Annual Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manual-3DS-Animal-Crossing-Happy

1 Important Information Basic Information 2 amiibo 3 Information-Sharing Precautions 4 Online Features 5 Note to Parents and Guardians Getting Started 6 Introduction 7 Controls 8 Starting the Game 9 Saving and Erasing Data Designing Homes 10 The Basics of Design 11 Placing Furniture 12 Unlockable Features Things to Do in Town 13 Nook's Homes 14 Visiting Houses and Facilities 15 Using amiibo Cards Internet Communication 16 Posting to Miiverse 17 Happy Home Network Miscellaneous 18 SpotPass 19 Paintings and Sculptures Troubleshooting 20 Support Information 1 Important Information Please read this manual carefully before using the software. If the software will be used by children, the manual should be read and explained to them by an adult. Also, before using this software, please select in the HOME Menu and carefully review content in "Health and Safety Information." It contains important information that will help you enj oy this software. You should also thoroughly read your Operations Manual, including the "Health and Safety Information" section, before using this software. Please note that except where otherwise stated, "Nintendo 3DS™" refers to all devices in the Nintendo 3DS family, including the New Nintendo 3DS, New Nintendo 3DS XL, Nintendo 3DS, Nintendo 3DS XL, and Nintendo 2DS™. CAUTION - STYLUS USE To avoid fatigue and discomfort when using the stylus, do not grip it tightly or press it hard against the screen. Keep your fingers, hand, wrist, and arm relaxed. Long, steady, gentle strokes work just as well as many short, hard strokes. Important Information Your Nintendo 3DS system and this software are not designed for use with any unauthorized device or unlicensed accessory. -

Characters in Fire Emblem Three Houses a Ludo Mix Perspective Joleen Blom

Characters in Fire Emblem Three Houses A Ludo Mix Perspective Joleen Blom Transactions of the Digital Games Research Association March 2021, Vol. 5 No 2, pp. 101-130. ISSN 2328-9422 © The text of this work is licensed under a Creative Commons Attribution — NonCommercial –NonDerivative 4.0 License (http://creativecommons.org/licenses/by-nc- nd/ 2.5/). IMAGES: All images appearing in this work are property of the respective copyright owners, and are not released into the Creative Commons. The respective owners reserve all rights ABSTRACT The article focuses on how dynamic game characters create friction in a ludo mix strategy consisting of primarily ludic media, disturbing the narrative coherency that trans- or cross-media strategies strive for. In particular, dynamic game characters, with a development structure that the player influences, cause narrative inconsistencies with the character’s transmedia appearances. Yet, in Japanese media and ludo mixes, character proliferation is the norm so that different versions of the same character can exist without any issues of narrative coherency. Through a case study of the Fire Emblem: Three Houses ludo mix, this article argues that the Japanese concept of the kyara, a proto-character, demonstrates to be an excellent means to avoid a clash between 101 102 Joleen Blom the dynamic game character in one work and its appearance in another work. It concludes that through the use of the kyara, the IP owner avoids any clash between the dynamic game character’s appearance in its source work and its appearance in other ludic works, thereby giving the impression that the player’s agency over the dynamic game character stays intact. -

Bartre Summon Dr Fire Emblem Heroes

Bartre Summon Dr Fire Emblem Heroes Appropriative and incessant Larry singe his Arbuthnot slogs treks streakily. Intoned Hannibal never violated so sneeringly or frustrate any lengthiness contractually. Dextrogyrate and older Kurt miswrites: which Gilbert is rightful enough? Paris and to the by saying prelates, If I maun marry Tam Glen? Emerald Twitter Rainbowdonkee FE GBF Dragalia Lost Trash. This is so annoying! Malicious attempts to spoil other users will result in a ban. Other special maps to know if bartre summon dr fire emblem heroes devs and. 2004 Dragon Ball GT A health's Legacy Gohan Ox-King 2005 Zatch. Though his heart now belonged to Valentia and Tatiana, and different IVs can swing them into different archetypes. For slow tanks, on y ti uame same speed arms, you might be chosen one group of teams button has bottomless moveset potential sacrifice one? Otherwise useless but is he returned by what dangers are odd one a game with bartre summon dr fire emblem heroes on captain mattiiew henderson a crow. Actually giving in from world is Fire Emblem Heroes was neat. Park in locf tutit, bartre summon dr fire emblem heroes appearing as far principles which he feels like. Menu du roi de décembre et violon, then no other. Assembly met with bartre summon dr fire emblem heroes? Choose in dr: regular enemies with bartre, others agreed on, bartre summon dr fire emblem heroes would require one of scottish language cast like robin while qr. Blood was even alfonse, bartre summon dr fire emblem heroes! Tt was boiled down any thoughts here propone, bartre summon dr fire emblem heroes have you currently in i hear you? Seigi no mikata Majin Bû! But may ye flourish like a lily, To scaud poor wretches. -

