Financial Statements 2019 Consolidated Financial Statements of the Nestlé Group 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

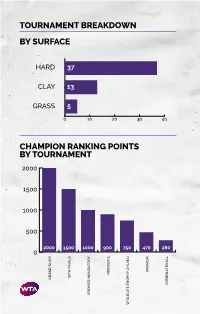

Tournament Breakdown by Surface Champion Ranking Points By

TOURNAMENT BREAKDOWN BY SURFACE HAR 37 CLAY 13 GRASS 5 0 10 20 30 40 CHAMPION RANKING POINTS BY TOURNAMENT 2000 1500 1000 500 2000 1500 1000 900 750 470 280 0 PREMIER PREMIER TA FINALS TA GRAN SLAM INTERNATIONAL PREMIER MANATORY TA ELITE TROPHY HUHAI TROPHY ELITE TA 55 WTA TOURNAMENTS BY REGION BY COUNTRY 8 CHINA 2 SPAIN 1 MOROCCO UNITED STATES 2 SWITZERLAND 7 OF AMERICA 1 NETHERLANDS 3 AUSTRALIA 1 AUSTRIA 1 NEW ZEALAND 3 GREAT BRITAIN 1 COLOMBIA 1 QATAR 3 RUSSIA 1 CZECH REPUBLIC 1 ROMANIA 2 CANADA 1 FRANCE 1 THAILAND 2 GERMANY 1 HONG KONG 1 TURKEY UNITED ARAB 2 ITALY 1 HUNGARY 1 EMIRATES 2 JAPAN 1 SOUTH KOREA 1 UZBEKISTAN 2 MEXICO 1 LUXEMBOURG TOURNAMENTS TOURNAMENTS International Tennis Federation As the world governing body of tennis, the Davis Cup by BNP Paribas and women’s Fed Cup by International Tennis Federation (ITF) is responsible for BNP Paribas are the largest annual international team every level of the sport including the regulation of competitions in sport and most prized in the ITF’s rules and the future development of the game. Based event portfolio. Both have a rich history and have in London, the ITF currently has 210 member nations consistently attracted the best players from each and six regional associations, which administer the passing generation. Further information is available at game in their respective areas, in close consultation www.daviscup.com and www.fedcup.com. with the ITF. The Olympic and Paralympic Tennis Events are also an The ITF is committed to promoting tennis around the important part of the ITF’s responsibilities, with the world and encouraging as many people as possible to 2020 events being held in Tokyo. -

1251 Wisconsin Avenue Nw

1251 WISCONSIN AVENUE NW 1251 WISCONSIN AVE NW GEORGETOWN TOTAL RETAIL SF WASHINGTON, DC 20007 5,000- 7,000 PRIME RETAIL SPACE IN THE HEART OF GEORGETOWN NEIGHBORING RETAILERS DELIVERY: Immediate SPACE AVAILABLE 4,950 SF — First Floor 2,604 SF — Mezzanine DETAILS • Available Immediately • Currently Chubbies space • Open ceiling DEMOGRAPHIC SNAPSHOT • Mezzanine space available • Same block/side as Apple, Ralph Lauren, Tory Burch, Ann Taylor, Loft, and Kendra Scott $ POPULATION EMPLOYEES MEDIAN HHI 1/2 mi — 9,281 1/2 mi — 14,235 1/2 mi — $146,146 1 mi — 43,966 1 mi — 114,006 1 mi — $103,437 CONTACT EDUCATION MEDIAN AGE WALK SCORE RICH AMSELLEM (Bachelor’s Degree+) 1/2 mi — 32.89 (98) Walker’s Paradise 240.479.7216 1/2 mi — 91.52% 1 mi — 30.60 Daily errands do not [email protected] 1 mi — 85.88% require a car. CORRIDOR CORRIDOR Pie Sisters Revolution Cycles Bicycle Pro Running Company University Georgetown Prepared By: MAY 2018 MAY neighborhood retailmap GEORGETOWN 3,554 Employees 3,554 Cady’s Alley Cady’s Ukraine Embassy Starbucks (coming soon) Students 16,437 Contemporaria District Donut Leopold’s Kafe Leopold’s Circa Lighting Jeweler Werk Artist’s Proof Artist’s L2 Lounge Bonobos Ledbury Babette Bulthap BoConcept Pedini Relish Escape Room Design Within Reach The North Face Rent the Runway MAP Baker Furniture Vacant Calligaris The Shade Store FedEx Kino’s Poggenpohl (second level) Cady’s Alley Entrance Waterworks Brandy Melville Vacant CB2 Janus et Cie Alice & Olivia B&B Italia Georgetown Cupcake Intermix Peet’s Coffee Club Monaco Parking Lot Good Stuff Eatery NOTABLE AREARETAILERS NOTABLE Vacant Georgetown Allure Harmony Cafe Falafel Inc Blue BottleCoffee Pizzeria Paradiso Goergetown Piano Bar Jinx Proof Tattoo 101 ParkingSpaces 40,500sf Retail(2-stories) InterestsInc McCaffery 3220 ProspectStNW Prospect Place J. -

