Efficient Coal Plants Are Still Competitive, but Nationwide Fleet Remains Under Pressure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Texas and Coal Ash Disposal in Ponds and Landfills

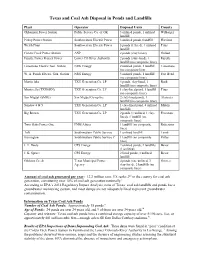

Texas and Coal Ash Disposal in Ponds and Landfills Plant Operator Disposal Units County Oklaunion Power Station Public Service Co. of OK 3 unlined ponds, 1 unlined Wilbarger landfill Pirkey Power Station Southwestern Electric Power 3 unlined ponds,1landfill Harrison Welsh Plant Southwestern Electric Power 3 ponds (1 lined), 1 unlined Titus landfill Coleto Creek Power Station ANP 2 ponds (clay liners) Goliad Fayette Power Project Power Lower CO River Authority 2 ponds (clay-lined), 1 Fayette landfill (no composite liner) Limestone Electric Gen. Station NRG Energy 2 unlined ponds, 1 landfill Limestone (no composite liner W. A. Parish Electric Gen. Station NRG Energy 5 unlined ponds, 1 landfill Fort Bend (no composite liner) Martin lake TXU Generation Co. LP 4 ponds, clay-lined, 1 Rusk landfill (no composite liner) Monticello (TXUGEN) TXU Generation Co. LP 1 clay-lined pond, 1 landfill Titus (no composite liner) San Miguel (SMIG) San Miguel Co-op Inc. 2 clay-lined ponds, 1 Atascosa landfill (no composite liner) Sandow 4 & 5 TXU Generation Co. LP 1 clay-lined pond, 4 unlined Milam landfills Big Brown TXU Generation Co. LP 2 ponds (1 unlined, 1 clay- Freestone lined), 1 landfill (no composite liner) Twin Oaks Power One PNM Altura 1 landfill (no composite Robertson liner) Tolk Southwestern Public Service 1 unlined landfill Lamb Harrington Southwestern Public Service C 1 landfill (no composite Potter liner) J. T. Deely CPS Energy 2 unlined ponds, 2 landfills Bexar (1 unlined) J. K. Spruce CPS Energy 2 lined ponds, 1 unlined Bexar landfill Gibbons Creek Texas Municipal Power 4 ponds (one unlined, 3 Grimes Agency clay-lined), 2 landfills (no composite liner) Amount of coal ash generated per year: 12.2 million tons. -

Texas and Coal Ash Disposal in Ponds and Landfills Summary:1

Texas and Coal Ash Disposal in Ponds and Landfills Summary:1 Oklaunion Power Station Public Service Co. of 3 Ponds Wilbarger Oklahoma Pirkey Power Station Southwestern Electric Power 6 Ponds/landfill* Harrison Co. Welsh Plant Southwestern Electric Power 3 Ponds/landfill* Titus Co Coleto Creek Power Station ANP 2 Ponds Goliad Fayette Power Project Power Lower Colorado River 1 Ponds Fayette Station Authority Limestone Electric Generating NRG Energy 3 Ponds/landfill* Limestone Station W. A. Parish Electric Generating NRG Energy 8 Ponds/landfill* Fort Bend Station Martin lake TXU Generation Co. LP landfill* Rusk Monticello (TXUGEN) TXU Generation Co. LP landfill* Titus San Miguel (SMIG) San Miguel Co-op Inc. data indeterminate Atascosa Sandow 4 & 5 TXU Generation Co. LP landfill* Milam Big Brown TXU Generation Co. LP landfill* Freestone Twin Oaks Power One PNM Altura landfill* Robertson Tolk Southwestern Public Service data indeterminate Lamb Co. Harrington Southwestern Public Service data indeterminate Potter Co. J. T. Deely CPS Energy landfill* Bexar Sandow Station Alcoa U.S. landfill* Milam J. K. Spruce CPS Energy landfill* Bexar Gibbons Creek Texas Municipal Power landfill* Grimes Agency AES Deepwater AES NUGs data indeterminate Harris Odessa Ector Generating Station PSEG Global data indeterminate Ector Guadalupe Generating Station PSEG Global data indeterminate Guadalupe *indicates one or more coal ash landfills.2 Amount of coal ash generated per year: 13.1 million tons. TX ranks 2nd in the country for coal ash generation.3 The U.S. EPA has not yet gathered information on coal ash disposal in landfills, so a detailed breakdown is not yet available. -

