G/SCM/N/343/CHN 19 July 2019 (19-4822) Page

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Research on the Influencing Factors of the Construction of Tourism and Leisure Characteristic Towns in Sichuan Province Under Th

2021 International Conference on Education, Humanity and Language, Art (EHLA 2021) ISBN: 978-1-60595-137-9 Research on the Influencing Factors of the Construction of Tourism and Leisure Characteristic Towns in Sichuan Province under the Background of New Urbanization Yi-ping WANG1,a,* and Xian-li ZHANG2,b 1,2School of Business, Southwest Jiaotong University Hope College, Chengdu, Sichuan, China [email protected], [email protected] *Corresponding author Keywords: Tourism and leisure characteristic towns, Influencing factors, New urbanization. Abstract. Promoting the construction of characteristic towns under the background of new urbanization is an important way for my country to break the bottleneck of economic development and realize economic transformation and upgrading. In recent years, although the construction of characteristic towns in Sichuan Province has achieved remarkable results and a large number, especially tourist and leisure characteristic towns accounted for the largest proportion, they still face urgent problems such as avoiding redundant construction, achieving scientific development, and overall planning. This study takes 20 cultural tourism characteristic towns selected by the first batch of Sichuan Province as the research object, combined with field research and tourist questionnaire surveys, and screened out relevant influencing factors of characteristic towns from different aspects such as transportation, economy, industry, ecology, historical and cultural heritage. Analyze the correlation with the development level of characteristic towns in order to find out the key factors affecting the development of characteristic towns of this type, provide a policy basis for the scientific development and overall planning of reserve characteristic towns in our province, and contribute to the construction of new urbanization And provide advice and suggestions on the development of tourism industry in our province. -

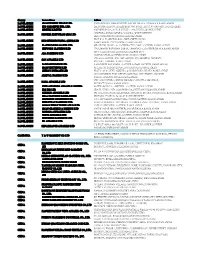

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation - Chinese Producers of Wooden Cabinets and Vanities Company Name Company Information Company Name: A Shipping A Shipping Street Address: Room 1102, No. 288 Building No 4., Wuhua Road, Hongkou City: Shanghai Company Name: AA Cabinetry AA Cabinetry Street Address: Fanzhong Road Minzhong Town City: Zhongshan Company Name: Achiever Import and Export Co., Ltd. Street Address: No. 103 Taihe Road Gaoming Achiever Import And Export Co., City: Foshan Ltd. Country: PRC Phone: 0757-88828138 Company Name: Adornus Cabinetry Street Address: No.1 Man Xing Road Adornus Cabinetry City: Manshan Town, Lingang District Country: PRC Company Name: Aershin Cabinet Street Address: No.88 Xingyuan Avenue City: Rugao Aershin Cabinet Province/State: Jiangsu Country: PRC Phone: 13801858741 Website: http://www.aershin.com/i14470-m28456.htmIS Company Name: Air Sea Transport Street Address: 10F No. 71, Sung Chiang Road Air Sea Transport City: Taipei Country: Taiwan Company Name: All Ways Forwarding (PRe) Co., Ltd. Street Address: No. 268 South Zhongshan Rd. All Ways Forwarding (China) Co., City: Huangpu Ltd. Zip Code: 200010 Country: PRC Company Name: All Ways Logistics International (Asia Pacific) LLC. Street Address: Room 1106, No. 969 South, Zhongshan Road All Ways Logisitcs Asia City: Shanghai Country: PRC Company Name: Allan Street Address: No.188, Fengtai Road City: Hefei Allan Province/State: Anhui Zip Code: 23041 Country: PRC Company Name: Alliance Asia Co Lim Street Address: 2176 Rm100710 F Ho King Ctr No 2 6 Fa Yuen Street Alliance Asia Co Li City: Mongkok Country: PRC Company Name: ALMI Shipping and Logistics Street Address: Room 601 No. -

