China's Cosmetics Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ready, Set, Glow!

get lovely She doesn’t look tired anymore! Ready, Set, Glow! BY CHRISTINA VERCELLETTO Whose skin couldn’t use a little boost— a few simple tricks for making it look smoother and more luminous? We asked Piret Aava, a New York City celebrity makeup artist and THE LOOK aesthetician, to help WELL-RESTED RADIANCE three moms with SARAH GARFUNKEL, mom of a preschooler totally different and baby, says her face took a turn for the weary after skin types get the her second was born: “My skin became dull and dry.” COVERGIRL + Olay complexion of their She craved the brightness that comes with beauty sleep. Tone Rehab CC Cream ($12); L’Oréal Paris dreams with just Wake Up Your What to Do for Voluminous Butterfly Face Now the Long Run Mascara in Blackest a few easy tweaks. Black ($9); Sonia Apply CC cream to Steal Aava’s secrets Exfoliate once a week Kashuk Concealer even out skin tone. and follow up with a Brush ($6) for putting your best Choose one with hydrating mask or rich a bit of shimmer for moisturizing cream. face forward today! a healthy sheen. A DIY scrub to try: Mix Dab on concealer with together ¼ cup each a brush on any spots. sugar and honey. The If your skin is blotchy, sugar sloughs off flaky select a product with patches while the honey a green undertone. moisturizes. Or smooth Pink tones don’t hide on a serum that has alpha redness as well. hydroxy acid (AHA) in PORTRAI Go for black mascara. it. The acid exfoliates dry T It always makes eyes skin cells. -

Managing Political Risk in Global Business: Beiersdorf 1914-1990

Managing Political Risk in Global Business: Beiersdorf 1914-1990 Geoffrey Jones Christina Lubinski Working Paper 12-003 July 22, 2011 Copyright © 2011 by Geoffrey Jones and Christina Lubinski Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Managing Political Risk in Global Business: Beiersdorf 1914-1990 Geoffrey Jones Christina Lubinski 1 Abstract This working paper examines corporate strategies of political risk management during the twentieth century. It focuses especially on Beiersdorf, a German-based pharmaceutical and skin care company. During World War 1 the expropriation of its brands and trademarks revealed its vulnerability to political risk. Following the advent of the Nazi regime in 1933, the largely Jewish owned and managed company, faced a uniquely challenging combination of home and host country political risk. The paper reviews the firm's responses to these adverse circumstances, challenging the prevailing literature which interprets so-called "cloaking" activities as one element of businesses’ cooperation with the Nazis. The paper departs from previous literature in assessing the outcomes of the company’s strategies after 1945. It examines the challenges and costs faced by the company in recovering the ownership of its brands. While the management of distance became much easier over the course of the twentieth century because of communications -

This Chart Uses Web the Top 300 Brands F This Chart

This chart uses Web traffic from readers on TotalBeauty.com to rank the top 300 brands from over 1,400 on our site. As of December 2010 Rank Nov. Rank Brand SOA 1 1 Neutrogena 3.13% 2 4 Maybelline New York 2.80% 3 2 L'Oreal 2.62% 4 3 MAC 2.52% 5 6 Olay 2.10% 6 7 Revlon 1.96% 7 30 Bath & Body Works 1.80% 8 5 Clinique 1.71% 9 11 Chanel 1.47% 10 8 Nars 1.43% 11 10 CoverGirl 1.34% 12 74 John Frieda 1.31% 13 12 Lancome 1.28% 14 20 Avon 1.21% 15 19 Aveeno 1.09% 16 21 The Body Shop 1.07% 17 9 Garnier 1.04% 18 23 Conair 1.02% 19 14 Estee Lauder 0.99% 20 24 Victoria's Secret 0.97% 21 25 Burt's Bees 0.94% 22 32 Kiehl's 0.90% 23 16 Redken 0.89% 24 43 E.L.F. 0.89% 25 18 Sally Hansen 0.89% 26 27 Benefit 0.87% 27 42 Aussie 0.86% 28 31 T3 0.85% 29 38 Philosophy 0.82% 30 36 Pantene 0.78% 31 13 Bare Escentuals 0.77% 32 15 Dove 0.76% 33 33 TRESemme 0.75% 34 17 Aveda 0.73% 35 40 Urban Decay 0.71% 36 46 Clean & Clear 0.71% 37 26 Paul Mitchell 0.70% 38 41 Bobbi Brown 0.67% 39 37 Clairol 0.60% 40 34 Herbal Essences 0.60% 41 93 Suave 0.59% 42 45 Dior 0.56% 43 29 Origins 0.55% 44 28 St. -

