The Impact of Cash Transfers on Local Markets in Iraq: Lessons from Baiji and Rawa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A New Formula in the Battle for Fallujah | the Washington Institute

MENU Policy Analysis / Articles & Op-Eds A New Formula in the Battle for Fallujah by Michael Knights May 25, 2016 Also available in Arabic ABOUT THE AUTHORS Michael Knights Michael Knights is the Boston-based Jill and Jay Bernstein Fellow of The Washington Institute, specializing in the military and security affairs of Iraq, Iran, and the Persian Gulf states. Articles & Testimony The campaign is Iraq's latest attempt to push militia and coalition forces into a single battlespace, and lessons from past efforts have seemingly improved their tactics. n May 22, the Iraqi government announced the opening of the long-awaited battle of Fallujah, the city only O 30 miles west of Baghdad that has been fully under the control of the Islamic State of Iraq and the Levant group for the past 29 months. Fallujah was a critical hub for al-Qaeda in Iraq and later ISIL in the decade before ISIL's January 2014 takeover. On the one hand it may seem surprising that Fallujah has not been liberated sooner -- after all, it has been the ISIL- controlled city closest to Baghdad for more than two years. The initial reason was that there was always something more urgent to do with Iraq's security forces. In January 2014, the Iraqi security forces were focused on preventing an ISIL takeover of Ramadi next door. The effort to retake Fallujah was judged to require detailed planning, and a hasty counterattack seemed like a pointless risk. In retrospect it may have been worth an early attempt to break up ISIL's control of the city while it was still incomplete. -

Japan's Official Development Assistance

Japan’s Official Development Assistance Japan pledged up to $ 5 billion of assistance for Technical reconstruction in Iraq Cooperation (Aimed at improving various skills) Madrid Conference (October 2003) Training FY 2003 - 2011 a total of about 5,000 Iraqi people participated Loan Assistance Grant Aid in training courses $ 3.5 billion $ 1.5 billion arranged by JICA in Japan or other countries. By JICA 15 projects Emergency assistance on Electricity, Oil, Water, basic infrastructures + Reconstruction in various Transportation, Irrigation, etc. Technical sectors + 4 new Cooperation Project 3 projects in the field of ⇒ beyond $ 4.1 billion + Agriculture in KRG & Japan pledged an 1 project in field of the additional $ 100 million Agriculture Irrigation in GOI Debt Reduction of grant aid. (2007) $ 6 billion JICA ODA Loan Projects in Iraq Water Supply Improvement Project in Kurdistan Region [JP¥ 34.3 bil / US$ 303 mil] Deralok Hydropower Plant Construction Project [[JP¥JP¥ 1 17.07.0 bil / US$ 165 mil] Electricity Sector Reconstruction Project in Kurdistan Region [ [JP¥JP¥ 14.7 bil / US$ 127 mil] Water Sector Loan Project in Midwestern Iraq [[JP¥JP¥ 41 41.3.3 bil / US$ 401 mil] Health Sector Reconstruction Project [[JP¥JP¥ 10.2 bil / US$ 126 mil] Irrigation Sector Loan [[JP¥JP¥ 9.5 bil bil// US$ 86 mil] AlAl-Akkaz-Akkaz Gas Power Plant Construction Project Electricity Sector Reconstruction Project [JP[JP¥¥ 29 29.6.6 bil / US$ 287 mil] JPJP¥¥ 32.6 bil bil// US$ 281 mil] ((BaijiBaiji Refinery Upgrading Project (E/S) Baghdad Sewerage Facilities -

