Payment Systems in Hong Kong

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report – Made in PRD: the Changing Face of HK Manufacturers – Released in 2003

MADE IN Challenges & Opportunities for HK Industry Made in PRD Study is a Federation of Hong Kong Industries project. The Hong Kong Centre for Economic Research was commissioned to carry out this two-year Study. Published and printed in Hong Kong. HK$500 Published by Federation of Hong Kong Industries. Copyright © 2007 Federation of Hong Kong Industries. All rights reserved. No part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the Federation of Hong Kong Industries. Website : http://www.industryhk.org Contents 2 Foreword 8 Chapter 1 : Hong Kong and the Pearl and Yangtze River Deltas 28 Chapter 2 : Industrial Performance in Gunagdong and the Role of Hong Kong 42 Chapter 3 : Hong Kong-Funded Enterprises and Enterprises in Other Contractual Forms 56 Chapter 4 : The Characteristics of Product Sales 66 Chapter 5 : Guangdong and Hong Kong in Parternership 80 Chapter 6 : Business Environment of the PRD 94 Chapter 7 : Research & Development 110 Chapter 8 : Policy Recommendations 126 Glossary 128 Acknowledgements 1 Since China embarked on the historic economic reform Foreword programmes in late 1970s, the Pearl River Delta (PRD) has developed by leaps and bounds from a predominately rural region into one of the fastest growing, export- oriented industrial centres in the world. This spectacular transformation and the contributions that Hong Kong manufacturers had made to the process have been lucidly depicted in our study report – Made in PRD: The Changing Face of HK Manufacturers – released in 2003. -

Annual Report 2014 • Hong Kong Monetary Authority Page 5

2014 Annual Report Page 2 Hong Kong Monetary Authority The Hong Kong Monetary Authority (HKMA) is the government authority in Hong Kong responsible for maintaining monetary and banking stability. The HKMA’s policy objectives are • to maintain currency stability within the framework of the Linked Exchange Rate system • to promote the stability and integrity of the financial system, including the banking system • to help maintain Hong Kong’s status as an international financial centre, including the maintenance and development of Hong Kong’s financial infrastructure • to manage the Exchange Fund. The HKMA is an integral part of the Hong Kong Special Administrative Region Government but operates with a high degree of autonomy, complemented by a high degree of accountability and transparency. The HKMA is accountable to the people of Hong Kong through the Financial Secretary and through the laws passed by the Legislative Council that set out the Monetary Authority’s powers and responsibilities. In his control of the Exchange Fund, the Financial Secretary is advised by the Exchange Fund Advisory Committee. The HKMA’s offices are at 55/F, Two International Finance Centre, 8 Finance Street, Central, Hong Kong Telephone : (852) 2878 8196 Facsimile : (852) 2878 8197 E-mail : [email protected] The HKMA Information Centre is located at 55/F, Two International Finance Centre, 8 Finance Street, Central, Hong Kong and is open from 10:00 a.m. to 6:00 p.m. Monday to Friday and 10:00 a.m. to 1:00 p.m. on Saturday (except public holidays). The Centre consists of an Exhibition Area and a Library containing materials on Hong Kong’s monetary, banking and financial affairs and central banking topics. -

Neobank Varo on Serving Customers' Needs As P2P Payments See A

AUGUST 2021 Neobank Varo on serving customers’ needs as P2P payments see Nigerian consumers traded $38 million worth of bitcoin on P2P platforms within the past month a rapid rise in usage — Page 12 (News and Trends) — Page 8 (Feature Story) How P2P payments are growing more popular for a range of use cases, and why interoperability will be needed to keep growth robust — Page 16 (Deep Dive) © 2021 PYMNTS.com All Rights Reserved 1 DisbursementsTracker® Table Of Contents WHATʼS INSIDE A look at recent disbursements developments, including why P2P payments are becoming more valuable 03 to consumers and businesses alike and how these solutions are poised to grow even more popular in the years ahead FEATURE STORY An interview with with Wesley Wright, chief commercial and product officer at neobank Varo, on the rapid 08 rise of P2P payments adoption among consumers of all ages and how leveraging internal P2P platforms and partnerships with third-party providers can help FIs cater to customer demand NEWS AND TRENDS The latest headlines from the disbursements space, including recent survey results showing that almost 12 80 percent of U.S. consumers used P2P payments last year and how the U.K. government can take a page from the U.S. in using instant payments to help SMBs stay afloat DEEP DIVE An in-depth look at how P2P payments are meeting the needs of a growing number of consumers, how 16 this shift has prompted consumers to expand how they leverage them and why network interoperability is key to helping the space grow in the future PROVIDER DIRECTORY 21 A look at top disbursement companies ABOUT 116 Information on PYMNTS.com and Ingo Money ACKNOWLEDGMENT The Disbursements Tracker® was produced in collaboration with Ingo Money, and PYMNTS is grateful for the companyʼs support and insight. -

