Taking Our Voice to the World

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An N U Al R Ep O R T 2018 Annual Report

ANNUAL REPORT 2018 ANNUAL REPORT The Annual Report in English is a translation of the French Document de référence provided for information purposes. This translation is qualified in its entirety by reference to the Document de référence. The Annual Report is available on the Company’s website www.vivendi.com II –— VIVENDI –— ANNUAL REPORT 2018 –— –— VIVENDI –— ANNUAL REPORT 2018 –— 01 Content QUESTIONS FOR YANNICK BOLLORÉ AND ARNAUD DE PUYFONTAINE 02 PROFILE OF THE GROUP — STRATEGY AND VALUE CREATION — BUSINESSES, FINANCIAL COMMUNICATION, TAX POLICY AND REGULATORY ENVIRONMENT — NON-FINANCIAL PERFORMANCE 04 1. Profile of the Group 06 1 2. Strategy and Value Creation 12 3. Businesses – Financial Communication – Tax Policy and Regulatory Environment 24 4. Non-financial Performance 48 RISK FACTORS — INTERNAL CONTROL AND RISK MANAGEMENT — COMPLIANCE POLICY 96 1. Risk Factors 98 2. Internal Control and Risk Management 102 2 3. Compliance Policy 108 CORPORATE GOVERNANCE OF VIVENDI — COMPENSATION OF CORPORATE OFFICERS OF VIVENDI — GENERAL INFORMATION ABOUT THE COMPANY 112 1. Corporate Governance of Vivendi 114 2. Compensation of Corporate Officers of Vivendi 150 3 3. General Information about the Company 184 FINANCIAL REPORT — STATUTORY AUDITORS’ REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS — CONSOLIDATED FINANCIAL STATEMENTS — STATUTORY AUDITORS’ REPORT ON THE FINANCIAL STATEMENTS — STATUTORY FINANCIAL STATEMENTS 196 Key Consolidated Financial Data for the last five years 198 4 I – 2018 Financial Report 199 II – Appendix to the Financial Report 222 III – Audited Consolidated Financial Statements for the year ended December 31, 2018 223 IV – 2018 Statutory Financial Statements 319 RECENT EVENTS — OUTLOOK 358 1. Recent Events 360 5 2. Outlook 361 RESPONSIBILITY FOR AUDITING THE FINANCIAL STATEMENTS 362 1. -

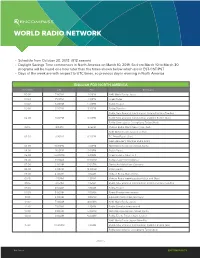

World Radio Network

WORLD RADIO NETWORK • Schedule from October 28, 2018 (B18 season) • Daylight Savings Time commences in North America on March 10, 2019. So from March 10 to March 30 programs will be heard one hour later than the times shown below which are in EST/CST/PST • Days of the week are with respect to UTC times, so previous day in evening in North America ENGLISH FOR NORTH AMERICA UTC/GMT EST PST Programs 00:00 7:00PM 4:00PM NHK World Radio Japan 00:30 7:30PM 4:30PM Israel Radio 01:00 8:00PM 5:00PM Radio Prague 00:30 8:30PM 5:30PM Radio Slovakia Radio New Zealand International: Korero Pacifica (Tue-Sat) 02:00 9:00PM 6:00PM Radio New Zealand International: Dateline Pacific (Sun) Radio Guangdong: Guangdong Today (Mon) 02:15 9:15PM 6:15PM Vatican Radio World News (Tue - Sat) NHK World Radio Japan (Tue-Sat) 02:30 9:30PM 6:30PM PCJ Asia Focus (Sun) Glenn Hauser’s World of Radio (Mon) 03:00 10:00PM 7:00PM KBS World Radio from Seoul, Korea 04:00 11:00PM 8:00PM Polish Radio 05:00 12:00AM 9:00PM Israel Radio – News at 8 06:00 1:00AM 10:00PM Radio France International 07:00 2:00AM 11:00PM Deutsche Welle from Germany 08:00 3:00AM 12:00AM Polish Radio 09:00 4:00AM 1:00AM Vatican Radio World News 09:15 4:15AM 1:15AM Vatican Radio weekly podcast (Sun and Mon) 09:15 4:15AM 1:15AM Radio New Zealand International: Korero Pacifica (Tue-Sat) 09:30 4:30AM 1:30AM Radio Prague 10:00 5:00AM 2:00AM Radio France International 11:00 6:00AM 3:00AM Deutsche Welle from Germany 12:00 7:00AM 4:00AM NHK World Radio Japan 12:30 7:30AM 4:30AM Radio Slovakia International 13:00 -