EASO Rapport D'information Sur Les Pays D'origine Iraq Individus Pris

European Asylum Support Office EASO Rapport d’information sur les pays d’origine Iraq Individus pris pour cible Mars 2019 SUPPORT IS OUR MISSION European Asylum Support Office EASO Rapport d’information sur les pays d’origine Iraq Individus pris pour cible Mars 2019 D’autres informations sur l’Union européenne sont disponibles sur l’internet (http://europa.eu). ISBN: 978-92-9485-051-5 doi: 10.2847/95098 © European Asylum Support Office 2019 Sauf indication contraire, la reproduction est autorisée, moyennant mention de la source. Pour les contenus reproduits dans la présente publication et appartenant à des tierces parties, se référer aux mentions relatives aux droits d’auteur desdites tierces parties. Photo de couverture: © Joel Carillet, un drapeau iraquien flotte sur le toit de l’église syro- orthodoxe Saint-Ephrem de Mossoul (Iraq), qui a été fortement endommagée, quelques mois après que ce quartier de Mossoul a été repris à l’EIIL. L’emblème de l’EIIL était peint sur la façade du bâtiment durant l’occupation de Mossoul par l’EIIL. EASO RAPPORT D’INFORMATION SUR LES PAYS D’ORIGINE IRAQ: INDIVIDUS PRIS POUR CIBLE — 3 Remerciements Le présent rapport a été rédigé par des experts du centre de recherche et de documentation (Cedoca) du bureau belge du Commissariat général aux réfugiés et aux apatrides. Par ailleurs, les services nationaux d’asile et de migration suivants ont procédé à une relecture du présent rapport, en concertation avec l’EASO: Pays-Bas, Bureau des informations sur les pays et de l’analyse linguistique, ministère de la justice Danemark, service danois de l’immigration La révision apportée par les départements, experts ou organisations susmentionnés contribue à la qualité globale du rapport, mais ne suppose pas nécessairement leur approbation formelle du rapport final, qui relève pleinement de la responsabilité de l’EASO. -

Iraq SITREP 2015-10-15

Iraq Situation Report: October 16 - 20, 2015 1 Chairman of the Joint Chiefs of Sta visits Iraq. Gen. Dunford, Chairman of the Joint 6 ISF and “Popular Mobilization” make progress in and around Baiji. Iraqi Chiefs of Sta, traveled to Arbil and Baghdad on October 20 for meetings with PM Haider Security Forces, Iranian proxy militias, and non-proxy militias seized Siniya al-Abadi, President Fuad Masoum, and American commanders. He stated that Abadi has not and the Siniya airport, west of Baiji, on October 15. Security forces also asked Russia to conduct airstrikes. recaptured several areas north of Baiji and trapped ISIS ghters to al-Fatha, between Mount Makhul and the Hamrin Mountains. Proxy militias and a Joint Operations Command spokesperson claimed full control over Baiji, though ghting in Baiji and the Baiji Oil Renery is ongoing. Six Coalition 2 Jordan-Iraq border temporarily opens. Jordan temporarily airstrikes targeted ISIS “near” Baiji between October 16 and October 20. re-opened the Trebil border crossing on October 18 to allow Iraqi trucks and goods to return to Iraq. Dahuk Mosul Dam 7 Diyala governor escapes assassination attempt. Two IEDs Mosul Arbil targeted the convoy of the Diyala governor, a senior Badr Organi- 3 ISF launches operation to re-secure key town near zation member, in al-Tahrir area south of Baquba on October 19. al-Asad Airbase. Jazeera and Badia Operations Command e governor escaped unharmed, but two bodyguards ( JBOC) launched an operation on October 16 to clear ISIS were wounded. As Sulaymaniyah from areas around Baghdadi sub-district, west of Ramadi, and destroyed three VBIEDs. -