North American Natural Gas Market Dynamics: Coal-Fired Generation in North America – a Review

Canadian Energy Research Institute North American Natural Gas Market Dynamics: Coal-fired Generation in North America – A Review Paul Kralovic Study No. 123 – Section III March 2011 Relevant • Independent • Objective NORTH AMERICAN NATURAL GAS MARKET DYNAMICS: COAL-FIRED GENERATION IN NORTH AMERICA – A REVIEW North American Natural Gas Market Dynamics: Coal-fired Generation in North America – A Review Copyright © Canadian Energy Research Institute, 2011 Sections of this study may be reproduced in magazines and newspapers with acknowledgement to the Canadian Energy Research Institute Study No. 123 – Section III ISBN 1-896091-97-0 Author: Paul Kralovic* *Paul Kralovic is an external consultant and is the Director of Calgary-based Kralovic Economics Inc. Acknowledgements: The author of this report would like to extend his thanks and gratitude to everyone involved in the production and editing of the material, including, but not limited to Megan Murphy and Peter Howard CANADIAN ENERGY RESEARCH INSITTUTE 150, 3512 – 33 Street NW Calgary, Alberta T2L 2A6 Canada www.ceri.ca March 2011 Printed in Canada North American Natural Gas Market Dynamics: iii Coal-fired Generation in North America – A Review Table of Contents LIST OF FIGURES .............................................................................................................................. v LIST OF TABLES ................................................................................................................................ vii COAL-FIRED GENERATION IN NORTH AMERICA -

September 5, 2018 Wyoming Public Commission Hansen Building 2515

September 5, 2018 Wyoming Public Commission Hansen Building 2515 Warren Ave., Suite 300 Cheyenne, WY 82002 Re: Concerns Over Tri-State Generation and Transmission Association, Inc.’s Energy Costs, Reasonableness of Wholesale Rates and Other Charges, and Lack of Legally Required Oversight by the Wyoming PSC Dear Wyoming Public Service Commission: We are writing to convey concerns over the lack of adequate regulatory oversight of Tri- State Generation and Transmission Association, Inc. (hereafter “Tri-State”) and the wholesale electric rates and other charges they assess upon their rural electric cooperative members in Wyoming. We strongly urge the Public Service Commission (“PSC”) to engage in a review of whether Wyoming law requires heightened oversight and whether Tri-State’s wholesale rates and other charges are just and reasonable. Our concerns arise as numerous recent reports indicate Tri-State’s heavy reliance on coal- fired power generation is: ● Leading to higher costs and financial risks for its rural electric cooperative members; ● Sustaining unnecessary and unhealthy amounts of air and water pollution; ● Posing increased coal mine cleanup liabilities on communities and taxpayers; and ● Overall stymieing local renewable and distributed energy development. All this could be avoided if the company would take steps to retire coal-fired generating facilities and coal mines, and integrate more affordable, locally developed renewable energy into its electric generation portfolio. Our concerns are bolstered by the fact that Tri-State’s wholesale rates and other charges appear to be subject to oversight and regulation by the PSC. Unfortunately, the PSC has not asserted oversight and Tri-State has not submitted to legally required regulation. -

Arkansas Public Service Commission ("APSC") (Collectively "The Agencies")

