Consolidated Financial Statements of the Nestlé Group 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nestlé Group 2012

Nestlé Group 2012 Nutrition to enhance the quality of life Key figures (consolidated) In millions of CHF 2012 Sales 92 186 Trading operating profit 14 012 as % of sales 15.2% Profit for the year attributable to shareholders of the parent (Net profit) 10 611 as % of sales 11.5% Capital expenditure 5 368 as % of sales 5.8% Equity attributable to shareholders of the parent (a) 60 947 Market capitalisation, end December 190 038 Operating cash flow 15 772 Free cash flow (b) 9 879 Net financial debt 18 152 Ratio of net financial debt to equity (gearing) 29.8% Per share Total basic earnings per share CHF 3.33 Underlying (c) CHF 3.37 Dividend (d) CHF 2.05 Stock exchange prices (high/low) CHF 62.30/52.50 Yield (e) % 3.3/3.9 (a) Before proposed appropriation of profit of Nestlé S.A. (b) Operating cash flow less capital expenditure, expenditure on intangible assets, sales of property, plant and equipment, investments (net of disinvestments) in associates and other investing cash flows. (c) Profit per share for the year attributable to shareholders of the parent before impairments, restructuring costs, results on disposals and significant one-off items. The tax impact from the adjusted items is also adjusted for. (d) As proposed by the Board of Directors of Nestlé S.A. (e) Calculated on the basis of the dividend for the year concerned, which is paid in the following year, and on high/low stock prices. Analysis of sales, trading operating profit and organic growth (OG) By operating segment Trading operating In millions of CHF Sales profit OG Zone Europe -

Financial Statements 2018

Financial Statements 2018 Consolidated Financial Statements of the Nestlé Group 2018 152nd Financial Statements of Nestlé S.A. Consolidated Financial Statements of the Nestlé Group 2018 Consolidated Financial Statements of the Nestlé Group 2018 63 65 Principal exchange rates 160 Statutory Auditor’s Report – Report on the Audit of the 66 Consolidated income statement for Consolidated Financial Statements the year ended December 31, 2018 166 Financial information – 5 year review 67 Consolidated statement of comprehensive income for the year 168 Companies of the Nestlé Group, joint ended December 31, 2018 arrangements and associates 68 Consolidated balance sheet as at December 31, 2018 70 Consolidated cash fl ow statement for the year ended December 31, 2018 71 Consolidated statement of changes in equity for the year ended December 31, 2018 73 Notes 73 1. Accounting policies 77 2. Scope of consolidation, acquisitions and disposals of businesses, assets held for sale and acquisitions of non-controlling interests 83 3. Analyses by segment 93 4. Net other trading and operating income/ (expenses) 94 5. Net fi nancial income/(expense) 95 6. Inventories 7. Trade and other receivables/payables 97 8. Property, plant and equipment 101 9. Goodwill and intangible assets 107 10. Employee benefi ts 117 11. Provisions and contingencies 119 12. Financial instruments 134 13. Taxes 137 14. Associates and joint ventures 139 15. Earnings per share 140 16. Cash fl ow statement 143 17. Equity 148 18. Transactions with related parties 150 19. Guarantees 20. Effects -

PDF-Xchange 4.0 Examples

WorldReginfo - f65a79fa-dec3-4614-8df6-74077a403cfa - WorldReginfo Annual Review 2015 Nestlé – Annual Review 2015 Our business Nestlé has grown from a company founded 150 years ago to a global leader in Nutrition, Health and Wellness. Wherever you are in What we sell (in CHF billion) the world we have safe, nutritious products to Powdered and Nutrition and Milk products Prepared dishes Liquid Beverages Health Science and Ice cream and cooking aids help you care for yourself and your family. Our product portfolio has seven categories, offering you 19.2 14.9 14.6 12.6 healthier and tastier choices at every stage of your life, at every time of the day. PetCare Confectionery Water 11.5 8.9 7.1 Our growth has enabled Where we sell (in CHF billion) us to help improve the lives of millions of people through the products EMENA and services we provide, 27.5 and through employment, our supplier networks and the contribution we make to economies around the world. AMS AOA 39.1 22.2 Number of employees Number of countries we sell in 335 000 189 Total group salaries and social Corporate taxes paid in 2015 welfare expenses (in CHF) (in CHF) 16 billion 3.3 billion WorldReginfo - f65a79fa-dec3-4614-8df6-74077a403cfa Our commitments Our 39 commitments in the Nestlé in society report guide all of us at Nestlé in our collective efforts to meet specific objectives. For a company to prosper Nutrition, health and wellness over the long term and create value for shareholders, it 192 billion 8041 must create value for society at the same time. -