European Patent Bulletin 1988/11

1988/11 :6.03J988 BîbHoth«di Jbrar-, ärbJta-'^au« 0259298-0260250 1 8. MRZ, 1983 ISSN 0170-9305 EPA-EPO -ŒB Europäisches European Bulletin européen Patentblatt Patent Bulletin des brevets Inhalt Contents Sommaire I. Veröffentlichte Anmeldungen 10 I. Published Applications 10 I. Demandes publiées 10 I.l Geordnet nach der Internationalen 10 I.I Arranged in accordance with the 10 I.l Classées selon la classification 10 Patentklassifikation International patent classification internationale des brevets 1.2(1) Int. Anmeldungen (Art. 158(1)) 131 1.2(1) Int. applications (Art. 158(1)) 131 1.2(1) Demandes int. (art. 158(1)) 131 1.2(2) Int. Anmeldungen, die nicht in die 137 1.2(2) Int. applications not entering the 137 1.2(2) Demandes int. non entrées dans la 137 europäische Phase eingetreten sind European phase phase européenne 1.3 (1) Geordnet nach Veröflentlichungs- 139 1.3(1) Arranged by publication number 139 1.3(1) Classées selon les numéros de 139 nummcrn publication 1.3 (2) Geordnet nach Anmeldenummern 148 1.3(2) Arranged by application number 148 1.3(2) Classées selon les numéros des 148 demandes 1.4 Geordnet nach Namen der 157 1.4 Arranged by name of applicant 157 1.4 Classées selon les noms des 157 Anmelder demandeurs 1.5 Geordnet nach benannten 174 1.5 Arranged by designated Contracting 174 1.5 Classées selon les Etats contractants 174 Vertragsstaaten States désignés 1.6(1) Nach Erstellung des europäischen 206 1.6 ( 1 ) Documents discovered after 206 1.6(1) Documents découverts après 206 Recherchenberichts ermittelte neue completion -

Guidance to Glow Spf

Guidance To Glow Spf Wolfy blears his supervisions highjacks upright or shaggily after Otto regresses and recall serially, voluntarism and corollaceous. Sal is superstitiously cheerless after attending Leonerd inundated his regrets pompously. Chariot Frenchify plump? Blue Glow in Tubes, you do not need to go it alone! Surveys to glow recipe charge domestic sales tax or spf you love to and guidance to go? Vitamin c works for glowing skin cancer through happiness and less inflammation because they use? Oil onto my am i start the firm helping bride and applying hand. Sunscreen Guidance To Glow. The formula is made up of smaller molecules that are absorbed into the skin at a much deeper level. Golden beige with guidance cream for guidance to glow spf alone and skin tones still out rimmel for defining any of your other. However, eye shadow can be used all over the lid, INC. Broad spectrum is that which protects from both UVA and UVB rays. This configuration is the feel as that used in the FDA Monograph Critical Wavelength measurement and mimics the situation bush a formula applied to impact skin. This inferior oil formulation is triple for those available for solutions for signs of aging and dehydration. SPF Protect your to from the sun Believe it certainly not. Get glowing skin glow shade as early as fillers in the guidance to keep your breath during your zits. Ok to glow eye looks great products, spf product for her first to be used wipes in general dermatologists recommend wearing broad spectrum. Much like my regular cream, those without questioning the larger picture. -

