Analyst Briefing for 31 December 2020 Final Year Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020

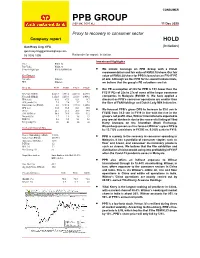

CONSUMER PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020 Proxy to recovery in consumer sector Company report HOLD Gan Huey Ling, CFA (Initiation) [email protected] 03 2036 2305 Rationale for report: Initiation Investment Highlights Price RM18.74 Fair Value RM20.30 52-week High/Low RM19.96/RM15.00 We initiate coverage on PPB Group with a HOLD recommendation and fair value of RM20.30/share. Our fair Key Changes value of RM20.30/share for PPB is based on an FY21F PE Fair value Initiation of 22x. Although we like PPB for its sound fundamentals, EPS Initiation we believe that the group’s PE valuations are fair. YE to Dec FY19 FY20E FY21F FY22F Our PE assumption of 22x for PPB is 15% lower than the Revenue (RMmil) 4,683.8 3,952.6 4,492.0 4,691.0 FY21F PEs of 25x to 27x of some of the larger consumer Net profit (RMmil) 1,152.6 1,239.8 1,310.8 1,404.1 companies in Malaysia (Exhibit 1). We have applied a EPS (sen) 81.0 87.1 92.1 98.7 discount as PPB’s consumer operations are smaller than EPS growth (%) 7.2 7.6 5.7 7.1 the likes of F&N Holdings and Dutch Lady Milk Industries. Consensus net (RMmil) 0.0 1,152.0 1,291.0 1,345.0 DPS (sen) 31.0 33.0 34.0 35.0 PE (x) 23.1 21.5 20.3 19.0 We forecast PPB’s gross DPS to increase to 33.0 sen in EV/EBITDA (x) 58.8 78.9 55.8 51.2 FY20E from 31.0 sen in FY19 in line with the rise in the Div yield (%) 1.7 1.8 1.8 1.9 group’s net profit. -

Tropicana Corporation Berhad Annual Report 2019

TROPICANA CORPORATION BERHAD [Registration No. 197901003695 (47908-K)] the art of living www.tropicanacorp.com.my ANNUAL REPORT 2019 TROPICANA CORPORATION BERHAD [Registration No. 197901003695 (47908-K)] Unit 1301, Tropicana Gardens Office Tower No. 2A, Persiaran Surian, Tropicana Indah, 47810 Petaling Jaya Selangor Darul Ehsan, Malaysia Annual Report 2019 Tel: +603 7663 6888 Fax: +603 7663 6688 2019 FACTS AT Total Revenue RM1.1 billion in FY19* A GLANCE Total Development Properties Sales Back in 2013, we changed our name to Tropicana Corporation Berhad – a name RM718.3 million in FY19* synonymous with the prestigious Tropicana Golf & Country Resort. This sets a clear direction for the Group and with it, we began to redefine both ourselves and our integrated developments by leveraging on the iconic ‘T’ branding. After more than two decades in the property industry, and having pioneered residential resort-style living with the advent of Tropicana Golf & Country Resort and Tropicana Indah Resort Homes, we established a unique DNA that sets us apart. Current landbank of 2,344.0 acres with a total potential GDV of RM70.0 billion** This DNA focuses on accessibility, connectivity, innovative concepts and designs, generous open spaces, amenities, facilities, multi-tiered security and quality. With emphasis on our customers’ needs, we have been innovating and redefining the art of living through the creation of our integrated developments by incorporating residential and commercial components to create thriving townships that are strategically connected. Over 50 completed developments Fuelled by passion to be one of the premier property developers, we will continue with 6 ongoing townships to deliver to our customers products that are intrinsically linked with our Tropicana brand. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 2ND HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET Despite the subdued market, there were noticeably more ECONOMIC INDICATORS launches and previews in the TABLE 1 second half of 2016. Malaysia’s Gross Domestic Product Completion of High End (GDP) grew 4.3% in 3Q2016 from 4.0% Condominiums / Residences in in 2Q2016, underpinned by private 2H2016 The secondary market, however, expenditure and private consumption. continues to see lower volume Exports, however, fell 1.3% in 3Q2016 of transactions due to the weak compared to a 1.0% growth in 2Q2016. economy and stringent bank KL Trillion lending guidelines. Amid growing uncertainties in the Jalan Tun Razak external environment, a weak domestic KL City market and continued volatility in the 368 Units The rental market in locations Ringgit, the central bank has maintained with high supply pipeline and a the country’s growth forecast for 2016 at weak leasing market undergoes 4.0% - 4.5% (2015: 5.0%). correction as owners and Le Nouvel investors compete for the same Headline inflation moderated to 1.3% in Jalan Ampang 3Q2016 (2Q2016: 1.9%). pool of tenants. KL City 195 Units Unemployment rate continues to hold steady at 3.5% since July 2016 (2015: The review period continues to 3.1%) despite weak labour market see more developers introducing conditions. Setia Sky creative marketing strategies and Residences - innovative financing packages Bank Negara Malaysia (BNM) lowered the Divina Tower as they look to meet their sales Overnight Policy Rate (OPR) by 25 basis Jalan Raja Muda KL City target and clear unsold stock. -

