Boardex Global-Gender-Balance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information Product Fee Schedule

INFORMATION PRODUCT FEE SCHEDULE Applicable from: 1 January 2020 (Version 7.0) CONTENTS GENERAL ................................................................................................................................................ 1 DIRECT ACCESS FEES ............................................................................................................................... 2 REDISTRIBUTION LICENCE FEES ............................................................................................................... 3 Real Time Redistribution Licence Fees ............................................................................................................... 3 Delayed Redistribution Licence Fees .................................................................................................................. 4 WHITE LABEL FEES .................................................................................................................................. 6 PUBLIC DISPLAY FEES .............................................................................................................................. 8 DISPLAY USE FEES ................................................................................................................................... 9 NON-PROFESSIONAL FEES1 ................................................................................................................... 11 PAGE VIEW FEES*................................................................................................................................. -

Compliance Statement

Compliance Statement Administrator: Euronext Dublin Full name: Euronext Dublin (The Irish Stock Exchange plc) Relevant National Competent Authority: CBI Compliance Statement Euronext Indices Euronext Dublin Version notes latest version February 2020 Version Version notes Euronext Dublin 1 October 2019 Initial version February 2020 Updated version including all new indices since 2 initial version. 3 4 5 6 Note: addition of indices does not lead to a new version of this statement. The lists will be kept up to date.The most recent update of the list was issued 09-Jun-2020. Only changes in significant indices and cessations of indices are marked as new version of the Compliance statement. This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided “as is” without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at terms of use euronext For further information in relation to Euronext Indices please contact: [email protected] (c) 2020 Euronext N.V. -

Financial Market Data for R/Rmetrics

Financial Market Data for R/Rmetrics Diethelm Würtz Andrew Ellis Yohan Chalabi Rmetrics Association & Finance Online R/Rmetrics eBook Series R/Rmetrics eBooks is a series of electronic books and user guides aimed at students and practitioner who use R/Rmetrics to analyze financial markets. A Discussion of Time Series Objects for R in Finance (2009) Diethelm Würtz, Yohan Chalabi, Andrew Ellis R/Rmetrics Meielisalp 2009 Proceedings of the Meielisalp Workshop 2011 Editor Diethelm Würtz Basic R for Finance (2010), Diethelm Würtz, Yohan Chalabi, Longhow Lam, Andrew Ellis Chronological Objects with Rmetrics (2010), Diethelm Würtz, Yohan Chalabi, Andrew Ellis Portfolio Optimization with R/Rmetrics (2010), Diethelm Würtz, William Chen, Yohan Chalabi, Andrew Ellis Financial Market Data for R/Rmetrics (2010) Diethelm W?rtz, Andrew Ellis, Yohan Chalabi Indian Financial Market Data for R/Rmetrics (2010) Diethelm Würtz, Mahendra Mehta, Andrew Ellis, Yohan Chalabi Asian Option Pricing with R/Rmetrics (2010) Diethelm Würtz R/Rmetrics Singapore 2010 Proceedings of the Singapore Workshop 2010 Editors Diethelm Würtz, Mahendra Mehta, David Scott, Juri Hinz R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer School and Workshop 2011 Editor Diethelm Würtz III tinn-R Editor (2010) José Cláudio Faria, Philippe Grosjean, Enio Galinkin Jelihovschi and Ri- cardo Pietrobon R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer Scholl and Workshop 2011 Editor Diethelm Würtz R/Rmetrics Meielisalp 2012 Proceedings of the Meielisalp Summer Scholl and Workshop 2012 Editor Diethelm Würtz Topics in Empirical Finance with R and Rmetrics (2013), Patrick Hénaff FINANCIAL MARKET DATA FOR R/RMETRICS DIETHELM WÜRTZ ANDREW ELLIS YOHAN CHALABI RMETRICS ASSOCIATION &FINANCE ONLINE Series Editors: Prof. -

