Key Financial Dates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020

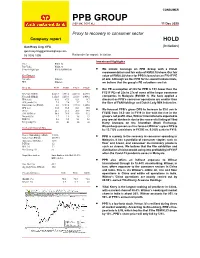

CONSUMER PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020 Proxy to recovery in consumer sector Company report HOLD Gan Huey Ling, CFA (Initiation) [email protected] 03 2036 2305 Rationale for report: Initiation Investment Highlights Price RM18.74 Fair Value RM20.30 52-week High/Low RM19.96/RM15.00 We initiate coverage on PPB Group with a HOLD recommendation and fair value of RM20.30/share. Our fair Key Changes value of RM20.30/share for PPB is based on an FY21F PE Fair value Initiation of 22x. Although we like PPB for its sound fundamentals, EPS Initiation we believe that the group’s PE valuations are fair. YE to Dec FY19 FY20E FY21F FY22F Our PE assumption of 22x for PPB is 15% lower than the Revenue (RMmil) 4,683.8 3,952.6 4,492.0 4,691.0 FY21F PEs of 25x to 27x of some of the larger consumer Net profit (RMmil) 1,152.6 1,239.8 1,310.8 1,404.1 companies in Malaysia (Exhibit 1). We have applied a EPS (sen) 81.0 87.1 92.1 98.7 discount as PPB’s consumer operations are smaller than EPS growth (%) 7.2 7.6 5.7 7.1 the likes of F&N Holdings and Dutch Lady Milk Industries. Consensus net (RMmil) 0.0 1,152.0 1,291.0 1,345.0 DPS (sen) 31.0 33.0 34.0 35.0 PE (x) 23.1 21.5 20.3 19.0 We forecast PPB’s gross DPS to increase to 33.0 sen in EV/EBITDA (x) 58.8 78.9 55.8 51.2 FY20E from 31.0 sen in FY19 in line with the rise in the Div yield (%) 1.7 1.8 1.8 1.9 group’s net profit. -

Interim Report

MANULIFE INVESTMENT -CM FLEXI FUND CONTENTS PAGE 1 General Information 1 2 Manager’s Report 3 3 Policy On Stockbroking Rebates And So Commissions 9 4 Statement By The Manager 10 5 Trustee’s Report 11 6 Statement Of Comprehensive Income 12 7 Statement Of Financial Position 13 8 Statement Of Changes In Equity 14 9 Statement Of Cash Flows 15 10 Summary Of Signicant Accounting Policies 16 11 Notes To The Financial Statements 21 12 Corporate Information 36 MANULIFE INVESTMENT -CM FLEXI FUND 1 GENERAL INFORMATION 1.1 THE TRUST The Fund commenced operations on 23 January 2007 and will continue its operations until terminated as provided under Clause 48.2 of the Deed. 1.2 FUND TYPE / CATEGORY Growth / Mixed Assets 1.3 BASE CURRENCY Ringgit Malaysia (RM) 1.4 OBJECTIVE OF THE FUND The Fund seeks to provide Unit Holders with long-term capital appreciation. Note: Any material change to the Fund’s investment objective would require Unit Holders’ approval. 1.5 DISTRIBUTION POLICY Income distribution (if any) is incidental. 1.6 PERFORMANCE BENCHMARK 50% FTSE Bursa Malaysia Top 100 Index (FBM100) + 50% CIMB 12-month xed deposit (FD) rate. Note: The composite benchmark provides a balanced gauge on the asset allocation of the Fund which can invest up to 98% of its net asset value (NAV) in equities and/or equity-related instruments or xed income instruments. The composite benchmark is only used as a reference for performance gauge purpose. The risk prole of the Fund is not the same as the risk prole of this benchmark. -

Adventure Tourism in Selangor: Explore, Experience and Enjoy!

ADVENTURE TOURISM IN SELANGOR: EXPLORE, EXPERIENCE AND ENJOY! By Nurul Azlyna (CIFP,Bach. Of Acc (Hons), CMI) LET’S HIT THE ROAD Millions of people travel across the world every year and thus, making the tourism industry as a key role in the global economy. According to World Travel and Tourism Council (WTTC), the industry accounted for 10.4% of global GDP and 319 million jobs, or 10% of total employment in 2018. Travellers travel with different purposes where some people travel for leisure or business while some travel due to specific interest such as medical or religion. Given the different purposes, tourism industry has been classified into various types to cater to the needs and preferences of all types of tourists. The following are the categories of tourism1: a. Leisure Under this purpose, travellers simply want to enjoy new experience of a destination and devoting their holiday to rest and relaxation. These tourists prefer to stay in some quiet and relaxed destination preferably at a hill resort, beach resort or island resort. b. Business The travellers’ main motive for travel is for work purpose such as attending a business meeting, conferences, conventions selling products, meeting clients. Business tourism is popularly known as MICE (Meetings, incentives, conferences, and exhibitions) tourism. c. Special Interest Interestingly, some people travel for special reasons such as religions, medical, education, hobbies and cultural. Under medical tourism for example, travellers go to places such as recommended specialist centre seeking for medical treatment. Meanwhile, the adventurous groups usually travel to spots that are popular for adventure activities such as bungee jumping or whale- 1 National Institute of Open Schooling watch. -

Annual Report 2002 Our Mission Is to Be the Leading Provider of Valued Services and Products in the Hospitality, Healthcare and Property Industries

Faber Group Berhad (COMPANY NO. 5067-M) annual report 2002 our mission is to be the leading provider of valued services and products in the hospitality, healthcare and property industries. Corporate Review Message from the Chairman 2 An Overview of Faber Group Corporate Information 6 Corporate Structure 7 Corporate Profile 8 Corporate Information Board of Directors’ Profile 10 Senior Management’s Profile 14 Operations Review Properties 16 Hotels 20 Healthcare 24 Human Resource Development 28 Green Initiatives 30 Community Relations 31 Group ISO Certification 32 Group Achievements 33 Group Financial Calendar 33 Group Corporate Calendar 34 Corporate Governance Statement 36 Statement on Internal Control 40 Audit Committee Report 42 Group Performance Review Group Financial Summary 46 Group Quarterly Performance 47 5-Year Group Financial Highlights 48 Statement of Directors’ Responsibility in 49 Respect of Audited Financial Statements Financial Statements Directors’ Report 51 Statement by Directors 54 Statutory Declaration 54 Report of the Auditors 55 Consolidated Income Statement 57 Consolidated Balance Sheet 58 Consolidated Statement of 59 Changes in Equity Consolidated Cash Flow Statement 60 Income Statement 62 Balance Sheet 63 Statement of Changes in Equity 64 Cash Flow Statement 65 Notes to the Financial Statements 66 Analysis of Shareholdings 111 Analysis of ICULS holders 114 Properties held by the Group 116 Other Information 120 Recurrent Related Party Transactions 122 Notice of the 39th 130 Annual General Meeting Notice of the 40th 135 Annual General Meeting Proxy Form (39th) Proxy Form (40th) message from the chairman DATO’ ANWAR BIN AJI Dear Shareholders, On behalf of the Board of Directors, I would like to present the Annual Report and Audited Financial Statements of Faber Group Berhad (“Faber”) for the 18-month period ended 31 December 2002. -

Ampang Point Branch Temporarily Closed Bandar Sri Damansara

NOTICE : REVISED OPERATING HOURS AS AT 12 JULY 2021 Updated as at 9.45am 12 July 2021 Updates are highlighted in yellow. Our Customer Contact Centre has been operating on a reduced capacity since 26 January 2021, in order to ensure the health and safety of our employees and to comply with the SOP on social distancing. You may reach us at [email protected] offsite ATMs and Cheque Deposit for Machinesassistance. (SSTs) within the MCO areas will be operational from 6.00am to 10.00pm. SSTs within branches will operate as stated below. Branch Operating Hours Branch Operating Hours SST Operating Hours SST Operating Hours RHB BANK - KLANG VALLEY NORTH REGION Notes From To From To Ampang Point Branch Temporarily closed Bandar Sri Damansara Branch 9.15am 2.00pm 8.00am 8.00pm Dataran Wangsa Melawati Branch Temporarily closed 8.00am 8.00pm Jalan Pasar Branch 9.15am 2.00pm 8.00am 8.00pm Kepong Branch 9.15am 2.00pm 8.00am 8.00pm Kuala Lumpur Main Branch 9.15am 2.00pm 8.00am 8.00pm Kota Damansara Branch 9.15am 2.00pm 8.00am 8.00pm Pandan Indah Branch 9.15am 2.00pm 8.00am 8.00pm Rawang Branch 9.15am 2.00pm 8.00am 8.00pm Setapak Branch 9.15am 2.00pm 8.00am 8.00pm Pasar Borong Selayang Branch 9.15am 2.00pm 8.00am 8.00pm Bandar Baru Sg Buloh Branch Temporarily closed Jinjang Utara Branch 9.15am 2.00pm 8.00am 8.00pm Jalan Bukit Bintang Branch 9.15am 2.00pm 8.00am 8.00pm Plaza OSK Branch 9.15am 2.00pm 8.00am 8.00pm Jalan Raja Laut Branch 9.15am 2.00pm 8.00am 8.00pm Cawangan Utama Kuala Lumpur 9.15am 2.00pm 8.00am 8.00pm KLCC Branch 9.30am 2.00pm -

File Download

special report S4 THEEDGE MALAYSIA | DECEMBER 17, 2018 Celebrating Corporate Malaysia’s CONTENTS crème de la crème Winners’ table 6 Overview 7 he Edge Billion Ringgit Club’s annual gala dinner held Weight to total score: Methodology & Highlights 8&12 on Dec 11 saw 40 companies picking up 55 awards for 3-year ROE 20% Value Creator: Outstanding CEO of Malaysia 16 being the best performers on Bursa Malaysia based on 3-year returns to shareholders 20% Ttheir fi nancial performances from FY2014 to FY2017. 3-year PAT growth 30% COMPANY OF THE YEAR Th is year, based on the March 31 cut-off date, there Corporate responsibility 30% Petronas Dagangan 18 were 170 companies listed on Bursa with a market capitalisation Th is year’s Company of the Year was Petronas Dagangan Bhd, Putting more thought into being better of RM1 billion or more. Although there were 184 listed companies which operates 1,000 petrol stations with over 700 Kedai Mesra in corporate citizens 22 last year, the total market cap of this year’s 170 came in higher the country, which have become one-stop centres for motorists BEST CR INITIATIVES at RM1.69 trillion versus RM1.59 trillion, and constituted 90.8% for fuelling, shopping and banking. of Bursa’s total market cap as at March 31. Th e company also achieved strong recurring pre-tax profi ts av- Petronas Chemicals, Sime Darby, The combined revenue of the 2018 BRC members was eraging RM1.2 billion a year between 2015 and 2017 while its mar- Sime Darby Plantation, Sunway 26&27 RM806.7 billion in FY2017, up from RM747.1 billion in FY2016 ket capitalisation more than doubled from RM11.6 billion in 2010 to Th e Edge Billion Ringgit Club gala dinner 30 to 39 while their collective pre-tax profi t was RM123.19 billion, up RM25 billion in 2017. -

Tropicana Corporation Berhad Annual Report 2019

TROPICANA CORPORATION BERHAD [Registration No. 197901003695 (47908-K)] the art of living www.tropicanacorp.com.my ANNUAL REPORT 2019 TROPICANA CORPORATION BERHAD [Registration No. 197901003695 (47908-K)] Unit 1301, Tropicana Gardens Office Tower No. 2A, Persiaran Surian, Tropicana Indah, 47810 Petaling Jaya Selangor Darul Ehsan, Malaysia Annual Report 2019 Tel: +603 7663 6888 Fax: +603 7663 6688 2019 FACTS AT Total Revenue RM1.1 billion in FY19* A GLANCE Total Development Properties Sales Back in 2013, we changed our name to Tropicana Corporation Berhad – a name RM718.3 million in FY19* synonymous with the prestigious Tropicana Golf & Country Resort. This sets a clear direction for the Group and with it, we began to redefine both ourselves and our integrated developments by leveraging on the iconic ‘T’ branding. After more than two decades in the property industry, and having pioneered residential resort-style living with the advent of Tropicana Golf & Country Resort and Tropicana Indah Resort Homes, we established a unique DNA that sets us apart. Current landbank of 2,344.0 acres with a total potential GDV of RM70.0 billion** This DNA focuses on accessibility, connectivity, innovative concepts and designs, generous open spaces, amenities, facilities, multi-tiered security and quality. With emphasis on our customers’ needs, we have been innovating and redefining the art of living through the creation of our integrated developments by incorporating residential and commercial components to create thriving townships that are strategically connected. Over 50 completed developments Fuelled by passion to be one of the premier property developers, we will continue with 6 ongoing townships to deliver to our customers products that are intrinsically linked with our Tropicana brand. -

Gcc Insurance Sector Facing Challenging Times

BRIDGING YOU TO ARAB WORLD Malaysia and the Arab World Arabic English Monthly Magazine (15th of Every Month), Issue 87, March 2016 GCC INSURANCE SECTOR FACING CHALLENGING TIMES UAE HOTELS RECORD HIGHEST OCCUPANCY RATE IN MIDEAST 9 772462 249006 ISSN ISSUE 87 RM 6 2462-2494 PP 16000/07/2013(032927) 87 ASWAQ INFO HALAL INDUSTRY CHALLENGES The Halal Industry is considered one of the fast growing industries in the world in regions with prevalence of Muslim communities. Arab countries have DIGITAL ISSUE begun to encourage investment in Halal industries for quite a while. The Halal industries is defined as any product or service produced according to Islamic Law (Sharia Law), and it takes into account all standards and procedures agreed upon, furthermore, it is characterized by quality and adherence to global health standards and codes. The importance of this industry lies within the contributions to the global economy, such as Islamic CHAIRMAN EDITORIAL QATAR OFFICE: Finance providing alternative finance solutions to credit companies that Dato Noor Mohamad Mohamed Al Soofi Tel: +974 6668 2824 lacks the ability to engage in traditional banking system. Maher Ibrahim Mob.: +974 33115135 With the continuous expansion of multi-Islamic economic categories, EXECUTIVE EDITOR-IN-CHIEF Yusuf Waswas Director & DG Eiad Mahmoud Yousuf Mohamad Al Boutary where there are a lot of the challenges workers face in this sector, Dr. Abdulrahim Abdulwahid Abdul Karem Al Jamal consequentially highlighting the important sectors of the Islamic economy, Heba Mostafa Hashem OMAN OFFICE: CONSULTANT BOARD Zanib Abdulrahim Mob.:+968 92925677 which has become a focal point of interest for investors and businessmen Datuk Seri Azman Ujang Director around the world, non-Muslims and Muslims alike, whom are expected to Dato Tuan Ibrahim ART DIRECTOR Mohamad Saad Manal Basalamah reach 2.2 billion Muslims in 2030. -

2019 Robotics Process and Intelligent Automation Conference

2019 ROBOTICS PROCESS AND INTELLIGENT AUTOMATION CONFERENCE FOUR SEASONS HOTEL KUALA LUMPUR PRE-CONFERENCE MASTERCLASS: 10 JUNE 2019 MAIN CONFERENCE: 11 - 12 JUNE 2019 Driving Massive Benefits in Productivity Through Robotic Automation KEY SPEAKERS INCLUDE ROBERTO NEETI MAHAJAN KEY THEMES RAMIREZ PINSON Managing Director, - Senior Vice Global Service Centre • Bank of America: How RPA Will be a Game President, Retail Risk / Head of Workforce & Changer in the World of Data Regulatory Capacity Management Reporting Global Global Operations • How RPA Deliver Massive Benefits in Lead and Data HSBC Malaysia Productivity Through Automation of Manual Strategy Expert Citibank Singapore Process • Citibank: Importance of Governance Models in RPA Implementation Roll-Outs ALLAN BOCQ FERHAD ISMAIL Data Analytic Project Senior Manager - • Scaling RPA to the Next Level: From Local to Leader (Leading IT Customer Engagement, Global Implementation Robotic Process Commercial and Bid Automation (RPA) Management • Axiata: Dealing with Unstructured Data Analysis in East Asia Japan Toll Group and Unclear Rules-Based Processes in RPA Pacific), Schneider Electric Bhd • Lessons Learnt from Failed Robotic Process Implementation • Barclays: Assessing RPA Missteps to Avoid SELVEEN MUNIADY RAJESH Failures in the Long Run Head, Robotics NANDAKUMAR Process Automation Head of Enterprise • CEVA Logistics: Setting up an RPA Center of Architecture RHB Malaysia Excellence Governance Global Consumer Technology • HSBC: How RPA Delivers Value by Improving Asia & EMEA Citibank -

Electronic Toll Collection (Etc) Systems Development in Malaysia

PIARC International Seminar on Intelligent Transport System (ITS) In Road Network Operations August 14, 2006 to August 16, 2006 The Legend Hotel, Kuala Lumpur, Malaysia ELECTRONIC TOLL COLLECTION (ETC) SYSTEMS DEVELOPMENT IN MALAYSIA Ir. Ismail Md. Salleh Deputy Director General (Planning and Development) Malaysian Highway Authority Km. 16, Jalan Serdang – Kajang 43000 Kajang, Selangor, Malaysia En. Khair Ul-Anwar Mohd Yusoff General Manager Rangkaian Segar Sdn Bhd 9th Floor, Menara 1, Faber Towers Jalan Desa Bahagia, Taman Desa Off Jalan Klang Lama 58100 Kuala Lumpur, Malaysia Pn. Zaida Bt. Abdul Aziz Assistant Director Malaysian Highway Authority Km. 16, Jalan Serdang – Kajang 43000 Kajang, Selangor, Malaysia ABSTRACT The first ETC system was implemented along 22km expressways in 1995 and as of today, the whole stretch of 1,459 km expressways are equipped with a single ETC system allowing for full interoperable. A Service Provider providing electronic payment service operates the system, not just for toll payment but also for payment of parking, public transportation fares. The journey towards achieving ‘single and interoperable ETC’ is started in 1994 and by July 2004, the system were implemented nationwide. During the earlier stage of ETC Development in Malaysia, various system and technology were introduced. The toll highway operators were actively involved in ETC development in Malaysia as they realized the needs to reduce cost of toll collection, capital investment savings, fraud elimination, faster journey time, increased fuel, less congestion and reduce pollution. The first ETC Technology implemented is 2.45GHz microwave in 1994 and another highway operator introduced the same technology in 1997. The system was further enhanced in 2001 to meet the international standard of 5.8GHz. -

Analyst Briefing for 31 December 2020 Final Year Results

UNAUDITED RESULTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020 Disclaimer: The contents of this presentation include materials which may be capable of being interpreted as forward-looking statements. Such statements are merely estimates and targets, based on circumstances and reasonable assumptions which apply only at the date of such statements. Accordingly, no reliance should be placed on any forward-looking statements, express or implied, contained in this presentation. 1 AGENDA GROUP FINANCIAL HIGHLIGHTS REVIEW OF MAJOR OPERATIONS Financial Performance Key Events in 2020 Developments for 2021 5-YEAR PBT TRACK RECORD CAPITAL AND OTHER COMMITMENTS DIVIDEND RECORD SHARIAH-COMPLIANCE STATUS PROSPECTS FOR 2021 2 GROUP FINANCIAL HIGHLIGHTS 3 FINANCIAL RESULTS FOR THE YEAR ENDED 31 DEC 2020 (Figures in RM) 2020 2019 Change Revenue 4.19 bil 4.68 bil (10.5%) Operating Expenses 4.17 bil 4.48 bil (6.9%) Share of Wilmar’s Profit 1.24 bil 0.96 bil 29.4% PBT 1.42 bil 1.27 bil 11.7% Profit attributable to 1.32 bil 1.15 bil 14.3% owners of the parent EPS 92.57 sen 81.02 sen 14.3% 4 SEGMENTAL INFORMATION FOR THE YEAR ENDED 31 DEC 2020 1% 1% 4% 3% 15% Total Segment Revenue: RM 4.19 billion Grains & Agribusiness Consumer Products Film Exhibition & Distribution 76% Environmental Engineering & Utilities Investments & Other Operations Property 5 SEGMENTAL INFORMATION FOR THE YEAR ENDED 31 DEC 2020 19% 2% 1% Total Segment Profit: RM1.42 billion -9% Grains & Agribusiness Consumer Products n.m Film Exhibition & Distribution Environmental Engineering & Utilities Investments & Other Operations 87% Property n.m. -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Malaysia USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country AirAsia Group Berhad 0.16 MALAYSIA Hong Leong Bank 1.83 MALAYSIA Press Metal Aluminium Holdings 2.07 MALAYSIA Alliance Bank Malaysia 0.48 MALAYSIA Hong Leong Financial 0.66 MALAYSIA Public Bank BHD 9.5 MALAYSIA AMMB Holdings 1.1 MALAYSIA IHH Healthcare 2.99 MALAYSIA QL Resources 1.31 MALAYSIA Astro Malaysia Holdings 0.22 MALAYSIA IJM 0.87 MALAYSIA RHB Bank 1.3 MALAYSIA Axiata Group Bhd 2.49 MALAYSIA IOI 2.73 MALAYSIA Sime Darby 1.65 MALAYSIA British American Tobacco (Malaysia) 0.27 MALAYSIA IOI Properties Group 0.31 MALAYSIA Sime Darby Plantation 3.39 MALAYSIA CIMB Group Holdings 4.14 MALAYSIA Kuala Lumpur Kepong 2.05 MALAYSIA Sime Darby Property 0.38 MALAYSIA Dialog Group 3.3 MALAYSIA Malayan Banking 8.28 MALAYSIA Telekom Malaysia 0.93 MALAYSIA Digi.com 2.8 MALAYSIA Malaysia Airports 0.74 MALAYSIA Tenaga Nasional 7.53 MALAYSIA FGV Holdings 0.41 MALAYSIA Maxis Bhd 2.65 MALAYSIA Top Glove Corp 8.82 MALAYSIA Fraser & Neave Holdings 0.64 MALAYSIA MISC 1.9 MALAYSIA Westports Holdings 0.8 MALAYSIA Gamuda 1.48 MALAYSIA Nestle (Malaysia) 1.69 MALAYSIA YTL Corp 0.72 MALAYSIA Genting 1.34 MALAYSIA PETRONAS Chemicals Group Bhd 3.28 MALAYSIA Genting Malaysia BHD 1.11 MALAYSIA Petronas Dagangan 1.18 MALAYSIA Hap Seng Consolidated 0.93 MALAYSIA Petronas Gas 1.79 MALAYSIA Hartalega Holdings Bhd 5.25 MALAYSIA PPB Group 2.49 MALAYSIA Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points.