Nestlé in the Greater China Region

Facts and Figures (July 2013) Nestlé in the Greater China Region Geographic area • China, Hong Kong, Macau, Taiwan Employees • About 50,000 (includes all partnerships, globally managed businesses and acquisitions, such as Yinlu Foods, Nestlé Professional, Nespresso, Nestlé Waters, and Wyeth Nutrition) Sales (2012) • CHF 5.2 billion • 35 million products sold every day • More than 90% of products sold in China are locally manufactured Nestlé sites in China • 1 corporate headquarters (Beijing) • 27 factories • 4 research and development centres (Beijing, Shanghai, Xiamen and Dongguan) • 4 Nespresso boutiques (Beijing, Hong Kong and Shanghai) Partnerships / products / • Hsu Fu Chi / confectionery, cereal-based snacks, packaged cakes and % held by Nestlé traditional Chinese snack ‘sachima’ / 60% • Yinlu / ready-to-eat rice congee and ready-to-drink peanut milk / 60% • Totole / bouillons, recipe mixes, sauces / 80% • Haoji / bouillons, spicy pastes / 80% • Dashan / bottled water / 70% Research and development • R&D Beijing: provides specialised support in packaging and analytical science and in development of dairy, nutrition, cereal, beverage mix, and pet care products with strong focus on food safety and quality and consumer insights. Strong basic research in health science. • R&D Shanghai: specialises in development of culinary products for retail, ‘out- of-home’ products for Nestlé Professional, and ice cream. Drives systems innovation in China, including beverage brands such as Nescafé Dolce Gusto. • R&D Xiamen: due to open in 2013. Specialised -

Corporate Governance Report 2018 Compensation Report 2018 Financial Statements 2018

Financial Statements 2018 Compensation Report 2018 Corporate Governance Report 2018 Good Food, Good Life Good Food, Nestlé – Corporate Governance Report 2018 | Compensation Report 2018 | Financial Statements 2018 Contents 1 Corporate Governance Report 2018 3 Group structure and shareholders 4 Capital structure 6 Board of Directors 18 Executive Board 22 Compensation, shareholdings and loans 23 Shareholders’ participation 24 Change of control and defence measures 25 Auditors 26 Information policy 27 General Organization of Nestlé S.A. 29 Compensation Report 2018 49 Statutory Auditor’s Report to the General Meeting 51 Articles of Association of Nestlé S.A. 61 Financial Statements 2018 63 Consolidated Financial Statements of the Nestlé Group 2018 65 Principal exchange rates 66 Consolidated income statement for the year ended December 31, 2018 67 Consolidated statement of comprehensive income for the year ended December 31, 2018 68 Consolidated balance sheet as at December 31, 2018 70 Consolidated cash flow statement for the year ended December 31, 2018 71 Consolidated statement of changes in equity for the year ended December 31, 2018 73 Notes 160 Statutory Auditor’s Report – Report on the Audit of the Consolidated Financial Statements 166 Financial information – 5 year review 168 Companies of the Nestlé Group, joint arrangements and associates 191 152nd Financial Statements of Nestlé S.A. 193 Income statement for the year ended December 31, 2018 194 Balance sheet as at December 31, 2018 195 Notes to the annual accounts 204 Proposed appropriation of profit 206 Statutory Auditor’s Report – Report on the Audit of the Financial Statements Front cover S.Pellegrino Essenza: Capturing the consumer shift to healthy hydration Our flagship premium waters brand is well positioned to strengthen its segment leadership with the addition of exciting fruit flavors. -