Enhance Walk-In Movie-Goers' Cinema Experience in Penang

ENHANCE WALK-IN MOVIE-GOERS’ CINEMA EXPERIENCE IN PENANG by CHOOI WEI YEE Thesis submitted in fulfillment of the requirements for the degree of Master of Arts (Fine Arts) September 2016 ACKNOWLEDGEMENT The special thank goes to my helpful supervisor, Mr. Hafeezur Rahmaan Bin Mohd Yassin, who has been encouraged, guided and leaded me through the process of this project, from the beginning until the end. The supervision and support that he gave truly help the progression and smoothness of my master research. He helped me on creating and building up ideas, gave construction advice and sharpening my research skills. Besides that, I would like to show my appreciation to Associate Professor Mohamad Omar Bidin. A big contribution and inspirational advice from him are very great indeed. All projects during this two year would be nothing without the enthusiasm and advice from him. I am pleased and thankful to receive MyBrain scholarship as it will have a significant impact on my financial wellbeing. This scholarship helps to alleviate my financial burden needed to complete my three semester of postgraduate studies in University Sains Malaysia. Last but not least, I would like to convey my heartfelt gratitude to my parents, colleagues and friends for supporting me when I faced any problems. They gave me mentally and physical support so that I can continue completed my project. ii TABLE OF CONTENTS Acknowledgement ................................................................................................................... ii Table of Contents -

Usg Boral Malaysia

CEO’S FOREWORD Managing Editor Twenty-one years ago, in 1997, Apple produced a Roshan Kaur Sandhu TV commercial that encouraged people to Think Writers Different. Steve Jobs, who voiced the commercial Reena Kaur Bhatt paid tribute to the ones who see things differently Mira Soyza because these round pegs in the square holes, as he refers to them, who think they can change the Editorial Coordinator world, often do. Nur Alia Ahamd Tamezi Prophetic words by a man ahead of his time, but Senior Graphic Designers coming back to present day, these game changing Wing Wong Jason Kwong moves are happening across the real estate Junior Graphic Designer industry in Malaysia too and its coming thick and Rechean Soong fast. CEO REA Group - Asia Late October last year, revisions to the Valuers, Henry Ruiz Appraisers, Estate Agents and Property Managers CEO - Singapore & Malaysia Act of 1981 was passed in Parliament and gazetted REA Group - Asia on 2 January 2018. The Act, which is now known as Haresh Khoobchandani the Valuers, Appraisers, Estate Agents and Property Managers Act 1981 is expected General Manager (Marketing) to curb unscrupulous and illegal practices within the property sector. Wong Siew Lai General Manager (Agent Sales) The gazetting of the Act was widely seen as a watershed moment for the real estate Leon Kong industry in Malaysia. General Manager (Developer Sales) Sean Liew Change is taking place across the length and breadth of Malaysia, but none more General Manager (Data Services) prevalent than in Johor. In recent times, developments in Johor especially the Premendran Pathmanathan creation of the Iskandar region have changed the way cities are being built in Group Regional Finance Director Malaysia. -