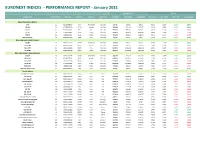

EURONEXT INDICES - PERFORMANCE REPORT - January 2021

EURONEXT INDICES - PERFORMANCE REPORT - January 2021 Closing Levels Returns Index Name Nr. of Constit. ISIN Code Mnemo Location Index Type 1/29/2021 12/31/2020 12/31/2020 Ann. 3 Year Ann. 5 Year 2021 YtD January 2021 Blue-Chip Indices (Price) AEX 25 NL0000000107 AEX Amsterdam Blue Chip 637,11 624,61 624,61 4,36% 8,12% 2,00% 2,00% BEL 20 20 BE0389555039 BEL20 Brussels Blue Chip 3623,60 3621,28 3621,28 -4,12% 0,78% 0,06% 0,06% CAC 40 40 FR0003500008 PX1 Paris Blue Chip 5399,21 5551,41 5551,41 -0,51% 4,10% -2,74% -2,74% PSI 20 18 PTING0200002 PSI20 Lisbon Blue Chip 4794,55 4898,36 4898,36 -5,40% -1,09% -2,12% -2,12% ISEQ 20 20 IE00B0500264 ISE20 Dublin Blue Chip 1231,18 1288,72 1288,72 2,39% 3,15% -4,46% -4,46% OBX Price index 25 NO0007035376 OBXP Oslo Blue Chip 471,53 469,24 469,24 1,291% 7,01% 0,49% 0,49% Blue-Chip Indices (Net Return) AEX NR 25 QS0011211156 AEXNR Amsterdam Blue Chip 1960,58 1922,11 1922,11 7,13% 11,22% 2,00% 2,00% BEL 20 NR 20 BE0389558066 BEL2P Brussels Blue Chip 7933,79 7924,32 7924,32 -1,98% 3,23% 0,12% 0,12% CAC 40 NR 40 QS0011131826 PX1NR Paris Blue Chip 11519,19 11831,28 11831,28 1,61% 6,44% -2,64% -2,64% PSI 20 NR 18 QS0011211180 PSINR Lisbon Blue Chip 9964,13 10179,88 10179,88 -2,44% 1,78% -2,12% -2,12% Blue-Chip Indices (Gross Return) AEX GR 25 QS0011131990 AEXGR Amsterdam Blue Chip 2257,47 2213,17 2213,17 7,64% 11,72% 2,00% 2,00% BEL 20 GR 20 BE0389557050 BEL2I Brussels Blue Chip 10425,53 10410,61 10410,61 -1,16% 4,15% 0,14% 0,14% CAC 40 GR 40 QS0011131834 PX1GR Paris Blue Chip 15034,98 15436,40 15436,40 2,48% -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

INDEX RULE BOOK Leverage, Short, and Bear Indices

INDEX RULE BOOK Leverage, Short, and Bear Indices Version 20-02 Effective from 15 May 2020 indices.euronext.com Index 1. Index Summary 1 2. Governance and Disclaimer 8 2.1 Indices 8 2.2 Administrator 8 2.3 Cases not covered in rules 8 2.4 Rule book changes 8 2.5 Liability 8 2.6 Ownership and trademarks 8 3. Calculation 9 3.1 Definition and Composition of the Index 9 3.2 Calculation of the Leverage Indices 9 3.3 Calculation of the Bear and Short Indices 9 3.4 Reverse split of index level 10 3.5 Split of index level 10 3.6 Financing Adjustment Rate (FIN) 10 4. Publication 11 4.1 Dissemination of Index Values 11 4.2 Exceptional Market Conditions and Corrections 11 4.3 Announcement Policy 14 5. ESG Disclosures 15 1. INDEX SUMMARY Factsheet Leverage, Short and Bear indices Index names Various based on AEX®, BEL 20®, CAC 40®, PSI 20® and ISEQ® Index type Indices are based on price index versions or Net return index or Gross return index versions. Administrator Euronext Paris is the Administrator and is responsible for the day-to-day management of the index. The underlying indices have independent Steering Committees acting as Independent Supervisor. Calculation Based on daily leverage. May include spread on interest rate or Financing Adjustment rate in the calculation Rule for exceptional trading Either suspend or reset if underlying index moved beyond certain threshold. See reference circumstances table. 1 Mnemo Full name Underlying Factor Rule for ISIN Base level index exceptional and date trading circumstances AEX® based AEXLV AEX® Leverage AEX® 2 Suspend if Underlying QS0011095898 1,000 at Index < 75% of close 31Dec2002 of previous day AEXNL AEX® Leverage AEX® NR 2 Suspend if Underlying QS0011216205 1,000 at NR Index < 75% of close 31Dec2002 of previous day AEXTL AEX® Leverage AEX® GR 2 Suspend if Underlying QS0011179239 1,000 at GR Index < 75% of close 31Dec2002 of previous day AEX3L AEX® NR 3 Reset if Underlying QS0011230115 10,000 at AEX® X3 Leverage Index < 85% of close 31Dec2008 NR of previous day. -