Chinese Underground Banking and 'Daigou'

Chinese Underground Banking and ‘Daigou’ October 2019 NAC/NECC v1.0 Purpose This document has been compiled by the National Crime Agency’s National Assessment Centre from the latest information available to the NCA regarding the abuse of Chinese Underground Banking and ‘Daigou’ for money laundering purposes. It has been produced to provide supporting information for the application by financial investigators from any force or agency for Account Freezing Orders and other orders and warrants under the Proceeds of Crime Act 2002. It can also be used for any other related purpose. This document is not protectively marked. Executive Summary • The transfer of funds for personal purposes out of China by Chinese citizens is tightly regulated by the Chinese government, and in all but exceptional circumstances is limited to the equivalent of USD 50,000 per year. All such transactions, without exception, are required to be carried out through a foreign exchange account opened with a Chinese bank for the purpose. The regulations nevertheless provide an accessible, legitimate and auditable mechanism for Chinese citizens to transfer funds overseas. • Chinese citizens who, for their own reasons, choose not to use the legitimate route stipulated by the Chinese government for such transactions, frequently use a form of Informal Value Transfer System (IVTS) known as ‘Underground Banking’ to carry them out instead. Evidence suggests that this practice is widespread amongst the Chinese diaspora in the UK. • Evidence from successful money laundering prosecutions in the UK has shown that Chinese Underground Banking is abused for the purposes of laundering money derived from criminal offences, by utilising cash generated from crime in the UK to settle separate and unconnected inward Underground Banking remittances to Chinese citizens in the UK. -

Lu Zhiqiang China Oceanwide

08 Investment.FIN.qxp_Layout 1 14/9/16 12:21 pm Page 81 Week in China China’s Tycoons Investment Lu Zhiqiang China Oceanwide Oceanwide Holdings, its Shenzhen-listed property unit, had a total asset value of Rmb118 billion in 2015. Hurun’s China Rich List He is the key ranked Lu as China’s 8th richest man in 2015 investor behind with a net worth of Rmb83 billlion. Minsheng Bank and Legend Guanxi Holdings A long-term ally of Liu Chuanzhi, who is known as the ‘godfather of Chinese entrepreneurs’, Oceanwide acquired a 29% stake in Legend Holdings (the parent firm of Lenovo) in 2009 from the Chinese Academy of Social Sciences for Rmb2.7 billion. The transaction was symbolic as it marked the dismantling of Legend’s SOE status. Lu and Liu also collaborated to establish the exclusive Taishan Club in 1993, an unofficial association of entrepreneurs named after the most famous mountain in Shandong. Born in Shandong province in 1951, Lu In fact, according to NetEase Finance, it was graduated from the elite Shanghai university during the Taishan Club’s inaugural meeting – Fudan. His first job was as a technician with hosted by Lu in Shandong – that the idea of the Shandong Weifang Diesel Engine Factory. setting up a non-SOE bank was hatched and the proposal was thereafter sent to Zhu Getting started Rongji. The result was the establishment of Lu left the state sector to become an China Minsheng Bank in 1996. entrepreneur and set up China Oceanwide. Initially it focused on education and training, Minsheng takeover? but when the government initiated housing Oceanwide was one of the 59 private sector reform in 1988, Lu moved into real estate. -

Initial Public Offering (Ipo) and Listing Process on the Sehk with Highlights

September 2019 RESEARCH REPORT INITIAL PUBLIC OFFERING (IPO) AND LISTING PROCESS ON THE SEHK WITH HIGHLIGHTS CONTENTS Page Summary ........................................................................................................................................ 1 1. General requirements for listing in Hong Kong ......................................................................... 2 1.1 Main Board listing conditions ........................................................................................... 2 1.2 Shareholding structures for listing in Hong Kong ............................................................. 3 Jurisdictions acceptable as place of incorporation ............................................... 3 Shareholding structures of Mainland companies seeking to list in Hong Kong ..... 3 Red-chip structure ............................................................................................... 4 Variable Interest Entity (VIE) structure ................................................................. 5 H-share structure ................................................................................................. 6 1.3 Listing of H-shares: An update ........................................................................................ 9 H-share companies have become an important part of the Hong Kong stock market ................................................................................................................. 9 Successful implementation of the H-share full circulation pilot programme -