Review of Content Regulation Models

Issues facing broadcast content regulation MILLWOOD HARGRAVE LTD. Authors: Andrea Millwood Hargrave, Geoff Lealand, Paul Norris, Andrew Stirling Disclaimer The report is based on collaborative desk research conducted for the New Zealand Broadcasting Standards Authority over a two month period. Issue date November 2006 © Broadcasting Standards Authority, New Zealand Contents Aim and Scope of this Report..................................................................................... 3 Executive Summary.................................................................................................... 4 A: Introduction............................................................................................................. 6 Background............................................................................................................. 6 Definitions............................................................................................................... 9 What is the justification for regulation?.................................................................... 9 Protective content regulation: an overview............................................................ 10 Proactive content regulation: an overview............................................................. 12 Co-regulation and self-regulation........................................................................... 12 Technological changes and convergence.............................................................. 15 Differences in devices.......................................................................................... -

AREC.Info Newsletter January 2020

Monthly newsletter of Amateur Radio Emergency Communications JANUARY 2020 AREC .info CIMS, Third Edition NATIONAL DIRECTOR The Coordinated Incident Management System (CIMS) 3rd edition represents New Zealand’s official framework Happy New Year! I hope you all have or are having to achieve effective co-ordinated incident management an enjoyable break over the holiday season. across responding agencies. From 1 July 2020 the 3rd edition replaces all previous versions of CIMS. I would like to thank all our AREC volunteers for the last 12 months. AREC is reliant on your voluntary More information, and links to copies of the new document can be found here efforts to keep our repeaters and equipment https://www.civildefence.govt.nz/resources/coordinated- running and to provide the services to our SAR and incident-management-system-cims-third-edition/ emergency and community partners. ZL4SB Recognised AREC support of a number of public events throughout the country service the purpose as both David Stevenson ZL4SB was recognised for 40-years of AREC exercises and training as well as providing a service at a LandSAR event in Dunedin during November. public service. Again, thanks again for your willing participation. Lindsey Ross, AREC Deputy Director (and MC on the night) commented “it is great to see how our members Thanks go to Soren Low for implementing the Tait skills and dedication make a real difference to the EnableFleet online radio programming system. This organisations we work with”. has been deployed in conjunction with LandSAR More here https://www.odt.co.nz/news/dunedin/40- under our Service Level Agreement with them to years-communications enable nationally consistent programming of the TM/TP9300 radio fleet. -

Mapping the Information Environment in the Pacific Island Countries: Disruptors, Deficits, and Decisions

December 2019 Mapping the Information Environment in the Pacific Island Countries: Disruptors, Deficits, and Decisions Lauren Dickey, Erica Downs, Andrew Taffer, and Heidi Holz with Drew Thompson, S. Bilal Hyder, Ryan Loomis, and Anthony Miller Maps and graphics created by Sue N. Mercer, Sharay Bennett, and Michele Deisbeck Approved for Public Release: distribution unlimited. IRM-2019-U-019755-Final Abstract This report provides a general map of the information environment of the Pacific Island Countries (PICs). The focus of the report is on the information environment—that is, the aggregate of individuals, organizations, and systems that shape public opinion through the dissemination of news and information—in the PICs. In this report, we provide a current understanding of how these countries and their respective populaces consume information. We map the general characteristics of the information environment in the region, highlighting trends that make the dissemination and consumption of information in the PICs particularly dynamic. We identify three factors that contribute to the dynamism of the regional information environment: disruptors, deficits, and domestic decisions. Collectively, these factors also create new opportunities for foreign actors to influence or shape the domestic information space in the PICs. This report concludes with recommendations for traditional partners and the PICs to support the positive evolution of the information environment. This document contains the best opinion of CNA at the time of issue. It does not necessarily represent the opinion of the sponsor or client. Distribution Approved for public release: distribution unlimited. 12/10/2019 Cooperative Agreement/Grant Award Number: SGECPD18CA0027. This project has been supported by funding from the U.S. -

