Full Annual Report ICL 24.11.2014.P65

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Government of India Ministry of Housing & Urban Affairs

GOVERNMENT OF INDIA MINISTRY OF HOUSING & URBAN AFFAIRS LOK SABHA UNSTARRED QUESTION No. 2503 TO BE ANSWERED ON JANUARY 2, 2018 URBAN INFRASTRUCTURE PROJECTS No. 2503. SHRI R. GOPALAKRISHNAN: Will the Minister of HOUSING & URBAN AFFAIRS be pleased to state: (a) whether the Government has granted approval and released funds for implementing a number of urban infrastructure projects of Tamil Nadu; (b) if so, the details thereof along with the funds allocated/released for the said purpose during the last three years and the current year, city-wise including Madurai city in Tamil Nadu; and (c) the present status of those projects and the steps taken/being taken for expediting these projects? ANSWER THE MINISTER OF STATE (INDEPENDENT CHARGE) IN THE MINISTRY OF HOUSING & URBAN AFFAIRS (SHRI HARDEEP SINGH PURI) (a) to (c) Yes Madam. The Ministry of Housing & Urban Affairs has approved and released funds for implementing urban infrastructure projects in Tamil Nadu under its various schemes, viz., Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Smart Cities Mission (SCM), Page 1 of 2 Heritage City Development and Augmentation Yojana (HRIDAY), Swacchh Bharat Mission – Urban [SBM (U)], Urban Infrastructure Development in Satellite Towns around Seven Mega Cities (UIDSST), Urban Transport (UT), Pradhan Mantri Awas Yojana-Urban [PMAY (U)] and Jawaharlal Nehru National Urban Renewal Mission (JnNURM). Under AMRUT, the Ministry of Housing & Urban Affairs does not approve projects for individual cities but accords approval to the State Annual Action Plans (SAAPs) only. Selection, approval and implementation of individual projects is done by State Government. Further, the Ministry of Housing & Urban Affairs does not release central share of funds city-wise, but funds are released State-wise. -

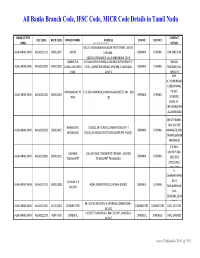

Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu

All Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu NAME OF THE CONTACT IFSC CODE MICR CODE BRANCH NAME ADDRESS CENTRE DISTRICT BANK www.Padasalai.Net DETAILS NO.19, PADMANABHA NAGAR FIRST STREET, ADYAR, ALLAHABAD BANK ALLA0211103 600010007 ADYAR CHENNAI - CHENNAI CHENNAI 044 24917036 600020,[email protected] AMBATTUR VIJAYALAKSHMIPURAM, 4A MURUGAPPA READY ST. BALRAJ, ALLAHABAD BANK ALLA0211909 600010012 VIJAYALAKSHMIPU EXTN., AMBATTUR VENKATAPURAM, TAMILNADU CHENNAI CHENNAI SHANKAR,044- RAM 600053 28546272 SHRI. N.CHANDRAMO ULEESWARAN, ANNANAGAR,CHE E-4, 3RD MAIN ROAD,ANNANAGAR (WEST),PIN - 600 PH NO : ALLAHABAD BANK ALLA0211042 600010004 CHENNAI CHENNAI NNAI 102 26263882, EMAIL ID : CHEANNA@CHE .ALLAHABADBA NK.CO.IN MR.ATHIRAMIL AKU K (CHIEF BANGALORE 1540/22,39 E-CROSS,22 MAIN ROAD,4TH T ALLAHABAD BANK ALLA0211819 560010005 CHENNAI CHENNAI MANAGER), MR. JAYANAGAR BLOCK,JAYANAGAR DIST-BANGLAORE,PIN- 560041 SWAINE(SENIOR MANAGER) C N RAVI, CHENNAI 144 GA ROAD,TONDIARPET CHENNAI - 600 081 MURTHY,044- ALLAHABAD BANK ALLA0211881 600010011 CHENNAI CHENNAI TONDIARPET TONDIARPET TAMILNADU 28522093 /28513081 / 28411083 S. SWAMINATHAN CHENNAI V P ,DR. K. ALLAHABAD BANK ALLA0211291 600010008 40/41,MOUNT ROAD,CHENNAI-600002 CHENNAI CHENNAI COLONY TAMINARASAN, 044- 28585641,2854 9262 98, MECRICAR ROAD, R.S.PURAM, COIMBATORE - ALLAHABAD BANK ALLA0210384 641010002 COIIMBATORE COIMBATORE COIMBOTORE 0422 2472333 641002 H1/H2 57 MAIN ROAD, RM COLONY , DINDIGUL- ALLAHABAD BANK ALLA0212319 NON MICR DINDIGUL DINDIGUL DINDIGUL -