珠海冠宇电池股份有限公司 Zhuhai Cosmx Battery Co.,Ltd

珠海冠宇电池股份有限公司 Zhuhai CosMX Battery Co.,Ltd. Tel:86-756-6199908 Fax:86-756-6199910 Web: www.cosmx.com Add:No.209, Zhufeng Road, Jing'an Town, Doumen District, Zhuhai City, Guangdong, P.R.China COSMX LITHIUM ION POLYMER BATTERY SAFETY DATA SHEET Ref No:ARC 20210101-030 PRODUCT NAME: Rechargeable Lithium Polymer single cell Battery, PACK CHEMICAL SYSTEM: Lithium Ion Designed for Recharge: yes Root-Deliverable HP RMN NO HP P/N CosMX P/N CosMX P/N Cell applied SP04061XL HSTNN-OB1B L28538-AC1 B00C436485D0001 B00C436485D0001 436485G-Q RR03048XL HSTNN-OB1A 851477-AC1 B00C606072D0001 B00C606072D0001 606072G-QA RE03045XL HSTNN-OB1C L32407-AC1 B00C515974D0001 B00C515974D0001 515974G-Q TF03041XL HSTNN-OB1E 920046-AC1 B00C515974C0001 B00C515974C0001 515974HV SA04055XL HSTNN-OB1F L43248-AC1 B00C515974C0004 B00C515974C0004 515974HV SA04055XL HSTNN-OB1G L43248-AC2 B00C515974C0005 B00C515974C0005 515974HV-Q HT03041XLHSTNN-OB1H L11421-AC1 B00C515974C0003 B00C515974C0003 515974HV-Q HT03041XL HSTNN-OB1H L11421-AC2 B00C515974C00017 B00C515974C0017 515974HV-Q PG03052XL HSTNN-OB1I L48430-AC1 B00C606072D0003 B00C606072D0003 606072G-QA PG03052XL HSTNN-OB1I L48430-AC2 B00C606072D0007 B00C606072D0007 606072G-QA RR04060XL HSTNN-OB1M L60213-AC1 B00C506373D0001 B00C506373D0001 506373G MD02040XL HSTNN-OB1N L63999-AC1 B00C368598D0001 B00C368598D0001 368598G RF03045XL HSTNN-OB1Q L83685-AC1 B00C545974D0002 B00C545974D0002 545974G-H SD03052XL HSTNN-OB1R L84357-AC1 B00C606072D0006 B00C606072D0006 606072G-QA BN03051XL HSTNN-OB1O L76965-AC1 B00C506479D0001 B00C506479D0001 506479G-Q SA04055XL HSTNN-OB1F L43248-AC3 B00C515974C0015 B00C515974C0015 515974HV SA04055XL HSTNN-OB1G L43248-AC4 B00C515974C0014 B00C515974C0014 515974HV-Q RE03045XL HSTNN-OB1C L32407-AC2 B00C515974D0004 B00C515974D0004 515974G-Q HT03045XL HSTNN-OB1L L56025-AC1 B00C515974D0002 B00C515974D0002 515974G-Q PV03043XLHSTNN-OB1P L83388-AC1 B00C446872D0001 B00C446872D0001 446872G AL08094XL HSTNN-OB1S L86155-AC1 B00C515961G0002 B00C515961G0002 515961E 第 1 页,共 9 页 珠海冠宇电池股份有限公司 Zhuhai CosMX Battery Co.,Ltd. -

Download Dr. Qin's CV

YOUPING QIN, Ph.D. National University of Natural Medicine 049 SW Porter St. Portland, OR 97201 Phone number: 503-323-0453 E-mail address: [email protected] EDUCATION 2002 Ph.D. (M.D. in China), Chengdu University of Traditional Chinese Medicine (TCM), Chengdu, Sichuan, PRC 1999 M.M.Sc. (Master degree of Medical Science), Chengdu University of TCM, Chengdu, Sichuan, PRC 1984 B.M., Chengdu University of TCM, Chengdu, Sichuan, PRC 1979 High School Student, The Fifth High School of Chengdu City, Chengdu, Sichuan, PRC TEACHING AND LECTURING 2001-present Instructor, School of Classical Chinese Medicine and Chair of acupuncture subcommittee, National University of Natural Medicine, Portland, OR 1998-01 Associate Professor (Associate Chief Physician), Acupuncture & Tuina College of Chengdu University of TCM, Chengdu, Sichuan, PRC 1984-01 Instructor, Teaching Hospital of Chengdu University of TCM, Chengdu, Sichuan, PRC 2000 Visiting Scholar, Shou Zhong School of Classical Acupuncture & TCM, Berlin, Germany Clinic & Chinese Herbal Laboratory of Dr. Karl Zippelius, M.D., Florence, Italy Clinic of Dr. Dimitris Sifneos, M.D., Paros, Greece Clinic of Joseline Chambrin, N.D. Nantes, France 1999-00 Accredited Instructor of the “Examinee Class of Traditional Chinese Medicine & Herbology for Intermediate Professional Promotion of Sichuan Province” (held by Health Department of Sichuan Province, PRC) 1998 Visiting Scholar, German Association for Classical Acupuncture and TCM Hamburg, Rottenburg & Munich, Germany 1995 Instructor, Shou Zhong School of Classical -