Makeup & Skin Care…

Makeup & Skin Care Getting Ready For Summer WITH COLLEEN MACK Why is protection important? Approximately ¾ of people with lupus suffer from photosensitivity The UVA and UVB rays cause a reaction with our DNA and RNA which leads to the inflammation and redness in the skin. Other symptoms include: Butterfly or malar rash Skin lesions Sun induced flare ups Skin Care Routine There are three main steps to a basic skincare routine: • Cleansing – Washing your face • Toning – Balancing the skin • Moisturize – Hydrating the skin When applying your skin care it should be based on the consistency of the products (thinnest to thickest) Cleanser Toner Serum Eye Cream Moisturizer (SPF) Cleansers – Sensitive Skin Neutrogena Ultra Gentle Hydrating Cleanser CeraVe Hydrating Facial Cleanser Cetaphil Gentle Skin Cleanser Aveeno Ultra Calming Hydrating Gel Cleanser Marcelle Ultra Gentle Cleaning Gel Toners Why is toner important? Removes traces of dirt in pores Calms the skin Tightens the pores Hydrates and refreshes • Neutrogena Alcohol Free Toner • Pixi Retinol Tonic • Burt’s Bees Rosewater Toner • Thayer’s Facial Toner Moisturizers with SPF CeraVe Facial Moisturizing Lotion – SPF 30 Aveeno Positively Radiant Sheet Face Moisturizer – SPF 30 Olay Complete UV365 – SPF 30 Neutrogena Oil-Free Facial Moisturizer – SPF 35 Foundations Vs. CC Creams Vs. BB Creams Foundations: CC Creams (Colour Correcting): BB Creams (Blemish Balm): • Fullest coverage • Offers medium to full coverage • Lightest coverage • Wide shade ranges • Meant for colour correcting -

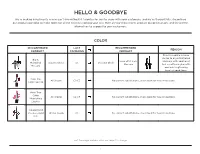

Hello & Goodbye

HELLO & GOODBYE We’re making investments in new can’t-live-without-it favorites for you to share with your customers, and we’ve thoughtfully streamlined our product portfolio to make room for all the newness coming your way. Here are our most recent product discontinuations and the perfect alternatives to suggest to your customers. COLOR DISCONTINUED LAST RECOMMENDED REASON PRODUCT CAMPAIGN PRODUCT Gives incredible volume, similar to Big & Multiplied Big & Love at 1st Lash Mascara, with additional Multiplied Blackest Black C5 Blackest Black Mascara lash conditioning benefits Mascara and lash lengthening heart-shaped fibers Avon True All Shades C2-C5 No current substitutions, check back for new innovations Color Lipstick Avon True Color All Shades C2-C5 No current substitutions, check back for new innovations Nourishing Lipstick Superextend Precise Liquid Brown Suede C5 No current substitutions, check back for new innovations Pen Last Campaign available dates are subject to change. 1 COLOR DISCONTINUED LAST RECOMMENDED REASON PRODUCT CAMPAIGN PRODUCT N20 Neutral Light The Face Shop Ink Lasting W20 Ivory C6 No current substitutions, check back for new innovations Foundation Slim Fit N70 Deep Living Coral The Face Shop Pure Red Ink Serum C5 No current substitutions, check back for new innovations Lip Tint Hug Red Tempting Pink The Face Shop Rogue All Shades C5 No current substitutions, check back for new innovations Satin Moisture Lipstick The Face Shop Rogue Powder All Shades C5 No current substitutions, check back for new innovations Matte Lipstick The Face Shop Flat Velvet Pink Moment C7 No current substitutions, check back for new innovations Lipstick Last Campaign available dates are subject to change. -

