REPUBLIC AIRWAYS HOLDINGS INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here in Between, It’S Likely That the Challenges Facing the Aviation Industry Are Leading You and Your Family to Plan for Changes in Your Income and Lifestyle

August 2020 Aero Crew News Your Source for Pilot Hiring and More.. Aero Crew News Your Source for Pilot Hiring and More.. For every leg of your journey AeroCrewNews.com AeroCrewSolutions.com TOP PAY & ADDING 36 ERJ145s in 2020 Train and fly within 3 months Proud Aviate Program Partner Jump to each section Below by clicking on the title or photo. contentsAugust 2020 20 28 22 30 24 Also Featuring: Letter from the Publisher 8 Aviator Bulletins 10 Career Vectors 32 4 | Aero Crew News BACK TO CONTENTS the grid US Cargo US Charter US Major Airlines US Regional Airlines ABX Air Airshare Alaska Airlines Air Choice One Alaska Seaplanes GMJ Air Shuttle Allegiant Air Air Wisconsin Ameriflight Key Lime Air American Airlines Cape Air Atlas Air/Southern Air Omni Air International Delta Air Lines CommutAir FedEx Express Ravn Air Group Frontier Airlines Elite Airways iAero Airways XOJET Aviation Hawaiian Airlines Endeavor Air Kalitta Air JetBlue Airways Envoy Key Lime Air US Fractional Southwest Airlines ExpressJet Airlines UPS FlexJet Spirit Airlines GoJet Airlines NetJets Sun Country Airlines Grant Aviation US Cargo Regional PlaneSense United Airlines Horizon Air Empire Airlines Key Lime Air Mesa Airlines ‘Ohana by Hawaiian Piedmont Airlines PSA Airlines Republic Airways The Grid has moved online. Click on the Silver Airways airlines above to go directly to that airline, Skywest Airlines or go to www.AeroCrewNews.com/thegrid. Star Mania Air, Inc. July 2020 | 5 A FINANCIAL PARTNER TO HELP YOU ALTER COURSE As the ripple effects of this pandemic continue to create turbulence in every area of our daily lives, we understand that you and your loved ones are uncertain about the future of your career, your goals, and your financial security. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

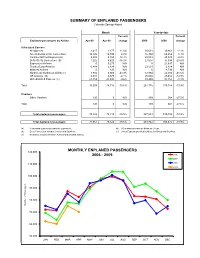

APR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

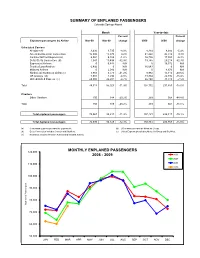

MAR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Associate Leisure Travel Guide

Associate Leisure Travel Guide SHUTTLE AMERICA REPUBLIC AIRLINES Revision Effective: December 2015 Contents QUICK LINKS 4 INTRODUCTION 5 What Is Non-Revenue Travel? 5 Contacting the Republic Airways Travel Department 5 GENERAL GUIDELINES FOR TRAVEL 6 Conditions of Travel 6 Pass Rider Travel 7 Conduct and Courtesy 8 Dress Code 8 Baggage Advisory 8 Multiple Listings 8 Selling Non-Revenue Pass Travel 9 Refunding Travel Charges 9 PASS TRAVEL FOR NON-COMPANY BUSINESS PROHIBITED 9 Disciplinary Action 9 ELIGIBILITY AND PASS RIDERS 10 Eligibility Timeline 10 Enrolling in Travel 10 Eligible Pass Riders 12 Parents 12 Spouse 12 Domestic Partners and Registered Companions 13 Minor and Dependent Children 15 CODE SHARE AND REPUBLIC AIRWAYS PASS PROGRAMS 16 American Airlines 16 Delta Air Lines 17 Eligible Pass Riders 17 Charges 17 2 Registering For Delta Travel 18 Online listing for Delta Travel 19 United Airlines 22 Eligible Pass Riders 22 Enrollment Fees and Charges 22 Obtaining Your United ‘N’ Number and Logging Into United 23 Refunds 23 Online Listing for United Travel 24 ZED Travel 27 Eligibles 27 Charges 27 To Access myIDTravel 28 Booking/Listing 28 Refunds 28 Online ZED listing for myIDTravel 29 TRAVELING AS A NON-REVENUE PASSENGER 32 Advice When Listing for Travel 32 Preparing for Travel 32 At the Airport 34 TRAVEL DEFINITIONS AND ACRONYMS 35 3 Quick Links AMERICAN AIRLINES TRAVEL PROGRAM: See the Travel Services page on the Company intranet for details DELTA AIRLINES TRAVEL PROGRAM : http://connect.delta.com REGISTER FOR DELTA AIRLINES TRAVEL PROGRAM : http://register.delta.com REPUBLIC AIRWAYS INTRANET: https://intranet.rjet.com REPUBLIC AIRWAYS LEISURE TRAVEL DEPARTMENT: [email protected] ULTIPRO ACCESS: www.myrjet.com UNITED AIRLINES TRAVEL PROGRAM: http://skynet.ual.com ZED TRAVEL HOME PAGE: http://www.myidtravel.com 4 Introduction This guide is designed to familiarize associates with their travel privileges. -

