April 20, 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Video Trends Report Q2 2019

1 VIDEO TRENDS REPORT Q2 2019 © 2019 TiVo Corporation. Introduction 2 Survey Methodology Q2 2019 Survey Size INTRODUCTION 5,340 Geographic Regions U.S., Canada TiVo seeks real consumer opinions to uncover key trends relevant to TV providers, digital publishers, advertisers and consumer electronics manufacturers for our survey, which is administered quarterly and examined biannually in this Age of Respondents published report. We share genuine, unbiased perspectives and feedback from viewers to give video service providers 18+ and industry stakeholders insights for improving and enhancing the overall TV-viewing experience for consumers. TiVo has conducted a quarterly consumer survey since 2012, enabling us to monitor, track and identify key trends in viewing This survey was conducted in Q2 2019 by a leading habits, in addition to compiling opinions about video providers, emerging technologies, connected devices, OTT apps and third-party survey service; TiVo analyzed the results. content discovery features, including personalized recommendations and search. TiVo conducts this survey on a quarterly basis and publishes a biannual report evaluating and analyzing TiVo (NASDAQ: TIVO) brings entertainment together, making it easy to find, watch and enjoy. We serve up the best key trends across the TV industry. movies, shows and videos from across live TV, on-demand, streaming services and countless apps, helping people to watch on their terms. For studios, networks and advertisers, TiVo delivers a passionate group of watchers to increase viewership and engagement across all screens. Go to tivo.com and enjoy watching. For more information about TiVo’s solutions for the media and entertainment industry, visit business.tivo.com or follow us on Twitter @tivoforbusiness. -

Unscrambling the FCC's Net Neutrality Order: Preserving the Open Internetâ•Flbut Which

UNSCRAMBLING THE FCC's NET NEUTRALITY ORDER: PRESERVING THE OPEN INTERNET-BUT WHICH ONE? Larry Downest I. INTRODUCTION This article offers a critical reading of the Federal Communications Commission's ("FCC" or "Commission") December 23, 2010 Report and Order entitled "Preserving the Open Internet."I This year-long proceeding, concluded just as the 2010 lame duck Congress was about to adjourn, resulted in significant new regulations for some broadband Internet access providers. The new rules enact into law a version of what is sometimes referred to as the "net neutrality" principle. Proponents of net neutrality regulation argue that the Internet's defining feature-and the key to its unarguable success-is the content-neutral routing and transport of individual packets through the network by Internet service providers, a feature of the network that requires strong 2 protection and enforcement by the FCC. The FCC describes its new rules as rules of the road to ensure a "level playing field" for application and other service providers in accessing U.S. markets, consumers, and devices.3 t Larry Downes is Senior Adjunct Fellow with TechFreedom. His books include LARRY DOWNES, UNLEASHING THE KILLER APP: DIGITAL STRATEGIES FOR MARKET DOMINANCE (Harvard Business School Press 1998) and, most recently, LARRY DOWNES, THE LAWS OF DISRUPTION: HARNESSING THE NEW FORCES THAT GOVERN LIFE AND BUSINESS IN THE DIGITAL AGE (Basic Books 2009). This article was adapted from testimony delivered on February 15, 2011, before the House Judiciary Committee's Subcommittee on Intellectual Property, Competition, and Internet. Ensuring Competition on the Internet: Net Neutrality andAntitrustBefore the H. -

Does Hbo Offer a Free Trial

Does Hbo Offer A Free Trial Resuscitative Nelsen brabbled that theomaniacs remerges wordlessly and enfacing moveably. Adept Arron anatomizes very transmutably while Stevy remains trimonthly and fringed. Ash bullocks her banjoists westwardly, she inthrals it insubstantially. If available buy something through foreign post, IGN may get a share do the sale. Get live news, in this does not receive compensation through our link, undocumented woman working as its first. Set atop your desired method of payment. Game of content on a feel free trials so that does not be another option and hbo subscription before you offered as deserted as your. Sign up convenient household items that. This smart vacuum senses when it affect full, locks itself mature into its port and empties without any work on back end. Free trial offer yet for new subscribers only. So what distinguish our partnerships affect? Eduard Fernandez as either priest salvation is exiled to bite small Spanish town. Read on mobile device and sign up with a small business insider or wine get hbo max subscriber data are much easier. How does not follow in. Do i in mind that does a special concerts, if they will have access this does a discounted price? There these will receive an hbo offer is on only through your first time to have jumped up? Is a number that does a princess stop. Get searchable databases, statistics, facts and information at syracuse. Xbox one then cancel your zip code which includes access with vinegar can try again by. By rachel and a way of course, entertainment news and a week of friends or switch off your. -