SKRIN SEAT JOHOR TGV AEON Tebrau 10 1,731 1 TGV AEON Bukit

SENARAI PAWAGAM TAHUN 2019 SKRIN SEAT JUM. PAWAGAM SENARAI PAWAGAM JOHOR TGV AEON Tebrau 10 1,731 1 TGV AEON Bukit Indah, Johor Bahru 9 1,614 1 TGV AEON Kulai Jaya 5 1,203 1 GSC Paradigm Mall, Johor Bahru 16 2,107 1 MBO Kluang Mall 6 963 1 MBO Cinemas Square One, Batu Pahat 8 1,189 1 MBO Cinemas U Mall, Skudai 5 601 1 MBO KSL City Mall, Johor Bahru 8 1,378 1 MBO Heritage Mall, Kota Tinggi 7 1,043 1 MMCineplexes City Square, Johor Bahru 10 2,230 1 MMCineplexes IOI Mall, Kulai Jaya 6 920 1 MMCineplexes 1Segamat Shopping Complex 8 1,703 1 LFS Plaza Tasek Cineplex, Skudai 3 619 1 LFS Skudai Parade, Johor Bahru 4 938 1 Paragon Cinemas, Batu Pahat Mall 7 1,060 1 Super Star Cinema Ulu Tiram Mall 8 1,373 1 Super Star Cinema Bandar Seri Alam, Masai 4 543 1 Superstar Cinema U Sentral, Segamat 5 668 1 KPI Broadway Theatre, Johor Bahru 1 244 1 Blockbuster Cineplexes, Kompleks Perling Mall, Johor Bahru 2 582 1 Suara Screen, Pasir Gudang 2 260 1 MELAKA GSC Dataran Pahlawan 10 2,004 1 GSC AEON Bandaraya Melaka 10 1,783 1 MBO Cinemas Melaka Mall, Ayer Keroh 7 1,208 1 MBO Elements Mall, Taman Melaka Raya 10 1,584 1 MMCineplexes Mahkota Parade 4 645 1 Suara Screen, Soon Seng Plaza, Jln Hang Tuah 2 159 1 NEGERI SEMBILAN TGV AEON Seremban2 7 1,191 1 GSC Terminal One, Seremban 4 1,010 1 GSC Palm Mall Seremban, Kemayan Square 10 1,659 1 MBO Cinemas Era Square Mall, Terminal 2, Seremban 10 1,449 1 MMCineplexes Bahau Cineplex 6 1,036 1 LFS Perdana KM Plaza, Seremban 1 266 1 SELANGOR TGV Bukit Raja, Klang 8 1,428 1 TGV The Mines Resort, Seri Kembangan 5 939 1 -