Raquel Lobão Evangelista.Pdf

Universidade do Minho Instituto de Ciências Sociais Raquel Lobão Evangelista abilidade: tent Comunicação organizacional e Sustentabilidade: Uma relação de mutualismo Comunicação organizacional e Sus Uma relação de mutualismo a elist uel Lobão Evang aq R 4 1 UMinho|20 fevereiro de 2014 Universidade do Minho Instituto de Ciências Sociais Raquel Lobão Evangelista Comunicação organizacional e Sustentabilidade: Uma relação de mutualismo Tese de Doutoramento em Ciências da Comunicação Especialidade em Comunicação Estratégica e Organizacional Trabalho realizado sob orientação da Professora Doutora Teresa Ruão e da Professora Doutora Helena Sousa fevereiro de 2014 A Portugal, país que por seis anos me acolheu, onde me tornei uma alfacinha de coração, onde superei meus próprios limites, onde descobri minhas origens, onde acumulei as experiências mais ricas de minha vida e cuja saudade já dói no peito. iii iv AGRADECIMENTOS As minhas orientadoras Professora Doutora Helena Sousa e Professor Doutora Teresa Ruão, pelos ensinamentos, conselhos e compreensão. Ao Francisco, a maior bênção de Deus em minha vida. A minha família, fonte de força e apoio permanente. A Renata de Freitas, minha luz nos momentos felizes e tristes. v Financiamento Investigação desenvolvida com apoio da FCT (Fundação para a Ciência e a Tecnologia) e cofinanciada pelo Fundo Social Europeu e pelo Programa Operacional Potencial Humano/POPH: vi RESUMO Comunicação Organizacional e Sustentabilidade: uma relação de mutualismo Esta investigação aborda as características que marcam a relação entre os conceitos de Comunicação Organizacional e Sustentabilidade, especialmente aquelas que dizem respeito aos níveis de participação, diálogo e comprometimento dos stakeholders, a partir de um estudo de caso aplicado a uma empresa líder de vendas do setor alimentar. -

Half-Yearly Report January–June 2011 Shareholder Information

Half-Yearly Report January–June 2011 Shareholder information Stock exchange listing Important dates Nestlé S.A. shares are listed on the SIX Swiss Exchange 20 October 2011 (ISIN code: CH0038863350). American Depositary Receipts 2011 Nine months sales figures (ADRs) (ISIN code: US6410694060) representing Nestlé S.A. shares are offered in the USA by Citibank. 16 February 2012 2011 Full Year Results Registered Offices Nestlé S.A. 19 April 2012 Avenue Nestlé 55 145th Annual General Meeting, “Palais de Beaulieu”, CH-1800 Vevey (Switzerland) Lausanne tel.: +41 (0)21 924 21 11 Nestlé S.A. (Share Transfer Office) Zugerstrasse 8 CH-6330 Cham (Switzerland) tel.: +41 (0)41 785 20 20 Further information For additional information, contact: Nestlé S.A. Investor Relations Avenue Nestlé 55 CH-1800 Vevey (Switzerland) tel.: +41 (0)21 924 35 09 fax: +41 (0)21 924 28 13 e-mail: [email protected] As to information concerning the share register (registrations, transfers, address changes, dividends, etc.), please contact: Nestlé S.A. (Share Transfer Office) Zugerstrasse 8 CH-6330 Cham (Switzerland) tel.: +41 (0)41 785 20 20 fax: +41 (0)41 785 20 24 e-mail: [email protected] The Half-Yearly Report is available on-line as a PDF file in English, French and German. The Company offers the possibility of depositing, free of charge, Nestlé S.A. shares traded on the SIX Swiss Exchange. Nestlé URL: www.nestle.com Letter to shareholders Fellow shareholders, Nestlé continued to make good progress in a period half year. There was a decrease in Group sales of 12.9% characterised by political and economic instability, natural to CHF 41 billion, due to an impact of 13.8% from foreign disasters, rising raw material prices and, yes, a strong exchange and of 6.6% from divestitures, net of acquisitions. -