SBIOA NEWS BULLETIN from SBI OFFICERS’ ASSOCIATION (CHENNAI CIRCLE)

SBIOA NEWS BULLETIN From SBI OFFICERS’ ASSOCIATION (CHENNAI CIRCLE) : 86, Rajaji Salai, Chennai - 600 001. : 044-25261013 (Housing) : 044-25227170/25228773 : [email protected] : 044-25220225 (For Internal Circulation only) September - 2020 So powerful is the light of unity that it can illuminate the whole earth. Baha'U'Llah Dear Comrade, As per the clarion call given by the UFBU & AIBOC, we were on war path during the months of January/February for our reasonable demands of early reasonable wage settlement, Updation of Pension/Family Pension, 5 days banking, Regulated Working hours for officers etc. and the demonstrations, strike on 31st January and 1st February have been a great success on account of the unity and solidarity shown by the rank and file of our association. Comrades, besides strike actions and other agitation programmes like demonstration, poster campaign, mass signature campaign, Your are well aware of the rapid spread of protest rallies, black badge wearing, candlelight pandemic disease COVID 19 across our Nation protest, press meet and dharna which are on since 23.03.2020 and Government of India and specific dates, UFBU has given a clarion call for Government of Tamilnadu is taking all 'withdrawal of extra cooperation. All the necessary steps to ensure that we are prepared programmes declared by the UFBU are well to face the challenge and threat posed by successfully implemented by your vigor, zeal the growing pandemic of COVID 19 – the and rock like solidarity. Corona Virus. The most important factor in preventing the spread of the Virus locally is to On 29th February 2020, another round of empower the citizens with the right information negotiation took place. -

Tirunelveli Sl.No

TIRUNELVELI SL.NO. APPLICATION NO NAME AND ADDRESS MUTHUKUMAR P, S/O.PETCHIMUTHU K, PLOT 66 KARPAGAM, 1 3250 NAGAR 7TH ST, KTC NAGAR, PALAYAMKOTTAI THIRUNELVELI-627011 VIJAYALAKSHMI.N, D/O NADARAJAN, 2 3251 24, RAJENDRANAGAR, PALAYAMCOTTAI, THIRUNELVELI-627002 THANGAMANI. C D/O.M CHINNAPPA, ARIYANAYAKIPURAM, 3 3252 VEERASIGAMANI, SANKARANKOIL TK- THIRUNELVELI GOVINDARAJ.S, S/O.P.S UDALAIMANI,, 9/32,A.EAST STREET,, 4 3253 VAIKKALPATTY,, METTUR,AMBAI TK THIRUNELVELI-627436 NAGESWARI.N, W/O.MANIKANDAN, DOOR NO. 13/106, AMBALAVANAPURAM 5 3254 PERIA THERU, VICKRAMASINGA - PURAM, AMBASAMUDRAM PO, THIRUNELVELI-627425 SAKILA.S, D/O.SENTHILVEL, 157/2, WEST STREET,, 6 3255 KUVALAIKANNI, SANKARANKOVIL TK., THIRUNELVELI KANAGARAJ.S, S/O.A.SUDALAIMUTHU, 16/A, AMMANKOVIL ST, 7 3256 MEENATCHIPURAM, PANPOZHI, TENKASI TK., THIRUNELVELI-627807 RAVINDRAN.N, S/O NALLA PERUMAL.K, CHIDAMBARAPURAM, 8 3257 KURUVIKULAM VIA, SANKARANKOIL TK. THIRUNELVELIPage 1 RAMESH AMARNATH.B, S/O.S.BALASUBRA- MANIAN, NO:9, 5TH STREET, 9 3258 STATE BANK COLONY, MELAGARAM, TENKASI TK, TIRUNELVELI-627818. JAIKUMAR.G.S S/O.M.G.G.SEKAR, 18, PUTHANERI WEST, 10 3259 SINGANERI PO, NANGUNERI TK., THIRUNELVELI-627108 VELMURUGESWARI.R, W/O AYYAPPAN, NO.10/1037.E SELVA VINAYAGAR PURAM, 11 3260 PAVOOR CHATRAM, TENKASI THIRUNELVELI- 0 JANITA MANO C, W/O AMARAN S, MAIN ROAD, KUVALAI KANNI, 12 3261 KARIVALAM VANDANALLUR THIRUNELVELI 627753 GANAGAMMAL., 14,RASIPURAM, 13 3262 TIRUNELVELI TOWN, THIRUNELVELI 0 RAJESWARI.V D/O.P.VELUCHAMY, AMBEDKAR STREET, 14 3263 MEENATCHIPOURAM, PANPOZHI THIRUNELVELI 0 KUMAR.K, S./O.K.KARUPPIAH,, 13A, KARUPPASAMY 15 3264 KOVIL STREET, KRISHNAPURAM THIRUNELVELI-627811 Page 2 RAJESWARAN.P, S/O.M.PAULRAJ,, 5/76A, AMMAN KOVIL ST, 16 3265 ALAGAPPAPURAM,, SAMBANKULAM, AMBAI THIRUNELVELI-627412 ANBU RAJ. -

