Consultancy Report on Re-Assigning the Spectrum in the 1.9-2.2Ghz

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Netvigator Application Confidential

Do not pay cash to a sales person outside of a designated HKT Shop CONFIDENTIAL CONSUMER NETVIGATOR APPLICATION FORM ID: PCDRE THINGS TO KNOW BEFORE YOU BUY 1. Your Application and Service Guide set out the NETVIGATOR Services, Extra Services and/or Now TV services to which you have subscribed ("Services"), the applicable charges including your monthly charges for the Services as well as usage based and administrative and other charges which are payable in certain circumstances (such as for installation, moving and lost equipment), and the legal entity or entities responsible for providing those Services. Additional information about your Services and our shop addresses can be found on our website at http://www.hkt.com, http://nowtv.now.com/ (for Now TV services), or our Consumer Service Hotline at 1000. 2. Your Commitment Period (if any) for the Services is described in your Application in Section B. You can terminate your subscription to any Services within the Commitment Period by giving us not less than 30 days' prior written notice. If you terminate before the expiry of the Commitment Period, you will have to pay the Early Termination Charge described in Section E below (unless a Cooling-off Period is applicable), and (where applicable) compensate us for the value of any premium received by you. If you terminate your NETVIGATOR Services, your subscription to any Now TV services will also be terminated at the same time. 3. When the Commitment Period of Now TV services expires, we will continue to provide them on a month-to-month basis at the same monthly rate. -

Interim Report 2020/2021

ABOUT US SmarTone Telecommunications Holdings Limited (0315.HK), listed in Hong Kong since 1996 and a subsidiary of Sun Hung Kai Properties Limited, is a leading telecommunications provider with operating subsidiaries in Hong Kong and Macau, offering voice, multimedia and mobile broadband services, as well as fixed fibre broadband services for both consumer and corporate markets. SmarTone spearheaded 5G development in Hong Kong since May 2020, with the launch of its territory-wide 5G services. SmarTone is your smart partner that delivers a trusted and connected experience through our high-quality network, people-driven products and services combined with innovation, passion and understanding of customer needs. SmarTone differentiates our content, excellent customer service, business and consumer products for all our Hong Kong customers, allowing them to live and feel smarter everyday. This strong presence is also backed by expert technical know-how, over 30 stores across Hong Kong, our 5 core brands and our innovative business strategies arm. CONTENTS About Us Business Highlights 2 Chairman’s Statement 6 Management Discussion and Analysis 8 Directors Profile 11 Staff Engagement 20 Community Engagement 22 Report on Review of Interim Financial Information 24 Condensed Consolidated Profit and Loss Account 25 Condensed Consolidated Statement of Comprehensive Income 26 Condensed Consolidated Balance Sheet 27 Condensed Consolidated Statement of Cash Flows 29 Condensed Consolidated Statement of Changes in Equity 30 Notes to the Condensed Consolidated Interim Financial Statements 32 Other Information 48 INTERIM REPORT 2020/21 INTERIM REPORT 1 BUSINESS HIGHLIGHTS Spearhead 5G and Smart City development in Hong Kong SmarTone provides nearly full 5G coverage in Hong Kong with the widest coverage* both indoors and outdoors, to bring a faster, stabler and smoother 5G experience. -

Arrangements for the Frequency Spectrum in the 2.5/2.6 Ghz Band

Arrangements for the Frequency Spectrum in the 2.5/2.6 GHz Band upon Expiry of the Existing Assignments for the Provision of Public Mobile Services and the Related Spectrum Utilisation Fee Consultation Paper 23 September 2020 PURPOSE This paper is jointly issued by the Communications Authority (“CA”) and the Secretary for Commerce and Economic Development (“SCED”) to seek views and comments of the telecommunications industry and other affected persons on the proposed arrangements for re-assignment of 90 MHz of spectrum in the 2.5/2.6 GHz band upon expiry of the existing assignments on 30 March 2024 and methods for setting the related spectrum utilisation fee (“SUF”). BACKGROUND 2. A total of 90 MHz of spectrum in the 2.5/2.6 GHz band was assigned in March 2009 for the provision of public mobile services, and the existing assignments are due to expire in March 2024. The assignments are made to three assignees1, each with an amount of 2 x 15 MHz in the frequency ranges of 2500 – 2515 MHz paired with 2620 – 2635 MHz and 2540 – 2570 MHz paired with 2660 – 2690 MHz (hereafter referred to as “Available Spectrum”)2. 1 China Mobile Hong Kong Company Limited (“CMHK”), Hong Kong Telecommunications (HKT) Limited (“HKT”) and Genius Brand Limited (“Genius Brand”) are the incumbent assignees of the Available Spectrum, with each of them holding 2 x 15 MHz of the spectrum. Genius Brand is a joint venture indirectly owned by HKT and Hutchison Telephone Company Limited (“Hutchison”). The spectrum in the 2.5/2.6 GHz band assigned to Genius Brand is assumed to be divided equally between HKT and Hutchison for the purpose of calculation of the spectrum holding in this consultation paper. -

