Every Step of Your Life

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Discourses of Ethno-Nationalism and Religious Fundamentalism

DISCOURSES OF ETHNO-NATIONALISM AND RELIGIOUS FUNDAMENTALISM SRI LANKAN DISCOURSES OF ETHNO-NATIONALISM AND RELIGIOUS FUNDAMENTALISM By MYRA SIVALOGANATHAN, B.A. A Thesis Submitted to the School of Graduate Studies In Partial Fulfillment of the Requirements for the Degree Master of Arts McMaster University © Copyright by Myra Sivaloganathan, June 2017 M.A. Thesis – Myra Sivaloganathan; McMaster University – Religious Studies. McMaster University MASTER OF ARTS (2017) Hamilton, Ontario (Religious Studies) TITLE: Sri Lankan Discourses of Ethno-Nationalism and Religious Fundamentalism AUTHOR: Myra Sivaloganathan, B.A. (McGill University) SUPERVISOR: Dr. Mark Rowe NUMBER OF PAGES: v, 91 ii M.A. Thesis – Myra Sivaloganathan; McMaster University – Religious Studies. Abstract In this thesis, I argue that discourses of victimhood, victory, and xenophobia underpin both Sinhalese and Tamil nationalist and religious fundamentalist movements. Ethnic discourse has allowed citizens to affirm collective ideals in the face of disparate experiences, reclaim power and autonomy in contexts of fundamental instability, but has also deepened ethnic divides in the post-war era. In the first chapter, I argue that mutually exclusive narratives of victimhood lie at the root of ethnic solitudes, and provide barriers to mechanisms of transitional justice and memorialization. The second chapter includes an analysis of the politicization of mythic figures and events from the Rāmāyaṇa and Mahāvaṃsa in nationalist discourses of victory, supremacy, and legacy. Finally, in the third chapter, I explore the Liberation Tiger of Tamil Eelam’s (LTTE) rhetoric and symbolism, and contend that a xenophobic discourse of terrorism has been imposed and transferred from Tamil to Muslim minorities. Ultimately, these discourses prevent Sri Lankans from embracing a multi-ethnic and multi- religious nationality, and hinder efforts at transitional justice. -

1066 1562924295465.Pdf

When it comes to our raring dare to do attitude, we are boundless... Expolanka experienced a journey this year in which the company made leaps and bounds in the industry. Most notably, the freight arm of the conglomerate performed admirably in the year under review as we not only expanded our geographical presence through 4PL services but also through product diversification and explored new avenues in digitalisation. With so many novel ventures highlighted during the past year, we felt it apt to look ahead and take stock of our options; a vast horizon that lies ahead. From the depths of our solid foundation to the seemingly impossible heights of opportunity, we are limitless.. CONTENTS About this Report 04 Group Milestones 05 Financial Highlights 06 Highlights of the Year 07 Chairman’s Message 10 Group CEO’s Review 13 Sustainability Strategy 29 Financial Indicators 17 Material Topics and Topic Boundaries 30 Board of Directors 18 Stakeholder Engagement 35 Organizational Structure 71 Senior Management Team 20 Stakeholder Value Creation 38 Our Footprint 72 Group Performance 23 Capital Management Reports 39 Business Reports 74 Group Strategy 24 Financial Capital 39 Logistics Sector 74 OVERVIEW Manufactured Capital 40 Leisure Sector 81 Intellectual Capital 41 Investments Sector 85 Human Capital 44 OPERATIONAL REVIEW Natural Capital 51 Social and Relationship Capital 60 GRI Index 64 Independent assurance Report 67 INTEGRATED MANAGEMENT DISCUSSION AND ANALYSIS 02 EXPOLANKA HOLDINGS PLC - ANNUAL REPORT 2018 | 2019 Group Real Estate Portfolio -

The Degree of Financial Literacy As a Deterministic Factor in Investment Decisions: Evidence from Colombo Stock Exchange (CSE) of Sri Lanka