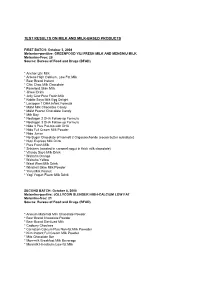

Test Results on Milk and Milk-Based Products

TEST RESULTS ON MILK AND MILK-BASED PRODUCTS FIRST BATCH: October 3, 2008 Melamine-positive: GREENFOOD YILI FRESH MILK AND MENGNIU MILK Melamine-Free: 28 Source: Bureau of Food and Drugs (BFAD) * Anchor Lite Milk * Anlene High Calcium, Low Fat Milk * Bear Brand Instant * Chic Choc Milk Chocolate * Farmland Skim Milk * Jinwei Drink * Jolly Cow Pure Fresh Milk * Kiddie Soya Milk Egg Delight * Lactogen 1 DHA Infant Formula * M&M Milk Chocolate Candy * M&M Peanut Chocolate Candy * Milk Boy * Nestagen 2 DHA Follow-up Formula * Nestagen 3 DHA Follow-up Formula * Nido 3 Plus Pre-bio with DHA * Nido Full Cream Milk Powder * Nido Junior * No Sugar Chocolate of Isomalt 2 Oligosaccharide (cocoa butter substitute) * Nutri Express Milk Drink * Pura Fresh Milk * Snickers (roasted in caramel nogut in thick milk chocolate) * Vitasoy Soya Milk Drink * Wahaha Orange * Wahaha Yellow * Want Want Milk Drink * Windmill Skim Milk Powder * Yinlu Milk Peanut * Yogi Yogurt Flavor Milk Drink SECOND BATCH: October 8, 2008 Melamine-postive: JOLLYCOW SLENDER HIGH-CALCIUM LOW FAT Melamine-free: 21 Source: Bureau of Food and Drugs (BFAD) * Anmum Maternal Milk Chocolate Powder * Bear Brand Chocolate Powder * Bear Brand Sterilized Milk * Cadbury Choclairs * Carnation Calcum Plus Non-fat Milk Poweder * Klim Instant Full Cream Milk Powder * Milo Chocolate Bar * Mon-milk Breakfast Milk Beverage * Monmilk Hi-calcuim Low-fat Milk * Monmilk Milk Deluxe Pure Milk * Nestlé Chocolate Flavored Ice Cream * Nestlé Dairy Farm Pure Milk * Nestlé Fresh Mlk * Nestlé Kit Kat * Nestlé Milk -

China and LA County, BYD Has Offices in Europe, Japan, South Korea, India, Taiwan, and Other Regions

GROWING TOGETHER China and Los Angeles County GROWING TOGETHER China and Los Angeles County PREPARED BY: Ferdinando Guerra, International Economist Principal Researcher and Author with special thanks to George Entis, Research Assistant June, 2014 Los Angeles County Economic Development Corporation Kyser Center for Economic Research 444 S. Flower St., 37th Floor Los Angeles, CA 90071 Tel: (213) 622-4300 or (888) 4-LAEDC-1 Fax: (213)-622-7100 E-mail: [email protected] Web: http://www.laedc.org The LAEDC, the region’s premier business leadership organization, is a private, non-profit 501(c)3 organization established in 1981. GROWING TOGETHER China and Los Angeles County As Southern California’s premier economic development organization, the mission of the LAEDC is to attract, retain, and grow businesses and jobs for the regions of Los Angeles County. Since 1996, the LAEDC has helped retain or attract more than 198,000 jobs, providing over $12 billion in direct economic impact from salaries and over $850 million in property and sales tax revenues to the County of Los Angeles. LAEDC is a private, non-profit 501(c)3 organization established in 1981. Regional Leadership The members of the LAEDC are civic leaders and ranking executives of the region’s leading public and private organizations. Through financial support and direct participation in the mission, programs, and public policy initiatives of the LAEDC, the members are committed to playing a decisive role in shaping the region’s economic future. Business Services The LAEDC’s Business Development and Assistance Program provides essential services to L.A. County businesses at no cost, including coordinating site searches, securing incentives and permits, and identifying traditional and nontraditional financing including industrial development bonds. -

General Corporation Tax (GCT)

CITY OF NEW YORK DEPARTMENT OF FINANCE 1998 - STOCK ALLOCATION BELOW 100 PERCENT REPORT NAME ISSUERS ALLOCATION PERCENT NAME ISSUERS ALLOCATION PERCENT #78 GIAC LEASING CORPORATION 1.33 A F FIRE PROTECTION CO INC 13.54 "K" LINE AIR SERVICE (U.S.A.) 23.80 A F LEWIS & CO OF NEW YORK 23.20 A B DISTRIBUTORS INC 92.94 A F SUPPLY CORP 82.38 A L SHET METAL FABRICATIONS 69.80 A FEIBUSCH CORP 83.30 A & B AGENCY 25.00 A FINE GAUGE INC 59.27 A & C MECHANICAL INC LONG IS 0.44 A FOSTER HIGGINS INC 16.05 A & D ENTERPRISES, INC 75.45 A G EDWARDS SONS INC 1.45 A & D MECHANICAL INC 65.57 A G H TRIMSOURCE INC 76.57 A & E BUSINESS ADVISORS INC 67.80 A G INTERNATIONAL INC 17.20 A & E DENTAL STUDIO INC 89.20 A G INTERTAINMENT 7.67 A & E MANAGEMENT SYST 2.00 A H ENGINEERS PC 97.22 A & F INSTALLATIONS INC 10.19 A H HARRIS SONS INC 0.17 A & J FIXTURES INC 10.20 A H SCHREIBER CO INC 24.04 A & J FIXTURES, INC. 5.81 A H SPORTSWEAR CO INC 69.19 A & J HEATING & AIR CONDITIONISERVICE 62.50 A H VIDEO SALES REPRESENTIVE 59.56 A & M BILLING CONSULTANTS INC 17.30 A HARTRODT VIA INC 63.60 A & M BRONX BAKING INC 24.95 A HELLER METALS CO INC 90.88 A & N DELIVERY SERVICE, INC. 10.09 A I & ASSOCIATES INC 5.08 A & R DEVELOPMENT INC 45.42 A I PROFESSIONAL CLEANING 88.00 A & R RECYCLING INC. -

