Petrochemicals in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Polyethylene Industry Outlook in India to 2016 - Market Size, Company Share, Price Trends, Capacity Forecasts of All Active and Planned Plants

Polyethylene Industry Outlook in India to 2016 - Market Size, Company Share, Price Trends, Capacity Forecasts of All Active and Planned Plants Reference Code: GDCH1786IDB Publication Date: December 2012 Polyethylene Industry Outlook in India to 2016 GDCH1786IDB/DEC 2012 © GlobalData. This report is a licensed product and is not to be copied, reproduced, shared or resold in any form Page 1 Table of Contents 1 Table of Contents 1 Table of Contents 2 1.1 List of Tables 5 1.2 List of Figures 6 2 India Polyethylene Industry, Supply Scenario, 2000-2016 7 2.1 India Polyethylene Industry, Total Plant Capacity, 2000-2016 7 2.2 India Polyethylene Industry, Installed Plant Capacity by Production Process, 2011 15 2.3 India Polyethylene Industry, Installed Plant Capacity by Technology, 2011 18 2.4 India Polyethylene Industry, Company Share, 2011 21 2.5 India, Polyethylene Industry, Planned Projects Details, 2012-2016 22 3 India Polyethylene Industry, Market Dynamics, 2000-2016 23 3.1 India Polyethylene Industry, Market Size, 2000-2016 23 3.2 India Polyethylene Industry, Demand and Production Outlook, 2000-2016 25 3.3 India Polyethylene Industry, Demand by End Use Sector, 2011 27 3.4 India Polyethylene Industry, Price Forecasts, 2000-2016 28 4 India Polyethylene Industry, Trade Balance, 2000-2016 30 4.1 India Polyethylene Industry, Imports and Exports, 2000-2016 30 4.2 India Polyethylene Industry, Net Exports, 2000-2016 32 4.3 India Polyethylene Industry, Imports as Percentage of Demand, 2000-2016 34 5 Reliance Industries Limited, Company Snapshot 36 5.1 Reliance Industries Limited, Company Overview 36 5.2 Reliance Industries Limited, Key Information 36 5.3 Reliance Industries Limited, Business Description 36 5.3.1 Business Overview 36 5.3.2 Oil and Gas 37 5.3.3 Others 38 5.3.4 Petrochemicals 39 5.3.5 Refining and Marketing 39 Polyethylene Industry Outlook in India to 2016 GDCH1786IDB/DEC 2012 © GlobalData. -

Pre-Feasibility Re Feasibility Report (PFR) Ibility Report

Proposed Crude to Chemical Complex at A.V. Nagaram village, Thondangi Mandal of East Godavari district, Andhra PradeshByM/s Haldia Petrochemicals Limited Pre-Feasibility Report (PFR) For Proposed Crude to Chemical, A Refinery cum Petrochemical Complex at at A.V. Nagaram village, Thondangi Mandal of East Godavari district, Andhra Pradesh By M/s Haldia Petrochemicals Limited Submitted by Prepared by ABC Techno Labs India Pvt. Ltd. Page 1 Proposed Crude to Chemical Complex at A.V. Nagaram village, Thondangi Mandal of East Godavari district, Andhra PradeshByM/s Haldia Petrochemicals Limited PROJECT DETAILS Name of Proposed Crude to Chemical Complex at at A.V. Nagaram village, Publication Thondangi Mandal of East Godavari district, Andhra PradeshByM/s Haldia Petrochemicals Limited. Project Number Version 1 Released February 2019 CONTACT DETAILS ABC Techno Labs India Pvt Ltd. #400, 13thStreet, SIDCO Industrial Estate (North Phase) Ambattur – 600 098 Land Mark: Near National Productivity Council Ph: +91-44-2616 1123 / 24 / 25. Fax: +91-44-2616 3456 E-mail: [email protected] DISCLAIMER ABC Techno Labs has used information provided to it by the Client and governmental registers, databases, departments and agencies in the preparation of this report. ABC Techno Labs does not know, nor does it have any reason to suspect, that the information provided to it was false, inaccurate, incomplete or misleading at the time of its receipt. This report is supplied on the basis that while ABC Techno Labs believes all the information in it is deemed reliable at the time of publication, it does not warrant its accuracy or completeness and to the full extent allowed by law excludes liability in contract or otherwise, for any loss or damage sustained by any person or body corporate arising from or in connection with the supply or use of the whole or any part of the information in this report through any cause whatsoever. -