Communications Lifeline Assets

West Coast Lifelines Vulnerability and Interdependency Assessment Supplement 7: Communications Lifeline Assets West Coast Civil Defence Emergency Management Group August 2017 IMPORTANT NOTES Disclaimer The information collected and presented in this report and accompanying documents by the Consultants and supplied to West Coast Civil Defence Emergency Management Group is accurate to the best of the knowledge and belief of the Consultants acting on behalf of West Coast Civil Defence Emergency Management Group. While the Consultants have exercised all reasonable skill and care in the preparation of information in this report, neither the Consultants nor West Coast Civil Defence Emergency Management Group accept any liability in contract, tort or otherwise for any loss, damage, injury or expense, whether direct, indirect or consequential, arising out of the provision of information in this report. This report has been prepared on behalf of West Coast Civil Defence Emergency Management Group by: Ian McCahon BE (Civil), David Elms BA, MSE, PhD Rob Dewhirst BE, ME (Civil) Geotech Consulting Ltd 21 Victoria Park Road Rob Dewhirst Consulting Ltd 29 Norwood Street Christchurch 38A Penruddock Rise Christchurch Westmorland Christchurch Hazard Maps The hazard maps contained in this report are regional in scope and detail, and should not be considered as a substitute for site-specific investigations and/or geotechnical engineering assessments for any project. Qualified and experienced practitioners should assess the site-specific hazard potential, including the potential for damage, at a more detailed scale. Cover Photo: Telecommunications cabinet hit by fallen power pole, Kaikoura earthquake 2016. Photo from Chorus. West Coast Lifelines Vulnerability and Interdependency Assessment Supplement 7: Communications Lifeline Assets Contents 1 OVERVIEW ................................................................................................................................. -

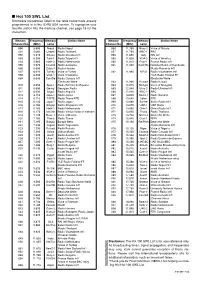

Hot 100 SWL List Shortwave Frequencies Listed in the Table Below Have Already Programmed in to the IC-R5 USA Version

I Hot 100 SWL List Shortwave frequencies listed in the table below have already programmed in to the IC-R5 USA version. To reprogram your favorite station into the memory channel, see page 16 for the instruction. Memory Frequency Memory Station Name Memory Frequency Memory Station Name Channel No. (MHz) name Channel No. (MHz) name 000 5.005 Nepal Radio Nepal 056 11.750 Russ-2 Voice of Russia 001 5.060 Uzbeki Radio Tashkent 057 11.765 BBC-1 BBC 002 5.915 Slovak Radio Slovakia Int’l 058 11.800 Italy RAI Int’l 003 5.950 Taiw-1 Radio Taipei Int’l 059 11.825 VOA-3 Voice of America 004 5.965 Neth-3 Radio Netherlands 060 11.910 Fran-1 France Radio Int’l 005 5.975 Columb Radio Autentica 061 11.940 Cam/Ro National Radio of Cambodia 006 6.000 Cuba-1 Radio Havana /Radio Romania Int’l 007 6.020 Turkey Voice of Turkey 062 11.985 B/F/G Radio Vlaanderen Int’l 008 6.035 VOA-1 Voice of America /YLE Radio Finland FF 009 6.040 Can/Ge Radio Canada Int’l /Deutsche Welle /Deutsche Welle 063 11.990 Kuwait Radio Kuwait 010 6.055 Spai-1 Radio Exterior de Espana 064 12.015 Mongol Voice of Mongolia 011 6.080 Georgi Georgian Radio 065 12.040 Ukra-2 Radio Ukraine Int’l 012 6.090 Anguil Radio Anguilla 066 12.095 BBC-2 BBC 013 6.110 Japa-1 Radio Japan 067 13.625 Swed-1 Radio Sweden 014 6.115 Ti/RTE Radio Tirana/RTE 068 13.640 Irelan RTE 015 6.145 Japa-2 Radio Japan 069 13.660 Switze Swiss Radio Int’l 016 6.150 Singap Radio Singapore Int’l 070 13.675 UAE-1 UAE Radio 017 6.165 Neth-1 Radio Netherlands 071 13.680 Chin-1 China Radio Int’l 018 6.175 Ma/Vie Radio Vilnius/Voice -