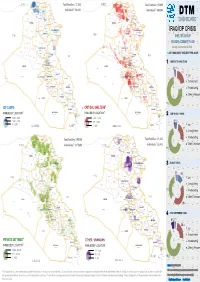

20141214 04 IOM DTM Repor

TURKEY Zakho Amedi Total Families: 27,209 TURKEY Zakho Amedi TURKEY Total Families: 113,999 DAHUK Mergasur DAHUK Mergasur Dahuk Sumel 1 Sumel Dahuk 1 Soran Individual : 163,254 Soran Individuals : 683,994 DTM Al-Shikhan Akre Al-Shikhan Akre Tel afar Choman Telafar Choman Tilkaif Tilkaif Shaqlawa Shaqlawa Al-Hamdaniya Rania Al-Hamdaniya Rania Sinjar Pshdar Sinjar Pshdar ERBIL ERBIL DASHBOARD Erbil Erbil Mosul Koisnjaq Mosul Koisnjaq NINEWA Dokan NINEWA Dokan Makhmur Sharbazher Penjwin Makhmur Sharbazher Penjwin Dabes Dabes IRAQ IDP CRISIS Al-Ba'aj SULAYMANIYAH Al-Ba'aj SULAYMANIYAH Hatra Al-Shirqat Kirkuk Hatra Al-Shirqat Kirkuk Sulaymaniya Sulaymaniya KIRKUK KIRKUK Al-Hawiga Chamchamal Al-Hawiga Chamchamal DarbandihkanHalabja SYRIA Darbandihkan SYRIA Daquq Daquq Halabja SHELTER GROUP Kalar Kalar Baiji Baiji Tooz Tooz BY DISPLACEMENT FLOW Ra'ua Tikrit SYRIA Ra'ua Tikrit Kifri Kifri January to December 9, 2014 SALAH AL-DIN Haditha Haditha SALAH AL-DIN Samarra Al-Daur Khanaqin Samarra Al-Daur Khanaqin Al-Ka'im Al-Ka'im Al-Thethar Al-Khalis Al-Thethar Al-Khalis % OF FAMILIES BY SHELTER TYPE AS OF: DIYALA DIYALA Ana Balad Ana Balad IRAN Al-Muqdadiya IRAN Al-Muqdadiya IRAN Heet Al-Fares Heet Al-Fares Tar m ia Tarm ia Ba'quba Ba'quba Adhamia Baladrooz Adhamia Baladrooz Kadhimia Kadhimia JANUARY TO MAY CRISIS KarkhAl Resafa Ramadi Ramadi KarkhAl Resafa 1 Abu Ghraib Abu Ghraib BAGHDADMada'in BAGHDADMada'in ANBAR Falluja ANBAR Falluja Mahmoudiya Mahmoudiya Badra Badra 2% 1% Al-Azezia Al-Azezia Al-Suwaira Al-Suwaira Al-Musayab Al-Musayab 21% Al-Mahawil -

MPLS VPN Service

MPLS VPN Service PCCW Global’s MPLS VPN Service provides reliable and secure access to your network from anywhere in the world. This technology-independent solution enables you to handle a multitude of tasks ranging from mission-critical Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), quality videoconferencing and Voice-over-IP (VoIP) to convenient email and web-based applications while addressing traditional network problems relating to speed, scalability, Quality of Service (QoS) management and traffic engineering. MPLS VPN enables routers to tag and forward incoming packets based on their class of service specification and allows you to run voice communications, video, and IT applications separately via a single connection and create faster and smoother pathways by simplifying traffic flow. Independent of other VPNs, your network enjoys a level of security equivalent to that provided by frame relay and ATM. Network diagram Database Customer Portal 24/7 online customer portal CE Router Voice Voice Regional LAN Headquarters Headquarters Data LAN Data LAN Country A LAN Country B PE CE Customer Router Service Portal PE Router Router • Router report IPSec • Traffic report Backup • QoS report PCCW Global • Application report MPLS Core Network Internet IPSec MPLS Gateway Partner Network PE Router CE Remote Router Site Access PE Router Voice CE Voice LAN Router Branch Office CE Data Branch Router Office LAN Country D Data LAN Country C Key benefits to your business n A fully-scalable solution requiring minimal investment -

SAD, Iraq 26/07/2021,14:00 AM to 13:00 Noon Emergency Livelihoods Sub-National Cluster Meeting in Salah Al-Din Meeting Minutes

SAD, Iraq 26/07/2021,14:00 AM to 13:00 Noon Emergency Livelihoods Sub-National Cluster Meeting in Salah Al-Din Meeting Minutes VENUE Remotely Via MS Teams Call DATE AND TIME 14:00 am – 15:00 Noon; Monday, July 26, 2021 Chair Oxfam in Salah Al Din PARTICIPANTS UN-WFP, UNOCHA, Mercy Corps, Mercy Hands (Co-Chair), SSDF, NEF, COOPI and OXFAM (Chair). RWG/DSTWG Missing: DRC SEDO, ICRC, WORLD VISION, Arche Nova Not attended Meeting Agenda 1. Introduction of the participants. 2. Approval of last meeting minutes and discussion/ follow-up on action points 3. Introduction of TASK FORCE formulated for Inputs on water scarcity and its impacts 4. Partners activity updates. 5. AOB and Next Meeting 1. Introduction of Meeting started off with the welcome note by EL Sub Cluster Coordinator. the participants. 2. Discussion of ➢ Agenda point formation of Task force were carried forward from the last meeting. previous meeting action points. 4. Water scarcity ➢ Task forces been initiative under EL- Sub cluster for SAD. All the members will be and drought impact informed for first formal meeting. 4. Partners’ Update Oxfam GFFO project is planned to target Baiji, Balad and Shirqat, to find the potential place, assets replacement and agriculture grants, establishment of community committee especially in Baiji for project implementation, CFW technical assessment for different schemes under WASH and Health sectors in Balad with engagement of 330 CfW participants. BMZ project. A three years project, while first year is finished and second year started verification with partner for farmers support through agriculture grants to restock their livestock and establishing community saving groups. -

