traditional (expensive) airlines in a city with explosive growth and an ideal location for popular west coast destinations. But the key to their long range success was their end-game plan. Using only Boeing 737 aircraft and adopting the highly successful “no frills” approach of Southwest Airlines, they built a company designed to be sold. In 1994 Southwest purchased its little look-alike for the tidy sum of $129 million. Morris Air had begun with the end in mind and ended on a note of stunning success. Not all businesses achieve the goals of their owners. -

The Effect of the Internet on Product Quality in the Airline Industry Itai

The Effect of the Internet on Product Quality in the Airline Industry Itai Ater (Tel Aviv University) and Eugene Orlov (Compass Lexecon) June 2012 Abstract How did the diffusion of the Internet affect product quality in the airline industry? We argue that the shift to online distribution channels has changed the way airlines compete for customers - from an environment in which airlines compete for space at the top of travel agents’ computer screens by scheduling the shortest flights, to an environment where price plays the dominant role in selling tickets. Using flight-level data between 1997 and 2007 and geographical growth patterns in Internet access, we find a positive relationship between Internet access and scheduled flight times. The magnitude of the effect is larger in competitive markets without low-cost carriers and for flights with shortest scheduled times. We also find that despite longer scheduled flight times, flight delays increased as passengers gained Internet access. More generally, these findings suggest that increased Internet access may adversely affect firms' incentives to provide high quality products. (Internet; e-commerce; Search; Air Travel; Product Quality) I. Introduction How do improvements in information availability affect markets? Researchers have long emphasized that price information is critical for the efficient functioning of markets. The growth of electronic commerce and Internet marketplaces has been considered as contributing towards market efficiency, because it has enabled consumers to compare prices across hundreds of vendors with much less effort than would be required in the physical world (e.g. Brynjolfsson and Smith 2000; Brown and Goolsbee 2002; Clemons et al.