Press Release CRH Completes Latest Phase of Share Buyback Programme

CRH plc T +353 (1) 404 1000 Stonemason’s Way E [email protected] Rathfarnham W www.crh.com Dublin 16 D16 KH51 Ireland 28 June 2021 Press Release CRH completes latest phase of Share Buyback Programme CRH plc, the leading building materials business in the world, is pleased to announce that it has completed the latest phase of its share buyback programme, returning a further $0.3 billion of cash to shareholders. Between 8 March and 24 June 2021, 5.8 million ordinary shares were repurchased on Euronext Dublin at an average discount of 1.03% to the volume weighted average price over the period. This brings total cash returned to shareholders under our ongoing share buyback programme to $2.3 billion since its commencement in May 2018. Further share buybacks are under active consideration. **** Contact CRH at Dublin 404 1000 (+353 1 404 1000) Albert Manifold Chief Executive Jim Mintern Finance Director Frank Heisterkamp Director of Capital Markets & ESG Tom Holmes Head of Investor Relations About CRH CRH (LSE: CRH, ISE: CRG, NYSE: CRH) is the leading building materials business in the world, employing c.77,000 people at c.3,100 operating locations in 29 countries. It is the largest building materials business in North America and Europe and also has regional positions in Asia. CRH manufactures and supplies a range of integrated building materials, products and innovative solutions which can be found throughout the built environment, from major public infrastructure projects to commercial buildings and residential structures. A Fortune 500 company, CRH is a constituent member of the FTSE 100 Index, the EURO STOXX 50 Index, the ISEQ 20 and the Dow Jones Sustainability Index (DJSI) Europe. -

Market Coverage Spans All North American Exchanges As Well As Major International Exchanges, and We Are Continually Adding to Our Coverage

QuoteMedia Data Coverage 1 03 Equities 04 International Equities 05 Options 05 Futures and Commodities 06-07 Market Indices 08 Mutual Funds, ETFs and UITs 09 FOREX / Currencies 10 Rates Data 11 Historical Data 12 Charting Analytics 13 News Sources 14 News Categories 15 Filings 16-17 Company Financials Data 18 Analyst Coverage and Earnings Estimates 18 Insider Data 19 Corporate Actions and Earnings 19 Market Movers 20 Company Profile, Share Information and Key Ratios 21 Initial Public Offerings (IPOs) 22 Contact Information 2 Equities QuoteMedia’s market coverage spans all North American exchanges as well as major international exchanges, and we are continually adding to our coverage. The following is a short list of available exchanges. North American New York Stock Exchange (NYSE) Canadian Consolidated Quotes (CCQ) • Level 1 • TSX Consolidated Level 1 • TSXV Consolidated Level 1 NYSE American (AMEX) Toronto Stock Exchange (TSX) Level 1 • Level 1 • Market by Price • Market By Order Nasdaq • Market By Broker • Level 1 • Level 2 Canadian Venture Exchange (TSXV) • Total View with Open View • Level 1 • Market by Price Nasdaq Basic+ • Market By Order • Level 1 • Market By Broker OTC Bulletin Board (OTCBB) Canadian Securities Exchange (CNSX) • Level 1 • Level 1 • Level 2 • Level 2 OTC Markets (Pinks) Canadian Alternative Trading Systems • Level 1 • Alpha Level 1 and Level 2 • Level 2 • CSE PURE Level 1 and Level 2 Cboe One • Nasdaq Canada Level 1 and Level 2 • Nasdaq CX2 Level 1 and Level 2 Cboe EDGX • Omega Canada Level 1 and Level 2 • LYNX Level 1 and Level 2 London Stock Exchange (LSE) • NEO and LIT • Level 1 • Instinet Canada (dark pool) • Level 2 • LiquidNet Canada (dark pool) • TriAct MatchNow (dark pool) 3 Equities Cont. -

