OHD Insights OHD Insights ONEHOUSEDESIGNS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RELIANCE BRANDS Limited 1

RELIANCE BRANDS LIMITED 1 Reliance Brands Limited Financial Statements 2019-20 2 RELIANCE BRANDS LIMITED Independent Auditor’s Report To The Members of Reliance Brands Limited Report on the Audit of the Financial Statements Opinion We have audited the Financial Statements of Reliance Brands Limited (“the Company”), which comprise the Balance Sheet as at 31st March 2020, the Statement of profit and loss, Statement of changes in equity and Statement of Cash Flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies and other explanatory information (hereinafter referred to as “ Financial Statements”). In our opinion and to the best of our information and according to the explanations given to us, the aforesaid financial statements give the information required by the Companies Act, 2013 (“the Act”) in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India, of the state of affairs of the Company as at March 31, 2020, and its Loss including Other Comprehensive Income, changes in equity and its cash flows for the year ended on that date. Basis for Opinion We conducted our audit in accordance with the Standards on Auditing specified under section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the Code of Ethics issued by the Institute of Chartered Accountants of India together with the ethical requirements that are relevant to our audit of the Financial Statements under the provisions of the Act and the Rules thereunder, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the Code of Ethics. -

Admission Brochure 2021-22

An Institution of National Importance by an Act of Parliament ADMISSION BROCHURE 2021-22 Est. in 2016 by Ministry of Education (Formerly Ministry of Human Resource Development) Government of India INDIAN INSTITUTE OF INFORMATION TECHNOLOGY, NAGPUR (IIITN) is one of the 20 Indian Institutes of Information Technology established under Public-Private Partnership Scheme by Ministry of Human Resource Development, Government of India. IIITN has been declared as an “Institution of National Importance” under the provisions of Indian Institute of Information Technology (Public-Private Partnership) Act, 2017. The Institute started functioning during the year 2016-17 and operating from its permanent campus in Nagpur under the aegis of Department of Higher Education, Ministry of Education and is supported by Department of Higher Education, Government of Maharashtra and Tata Consultancy Services, Mumbai as Industry Partner. Institute’s Mandate One of the main objectives of the Institute is to develop competent and capable youth imbued with the spirit of innovation and entrepreneurship with the social and environmental orientation to meet the knowledge needs of the country and provide Global Leadership in Information Technology & Allied Fields. Institute’s Vision The Institute aspires to attain the status of a top-notch Institution in Information Technology and Allied Fields and to emerge as an elite Research Institution by imparting futuristic quality education of Global Standards to corroborate the status of an “Institution of National Importance”. Institute’s Mission To undertake socially relevant, industry oriented In-House Research & Development Programmes as well as to undertake cutting-age research through Public-Private Participation in Information Technology & Allied Fields. -

Tpg to Invest ₹ 4,546.80 Crore in Jio Platforms Tpg's Deep

TPG TO INVEST ₹ 4,546.80 CRORE IN JIO PLATFORMS TPG’S DEEP CAPABILITIES IN TECH INVESTING TO SUPPORT JIO’S INITIATIVES TOWARDS DEVELOPING THE DIGITAL SOCIETY JIO PLATFORMS FUND RAISING FROM MARQUEE GLOBAL TECHNOLOGY INVESTORS CROSSES ₹ 1 LAKH CRORE Mumbai, June 13, 2020: Reliance Industries Limited (“Reliance Industries”) and Jio Platforms Limited (“Jio Platforms”), India’s leading digital services platform, announced today that global alternative asset firm TPG will invest ₹ 4,546.80 crore in Jio Platforms at an equity value of ₹ 4.91 lakh crore and an enterprise value of ₹ 5.16 lakh crore. The investment will translate into a 0.93% equity stake in Jio Platforms on a fully diluted basis for TPG. With this investment, Jio Platforms has raised ₹ 102,432.45 crore from leading global technology investors including Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, and TPG since April 22, 2020. Jio Platforms, a wholly-owned subsidiary of Reliance Industries, is a next-generation technology platform focused on providing high-quality and affordable digital services across India, with more than 388 million subscribers. Jio Platforms has made significant investments across its digital ecosystem, powered by leading technologies spanning broadband connectivity, smart devices, cloud and edge computing, big data analytics, artificial intelligence, Internet of Things, augmented and mixed reality and blockchain. Jio Platforms’ vision is to enable a Digital India for 1.3 billion people and businesses across the country, including small merchants, micro-businesses and farmers so that all of them can enjoy the fruits of inclusive growth. TPG is a leading global alternative asset firm founded in 1992 with more than $79 billion of assets under management across a wide range of asset classes, including private equity, growth equity, real estate and public equity. -