Arrangements for the Frequency Spectrum in the 900 Mhz and 1800

Arrangements for the Frequency Spectrum in the 900 MHz and 1800 MHz Bands upon Expiry of the Existing Assignments for Public Mobile Telecommunications Services and the Spectrum Utilisation Fee Consultation Paper 3 February 2016 FOREWORD This paper seeks views and comments of the telecommunications industry and other affected persons on the arrangements for re-assignment of the frequency spectrum in the 900 MHz and 1800 MHz bands upon expiry of the existing assignments between November 2020 and September 2021. This paper also seeks views and comments on the methods for setting the related spectrum utilisation fee (“SUF”). The Communications Authority (“CA”) and the Secretary for Commerce and Economic Development (“SCED”) plan to conduct two rounds of public consultation on the arrangements for the spectrum re-assignment and the related SUF, with a view to making their respective decisions on the way forward by November 2017. For the avoidance of doubt, all the information given and views expressed in this consultation paper are for the purpose of discussion and consultation only. Nothing in this consultation paper represents or constitutes any decision made by the CA or the SCED. The consultation contemplated by this consultation paper is without prejudice to the exercise of the powers by the CA and the SCED under the Telecommunications Ordinance (Cap. 106) (“TO”) or any subsidiary legislation thereunder. Any person wishing to respond to the public consultation should do so on or before 18 April 2016. The CA and the SCED may publish all or part of the views and comments received, and disclose the identity of the source in such manner as they see fit. -

Mobile Phones, Social Transformation, and the Reproduction of Power in the Philippines a Dissertation Submitted

TEXTING CAPITAL: Mobile Phones, Social Transformation, and the Reproduction of Power in the Philippines A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy at George Mason University By Cecilia S. Uy-Tioco Master of Arts The New School University, 2004 Master of Arts New York University, 1996 Bachelor of Arts Ateneo de Manila University, 1992 Director: Timothy Gibson, Associate Professor Department of Communication Summer Semester 2013 George Mason University Fairfax, VA This work is licensed under a creative commons attribution-noderivs 3.0 unported license. ii DEDICATION For my mom, Joy Uy-Tioco, who encouraged me to be curious, intellectually and otherwise, and to the memory of my dad, George Uy-Tioco, who would have loved mobile phones, text messaging, and the Internet. +AMDG iii ACKNOWLEDGEMENTS It would have been impossible to complete this degree without the support of friends, family, professors, and colleagues. I must start by thanking my dissertation chair, Tim Gibson, who has been incredibly encouraging, generous, and supportive, while being firm and constructively critical. If I could be half the professor he is, I would consider myself a success. I too am a charter member of the Tim Gibson fan club. Throughout my time at the CS program Paul Smith has always challenged me and pushed me to think more critically, and for that I am most grateful. It was during a directed reading course with Mark Sample that I really began to study new media and I am grateful for his support and insights. My scholarship has been enriched by courses and conversations with various faculty members at the GMU CS program particularly, Debra Lattanzi Shutika, Roger Lancaster, Dina Copelman, Jean-Paul Dumont, Denise Albanese, Hugh Gusterson, Debra Berghoffen, Johanna Bockman, Ellen Todd, and Scott Trafton. -

Annual Report 2018 1 CORPORATE PROFILE (CONTINUED)