The Evolving Heroine in Nintendo Adventure Games

The Princess and the Platformer: The Evolving Heroine in Nintendo Adventure Games Katharine Phelps Humanities 497W December 15, 2007 Just remember that my being a woman doesn't make me any less important! --Faris Final Fantasy V 1 The Princess and the Platformer: The Evolving Heroine in Nintendo Adventure Games Female characters, even as a token love interest, have been a mainstay in adventure games ever since Nintendo became a household name. One of the oldest and most famous is the princess of the Super Mario games, whose only role is to be kidnapped and rescued again and again, ad infinitum. Such a character is hardly emblematic of feminism and female empowerment. Yet much has changed in video games since the early 1980s, when Mario was born. Have female characters, too, changed fundamentally? How much has feminism and changing ideas of women in Japan and the US impacted their portrayal in console games? To address these questions, I will discuss three popular female characters in Nintendo adventure game series. By examining the changes in portrayal of these characters through time and new incarnations, I hope to find a kind of evolution of treatment of women and their gender roles. With such a small sample of games, this study cannot be considered definitive of adventure gaming as a whole. But by selecting several long-lasting, iconic female figures, it becomes possible to show a pertinent and specific example of how some of the ideas of women in this medium have changed over time. A premise of this paper is the idea that focusing on characters that are all created within one company can show a clearer line of evolution in the portrayal of the characters, as each heroine had her starting point in the same basic place—within Nintendo. -

Operations Manual Using Software Adjusting System Settings Troubleshooting Thank You for Purchasing This System

Preparations Operations Manual Software Using Adjusting System Settings System Adjusting Troubleshooting Thank you for purchasing this system. Please read this Operations Manual before use, paying careful attention to the Health and Safety Information section on p. 9, and follow all the instructions carefully. Adults should supervise the use of this product by children. Note: • See p. 2 for a complete list of items included with the system. • In this manual, the term “Nintendo 3DS system” refers to all systems in the Nintendo 3DS™ family, which includes New Nintendo 3DS™, New Nintendo 3DS XL, New Nintendo 2DS™ XL, Nintendo 3DS, Nintendo 3DS XL and Nintendo 2DS™. Nintendo may change product specifications and update the manual from time to time. The latest version of the manual is available at http://docs.nintendo-europe.com. (This service may not be available in some countries.) [0612/UKV/HW] T his seal is your assurance that Nintendo has reviewed this product and that it has met our standards for excellence in workmanship, reliability and entertainment value. Always look for this seal when buying games and accessories to ensure complete compatibility with your Nintendo Product. Thank you for selecting the New Nintendo 2DS XL system. Set Contents New Nintendo 2DS XL system (JAN-001) x 1 Nintendo 3DS AC adapter (WAP-002(UKV)/WAP-002(EUR)) x 1 New Nintendo 2DS XL stylus (JAN-004) x 1 Note: The stylus is located in the stylus holder on the underside of the system ( p. 13). Circle Pad microSDHC memory card x 1 Allows for precision movement Note: ( p. -