Arkansas Department Arkansas Public of Environmental Quality Service Commission 5301 Northshore Drive 1000 Center; P.O. Box 400 North Little Rock, Arkansas 72118-5317 Little Rock, Arkansas 72203-0400 November 26, 2014 Via Electronic Mail Transmission via the Federal eRulemaking Portal and U.S. Mail Delivery Ms. Gina McCarthy Administrator Environmental Protection Agency EPA Docket Center (EP AlDC) Mailcode 28221 T Attention: Docket ID No. OAR-2013-0602 1200 Pennsylvania Avenue, NW Washington, DC 20460 Dear Administrator McCarthy: The attached comments document is submitted jointly on behalf of both the Arkansas Department of Environmental Quality ("ADEQ") and the Arkansas Public Service Commission ("APSC") (collectively "the Agencies"). The purpose of our comments is to provide to the Environmental Protection Agency ("EPA") our technical analysis of and recommendations for the "Carbon Pollution Emission Guidelines for Existing Stationary Sources: Electric Utility Generating Units" proposed rule that was published in the Federal Register on June 18, 2014 ("Proposed Rule"). The Agencies understand that the Attorney General of the State of Arkansas will comment on the legality ofthe Proposed Rule. As the agencies that regulate environmental issues and ensure reliable utility service at just and reasonable rates respectively in our state, ADEQ and APSC began collaborating in preparation for the release of EPA's Proposed Rule months before its publication. These comments are the result of our joint efforts in evaluating the components of the Proposed Rule as they pertain to Arkansas. Under the Proposed Rule, Arkansas would have one of the most stringent goals in the country for reducing the rate of carbon emissions from its electric generating units. -

Dirty Kilowatts America’S Most Polluting Power Plants

Dirty Kilowatts America’s Most Polluting Power Plants July 2006 About the Environmental Integrity Project The Environmental Integrity Project (EIP) is a nonpartisan, nonprofit organization dedicated to more effective enforcement of environmental laws and to the prevention of political interference with those laws. EIP was founded by Eric Schaeffer, who directed the U.S. Environmental Protection Agency's Office of Regulatory Enforcement until 2002. EIP’s research and reports shed light on how environmental laws affect public health. EIP works closely with communities seeking to enforce those laws. Acknowledgements We wish to acknowledge the significant contribution of Lance Christian, a graduate student in the Department of Geological Sciences at the University of Texas at Austin. We are grateful for the support of Changing Horizons, The John Merck Fund, and the Rockefeller Family Fund, without which this report would not have been possible. Data Limitations EIP’s rankings of the nation’s dirtiest power plants are based on data from the U.S. Environmental Protection Agency and the U.S. Department of Energy. Additional data are from Argus Media’s Scrubber Report 2006. Occasionally, government and commercial data may contain errors, either because information is inaccurately reported by power companies or incorrectly transcribed by agencies. EIP is committed to ensuring that the data we present are as accurate as possible, and we will correct any errors that are verifiable. Photo credits: Power plant and stacks photos courtesy of Clean Air Task Force and Ontario Clean Air Alliance (by Martin Edmonds, Jesse Gibb, Sandy Bell, John Wellner, and Albert Koehl); Asthma, iceberg, and smog photos courtesy of United States Environmental Protection Agency and National Oceanic and Atmospheric Administration; Fish advisory photo courtesy of Clean Water Action. -

Chapter 9: Coal (PDF)

9. Coal The next three chapters cover the representation and underlying assumptions for fuels in EPA Base Case v.5.13. The current chapter focuses on coal, chapter 10 on natural gas, and chapter 11 on other fuels (fuel oil, biomass, nuclear fuel, and waste fuels) represented in the base case. This chapter presents four main topics. The first is a description of how the coal market is represented in EPA Base Case v.5.13. This includes a discussion of coal supply and demand regions, coal quality characteristics, and the assignment of coals to power plants. The next topic is the coal supply curves which were developed for EPA Base Case v.5.13 and the bottom-up, mine-based approach used to develop curves that would depict the coal choices and associated prices that power plants will face over the modeling time horizon. Included are discussions of the methods and data used to quantify the economically recoverable coal reserves, characterize their cost, and build the 67 coal supply curves that are implemented in EPA Base Case v.5.13. Illustrative examples are included of the step-by-step approach employed in developing the supply curves. The third topic is coal transportation. It includes a description of the transport network, the methodology used to assign costs to the links in the network, and a discussion of the geographic, infrastructure, and regulatory considerations that come into play in developing specific rail, barge and truck transport rates. The last topic covered in this chapter is coal exports, imports, and non-electric sector demand. -