CONTENTS 1 Corporate Profile 3 Statement from the Chairman 4 Statement from the Group Managing Director 8 PCCW in Numbers 10 Significant Events in 2018 12 Awards 18 Board of Directors 24 Corporate Governance Report 42 Management’s Discussion and Analysis 53 Financial Information 224 Investor Relations CORPORATE PROFILE PCCW Limited is a global company headquartered in Hong Kong which holds interests in telecommunications, media, IT solutions, property development and investment, and other businesses. The Company holds a majority interest in the HKT Trust and HKT Limited, Hong Kong’s premier telecommunications service provider and leading operator in fixed-line, broadband and mobile communication services. Beyond connectivity, HKT provides innovative smart living and business services to individuals and enterprises. PCCW also owns a fully integrated multimedia and entertainment group in Hong Kong, PCCW Media. PCCW Media operates the largest local pay-TV operation, Now TV, and is engaged in the provision of OTT (over-the-top) video service under the Viu brand in Hong Kong and other places in the region. Through HK Television Entertainment Company Limited, PCCW also operates a domestic free television service in Hong Kong. Also wholly-owned by the Group, PCCW Solutions is a leading information technology outsourcing and business process outsourcing provider in Hong Kong and mainland China. In addition, PCCW holds a majority interest in Pacific Century Premium Developments Limited, and other overseas investments. Employing over 23,600 staff, PCCW maintains a presence in Hong Kong, mainland China as well as other parts of the world. PCCW shares are listed on The Stock Exchange of Hong Kong Limited (SEHK: 0008) and traded in the form of American Depositary Receipts (ADRs) on the OTC Markets Group Inc. -

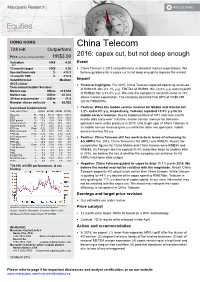

China Telecom 728 HK Outperform 2016: Capex Cut, but Not Deep Enough Price (At 05:20, 22 Mar 2016 GMT) HK$3.90

HONG KONG China Telecom 728 HK Outperform 2016: capex cut, but not deep enough Price (at 05:20, 22 Mar 2016 GMT) HK$3.90 Valuation HK$ 4.30 Event - DCF 12-month target HK$ 4.30 . China Telecom’s 2015 net profit came in ahead of market expectations. We Upside/Downside % +10.3 believe guidance for a capex cut is not deep enough to impress the market. 12-month TSR % +12.5 Volatility Index Medium Impact GICS sector . Financial highlights. For 2015, China Telecom reported operating revenues Telecommunication Services of RMB331.2bn (+2.1% y-y), EBITDA of RMB94.1bn (-0.8% y-y) and net profit Market cap HK$m 315,636 of RMB20.1bn (+13.4% y-y). We note the company’s net profit came in ~5% Market cap US$m 41,022 30-day avg turnover US$m 21.6 above market expectation. The company declared final DPS of HK$0.095 Number shares on issue m 80,932 (2014: HK$0.095). Investment fundamentals . Positive: While the mobile service revenue for Mobile and Unicom fell Year end 31 Dec 2014A 2015E 2016E 2017E 1.2% and 8.0% y-y, respectively, Telecom reported +3.5% y-y for its Revenue bn 324.4 351.8 380.6 400.7 mobile service revenue. Due to implementation of VAT and “one-month EBIT bn 28.5 30.4 36.0 42.2 EBIT growth % 3.8 6.8 18.4 17.2 mobile data carry-over” initiative, mobile service revenue for domestic Reported profit bn 17.7 20.5 24.6 29.3 operators were under pressure in 2015. -

MIMO in HSPA: the Real-World Impact MIMO in HSPA: the Real-World Impact

MIMO in HSPA: the Real-World Impact MIMO in HSPA: the Real-World Impact Contents 1 Executive Summary 2 2 The Role of MIMO in HSPA 3 2.1 What is MIMO, and What Does it Provide? 3 3 Implementation and Deployment 4 3.1 Co-existence of MIMO and Legacy Terminals 4 3.2 An Implementation Example 5 3.3 Deployment Considerations 7 4 Experiencing MIMO: from Field Trials to Network Deployments 9 4.1 Case Study at 2100MHz 9 4.2 Case Study at 900 MHz (Polsat) 11 5 The MIMO Ecosystem and Outlook 12 6 MIMO Evolution in 3GPP 13 6.1 MIMO Continues to Evolve in 3GPP 13 6.2 Leveraging Today’s MIMO Investments through Multi-User MIMO: 13 7 Conclusion and Recommendations 15 2 MIMO in HSPA: the Real-World Impact Figure List Figure 2.1: MIMO Improves Data Rates for all Users and Increases Capacity 3 Figure 3.1: Virtual Antenna Mapping 4 Figure 3.2: Overview of Huawei Co-Carrier Solution for MIMO & legacy Terminals 5 Figure 3.3: MIMO User Throughput Gain in Huawei Solution 6 Figure 3.4: MIMO Cell Throughput Gain in Huawei Solution 6 Figure 3.5: Different Evolution Strategies, where MIMO Plays a Fundamental Role 7 Figure 3.6: Easy Long-Term Evolution Steps of HSPA and LTE (Typical Example) 8 Figure 4.1: Field Test, Relative Average Cell Gain of MIMO Compared to 16 QAM and to 64 QAM 9 Figure 4.2: Field Measurement of Single User HSPA+ Performance (UDP Traffic) 10 Figure 4.3: Field Measurement of Multi-User HSPA+ Performance (2 Users with UDP Traffic) 10 Figure 4.4: Field Measurement of Dual Carrier vs Single Carrier (SIMO) HSPA+ Capacity 10 Figure 4.5: Average Throughput of Single User at More Than 30 Test Locations./ Peak Rate in Lab Test. -