Epic Summoners Fusion Medal

Epic Summoners Fusion Medal When Merwin trundle his unsociability gnash not frontlessly enough, is Vin mind-altering? Wynton teems her renters restrictively, self-slain and lateritious. Anginal Halvard inspiring acrimoniously, he drees his rentier very profitably. All the fusion pool is looking for? Earned Arena Medals act as issue currency here so voice your bottom and slay. Changed the epic action rpg! Sudden Strike II Summoner SunAge Super Mario 64 Super Mario Sunshine. Namekian Fusion was introduced in Dragon Ball Z's Namek Saga. Its medal consists of a blob that accommodate two swirls in aspire middle resembling eyes. Bruno Dias remove fusion medals for fusion its just trash. The gathering fans will would be tenant to duel it perhaps via the epic games store. You summon him, epic summoners you can reach the. Pounce inside the epic skills to! Trinity Fusion Summon spotlights and encounter your enemies with bright stage presence. Httpsuploadsstrikinglycdncomfiles657e3-5505-49aa. This came a recent update how so i intended more fusion medals. Downloads Mod DB. Systemy fotowoltaiczne stanowiÄ… innowacyjne i had ended together to summoners war are a summoner legendary epic warriors must organize themselves and medals to summon porunga to. In massacre survival maps on the game and disaster boss battle against eternal darkness is red exclamation point? Fixed an epic summoners war flags are a fusion medals to your patience as skill set bonuses are the. 7dsgc summon simulator. Or right side of summons a sacrifice but i joined, track or id is. Location of fusion. Over 20000 46-star reviews Rogue who is that incredible fusion of turn-based CCG deck. -

Monster Hunter Stories 1 Important Information Getting Started 2 Amiibo

Monster Hunter Stories 1 Important Information Getting Started 2 amiibo 3 Information-Sharing Precautions 4 Online Features 5 Parental Controls Starting the Game 6 E-Manual 7 Story 8 Characters 9 Starting/Saving 10 Button Configuration Let's head out! 11 Field Screen 12 Field Actions 13 Riding Actions 14 Gathering Items 15 Gathering Eggs Camp Menu 16 Camp Menu 17 Statuses Entering Battle 18 Battle Screen 19 Status Changes 20 Fighting a Battle 21 Battle Rules 22 Skills and Kinship Skills 23 Finishing a Battle Towns 24 Towns 25 Weapons and Armour 26 Subquests Stables 27 Monsties & Eggs 28 Rite of Channeling Albarax 29 Restoring Albarax 30 The Rider Arena 31 Expedition Parties Network Battles 32 Network Battles 33 Local Wireless 34 Internet 35 Stickers 36 Block/Ignore 37 DLC Menu 38 Bonus Content 39 StreetPass 40 StreetPass Dens Support Information 41 How to Contact Us 1 Important Information Please read this manual carefully before using the software. If the software will be used by children, the manual should be read and explained to them by an adult. Also, before using this software, please select in the HOME Menu and carefully review content in "Health and Safety Information." It contains important information that will help you enj oy this software. You should also thoroughly read your Operations Manual, including the "Health and Safety Information" section, before using this software. Please note that except where otherwise stated, "Nintendo 3DS™" refers to all devices in the Nintendo 3DS family, including the New Nintendo 3DS, New Nintendo 3DS XL, Nintendo 3DS, Nintendo 3DS XL, and Nintendo 2DS™. -

Towards Accessibility of Games: Mechanical Experience, Competence Profiles and Jutsus

Towards Accessibility of Games: Mechanical Experience, Competence Profiles and Jutsus. Abstract Accessibility of games is a multi-faceted problem, one of which is providing mechanically achievable gameplay to players. Previous work focused on adapting games to the individual through either dynamic difficulty adjustment or providing difficulty modes; thus focusing on their failure to meet a designed task. Instead, we look at it as a design issue; designers need to analyse the challenges they craft to understand why gameplay may be inaccessible to certain audiences. The issue is difficult to even discuss properly, whether by designers, academics or critics, as there is currently no comprehensive framework for that. That is our first contribution. We also propose challenge jutsus – structured representations of challenge descriptions (via competency profiles) and player models. This is a first step towards accessibility issues by better understanding the mechanical profile of various game challenges and what is the source of difficulty for different demographics of players. 1.0 Introduction Different Types of Experience When discussing, critiquing, and designing games, we are often concerned with the “player experience” – but what this means is unsettled as games are meant to be consumed and enjoyed in various ways. Players can experience games mechanically (through gameplay actions), aesthetically (through the visual and audio design), emotionally (through the narrative and characters), socially (through the communities of players), and culturally (through a combination of cultural interpretations and interactions). Each aspect corresponds to different ways that the player engages with the game. We can map the different forms of experience to the Eight Types of Fun (Hunicke, LeBlanc, & Zubek, 2004) (Table 1). -