Tirunelveli Sl.No

TIRUNELVELI SL.NO. APPLICATION NO. NAME AND ADDRESS MARUTHAMMAL.C D/O CHINNAPOOCHAN 1 3138 54 MANGAMMA SALAI, TENKASI, THIRUNELVELI 627811 MADASAMY alias RAVICHANDARAN.S 2 3139 S/O K.SUBRAMANIAN 15/91,KAILASAPURAM, ST, THIRUNELVELI 627001 RAMANIAMMAL.R D/O RAJADURAI 3 3140 12/6,TYPE I,CAMP II, HARBOUR ESTATE, TUTICORIN 628004 HEMARANI.J D/O B.JEYARAJ 4 3141 306,S.SIVANTHAKULAM RD, DAMODHAR NAGAR, TUTICORIN ALAGUSELVI.A D/O ALAGARSAMY 5 3142 U 86,MADASAMY KOVIL STREET, ABINAYAMAHAL NEAR, TUTICORIN 628002 KARTHIKA.M D/O K.MANAVALAN 9/A BRYANTNAGAR , 6 3143 10TH STREET, THOOTHUKUDI , TUTICORIN 628008 SARAVANAKUMAR.T S/O THIRUSENTHILNAYAGAM 2/ 95, SUBBAMMAL PURAM, 7 3144 SILANGULAM, OTTAPIDARAM TK, THOOTHUKUDI DIST, TUTICORIN 628718 MANTHIRAMOORTHY.G S/O GOPAL.M 6 SOUTH STREET, 8 3145 EAST URUDAIYARPURAM, THACHANALLUR, THIRUNELVELI 627358 JEGANATH.S OLD NO.2/22 NEW NO.2/6, NORTH STREET, 9 3146 V.KOVIL PATHU, SRIVAIKUNDAM TALUK, THIRUNELVELI 628809 ARUN KUMAR.N S/O C.NATARAJAN 321B/3 VIJAYAPURI RD, 10 3147 SOUTH THITTANKULAM, KOVILPATTI TK, TUTICORIN SUBASH.M 11 3148 1/194 VMS NAGAR, TUTICORIN 628002 NAGARAJ.K S/O T.KARUPPASAMY 23B/1,PAGALAMUDAI YAN ST, 12 3149 T.N.PUTHUKUDI, PULIYANGUDI, THIRUNELVELI SURESH.M S/O K.MURUGAN 13 3150 93C-5 VAKIL ST, KOVILPATTI, TUTICORIN 628501 KUMAR.M S/O U.MANI 14 3151 A.39 HEAVY WATER, COLONY, TOOTHUKUD I 7 VELRAJ.M 5/54 POST OFFICE THERU, 15 3152 KAMBANERI, TENKASI TK, THIRUNELVELI 627857 SADEESH KUMAR.S S/O P.SIVAPERUMAL 16 3153 2/121 VOC STREET, OTTAPIDARAM, TUTICORIN 628401 PREMKUMAR .S S/O.SUDALAIMANI -