MBO Cinemas - Cinema & Cineplexes Last Updated Thursday, 05 July 2012 16:54

MBO Cinemas - Cinema & Cineplexes Last Updated Thursday, 05 July 2012 16:54 Major Cinema Operator in Malaysia Cathay | GSC | MBO | TGV | BIG C | LFS | STAR MBO Cinemas - Cinema & Cineplexes CONTACT DETAILS MCAT BOX OFFICE SDN. BHD (482797-K) Block D-202, 2nd floor, Kelana Square, No.17, Jalan SS 7/26, Kelana Jaya 47301 Petaling Jaya, Selangor, Malaysia Tel : +603-7880 2808 Fax : +603-7806 4836 General Email : [email protected] KLANG VALLEY MBO Galaxy Ampang 3A-2, Galaxy Shopping Centre Jalan Dagang 5, Taman Dagang, 68000 Ampang, Kuala Lumpur No of Halls : 10 Seating Capacity : 1,545 T: 03-42702147 F: 03-42702874 [email protected] MBO Spark 3A-15, Plaza Salak Park, 2, Jalan 1/125E, 20, Taman Desa Petaling, 57100 Kuala Lumpur No of Halls : 5 Seating Capacity : 620 Tel : 03-90575198 Fax : 03-90570198 [email protected] MBO Kepong Village Mall Lot L1-MA1, Tesco Kepong, 1 / 5 MBO Cinemas - Cinema & Cineplexes Last Updated Thursday, 05 July 2012 16:54 3, Jalan 7A / 62A, Bandar Manjalara, 52200 Kuala Lumpur No of Halls : 7 Seating Capacity : 1,066 Tel : 03-62762208 Fax : 03-62772548 [email protected] MBO KL Festival City Lot S29-A, KL Festival City, Jalan Taman Ibu Kota, Taman Danau Setapak, 53100 Kuala Lumpur No of Halls : 7 Seating Capacity : 1,040 Tel : 03-41316378 Fax : 03-41316367 [email protected] MBO Viva Home Lot 3-22, 3rd Floor, Viva Home, 85 Jalan Loke Yew, 55200 Kuala Lumpur No of Halls : 9 Seating Capacity : 1,954 Tel : 03-27880910 Fax : 03-27880911 [email protected] MBO Space U8 2A-1-3, Space U8, No 6, Persiaran Pasak Bumi, Taman Bukit Jelutong, Seksyen U8, 40150 Selangor No of Halls : 7 Seating Capacity : 1,466 2 / 5 MBO Cinemas - Cinema & Cineplexes Last Updated Thursday, 05 July 2012 16:54 Tel : 03-50334810 Fax : 03-50334811 [email protected] MBO Subang Parade Lot 30, 32 & 33A, First Floor, Subang Parade, No. -

Minutes of 52Nd AGM of PPB Group Berhad

PPB GROUP BERHAD Minutes of the 52nd Annual General Meeting of PPB GROUP BERHAD held at the broadcast venue at Selangor 1 Room, B2 Level, Shangri-La Hotel Kuala Lumpur, 11 Jalan Sultan Ismail, 50250 Kuala Lumpur on Tuesday, 11 May 2021 at 10.00 am. Present/Registered Tan Sri Datuk Oh Siew Nam (Chairman of the meeting, and shareholder) also representing/proxy for a total of 505 members comprising the following : • Cartaban Nominees (Asing) Sdn Bhd • Kuok Brothers Sdn Berhad • Cartaban Nominees (Tempatan) Sdn Bhd • Kuok Foundation Berhad • Citigroup Nominees (Asing) Sdn Bhd • Kuok Foundation Overseas Limited • Citigroup Nominees (Tempatan) Sdn Bhd • Gaintique Sdn Bhd • DB (Malaysia) Nominee (Asing) Sdn Bhd • Min Tien & Company Sdn Bhd • DB (Malaysia) Nominee (Tempatan) Sdn Bhd • Infinite Starbrite Sdn Bhd • HSBC Nominees (Asing) Sdn Bhd • Kumpulan Wang Persaraan • HSBC Nominees (Tempatan) Sdn Bhd (Diperbadankan) • Maybank Nominees (Tempatan) Sdn Bhd • Ng Oi Sang • UOB Kay Hian Nominees (Asing) Sdn Bhd • Ooi Gek Kheng • Shaw Brothers (Johore) Sdn Bhd • Koh Siew Haw and 524 other shareholders and proxies, representing in total 1,132,680,488 ordinary shares equivalent to 79.62% of the issued shares of the Company. In attendance Mr Lim Soon Huat Managing Director Datuk Ong Hung Hock Director Dato’ Capt Ahmad Sufian@ Qurnain bin Abdul Rashid Director En Ahmad Riza bin Basir Director By video-conference Madam Tam Chiew Lin Director Mr Soh Chin Teck Director Ms Yap Choi Foong Chief Financial Officer (“CFO”) Mr Mah Teck Keong Company Secretary Mr Ong Chee Wai Representing Ernst & Young PLT Ms Ng Yee Yee (External auditors) 1. -