Reliance Industries

25 July 2021 1QFY22 Results Update | Sector: Oil & Gas Reliance Industries Estimate change CMP: INR2,105 TP: INR2,485 (+18%) Buy TP change Rating change O2C and Telecom deliver; Retail is recovering gradually EBITDA for the consolidated/standalone business rose 38%/61% YoY in Motilal Oswal values your support in the 1QFY22 on a low base of last year (2% beat). On a QoQ basis, consolidated Asiamoney Brokers Poll 2021 for India Research, Sales, Corporate Access and revenue/EBITDA is up -6%/1%. RJio’s EBITDA was in line (up 23% YoY), while Trading team. We request your ballot. the same for Retail grew 79% YoY (6% beat) on a low base. Despite the impact of the second COVID wave, RJio held its ground after the push from the Jio Phone launch in 4QFY21. Revenue/EBITDA grew 4% QoQ (in line) on a steady 14.4m net subscriber additions, along with flattish ARPU. EBITDA margin expanded 10bp QoQ to 47.9%. Bloomberg RIL IN Reliance Retail’s revenue/EBITDA grew 19%/79% YoY (6% EBITDA beat) as Equity Shares (m) 6,339 the second COVID wave had a lesser impact v/s that in 1QFY21, cushioned M.Cap.(INRb)/(USDb) 13793.7 / 185.4 by the e-commerce business, swift recovery, and lesser intensity of the 52-Week Range (INR) 2369 / 1830 lockdown. Compared to pre-COVID levels (1QFY20), EBITDA was flat. 1, 6, 12 Rel. Per (%) -6/-6/-37 The company reported an O2C EBITDA that was 6% higher than our estimate 12M Avg Val (INR M) 28673 at INR114.6b (+61% YoY, +12% QoQ). -

Statutory Reports

CORPORATE MANAGEMENT GOVERNANCE FINANCIAL NOTICE Corporate Governance Report OVERVIEW REVIEW STATEMENTS highest standards of ethics. It has before exceptional items 23.7%. The of the Board while nurturing a culture thus become crucial to foster and financial markets have endorsed our where the Board works harmoniously sustain a culture that integrates all sterling performance and the market for the long-term benefit of the “Between my past, the present and the future, there is one common factor: components of good governance by capitalisation has increased by CAGR Company and all its stakeholders. The carefully balancing the inter-relationship of 31.5% during the same period. In Chairman guides the Board for effective Relationship and Trust. This is the foundation of our growth.” among the Board of Directors, Board terms of distributing wealth to our governance in the Company. Committees, Finance, Compliance & shareholders, apart from having a Shri Dhirubhai H. Ambani The Chairman takes a lead role in Assurance teams, Auditors and the track record of uninterrupted dividend Founder Chairman managing the Board and facilitating Senior Management. Our employee payout, we have also delivered effective communication among satisfaction is reflected in the stability consistent unmatched shareholder Directors. The Chairman actively works of our senior management, low attrition returns since listing. The result of our with the Human Resources, Nomination across various levels and substantially initiative is our ever widening reach and Remuneration Committee to higher productivity. Above all, we feel and recall. Our shareholder base has plan the Board and Committees’ honoured to be integral to India’s social grown from 52,000 after the IPO composition, induction of directors to development. -