Mint Building S.O Chennai TAMIL NADU

pincode officename districtname statename 600001 Flower Bazaar S.O Chennai TAMIL NADU 600001 Chennai G.P.O. Chennai TAMIL NADU 600001 Govt Stanley Hospital S.O Chennai TAMIL NADU 600001 Mannady S.O (Chennai) Chennai TAMIL NADU 600001 Mint Building S.O Chennai TAMIL NADU 600001 Sowcarpet S.O Chennai TAMIL NADU 600002 Anna Road H.O Chennai TAMIL NADU 600002 Chintadripet S.O Chennai TAMIL NADU 600002 Madras Electricity System S.O Chennai TAMIL NADU 600003 Park Town H.O Chennai TAMIL NADU 600003 Edapalayam S.O Chennai TAMIL NADU 600003 Madras Medical College S.O Chennai TAMIL NADU 600003 Ripon Buildings S.O Chennai TAMIL NADU 600004 Mandaveli S.O Chennai TAMIL NADU 600004 Vivekananda College Madras S.O Chennai TAMIL NADU 600004 Mylapore H.O Chennai TAMIL NADU 600005 Tiruvallikkeni S.O Chennai TAMIL NADU 600005 Chepauk S.O Chennai TAMIL NADU 600005 Madras University S.O Chennai TAMIL NADU 600005 Parthasarathy Koil S.O Chennai TAMIL NADU 600006 Greams Road S.O Chennai TAMIL NADU 600006 DPI S.O Chennai TAMIL NADU 600006 Shastri Bhavan S.O Chennai TAMIL NADU 600006 Teynampet West S.O Chennai TAMIL NADU 600007 Vepery S.O Chennai TAMIL NADU 600008 Ethiraj Salai S.O Chennai TAMIL NADU 600008 Egmore S.O Chennai TAMIL NADU 600008 Egmore ND S.O Chennai TAMIL NADU 600009 Fort St George S.O Chennai TAMIL NADU 600010 Kilpauk S.O Chennai TAMIL NADU 600010 Kilpauk Medical College S.O Chennai TAMIL NADU 600011 Perambur S.O Chennai TAMIL NADU 600011 Perambur North S.O Chennai TAMIL NADU 600011 Sembiam S.O Chennai TAMIL NADU 600012 Perambur Barracks S.O Chennai -