Contact Information for BSA Callers

Contact information for BSA callers Our website has links to the main broadcasters’ websites and contact details (see Broadcaster Links). Links to the broadcasters’ online complaints forms appear under Formal Complaint to the Broadcaster/'If you are ready to make a complaint to the broadcaster now'. ABLE (captioning and audio description service) www.able.co.nz Advertising Standards Authority (help line) 0800 234 357 deals with complaints about advertisements [email protected] / www.asa.co.nz APRA (The Australasian Performing Right Assn) 0800 692 772 issues licences for businesses to play recorded www.apra.co.nz music in public Births, Deaths and Marriages 0800 22 52 52 copy of birth certificate required BSA freephone number 0800 366 996 Coalition for Better Broadcasting 021 666297 advocates for higher standards & better content www.betterbroadcasting.co.nz Complaints agencies: Complaint Line for a list of all agencies dealing with complaints www.complaintline.org.nz Consumer Affairs 04 474 2750 deals with scams www.consumeraffairs.govt.nz/scams information on how to complain for consumers www.consumeraffairs.govt.nz/for- consumers/how-to-complain Copyright: Copyright Council of New Zealand www.copyright.org.nz Ministry of Business, Innovation and www.med.govt.nz/business/intellectual- Employment (MBIE) property/copyright Department of Building and Housing 0800 737 666 PO Box 10729 Wellington 6143 Freeview channels not working: 0800 373 384 (Freeview 0800 number) Going Digital www.goingdigital.co.nz Fair Go NO phone calls Private Bag fax: -

Annual Report 2008

A VOICE THAT SPEAKS FOR ALL ANNUAL REPORT 2007-2008 NEW ZEALANDERS RADIO NEW ZEALAND Contents Chairman’s REPORT•••••••••••••••••••••••••••••••••••• 2 CHIEF EXECUTIVE REPORT••••••••••••••••••••••••••••• 10 BOARD OF GOVERNORS•••••••••••••••••••••••••••••••••• 5 PERFORMANCE MANAGEMENT•••••••••••••••••••••••• 14 OUR CHARTER••••••••••••••••••••••••••••••••••••••••••• 6 FINANCIAL PERFORMANCE•••••••••••••••••••••••••••• 34 OUR PERFORMANCE BASED ON PubLIC VALUE AND DIRECTORY• ••••••••••••••••••••••••••••••••••••••••••• 72 OUR CHARTER OBJECTIVES•••••••••••••••••••••••••••••• 7 GOOD EMPLOYER AND EQUAL EMPLOYMENT OPPORTUNITIES REPORTING•••••••••••••••••••••••••••• 8 SOUNDS LIKE US. 1 “As an independent and commercial-free public service broadcaster, the purpose of Radio New Zealand is to serve the public interest.” Chairman’s Report Chairman’s BRIAN CORBAN QSO – Chairman INTRODUCTION However, rising costs are now threatening the gains made in recent As an independent and commercial-free public service broadcaster, years and we have been forced to shift our strategic focus towards Radio New Zealand’s purpose is to serve the public interest, and the ensuring the sustainability of both the range and quality of Radio ongoing protection of public service broadcasting values remains of New Zealand’s current services. critical importance to us all. During the course of the 2007-2008 financial year, independent New Zealand is justifiably proud of its unique national identity, consultants conducted a comprehensive Baseline Funding Review to particularly the shared sense of belonging and evolving cultural values determine the level of funding required to maintain Radio New Zealand that bring us together and contribute to our sense of self. services at their current levels. Awareness and preservation of that shared culture are critical factors The results of that review will inform future funding discussions with in sustaining a unique New Zealand identity and a strong, independent Shareholding Ministers. -