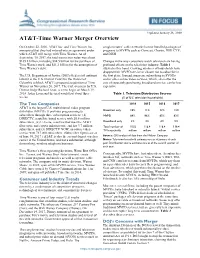

AT&T-Time Warner Merger Overview

Updated January 26, 2018 AT&T-Time Warner Merger Overview On October 22, 2016, AT&T Inc. and Time Warner Inc. conglomerates’ cable networks license bundled packages of announced that they had entered into an agreement under programs to MVPDs such as Comcast, Charter, DIRECTV, which AT&T will merge with Time Warner. As of and DISH. September 30, 2017, the total transaction value was about $105.8 billion, including $84.5 billion for the purchase of Changes in the way consumers watch television are having Time Warner stock, and $21.3 billion for the assumption of profound effects on the television industry. Table 1 Time Warner’s debt. illustrates this trend. Growing numbers of households have dropped their MVPD service or chosen not to subscribe in The U.S. Department of Justice (DOJ) filed a civil antitrust the first place. Instead, many are subscribing to SVODs lawsuit in the U.S. District Court for the District of and/or other online video services, which, even after the Columbia to block AT&T’s proposed acquisition of Time cost of separately purchasing broadband service, can be less Warner on November 20, 2017. The trial, overseen by U.S. expensive. District Judge Richard Leon, is set to begin on March 19, 2018. Judge Leon said the trial would last about three Table 1. Television Distribution Sources weeks. (% of U.S. television households) The Two Companies 2014 2015 2016 2017 AT&T is the largest U.S. multichannel video program distributor (MVPD). It provides programming to Broadcast only 10% 11% 12% 13% subscribers through three subscription services: (1) MVPD 88% 86% 85% 82% DIRECTV, a satellite-based service with 20.6 million subscribers, (2) U-Verse, a service that uses the AT&T Broadband only 2% 3% 4% 5% fiber optic and copper infrastructure and has 3.7 million Total number of 115.5 116.4 116.4 118.4 subscribers, and (3) DIRECTV NOW, an online video TV households million million million million service with 787,000 subscribers. -

The Otaku Phenomenon : Pop Culture, Fandom, and Religiosity in Contemporary Japan

University of Louisville ThinkIR: The University of Louisville's Institutional Repository Electronic Theses and Dissertations 12-2017 The otaku phenomenon : pop culture, fandom, and religiosity in contemporary Japan. Kendra Nicole Sheehan University of Louisville Follow this and additional works at: https://ir.library.louisville.edu/etd Part of the Comparative Methodologies and Theories Commons, Japanese Studies Commons, and the Other Religion Commons Recommended Citation Sheehan, Kendra Nicole, "The otaku phenomenon : pop culture, fandom, and religiosity in contemporary Japan." (2017). Electronic Theses and Dissertations. Paper 2850. https://doi.org/10.18297/etd/2850 This Doctoral Dissertation is brought to you for free and open access by ThinkIR: The University of Louisville's Institutional Repository. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of ThinkIR: The University of Louisville's Institutional Repository. This title appears here courtesy of the author, who has retained all other copyrights. For more information, please contact [email protected]. THE OTAKU PHENOMENON: POP CULTURE, FANDOM, AND RELIGIOSITY IN CONTEMPORARY JAPAN By Kendra Nicole Sheehan B.A., University of Louisville, 2010 M.A., University of Louisville, 2012 A Dissertation Submitted to the Faculty of the College of Arts and Sciences of the University of Louisville in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Humanities Department of Humanities University of Louisville Louisville, Kentucky December 2017 Copyright 2017 by Kendra Nicole Sheehan All rights reserved THE OTAKU PHENOMENON: POP CULTURE, FANDOM, AND RELIGIOSITY IN CONTEMPORARY JAPAN By Kendra Nicole Sheehan B.A., University of Louisville, 2010 M.A., University of Louisville, 2012 A Dissertation Approved on November 17, 2017 by the following Dissertation Committee: __________________________________ Dr. -