In Support of the City of Austin Divesting from the Fayette Power Project

\:ASS~O b~ Vb i C:e '("'(l::I..~ O c- ~ ts Smdcnr Govcrnmenr 10\~\oi THE UNIVERSITY OF TEXAS AT AUSTIN 1 University Station, A6210 • Austin, TX 78712-0180 • 512-471-3 166 • Fax: 512-471-3408 http://www.11tsg.org ~R18 In Support of the City of Austin divesting from the Fayette Power Project Authors: Rachel Aitkens, Andy Jones, Brittany Dawn McAllister, and Melessa Rodriguez Sponsors: Representatives Sarah Hobson, Andy Jones, John Lawler Joseph Lee, Melessa Rodriguez, Jimmy Talarico, John Woods, and Thaddeus Scott Woody WHEREAS, The Campus Environmental Center, an agency of the Student Government of the University of Texas at Austin, voted to invest time and energy in a campaign to encourage divestment from the Fayette Power Project; and WHEREAS, It is the mission of the Student Government at the University of Texas at Austin "to support students and student organizations in their academic and community endeavors" i; and WHEREAS, Energy from the Fayette Power Project, a coal plant located in La Grange, Texas and co-owned by the Lower Colorado River Authority and Austin Energy, accounts for 32% of Austin Energy's resource mix and 70% of Austin Energy's carbon dioxide emissions" ; and WHEREAS, Austin Energy has proposed to reduce their use of.. coal to 23% of their overall resource mix which would reduce the amount of emissions from coal to 50%"'; and WHEREAS, Austin's dependency on coal is not only financially expensive but costly in terms of negative externalities, including negative health effects on mountain communities in the Powder -

Q7 Report Layout

Economics of mercury control Lesley L Sloss CCC/134 June 2008 Copyright © IEA Clean Coal Centre ISBN 978-92-9029-453-5 Abstract With mercury legislation now in place in Canada and under revision in the USA, and action being considered on a global scale, there is a flood of new technologies into the market place – from treatments for enhancing existing control technologies to completely new, mercury-specific, systems. Since there is currently no universal ‘best available technique’ for mercury removal, the approach at each plant is being determined on a case-by-case basis. This report summarises the regulatory situation regarding mercury emissions in different countries, the status of mercury control technology development, and the costs of emission reduction. Where possible, the economic evaluation includes any increased costs due to changes in waste disposal options for coal combustion by-products. The report also considers mercury control options during coal processing and preparation. Acknowledgement A summary of this report has been provided as a contribution to the United Nations Environment Programme Global Mercury Partnership. Acronyms and abbreviations ACI activated carbon injection PRB Powder River Basin ALAPCO Association of Local Air Pollution Control PRTR Pollutant Release and Transfer Register, EC Officials, USA ROM rough order-of-magnitude BAT best available technique or technology SAICM Strategic Approach to International BEP best environmental practice Chemicals Management CAIR Clean Air Interstate Rule. USA SCR selective -

G~EARTHJUSTICE ADVOCATES Principal Authors: Lisa Evans Senior Administrative Counsel Earthjustice

STATE OF FAILURE HOV\1 STATES FAIL TO PROTECT OUR HEALTH AND DRINKING WATER FROM TOXIC COAL ASH THIRTY-SEVEN COAL ASH REGULATORY PROGRAMS THAT PLACE OUR AIR, WATER AND HEALTH IN DANGER AUGUST 2011 APPALACHIAN MOUNTAIN G~EARTHJUSTICE ADVOCATES Principal Authors: Lisa Evans Senior Administrative Counsel Earthjustice Michael Becher Attorney Appalachian Center for the Economy and the Environment Bridget Lee Attorney Earth justice Additional Contributors: Jeff Stant and John Dawes Environmental Integrity Project Appreciation: We thank Sue Sturgis of the Institute for Southern Studies and author of Facing South for the use of her compilation of coal ash damage cases (Appendix 1 of this report). Cover photo: Coal ash spill in Forward Township, PA, January 2005. STATE OF FAILURE How States Fail to Protect Our Health and Drinking Water from Toxic Coal Ash Introduction: An Unhealthy Union Coal ash is the second largest industrial waste stream in the United States. More than 140 million tons of coal ash, comprised of fly ash, bottom ash, boiler slag and flue gas desulfurization (FGD) sludge, is generated annually by the nation's coal-fired power plants. Coal ash contains a long list of carcinogenic and neurotoxic chemicals such as arsenic, lead, hexavalent chromium, cadmium and mercury. The toxic brew is stored in more than a thousand unstable ponds and landfills, which are located in nearly every state in the nation. Yet most states don't have regulations in place to keep these toxic chemicals safely entombed and out of our air and drinking water. Earthjustice and Appalachian Center for the Economy and the Environment (ACEE) uncovered the details of this state of failure in an exhaustive review of state regulations in 37 states, which together comprise over 98 percent of all the coal ash generated nationally. -