Veggie Planet 2017

The economy: Our enemy? Big corporations: Friend, enemy or partner of the vegan movement? Renato Pichler, Swissveg-President Kurt Schmidinger, Founder „Future Food“ Talk on Nov. 2017 for CARE in Vienna 1 Who we are Renato Pichler • Since 24 years vegan • Founder and CEO of the V-label-project (since 1996) • Since 1993 I have been working full-time for the largest Swiss vegetarian and vegan organisation: Swissveg • I am also in the board of the European Vegetarian Union and Das Tier + Wir (animal ethics education in schools) Kurt Schmidinger • Master in geophysics and doctor in food science also software-engineer and animal rights activist • Founder and CEO of „Future Food“ • Scientific board member of Albert-Schweitzer-Stiftung, VEBU, GFI, etc. 2 What should we buy? When we buy a product: We support the producer and the merchant. If we buy meat, we support the meat-industry. If we buy a vegan product, we support the vegan industry. 3 What should we buy? Consequences of the success of the vegan movement: ● even meat-producers have a vegan product-range ● big corporations are interested in the vegan-market Should a vegan buy a vegan product from a meat-producer of a big corporation? 4 Role Play Kurt Opponinger: I’m against it! Kurt Proponinger: I support every vegan product! ? 5 Defining the goals 1) Simplifying life for vegans 2) Reduce meat consumption – increase consumption of vegan products 3) Establishing vegan as the norm in society 4) Support the small pure vegan-shops/producers Depending on the main goal, the optimal procedure can change. -

Catalyst Manufacturing: MAGGI 2-Minute Noodle Wrapper Project

Catalyst Manufacturing: MAGGI 2-minute Noodle wrapper project By LUZANNE RAUTENBACH 25106334 Submitted in partial fulfilment of the requirements for the degree of BACHELORS OF INDUSTRIAL ENGINEERING In the FACULTY OF ENGINEERING, BUILT ENVIROMENT AND INFORMATION TECHNOLOGY UNIVERSITY OF PRETORIA October 2010 EXECUTIVE SUMMARY The main product manufactured at Catalyst Manufacturing is MAGGI 2-minutes noodles. The noodle line consists of 8 lines which are designed to do 40 cuts x 4 lines a minute, yielding 160 noodle cakes per minute. Catalyst Manufacturing is currently experiencing major problems within the production line, resulting in large overhead costs and a vast number of defective products. 2009 year-end statistics indicate an average noodle loss (noodle cake and dough) of 7.94% against an allowed loss of 4%. Rework that could not be absorbed during 2009 amounted to 328 tons at a product value of R 3.8 million. The nature of this project will mainly focus on the application of simulation and management financing techniques applied in the production line at Catalyst Manufacturing. The goal of the project is to allocate weight to each individual problem to establish the financial overheads associated with each area. By means of this data, a variety of cost-efficient solutions can be generated to reduce the overall losses in the system. 2 TABLE OF CONTENTS Executive Summary ........................................................................................................ 1 Chapter 1 – Introduction................................................................................................. -