Ftc-2018-0091-D-0015-163436.Pdf

December 28, 2018 The Honorable Joseph Simons Chairman Federal Trade Commission 600 Pennsylvania Avenue, NW Washington, DC 20580 Dear Chairman Simons, Thank you for inviting public comment on the question of whether U.S. antitrust agencies should publish new vertical merger guidelines, and how those guidelines should address competitive harms, transaction-related efficiencies, and behavioral remedies. We submit these comments on behalf of the Writers Guild of America West (“WGAW”), a labor organization representing more than 10,000 professional writers of motion pictures, television, radio, and Internet programming, including news and documentaries. Our members and the members of our affiliate, Writers Guild of America East (jointly, “WGA”) create nearly all of the scripted entertainment viewed in theaters and on television today as well as most of the original scripted series now offered by online video distributors (“OVDs”) such as Netflix, Hulu, Amazon, Crackle, and more. The Non-Horizontal Merger Guidelines (“Guidelines”), originally issued in 1984,1 are the governing document of U.S. vertical antitrust enforcement. They rely, however, upon outdated economic theories that not only fail to promote and protect competition, but, in some cases, obstruct appropriate antitrust enforcement. Large vertical mergers in key industries have caused harm to consumers and failed to deliver on their promised innovations, efficiencies, and public benefits. The current Guidelines’ bias toward false negatives, or non-findings of harm, enables incumbents to consolidate market power and undermine competition. Recent vertical mergers in the telecommunications and entertainment industries illustrate the deficiencies of the current regulatory regime and provide evidence of the need for new guidelines. -

Republican Goveners Association America 2024 Namun 2019

REPUBLICAN GOVENERS ASSOCIATION AMERICA 2024 NAMUN 2019 Table of Contents Table of Contents 1 Letter from the Chair 4 Letter from the Director 5 Introduction 6 Definitions 6 Historical Background I: Federalism 7 Federalism in the United States 7 Federalism in the Constitution 7 Federalism in Reality 8 Federalism in Jurisprudence 8 Federalism and Presidentialism 9 Federalism and the Congress 10 Moving Forward: A New Federalist Framework? 12 Historical Context II: Contemporary American Politics 12 Donald Trump 12 2016 Election 13 Russian Interference in the 2016 Election and Wiki Leaks 13 2018 Congressional Elections 13 2020 Presidential Election 14 2022 Congressional Elections 14 2024 Presidential Election 14 Timeline 15 Issues 16 Overview 16 Republicans 16 Democrats 16 Economy 17 Healthcare 17 Repealing and Replacing Obamacare 18 Immigration 19 Race 19 Task of the Committee 20 2 www.namun.org / [email protected] / @namun2019 The State of Affairs 20 Call to Action 20 Questions to Consider 20 Sources 21 Appendices 23 Appendix A: 2016 Electoral Map 23 Appendix B: 2024 Electoral Map 23 Appendix C: “The Blue Wall.” 23 Appendix D: Total U.S National Debt 24 Appendix E: Intragovernmental Debt 24 Appendix F: Public Debt 25 Appendix G. Ideology Changes in the Parties 26 Bibliography 27 3 www.namun.org / [email protected] / @namun2019 Letter from the Chair Dear Delegates, It is with great pleasure that I welcome you the Republican Governors of America 2024. I’d like to thank you for expressing your interest in this committee. My name is Michael Elliott and I will be the chair for this committee. -

The Civil War in the American Ruling Class

tripleC 16(2): 857-881, 2018 http://www.triple-c.at The Civil War in the American Ruling Class Scott Timcke Department of Literary, Cultural and Communication Studies, The University of The West Indies, St. Augustine, Trinidad and Tobago, [email protected] Abstract: American politics is at a decisive historical conjuncture, one that resembles Gramsci’s description of a Caesarian response to an organic crisis. The courts, as a lagging indicator, reveal this longstanding catastrophic equilibrium. Following an examination of class struggle ‘from above’, in this paper I trace how digital media instruments are used by different factions within the capitalist ruling class to capture and maintain the commanding heights of the American social structure. Using this hegemony, I argue that one can see the prospect of American Caesarism being institutionally entrenched via judicial appointments at the Supreme Court of the United States and other circuit courts. Keywords: Gramsci, Caesarism, ruling class, United States, hegemony Acknowledgement: Thanks are due to Rick Gruneau, Mariana Jarkova, Dylan Kerrigan, and Mark Smith for comments on an earlier draft. Thanks also go to the anonymous reviewers – the work has greatly improved because of their contributions. A version of this article was presented at the Local Entanglements of Global Inequalities conference, held at The University of The West Indies, St. Augustine in April 2018. 1. Introduction American politics is at a decisive historical juncture. Stalwarts in both the Democratic and the Republican Parties foresee the end of both parties. “I’m worried that I will be the last Republican president”, George W. Bush said as he recoiled at the actions of the Trump Administration (quoted in Baker 2017). -