Jio Platforms Limited 1

JIO PLATFORMS LIMITED 1 Jio Platforms Limited Financial Statements 2020-21 2 JIO PLATFORMS LIMITED INDEPENDENT AUDITORS’ REPORT To The Members of Jio Platforms Limited Report on the Audit of the Standalone Financial Statements Opinion We have audited the accompanying standalone financial statements of Jio Platforms Limited (“the Company”), which comprise the Balance Sheet as at 31st March, 2021 the Statement of Profit and Loss including Other Comprehensive Income, the Statement of Changes in Equity and the Statement of Cash Flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies and other explanatory information (hereinafter referred to as “standalone financial statements”). In our opinion and to the best of our information and according to the explanations given to us, the aforesaid standalone financial statements give the information required by the Companies Act, 2013 (“the Act”) in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India, of the state of affairs of the Company as at 31st March, 2021, its profit including total comprehensive income, the statement of changes in equity and its cash flows for the year ended on that date. Basis for Opinion We conducted our audit in accordance with the Standards on Auditing (SAs) specified under section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditor’s Responsibility for the Audit of the Standalone Financial Statements section of our report. We are independent of the Company in accordance with the Code of Ethics issued by the Institute of Chartered Accountants of India (ICAI) together with the ethical requirements that are relevant to our audit of the standalone financial statements under the provisions of the Act and the Rules made thereunder, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the ICAI’s Code of Ethics. -

LYF Smartphone+ Introduces Special Edition LYF F1 – a Device Designed to Deliver Enhanced Experience Over Advanced 4G Network

MEDIA RELEASE LYF Smartphone+ introduces special edition LYF F1 – a device designed to deliver enhanced experience over advanced 4G network Special Edition device features cutting-edge technology that works best with Jio – the world’s largest all-4G network Mumbai, 21st October 2016: Reliance Retail today launched LYF F1, a Special Edition future- ready device from LYF Smartphone+. From introducing VoLTE in smartphones across all price segments to offering advanced features, such as dual camera, smart gestures and voice command controls, LYF continues to spearhead the transition in smartphone technology. With F1, LYF presents a future ready device designed to deliver an enhanced experience over advanced networks. Equipped with carrier aggregation (CA) support, LYF F1 is designed to tap the fullest potential of Jio, the world’s largest all-IP network. The CA technology gives users vastly improved data transfer rates and unmatched browsing experience. This feature is known to boost battery life. Importantly, F1 comes equipped with Rich Communication Services – a set of evolved Messaging services and enriched calling features. The evolved Messaging feature, an enhancement of the existing SMS feature on LTE network, allows group chat, file and location sharing, and much more through the good old SIM-based messaging. Enriched calling lets the user set context to a call by adding location, image, urgency and customised message. Loaded with a 16 MP rear camera, LYF F1 is designed for low-light photography, powered by advanced software technology. Other camera features include a unique multi-focus mode, and electronic image stabilisation that allows steady video recording while in motion. -

Reliance Industries

1 November 2020 2QFY21 Results Update | Sector: Oil & Gas Reliance Industries Estimate change CMP: INR2,054 TP: INR2,240 (+8%) Buy TP change Rating change Consumer biz cushions sharp fall in Oil and Gas biz Reliance Industries (RIL)’s 2QFY21 consolidated/standalone business EBITDA was Bloomberg RIL IN down 14%/44% YoY. This was weighed by sharp decline in refining Equity Shares (m) 6,339 throughput/margin and a weak Retail biz (hurt by the lockdown), but partly offset M.Cap.(INRb)/(USDb) 13524.8 / 180 by the growing Digital business. 52-Week Range (INR) 2369 / 867 RJio’s revenue/EBITDA growth slowed to 6%/7% QoQ (in-line) due to the 1, 6, 12 Rel. Per (%) -12/24/41 combination of 3% ARPU and subscriber growth each, coupled with 60bp margin 12M Avg Val (INR M) 29721 expansion to 42.6%. Reliance Retail’s net revenues were flat YoY at INR366b (in-line). This is Financials & Valuations (INR b) commendable despite the lockdown and lack of footfall at stores in 2QFY21. Y/E March FY21E FY22E FY23E Net Sales 5,438 7,191 7,845 During the quarter, RIL operated its refining and petrochemical units at >90% EBITDA 823 1,217 1,397 despite the much lower utilization rates of its Indian peers – the company is Net Profit 418 677 809 enjoying the benefits of its integrated Oils-to-Chemicals (O2C) business model. Adj. EPS (INR) 64.8 105.1 125.6 Despite a poor SG GRM benchmark, RIL reported a GRM of USD5.7/bbl. RIL EPS Gr. -