Sri Lanka Journal of Economic Research The Degree of Financial Literacy as a Vol. 07(1): pp 15-44 Sri Lanka Forum of University Deterministic Factor in Investment Economists ISSN: 2345-9913 Decisions: Evidence from Colombo Stock Exchange (CSE) of Sri Lanka S.R.S.D.K. Weerawansa1 and N.S. Morage2 Abstract Local retail investors at the CSE are not gaining the optimum benefits out of the market whereas, the foreign investors are gaining high profits through trading stocks. In addition, the financial literacy level of Sri Lankans is low compared to other countries. The main target of the researcher is to determine “The Impact of Behavioral Finance on Investment Decision-Making in the Stock Market and the Moderating Role of Financial Literacy: with special reference to local individual investors at the CSE of Sri Lanka”. The findings of the study revealed that a significant relationship exists between behavioral finance and investment decision-making. It was also established that financial literacy moderates the relationship between the independent variables and the dependent variable. The qualitative findings resulted in a final thematic analysis which gave rise to additional independent variables and moderating variables which were suggested for future research by the author. Keywords: Stock Market; Financial literacy; Behavioral finance; Gambler’s Fallacy; Herd Behaviour; Sri Lanka 1 Department of Economics, University of Colombo, Sri Lanka. 2 Imperial Institute of of Higher education (IIHE), Sri Lanka. 15 The Degree of Financial Literacy as a Deterministic Factor in Investment Decisions: Evidence from Colombo Stock Exchange (CSE) of Sri Lanka Introduction Behavioral finance is an emerging area in research where one can ascertain the factors affecting the investment decision-making. -

Gender, Lineage, and Localization in Sri Lanka's

GLOBAL NETWORKS, LOCAL ASPIRATIONS: GENDER, LINEAGE, AND LOCALIZATION IN SRI LANKA’S BHIKKHUNĪ ORDINATION DISPUTE by TYLER A. LEHRER B.A., California State University, Sacramento, 2013 A thesis submitted to the Faculty of the Graduate School of the University of Colorado in partial fulfillment of the requirement for the degree of Master of Arts Department of Religious Studies 2016 This thesis entitled: Global Networks, Local Aspirations: Gender, Lineage, and Localization in Sri Lanka’s Bhikkhunī Ordination Dispute written by Tyler A. Lehrer has been approved for the Department of Religious Studies ________________________________________________________ Dr. Holly Gayley, Committee Chair Assistant Professor, Religious Studies ________________________________________________________ Dr. Deborah Whitehead Associate Professor, Religious Studies ________________________________________________________ Dr. Carla Jones Associate Professor, Anthropology Date _____________________ The final copy of this thesis has been examined by the signatories, and we find that both the content and the form meet acceptable presentation standards of scholarly work in religious studies. IRB protocol #: 15-0563 iii Lehrer, Tyler A. (M.A., Religious Studies) Global Networks, Local Aspirations: Gender, Lineage, and Localization in Sri Lanka’s Bhikkhunī Ordination Dispute Thesis directed by Assistant Professor Dr. Holly Gayley This thesis investigates many of the figures and events that have made full ordinations of Buddhist nuns (bhikkhunīs) both possible and contested -

© DLIFLC | I SRI LANKA in Perspective an Orientation Guide

SRI LANKA in Perspective An Orientation Guide © DLIFLC | i SRI LANKA in Perspective An Orientation Guide TABLE OF CONTENTS CHAPTER 1: GEOGRAPHY......................................................................................................... 1 Introduction .............................................................................................................................. 1 Geographic Divisions and Topographic Features .................................................................... 1 Knuckles Mountains ......................................................................................................... 2 Hanthana Mountains ......................................................................................................... 2 Sabaragamuwa Mountains ................................................................................................ 2 Climate ..................................................................................................................................... 3 Rivers and Bodies of Water ..................................................................................................... 3 Indian Ocean ..................................................................................................................... 3 Bay of Bengal ................................................................................................................... 3 Palk Bay ............................................................................................................................ 4 -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