Monthly Index Key Facts

MONTHLY INDEX KEY FACTS Key Index Facts on 30/09/2020 EURONEXT INDICES AEX AMX BEL20 PX1 CACMD PSI20 ISE20 LC100 Low Carbon 100 Financial Ratios AEX® AMX® BEL 20® CAC 40® CAC® Mid 60 PSI 20® ISEQ 20® Europe ® Price/Earnings w Neg 40,35 13,80 - - 12,88 16,72 53,76 17,87 Price/Book 8,90 4,07 1,98 4,26 3,25 1,88 2,83 5,02 Price/Cash Flow 79,93 6,09 7,36 14,92 13,79 7,18 18,34 16,49 Price/Sales 6,97 4,02 25,81 2,78 2,66 1,77 2,75 3,97 Dividend Yield 2,26% 2,24% 3,14% 2,21% 1,67% 4,62% 0,26% 2,22% Index Cap of Constituents (Millions) Largest € 84 501 € 4 053 € 16 778 € 110 880 € 5 612 € 1 319 € 19 828 € 164 554 Average € 22 268 € 1 577 € 5 990 € 27 247 € 1 705 € 501 € 4 826 € 21 294 Median € 17 249 € 1 313 € 4 537 € 17 936 € 1 387 € 438 € 683 € 12 262 Smallest € 2 695 € 301 € 1 207 € 4 362 € 136 € 42 € 354 € 2 017 Total index value € 556 689 € 39 420 € 119 796 € 1 089 867 € 102 272 € 9 016 € 96 526 € 2 150 661 Full Market Cap Of Constituents (Millions) Largest € 133 955 € 6 144 € 78 270 € 201 600 € 15 837 € 16 644 € 24 291 € 164 554 Average € 30 224 € 2 290 € 11 759 € 38 226 € 3 545 € 3 039 € 5 568 € 21 294 Median € 17 249 € 1 679 € 7 721 € 23 772 € 2 624 € 1 186 € 748 € 12 262 Smallest € 3 368 € 301 € 1 638 € 4 362 € 190 € 96 € 421 € 2 017 Total index value with full MC constituents € 755 607 € 57 241 € 235 188 € 1 529 030 € 212 671 € 54 708 € 111 370 € 2 150 661 Low Carbon 100 Sector Weights AEX® AMX® BEL 20® CAC 40® CAC® Mid 60 PSI 20® ISEQ 20® Europe ® Banks 4,72% 22,14% 4,83% 1,78% 7,40% 2,24% 4,03% Cable Television Services 7,01% Computer -

Econometric Analysis of International Financial Markets

Econometric Analysis of International Financial Markets Thomas Ernst Herbert Dimpfl Dissertation zur Erlangung des Grads eines Doktors der Wirtschaftswissenschaft (Dr. rer. pol.) der Universität Erfurt, Staatswissenschaftliche Fakultät 2010 Gutachter: Prof. Dr. Robert Jung Gutachter: Prof. Dr. Joachim Grammig Datum der Disputation: 16. Juli 2010 urn:nbn:de:gbv:547-201000562 Zusammenfassung Die zentrale Fragestellung meines Dissertationsprojektes „Ökonometrische Un- tersuchung internationaler Finanzmärkte“ ist der Zusammenhang globaler Fi- nanzmärkte in Bezug auf Informations- und Volatilitätsübertragung. Mit Hilfe verschiedener ökonometrischer Methoden werden gezielt Dynamiken offenge- legt und einige der in der Literatur als Standard angesehenen Phänomene hinterfragt. Der erste Teil behandelt die sogenannten Informations- und Volatilitätsspill- overs. Von zentraler Bedeutung ist hier die Tatsache, dass aus globaler Sicht der Handel an Börsen als kontinuierlich angesehen werden kann. Aus diesem Grund sollte es möglich sein, Informations- und Volatilitätsspillovers um den Erdball in Übereinstimmung mit der Abfolge aus Öffnen und Schließen der Märkte in Asien, Europa und den USA nachzuvollziehen. Der zweite Teil der Arbeit setzt sich mit Kointegration von Aktienmärkten und den speziellen Her- ausforderungen von Finanzmarktdatensätzen auseinander. Kointegration ist eine ökonometrische Methode, welche herangezogen wird, um den Integrations- grad internationaler Finanzmärkte zu messen. Die Ergebnisse sind jedoch sehr heterogen. Wir zeigen, -