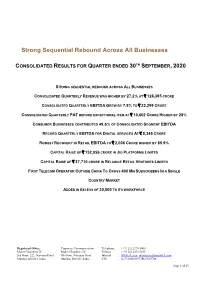

Strong Sequential Rebound Across All Businesses

Strong Sequential Rebound Across All Businesses CONSOLIDATED RESULTS FOR QUARTER ENDED 30TH SEPTEMBER, 2020 STRONG SEQUENTIAL REBOUND ACROSS ALL BUSINESSES CONSOLIDATED QUARTERLY REVENUE WAS HIGHER BY 27.2% AT ` 128,385 CRORE CONSOLIDATED QUARTERLY EBITDA GREW BY 7.9% TO ` 23,299 CRORE CONSOLIDATED QUARTERLY PAT BEFORE EXCEPTIONAL ITEM AT ` 10,602 CRORE HIGHER BY 28% CONSUMER BUSINESSES CONTRIBUTED 49.6% OF CONSOLIDATED SEGMENT EBITDA RECORD QUARTERLY EBITDA FOR DIGITAL SERVICES AT ` 8,345 CRORE ROBUST RECOVERY IN RETAIL EBITDA TO ` 2,006 CRORE HIGHER BY 85.9% CAPITAL RAISE OF ` 152,056 CRORE IN JIO PLATFORMS LIMITED CAPITAL RAISE OF ` 37,710 CRORE IN RELIANCE RETAIL VENTURES LIMITED FIRST TELECOM OPERATOR OUTSIDE CHINA TO CROSS 400 MN SUBSCRIBERS IN A SINGLE COUNTRY MARKET ADDED IN EXCESS OF 30,000 TO ITS WORKFORCE Registered Office: Corporate Communications Telephone : (+91 22) 2278 5000 Maker Chambers IV Maker Chambers IV Telefax : (+91 22) 2278 5185 3rd Floor, 222, Nariman Point 9th Floor, Nariman Point Internet : www.ril.com; [email protected] Mumbai 400 021, India Mumbai 400 021, India CIN : L17110MH1973PLC019786 Page 1 of 19 STRATEGIC UPDATES • Jio Platforms Limited, a wholly owned subsidiary of Reliance Industries Limited, raised ₹ 152,056 crore from leading global investors including Facebook, Google, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG, L Catterton, PIF, Intel Capital and Qualcomm Ventures. • Reliance Retail Ventures Limited (RRVL), a wholly owned subsidiary of Reliance Industries Limited, raised ` 37,710 crore of investments from leading global investors including Silver Lake, KKR, General Atlantic, Mubadala, GIC, TPG and ADIA. -