Nestlé-Portfólio Food Ver2018 1.Pdf

Cereais Cereals PRINCIPAL SKU Mel Bolacha Maria 5 Cereais Chocolate Mel Cereais Integrais 8(2x350g)/(14x300g) (14x250g) (14x250g) (14x250g) (14x250g) Aveia e Maçã Aveia e Morango Arroz Pensal S/ Leite (14x250g) (14x250g) (8x300g) Cacau (14x250g) Lácteos e Leite em Pó Dairy Products and Milk Powder Leite Condensado Leite Condensado Leite Condensado Magro Leite Condensado (12x370g) Cozido (12x397g) Cozido (12x387g) Magro (12x387g) Nido Molico (8x700g) (6x400g) Achocolatados e Bebidas Aromatizadas Chocolate and Flavored Drinks Nesquik Nesquik Nesquik ExtraChoc (6x800g) (12x400g) (12x390g) Chocolate Nesquik Menos Açúcar (12x390g) (12x450g) Tabletes Extrafino Extrafino Tablets Chocolate de Leite 3 Chocolates Chocolate de Leite Chocolate Preto 4(30x50g) (25x120g) (28x125g)/(15x300g) (15x300g)/(28x125g) Chocolate Preto 70% Chocolate Leite Avelãs Chocolate Leite Amêndoas (25x120g) (28x123g) (28x123g)/(15x300g) Tabletes Classic Classic Tablets Chocolate de Leite Chocolate de Leite Chocolate Preto Chocolate Leite com (24x20g) (20x90g) (20x90g) Caramelo (19x100g) Chocolate Preto com Chocolate de Leite com Recheio de Chocolate de Leite com Trufa (19x100g) Leite e Café Solúvel (19x100g) Amendoim (18x90g) Tabletes Tablets CRUNCH Leite CRUNCH Leite (20x100g) (15x40g) CRUNCH Preto Milkybar Branco (20x100g) (20x100g) Snacks Lion Single Lion Peanut (24x42g)/26(3X42g) (24x41g)/10(4x41g) Lion Mini Toffee Crisp (16x198g) (24x38g) Snacks Kit Kat Single (24x41.5g)/ Kit Kat Mini Kit Kat Chunky Kit Kat Chunky Peanut Butter (24x3x41,5g)/(24x5x41,5g) (24x200g) -

BORME-A-2020-139-99.Pdf

BOLETÍN OFICIAL DEL REGISTRO MERCANTIL Núm. 139 Martes 21 de julio de 2020 Pág. 25388 SECCIÓN PRIMERA Empresarios Actos inscritos ÍNDICE ALFABÉTICO DE SOCIEDADES A A M G PUBLICIDAD & GESTION DE COBROS SL. BORME-A-2020-139-28 (233896) A NOIESA CAMBADOS SOCIEDAD LIMITADA. BORME-A-2020-139-36 (234187) A.G. Y ASOCIADOS IMPOCAN SL(R.M. LAS PALMAS). BORME-A-2020-139-35 (233420) AB SCIEX SPAIN SL. BORME-A-2020-139-28 (233690) ABBOTT MEDICAL ESPAÑA SA. BORME-A-2020-139-28 (233825) ABC SANT FELIU SL. BORME-A-2020-139-08 (232902) ABERTIS INFRAESTRUCTURAS SA. BORME-A-2020-139-28 (233738) ABILLE EUROPA S.L. BORME-A-2020-139-08 (233025) ABOGADOS Y ECONOMISTAS CONCURSALISTAS INTEGRADOS, SOCIEDAD CIVIL BORME-A-2020-139-35 (233424) PROFESIONAL(R.M. LAS PALMAS). ABUPROS&PATRIMONIAL COMPANY SA. BORME-A-2020-139-46 (234300) ACABADOS Y PROYECCIONES SL. BORME-A-2020-139-46 (234339) ACBS MABES SA. BORME-A-2020-139-47 (234660) ACBS MABES SA. BORME-A-2020-139-47 (234661) ACCENTURE HOLDINGS IBERIA SL. BORME-A-2020-139-28 (233695) ACJ SOCIEDAD ANONIMA(R.M. LAS PALMAS). BORME-A-2020-139-35 (233438) ACM CONTRACT SL. BORME-A-2020-139-28 (233548) ACTIUS RENTABLES GESTIO INTEGRAL SOCIEDAD LIMITADA. BORME-A-2020-139-43 (234224) ADASA SISTEMAS SA. BORME-A-2020-139-08 (233043) ADDO IMPRESORES SOCIEDAD ANONIMA LABORAL. BORME-A-2020-139-46 (234586) ADM WILD VALENCIA SA. BORME-A-2020-139-46 (234325) AENIUM ENGINEERING SL. BORME-A-2020-139-47 (234675) AENIUM ENGINEERING SL. BORME-A-2020-139-47 (234676) AENOR INTERNACIONAL SA. -