![Haldia Petrochemicals Limited: Long Term Rating Revised to [ICRA]A+(Stable); Short Term Rating Reaffirmed; NCD Rating Withdrawn](https://docslib.b-cdn.net/cover/1104/haldia-petrochemicals-limited-long-term-rating-revised-to-icra-a-stable-short-term-rating-reaffirmed-ncd-rating-withdrawn-1571104.webp)

Haldia Petrochemicals Limited: Long Term Rating Revised to [ICRA]A+(Stable); Short Term Rating Reaffirmed; NCD Rating Withdrawn

September 03, 2020 Haldia Petrochemicals Limited: Long Term rating revised to [ICRA]A+(Stable); short term rating reaffirmed; NCD rating withdrawn Summary of rating action Previous Rated Amount Current Rated Instrument* Rating Action (Rs. crore) Amount(Rs. crore) [ICRA]A+(Stable); downgraded from Long Term Limits- Term Loans 3,068.00 3,068.00 [ICRA]AA-(Negative) [ICRA]A+(Stable); downgraded from Long-term Limits-Fund-based 381.00 381.00 [ICRA]AA-(Negative) Short-term Limits- Non-fund 1606.00 1606.00 [ICRA]A1+; reaffirmed Based Limits [ICRA]A+ (Stable); downgraded from Long-term/Short-term 5003.00 5003.00 [ICRA]AA-(Negative)/[ICRA]A1+; Unallocated reaffirmed; [ICRA]A+(Stable); downgraded from Proposed NCD Programme 1,000.00 0.00 [ICRA]AA-(Negative); withdrawn [ICRA]A+(Stable); downgraded from Issuer Rating1 - - [ICRA]AA-(Negative) Short Term – Commercial Paper [ICRA]A1+; reaffirmed 100.00 100.00 programme [ICRA]A+(Stable); downgraded from Long Term-Non fund based 4000.00 4000.00 [ICRA]AA-(Negative) Total 15,158.00 14,158.00 *Instrument details are provided in Annexure-1 Rationale The rating revision factors in the anticipated adverse impact on the key credit metrics of Haldia Petrochemicals Limited’s (HPL) due to the proposed acquisition of ~7% additional equity stake in the technology division of McDermott International Inc (MDR) from Rhone Capital for a consideration of $70-75 million apart from existing ~57% equity stake acquired in June 2020 for ~$690 million. The acquisition of the additional 7% stake is expected to be funded by debt of ~$ 53 million and the balance from the existing cash balances of HPL. -

Environmental Statement FY 2017-18

Haldia Petrochemicals Ltd. Environmental Statement FY 2017-18 Chapter No. Detail Description Page No. 1.0 SALIENT FEATURES 1 2.0 ENVIRONMENTAL STATEMENTS - FORM V 2 (PART A TO PART I) 3.0 PRODUCTION DETAILS 34 4.0 SOLID WASTE DETAILS (NON-HAZARDOUS) 35 5.0 HAZARDOUS WASTE DETAILS (FORM – IV) 36 Haldia Petrochemicals Ltd. SALIENT FEATURES OF HPL COMPLEX Name of the Unit : Haldia Petrochemicals Limited Size of Industry : Large Water Supply : Water is supplied by M/s. Haldia Development Authority from Geonkhali Water Works. (Normal requirement is 7.73 MGD whereas permissible maximum quantity is 8.4 MGD). Power Supply : Captive Power Plant & WBSEDCL Main Raw Material : NAPHTHA Gross Capital Investment on : Rs. 12560 Crores as on 31.03.18 land, building, plant & machinery excluding capital investment on pollution control system Total area : 453 Hectare Green Belt Area : 103 Hectare Manpower : 727 (own employees) as on 31-03-18 1 Haldia Petrochemicals Ltd. [FORM – V] (SEE RULE 14) Environmental Statement for the Financial Year ending the 31st March 2018 PART – A (i) Name and address of the owner/occupier of the industry, operation or process : Mr. Subhasendu Chatterjee Haldia Petrochemicals Limited Plant : P. B. No. 12, Durgachak, Haldia, Dist. – Purba Midnapore, Pin – 721 602 Tel: (03224) 274007/384/400 Fax: (03224) 272755/274880 Registered Office: Tower 1, Bengal Eco Intelligence Park (Techna), Block EM, Plot No. 3, Sector V, Salt Lake, PO: Bidhan Nagar, District: North 24 Paraganas, Kolkata 700 091, Tel: 7112 2334, 7112 2445 (ii) Industry Category : Special Red (iii) Production Capacity : 7,00,000 TPA of Ethylene (iv) Year of Establishment : 2000 (v) Date of last Environmental Statement Submitted : September 23, 2017 2 Haldia Petrochemicals Ltd. -