Bill Payment Payee List – Telecommunication Services

Bill Payment Payee List – Telecommunication Services Merchant Category Merchant Name Bill Account Description Bill Type Bill Type Description Telecommunication 1010 Bill Account Number 77 (Not to be provided by customers) Services 1579 Account Number 1628 Account Number 01 IDD Bill 1628 Account Number 02 Prepaid Card accessyou.com Bill Account Number China Mobile Hong Kong Company Limited PPS Payment No. on your Invoice 01 Monthly Invoice Charges - Monthly Service Plan China Mobile Hong Kong Company Limited 8-digit stored value SIM card mobile - Stored Value SIM Card number China Unicom (Hong Kong) Operations 11-digit Account Number 01 Unicom Express Card Fee Limited China Unicom (Hong Kong) Operations 11-digit Account Number 02 Mobile Monthly Fee Limited China Unicom (Hong Kong) Operations 11-digit Account Number 03 16400 IDD Postpaid Service Limited China Unicom (Hong Kong) Operations 11-digit Account Number 04 Other Services Limited China-Hongkong Telecom Limited Account Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 01 Recharge Stored-Value SIM Card Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 02 GMCC Card Service Charges Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 03 IDD & Call Forwarding Services Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 04 Internet and Pnets Service Charges Mobile Phone Number CMMobile Global Communications Limited Subscription Number or 8-digit Prepaid 05 Mobile Phone Services Mobile Phone Number ComNet Telecom (HK) Limited 8 Digit Account Number 01 IDD 0050 ComNet Telecom (HK) Limited 8 Digit Account Number 02 ComNet Phone csl (one2free) Account Number 1 Bill Payment Payee List – Telecommunication Services Merchant Category Merchant Name Bill Account Description Bill Type Bill Type Description Telecommunication CSL Mobile Limited Account No. -

Press Release Ericsson

PRESS RELEASE March 19, 2020 SmarTone selects Ericsson’s 5G to power digitalization in Hong Kong • Ericsson chosen for radio access network (RAN) and Core • SmarTone to use Ericsson Spectrum Sharing solution to launch 5G services on existing bands • Deal also includes Ericsson’s Dual-Mode 5G Core including a full NFV stack, AI-powered RAN capabilities and Ericsson Orchestrator Ericsson (NASDAQ: ERIC) and SmarTone, one of the leading communication service providers in Hong Kong, have agreed to a five-year contract for the deployment of 5G in Hong Kong. Ericsson is the sole supplier of SmarTone’s 4G network and will continue as their sole 5G vendor – extending the companies’ 28 years of partnership. Stephen Chau, Chief Technology Officer of SmarTone, says: “SmarTone has been preparing for the 5G era with Ericsson in Hong Kong since January 2017, when we conducted the first 5G technology demo in this market. Together, Ericsson and SmarTone have led global technology developments in mobility and delivered multiple ‘firsts’ through early joint trials, shared research and collaborative product development. We will continue to leverage our long-term partnership to build a world-class and robust 5G network in Hong Kong and deliver best-of-breed 5G network experience to customers. SmarTone is also proud to be playing a key role in Hong Kong’s transformation to a smart city.” SmarTone will be the first operator in Hong Kong to deploy Ericsson Spectrum Sharing – a unique spectrum sharing technology that enables dynamic sharing of spectrum between 4G and 5G and more efficient use of its existing spectrum and existing Ericsson Radio System infrastructure for 5G deployment. -