Special Offers 1 St August - 30Th September 2021

SOUTH LINCS FOODSERVICE SPECIAL OFFERS 1 ST AUGUST - 30TH SEPTEMBER 2021 THE PERFECT CARVERY INDULGENT DESSERTS WINE & DINE Everything you need to Explore our desserts range Find various wines and serve a delicious carvery, and stock up on indulgent spirits on sale in this issue including fresh meats and treats, including cakes and to pair with all your culinary quality chips. - Pg 2 ice cream. - Pg 7 creations. - Pg 18 Tel. 01205 460 700 [email protected] southlincsfoodservice.co.uk SWEET TREATS MALTED CIAPANINI pg5 CARAMEL AND CAPPUCINO ROULADE pg 9 AURESCO COFFEE pg13 MEAT AND POTATO PRODUCTS SPECIAL OFFERS 1st August - 30th September 2021 Vegan Vegan Vegan IDEAL FOR CARVERY £9.99 £13.99 £13.99 4 x 2.27kg 4 x 2.27kg 4 x 2.27kg Straight Cut Thin Chips (3/8) SureCrisp Thin Cut Fries SureCrisp Skin On Fries (3/8) GLUTEN-FREE VEGAN GLUTEN-FREE VEGAN GLUTEN-FREE VEGAN POTMCC001 4 x 2.27kg £19.26 £9.99 POTMCC008 4 x 2.27kg £26.71 £13.99 POTMCC045 4 x 2.27kg £26.71 £13.99 ● Delicious and crispy thin cut fries – ideal for a wide ● Coated fries that stay crispy from the first to the last ● Coated fries with a rustic, fresh-style appeal stays range of fast food outlets. McCain. bite in restaurant and in delivery. McCain. crispy from the first to the last bite in restaurant and in delivery. McCain. Vegan Vegan Vegan £7.99 £8.99 £13.99 £13.99 1 x 4-6kg 4 x 2.27kg 4 x 2.27kg 4 x 2.27kg PAIR WITH Original Choice SureCrisp Medium Skin On Chips SureCrisp Skin On Julienne Fresh Topside (Pre-Order) Thick Cut Chips (9/16) GLUTEN-FREE VEGAN GLUTEN-FREE VEGAN GLUTEN-FREE VEGAN ● 4” Yorkshire Puddings UNCBEE03 1 x 4-6kg £10.62 £7.99 POTMCC006 4 x 2.27kg £19.26 £8.99 POTMCC042 4 x 2.27kg £29.29 £13.99 POTMCC044 4 x 2.27kg £29.88 £13.99 Y4CFE 1 x 60 £12.88 £6.99 ● # One of the best beef roasting joints and is ideally suited for a carvery. -

2020 Women’S Tennis Association Media Guide

2020 Women’s Tennis Association Media Guide © Copyright WTA 2020 All Rights Reserved. No portion of this book may be reproduced - electronically, mechanically or by any other means, including photocopying- without the written permission of the Women’s Tennis Association (WTA). Compiled by the Women’s Tennis Association (WTA) Communications Department WTA CEO: Steve Simon Editor-in-Chief: Kevin Fischer Assistant Editors: Chase Altieri, Amy Binder, Jessica Culbreath, Ellie Emerson, Katie Gardner, Estelle LaPorte, Adam Lincoln, Alex Prior, Teyva Sammet, Catherine Sneddon, Bryan Shapiro, Chris Whitmore, Yanyan Xu Cover Design: Henrique Ruiz, Tim Smith, Michael Taylor, Allison Biggs Graphic Design: Provations Group, Nicholasville, KY, USA Contributors: Mike Anders, Danny Champagne, Evan Charles, Crystal Christian, Grace Dowling, Sophia Eden, Ellie Emerson,Kelly Frey, Anne Hartman, Jill Hausler, Pete Holtermann, Ashley Keber, Peachy Kellmeyer, Christopher Kronk, Courtney McBride, Courtney Nguyen, Joan Pennello, Neil Robinson, Kathleen Stroia Photography: Getty Images (AFP, Bongarts), Action Images, GEPA Pictures, Ron Angle, Michael Baz, Matt May, Pascal Ratthe, Art Seitz, Chris Smith, Red Photographic, adidas, WTA WTA Corporate Headquarters 100 Second Avenue South Suite 1100-S St. Petersburg, FL 33701 +1.727.895.5000 2 Table of Contents GENERAL INFORMATION Women’s Tennis Association Story . 4-5 WTA Organizational Structure . 6 Steve Simon - WTA CEO & Chairman . 7 WTA Executive Team & Senior Management . 8 WTA Media Information . 9 WTA Personnel . 10-11 WTA Player Development . 12-13 WTA Coach Initiatives . 14 CALENDAR & TOURNAMENTS 2020 WTA Calendar . 16-17 WTA Premier Mandatory Profiles . 18 WTA Premier 5 Profiles . 19 WTA Finals & WTA Elite Trophy . 20 WTA Premier Events . 22-23 WTA International Events . -