Major Strategic Projects Available for Investment According to Sectors

Republic of Iraq Presidency of Council of Ministers National Investment Commission MAJOR STRATEGIC (LARGE) AND (MEDIUM-SIZE)PROJECTS AVAILABLE FOR INVESTMENT ACCORDING TO SECTORS NUMBER OF INVESTMENT OPPORTUNITIES ACCORDING TO SECTORS No. Sector Number of oppurtinites Major strategic projects 1. Chemicals, Petrochemicals, Fertilizers and 18 Refinery sector 2 Transportation Sector including (airports/ 16 railways/highways/metro/ports) 3 Special Economic Zones 4 4 Housing Sector 3 Medium-size projects 5 Engineering and Construction Industries Sector 6 6 Commercial Sector 12 7 tourism and recreational Sector 2 8 Health and Education Sector 10 9 Agricultural Sector 86 Total number of opportunities 157 Major strategic projects 1. CHEMICALS, PETROCHEMICALS, FERTILIZERS AND REFINERY SECTOR: A. Rehabilitation of existing fertilizer plant in Baiji and the implementation of new production lines (for export). • Production of 500 ton of Urea fertilizer • Expected capital: 0.5 billion USD • Return on Investment rate: %17 • The plant is operated by LPG supplied by the North Co. in Kirkuk Province. 9 MW Generators are available to provide electricity for operation. • The ministry stopped operating the plant on 1/1/2014 due to difficult circumstances in Saladin Province. • The plant has1165 workers • About %60 of the plant is damaged. Reconstruction and development of fertilizer plant in Abu Al Khaseeb (for export). • Plant history • The plant consist of two production lines, the old production line produced Urea granules 200 t/d in addition to Sulfuric Acid and Ammonium Phosphate. This plant was completely destroyed during the war in the eighties. The second plant was established in 1973 and completed in 1976, designed to produce Urea fertilizer 420 thousand metric ton/y. -

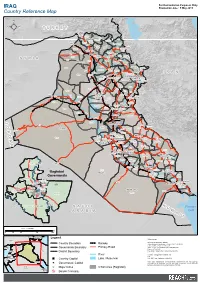

Country Reference Map

For Humanitarian Purposes Only IRAQ Production date : 5 May 2015 Country Reference Map T U R K E Y Ibrahim Al-Khalil (Habour) Zakho Zakho Amedi Dahuk Amedi Mergasur Dahuk Sumel Dahuk Rabia Mergasur Soran Sumel Shikhan Akre Haji Omaran Shikhan Akre Soran Telafar Choman Tilkaif Tilkaif Choman Shaqlawa Telafar Shaqlawa Sinjar Mosul Hamdaniya Rania Pshdar Sinjar Hamdaniya Erbil Ranya Qalat Erbil Dizah SYRIA Ba'aj Koisnjaq Mosul Erbil Ninewa Koisnjaq Dokan Baneh Dokan Makhmur Sharbazher Ba'aj Chwarta Penjwin Dabes Makhmur Penjwin Hatra Dabes Kirkuk Sulaymaniyah Chamchamal Shirqat Kirkuk IRAN Sulaymaniyah Hatra Shirqat Hawiga Daquq Sulaymaniyah Kirkuk Halabja Hawiga Chamchamal Darbandihkan Daquq Halabja Halabja Darbandikhan Baiji Tooz Khourmato Kalar Tikrit Baiji Tooz Ru'ua Kifri Kalar Tikrit Ru'ua Ka'im Salah Daur Kifri Ka'im Ana Haditha Munthiriya al-Din Daur Khanaqin Samarra Samarra Ka'im Haditha Khanaqin Balad Khalis Diyala Thethar Muqdadiya Balad Ana Al-Dujayl Khalis Muqdadiya Ba`aqubah Mandali Fares Heet Heet Ba'quba Baladrooz Ramadi Falluja Baghdad J Ramadi Rutba Baghdad Badra O Baramadad Falluja Badra Anbar Suwaira Azezia Turaybil Azezia R Musayab Suwaira Musayab D Ain Mahawil Al-Tamur Kerbala Mahawil Wassit Rutba Hindiya Na'miya Kut Ali Kerbala Kut Al-Gharbi A Ain BabylonHilla Al-Tamur Hindiya Ali Hashimiya Na'maniya Al-Gharbi Hashimiya N Kerbala Hilla Diwaniya Hai Hai Kufa Afaq Kufa Diwaniya Amara Najaf Shamiya Afaq Manathera Amara Manathera Qadissiya Hamza Rifa'i Missan Shamiya Rifa'i Maimouna Kahla Mejar Kahla Al-Kabi Qal'at Hamza -

