Enhance Walk-In Movie-Goers' Cinema Experience in Penang

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020

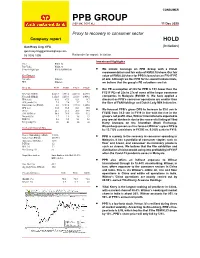

CONSUMER PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020 Proxy to recovery in consumer sector Company report HOLD Gan Huey Ling, CFA (Initiation) [email protected] 03 2036 2305 Rationale for report: Initiation Investment Highlights Price RM18.74 Fair Value RM20.30 52-week High/Low RM19.96/RM15.00 We initiate coverage on PPB Group with a HOLD recommendation and fair value of RM20.30/share. Our fair Key Changes value of RM20.30/share for PPB is based on an FY21F PE Fair value Initiation of 22x. Although we like PPB for its sound fundamentals, EPS Initiation we believe that the group’s PE valuations are fair. YE to Dec FY19 FY20E FY21F FY22F Our PE assumption of 22x for PPB is 15% lower than the Revenue (RMmil) 4,683.8 3,952.6 4,492.0 4,691.0 FY21F PEs of 25x to 27x of some of the larger consumer Net profit (RMmil) 1,152.6 1,239.8 1,310.8 1,404.1 companies in Malaysia (Exhibit 1). We have applied a EPS (sen) 81.0 87.1 92.1 98.7 discount as PPB’s consumer operations are smaller than EPS growth (%) 7.2 7.6 5.7 7.1 the likes of F&N Holdings and Dutch Lady Milk Industries. Consensus net (RMmil) 0.0 1,152.0 1,291.0 1,345.0 DPS (sen) 31.0 33.0 34.0 35.0 PE (x) 23.1 21.5 20.3 19.0 We forecast PPB’s gross DPS to increase to 33.0 sen in EV/EBITDA (x) 58.8 78.9 55.8 51.2 FY20E from 31.0 sen in FY19 in line with the rise in the Div yield (%) 1.7 1.8 1.8 1.9 group’s net profit. -

Tropicana Corporation Berhad Annual Report 2019

TROPICANA CORPORATION BERHAD [Registration No. 197901003695 (47908-K)] the art of living www.tropicanacorp.com.my ANNUAL REPORT 2019 TROPICANA CORPORATION BERHAD [Registration No. 197901003695 (47908-K)] Unit 1301, Tropicana Gardens Office Tower No. 2A, Persiaran Surian, Tropicana Indah, 47810 Petaling Jaya Selangor Darul Ehsan, Malaysia Annual Report 2019 Tel: +603 7663 6888 Fax: +603 7663 6688 2019 FACTS AT Total Revenue RM1.1 billion in FY19* A GLANCE Total Development Properties Sales Back in 2013, we changed our name to Tropicana Corporation Berhad – a name RM718.3 million in FY19* synonymous with the prestigious Tropicana Golf & Country Resort. This sets a clear direction for the Group and with it, we began to redefine both ourselves and our integrated developments by leveraging on the iconic ‘T’ branding. After more than two decades in the property industry, and having pioneered residential resort-style living with the advent of Tropicana Golf & Country Resort and Tropicana Indah Resort Homes, we established a unique DNA that sets us apart. Current landbank of 2,344.0 acres with a total potential GDV of RM70.0 billion** This DNA focuses on accessibility, connectivity, innovative concepts and designs, generous open spaces, amenities, facilities, multi-tiered security and quality. With emphasis on our customers’ needs, we have been innovating and redefining the art of living through the creation of our integrated developments by incorporating residential and commercial components to create thriving townships that are strategically connected. Over 50 completed developments Fuelled by passion to be one of the premier property developers, we will continue with 6 ongoing townships to deliver to our customers products that are intrinsically linked with our Tropicana brand. -

Analyst Briefing for 31 December 2020 Final Year Results

UNAUDITED RESULTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020 Disclaimer: The contents of this presentation include materials which may be capable of being interpreted as forward-looking statements. Such statements are merely estimates and targets, based on circumstances and reasonable assumptions which apply only at the date of such statements. Accordingly, no reliance should be placed on any forward-looking statements, express or implied, contained in this presentation. 1 AGENDA GROUP FINANCIAL HIGHLIGHTS REVIEW OF MAJOR OPERATIONS Financial Performance Key Events in 2020 Developments for 2021 5-YEAR PBT TRACK RECORD CAPITAL AND OTHER COMMITMENTS DIVIDEND RECORD SHARIAH-COMPLIANCE STATUS PROSPECTS FOR 2021 2 GROUP FINANCIAL HIGHLIGHTS 3 FINANCIAL RESULTS FOR THE YEAR ENDED 31 DEC 2020 (Figures in RM) 2020 2019 Change Revenue 4.19 bil 4.68 bil (10.5%) Operating Expenses 4.17 bil 4.48 bil (6.9%) Share of Wilmar’s Profit 1.24 bil 0.96 bil 29.4% PBT 1.42 bil 1.27 bil 11.7% Profit attributable to 1.32 bil 1.15 bil 14.3% owners of the parent EPS 92.57 sen 81.02 sen 14.3% 4 SEGMENTAL INFORMATION FOR THE YEAR ENDED 31 DEC 2020 1% 1% 4% 3% 15% Total Segment Revenue: RM 4.19 billion Grains & Agribusiness Consumer Products Film Exhibition & Distribution 76% Environmental Engineering & Utilities Investments & Other Operations Property 5 SEGMENTAL INFORMATION FOR THE YEAR ENDED 31 DEC 2020 19% 2% 1% Total Segment Profit: RM1.42 billion -9% Grains & Agribusiness Consumer Products n.m Film Exhibition & Distribution Environmental Engineering & Utilities Investments & Other Operations 87% Property n.m. -

Short PDF Presentation

Let us introduce you to the World Film Fair……... The World Film Fair is a large scale film market event, happening in October this year in New York. The Fair will be the perfect place for all members of the film industry such as distribution companies, production companies, film buyers, investors and of course filmmakers to meet and network together all under one roof. The World Film Fair will be bringing a unique, fresh and exciting perspective and will be unlike any other Film Fair. It takes place in a range of venues, not only in New York but also in cities and countries all over the World! A list of the venues can be found below: New York Locations: ● Trump Hotel, 1 Central Park West, New York, NY 10023, USA ● Cinepolis, 260 W 23rd St, New York, NY 10011, USA ● Producers Club, 358 W 44th St, New York, NY 10036, USA ● School of Visual Arts New York City, 209 East 23 Street, NY, NY 10010-3994, USA ● The Barrow Group Theatre Company and School, 312 West 36th Street, New York, NY 10018 ● Ghetto Film School Inc, 79 Alexander Ave # 41A, Bronx, NY 10454, USA ● The Actors Theatre Workshop, Inc, 145 W. 28th Street, Third Floor, New York, N.Y. 10001 ● Five Myles, 558 Saint Johns Place Brooklyn, New York 11238 United States ● Martin W Kappel theater located at 27 W. Main St. Norwich, NY 13815. ● 4th Avenue Arts 1030 4th Avenue Huntington, West Virginia 25701 United States ● Laemmle, Encino Town Center, 17200 Ventura Blvd #121, Encino, CA 91316 ● Solamonte Theaters 9200 Milliken Avenue Rancho Cucamonga, California 91730 United States ● Promenade Playhouse, 1404 3rd Street Promenade, Santa Monica, CA 90401, USA ● 5333 RED SQUIRREL LN Show Low, Arizona 85929-5344 United States ● Pride Arts Center 4139 N. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 2ND HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET Despite the subdued market, there were noticeably more ECONOMIC INDICATORS launches and previews in the TABLE 1 second half of 2016. Malaysia’s Gross Domestic Product Completion of High End (GDP) grew 4.3% in 3Q2016 from 4.0% Condominiums / Residences in in 2Q2016, underpinned by private 2H2016 The secondary market, however, expenditure and private consumption. continues to see lower volume Exports, however, fell 1.3% in 3Q2016 of transactions due to the weak compared to a 1.0% growth in 2Q2016. economy and stringent bank KL Trillion lending guidelines. Amid growing uncertainties in the Jalan Tun Razak external environment, a weak domestic KL City market and continued volatility in the 368 Units The rental market in locations Ringgit, the central bank has maintained with high supply pipeline and a the country’s growth forecast for 2016 at weak leasing market undergoes 4.0% - 4.5% (2015: 5.0%). correction as owners and Le Nouvel investors compete for the same Headline inflation moderated to 1.3% in Jalan Ampang 3Q2016 (2Q2016: 1.9%). pool of tenants. KL City 195 Units Unemployment rate continues to hold steady at 3.5% since July 2016 (2015: The review period continues to 3.1%) despite weak labour market see more developers introducing conditions. Setia Sky creative marketing strategies and Residences - innovative financing packages Bank Negara Malaysia (BNM) lowered the Divina Tower as they look to meet their sales Overnight Policy Rate (OPR) by 25 basis Jalan Raja Muda KL City target and clear unsold stock. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2019 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR More market activity in the high-end condominium / HIGH END CONDOMINIUM serviced apartment segment (> RM1 million) in 2018 and MARKET this momentum is expected to continue into 2019. MARKET SUPPLY AND 1H2019 saw the launches of a INDICATIONS DEMAND few high-end condominium / The Malaysian economy continues with As of 1H2019, the completion of 602 units serviced apartment projects in its growth momentum albeit at a slower of high-end condominiums / serviced Kuala Lumpur City. The projects pace of 4.7% in 2018 (2017: 5.9%). It apartments from two projects brought are generally smaller in scale, on continued to expand 4.5% in 1Q2019 the cumulative supply in Kuala Lumpur pockets of land. (4Q2018: 4.7%), supported by private to 56,786(R) units. The completed projects sector expenditure. For the whole year were Opus KL (357 units) and Residensi The prices of new launches of 2019, economic growth is expected Sefina (245 units). remain flattish as the high-end to range between 4.3% and 4.8%. In (Note: (R) The cumulative supply has residential segment continues to May 2019, the Department of Statistics been revised) be challenging. Malaysia (DOSM) rebased of the country’s gross domestic product (GDP), The scheduled completion of Sky Suites In the secondary market, the from year 2010 to 2015. @ KLCC (986 units), 8 Kia Peng (442 units), Tower 1 and Tower 2 @ Star overall transacted price of The current period of low headline Residences (1,039 units), Aria KLCC selected schemes analysed was inflation, recorded at 1.0% in 2018 (2017: (598 units), Stonor 3 (400 units), Novum lower by 1.6% when compared 3.7%), is largely due to key policies such Bangsar (729 units), TWY Mont’ Kiara to 2018 as purchasers continue as the fixing of domestic retail fuel prices (484 units), Arte Mont’ Kiara (1,706 to be spoilt for choice. -

Subsektor Pengangkutan Dan Penyimpanan Pengangkutan

Maklumat Lanjut DOSM/BPP/5.2020/Siri 27 Disediakan oleh: NORAZLIN MUHARAM Ketua Penolong Pengarah, BPP Segmen Pengangkutan, Informasi dan Komunikasi meliputi perkhidmatan Pengangkutan & penyimpanan dan Perkhidmatan Maklumat & komunikasi. Berdasarkan Banci Ekonomi 2016, sejumlah 54,190 pertubuhan telah direkodkan dalam subsektor Pengangkutan dan penyimpanan. Manakala 8,008 pertubuhan telah direkodkan bagi subsektor Maklumat dan komunikasi. Segmen ini menyumbang sebanyak 9.7% kepada KDNK pada 2019. SUBSEKTOR PENGANGKUTAN DAN PENYIMPANAN PENGANGKUTAN DEFINISI: Seksyen ini termasuk penyediaan bagi Pengangkutan Penggudangan & pengangkutan penumpang atau muatan, Air Aktiviti sokongan sama ada berjadual atau tidak, melalui rel, saluran paip, jalan raya, air atau udara dan aktiviti yang berhubungkait seperti kemudahan terminal dan tempat memakir pesawat, pengendalian kargo, penyimpanan dll. Termasuk dalam seksyen ini adalah penyewaan Pengangkutan Pengangkutan Pos & kelengkapan pengangkutan dengan pemandu Darat Udara Kurier atau operator dan juga perkhidmatan pos dan kurier. Prestasi Perkhidmatan Pengangkutan dan Penyimpanan Pada tahun 2019, subsektor Pengangkutan dan penyimpanan Bilangan pekerja pada 2015 adalah merekodkan RM53.7 bilion dan menyumbang 3.8% kepada 411,273 orang berbanding 312,692 KDNK negara. orang pada 2010 dengan kadar Tiga negeri dengan nilai output pertumbuhan tahunan 5.6%. Pada tahun 2015, sejumlah kasar tertinggi RM109.2 billion output Pekerja bergaji Pemilik yang bekerja & kasar telah dihasilkan sambilan Selangor pekerja keluarga tidak berbanding RM76.3 billion 4,871 orang bekerja (1.2%) pada tahun 2010 dengan 47,273 orang W.P. Kuala (11.5%) Pekerja bergaji kadar pertumbuhan Lumpur sepenuh masa tahunan 7.4%. 358,916 orang Johor (87.3%) RM (bilion) Saiz PKS Bilangan Pertubuhan Peratus PKS: 53,705 Mikro 50,755 94.5% pertubuhan Kecil 1,538 2.9% (99.1%) adalah Jumlah gaji & upah yang dibayar Sederhana 1,412 2.6% PKS. -

Pa International Property Consultants (Kl) Sdn

MONTH: MAY 2012 ISSUE: 05/2012 Property News PA International Property Consultants is a registered real estate firm committed to providing a comprehensive range of property solutions to meet the needs of investors, occupiers and developers. The Research Division provides core real estate information to clients and internal departments in order to ensure accurate real estate decision-making. Our research team has completed market studies and research work for various ongoing development schemes within Klang Valley, providing comprehensive economic analysis, property PA INTERNATIONAL market information, forecasts and consulting advice based PROPERTY CONSULTANTS (KL) SDN BHD on reliable sources. Phone: 03-7958 5933 We constantly strive to present the most up-to-date Fax: 03-7957 5933 Website: http://www.pa.com.my market knowledge in order to ensure clients are well- Email: [email protected] armed with sufficient data to make the right property decisions. Issue 05: 1- 31 May 2012 GENERAL ECONOMIC & PROPERTY MARKET 1. Najib unveils 21 new projects worth RM20.46 billion (Bernama, 28-May-2012) . Prime Minister Datuk Seri Najib Tun Abdul Razak announced 21 new projects worth RM20.46 billion under seven National Key Economic Areas (NKEAs). The projects are expected to boost Gross National Income (GNI) by RM4.59 billion and create 39,918 jobs. Najib said the 21 projects fell under agriculture, business services, education, healthcare, wholesale and retail, electrical and electronics and the Greater KL/Klang Valley NKEAs. With Gross Domestic Products (GDP) growing at 4.7% in the first quarter of the year, which was above general consensus, Najib reminded Malaysians that the ETP was “ far from saying mission accomplished”. -

OUTLET LIST (For Call Centre Use) Telephone Operating Hours Detailed Location ROCK CORNER, S205, 2Nd Floor, 1 Utama Shopping

OUTLET LIST (for call centre use) KLANG VALLEY Telephone Operating Hours Detailed Location ROCK CORNER, S205, 2nd Floor, 1 Utama Shopping Centre 03-7733 5667 ONE UTAMA Lebuh Bandar Utama 03-7725 5667 10am-10pm Everyday On same level as TGV Cinemas 48700 Petaling Jaya Shaiful ROCK CORNER, G6, Ground Floor, The Curve THE CURVE No. 6, Jalan PJU 7/3, Mutiara Damansara 03-7733 1139 10am-10pm Everyday Beside McDonalds in The Curve 47800 Petaling Jaya Jun ROCK CORNER, LG 20 C & D, Subang Parade 10am-9.45pm SUBANG PARADE No.5, Jalan SS16/1 03-5613 1139 Lower Ground Everyday 47500 Subang Jaya Viswa ROCK CORNER, T-206, 3rd Floor, The Gardens, THE GARDENS Mid Valley City, Lingkaran Syed Putra, 03-2201 4893 10am-10pm Everyday 59200 Kuala Lumpur Kuen ROCK CORNER, Lot 328, Level 3, Suria KLCC Shopping Centre,, P. Ramlee Entrance Side. Beside KLCC Kuala Lumpur City Centre, 03-2181 5560 10am-10pm Everyday Starbucks 50088, Kuala Lumpur Joanne ROCK CORNER, Lot 15, 1st Floor, Bangsar Village I, BANGSAR VILLAGE No.1, Jalan Telawi Satu, 03-2202 1139 10am-10pm Everyday Bangsar Baru, Andru 59100 Kuala Lumpur. ROCK CORNER, T.208 & T.053 3rd Flr, MIDVALLEY MEGAMALL Mid Valley Megamall, 03-2201 1423 On same level as GSC Cinemas and 10am-10pm Everyday Lingkaran Syed Putra, Elaine opposite of Nike Store 59200 Kuala Lumpur. THE GUITAR STORE, 57-2, Jalan Manis 3 10am-8pm CHERAS Taman Segar, Cheras 03-9133 2822 (Mon - Sat) 56100 Kuala Lumpur. Opposite of Cheras Leisure Mall 10am-6pm (Sun) Closed on Pb holiday THE GUITAR STORE, 31-1,32-3, Jalan 25/70A 10am-8pm DESA SRI HARTAMAS Desa Sri Hartamas 03-2300 2822 (Tues - Sat) 50480 Kuala Lumpur. -

CHEKSERN YOUNG BUILDERS SDN. BHD. (Formerly Known As Syabas Saga Sdn

CHEKSERN YOUNG BUILDERS SDN. BHD. (formerly known as Syabas Saga Sdn. Bhd.) A MEMBER OF CSY GROUP. COMPANY PROFILE No. 2B, Jalan BM 1/2, Tel 603-7804-3393 Taman Bukit Mayang Emas, Fax 603-7803-4492 47301 Petaling Jaya, Web www.cheksernyoung.com Selangor Darul Ehsan, Malaysia Email [email protected] CSY/20170301/05 CONTENTS 1. Introduction 2. Company Information 3. Statutory Registrations 4. Organization Chart 5. Current & Completed Projects 6. Project Photographs INTRODUCTION Cheksern Young Builders Sdn. Bhd. founder Mr. Tan Foh Hua began his quest in the art of building construction in the year 1984 under his first construction company Cheksern Young Sdn. Bhd. After practicing and understanding the needs of this demanding yet fulfilling industry, Mr. Tan decided to transfer this business to a new entity Syabas Saga Sdn. Bhd in 1999. Subsequently on 25th April 2013, Syabas Saga Sdn. Bhd. name was changed and reverted back to its former name Cheksern Young Builders Sdn. Bhd. Thus the re-birth of Cheksern Young Builders Sdn. Bhd. with a vision to pursue excellence, competitive pricing, quality of works and timely delivery of all its construction activities. Cheksern Young Builders Sdn. Bhd. is now braced with expertise and professionalism through its management team and have participated in many prestigious projects in its home country Malaysia and also to overseas countries such as Thailand and Qatar. The new and improved Cheksern Young Builders Sdn. Bhd. is now specialized to provide excellent services in any Interior Works, Upgrading Works, Refurbishment and Signage. Our special expertise in project management will also ensure all undertaken projects are completed on time and aims to please our client’s demanding expectation and satisfaction. -

Usg Boral Malaysia

CEO’S FOREWORD Managing Editor Twenty-one years ago, in 1997, Apple produced a Roshan Kaur Sandhu TV commercial that encouraged people to Think Writers Different. Steve Jobs, who voiced the commercial Reena Kaur Bhatt paid tribute to the ones who see things differently Mira Soyza because these round pegs in the square holes, as he refers to them, who think they can change the Editorial Coordinator world, often do. Nur Alia Ahamd Tamezi Prophetic words by a man ahead of his time, but Senior Graphic Designers coming back to present day, these game changing Wing Wong Jason Kwong moves are happening across the real estate Junior Graphic Designer industry in Malaysia too and its coming thick and Rechean Soong fast. CEO REA Group - Asia Late October last year, revisions to the Valuers, Henry Ruiz Appraisers, Estate Agents and Property Managers CEO - Singapore & Malaysia Act of 1981 was passed in Parliament and gazetted REA Group - Asia on 2 January 2018. The Act, which is now known as Haresh Khoobchandani the Valuers, Appraisers, Estate Agents and Property Managers Act 1981 is expected General Manager (Marketing) to curb unscrupulous and illegal practices within the property sector. Wong Siew Lai General Manager (Agent Sales) The gazetting of the Act was widely seen as a watershed moment for the real estate Leon Kong industry in Malaysia. General Manager (Developer Sales) Sean Liew Change is taking place across the length and breadth of Malaysia, but none more General Manager (Data Services) prevalent than in Johor. In recent times, developments in Johor especially the Premendran Pathmanathan creation of the Iskandar region have changed the way cities are being built in Group Regional Finance Director Malaysia. -

Forging Ahead of the Game

ANNUAL REPORT 2017 FORGING AHEAD OF THE GAME RATIONALE SUNWAY REIT ANNUAL REPORT 2017 Sunway REIT aims to be at the forefront of the industry with Main Governing Regulations and Guidelines game-changing strategies that place Sunway REIT ahead of the • The Securities Commission Guidelines on Real Estate curve. Investment Trusts • Bursa Malaysia Main Market Listing Requirements • Capital Markets and Services Act 2007 • Securities Commission Licensing Handbook • The Malaysian Code on Corporate Governance 2017 • Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 • Malaysian Financial Reporting Standards • International Financial Reporting Standards • Global Reporting Initiatives (GRI) Standards Printed Version Please contact [email protected] to request for a printed copy of the annual report. For environmental preservation, we encourage the use of online version. Online Version www.sunwayreit.com/investor-relations Sunway REIT embarks on its integrated reporting journey in this annual report. Below entails the guide to navigate through this annual report and additional online information is available on Sunway REIT’s website. Navigation Guide and Legends Connect you to more information within this report Connect you to more information online at www.sunwayreit.com The Manager Property Level / Facilities Management Team Residual Risk Rating Risk Trend DISCLAIMER: This annual report may contain forward-looking statements that involve risks and uncertainties. Actual future performance, outcomes