Report on Developing Baseline Specific Energy Consumption in Petrochemicals Industry in India

Report on Developing Baseline Specific Energy Consumption in Petrochemicals Industry in India April 2013 www.deloitte.com/in Disclaimer The views expressed in this document do not necessarily reflect the view of Shakti Sustainable Energy Foundation. The organization also does not guarantee accuracy of any data included in this publication nor does it accept any responsibility for the consequences of its use. Contents CONTENTS .............................................................................................................................................................3 EXECUTIVE SUMMARY ...................................................................................................................................... 10 OVERVIEW OF GLOBAL PETROCHEMICALS INDUSTRY.............................................................................. 12 TRENDS OF GLOBAL PETROCHEMICAL INDUSTRY............................................................................................... 13 ENERGY CONSUMPTION TRENDS IN PETROCHEMICAL INDUSTRY ........................................................................ 14 TECHNOLOGY TRENDS IN PETROCHEMICAL INDUSTRY ....................................................................................... 15 GLOBAL DEMAND SUPPLY AND CAPACITY ......................................................................................................... 16 OVERVIEW OF INDIAN PETROCHEMICALS INDUSTRY ................................................................................ 20 TRENDS IN INDIAN PETROCHEMICAL -

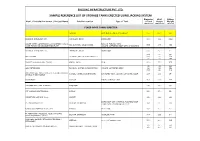

Sample Reference List of Storage Tanks Erected

BYGGING INFRASTRUCTURE PVT. LTD. SAMPLE REFERENCE LIST OF STORAGE TANKS ERECTED USING JACKING SYSTEM Diameter Shell Lifting Plant / Installation Owner / Project Name Jobsite Location Type of Tank of Tank Height Weight (Meters) (Meters) (Tons) FIXED ROOF TANKS ERECTED UKRAINE GASHOLDER FOR BLAST FURNACE 55.7 64.0 1900 RELIANCE PETROLEUM LTD. JAMNAGAR, INDIA DOME ROOF 64.0 18.1 1368 SALINE WATER CONVERSION CORPORATION / RAS AL- BACK-UP FUEL OIL TANK RAS AL-KHAIR, SAUDI ARABIA 66.5 17.6 962 KHAIR POWER AND DESALINATION PLANT COLUMN SUPPORTED ROOF WITH 37 COLUMNS RELIANCE PETROLEUM LTD. JAMNAGAR, INDIA DOME ROOF 57.0 20.0 900 52.6 22 590 GPS CHEMOIL FUJAIRAH, UNITED ARAB EMIRATES 34.5 22 259 27 22 166 BHARAT ALUMINIUM CO. (BALCO) KORBA, INDIA SILO 30.0 27.0 575 45 25 491 GULF PETROCHEM FUJAIRAH, UNITED ARAB EMIRATES COLUMN SUPPORTED ROOF 26 25 256 35.5 25 302 ABU DHABI GAS INDUSTRIES LTD (GASCO) RUWAIS / RUWAIS, UNITED ARAB EMIRATES DM WATER TANK, COLUMN SUPPORTED ROOF 28.5 28.1 450 4TH NGL TRAIN PROJECT EXXONMOBIL NIGERIA MOGAS STORAGE TANK 36.0 13.2 394 VAN OOMERAN TANK TERMINAL SINGAPORE 29.0 28.0 360 VTT VASILIKO OIL TERMINAL CYPRUS 35.0 27.0 350 KUWAIT OIL COMPANY K.S.C. KUWAIT 35.0 12.2 341 DOME ROOF WITH INTERNAL FLOATING ROOF PT. PERTAMINA RU IV CILACAP, INDONESIA 34.2 22.0 329 (LIGHT NAPHTA STORAGE) 8700 M3 KUWAIT OIL COMPANY K.S.C. GC-4 KUWAIT DUAL TANK 33.0 15.0 300 PT. PERTAMINA - RESIDUAL FLUID CATALYTIC CILACAP, INDONESIA GASOLINE TANK 34.8 23.2 300 CRACKING PROJECT (RFCC) VANPHONG BONDED PETROLEUM TERMINAL / VIETNAM 20.000 M3 MOGAS TANK 37.0 20.0 295 PETROLIMEX 31.7 20.0 295 BHARAT PETROLEUM CORORATION LTD. -

Industrial Hazard, Vulnerability and Risk Assessment for Landuse Planning: a Case Study of Haldia Town, West Bengal, India