High Casualty Terrorist Bombings (HCTB) Page 1 March 11, 1998 - March 10, 2020

High Casualty Terrorist Bombings (HCTB) Page 1 March 11, 1998 - March 10, 2020 LOC DEATH NINCD MONTH DAY YEAR LOCATION COL 25 3 5 13 1990 Cali, Niza, Quirigua USR 20 1 8 10 1990 Gyandzha, Azerbaijan COL 22 1 2 16 1991 Medellin TUR 36 1 4 9 1991 Istanbul IND 41 2 10 18 1991 Rudrapur ARG 28 1 3 17 1992 Buenos Aires PER 20 1 7 16 1992 Lima PAK 20 1 1 11 1993 Kotri PAK 23 2 1 24 1993 Hyderabad COL 20 1 1 30 1993 Bogota IND 317 13 3 12 1993 Bombay (Mumbai) IND 86 1 3 16 1993 Calcutta COL 15 1 4 15 1993 Bogota IRN 25 1 6 20 1994 Meshed ARG 96 1 7 18 1994 Buenos Aires PAN 21 1 7 19 1994 Colon ISR 23 1 10 19 1994 Tel Aviv ISR 22 2 1 22 1995 Netanya ALG 42 1 1 30 1995 Algiers IRQ 54 1 2 27 1995 Zakho USA 168 1 4 19 1995 Oklahoma City COL 29 1 6 11 1995 Medellin IND 17 1 7 20 1995 Jammu IND 16 1 8 31 1995 Chandigarh SRI 15 2 11 11 1995 Colombo PAK 17 1 11 19 1995 Islamabad IRQ 33 1 11 31 1995 Salahuddin PAK 45 1 12 21 1995 Peshawar SRI 96 1 1 31 1996 Colombo ISR 23 1 2 25 1996 Jerusalem ISR 19 1 3 3 1996 Jerusalem ISR 15 1 3 4 1996 Tel Aviv IND 25 1 3 21 1996 Delhi PAK 60 1 4 28 1996 Bhai Pheri SAU 19 1 6 25 1996 Dhahran SRI 64 1 7 24 1996 Dehiwala TUR 17 1 11 17 1996 Istanbul PER 17 1 12 17 1996 Lima IND 33 1 12 30 1996 Brahmaputra Mail (Assam) CAM 19 4 3 30 1997 Phnom Penh ALG 22 1 4 25 1997 Train near Algiers ALG 15 1 5 3 1997 Sidi Bouhanifa IND 33 1 7 8 1997 Bhatinda ISR 16 2 7 30 1997 Jerusalem SRI 18 1 10 15 1997 Colombo EGY 70 1 11 17 1997 Luxor ALG 103 1 1 11 1998 Sidi Hamed CHN 50 1 2 14 1998 Wuhan IND 46 13 2 14 1998 Coimbatore ALG 18 -