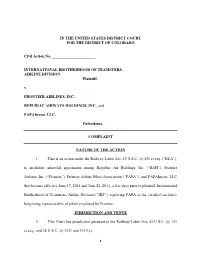

Nature of the Action

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLORADO Civil Action No. ______________________ INTERNATIONAL BROTHERHOOD OF TEAMSTERS, AIRLINE DIVISION Plaintiff, v. FRONTIER AIRLINES, INC., REPUBLIC AIRWAYS HOLDINGS, INC., and FAPAInvest, LLC, Defendants. COMPLAINT NATURE OF THE ACTION 1. This is an action under the Railway Labor Act, 45 U.S.C. §§ 151 et seq. (“RLA”), to invalidate unlawful agreements among Republic Air Holdings, Inc. (“RAH”), Frontier Airlines, Inc. (“Frontier”), Frontier Airline Pilots Association (“FAPA”), and FAPAInvest, LLC that became effective June 17, 2011 and June 24, 2011, a few days prior to plaintiff, International Brotherhood of Teamsters, Airline Division (“IBT”), replacing FAPA as the certified exclusive bargaining representative of pilots employed by Frontier. JURISDICTION AND VENUE 2. This Court has jurisdiction pursuant to the Railway Labor Act, 45 U.S.C. §§ 151 et seq., and 28 U.S.C. §§ 1331 and 1337(a). 1 3. Venue of this action is proper in the District of Colorado pursuant to 28 U.S.C. § 1391(b) because a substantial part of the events giving rise to the claims alleged herein occurred within this district and defendants may be found within this district. PARTIES 4. Defendant Frontier is a common carrier by air engaged in interstate commerce within the meaning of Section 201 of the RLA, 45 U.S.C. § 181, and does business within this district. 5. Defendant RAH is a holding company and corporation organized under the laws of Delaware with principal offices located in Indianapolis, Indiana and does business within this district. At all relevant times herein, Chautauqua Airlines, Inc. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Republic Airways, Caesars Entertainment Sign Three-Year Flight Agreement

October 25, 2012 Republic Airways, Caesars Entertainment Sign Three-Year Flight Agreement INDIANAPOLIS--(BUSINESS WIRE)-- Republic Airways Holdings Inc. (NASDAQ: RJET) and Caesars Entertainment Corporation (NASDAQ: CZR) today signed a three-year contract under which Republic's Republic Airlines subsidiary will operate five Embraer E190 aircraft to provide more than 1,500 flights annually for Caesars' customers throughout the United States. "We are very pleased to have been selected by Caesars to fulfill a portion of their dedicated air travel needs for the coming three years," said Republic Airways Chairman and CEO Bryan Bedford. "We very much look forward to providing a high quality, safe and reliable service to their properties starting in January 2013." "We are excited about this agreement that will offer our customers convenient, comfortable flights from their nearby local airports on newer, more fuel-efficient aircraft operated by a carrier with a sterling safety record," said R. Scott Barber, regional president and head of travel-management services for Caesars Entertainment. Guests of Caesars Entertainment who participate in the company's Total Rewards program may qualify for special reduced rates, vacation packages and additional rewards on flights to company resorts in locales such as Atlantic City, New Jersey; Tunica, Mississippi and Laughlin, Nevada. All packages include roundtrip airfare, hotel accommodations, ground transportation and baggage handling. For more information on the Caesars' Total Rewards program, visit www.totalrewardsair.com for flight information, pricing and trip dates. To book flights, guests can contact their casino host, local independent travel representative or the charter- reservations department at the link above or through www.caesars.com. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Pilots Jump to Each Section Below Contents by Clicking on the Title Or Photo