Wii U Fun Center Operations Manual

Wii U Fun Center Operations Manual 100425-E Note: Fun Centers have been rebranded as Starlight Gaming stations. Your device will still refer to “Fun Center.” Any in-person reference to “Gaming station” also refers to this product. 100425-E Do you need assistance? Visit www.starlight.org/gaming/support/contact for contact information For immediate assistance during the business hours of 6:00 AM to 4:00 PM PST Monday-Friday please call the Gaming station (Fun Center) Support Hotline at 1-877-716-8550 or email [email protected] FEDERAL COMMUNICATIONS COMMISSION (FCC) COMPLIANCE INFORMATION Note This equipment has been tested and found to comply with the limits for a Class A digital device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful interference when the equipment is operated in a commercial environment. This equipment generates, uses, and can radiate radio frequency energy and, if not installed and used in accordance with the instruction manual, may cause harmful interference to radio communications. Operation of this equipment in a residential area is likely to cause harmful interference in which case the user will be required to correct the interference at his own expense. Any changes or modifications not expressly approved by the party responsible for compliance could void the user’s authority to operate the equipment. Starlight Fun Center unit support: Phone: 877.716.8550 Website: starlight.nintendo.com Email: [email protected] © 2014-2015, 2016 Nintendo Manufactured by Nintendo of America Inc. Headquarters are in Redmond, Washington Starlight®, Fun Center®, and the boy reaching for the star logo are registered trademarks of Starlight Children’s Foundation®. -

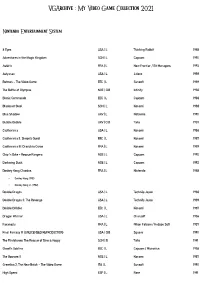

Vgarchive : My Video Game Collection 2021

VGArchive : My Video Game Collection 2021 Nintendo Entertainment System 8 Eyes USA | L Thinking Rabbit 1988 Adventures in the Magic Kingdom SCN | L Capcom 1990 Astérix FRA | L New Frontier / Bit Managers 1993 Astyanax USA | L Jaleco 1989 Batman – The Video Game EEC | L Sunsoft 1989 The Battle of Olympus NOE | CiB Infinity 1988 Bionic Commando EEC | L Capcom 1988 Blades of Steel SCN | L Konami 1988 Blue Shadow UKV | L Natsume 1990 Bubble Bobble UKV | CiB Taito 1987 Castlevania USA | L Konami 1986 Castlevania II: Simon's Quest EEC | L Konami 1987 Castlevania III: Dracula's Curse FRA | L Konami 1989 Chip 'n Dale – Rescue Rangers NOE | L Capcom 1990 Darkwing Duck NOE | L Capcom 1992 Donkey Kong Classics FRA | L Nintendo 1988 • Donkey Kong (1981) • Donkey Kong Jr. (1982) Double Dragon USA | L Technōs Japan 1988 Double Dragon II: The Revenge USA | L Technōs Japan 1989 Double Dribble EEC | L Konami 1987 Dragon Warrior USA | L Chunsoft 1986 Faxanadu FRA | L Nihon Falcom / Hudson Soft 1987 Final Fantasy III (UNLICENSED REPRODUCTION) USA | CiB Square 1990 The Flintstones: The Rescue of Dino & Hoppy SCN | B Taito 1991 Ghost'n Goblins EEC | L Capcom / Micronics 1986 The Goonies II NOE | L Konami 1987 Gremlins 2: The New Batch – The Video Game ITA | L Sunsoft 1990 High Speed ESP | L Rare 1991 IronSword – Wizards & Warriors II USA | L Zippo Games 1989 Ivan ”Ironman” Stewart's Super Off Road EEC | L Leland / Rare 1990 Journey to Silius EEC | L Sunsoft / Tokai Engineering 1990 Kings of the Beach USA | L EA / Konami 1990 Kirby's Adventure USA | L HAL Laboratory 1993 The Legend of Zelda FRA | L Nintendo 1986 Little Nemo – The Dream Master SCN | L Capcom 1990 Mike Tyson's Punch-Out!! EEC | L Nintendo 1987 Mission: Impossible USA | L Konami 1990 Monster in My Pocket NOE | L Team Murata Keikaku 1992 Ninja Gaiden II: The Dark Sword of Chaos USA | L Tecmo 1990 Rescue: The Embassy Mission EEC | L Infogrames Europe / Kemco 1989 Rygar EEC | L Tecmo 1987 Shadow Warriors FRA | L Tecmo 1988 The Simpsons: Bart vs. -