Industrial Hazard, Vulnerability and Risk Assessment for Landuse Planning: A Case Study of Haldia Town, West Bengal, India Anandita Sengupta January, 2007 Industrial Hazard, Vulnerability and Risk Assessment for Landuse Planning A Case Study of Haldia, West Bengal, India by Anandita Sengupta Thesis submitted to the International Institute for Geo-information Science and Earth Observation and Indian Institute of Remote Sensing (NRSA) in partial fulfilment of the requirements for the degree of Master of Science in Geo-information Science and Earth Observation, Specialisation: (Geo-Hazards) THESIS ASSESSMENT BOARD Prof. Victor Jetten, ITC (Chairman) Prof. Dr. Ashok Kumar Dr. Cees J. van Westen, (ITC) School of Planning & Architecture Prof. B. S. Sokhi (IIRS) (External Expert) Mr. B. D. Bharath (IIRS) SUPERVISORS ITC ERRIS Project Dr. Cees J. van Westen Mr. Debanjan Bandyopadhyay Associate Professor IIRS Mr. B. D. Bharath Scientist INTERNATIONAL INSTITUTE FOR GEO-INFORMATION SCIENCE AND EARTH OBSERVATION ENSCHEDE, THE NETHERLANDS AND INDIAN INSTITUTE OF REMOTE SENSING (NRSA) DEHRADUN, INDIA. I certify that although I may have conferred with others in preparing for this thesis, and drawn upon a range of sources cited in this work, the content of this Thesis Report is my original work. Signed ………………. Disclaimer This document describes work undertaken as part of a programme of study at the International Institute for Geo-information Science and Earth Observation and Indian Institute of Remote Sensing (NRSA). All views and opinions expressed therein remain the sole responsibility of the author, and do not necessarily represent those of the institute. Anandita Sengupta Restriction on the Report Usage Certain sections of the text and imagery contained herein in this thesis include information that could be sensitive and therefore are of concern to the national security of India. -

Feedstock for the Petrochemical Industry

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Ray, Saon; Goldar, Amrita; Saluja, Swati Working Paper Feedstock for the petrochemical industry Working Paper, No. 271 Provided in Cooperation with: Indian Council for Research on International Economic Relations (ICRIER) Suggested Citation: Ray, Saon; Goldar, Amrita; Saluja, Swati (2014) : Feedstock for the petrochemical industry, Working Paper, No. 271, Indian Council for Research on International Economic Relations (ICRIER), New Delhi This Version is available at: http://hdl.handle.net/10419/176289 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Working Paper 271 Feedstock for the Petrochemical Industry Saon Ray Amrita Goldar Swati Saluja February 2014 1 INDIAN COUNCIL FOR RESEARCH ON INTERNATIONAL ECONOMIC RELATIONS Table of Contents Abstract ......................................................................................................................................... -

Edelweiss India Conference 14Th March, 2008, Mumbai 14 March

Edelweiss India Conference 14th March, 2008, Mumbai AdAgenda Reflections Oil Industry Overview Company Overview Review of Operations Financial Overview Strategic Initiatives Group Companies 11 Reflections FY 07: z Crude oil market remained highly volatile: ¾ touched all time high of USD 78/bbl in Aug 06 mainly due to geopolitical disturbances and strong global demand ¾ softened upto USD 50/bbl levels in Jan 07 mainly due to unusually warm winter in the Northern Hemisphere and huge fund liquidation in the paper market ¾ started rising again due to growing demand and touched a level of USD 69/bbl in March 07 z Rupee appreciated sharply after initial depreciation due to huge inflows z Continued under realization by downstream oil companies FY 08 (till Feb 08) z Crude Oil Prices firming up ¾ reached an all time high of three digits in Jan - Feb 08; mainly due to strong demand, cold weather in US, geo-political disturbances, speculative activity and also dollar weakness z Rupee in appreciation mode except for recent volatility z Under recoveries continue for downstream oil companies 22 RfltiReflections During FY 07, IndianOil… z Achieved highest ever Turnover of Rs. 220,779 crore z Achieved highest ever Net Profit of Rs. 7,499 crore z IBP merged on 2nd May 07 w.e.f. 31st March 07 z Expansion of Panipat refinery from 6 to 12 MMTPA in Aug 06 z Commissioning of Px/PTA plant at Panipat refinery in Aug 06 z BRPL merger approved by the Board in Nov 06 During FY 08, IndianOil…. z Till Dec 07 achieved ¾ Turnover of Rs. -

Report of the Expert Committee to Review Guidelines for Granting Authorisation to Market Transportation Fuels