International Registration Designating India Trade Marks Journal No: 1910 , 15/07/2019 Class 1

International Registration designating India Trade Marks Journal No: 1910 , 15/07/2019 Class 1 Priority claimed from 17/03/2017; Application No. : 1832568 ;Australia 3676488 15/09/2017 [International Registration No. : 1373849] Nutrian Pty Ltd C/- Australasia IP Pty Ltd, PO BOX 7345 BRIGHTON VIC 3186 AU Address for service in India/Attorney address: KHURANA & KHURANA E-13, UPSIDC Site IV, Kasna Road, Behind Grand Venice, Greater Noida, 201310 Proposed to be Used IR DIVISION Chemicals used in agriculture, horticulture and forestry; chemicals for conditioning and treatment of soils; liquid fertilizers; trace elements for use in horticulture, agriculture and forestry. THE MARK TO BE USED AS WHOLE AND AS PER LABLE PROVIDED IN THE BIRTH NOTIFICATION. 4792 Trade Marks Journal No: 1910 , 15/07/2019 Class 1 Priority claimed from 10/12/2018; Application No. : 725372 ;Switzerland 4190293 15/03/2019 [International Registration No. : 1467666] Syngenta Participations AG Schwarzwaldallee 215 CH-4058 Basel Switzerland Proposed to be Used IR DIVISION Active chemical ingredients for use in the manufacture of fungicides, herbicides, insecticides and nematicides; chemical products used in agriculture, horticulture and forestry; bio-stimulant products; preparations for improving crops; preparations for fortifying plants; chemical and/or biological preparations for stress management in plants; plant growth regulating preparations; chemical preparations for seed treatment; additives other than for medical or veterinary purposes. 4793 Trade Marks Journal No: -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

An Overview of the Red Imported Fire Ant (Hymenoptera: Formicidae) in Mainland China

Zhang et al.: Imported Fire Ants in Mainland China 723 AN OVERVIEW OF THE RED IMPORTED FIRE ANT (HYMENOPTERA: FORMICIDAE) IN MAINLAND CHINA RUNZHI ZHANG1,2, YINGCHAO LI1, NING LIU1 AND SANFORD D. PORTER3 1State Key Laboratory of Integrated Management of Pest Insects and Rodents, Institute of Zoology, Chinese Academy of Sciences, Beijing 100101, China 2E-mail: [email protected] 3USDA-ARS, Center for Medical, Agricultural and Veterinary Entomology, 1600 SW 23rd Drive, Gainesville, FL 32608 ABSTRACT The red imported fire ant, Solenopsis invicta Buren is a serious invasive insect that is native to South America. Its presence was officially announced in mainland China in Jan 2005. To date, it has been identified in 4 provinces in mainland China (Guangdong, Guangxi, Hunan, Fujian) in a total of 31 municipal districts. The total area reported to be infested by S. invicta in late 2006 was about 7,120 ha, mainly in Guangdong Province (6,332 ha). Most of the re- ported human stings are in the heavily infested area around Wuchuan City. The most com- monly reported reactions have been abnormal redness of the skin, sterile pustules, hives, pain, and/or fever. It has been predicted that most of mainland China is viable habitat for red imported fire ants, including 25 of 31 provinces. The probable northern limit of expan- sion reaches Shandong, Tianjing, south Henan, and Shanxi provinces. Traditional and new insecticides including the bait N-butyl perfluorooctane sulfonamide and the contact insecti- cide Yichaoqing have been developed and used to control S. invicta. The Ministry of Agricul- ture and the Chinese government have established an 8-year eradication program (2006 to 2013) for S. -