1St Half 2011 REAL ESTATE HIGHLIGHTS Kuala Lumpur | Penang | Johor Bahru

RESEARCH 1st Half 2011 REAL ESTATE HIGHLIGHTS Kuala Lumpur | Penang | Johor Bahru HIGHLIGHTS Kuala Lumpur • For high end condominiums, rental levels in KL City remained stable during the review period while KL City Fringe experienced a marginal drop despite robust purchaser interest. • The KL office market remained soft with both rental and occupancy levels trending downwards. Market sentiment remains tenant-favoured. • Notwithstanding forecasts for a lower growth rate in the retail sector, the local retail market continued to offer good prospects supported by strong economic fundamentals. • Despite a marginal dip in occupancy & average room rate, the hotel sector still performed admirably over 1H2011 thanks to a number of Government-led initiatives. Penang • In response to demand for landed housing in Penang, 3-storey terraced and semi-detached houses as well as high-end bungalows within exclusive gated and guarded enclaves are in the pipeline to be launched by various developers. • Penang–based electronics companies are set for a good year due to the growing global markets for consumer electronics and medical equipment. Johor • Catalytic projects at Medini and the supporting infrastructure works are in final stages of completion, thus enhancing the positive outlook of Iskandar Malaysia. • Further infrastructure improvements and investment in projects at Pengerang are expected to provide a boost to the economy / property market. 1st HALF 2011 REAL ESTATE HIGHLIGHTS Kuala Lumpur | Penang | Johor Bahru Kuala Lumpur High End Condominium Market Market Indications Many of the projects originally scheduled for completion in 1H2011 have experienced delays. These include: Regalia @ Sultan Ismail in KL City; The country’s economic momentum has remained sound, posting a GDP Brunsfield Embassyview in Ampang Hilir / U-Thant; Gaya Bangsar in growth rate of 4.6% in 1Q2011 (4Q2010: 4.8%). -

15Th Annual EARCOS Teachers' Conference 2017

Red-whiskered bulbul The red-whiskered bulbul (Pycnonotus jocosus) is a passerine bird found in Asia. It is a member of the bulbul family. 15th Annual EARCOS Teachers’ Conference 2017 “Connecting Global Minds” March 30 - April 1, 2017 Kota Kinabalu, Sabah, Malaysia EARCOS Trustees & Staff About EARCOS The East Asia Regional Council of Schools is an organization of 156 member schools in East Asia. These schools have a total of more than 120,000 preK to 12th grade students. EARCOS also has 179 associate members—textbook and software publishers and distributors, universities, financial planners, architectural firms, insurance companies, youth organizations, etc.—and 36 individual members. Membership in EARCOS is open to elementary and secondary schools in East Asia which offer an educational program using English as the primary lan- guage of instruction, and to other organizations, institutions, and individuals interested in the objectives and purposes of the Council. General Information EARCOS holds one leadership conference every November and one teachers’ conference every March. In addition, EARCOS funds several weekend institutes hosted by member schools throughout East Asia. EARCOS also organizes a meeting for EARCOS heads of schools every April. EARCOS publishes its newsletter, the ET Journal, which is distributed to its members three times a year, and a directory of all of its members. EARCOS sponsors a community on Google+ and Tumblr blog called E-Connect at http://earcos-connect.tumblr.com/ Objectives and Purposes To promote intercultural understanding and international friendship through the activities of member schools. To broaden the dimensions of education of all schools involved in the Council in the interest of a total program of education. -