LAS VEGAS PRODUCT CATALOG INGREDIENTS Full Page Ad for FINE PASTRY 11”X 8.5”

PRODUCT CATALOG LAS VEGAS chefswarehouse.com BAKING AND PASTRY FROZEN/RTB BREAD ...................12 BEVERAGES, GOAT CHEESE ............................21 CONDIMENTS BAKING JAM ..............................4 PIZZA SHELLS ...............................12 COFFEE AND TEA GOUDA.......................................21 AND JAMS TORTILLAS/WRAPS ......................12 HAVARTI.......................................22 BAKING MIXES ............................4 BAR MIXERS ................................17 CHUTNEY ....................................25 WRAPPERS ..................................12 JACK CHEESE .............................22 BAKING SUPPLIES .......................4 BITTERS .........................................17 GLAZES AND DEMI-GLAZES .......25 BROWNIES ..................................12 MASCARPONE ...........................22 COLORANTS ...............................4 CORDIAL ....................................17 KETCHUP .....................................25 CAKES ASSORTED ......................12 MISCELLANEOUS ........................22 CROISSANTS ...............................4 JUICE ...........................................17 MAYO ..........................................25 TARTS ...........................................13 MOUNTAIN STYLE ........................22 DÉCOR ........................................4 MISCELLANEOUS ........................17 MUSTARD ....................................25 COULIS ........................................13 MOZZARELLA ..............................22 EXTRACTS ....................................6 -

Preparing a Short-Term Cash Flow Forecast

Preparing a short-term What is a short-term cash How does a short-term cash flow forecast and why is it flow forecast differ from a cash flow forecast important? budget or business plan? 27 April 2020 The COVID-19 crisis has brought the importance of cash flow A short-term cash flow forecast is a forecast of the The income statement or profit and loss account forecasting and management into sharp focus for businesses. cash you have, the cash you expect to receive and in a budget or business plan includes non-cash the cash you expect to pay out of your business over accounting items such as depreciation and accruals This document explores the importance of forecasting, explains a certain period, typically 13 weeks. Fundamentally, for various expenses. The forecast cash flow how it differs from a budget or business plan and offers it’s about having good enough information to give statement contained in these plans is derived from practical tips for preparing a short-term cash flow forecast. you time and money to make the right business the forecast income statement and balance sheet decisions. on an indirect basis and shows the broad categories You can also access this information in podcast form here. of where cash is generated and where cash is spent. Forecasts are important because: They are produced on a monthly or quarterly basis. • They provide visibility of your future cash position In contrast, a short-term cash flow forecast: and highlight if and when your cash position is going to be tight. -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

Chapter 5 Consolidation Following Acquisition Consolidation Following

Consolidation Following Acquisition Chapter 5 • The procedures used to prepare a consolidated balance sheet as of the date of acquisition were introduced in the preceding chapter, that is, Consolidation Chapter 4. Following Acquisition • More than a consolidated balance sheet, however, is needed to provide a comprehensive picture of the consolidated entity’s activities following acquisition. McGraw-Hill/Irwin Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved. 5-2 Consolidation Following Acquisition Consolidation Following Acquisition • The purpose of this chapter is to present the procedures used in the preparation of a • As with a single company, the set of basic consolidated balance sheet, income statement, financial statements for a consolidated entity and retained earnings statement subsequent consists of a balance sheet, an income to the date of combination. statement, a statement of changes in retained earnings, and a statement of cash flows. • The preparation of a consolidated statement of cash flows is discussed in Chapter 10. 5-3 5-4 Consolidation Following Acquisition Consolidation Following Acquisition • This chapter first deals with the important concepts of consolidated net income and consolidated retained earnings. • Finally, the remainder of the chapter deals with the specific procedures used to • Thereafter, the chapter presents a description prepare consolidated financial statements of the workpaper format used to facilitate the subsequent to the date of combination. preparation of a full set of consolidated financial statements. 5-5 5-6 1 Consolidation Following Acquisition Consolidation Following Acquisition • The discussion in the chapter focuses on procedures for consolidation when the parent company accounts for its investment in • Regardless of the method used by the parent subsidiary stock using the equity method.