China - Peoples Republic Of

GAIN Report – CH9621 Page 1 of 25 THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 11/24/2009 GAIN Report Number: CH9621 China - Peoples Republic of Post: Guangzhou Zhuhai, South China’s city of romance . and more Report Categories: Market Development Reports Approved By: Joani Dong, Director Prepared By: May Liu Report Highlights: Zhuhai is touted as a romantic city because of its seaside beauty. But the place is more than just looks and proximity to Macau and Hong Kong. It’s one of China’s five Special Economic Zones and transportation and logistic hubs. It’s where the Aviation and Aerospace Exhibition is held and last year exhibited the Shenzhou 7 orbital module, famous for the first Chinese space walk. What’s more, Zhuhai is a market for U.S. agric ultural products in the retail sector and has links in the American swine sector. Its growth in the retail, restaurant and tourism sectors point to niche opportunities for U.S. agricultural products. This tiny, yet mighty city of 1.4 million is open for business. UNCLASSIFIED USDA Foreign Agricultural Service GAIN Report – CH9621 Page 2 of 25 Includes PSD Changes: No Includes Trade Matrix: No Annual Report Guangzhou ATO [CH3] [CH] Table of Content UNCLASSIFIED USDA Foreign Agricultural Service GAIN Report – CH9621 Page 3 of 25 I. Zhuhai Overview Zhuhai is known as a romantic city, clean and attractive, young and energetic. It is a relaxing place with rich natural resources; a population mixed with Macau, Hong Kong and expat transplants; and free trade zone open policy favorable for the younger generation and trade businessmen. -

20200316 Factory List.Xlsx

Country Factory Name Address BANGLADESH AMAN WINTER WEARS LTD. SINGAIR ROAD, HEMAYETPUR, SAVAR, DHAKA.,0,DHAKA,0,BANGLADESH BANGLADESH KDS GARMENTS IND. LTD. 255, NASIRABAD I/A, BAIZID BOSTAMI ROAD,,,CHITTAGONG-4211,,BANGLADESH BANGLADESH DENITEX LIMITED 9/1,KORNOPARA, SAVAR, DHAKA-1340,,DHAKA,,BANGLADESH JAMIRDIA, DUBALIAPARA, VALUKA, MYMENSHINGH BANGLADESH PIONEER KNITWEARS (BD) LTD 2240,,MYMENSHINGH,DHAKA,BANGLADESH PLOT # 49-52, SECTOR # 08 , CEPZ, CHITTAGONG, BANGLADESH HKD INTERNATIONAL (CEPZ) LTD BANGLADESH,,CHITTAGONG,,BANGLADESH BANGLADESH FLAXEN DRESS MAKER LTD MEGHDUBI, WARD: 40, GAZIPUR CITY CORP,,,GAZIPUR,,BANGLADESH BANGLADESH NETWORK CLOTHING LTD 228/3,SHAHID RAWSHAN SARAK, CHANDANA,,,GAZIPUR,DHAKA,BANGLADESH 521/1 GACHA ROAD, BOROBARI,GAZIPUR CITY BANGLADESH ABA FASHIONS LTD CORPORATION,,GAZIPUR,DHAKA,BANGLADESH VILLAGE- AMTOIL, P.O. HAT AMTOIL, P.S. SREEPUR, DISTRICT- BANGLADESH SAN APPARELS LTD MAGURA,,JESSORE,,BANGLADESH BANGLADESH TASNIAH FABRICS LTD KASHIMPUR NAYAPARA, GAZIPUR SADAR,,GAZIPUR,,BANGLADESH BANGLADESH AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,,SAVAR,DHAKA,BANGLADESH BANGLADESH CHERRY INTIMATE LTD PLOT # 105 01,DEPZ, ASHULIA, SAVAR,DHAKA,DHAKA,BANGLADESH COLOMESSHOR, POST OFFICE-NATIONAL UNIVERSITY, GAZIPUR BANGLADESH ARRIVAL FASHION LTD SADAR,,,GAZIPUR,DHAKA,BANGLADESH VILLAGE-JOYPURA, UNION-SHOMBAG,,UPAZILA-DHAMRAI, BANGLADESH NAFA APPARELS LTD DISTRICT,DHAKA,,BANGLADESH BANGLADESH VINTAGE DENIM APPARELS LIMITED BOHERARCHALA , SREEPUR,,,GAZIPUR,,BANGLADESH BANGLADESH KDS IDR LTD CDA PLOT NO: 15(P),16,MOHORA -

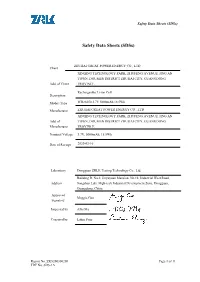

Safety Data Sheets (Sdss)