AND IT's CONTACT NUMBER Tirunelveli 0462

IMPORTANT PHONE NUMBERS AND EMERGENCY OPERATION CENTRE (EOC) AND IT’S CONTACT NUMBER Name of the Office Office No. Collector’s Office Control Room 0462-2501032-35 Collector’s Office Toll Free No. 1077 Revenue Divisional Officer, Tirunelveli 0462-2501333 Revenue Divisional Officer, Cheranmahadevi 04634-260124 Tirunelveli 0462 – 2333169 Manur 0462 - 2485100 Palayamkottai 0462 - 2500086 Cheranmahadevi 04634 - 260007 Ambasamudram 04634- 250348 Nanguneri 04635 - 250123 Radhapuram 04637 – 254122 Tisaiyanvilai 04637 – 271001 1 TALUK TAHSILDAR Taluk Tahsildars Office No. Residence No. Mobile No. Tirunelveli 0462-2333169 9047623095 9445000671 Manoor 0462-2485100 - 9865667952 Palayamkottai 0462-2500086 - 9445000669 Ambasamudram 04634-250348 04634-250313 9445000672 Cheranmahadevi 04634-260007 - 9486428089 Nanguneri 04635-250123 04635-250132 9445000673 Radhapuram 04637-254122 04637-254140 9445000674 Tisaiyanvilai 04637-271001 - 9442949407 2 jpUney;Ntyp khtl;lj;jpy; cs;s midj;J tl;lhl;rpah; mYtyfq;fspd; rpwg;G nray;ghl;L ikaq;fspd; njhiyNgrp vz;fs; kw;Wk; ,izatop njhiyNgrp vz;fs; tpguk; fPo;f;fz;lthW ngwg;gl;Ls;sJ. Sl. Mobile No. with Details Land Line No No. Whatsapp facility 0462 - 2501070 6374001902 District EOC 0462 – 2501012 6374013254 Toll Free No 1077 1 Tirunelveli 0462 – 2333169 9944871001 2 Manur 0462 - 2485100 9442329061 3 Palayamkottai 0462 - 2501469 6381527044 4 Cheranmahadevi 04634 - 260007 9597840056 5 Ambasamudram 04634- 250348 9442907935 6 Nanguneri 04635 - 250123 8248774300 7 Radhapuram 04637 – 254122 9444042534 8 Tisaiyanvilai 04637 – 271001 9940226725 3 K¡»a Jiw¤ jiyt®fë‹ bršngh‹ v§fŸ mYtyf vz; 1. kht£l M£Á¤ jiyt®, ÂUbešntè 9444185000 2. kht£l tUthŒ mYty®, ÂUbešntè 9445000928 3. khefu fhtš Miza®, ÂUbešntè 9498199499 0462-2970160 4. kht£l fhtš f§fhâ¥ghs®, ÂUbešntè 9445914411 0462-2568025 5. -

Feasibility Report for Talaiyuthu Limestone Mine (G.O

Feasibility Report for Talaiyuthu Limestone Mine (G.O. (3D) No. 154, Extent - 22.305 Ha) of The India Cements Limited (ICL), Sankarnagar, Tirunelveli District, Tamil Nadu FEASIBILITY REPORT 1 Creative Engineers & Consultants Feasibility Report for Talaiyuthu Limestone Mine (G.O. (3D) No. 154, Extent - 22.305 Ha) of The India Cements Limited (ICL), Sankarnagar, Tirunelveli District, Tamil Nadu CONTENTS CHAPTER NO. PARTICULARS PAGE NO PRE - FEASIBILITY REPORT I EXECUTIVE SUMMARY 4 INTRODUCTION OF THE PROJECT / BACKGROUND II 11 INFORMATION III PROJECT DESCRIPTION 19 IV SITE ANALYSIS 33 V PLANNING BRIEF 38 VI PROPOSED INFRASTRUCTURE 40 VII REHABILITATION & RESETTLEMENT (R&R) PLAN 40 VIII PROJECT SCHEDULE & COST ESTIMATES 40 IX ANALYSIS OF PROPOSAL (FINAL RECOMMENDATIONS) 41 2 Creative Engineers & Consultants Feasibility Report for Talaiyuthu Limestone Mine (G.O. (3D) No. 154, Extent - 22.305 Ha) of The India Cements Limited (ICL), Sankarnagar, Tirunelveli District, Tamil Nadu LIST OF FIGURES FIGURE PARTICULARS PAGE NO NO. 1. LOCATION MAP 15 2. LEASE PLAN 16 3. GEOLOGICAL PLAN 24 4. GEOLOGICAL CROSS SECTION 25 5. SURFACE LAYOUT PLAN 26 6. MINE POSITION AT THE END OF PRESENT PLAN PERIOD 27 7. CONCEPTUAL PLAN 28 8. CONCEPTUAL CROSS SECTION 29 9. STUDY AREA WITHIN 10 KM RADIUS 35 LIST OF ANNEXURES ANNEXURE PARTICULARS PAGE NO NO. 1 MINE GO COPY FOR G.O. (3D) No. 154 43 COPY OF RENEWAL APPLICATION IN FORM-J AND ITS 2 49 ACKNOWLEDGEMENT IN FORM-D 3 MININIG PLAN APPROVAL LETTER 55 3 Creative Engineers & Consultants Feasibility Report for Talaiyuthu Limestone Mine (G.O. (3D) No. 154, Extent - 22.305 Ha) of The India Cements Limited (ICL), Sankarnagar, Tirunelveli District, Tamil Nadu CHAPTER I EXECUTIVE SUMMARY 1.0 INTRODUCTION OF THE PROJECT / BACKGROUND INFORMATION M/S. -