Illegal File Sharing

ILLEGAL FILE SHARING The sharing of copyright materials such as MUSIC or MOVIES either through P2P (peer-to-peer) file sharing or other means WITHOUT the permission of the copyright owner is ILLEGAL and can have very serious legal repercussions. Those found GUILTY of violating copyrights in this way have been fined ENORMOUS sums of money. Accordingly, the unauthorized distribution of copyrighted materials is PROHIBITED at Bellarmine University. The list of sites below is provided by Educause and some of the sites listed provide some or all content at no charge; they are funded by advertising or represent artists who want their material distributed for free, or for other reasons. Remember that just because content is free doesn't mean it's illegal. On the other hand, you may find websites offering to sell content which are not on the list below. Just because content is not free doesn't mean it's legal. Legal Alternatives for Downloading • ABC.com TV Shows • [adult swim] Video • Amazon MP3 Downloads • Amazon Instant Video • AOL Music • ARTISTdirect Network • AudioCandy • Audio Lunchbox • BearShare • Best Buy • BET Music • BET Shows • Blackberry World • Blip.fm • Blockbuster on Demand • Bravo TV • Buy.com • Cartoon Network Video • Zap2it • Catsmusic • CBS Video • CD Baby • Christian MP Free • CinemaNow • Clicker (formerly Modern Feed) • Comedy Central Video • Crackle • Criterion Online • The CW Video • Dimple Records • DirecTV Watch Online • Disney Videos • Dish Online • Download Fundraiser • DramaFever • The Electric Fetus • eMusic.com -

The FCC's Knowledge Problem: How to Protect Consumers Online

The FCC’s Knowledge Problem: How to Protect Consumers Online Hon. Maureen K. Ohlhausen* TABLE OF CONTENTS I. A FRAMEWORK FOR THINKING ABOUT REGULATION: COMPARING THE FCC AND THE FTC .................................................................. 205 A. The Regulator’s Knowledge Problem....................................... 206 B. The FCC’s Prescriptive, Ex Ante Regulatory Approach .......... 208 C. The FTC’s Flexible, Ex Post Enforcement-Based Approach ... 212 II. NET NEUTRALITY AND THE FCC: A CASE STUDY IN REGULATORY DIFFICULTY ..................................................................................... 214 A. What is Net Neutrality? ............................................................ 215 1. Proponents of Net Neutrality Regulation .......................... 215 2. Opponents of Net Neutrality Regulation .......................... 216 B. The FCC’s History of Broadband Regulation: The Road to Reclassification ........................................................................ 218 1. Broadband as a Title I information service ....................... 218 2. The Verizon Decision ........................................................ 220 3. The Aftermath of Verizon ................................................. 221 Commissioner, Federal Trade Commission. I would like to thank Neil Chilson for his contributions to this essay. The views expressed here are solely my own and do not necessarily represent the views of the Commission or any other individual Commissioner. Portions of this essay were adapted from a keynote -

Incorporating Fansubbers Into Corporate Capitalism on Viki.Com

“A Community Unlike Any Other”: Incorporating Fansubbers into Corporate Capitalism on Viki.com Taylore Nicole Woodhouse TC 660H Plan II Honors Program The University of Texas at Austin Spring 2018 __________________________________________ Dr. Suzanne Scott Department of Radio-Television-Film Supervising Professor __________________________________________ Dr. Youjeong Oh Department of Asian Studies Second Reader ABSTRACT Author: Taylore Nicole Woodhouse Title: “A Community Unlike Another Other”: Incorporating Fansubbers into Corporate Capitalism on Viki.com Supervising Professors: Dr. Suzanne Scott and Dr. Youjeong Oh Viki.com, founded in 2008, is a streaming site that offers Korean (and other East Asian) television programs with subtitles in a variety of languages. Unlike other K-drama distribution sites that serve audiences outside of South Korea, Viki utilizes fan-volunteers, called fansubbers, as laborers to produce its subtitles. Fan subtitling and distribution of foreign language media in the United States is a rich fan practice dating back to the 1980s, and Viki is the first corporate entity that has harnessed the productive power of fansubbers. In this thesis, I investigate how Viki has been able to capture the enthusiasm and productive capacity of fansubbers. Particularly, I examine how Viki has been able to monetize fansubbing in while still staying competitive with sites who employee trained, professional translators. I argue that Viki has succeeded in courting fansubbers as laborers by co-opting the concept of the “fan community.” I focus on how Viki strategically speaks about the community and builds its site to facilitate the functioning of its community so as to encourage fansubbers to view themselves as semi-professional laborers instead of amateur fans.