SKRIN SEAT JOHOR TGV AEON Tebrau 10 1,731 1 TGV AEON Bukit

SENARAI PAWAGAM TAHUN 2019 SKRIN SEAT JUM. PAWAGAM SENARAI PAWAGAM JOHOR TGV AEON Tebrau 10 1,731 1 TGV AEON Bukit Indah, Johor Bahru 9 1,614 1 TGV AEON Kulai Jaya 5 1,203 1 TGV Toppen Shopping Centre, Taman Desa Tebrau, JB 9 1,443 1 GSC Paradigm Mall, Johor Bahru 16 2,107 1 GSC Mid Valley Southkey, Johor Bahru 18 1,645 1 MBO Kluang Mall 6 963 1 MBO Cinemas Square One, Batu Pahat 8 1,189 1 MBO Cinemas U Mall, Skudai 5 601 1 MBO KSL City Mall, Johor Bahru 8 1,378 1 MBO Heritage Mall, Kota Tinggi 7 1,043 1 MBO AEON Mall Bandar Dato Onn 5 663 1 MMCineplexes City Square, Johor Bahru 10 2,230 1 MMCineplexes IOI Mall, Kulai Jaya 6 920 1 MMCineplexes 1Segamat Shopping Complex 8 1,703 1 LFS Plaza Tasek Cineplex, Skudai 3 619 1 LFS Skudai Parade, Johor Bahru 4 938 1 Paragon Cinemas, Batu Pahat Mall 7 1,060 1 Super Star Cinema Ulu Tiram Mall 8 1,373 1 Super Star Cinema Bandar Seri Alam, Masai 4 543 1 Superstar Cinema U Sentral, Segamat 5 668 1 Emperor Cinemas, R&F Mall, Johor Bahru 8 745 1 Womei Cineplex, Beletime Shopping Mall, Johor Bahru 9 1,041 1 KPI Broadway Theatre, Johor Bahru 1 244 1 Blockbuster Cineplexes, Kompleks Perling Mall, Johor Bahru 2 582 1 Suara Screen, Pasir Gudang 2 260 1 MELAKA GSC Dataran Pahlawan 10 2,004 1 GSC AEON Bandaraya Melaka 10 1,783 1 MBO Cinemas Melaka Mall, Ayer Keroh 7 1,208 1 MBO Elements Mall, Taman Melaka Raya 10 1,584 1 MMCineplexes Mahkota Parade 4 645 1 MMCineplexes Mesa Mall, Nilai 9 1,088 1 Suara Screen, Soon Seng Plaza, Jln Hang Tuah 2 159 1 NEGERI SEMBILAN TGV AEON Seremban2 7 1,191 1 GSC Terminal One, -

Malaysia Real Estate Highlights

A comprehensive analysis of Malaysia's residential, retail, office and industrial markets Real Estate h Highlights knightfrank.com/researc Research, 2nd Half 2020 REAL ESTATE HIGHLIGH TS K U A L A L U M P U R H I G H E N D C O N D O M I N I U M M A R K E T Market Indications Rate (OPR) by 25-basis points to 1.75%on 7 J uly 2020, the fourth cut this year to Highlights Malaysia has been caught in the third wave stimulate economic growth due to the severe of COVID-19 infections since September impact of the COVID-19 pandemic. The 2020 and this has led to the re-imposition current level of OPR is the lowest since the Full stamp duty waiver for first-time of the conditional movement control order introduction of the policy tool in 2004. homebuyers, applicable for the (CMCO) in selected states and localities in sale and purchase agreements on the country including Kuala Lumpur and Supply &Demand purchases that are completed from 1 Selangor since 14 October 2020. Although January 2021 until 31 December 2025 the government has allowed most business As of 2H2020, the cumulative supply as provided under Budget 2021. operations to return to normalcy with of high-end condominiums / strict adherence to standard operating residences in KualaLumpurstood at 64,272 Five notable project completions procedures (SOPs), this phase of CMCO units and two new launches of high-end which sees a sharp resurgence in cases, is following the completion of five projects condominiums / residences during the slowing economic recovery.