Iraq SITREP 2015-5-22

Iraq Situation Report: July 07 - 08, 2015 1 On July 6, Iraqi Army (IA) and Counter-Terrorism Service (CTS) reinforcements arrived in 6 On July 6, the DoD reported one airstrike “near Baiji.” On July 7, one SVBIED Barwana sub-district, south of Haditha. On July 7, Prime Minister (PM) Abadi ordered the exploded in the Baiji Souq area in Baiji district, and two SVBIEDs exploded in the Sakak deployment of SWAT reinforcements to Haditha. Also on July 7, Iraqi Security Forces (ISF) and area west of Baiji, killing ten IA and “Popular Mobilization” members and wounding over tribal ghters, reportedly supported by Iraqi and U.S.-led Coalition air support, attacked ISIS in 30. Federal Police (FP) and “Popular Mobilization” forces repelled an attack by ISIS at Barwana and Alus sub-districts, south of Haditha, and destroyed two SVBIEDs in al-Sakran area, al-Fatha, northeast of Baiji, killing 20 ISIS ghters. On July 8, IA and “Popular Mobili- northeast of Haditha, before they reached their targets. Albu Nimr and Albu Mahal tribal ghters zation” reinforcements reportedly arrived in Baiji. Clashes reportedly continue in the Baiji later repelled a counterattack by ISIS against Barwana. IA Aviation and U.S.-led Coalition Souq area of Baiji and in the Sakak area, west of Baiji. IA Aviation and the U.S.-led airstrikes also reportedly destroyed an ISIS convoy heading from Baiji to Barwana. Between July 6 Coalition conducted airstrikes on al-Siniya and al-Sukaria, west of Baiji and on the and 7, the DoD reported eight airstrikes “near Haditha.” On July 8, ISF and tribal ghters repelled petrochemical plant, north of Baiji. -

Preparatory Surevey Report on the Construction and Development of Telecommunications Network for Major Provinces in Iraq

Republic of Iraq Ministry of Communications Iraqi Telecommunications and Post Company State Company for Internet Service PREPARATORY SUREVEY REPORT ON THE CONSTRUCTION AND DEVELOPMENT OF TELECOMMUNICATIONS NETWORK FOR MAJOR PROVINCES IN IRAQ MARCH 2011 JAPAN INTERNATIONAL COOPERATION AGENCY NIPPON KOEI CO., LTD. 42 44 46 48 ° Hakkâri ° Lake Urmia ° ° TURKEY Orumiyeh Mianeh Q e (Umia) ze l O Zakhu wz DAHUK an Al Qamishli Dahuk Miandowab 'Aqrah Rayat Zanjan ab Z t ARBIL Mosul A Sinjar a re Tall 'Afar G S 36 Ar Raqqah Arbil S ° U NINAWA 36° L r Kuysanjaq - u Al Qayyarah A - b Makhmur a Y h M K l Al Hadr a A As r b N h a Sulaymaniyah a Z e AT I Sanandaj Dayr az Zawr N l Kirkuk Y itt L A Halabjah TA'MIM H SYRIAN ARAB Bayji N T a ISLAMIC REPUBLIC OF i hr Tawuq g a r l á REPUBLIC is 'U - l a z y Hamadan a i y m D s r IRAN rate Buhayrat al h Euph - SALAH AD a Abu Kamal Qadisiyah N Anah DIN Qasr-e Shirin A l Khanaqin Kermanshah Thartha Samarra' 34 Q ° a Al Hadithah Lake DIYALA 34 'im - ° - Borujerd Al H Ba'qubah abba Akashat ni - Hit ya Al Walid wran h Ilam Ha - -i R -- - i Ar Ramadi Baghdad u- Khorramabad ad dh W ha- Habbaniyah h BAGHDAD ne ja h-y Lake u Mehran e S - a ll im Al F ar Ar Rutbah AL ANBAR eh -i Trebil - Gha¸daw - di al Razzaza WASIT Dehloran Wa - - Lake Karbala' BABIL Shaykh Sa'd Al Hillah KARBALA'- Al Kut JORDAN 'Ali al Gharbi Dezful Al Hayy MAYSAN bayyid 32 -i al U ¸ ° -ad Ad Diwaniyah 32 W Nukhayb An Najaf ° - S Al 'Amarah h Abu Sukhayr T AL QADISIYAH a i t Qal'at Sukkar g t r a i s - l Qal'at Salih DHI QAR Judayyidat 'Ar'ar Qaryat