Prospectus Bogawantalawa Tea Estates

PROSPECTUS BOGAWANTALAWA TEA ESTATES PLC ISSUE OF 10,000,000 SENIOR, LISTED, RATED, CONVERTIBLE, UNSECURED, REDEEMABLE, LKR 100 DEBENTURES ISSUED AT LKR 85 EACH TO RAISE SRI LANKA RUPEES EIGHT HUNDRED AND FIFTY MILLION (LKR 850,000,000) TO BE LISTED ON THE COLOMBO STOCK EXCHANGE Rated [SL] BBB+ with Negative Outlook by ICRA Lanka Limited ISSUE OPENS ON 18TH JULY 2019 MANAGERS TO THE ISSUE TRUSTEES TO THE ISSUE Areva Investments (Pvt) Ltd Hatton National Bank PLC PROSPECTUS BOGAWANTALAWA TEA ESTATES PLC ISSUE OF 10,000,000 SENIOR, LISTED, RATED, CONVERTIBLE, UNSECURED, REDEEMABLE, LKR 100 DEBENTURES ISSUED AT LKR 85 EACH TO RAISE SRI LANKA RUPEES EIGHT HUNDRED AND FIFTY MILLION (LKR 850,000,000) TO BE LISTED ON THE COLOMBO STOCK EXCHANGE Rated [SL] BBB+ with Negative Outlook by ICRA Lanka Limited ISSUE OPENS ON 18TH JULY 2019 MANAGERS TO THE ISSUE TRUSTEES TO THE ISSUE Areva Investments (Pvt) Ltd Hatton National Bank PLC “THE COLOMBO STOCK EXCHANGE (CSE) HAS TAKEN REASONABLE CARE TO ENSURE FULL AND FAIR DISCLOSURE OF INFORMATION IN THIS PROSPECTUS. HOWEVER, THE CSE ASSUMES NO RESPONSIBILITY FOR THE ACCURACY OF THE STATEMENTS MADE, OPINIONS EXPRESSED OR REPORTS INCLUDED IN THE PROSPECTUS. MOREOVER, THE CSE DOES NOT REGULATE THE PRICING OF THE DEBENTURES ISSUED HEREIN, WHICH IS DECIDED SLOELY BY THE ISSUER. THE DELIVERY OF THIS PROSPECTUS SHALL NOT UNDER ANY CIRCUMSTANCE CONSTITUTE A REPRESENTATION OR CREATE ANY IMPLICATION OR SUGGESTION THAT THERE HAS BEEN NO MATERIAL CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE OF THE PROSPECTUS. IF THERE IS A MATERIAL CHANGE, SUCH MATERIAL CHANGE WILL BE DISCLOSED TO THE MARKET. -

Listing on the Colombo Stock Exchange

Contents Listing on the Colombo Stock Exchange 2 Success Stories 11 Going public: Is an IPO right for your company? 13 The Listing Process 17 Life as a listed company 25 FAQs 27 Key Contacts 29 1 Listing on the Colombo Stock Exchange About CSE A Steady Growth Trajectory Profile At CSE, we are focused on doing what we do best and that includes further developing the exchange and leveraging our The Colombo Stock Exchange (CSE) is the nucleus of Sri strength to be not only a leading international marketplace Lanka’s capital market as the licensed operator of the stock for securities focused on Sri Lanka but also for the rest of market. We are regulated by the Securities and Exchange the region. We are poised to diversify with the planned Commission of Sri Lanka (SEC) and was incorporated as a introduction of multi-currency markets and other new company limited by guarantee over 30 years ago. products. Alongside the wider community which interact with us, our core stakeholder base constitutes of 31 Members and In the midst of the various growth initiatives we are pursuing, Trading Members, 295 issuers, 750,000 investors, over 150 what remains unchanged is our focus on maintaining our employees, and other stakeholders. market’s integrity and quality. We are fully aware that only operating an open, secure, fair, orderly and transparent As an institution of national significance, we maintain marketplace will offer us the investor confidence required to an unwavering focus and commitment towards creating make the expansion of our exchange possible. conditions that support growth. -