DX Times Master Page Copy

N.Z. RADIO New Zealand DX Times N.Z. RADIO Monthly journal of the D X New Zealand Radio DX League (est. 1948) D X April 2003 - Volume 55 Number 6 LEAGUE http://radiodx.com LEAGUE . As Radio Hobbyists (DX’ers or Listeners) we are able to tune into Shortwave broadcasts from countries involved in the Iraqi conflict or neighbouring countries. Whether you agree or disagree with what has occurred, we are fortunate to be able to listen to those differing viewpoints and make up our own minds. You will find a list of English Broadcast frequencies from countries involved in the Iraqi conflict and its neighbours, compiled by Paul Ormandy on page 17, plus the normal ‘Unofficial Radio’ ‘Under 9’ & ‘Over 9’ Bandwatch columns and ‘Shortwave Report’ Contribution deadline for next issue is Wed 7th May 2003 PO Box 3011, Auckland Some of the International Broadcasters also CONTENTS have thought provoking comments or editorials about the conflict such as the editorial by Andy Sennitt on REGULAR COLUMNS the Radio Netherlands website at Bandwatch Under 9 3 http://www.rnw.nl/realradio/features/html/editorial.html with Ken Baird The Iraqi conflict has also shown that Bandwatch Over 9 6 Shortwave Radio is still a powerful tool, for general with Andy McQueen news and discussion and also as a Propaganda Shortwave Report 10 with Ian Cattermole outlet. English in Time Order 20 An interesting article as mentioned in the with Yuri Muzyka Unofficial Radio pages concerning Commando Solo Shortwave Mailbag 23 missions by the U.S. Air Force EC-130E aircraft and with Paul Ormandy other special forces broadcasts is on the dxing.info Utilities 25 website at. -

Palmerston North Radio Stations

Palmerston North Radio Stations Frequency Station Location Format Whanganui (Bastia Hill) Mainstream Radio 87.6 FM and Palmerston rock(1990s- 2018 Hauraki North (Wharite) 2010s) Palmerston Full service iwi 89.8 FM Kia Ora FM Unknown Unknown North (Wharite) radio Palmerston Contemporary 2QQ, Q91 FM, 90.6 FM ZM 1980s North (Wharite) hits ZMFM Palmerston Christian 91.4 FM Rhema FM Unknown North (Wharite) contemporary Palmerston Adult 92.2 FM More FM 1986 2XS FM North (Wharite) contemporary Palmerston Contemporary 93.0 FM The Edge 1998 Country FM North (Wharite) Hit Radio Palmerston 93.8 FM Radio Live Talk Radio Unknown Radio Pacific North (Wharite) Palmerston 94.6 FM The Sound Classic Rock Unknown Solid Gold FM North (Wharite) Palmerston 95.4 FM The Rock Rock Unknown North (Wharite) Palmerston Hip Hop and 97.0 FM Mai FM Unknown North (Wharite) RnB Classic Hits Palmerston Adult 97.8 FM The Hits 1938 97.8 ZAFM, North (Wharite) contemporary 98FM, 2ZA Palmerston 98.6 FM The Breeze Easy listening 2006 Magic FM North (Wharite) Palmerston North Radio Stations Frequency Station Location Format Radio Palmerston 99.4 FM Campus radio Unknown Radio Massey Control North (Wharite) Palmerston 104.2 FM Magic Oldies 2014 Magic FM North (Wharite) Vision 100 Palmerston 105.0 FM Various radio Unknown Unknown FM North (Kahuterawa) Palmerston Pop music (60s- 105.8 FM Coast 2018 North (Kahuterawa) 1970s) 107.1 FM George FM Palmerston North Dance Music Community 2XS, Bright & Radio Easy, Classic 828 AM Trackside / Palmerston North TAB Unknown Hits, Magic, TAB The Breeze Access Triple Access Community Nine, 999 AM Palmerston North Unknown Manawatu radio Manawatu Sounz AM Pop Palmerston 1548 AM Mix music (1980s- 2005 North (Kahuterawa) 1990s) Palmerston North Radio Stations New Zealand Low Power FM Radio Station Database (Current List Settings) Broadcast Area: Palmerston North Order: Ascending ( A-Z ) Results: 5 Stations Listed. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM