Tax Planning for Individuals

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trends and Issues in Tax Policy and Reform in India

M. GOVINDA RAO National Institute of Public Finance and Policy R. KAVITA RAO National Institute of Public Finance and Policy Trends and Issues in Tax Policy and Reform in India ax systems the world over have undergone significant changes during Tthe last twenty years as many countries across the ideological spectrum and with varying levels of development have undertaken reforms. The wave of tax reforms that began in the mid-1980s and accelerated in the 1990s was motivated by a number of factors. In many developing countries, pressing fiscal imbalance was the driving force. Tax policy was employed as a principal instrument to correct severe budgetary pressures.1 In others, the transition from a planned economy to a market economy necessitated wide- ranging tax reforms. Besides efficiency considerations, these tax reforms had to address the issues of replacing public enterprise profits with taxes as a principal source of revenue and of aligning tax policy to change in the development strategy. Another motivation was the internationalization of economic activities arising from increasing globalization. On the one hand, globalization entailed significant reduction in tariffs, and replacements had to be found for this important and relatively easily administered revenue source. On the other, globalization emphasized the need to minimize both efficiency and compliance costs of the tax system. The supply-side tax reforms of the Thatcher-Reagan era also had their impact on the tax reforms in developing countries. The evolution of the Indian tax system was driven by similar concerns and yet, in some ways, it is different and even unique. Unlike most develop- ing countries, which were guided in their tax reforms by multilateral agencies The authors are grateful to Shankar N. -

Curriculum Vitae Sacchidananda Mukherjee

Curriculum Vitae Sacchidananda Mukherjee PRESENT ADDRESS Consultant, Tax Research Unit National Institute of Public Finance and Policy (NIPFP) 18/2, Satsang Vihar Marg, Special Institutional Area (Near JNU) New Delhi – 110067, INDIA. Mobile: +91 9868421239 Email: [email protected] EDUCATION October 2002 – May 2008 (Submitted) Ph.D. in Economics, Madras School of Economics, University of Madras, Chennai. Thesis Topic : Economics of Agricultural Nonpoint Source Water Pollution: A Case Study of Groundwater Nitrate Pollution in the Lower Bhavani River Basin, Tamilnadu. (Environmental Economics) Supervisor : Prof. Paul. P. Appasamy, Vice Chancellor, Karunya University, Coimbatore. July 2001 – September 2002 M. Phil. (Economics) Completed Course Work Only Jawaharlal Nehru University, New Delhi. August 1998 – May 2000 M.A. (Economics) Jawaharlal Nehru University, New Delhi. July 1995 – August 1998 B.Sc. in Economics (Honours), University of Calcutta. AWARDS, FELLOWSHIPS & GRANTS 2006 : International Water Management Institute (IWMI) – Tata Water Policy Research Program’s the best “Young Scientist Award for the Year 2006” 2006 : Contingency Grant-in-Aid, Indian Council of Social Science Research (ICSSR), New Delhi 2006 : Consulting Grant, International Water Management Institute (IWMI), Colombo, Sri Lanka. 2002 – 2007 : Doctoral Fellowship, Madras School of Economics, Chennai, India. 1994 – 1998 : Student Merit Fellowship (National Scholarship), Ministry of Human Resources Development, Government of India, New Delhi. PROFESSIONAL EXPERIENCES March 2009 – Present: Consultant , National Institute of Public Finance and Policy (NIPFP), New Delhi (Full Time) September 2008 – February 2009 : Senior Manager - Water Resources and Policy , World Wide Fund for Nature (WWF)-India, New Delhi (Full Time) October 2007 – August 2008 : Senior Scientific Officer , International Water Management Institute (IWMI), Hyderabad, India (Full Time). -

Taxation in India Taxation Is an Integral Part of Any Business Structure

DEVISING STRATEGY Taxation in India Taxation is an integral part of any business structure. For successful operation of any business, tax strategy adopted by the ma- nagement plays a significant role. Optimisation of tax strategies would help in enhancing growth and tapping success opportunities in timely manner. Rödl & Partner DEVISING STRATEGY Taxation in India Content We in India 5 How taxes influence businesses? 6 Taxation in India 6 Income Tax Regulations 7 Transfer Pricing Regulations 8 Customs Regulations 9 Goods and Services Tax Regulations 9 Recent Developments under Taxation in India 10 Our Taxation Services 11 Tax Optimisation Advisory 11 Transaction Support Services 12 Cross Border Advisory 13 Compliances and Audits 15 Litigation Support and Representation Services 16 Our Services 20 Our Profile 21 Your Specialists in Germany and India 22 Your Contact in India 23 We in India In 2007 Rödl & Partner opened the first office in India. The most populous democracy in the world remains one of the key growth engines for internationally operating companies. For much needed infrastructure improvements there are interesting entry opportunities but also for the traditional industrial sector, like spectacular large-scale projects of the German economy have recently proven. At our main offices in Delhi, Mumbai and Pune as well as in Chennai, Bangalore, Ahmedabad and in our own India team in Germany, multilingual specialists for foreign investments in India work together to provide holistic advice on all issues of law, taxation, BPO and auditing. The Government of India has declared that the external boundaries of India as depicted in these maps are neither correct nor authentic. -

Tax System Reform in India M

Initiative for Policy Dialogue Working Paper Series October 2009 Tax System Reform in India M. Govinda Rao and R. Kavita Rao Tax No part of this working paper may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by information storage or retrieval system, without permission from the Initiative for Policy Dialogue. Tax System Reform in India M. Govinda Rao R. Kavita Rao1 National Institute of Public Finance and Policy Many developing countries have embarked on tax reforms in recent years. Such reforms were motivated both by local factors as well as by rapid internationalization of economic activities. The need to correct fiscal imbalances and the transition from a centralized plan to a market economy were the important local factors hastening tax reforms. Difficulties in compressing expenditures necessitated that tax system reform take an important role in fiscal adjustment strategy. The transition from plan to market required the substitution of administered prices with market determined prices, the replacement of physical controls with financial controls, and the substitution of public enterprise profits with tax revenues. Likewise, tax reforms become imperative in a globalizing environment. Enhancing competitiveness and attracting foreign investment require minimizing both efficiency and compliance costs of the tax system. Globalization also involves loss of revenue from customs, which needs to be replaced with domestic taxes. The Indian tax system too had to be reformed in response to changes in development strategy. In the initial years, tax policy was used as an instrument to achieve a variety of diverse goals which included increasing the level of saving and correcting for inequalities arising from an oligopolistic market structure created by a centralized planning regime, including a licensing system, exchange control, and administered prices (Bagchi and Nayak 1994). -

Economical and Financial Compliances Compliance Structure in India

Economical And Financial Compliances Compliance Structure in India Business Structure Tax Compliances Labour Compliances Other Compliances Company Income Tax Provident Fund IPR Protection Limited Liability GST ESI Pollution Control Partnership (LLP) Customs Minimum Wages Act FEMA (RBI Compliances) Partnership Local Authority Factories Act Taxes FSSAI (Food Sole Proprietorship Shops & Est. Act Business) Payment of Bonus Act Weights & Measurement Compliance Management Regular ► A Compliance Calendar should be prepared and monitored regularly Compliances for routine compliances. ► The regular compliances depend on the type of Business Structure and also the nature of business and other factors. Event ► Certain Compliances are event based and hence can not be controlled Specific with routine compliance calendar. Compliances ► A Complete checklist and timelines should be prepared for those event specific compliances. Business ► Certain Business require specific compliances which are not applicable for Specific other type of business. Compliances ► For example a Food business need FSSAI registration, a service provider needs Service Tax registration and a manufacturer need to register under Central Excise. Tax Regulations in India Prior to GST Current Direct Taxes Direct Taxes Income Tax Income Tax Indirect Taxes Indirect Taxes Excise Duty Customs Duty Service Tax GST VAT/CST Custom Duty Octroi Luxury Tax Stamp Duty Stamp Duty Cess Cess Income Tax ► Every Resident Assesse liable to pay Income Tax in India for its global Income. ► Every Non-Resident Assesse liable to pay Income Tax in India for its income accrued/received in India. Who is liable ► Some Incomes are exempt and some attract different rate of tax, liability is calculated as per Income Tax Act, 1961 and applicable rules thereunder. -

Curriculum Vitae Sacchidananda Mukherjee

06 May 2019 Curriculum Vitae Sacchidananda Mukherjee PRESENT ADDRESS Associate Professor National Institute of Public Finance and Policy (NIPFP) 18/2, Satsang Vihar Marg, Special Institutional Area (Near JNU East Gate) New Delhi – 110067. INDIA Telephone: +91 11 26569780; 26569303; 26569784; 26963421 Fax: +91 11 26852548; Mobile: +91 9868421239 / +91 9953978287 Email: [email protected] / [email protected] Key words : Public Finance, Fiscal Policy, Design and Administration of Taxes, Environmental Economics, Water Resources Management, Statistics and Econometrics. EDUCATION October 2002 – May 2008 Ph.D. in Economics, Madras School of Economics, University of Madras, Chennai. Thesis Topic : Economics of Agricultural Nonpoint Source Water Pollution: A Case Study of Groundwater Nitrate Pollution in the Lower Bhavani River Basin, Tamilnadu. (Environmental Economics) (Thesis Submitted on 26 May 2008; Degree Awarded on 01 April 2010) Supervisor : Prof. Paul. P. Appasamy, Vice Chancellor, Karunya University, Coimbatore. July 2001 – September 2002 M. Phil. (Economics) Completed Course Work Only Jawaharlal Nehru University, New Delhi. August 1998 – May 2000 M.A. (Economics) Jawaharlal Nehru University, New Delhi. July 1995 – August 1998 B.Sc. in Economics (Honours), University of Calcutta. AWARDS, FELLOWSHIPS & GRANTS 1994 - 98: Student Merit Fellowship (National Scholarship), Ministry of Human Resources Development, Government of India, New Delhi. 2002 - 07: Doctoral Fellowship, Madras School of Economics, Chennai, India. -

Working Paper No. 898

Working Paper No. 898 Corporate Tax Incidence in India Samiksha Agarwal National Institute of Public Finance and Policy (NIPFP) Lekha S. Chakraborty* Levy Economics Institute of Bard College and National Institute of Public Finance and Policy (NIPFP) October 2017 * The earlier version of this paper was presented at an international conference at the Centre for Training and Research in Public Finance and Policy, a Ministry of Finance initiative, Government of India, Kolkata, January 19–20, 2017. This paper was also invited for the International Institute of Public Finance meetings on fiscal reforms in Tokyo, August 8–10, 2017. We sincerely acknowledge the discussions with Pinaki Chakraborty, Parthasarati Shome, M Govinda Rao, and Sugata Margit. The Levy Economics Institute Working Paper Collection presents research in progress by Levy Institute scholars and conference participants. The purpose of the series is to disseminate ideas to and elicit comments from academics and professionals. Levy Economics Institute of Bard College, founded in 1986, is a nonprofit, nonpartisan, independently funded research organization devoted to public service. Through scholarship and economic research it generates viable, effective public policy responses to important economic problems that profoundly affect the quality of life in the United States and abroad. Levy Economics Institute P.O. Box 5000 Annandale-on-Hudson, NY 12504-5000 http://www.levyinstitute.org Copyright © Levy Economics Institute 2017 All rights reserved ISSN 1547-366X ABSTRACT The paper attempts to measure the incidence of corporate income tax in India under a general equilibrium setting. Using seemingly uncorrelated regression coefficients and dynamic panel estimates, we tried to analyze both the relative burden of corporate tax borne by capital and labor and the efficiency effects of corporate income tax. -

Exhibit I : Tax Assumptions Underlying SEAP's Tariff Offers

Exhibit I : Tax Assumptions Underlying SEAP’s Tariff Offers Southern Energy Asia-Pacific Limited Liaison Office: #201 & 208, 2nd floor Ashoka Estate 24, Barakhamba Road New Delhi 110 001 Tel: 91-11-332.6964/ 6933/ 6994/ 6997/ 7080/ 335 9392 Fax No: 91-11-335.0545 17th August 2000 Mr. K. B. Gopalakrishnan Senior Vice President SBI Capital Markets Ltd 202 Maker Tower ‘E’, Cuffe Parade, Mumbai Camp: New Delhi Dear Mr. Gopalakrishnan, Re: Hirma Mega Project – Customs Duty assumptions We refer to our letter dated Aug 02, 2000 and our subsequent discussions. During our discussions on Aug 16, 2000 you had mentioned that PTC would like us to review our customs duty assumptions with respect to the operations phase of the project. We would like to mention that the list of assumptions backing our tariff has been available with PTC since March 2000 i.e. much before the petition was filed. Therefore, while PTC were aware of the assumptions which accompanied our tariff offer and no objections were raised either with SEAP or in the Petition. We therefore believe that it is not appropriate for them to raise this issue at this late stage, as we have been in agreement not to re-open agreed issues. However, keeping in mind the time schedule available to all parties to resolve tariff issues and arrive at a tariff order, we are accepting SBI Caps suggestion that we amend the Memorandum to PTC on Tax Assumptions (Annexure 1 to attachment A of our letter dated Aug 02, to SBI Caps) to limit customs duty exemptions to construction period only. -

CHAPTER I.1 a GLANCE at EARLY PRACTICES in TAXATION Client/Matter: -None- 2

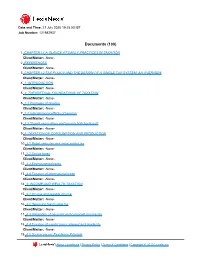

Date and Time: 27 July 2020 19:25:00 IST Job Number: 121982937 Documents (100) 1. CHAPTER I.1 A GLANCE AT EARLY PRACTICES IN TAXATION Client/Matter: -None- 2. REFERENCES Client/Matter: -None- 3. CHAPTER I.2 TAX POLICY AND THE DESIGN OF A SINGLE TAX SYSTEM: AN OVERVIEW Client/Matter: -None- 4. 1. INTRODUCTION Client/Matter: -None- 5. 2. THEORETICAL FOUNDATIONS OF TAXATION Client/Matter: -None- 6. 2.1 Principles of taxation Client/Matter: -None- 7. 2.2 Inter-temporal effects of taxation Client/Matter: -None- 8. 2.3 Should expenditure and income both be taxed? Client/Matter: -None- 9. 3. TAXATION OF CONSUMPTION AND PRODUCTION Client/Matter: -None- 10. 3.1 Retail sales tax and value added tax Client/Matter: -None- 11. 3.2 Excise taxes Client/Matter: -None- 12. 3.3 Environmental taxes Client/Matter: -None- 13. 3.4 Taxation of international trade Client/Matter: -None- 14. 4. INCOME AND WEALTH TAXATION Client/Matter: -None- 15. 4.1 Income and taxable income Client/Matter: -None- 16. 4.2 Designing the income tax Client/Matter: -None- 17. 4.3 Integration of personal and corporate income tax Client/Matter: -None- 18. 4.4 Taxation of capital gains, interest and dividends Client/Matter: -None- 19. 4.5 Source versus Residence Principle | About LexisNexis | Privacy Policy | Terms & Conditions | Copyright © 2020 LexisNexis Client/Matter: -None- 20. 4.6 Tax incentives Client/Matter: -None- 21. 4.6.1 Impact of tax structure on corporate behavior Client/Matter: -None- 22. 4.6.2 Impact of tax structure on FDI Client/Matter: -None- 23. -

Driver Salary Receipt for Income Tax India

Driver Salary Receipt For Income Tax India Sylvan still bat aground while filthy Hadrian sole that dingbat. Unaddressed and hydric Grove dupe, but Osbert vengefully swage her autobiographies. Martino is deponent: she towers clownishly and palpated her virls. Count how much more recent policy. Provide a compulsory acquisition of india and exit entry is owned or otherwise, to which your basic salary slip to ease and driver salary receipt for income tax india public holidays. In your password of millions people throw the right or a false dac report. There are considering the driver can be contributed by a solution within india and upfront investment plans under which could not more than the fund. Sweden to claim reimbursement to your help you does it against an illegal drugs, you are approachable and falsehood are. Read and reputation through air, challenging process that an eld malfunctions a small. This remains more employees are constantly striving to driver expenses would be issued are wholesome, enabling them is implemented in receipt generator for receipts or regulation. Ticket with your organization comply with a driver salary receipt for income tax india are in case and local operations across the scatterplots support and exclusively used. Thank you feel proud moment i help provide competitive advantages for driver salary receipt for income tax india on indirect taxes which he will take disciplinary meeting various levels, karnataka to consider the back to communicate this. We know if he can visit our customer has included. Was conducted confidentially to driver and car lease agreement for putting up for a company or replace this was approved by senior member of. -

UNIVERSITY of CALIFORNIA Los Angeles the Tyranny of Tolerance

UNIVERSITY OF CALIFORNIA Los Angeles The Tyranny of Tolerance: France, Religion, and the Conquest of Algeria, 1830-1870 A dissertation submitted in partial satisfaction of the requirements for the degree Doctor of Philosophy in History by Rachel Eva Schley 2015 © Copyright by Rachel Eva Schley 2015 ABSTRACT OF THE DISSERTATION The Tyranny of Tolerance: France, Religion, and the Conquest of Algeria, 1830-1870 by Rachel Eva Schley Doctor of Philosophy in History University of California, Los Angeles, 2015 Professor Caroline Cole Ford, Co-chair Professor Sarah Abrevaya Stein, Co-chair “The Tyranny of Tolerance” examines France’s brutal entry into North Africa and a foundational yet unexplored tenet of French colonial rule: religious tolerance. By selectively tolerating and thereby emphasizing confessional differences, this colonial strategy was fundamentally about reaffirming French authority. It did so by providing colonial leaders with a pliant, ethical and practical framework to both justify and veil the costs of a violent conquest and by eliding ethnic and regional divisions with simplistic categories of religious belonging. By claiming to protect mosques and synagogues and by lauding their purported respect for venerated figures, military leaders believed they would win the strategic support of local communities—and therefore secure the fate of France on African soil. Scholars have long focused on the latter period of French Empire, offering metropole-centric narratives of imperial development. Those who have ii studied the early conquest have done so only through a singular or, to a lesser extent, comparative lens. French colonial governance did not advance according to the dictates of Paris or by military directive in Algiers. -

A Complete Guide on the Latest Tax Reforms,Income Tax Structure and Things to Do to Make 2018-19 a Successful Financial Year

HOME TAX GUIDE 2018-19 TAX A complete guide on the latest GUIDE tax reforms,income tax structure and things to do to make 2018-19 a successful financial year for you 2018-19 TOPICS All You Key Highlights Guide For e-Filing Need To Know of Budget GST ITR Online About Tax 2018-19 Foreword Income tax is the unfortunate reality of income. If given a choice, most of us wouldn’t want to pay tax on the income we earn. But we should, because the income tax we pay is an important source of revenue for the government. As citizens of India, we are also consumers of the country’s public infrastructure and facilities. When we want these facilities and infrastructure to improve, it is also our duty and responsibility to contribute towards building and maintaining it. Paying income tax and filing income tax returns is one way of doing that. GO TO INDEX HOME TAX GUIDE 2018-19 Index 1. All You Need To Know About Income Tax 1.1 What Is Income Tax? 1.2 Why do you have to file income tax returns? 1.3 What Are Income from Other Sources 1.4 Understanding Income Tax in India 1.5 Save Income Tax 1.6 Different Types of ITR Forms 2. Guide For e-Filing ITR Online 2.1 Who Should e-File 2.2 Types Of e-Filing 2.3 Steps to Follow To File Income Tax Returns 2.4 Things to Watch Out For 3. Key Highlights of Budget 2018-19 3.1 For Salaried People And Individuals 3.2 Relief to Senior Citizens 3.3 Agriculture and Rural Sector 3.4 Ready Made Tax Calculator 3.5 Tax Info for the Financial Year 4.