Jan'2019 to June'2019

KAMARAJAR PORT LIMITED Compliance Report On Ministry’s guidelines for “CONSTRUCTION OF NEW SATELLITE PORT AT ENNORE” CONDITIONS COMPLIED AS PER THE GUIDELINES OF THE MINISTRY OF ENVIRONMENT AND FOREST ISSUED VIDE LETTER DATED 28/9/1992 Ref: J-16011/9/87-IA, III dated 28.9.1992 The port has been planned and developed for receiving coal exclusively for Thermal Power stations of TANGEDCO (TNEB) using shore based grab un- loaders plus conveyors and with ship un-loaders and harbour mobile hoppers plus conveyors-now being modified similar to shore based grab unloaders. Ennore Port was declared as major port on March 23, 1999. First Major Port incorporated as a company under the Companies Act, 1956 on October 11, 1999. The commercial operation of Port was started on June 22, 2001. S.No MoEF Guidelines Compliance report (i) The total land area of the Project As per Environment clearance letter should be limited to 400 Ha as issued by Ministry of Environment & proposed Forests for the “Construction of new satellite port at Ennore near Madras in Tamilnadu” vide letter dated 28.9.1992, the total land area accorded was 400 ha. Subsequently port has developed new projects under Phase-II and port has developed various new projects phase wise. Port has acquired additional lands from various Government authorities like TIDCO, TNEB, salt Department, except 31.97 Acres of land which was transferred from private party (patta land). At present total Port area is 1128.45 Ha. The details of land acquired is enclosed as Annexure-I. (ii) Hill features of Karikkal and No quarrying operation has been Bodiparai hills should not be carried out in Bodaparai hill. -

List of Town Panchayats Name in Tamil Nadu Page 1 District Code

List of Town Panchayats Name in Tamil Nadu Sl. No. District Code District Name Town Panchayat Name 1 1 KANCHEEPURAM ACHARAPAKKAM 2 1 KANCHEEPURAM CHITLAPAKKAM 3 1 KANCHEEPURAM EDAKALINADU 4 1 KANCHEEPURAM KARUNGUZHI 5 1 KANCHEEPURAM KUNDRATHUR 6 1 KANCHEEPURAM MADAMBAKKAM 7 1 KANCHEEPURAM MAMALLAPURAM 8 1 KANCHEEPURAM MANGADU 9 1 KANCHEEPURAM MEENAMBAKKAM 10 1 KANCHEEPURAM NANDAMBAKKAM 11 1 KANCHEEPURAM NANDIVARAM - GUDUVANCHERI 12 1 KANCHEEPURAM PALLIKARANAI 13 1 KANCHEEPURAM PEERKANKARANAI 14 1 KANCHEEPURAM PERUNGALATHUR 15 1 KANCHEEPURAM PERUNGUDI 16 1 KANCHEEPURAM SEMBAKKAM 17 1 KANCHEEPURAM SEVILIMEDU 18 1 KANCHEEPURAM SHOLINGANALLUR 19 1 KANCHEEPURAM SRIPERUMBUDUR 20 1 KANCHEEPURAM THIRUNEERMALAI 21 1 KANCHEEPURAM THIRUPORUR 22 1 KANCHEEPURAM TIRUKALUKUNDRAM 23 1 KANCHEEPURAM UTHIRAMERUR 24 1 KANCHEEPURAM WALAJABAD 25 2 TIRUVALLUR ARANI 26 2 TIRUVALLUR CHINNASEKKADU 27 2 TIRUVALLUR GUMMIDIPOONDI 28 2 TIRUVALLUR MINJUR 29 2 TIRUVALLUR NARAVARIKUPPAM 30 2 TIRUVALLUR PALLIPATTU 31 2 TIRUVALLUR PONNERI 32 2 TIRUVALLUR PORUR 33 2 TIRUVALLUR POTHATTURPETTAI 34 2 TIRUVALLUR PUZHAL 35 2 TIRUVALLUR THIRUMAZHISAI 36 2 TIRUVALLUR THIRUNINDRAVUR 37 2 TIRUVALLUR UTHUKKOTTAI Page 1 List of Town Panchayats Name in Tamil Nadu Sl. No. District Code District Name Town Panchayat Name 38 3 CUDDALORE ANNAMALAI NAGAR 39 3 CUDDALORE BHUVANAGIRI 40 3 CUDDALORE GANGAIKONDAN 41 3 CUDDALORE KATTUMANNARKOIL 42 3 CUDDALORE KILLAI 43 3 CUDDALORE KURINJIPADI 44 3 CUDDALORE LALPET 45 3 CUDDALORE MANGALAMPET 46 3 CUDDALORE MELPATTAMPAKKAM 47 3 CUDDALORE PARANGIPETTAI -