Safety Data Sheets (SDSs) Safety Data Sheets (SDSs) ZHUHAI GREAT POWER ENERGY CO., LTD Client XINQING TECHNOLOGY PARK, ZHUFENG AVENUE, JING AN TOWN, DOUMEN DISTRICT ZHUHAI CITY, GUANGDONG Add. of Client PROVINCE Rechargeable Li-ion Cell Description Model /Type ICR26650 3.7V 5000mAh 18.5Wh Manufacturer ZHUHAI GREAT POWER ENERGY CO., LTD XINQING TECHNOLOGY PARK, ZHUFENG AVENUE, JING AN Add. of TOWN, DOUMEN DISTRICT ZHUHAI CITY, GUANGDONG Manufacturer PROVINCE Nominal Voltage 3.7V, 5000mAh, 18.5Wh Date of Receipt 2020-03-16 Laboratory Dongguan ZRLK Testing Technology Co., Ltd. Building D, No.2, Jinyuyuan Mansion, No.18, Industrial West Road, Address Songshan Lake High-tech Industrial Development Zone, Dongguan, Guangdong, China Approved Maggie.Gao Signatory Inspected by Ailis.Ma Censored by Lahm Peng Report No.:ZKS200300208 Page 1 of 11 TRF No. SDS-1A Safety Data Sheets (SDSs) 1. IDENTIFICATION OF THE SUBSTANCE/PREPARATION AND OF THE COMPANY/UNDERTAKING Product Identifier Product name: Rechargeable Li-ion Cell Model: ICR26650 3.7V 5000mAh 18.5Wh Other means of identification Synonyms:none Recommended use of the chemical and restrictions on use Recommended Use:Used in portabl electronic equipments; Uses advidsed against: a) Do not dismantle, open or shred secondary cells or batteries. b) Keep batteries out of the reach of children Battery usage by children should be supervised. Especially keep small batteries out of reach of small children. c) Seek medical advice immediately if a cell or a battery has been swallowed. d) Do not expose cells or batteries to heat or fire. Avoid storage in direct sunlight. e) Do not short-circuit a cell or a battery. -

Interaction and Social Complexity in Lingnan During the First Millennium B.C

Interaction and Social Complexity in Lingnan during the First Millennium B.C. FRANCIS ALLARD SEPARATED FROM AREAS north of it by mountain ranges and drained by a single river system, the region of Lingnan in southeastern China is a distinct physio graphic province (Fig. 1). The home of historically recorded tribes, it was not until the late first millennium B.C. that Lingnan was incorporated into the ex panding Chinese polities of central and northern China. The Qin, Han, and probably the Chu before them not only knew of those they called barbarians in southeastern China but also pursued an expansionary policy that would help es tablish the boundaries of the modem Chinese state in later times. The first millennium B.C. in Lingnan witnessed the development of a bronze metallurgy and its subsequent widespread use by the seventh or sixth centuries B.C. Archaeological work over the last decades has led to the discovery of a num ber ofBronze Age burials scattered over much of northern Lingnan and dating to approximately 600 to 200 B.C., a period covering the middle-late Spring and Autumn period and all of the Warring States period (Fig. 2). These important discoveries have helped establish the region as the theater for the emergence of social complexity before the arrival of the Qin and Han dynasties in Lingnan. Nevertheless, and in keeping with traditional models of interpretation, Chinese archaeologists have tried to understand this material in the context of contact with those expanding states located to the north of Lingnan. The elaborate ma terial culture and complex political structures associated with these states has usually meant that change in those so-called peripheral areas (including Lingnan) could only be the result of cultural diffusion from the center. -

China 21St Century Education Group Limited 中國21世紀教育集團有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1598)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. China 21st Century Education Group Limited 中國21世紀教育集團有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1598) ANNOUNCEMENT OF INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 FINANCIAL HIGHLIGHTS Six months ended 30 June Percentage of 2019 2018 Changes changes (RMB’000) (RMB’000) (RMB’000) (Unaudited) (Unaudited) Revenue 118,568 101,610 16,958 16.7% Gross Profit 65,049 49,499 15,550 31.4% Profit for the Period 50,538 29,299 21,239 72.5% Adjusted Net Profit (Note) 50,538 39,784 10,754 27.0% School year School year Percentage of 2018/2019 2017/2018 Change change Number of Students 29,985 21,682 8,303 38.3% Note: The Company defined its adjusted net profit as its profit for the period after adjusting for those items which were not indicative of the Company’s operating performances. Please refer to the section headed “Financial Review” of this announcement for details. The Board of China 21st Century Education Group Limited is pleased to announce the unaudited interim condensed consolidated financial statements of the Group for the six months ended 30 June 2019, together with the comparative figures for the corresponding period of 2018.