Nestlé Waters Is Leading a Fast‑Growing Category, with a Unique Brand Portfolio Including the World’S Largest Water Brand, Nestlé Pure Life

Nestlé – Annual Review 2017 Good Food, Good Life Annual Review 2017 Nestlé. Enhancing quality of life and contributing to a healthier future. WorldReginfo - d1a94fd3-260e-4ebe-b3d1-b77a35d9f812 Our purpose Nestlé. Enhancing quality of life and contributing to a healthier future. Nestlé is the world’s largest food and beverages company and is present in 189 countries around the world. We offer a wide portfolio of products and services for people and their pets throughout their lives. Our more than 2000 brands range from global icons like Nescafé and Nespresso to local favourites like Ninho. Nestlé is based in the Swiss town of Vevey where it was founded more than 150 years ago. Contents Accompanying reports 2 Letter to our shareholders Annual Review 2017 6 Our strategy Corporate Governance Report 2017 Compensation Report 2017 10 Innovating for a changing world Financial Statements 2017 14 Connecting through our brands 26 Creating Shared Value 38 Financial review Online 54 Corporate Governance and Compliance You can find more information about the Nestlé Group at 61 Shareholder information www.nestle.com Find out more about Creating Shared Value at www.nestle.com/csv WorldReginfo - d1a94fd3-260e-4ebe-b3d1-b77a35d9f812 Our performance Our performance is driven by our Nutrition, Health and Wellness strategy, the engine of our value creation. Our 2017 organic sales Group sales (in CHF) Organic growth * Real internal growth * growth was within the guided range but below our 89.8 billion 2.4% 1.6% expectations. Our cost reduction initiatives delivered margin improvement ahead of expectations. On the right is a summary of the results Underlying trading Underlying trading Underlying trading we achieved during the year. -

The World's Leading Nutrition, Health and Wellness Company Annual

The World’s leading Nutrition, Health and Wellness Company Annual Report 2011 Our objective is to be the recognised leader in Nutrition, Health and Wellness and the industry reference for financial performance Table of contents 2 Letter to our shareholders 30 Financial review 6 Corporate Governance 31 Principal key figures (illustrative) and Compliance 32 Overview Board of Directors of Nestlé S.A. 42 Management responsibilities: 7 Executive Board of Nestlé S.A. Continuing operations 11 The Nestlé Roadmap to 44 Leading positions Good Food, Good Life in dynamic categories Four competitive advantages 46 Geographic data: Four growth drivers people, factories and sales 12 Four operational pillars 48 Shareholder information 13 2011 Highlights 16 Innovating in Nutrition, Health and Wellness 20 Growing with emerging consumers and PPP globally 26 Adding value through innovation and premiumisation Accompanying reports Creating Shared Value Corporate Governance Report 2011 Summary Report 2011 2011 Financial Statements The brands in italics are registered trademarks of the Nestlé Group. Key figures (consolidated) Continuing operations In millions of CHF (except per share data) 2010 2010 2011 Sales (a) 93 015 87 906 83 642 Trading operating profit (a) 14 832 12 676 12 538 as % of sales 15.9% 14.4% 15.0% Profit for the period attributable to shareholders of the parent (Net profit) 34 233 8 777 9 487 as % of sales 36.8% 11.3% Equity attributable to shareholders of the parent before proposed appropriation of profit of Nestlé S.A. 61 867 56 797 Market capitalisation, end December 178 316 171 287 Operating cash flow 13 608 11 724 9 763 Free cash flow(b) 7 761 4 491 Capital expenditure 4 576 4 384 4 779 as % of sales 4.9% 5.0% 5.7% Net financial debt 3 854 14 319 Ratio of net financial debt to equity (gearing) 6.2% 25.2% Per share Total basic earnings per share CHF 10.16 2.60 2.97 Underlying (c) CHF 3.32 3.08 Dividend as proposed by the Board of Directors of Nestlé S.A.