The List of Approved Stock Exchanges

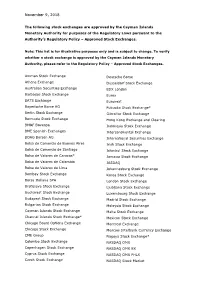

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

Over 1200 Foreign Buyers and Investors Attend EXPO 2012

PUBLISHED BY THE TIMES OF SRI LANKA IN TORONTO, CANADA VOLUME 18 – APRIL 2012 Over 1200 foreign buyers and investors attend EXPO 2012 Sri Lanka President Mahinda Rajapaksa officially opened EXPO 2012 around 10:30 am on March 28, flanked by Industry & Commerce Minister Rishad Bathiudeen and Sri Lanka Export Development Board Chairman Janaka Ratnayaka. Over 1200 foreign delegates, diplomats, trade commissioners, corporate and business leaders were present to take in the engaging opening ceremony at BMICH. Addressing the large gathering, President Rajapaksa welcomed the delegates and distinguished guests and said that Sri Lanka is now open for business and invited the delegates to invest in Sri Lanka. “Peace has dawned on the country and Sri Lanka is experiencing a tremendous growth pattern that is consistent with a rapidly developing country”, said the president. President Rajapaksa explained that Asia, as a region is acclaimed today as the new economic hub of the world, and along with this positioning Sri Lanka is making giant strides to build its vision as a strategically important economic centre within the region. “This is why Foreign Direct Investment (FDI) in Sri Lanka has more than doubled in the past year. Statistics of new inflows to the Colombo Stock Exchange (CSE) remain buoyant just as much as the inflows of investment in commercial banks. Foreign investors are ready to place their trust in Sri Lanka’s Development bonds. CSE has also seen many new Initial Public Offerings (IPO),” said the president. “International hotel chains like Shangri-la, Sun City and Sheraton have decided to invest in Sri Lanka, while there are many others in the investment pipeline. -

11082/Sampath Eng. Final

Where technology and tradition meet The world may be spinning at a dizzying rate with technology setting a breathtaking pace. But Sampath Bank understands that technology without the wisdom of tradition can slow everything down. Our approach to business is a confluence. A healthy borrowing of the two worlds. A merger that ultimately enriches our world, our life. Where Technology & Tradition meet.. In 1932, Wilhelm Geiger, a German Indologist wrote thus: We have been trailblazers – spearheading a path of ‘It is a well known fact that for hardly any part of the pioneering banking technology to Sri Lanka, presenting continent of India is there such an uninterrupted historical the future while creating history. We are constantly tradition as for the island of Ceylon’. So it was then, as scouring the world, looking for innovative technologies recorded in the ancient literary works of the Mahavamsa that would give our people an edge in this competitive and Chulavamsa, that Sri Lanka has always been regarded world. But, we do not use technology as it is. No – we as the bulwark of civilisation, drawing from traditions and customize the technology of the world to suit our more history to create a race of people revered as technologically diverse needs. Being a local bank, we serve a genre of advanced from eras gone by. customers from the elite residing in the chic echelons of Colombo to the farmer who toils in the rural outback. We Stone working technologies impacted us as far back as transform and adapt technology so that this eclectic mix of 5,000 BC. -

Bank of Ceylonannual Repor

ANNUAL REPORT 2020 ANNUAL REPORT BANK OF CEYLON Bank of Ceylon, No. 01, BOC Square, Bank of Ceylon Mawatha, Colombo 01 Sri Lanka BANK OF CEYLON ANNUAL REPORT 2020 As we traversed a new terrain in 2020 engulfed by unprecedented challenges, we at BoC demonstrated resilience and strength across many dimensions. As the world stood still during the pandemic, we ensured that we reach out to our customers through digital platforms. Our efforts to harness the power of new technology over the years allowed us to adapt and pivot seamlessly to the new normal. Leading the way, we have powered the economy through many development projects of national interest which will stimulate prosperity and development across the Island. As the unequivocal leader in the banking sphere we inspired the way by helping the state navigate through a challenging era. We set the pace for economic resurgence by granting financial support to industries affected by the pandemic creating a strong bedrock to help the Nation chart its way in the new economy. Standing tall as a pillar of support to the Nation and its people with unwavering support we are truly Leading to inspire. BANK OF CEYLON ANNUAL REPORT 2020 Contents 3 - 4 74 - 83 320 - 365 Our Integrated Delivering Value Compliance Annexes Annual Report Integrated value creation through our Compliance with Code of Best Practice on strategy\ 74 Corporate Governance 2017 issued by CA 6 - 29 Chief Financial Officer’s Review\ 75 Sri Lanka\ 320 Business Line Reviews\ 79 Compliance Requirements as per Banking Act Direction No.