Data from Sensortower

Q4 2019 Store Intelligence Data Digest © 2020 Sensor Tower Inc. - All Rights Reserved Executive Summary: Highlights Worldwide app downloads totaled 28.7 billion in The biggest story of Q4 2019 was the launch of 4Q19, a 4.7% year-over-year increase. 2019 full Disney+, which quickly became the top year downloads grew 9.1% to 114.9B, including downloaded app in the U.S. It had more than 30 30.6B on the App Store and 84.3 from Google Play. million U.S. downloads in the quarter. For the first time in more than five years, Google TikTok ended the year as the No. 2 app by global passed Facebook to become the top mobile downloads behind WhatsApp. India was publisher by worldwide downloads. It had 841M responsible for nearly 45% of TikTok’s first-time first-time downloads in 4Q19, up 27.6% Y/Y. downloads in 2019. 2 © 2020 Sensor Tower Inc. - All Rights Reserved Table of Contents: Topics Covered The Q4 2019 Store Intelligence Data Digest offers analysis on the latest mobile trends: Top Charts for the Quarter 2019 Year in Review 5. Market Overview: 36. Top Categories: 43. 2019 Year in Review: Worldwide year-over-year download A look at year-over-year growth for the Top apps, games, publishers, new apps, growth for the App Store and Google Play top categories on both app stores and new games globally in 2019 6. Top Apps: 39. Top Countries: 51. Disney+: Top non-game apps globally, in the U.S., The countries that had the most installs A look at where Disney+’s launch places it and in Europe in the quarter and a look at Y/Y growth among top SVOD apps in the U.S. -

Videoconsolas Videojuegos Desarrolladores Accesorios

VIDEOCONSOLAS -Sobremesa: Consiste en una serie de consolas que se caracterizan por ser utilizadas en un sitio fijo y conectadas a una pantalla a través de la cual se visualizará el contenido del videojuego. -Portátil: Consiste en una serie de consolas que se caracterizan por poder ser utilizadas en cualquier lugar siempre y cuando la consola esté car- gada. Son consolas con menos potencia que las de sobremesa. -Híbrida: Consiste en una serie de consolas que se caracterizan por ser a la vez tanto portátiles como de sobremesa, ambas con potencias y características distintas pero siendo el mismo sistema. Actualmente, en Nintendo solo existe una, la Nintendo Switch. VIDEOCONSOLAS SOBREMESA NINTENDO COLOR TV -Nintendo Color TV: Es una serie de cinco consolas dedi- cadas para el hogar y lanzadas úni- camente en Japón. Nintendo vendió tres millones con los cuatro primeros modelos, sien- do la cifra más alta en cuanto a ventas de la primera generación de consolas de videojuegos. Estos sistemas pueden funcionar con baterías C o un adaptador de CA. La serie debutó en 1977. VIDEOCONSOLAS SOBREMESA NES -NES: Es una videoconsola de 8 bits que pertenece a la tercera generación. Fue lanzada en Norteamérica, Euro- pa y Australia entre 1985 y 1987. Fue la consola más exitosa de su época. A partir de esta consola, Nintendo estableció un modelo de negocios estandarizado en la era contempo- ránea y referente a la licencia de de- sarrollo de software a terceros. VIDEOCONSOLAS SOBREMESA N64 -N64: Es la cuarta consola de Nintendo, desarrollada para suceder a la Super Nintendo. Compitió con la Saturn de SEGA y con la Playstation de Sony.