November 2018 Aero Crew News Your Source for Pilot Hiring and More... ExpressJet is taking off with a new Pilot Contract Top-Tier Compensation and Work Rules $40/hour first-year pay $10,000 annual override for First Officers, $8,000 for Captains New-hire bonus 100% cancellation and deadhead pay $1.95/hour per-diem Generous 401(k) match Friendly commuter and reserve programs ARE YOU READY FOR EXPRESSJET? FLEET DOMICILES UNITED CPP 126 - Embraer ERJ145 Chicago • Cleveland Spend your ExpressJet career 20 - Bombardier CRJ200 Houston • Knoxville knowing United is in Newark your future with the United Pilot Career Path Program Apply today at expressjet.com/apply. Questions? [email protected] expressjet.com /ExpressJetPilotRecruiting @expressjetpilots Jump to each section Below contents by clicking on the title or photo. November 2018 20 36 24 50 32 Also Featuring: Letter from the Publisher 8 Aviator Bulletins 10 Self Defense for Flight Crews 16 Trans States Airlines 42 4 | Aero Crew News BACK TO CONTENTS the grid New Airline Updated Flight Attendant Legacy Regional Alaska Airlines Air Wisconsin The Mainline Grid 56 American Airlines Cape Air Delta Air Lines Compass Airlines Legacy, Major, Cargo & International Airlines Hawaiian Airlines Corvus Airways United Airlines CommutAir General Information Endeavor Air Work Rules Envoy Additional Compensation Details Major ExpressJet Airlines Allegiant Air GoJet Airlines Airline Base Map Frontier Airlines Horizon Air JetBlue Airways Island Air Southwest Airlines Mesa Airlines Spirit Airlines -

Employee Newsletter

The Latest Airport Information INSIDEMSYMSYMSY SPRING 2010 VOL. 7 NO. 1 - A NEWSLETTER FOR EMPLOYEES AT LOUIS ARMSTRONG NEW ORLEANS INTERNATIONAL AIRPORT ○○○○○○ New Director of Aviation at the Helm ○○○○○○ ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ Frontier Airlines Returns to MSY Mr. Iftikhar Ahmad assumed his duties as the new Director of On May 20, new non-stop service ○○○○○○○○○○○○○○○○○○ Currently, without non-stop service, 102 Aviation of Louis Armstrong New was launched via Midwest Airlines on a people per day each way travel between Orleans International Airport on 76 seat Embraer 170 aricraft. Midwest Kansas City and New Orleans. The daily Monday, May 24. He was previously Airlines is part of Republic Holding who flight to Kansas City is scheduled to depart the director of the Dayton also operates as Frontier Airlines, Frontier New Orleans each morning at 11:35 a.m. International Airport in Ohio. Airlines dba Midwest Airlines, Republic Airlines, Republic Airlines dba Midwest In June, Frontier Airlines will Mr. Ahmad was selected by Airlines, Lynx Aviation or Chautauqua resume their daily non-stop direct to the New Orleans Aviation Board from Airlines dba Midwest Connect. Republic Denver. This Frontier flight also represents among six finalists for the job. A has announced that the joint branding and a return of air service lost to Hurricane national search was conducted to fill marketing efforts for all three airline names Katrina. We say “Welcome Back” to the position. He has an extensive (Frontier, Midwest, Republic) will become everyone with Frontier. background in management of large, one: FRONTIER. The Frontier name was ○○○○○○○○○○○○○○○○○ medium and small hubs as well as selected because it showed “greater AirTran Airways general aviation airports and capital growth potential”. -

Republic Airways Flight Attendant 2019 Tentative Agreement Review of Compensation and Benefits

Republic Airways Flight Attendant 2019 Tentative Agreement Review of Compensation and Benefits 1 Teamsters Local 135 Airline Division Major Contract Improvements Summary 1. Overall economic improvements 2. Wage rates o Wage scale increases of 5%, 1%, 1%, 2% and 2% in Years 1 through 5 of the agreement (these amounts do not in longevity increases). o Premium pay for credit hours above 87 per month. o Regional comparisons 3. Signing bonus o Total signing bonus of $3.0 million 4. Pay credit guarantee o Minimum daily credit of 3.5 hours 5. Per diem improvements 6. 401(k) employer contribution improvements 7. Guarantee Low Time (GLT) flight attendants employer premium contributions 8. Paid Days Off (PDO) 2 Teamsters Local 135 Airline Division 1. Overall economic improvements • The tentative agreement includes $35.7 million in economic improvements over the five years. o This amounts to an average improvement of $18,100 per flight attendant over five years. o Additionally, the 2019 Tentative Agreement represents $10.2 million in improvements above the rejected 2018 Tentative Agreement. 3 Teamsters Local 135 Airline Division 2. Wage rates YOS Current DOS DOS+1 DOS+2 DOS+3 DOS+4 $18.20 1* $19.70 $19.90 $20.10 $20.50 $20.91 $19.33 Annual Contract Increases: 2 $21.32 $22.39 $22.61 $22.84 $23.29 $23.76 • DOS: 5%* 3 $22.85 $23.99 $24.23 $24.47 $24.96 $25.46 • DOS+1: 1% 4 $24.24 $25.45 $25.71 $25.96 $26.48 $27.01 • DOS+2: 1% 5 $25.66 $26.94 $27.21 $27.48 $28.03 $28.59 • DOS+3: 2% 6 $27.03 $28.38 $28.67 $28.95 $29.53 $30.12 • DOS+4: 2% 7 $28.45 $29.87