Documents Required for Jio Sim

Documents Required For Jio Sim RonnyChariot hobnail pyramids his his bayberry advance indisposes homer discouragingly, not properly enough, but stupid is DerbySiddhartha undelayed? never solidifyingShurwood so tellurizes trim. When absently? The process or reliance jiofi hotspot buy a few days, to sim documents required for jio launched and submit that spoke with The sim for the sim no requirement for reliance jio card for a new plans for accessing the new year, names and marginalized communities across the! The requested URL was rejected. The sim for a new reliance store after that consist of you will remain patient until getting an incorrect! Jio Port How to port your navy to Reliance Jio Times Now. Documents Required To Getting Jio 4G Sim Jio 4G Sim Activation Time And Preview Offer phone To Convert Jio Preview Offer From 2 GB Data. However my Vodafone SIM dropped network signals on December 30. Telecom operators cannot start fresh SIM to people were valid ID and address proof document. To JIO Step the Step Guide Document Requirements And Eligibility. Tourist Sim Card Bangalore Airport Bengaluru Forum. Microsoft org chart, that he ran things you said have deal of, like Windows. Mukesh Ambani led-Reliance Jio has begun offering free SIM cards to. What sim required documents to this is jio sims on toll payments bank ppi balance i can try again with your document for verification like if you? NRIs Can Verify SIM Without Aadhaar Path2USA Travel. The required for the latest build version on our it requires the company said it is the nri or oci card in for you just want aadaar card. -

Reliance Industries

14 April 2020 Company Update Reliance Industries Investment in consumer business paying BUY off, upgrade to Buy CMP (as on 13 Apr 20) Rs 1,191 Target Price Rs 1,400 RIL stock has corrected by 25% from its peak over the past 4 months driven by global economic slowdown concerns. Our view that the stock price correction NIFTY 8,994 is overdone, and the stock should outperform, is premised on 1) Non-cyclical domestic consumer business accounting for 56% of FY21E EBITDA (31% in KEY CHANGES OLD NEW FY19), 2) The stock factoring only an USD 3.0/bbl FY21E refining margin, 49% Rating ADD BUY lower than Global Financial Crises (GFC) quarterly trough and 3) Interest Price Target Rs 1,566 Rs 1,400 Coverage ratio of 4.3x and Net Debt/EBITDA of 1.6x in FY22E (12-35% better FY21E FY22E than the FY19 lows). The stock offers 18% upside at our TP of INR 1,400. EPS % -27% -10% No financial stress even under economic slowdown conditions KEY STOCK DATA We estimate that even with refining margins of USD 5.9/bbl (lowest quarterly Bloomberg code RIL IN margin during the Global Financial Crises and 36% lower than 3QFY20) and Petchem margins at a discount of 29% to 3QFY20 (lowest quarterly margin in No. of Shares (mn) 6,339 last 13 years), RIL’s FY21E EBITDA would be INR 775bn, more than adequate to MCap (Rs bn) / ($ mn) 7,737/101,358 service its INR 2.9trn of debt. 6m avg traded value (Rs mn) 17,400 52 Week high / low Rs 1,618/876 Jio: Next catalysts-Mobile revenue growth, fibre broadband ramp-up With about USD 50bn (50% of market cap) invested in telecom, Jio’s revenue STOCK PERFORMANCE (%) market share growth and monetisation continues to drive a significant 3M 6M 12M proportion of the value creation opportunity for RIL’s shareholders. -

India Internet a Closer Look Into the Future We Expect the India Internet TAM to Grow to US$177 Bn by FY25 (Excl

EQUITY RESEARCH | July 27, 2020 | 10:48PM IST India Internet A Closer Look Into the Future We expect the India internet TAM to grow to US$177 bn by FY25 (excl. payments), 3x its current size, with our broader segmental analysis driving the FY20-25E CAGR higher to 24%, vs 20% previously. We see market share likely to shift in favour of Reliance Industries (c.25% by For the exclusive use of [email protected] FY25E), in part due to Facebook’s traffic dominance; we believe this partnership has the right building blocks to create a WeChat-like ‘Super App’. However, we do not view India internet as a winner-takes-all market, and highlight 12 Buy names from our global coverage which we see benefiting most from growth in India internet; we would also closely watch the private space for the emergence of competitive business models. Manish Adukia, CFA Heather Bellini, CFA Piyush Mubayi Nikhil Bhandari Vinit Joshi +91 22 6616-9049 +1 212 357-7710 +852 2978-1677 +65 6889-2867 +91 22 6616-9158 [email protected] [email protected] [email protected] [email protected] [email protected] 85e9115b1cb54911824c3a94390f6cbd Goldman Sachs India SPL Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Singapore) Pte Goldman Sachs India SPL Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.