The Digital Yuan and China's Potential Financial Revolution

JULY 2020 The digital Yuan and China’s potential financial revolution: A primer on Central Bank Digital Currencies (CBDCs) BY STEWART PATERSON RESEARCH FELLOW, HINRICH FOUNDATION Contents FOREWORD 3 INTRODUCTION 4 WHAT IS IT AND WHAT COULD IT BECOME? 5 THE EFFICACY AND SCOPE OF STABILIZATION POLICY 7 CHINA’S FISCAL SYSTEM AND TAXATION 9 CHINA AND CREDIT AND THE BANKING SYSTEM 11 SEIGNIORAGE 12 INTERNATIONAL AND TRADE RAMIFICATIONS 13 CONCLUSIONS 16 RESEARCHER BIO: STEWART PATERSON 17 THE DIGITAL YUAN AND CHINA’S POTENTIAL FINANCIAL REVOLUTION Copyright © Hinrich Foundation. All Rights Reserved. 2 Foreword China is leading the way among major economies in trialing a Central Bank Digital Currency (CBDC). Given China’s technological ability and the speed of adoption of new payment methods by Chinese consumers, we should not be surprised if the CBDC takes off in a major way, displacing physical cash in the economy over the next few years. The power that this gives to the state is enormous, both in terms of law enforcement, and potentially, in improving economic management through avenues such as surveillance of the shadow banking system, fiscal tax raising power, and more efficient pass through of monetary policy. A CBDC has the potential to transform the efficacy of state involvement in economic management and widens the scope of potential state economic action. This paper explains how a CBDC could operate domestically; specifically, the impact it could have on the Chinese economy and society. It also looks at the possible international implications for trade and geopolitics. THE DIGITAL YUAN AND CHINA’S POTENTIAL FINANCIAL REVOLUTION Copyright © Hinrich Foundation. -

Video on Showcase of Awarded Websites and Mobile Applications

Video on Showcase of Awarded Websites and Mobile Applications Most Favourite Websites 1. The Kowloon Motor Bus Company (1933) Limited [www.kmb.hk] 2. The University of Hong Kong [www.hku.hk] 3. The Chinese University of Hong Kong [www.cuhk.edu.hk] Most Favourite Mobile App 4. MTR Corporation Limited [MTR Mobile , iOS / Android] 5. Airport Authority Hong Kong [HKG My Flight , iOS / Android] 6. Hong Kong Blind Union [Searching & Exploring with Speech Augmented Map Information (SESAMI) , iOS] Designer Award 1. TheOrigo Ltd. 2. Palmary Solutions Company Limited 3. KanHan Technologies Limited Triple Gold Award 1. Arcotect Limited [www.arcotect.com] 2. Automated Systems Holdings Limited [www.asl.com.hk] 3. The Chinese University of Hong Kong [www.cuhk.edu.hk] 4. City University of Hong Kong [www.cityu.edu.hk/cityu] 5. City University of Hong Kong [www.cityu.edu.hk/cio] 6. Fish Marketing Organization [www.fmo.org.hk] 7. Freedom Communications Limited [www.freecomm.com/entxt_index.php] 8. The Hong Kong Council of Social Service [dsf.org.hk] 9. HKCSS - HSBC Social Enterprise Business Centre [www.sobiz.hk] 10. Information Technology Resource Centre Limited [itrc.hkcss.org.hk] 11. Hong Kong Council on Smoking and Health [www.smokefree.hk] 12. Hong Kong Cyberport Management Company Limited [www.cyberport.hk] 13. Hong Kong Institute of Vocational Education [it.vtc.edu.hk] 14. Hong Kong Lutheran Social, LC-HKS - Shek Kip Mei Lutheran Centre for the Blind [smartlink.hklcb.org/index2.php] 15. Hong Kong Note Printing Limited [www.hknpl.com.hk] 16. Health, Safety and Environment Office, The Hong Kong Polytechnic University [www.polyu.edu.hk/hseo] 17. -