Report of the Expert Committee to review guidelines for granting authorisation to market transportation fuels Ministry of Petroleum & Natural Gas Government of India April 2019 Report of the Expert Committee to review guidelines for granting authorisation to market transportation fuels | 1 Report of the Expert Committee to review guidelines for granting authorisation to market transportation fuels We the undersigned, Members of the Expert Committee to review guidelines for granting authorisation to market transportation fuels to oil companies, constituted by the Ministry of Petroleum & Natural Gas, Government of India vide Office Memorandum M-12029(11)/2/2018-OMC-PNG dated 5.10.2019 have adopted the Report and submitted it. Dr Kirit Parikh Shri G.C. Chaturvedi Member Member Shri M.A. Pathan Dr Errol D’Souza Member Member Shri Ashutosh Jindal Member Secretary Report of the Expert Committee to review guidelines for granting authorisation to market transportation fuels | 2 Report of the Expert Committee to review guidelines for granting authorisation to market transportation fuels | 3 Table of Contents Abbreviations ....................................................................................................................................6 1 Introduction ............................................................................................................................. 10 1.1 Background ....................................................................................................................... 10 1.1.1 Existing -

Haldia Petrochemicals Limited: Ratings Reaffirmed; Outlook Revised to Positive

February 19, 2021 Haldia Petrochemicals Limited: Ratings reaffirmed; outlook revised to Positive Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]A+ reaffirmed; Outlook Long Term Limits- Term Loans 3,068.00 3,068.00 revised to Positive from Stable [ICRA]A+ reaffirmed; Outlook Long-term Limits-Fund-based 381.00 731.00^ revised to Positive from Stable Short-term Limits- Non-fund 1606.00 1505.00 [ICRA]A1+; reaffirmed Based Limits [ICRA]A+ reaffirmed; Outlook Long-term/Short-term 5003.00 4754.00 revised to Positive from Stable; Unallocated /[ICRA]A1+; reaffirmed; [ICRA]A+ reaffirmed; Outlook Issuer Rating1 - - revised to Positive from Stable Short Term – Commercial [ICRA]A1+; reaffirmed 100.00 100.00 Paper programme [ICRA]A+ reaffirmed; Outlook Long Term-Non fund based 4000.00 4000.00 revised to Positive from Stable Total 14,158.00 14,158.00 *Instrument details are provided in Annexure-1, ^of which Rs 500 crore of long term fund based limits are fully interchangeable with short term non-fund based limits Rationale The revision in outlook is on account of the scrapping of the plan to acquire an additional 7% equity stake in Lummus Technologies by Haldia Petrochemical Limited (HPL) from Rhone Capital LLC. Post the acquisition of 57% stake in Lummus Technologies in June 2020, HPL had planned to acquire an additional 7% stake which would have entailed an outgo of about ~$70-75 million that was to be significantly debt funded. However, with the cancellation of plans to acquire the additional stake, the company has obviated the need to avail further debt and dip into its cash reserves. -

Haldia Petrochemicals Limited: Ratings Placed on Watch with Negative Implications

December 13, 2019 Haldia Petrochemicals Limited: Ratings placed on watch with negative implications Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) [ICRA]AA@; placed on watch with Long Term Limits- Term Loans 3,031.30 3,031.30 negative implications [ICRA]AA@; placed on watch with Long-term Limits-Fund-based 319.00 319.00 negative implications [ICRA]A1+@; placed on watch with Short-term Limits- Non-fund Based Limits 3,687.00 3,687.00 negative implications [ICRA]AA@ /[ICRA]A1+@; placed on Long-term/Short-term Unallocated 3,020.70 3,020.70 watch with negative implications [ICRA]AA@; placed on watch with Proposed NCD Programme 1,000.00 1,000.00 negative implications [ICRA]AA@; placed on watch with Issuer Rating1 - - negative implications Short Term – Commercial Paper [ICRA]A1+@; placed on watch with 100.00 100.00 programme negative implications Total 11,158.00 11,158.00 *Instrument details are provided in Annexure-1 @ denotes rating watch with negative implications Rationale ICRA has placed the long term rating of [ICRA]AA (pronounced ICRA double A) and short term rating of [ICRA]A1+ outstanding on the various debt programmes of HPL under ‘rating watch with negative implications’. The rating watch follows the funding support proposed to be extended by Haldia Petrochemicals Limited to its group company TCG Advisory Services Private Limited to fund the acquisitions of 100% equity stake in the Religare Finvest limited (RFL) from Religare Enterprises Limited (REL) for a consideration of Rs 330 crore. The Board of HPL has approved extending funding support in the form of optionally convertible debenture up to Rs 700 crore to TCG Advisory Services Private Limited to fund the acquisition, though, initially HPL will be extending Rs 330 crore.