Fayette Power Project Unit 3 FGD Upgrade: Design and Performance for More Cost- Effective SO2 Reduction

Technical Paper BR-1845 Fayette Power Project Unit 3 FGD Upgrade: Design and Performance for More Cost- Effective SO2 Reduction Authors: C. Frazer Lower Colorado River Authority Austin, Texas, U.S.A. A. Jayaprakash S. M. Katzberger Sargent & Lundy, L.L.C. Chicago, Illinois, U.S.A. Y. J. Lee B. R. Tielsch Babcock & Wilcox Power Generation Group, Inc. Barberton, Ohio, U.S.A. Presented to: EPRI Power Plant Air Pollutant Control Mega Symposium Date: August 30 - Sept. 2, 2010 Location: Baltimore, Maryland, U.S.A. Fayette Power Project Unit 3 FGD Upgrade: Design and Performance for More Cost-Effective SO2 Reduction Y. J. Lee A. Jayaprakash C. Frazer B. R. Tielsch S. M. Katzberger Lower Colorado River Authority Babcock & Wilcox Sargent & Lundy, L.L.C. Austin, Texas, U.S.A. Power Generation Group, Inc. Chicago, Illinois, U.S.A. Barberton, Ohio, U.S.A. Presented to: BR-1845 EPRI Mega Symposium 2010 August 30 - Sept. 2, 2010 Baltimore, Maryland, U.S.A. Introduction through a pair of regenerative Ljungstrom air preheaters, before passing through a cold-side electrostatic precipitator Lower Colorado River Authority’s (LCRA) Fayette (ESP) and then approximately 95 to 99% of the flue gas is Power Project – Unit 3 (FPP3), located near La Grange, treated in a WFGD system. The treated flue gas is mixed Texas, was completed in 1988. The original wet flue gas with bypassed flue gas and then emitted from the station desulfurization (WFGD) system design was to reduce sulfur through a dry chimney. dioxide (SO2) by approximately 90% across the absorbers, while burning high-sulfur Texas lignite and bypassing up to 20% of the flue gas. -

Model Documentation and Results for ERCOT Scenarios

The Full Cost of Electricity (FCe-) Capacity Expansion and Dispatch Modeling: Model Documentation and Results for ERCOT Scenarios PART OF A SERIES OF WHITE PAPERS THE FULL COST OF ELECTRICITY is an interdisciplinary initiative of the Energy Institute of the University of Texas to identify and quantify the full-system cost of electric power generation and delivery – from the power plant to the wall socket. The purpose is to inform public policy discourse with comprehensive, rigorous and impartial analysis. The generation of electric power and the infrastructure that delivers it is in the midst of dramatic and rapid change. Since 2000, declining renewable energy costs, stringent emissions standards, low-priced natural gas (post-2008), competitive electricity markets, and a host of technological innovations promise to forever change the landscape of an industry that has remained static for decades. Heightened awareness of newfound options available to consumers has injected yet another element to the policy debate surrounding these transformative changes, moving it beyond utility boardrooms and legislative hearing rooms to everyday living rooms. The Full Cost of Electricity (FCe-) study employs a holistic approach to thoroughly examine the key factors affecting the total direct and indirect costs of generating and delivering electricity. As an interdisciplinary project, the FCe- synthesizes the expert analysis and different perspectives of faculty across the UT Austin campus, from engineering, economics, law, and policy. In addition to producing authoritative white papers that provide This paper is one in comprehensive assessment and analysis of various electric power a series of Full Cost system options, the study team developed online calculators that allow of Electricity white policymakers and other stakeholders, including the public, to estimate papers that examine the cost implications of potential policy actions.