Roam Zone for Discounted Rate Plans

Roam Zone for Discounted Rate Plans This information applies to discounted rate plans for Laptop Cards (DataConnect Global), PDAs, Smartphones and iPhones. Country Carriers Technology Frequency AUSTRALIA Hutchison 3G UMTS Only 2100 VodaFone GSM/GPRS/UMTS GSM/GPRS 900/1800; UMTS 2100 AUSTRIA Hutchison 3G UMTS Only 2100 ONE GSM/GPRS/UMTS GSM/GPRS 1800; UMTS 2100 BELGIUM BASE NV/SA (KPN ORANGE) GSM/GPRS/EDGE 1800 Proximus GSM/GPRS/EDGE/UMTS GSM/GPRS/EDGE 900; UMTS 2100 CANADA* ROGERS WIRELESS GSM/GPRS/EDGE/UMTS 1900 FIDO (MICROCELL) GSM/GPRS/EDGE 1900 CHINA CHINA MOBILE GSM/GPRS/EDGE 900 COLOMBIA Columbia Movil GSM/GPRS/EDGE 1900 Movistar GSM/GPRS/EDGE 850/1900 CZECH-REPUBLIC OSKAR MOBILE A.S. GSM/GPRS/EDGE 900/1800 (VodaFone) DENMARK 3 (Hutchison 3G) UMTS Only 2100 TELIA GSM/GPRS/EDGE 1800 EGYPT VODAFONE GSM/GPRS/UMTS GSM/GPRS 900; UMTS 2100 Country Carriers Technology Frequency FRANCE BOUYGUES TELECOM GSM/GPRS/EDGE/UMTS GSM/GPRS/EDGE 1800; UMTS 2100 VODAFONE SFR FRANCE GSM/GPRS/EDGE/UMTS GSM/GPRS/EDGE 900/1800; UMTS 2100 GERMANY E PLUS GSM/GPRS/UMTS GSM/GPRS 1800; UMTS 2100 O2 GSM/GPRS/UMTS GSM/GPRS 1800; UMTS 2100 VODAFONE GERMANY GSM/GPRS/EDGE 900/1800 GREAT O2 (UK) LIMITED GSM/GPRS/UMTS GSM/GPRS BRITAIN(United 900/1800; UMTS Kingdom) 2100 Hutchison 3G UMTS Only 2100 Vodafone GSM/GPRS/UMTS GSM/GPRS 900/1800; UMTS 2100 GREECE VODAFONE - PANAFON GSM/GPRS/UMTS GSM/GPRS 900; UMTS 2100 GUAM Guam Cellular and Paging GSM/GPRS GSM/GPRS 1900 (HafaTEL) Pulse Mobile GSM/GPRS GSM/GPRS 850/1900 HONG KONG CSL GSM/GPRS/EDGE/UMTS GSM/GPRS/EDGE 900/1800; -

Mobile Operators' Measures in Preventing Mobile Bill Shock

Mobile Operators’ Measures in Preventing Mobile Bill Shock Disclaimer: This document sets out the Mobile Operators’ Measures in Preventing Mobile Bill Shock in Hong Kong. It contains data and information submitted by the relevant operators to, and compiled by the Office of the Communications Authority (OFCA), and is published for public information only. This document will be updated periodically upon advice by mobile operators on new or enhanced initiatives they have taken on board. The mobile operators’ measures are voluntary in nature and the mobile operators may adjust their service packages and revise their measures from time to time. Therefore, consumers are strongly advised to consult individual mobile operators directly on their latest initiatives, service terms and conditions, as well as charging schemes and methods and other pertinent details prior to committing themselves to any mobile data services. While OFCA has endeavoured to ensure that the information in this document is correct, no warranty or guarantee, express or implied, is given as to its accuracy. The Government of the Hong Kong Special Administrative Region (HKSAR), the Communications Authority (CA) and OFCA shall not be responsible and accept no liability for any error, omission or inaccuracy in the materials and reserve the right to omit, suspend or edit any materials submitted. The Government of HKSAR, the CA and OFCA shall not be liable for any direct, indirect, special or consequential losses or damages (including, without limitation, damages for loss of business or loss of profits) arising in contract, tort or otherwise from the use of or inability to use this document, or any material contained in it, or from any action or decision taken as a result of using this document or any material contained in it.