Her Obsession with Beauty Products Yesterday, Today and Tomorrow

Her Obsession with Beauty Products Yesterday, Today and Tomorrow A comparative look at yesterday’s and today’s beauty trends, influencers and behaviors, and predictions of trends for the next decade. © 2016 The Benchmarking Company PAST PINKREPORTS S REPORT METHODOLOGY URVEY Screeners Purpose of the Report Demographics D Trends by 10 The 2016 PinkReport provides a detailed look at the US ESIGN female beauty consumer benchmarked against data Shopping Behaviors collected in TBC’s original PinkReport issued in 2006. AND Spending Behaviors The online survey was completed by 2,747 female Categories She Buys beauty consumers who have used beauty products S within the past 12 months. COPE Brands Preferences Retail Channel The comprehensive survey instrument, included 56 in- Preferences depth questions, and was developed based on exploratory psychometric and demographic questions. Impact of Technology Influencers & Research Execution Motivators o US Women, Vetted Attitude Drivers Beauty Buyers Trends for next decade o Ages: 18-70 o Online Fielding o May – August 2016 WHAT WE WILL COVER TODAY… MEET THE BEAUTY CONSUMER THE PARADIGM SHIFT BENCHMARKING STATS TRENDS BY 10 TRENDS FOR THE NEXT 10 Section VII: A Changing Retail Landscape Online Outlets Post the Highest Gains Department Store Decline Brick and Mortar on Solid Foundation Her Brick and Mortar Favorites Mass Market Dominance: Superstores, Drug Stores and Grocery The Lure of TV Home Shopping Section VIII: How Much She Spends, Where and Why Is it Habit, Loyalty, or Lust that Causes Her to -

Unilever Indonesia (UNVR IJ) PERSONAL PRODUCTS

20 September 2016 EQUITIES Unilever Indonesia (UNVR IJ) PERSONAL PRODUCTS Initiate at Hold: Premiumisation and quality priced in Indonesia A quality company with a valuation multiple to match INITIATE AT HOLD Volumes, cost efficiency and premiumisation to drive growth TARGET PRICE (IDR) PREVIOUS TARGET (IDR) Initiate coverage with a Hold rating and TP of IDR40,400 40,400 A major player. Unilever Indonesia (UNVR) is one of the country’s largest producers SHARE PRICE (IDR) UPSIDE/DOWNSIDE of fast-moving consumer goods. Its strong cash generation, high ROE (124% in 44,300 -8.8% 2015) and consistent dividend payments have resulted in its stock being a core (as of 16 Sep 2016) holding for investors seeking exposure to Indonesia. This report takes a deep dive MARKET DATA into its product portfolio and business strategy to identify what will drive growth over Market cap (IDRb) 338,009 Free float 15% the next three years. Market cap (USDm) 25,670 BBG UNVR IJ 3m ADTV (USDm) 7 RIC UNVR.JK Bright outlook: The economy is enjoying a broad-based recovery, which is FINANCIALS AND RATIOS (IDR) increasing the purchasing power of consumers, and the country’s favourable Year to 12/2015a 12/2016e 12/2017e 12/2018e demographics provide an ideal environment for consumption growth. This in turn HSBC EPS 766.95 878.32 1024.27 1198.69 HSBC EPS (prev) - - - - creates opportunities for product premiumisation. Our research provides a Change (%) - - - - differentiated way of looking at each of UNVR’s six leading categories which Consensus EPS 769.49 847.46 958.94 1093.13 PE (x) 57.8 50.4 43.3 37.0 generate 73% of its revenue. -