Euronext Financial Derivatives Markets Fees LCH SA - Effective from 6 May 2021

Euronext financial derivatives markets fees LCH SA - Effective from 6 May 2021 CONTENTS Clearing fees.................................................................................................. 3 Amsterdam clearing segment: “Dutch” products ..................................................... 3 Amsterdam clearing segment: others products ....................................................... 4 Brussels clearing segment ....................................................................................... 4 Lisbon clearing segment .......................................................................................... 5 Oslo clearing segment ............................................................................................. 5 Paris clearing segment ............................................................................................ 6 Exercise (Tender) / Assignment, Cash Settlement and Delivery fees ............. 7 Amsterdam clearing segment: “Dutch” products ..................................................... 8 Amsterdam clearing segment: others products ....................................................... 9 Brussels clearing segment ....................................................................................... 9 Lisbon clearing segment ........................................................................................ 10 Oslo clearing segment ........................................................................................... 10 Paris clearing segment ......................................................................................... -

EURONEXT INDICES - PERFORMANCE REPORT - May 2021

EURONEXT INDICES - PERFORMANCE REPORT - May 2021 Closing Levels Returns Index Name Nr. of Constit. ISIN Code Mnemo Location Index Type 5/31/2021 4/30/2021 12/31/2020 Ann. 3 Year Ann. 5 Year 2021 YtD May 2021 Blue-Chip Indices (Price) AEX 25 NL0000000107 AEX Amsterdam Blue Chip 709,36 707,56 624,61 8,66% 9,63% 13,57% 0,25% BEL 20 20 BE0389555039 BEL20 Brussels Blue Chip 4060,36 4014,30 3621,28 2,56% 2,93% 12,12% 1,15% CAC 40 40 FR0003500008 PX1 Paris Blue Chip 6447,17 6269,48 5551,41 6,10% 7,43% 16,14% 2,83% PSI 20 18 PTING0200002 PSI20 Lisbon Blue Chip 5180,18 5050,69 4898,36 -1,79% 0,88% 5,75% 2,56% ISEQ 20 20 IE00B0500264 ISE20 Dublin Blue Chip 1433,05 1408,56 1288,72 6,80% 5,96% 11,20% 1,74% OBX Price index 25 NO0007035376 OBXP Oslo Blue Chip 523,82 511,78 469,24 2,943% 7,76% 11,63% 2,35% Blue-Chip Indices (Net Return) AEX NR 25 QS0011211156 AEXNR Amsterdam Blue Chip 2204,94 2188,35 1922,11 11,27% 12,56% 14,71% 0,76% BEL 20 NR 20 BE0389558066 BEL2P Brussels Blue Chip 8983,35 8821,97 7924,32 4,61% 5,29% 13,36% 1,83% CAC 40 NR 40 QS0011131826 PX1NR Paris Blue Chip 13908,85 13410,71 11831,28 8,18% 9,71% 17,56% 3,71% PSI 20 NR 18 QS0011211180 PSINR Lisbon Blue Chip 11037,10 10532,18 10179,88 1,32% 3,88% 8,42% 4,79% Blue-Chip Indices (Gross Return) AEX GR 25 QS0011131990 AEXGR Amsterdam Blue Chip 2541,88 2521,12 2213,17 11,72% 13,03% 14,85% 0,82% BEL 20 GR 20 BE0389557050 BEL2I Brussels Blue Chip 11852,39 11606,46 10410,61 5,40% 6,19% 13,85% 2,12% CAC 40 GR 40 QS0011131834 PX1GR Paris Blue Chip 18226,85 17520,17 15436,40 9,01% 10,66% 18,08%