Axis Bank-RAC, Arcot Plaza, Old No.38, New No.165, Arcot Road, Kodambakkam, Chennai - 600024

Retail Lending and Payment Group (South Zonal Office/Branch):Axis Bank-RAC, Arcot Plaza, Old No.38, New No.165, Arcot Road, Kodambakkam, Chennai - 600024. Corporate Office:-, “Axis House”, C-2, Wadia International Centre, Pandurang Budhkar Marg, Worli, Mumbai – 400025. Registered Office: “Trishul”, 3rd Floor Opp. Samartheshwar Temple Law Garden, Ellisbridge Ahmedabad – 380006. Public notice for Sale/Auction of immovable properties Under SARFAESI Act read with proviso to Rule 8 (6) of the Security Interest (Enforcement) Rules Whereas the Authorized Officer of Axis Bank Ltd. (hereinafter referred to as ‘the Bank’), under Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (in short ‘SARFAESI Act) and in exercise of powers conferred under Section 13(12) read with the Security Interest (Enforcement) Rules, 2002 issued Demand Notice under Sec. 13(2) of SARFAESI Act calling upon the below-mentioned Borrowers/Co-borrowers/mortgagors/Guarantors to repay the amount mentioned in the notice being the amount due together with further interest thereon at the contractual rate plus all costs charges and incidental expenses etc. till the date of payment within 60 days from the date of the said notice. The Borrowers/Co-borrowers/mortgagors/Guarantors having failed to repay the above said amount within the specified period, the authorized officer has taken over physical possession in exercise of powers conferred under Section 13(4) of SARFAESI Act read with Security Interest (Enforcement) Rules, 2002, which -

January 2021 Chennai Jesuits News Volume 02 |No

nrk;kly; ESUIT CHEMMADAL JCHENNAI PROVINCE Our Lady of the Way JANUARY 2021 CHENNAI JESUITS NEWS VOLUME 02 |NO. 01 “ Year of Saint Joseph” 8 Dec 2020 - 8 Dec 2021 Provincial’s Message Cross:(Provincial’s Power Address of the delivered Powerlessness on the occasion of the celebration of the First Province Day on 28 Dec 2020) Dear Friends in the Lord, I wish you all a happy and a challenging NEW YEAR 2021. It gives me immense joy to virtually see all of you cheerfully celebrating our First Province Day as one Jesuit Family of Chennai Province, on the occasion of the completion of a year of the birth of our Province. We are celebrating this day with a sense of gratitude to the Lord, our Mother Mary and the Mother Man Society. We have been spending the whole day in thanking with a Father’s the Lord, for His intimate accompaniment, and in reflecting together on the challenges that are placed before us and thus Heart strengthening our hope. The consolations that fill our hearts overpower the challenges that we encounter these days. At the outset, I thank the Lord for keeping all of us safe in good health throughout the year, despite the COVID-19 pandemic that terrorized the entire humanity. Though some of our friends were affected, no doubt, our prayers were heard and the Lord protected them. In spite of the continuous lockdown from the end of March 2020, with the Spirit of the Lord, we were able to reach out through our simple and committed services the unreached people who were affected by the pandemic.