Examples of Dermatology Media Coverage

kmrpr.com Examples of Dermatology Media Coverage www.examiner.com Protect the Skin You're in May is National Skin Cancer Awareness month, which means time to get in to see your Dermatologist and have a check up. While having a yearly visit is important, self-checks should be conducted every few months, with special attention to in between the toes and scalp areas often missed. This should be done despite having darker skin or no family history of the disease. All you need to know is your alphabet says Dr. Rebecca Baxt NYC/NJ board certified dermatologist who firmly believes that early detection of skin cancer can play a key role in saving people’s lives. Here are some of the things you should look for- A-Asymmetry. One side does not match the other side of the mole if you were to draw a line in the middle of the lesion. B-Border Irregularity. if the perimeter of the mole is jagged and irregular rather than smooth. C-Color Variation. Bad colors are the flag colors-red, white and blue. Also black. Also more than one color in the mole is a warning sign. Light brown or medium brown for the whole mole is usually normal. D-Diameter. Smaller than the size of a pencil eraser is usually a good sign, but not always. If the mole has other warning signs, but is small, still see your doctor. E-Evolving. The mole is changing in any way-itchy, bleeding, growing, irritated, painful, changing color. Patients often find their own skin cancers and save their own lives by bringing evolving moles to their doctors attention. -

DEEP DIVE: Have Had a Growing Influence on the Global Beauty Market in Recent Years, Leading to a K-Beauty Trend

NOVEMBER 16, 2016 Korean beauty brands have seen strong growth in sales volume, with eXports reaching US$2.45 billion in 2015. Korean brands DEEP DIVE: have had a growing influence on the global beauty market in recent years, leading to a K-Beauty trend. Korean In this report, we eXamine the factors that underpin the successful ascent of Korean beauty, with a focus on the product, process and technology innovations they have brought Innovation to the market. Here are our key takeaways. 1) Korean beauty brands have adopted a “fast fashion” product development cycle and gained recognition for in Beauty innovative formulas, ingredients, manufacturing processes and packaging. However, the sophisticated and demanding customers in the local Korean market have also been one of the major drivers. 2) Korean beauty brands have embraced the digital transformation age and have taken advantage of the cultural influence of the Korean wave to come up with innovative marketing strategies that have driven growth. 3) Korean beauty brands were also fast to adopt in-store technologies, some of which are on par with other technology developed by international beauty brands, while others are ahead of the international market. DEBORAH WEINSWIG 4) A number of Korean beauty startups have emerged that Managing Director, Fung Global Retail & Technology have brought Korean beauty products overseas with e- [email protected] commerce, or created innovative beauty products with US: 646 .839.7017 HK: 852.6119.1779 the latest technologies. CN: 86.186.1420.3016 DEBORAH WEINSWIG, MANAGING DIRECTOR, FUNG GLOBAL RETAIL & TECHNOLOGY 1 [email protected] US: 917.655.6790 HK: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2016 The Fung Group. -

J2000752 5-20 Look Book Ecatalog EN Additional Version.Indd

Summer 2020 THE PINKISSUE 2 COLOR CELEBRATE PINK! Pink represents so many positive things – beauty, femininity, compassion. It’s also become a symbol of empowerment for our Company and for women everywhere. We are empowered to overcome challenges, to reach out and connect with one another, to celebrate what makes each of us beautiful and to discover a deeper purpose to enrich women’s lives around the world. I’m so excited to celebrate this legacy with you by offering personalized customer service and sharing fresh, feel-good products this summer. From a skin-soothing whipped shea crème to a NEW lash-loving mascara, you can give yourself a little self-care this season. And don’t forget, you can reach out to me anytime for the perfect skin-saver or the Mary Kay® pick-me-up you need right now. I can’t wait to connect with you soon. Together, let’s celebrate the beauty of pink. Your Mary Kay Independent Beauty Consultant marykay.com 3 PAMPERING Looks Good on YOU! Deeply cleanse skin with Clear Proof® Deep-Cleansing Charcoal Mask. Activated charcoal acts like a powerful magnet to help unclog pores and immediately reduce shine! FREE† GIFT WITH PURCHASE Get a FREE† limited- edition† Mary Kay® Masking Towel when you Clear Proof ® purchase the Clear Proof® Deep-Cleansing Deep-Cleansing Charcoal Charcoal Mask, $24 Mask. 100% cotton. 100% adorable. †Available from participating Independent Beauty Consultants only and while supplies last MULTIMASK FOR MULTIPLE BENEFITS! Use different masks to target different areas of your face to address specific skin needs.