俊盟國際控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) Stock Code: 8062

EFT Solutions Holdings Limited 俊盟國際控股有限公司 (Incorporated in the Cayman Islands with limited liability) Stock Code: 8062 PUBLIC OFFER AND PLACING Sole Sponsor Sole Bookrunner and Sole Lead Manager IMPORTANT If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. EFT Solutions Holdings Limited 俊盟國際控股有限公司 (Incorporated in the Cayman Islands with limited liability) LISTING ON THE GROWTH ENTERPRISE MARKET OF THE STOCK EXCHANGE OF HONG KONG LIMITED BY WAY OF PUBLIC OFFER AND PLACING Number of Offer Shares : 120,000,000 Shares, comprising 96,000,000 New Shares and 24,000,000 Sale Shares Number of Placing Shares : 108,000,000 Shares, comprising 84,000,000 New Shares and 24,000,000 Sale Shares (subject to re-allocation) Number of Public Offer Shares : 12,000,000 New Shares (subject to re-allocation) Offer Price : Not more than HK$0.60 and expected to be not less than HK$0.40 per Offer Share, plus brokerage of 1%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund) Nominal value : HK$0.01 per Share Stock code : 8062 Sole Sponsor Sole Bookrunner and Sole Lead Manager Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. -

Graduates Subsidy Programme 2021

Guidance Notes on Application for Green Employment Scheme: Graduates Subsidy Programme 2021 Preamble The purpose of Green Employment Scheme: Graduates Subsidy Programme 2021 (the Programme) is to provide subsidies to prospective employers of graduates of environment- related disciplines with a view to sustaining the provision of job opportunities for fresh graduates to work in environment-related areas as well as nurturing young people with environmental knowledge, talents and passion to meet the environmental needs of Hong Kong. Responsible Government Department 2. Environmental Protection Department (EPD) is responsible for the implementation of the Programme. Eligibility for the Programme 3. An applicant must be a holder of a valid business registration certificate and (a) has recently recruited an Eligible Graduate employee (see para.5 below) who reported duty on or after 1 April 2021; or (b) is in the process of recruiting; or (c) is planning to recruit at least one Eligible Graduate employee, to work on a full-time basis in an Eligible Job Place (see para.6 below). 4. An applicant without a valid business registration certificate and under the following circumstances will also be considered on a case-by-case basis: (a) Applicant registered in Company Registry with valid Company Registration Certificate; or (b) Applicant being a charitable institution under Section 88 of the Inland Revenue Ordinance; or (c) Applicant being an organization registered under the Societies Ordinance (Cap. 151). 5. An Eligible Graduate employee under the Programme must be: (a) a fresh graduate who has completed a Bachelor’s degree programme in a relevant environment-related subjectNote 1 from a Hong Kong higher education institution, or equivalent, in 2020 or 2021; (b) a Hong Kong Special Administrative Region (HKSAR) resident with a valid Hong Kong Identity Card; and Note 1 Environmental conservation, environmental science, environmental management, sustainable development or other subjects relevant to the duties of the Eligible Job Places. -

List of CMU Members 2021-08-18

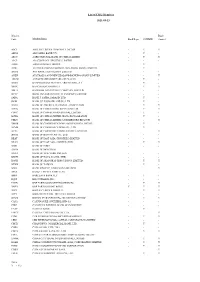

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

Room Document 9 Statistics and Data on the Securities and Futures Markets of Hong Kong by Mr. Mark Dickens Asian Development

Fourth Round Table on Capital Market Reform in Asia 09-10 April 2002, Tokyo Room Document 9 Statistics and Data on the Securities and Futures Markets of Hong Kong By Mr. Mark Dickens ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Asian Development Bank Institute 1 Statistics/data on the Securities and Futures Markets of Hong Kong Table 1 – Major Indicators of the Securities Markets in Hong Kong (Period-end figures unless otherwise specified) Cash Market 1996 1997 1998 1999 2000 2001 Main Board Number of Listed Companies 583 658 680 701 736 756 Market Capitalisation Total 3,476 3,202 2,662 4,728 4,795 3,885 (HK$ billion) HSI Constituents 2,436 2,132 2,106 3,744 3,866 3,136 Worldwide Ranking by Market Capitalisation 7 9 11 10 10 10 Market Capitalisation to GDP (%) 292 242 211 384 377 306 Market Value of Top 10 Stocks over Total Market Capitalisation (%) 52 n.a. n.a. 66 66 63 Average Daily Turnover Total 5,672 15,465 6,887 7,757 12,338 8,025 (HK$ million) HSI Constituents 3,075 5,534 4,550 3,766 5,677 4,558 Number of Trading Days 249 245 247 247 247 243 Liquidity (%) (Turnover / Year-end Market Capitalisation) 41 118 64 41 64 50 Hang Seng Index 13,451 10,723 10,049 16,962 15,096 11,397 P/E ratio (HSI) 17.30 12.29 12.36 27.88 12.74 15.06 Funds Raised (HK$ billion, annual) 100 248 38 148 451 59 Growth Enterprise Market Number of Listed Companies n.a.